Green Refrigerants Market Synopsis:

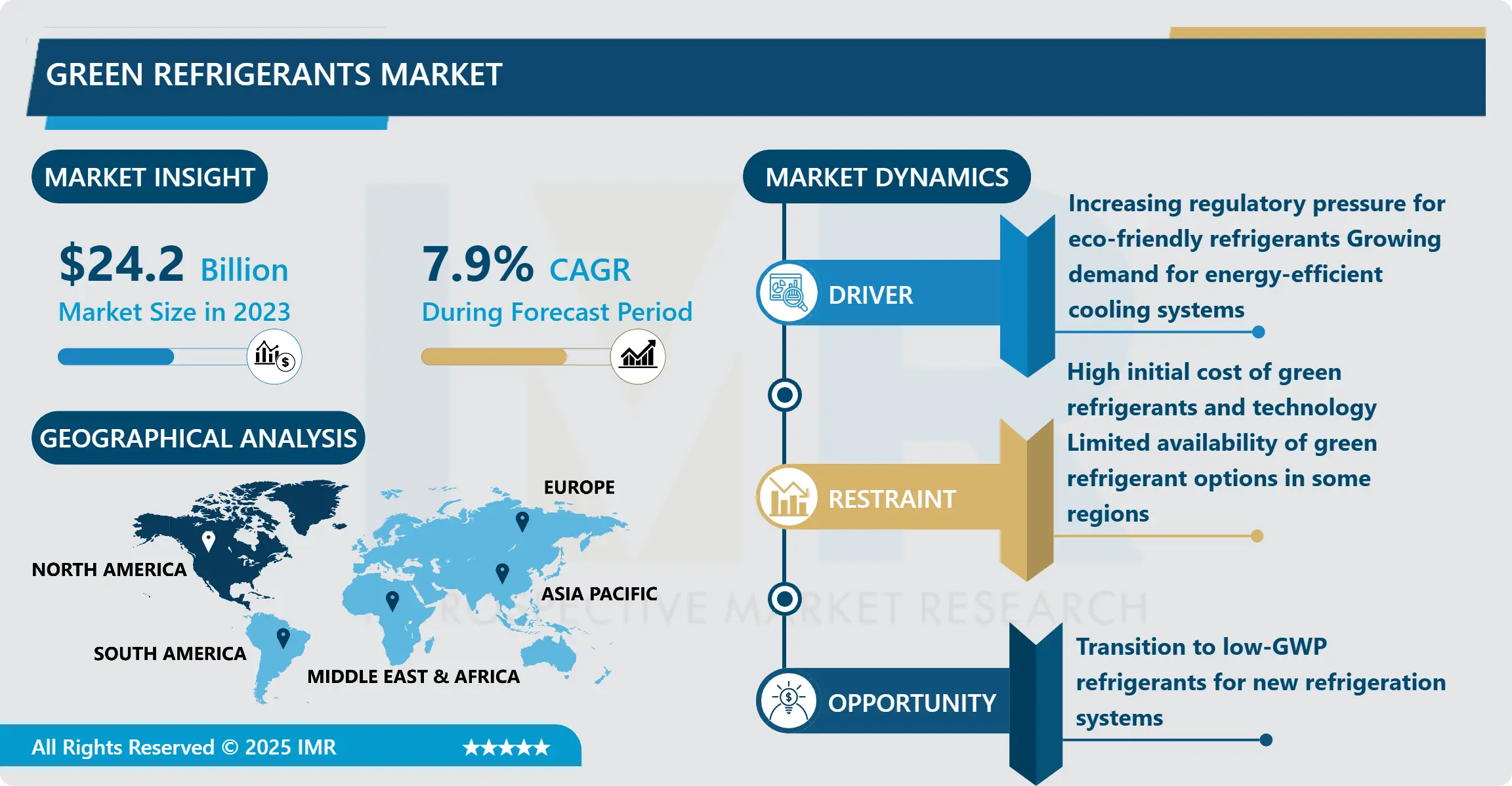

Green Refrigerants Market Size Was Valued at USD 24.20 Billion in 2023, and is Projected to Reach USD 47.98 Billion by 2032, Growing at a CAGR of 7.9% From 2024-2032.

The green refrigerants market is a segment of refrigerants that is environmentally friendly as compared to the regular refrigerants on the market. These are also called green refrigerants, and are as well used in refrigeration and air conditioning for the cooling purposes with less impact on the environment in the aspects of ozone depletion and Global warming potential (GWP). Natural non-toxic green refrigerants are CO2, ammonia, hydrocarbons (propane, butane), and HFOs which replace dangerous compounds as CFCs, HCFCs, and HFCs which are so dangerous to the environment.

Earlier the green refrigerants market was not much developed but due to the soaring pressure that regulations established over the utilization of traditional refrigerants that exert negative effect on global climate and ozone layer, its’ market has increased rapidly in recent years. International and supranational bodies including governments and the United Nations and the European Union have laid down legislations to ban environmentally unfriendly refrigerants including HFCs (hydrofluorocarbons) and substituting them with green solutions. Growing concerns for environmental conservation has triggered the need for natural refrigerants alongside advancement in techniques used in refrigeration. The market is expanding rapidly since more industries in diverse sectors like heating, ventilation, and air conditioning; food processing; transport; and pharmaceuticals are incorporating greener solutions due to increased regulation and adoption of sustainable measures.

However, this market has continued to grow because of the regulatory factors such as the need to meet energy efficient cooling system. Technological improvement has also contributed to the development of improved environmentally friendly refrigerants that are with comparative advantage. Other refrigerants such as the CO2 and ammonia are being embraced because they have a low GWP and ODP making them ideal for use in industrial as well as in residential uses. Besides, the growing preference towards decreasing operating costs coupled with up surging demand for energy efficient refrigeration systems shall also contribute toward increased market for the green refrigerants.

Green Refrigerants Market Trend Analysis:

Increasing Adoption of Natural Refrigerants in Commercial Applications

-

The use of natural refrigerants and moreover CO2, ammonia, hydrocarbons are another trend in the green refrigerants market measured on application level, especially in supermarkets, cold storages and food processing industries. Thus, natural refrigerants have an advantage over synthetic ones in terms of lower GWP as well as in having zero ODPs.

- CO2 especially has attracted interest because of its environmental advantage and for refrigeration applications; ammonia is used widely in industrial refrigeration because of economy and high energy efficiency. Natural refrigerants are being promoted due to vigorous policies and standards and the rising need for more environmentally friendly solutions on the commercial and industrial levels. In addition technology has advanced to a level that makes it possible to incorporate these natural refrigerants to already existing refrigeration networks thereby increasing their adoption.

Transitioning to Low-GWP Refrigerants for New Refrigeration Systems

-

The largest market for green refrigerants remains the conversion of newer low GWP refrigerants into new refrigeration and air conditioning products. Therefore, as the need for energy efficient and environment friendly coolants is felt in cooler regions and as new equipment’s are being produced, there is greater emphasis on using low GWP refrigerants.

- Indeed, this shift offers a good chance to market actors to transform & introduce goods that are both compliant with these enviro standards & consumer desires. With the ban on the use of high-GWP refrigerants out of the market, industries that manufacture green refrigerant with low optimal costs and high energy-efficiency stand to gain market share. Additionally, rising trend towards green infrastructure construction and sustainable urban design, as well as advanced smart refrigeration systems is anticipated to create a higher demand for low GWP refrigerants.

Green Refrigerants Market Segment Analysis:

Green Refrigerants Market is Segmented on the basis of Type, Application, End User, and Region

By Type, Natural Refrigerants segment is expected to dominate the market during the forecast period

-

Natural Refrigerants segment is the substances available naturally in the environment with least measure of effect on environment. These refrigerants are preferred because they have a low GWP and, more importantly, they have an ODP of zero. Some of the examples include; Carbon dioxide (CO2) Ammonia (NH3) Propane (R-290) Butane (R-600a) Water etc. These refrigerants are gradually being used in many applications such as refrigeration and air conditioning, HVAC and Industrial cooling. Natural refrigerants are appealing due to their energy efficiency and Global Warming Potential, making them excellent options as legislation moves to eliminate many high GWP systems.

- Types of Synthetic Refrigerants include compounds that are synthetically produced and most popular types are the Hydrofluoroolefins (HFOs) and the Hydrofluorocarbons (HFCs). Thus, new eco-friendly HFOs, including R-1234yf, are being employed as potential substitutes for conventional HFCs providing lower GWP and increased energy-indicator efficacy. New synthetic refrigerants are often used due to their energy efficiency in some systems, however, they have potential problems with GWP. But recently technological developments were made that offered improved synthetic types of the refrigerant to be used in the interim by those industries that seek to minimize their impact on the environment.

By Application, Food & Beverages segment expected to held the largest share

-

The HVAC & Refrigeration segment is expected to occupy a large market share of green refrigerants, since the usage of environment-friendly refrigerants is increasing in heating, ventilation, and air conditioning systems. Low-GWP refrigerants are used to meet current and planned environmental requirement on refrigerant usage for both residential and commercial buildings. Another application area is Commercial Refrigeration as green refrigerants are being adopted in supermarkets, cold storage and other retail food stores. This evolution is in line with the increasing demand in the reduction of the environmental effectiveness of the refrigerants used in the systems. The industrial refrigerator, which is the large-scale refrigerator used in the chemical processing industries, is also moving towards green refrigerator because it has number of advantages regarding atmosphere and efficiency.

- Annual low-GWP refrigerant use in the Automotive Air Conditioning segment also began to rise HFO such as R-1234yf replaced the HFC such as R-134a. Also, interestingly, the Food & Beverages sector is also using green refrigerants for cold storage, food processing and cold chain logistics, primarily for sustainability as well as efficiency. Pharmaceuticals industry especially for vaccines and certain medicines depends on the temperature control of their products; for this purpose, they have to look for efficient and eco-friendly refrigerants. Other applications such as Marine and Residential refrigeration applications are also gradually shifting to green refrigerants to adapt the global, environmental trends towards sustainability and energy conservation.

Green Refrigerants Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

Some of the factors that were highlighted for Europe to lead the green refrigerants market in 2023 include the following the region comprises of strict environmental regulation, has a broad coverage for sustainable green technology, and numerous policies that support the replacement of traditional refrigerants with green ones. Europe has been particularly active in shifting away from hazardous refrigerator, with the F-Gas Regulation being an example of how existing rules could need to be advanced towards low-GWP refrigerator.

- Thus, Europe had a large share in the worldwide green refrigerants market, with forecasts that it contributed to around 40-45% of the market. The key factors contributing to the growth of the Europe market are the rising demand for natural refrigerants, particularly CO2 in commercial industrial applications and the growing concern for energy efficient refrigeration solution in HVAC, food processing and pharma sectors. Due to favourable environmental factors as well as having benefitted from technological progress and policies, the region will continue dominating the market in the coming years.

Active Key Players in the Green Refrigerants Market:

- A-Gas (UK)

- Air Liquide (France)

- Arkema (France)

- Beijing Tongshi (China)

- Chemours (USA)

- Daikin Industries (Japan)

- Dongyue Group (China)

- Honeywell International (USA)

- Johnson Controls (USA)

- Linde plc (UK)

- Mexichem (Mexico)

- Navigant Research (USA)

- Solvay S.A. (Belgium)

- The Refrigerant Company (Canada)

- Thermo Fisher Scientific (USA)

- Other Active Players

|

Green Refrigerants Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 24.20 Billion |

|

Forecast Period 2024-32 CAGR: |

7.9% |

Market Size in 2032: |

USD 47.98 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Green Refrigerants Market by Type

4.1 Green Refrigerants Market Snapshot and Growth Engine

4.2 Green Refrigerants Market Overview

4.3 Natural Refrigerants

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Natural Refrigerants: Geographic Segmentation Analysis

4.4 Synthetic Refrigerants

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Synthetic Refrigerants: Geographic Segmentation Analysis

Chapter 5: Green Refrigerants Market by Application

5.1 Green Refrigerants Market Snapshot and Growth Engine

5.2 Green Refrigerants Market Overview

5.3 HVAC & Refrigeration

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 HVAC & Refrigeration: Geographic Segmentation Analysis

5.4 Commercial Refrigeration

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Commercial Refrigeration: Geographic Segmentation Analysis

5.5 Industrial Refrigeration

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Industrial Refrigeration: Geographic Segmentation Analysis

5.6 Automotive Air Conditioning

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Automotive Air Conditioning: Geographic Segmentation Analysis

5.7 Food & Beverages

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Food & Beverages: Geographic Segmentation Analysis

5.8 Pharmaceuticals

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Pharmaceuticals: Geographic Segmentation Analysis

5.9 Others (Marine

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 Others (Marine: Geographic Segmentation Analysis

5.10 Residential)

5.10.1 Introduction and Market Overview

5.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.10.3 Key Market Trends, Growth Factors and Opportunities

5.10.4 Residential): Geographic Segmentation Analysis

Chapter 6: Green Refrigerants Market by End User

6.1 Green Refrigerants Market Snapshot and Growth Engine

6.2 Green Refrigerants Market Overview

6.3 Commercial

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Commercial: Geographic Segmentation Analysis

6.4 Industrial

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Industrial: Geographic Segmentation Analysis

6.5 Residential

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Residential: Geographic Segmentation Analysis

6.6 Automotive

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Automotive: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Green Refrigerants Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 A-GAS (UK)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AIR LIQUIDE (FRANCE)

7.4 ARKEMA (FRANCE)

7.5 BEIJING TONGSHI (CHINA)

7.6 CHEMOURS (USA)

7.7 DAIKIN INDUSTRIES (JAPAN)

7.8 DONGYUE GROUP (CHINA)

7.9 HONEYWELL INTERNATIONAL (USA)

7.10 JOHNSON CONTROLS (USA)

7.11 LINDE PLC (UK)

7.12 MEXICHEM (MEXICO)

7.13 NAVIGANT RESEARCH (USA)

7.14 SOLVAY S.A. (BELGIUM)

7.15 THE REFRIGERANT COMPANY (CANADA)

7.16 THERMO FISHER SCIENTIFIC (USA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Green Refrigerants Market By Region

8.1 Overview

8.2. North America Green Refrigerants Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Natural Refrigerants

8.2.4.2 Synthetic Refrigerants

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 HVAC & Refrigeration

8.2.5.2 Commercial Refrigeration

8.2.5.3 Industrial Refrigeration

8.2.5.4 Automotive Air Conditioning

8.2.5.5 Food & Beverages

8.2.5.6 Pharmaceuticals

8.2.5.7 Others (Marine

8.2.5.8 Residential)

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Commercial

8.2.6.2 Industrial

8.2.6.3 Residential

8.2.6.4 Automotive

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Green Refrigerants Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Natural Refrigerants

8.3.4.2 Synthetic Refrigerants

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 HVAC & Refrigeration

8.3.5.2 Commercial Refrigeration

8.3.5.3 Industrial Refrigeration

8.3.5.4 Automotive Air Conditioning

8.3.5.5 Food & Beverages

8.3.5.6 Pharmaceuticals

8.3.5.7 Others (Marine

8.3.5.8 Residential)

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Commercial

8.3.6.2 Industrial

8.3.6.3 Residential

8.3.6.4 Automotive

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Green Refrigerants Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Natural Refrigerants

8.4.4.2 Synthetic Refrigerants

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 HVAC & Refrigeration

8.4.5.2 Commercial Refrigeration

8.4.5.3 Industrial Refrigeration

8.4.5.4 Automotive Air Conditioning

8.4.5.5 Food & Beverages

8.4.5.6 Pharmaceuticals

8.4.5.7 Others (Marine

8.4.5.8 Residential)

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Commercial

8.4.6.2 Industrial

8.4.6.3 Residential

8.4.6.4 Automotive

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Green Refrigerants Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Natural Refrigerants

8.5.4.2 Synthetic Refrigerants

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 HVAC & Refrigeration

8.5.5.2 Commercial Refrigeration

8.5.5.3 Industrial Refrigeration

8.5.5.4 Automotive Air Conditioning

8.5.5.5 Food & Beverages

8.5.5.6 Pharmaceuticals

8.5.5.7 Others (Marine

8.5.5.8 Residential)

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Commercial

8.5.6.2 Industrial

8.5.6.3 Residential

8.5.6.4 Automotive

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Green Refrigerants Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Natural Refrigerants

8.6.4.2 Synthetic Refrigerants

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 HVAC & Refrigeration

8.6.5.2 Commercial Refrigeration

8.6.5.3 Industrial Refrigeration

8.6.5.4 Automotive Air Conditioning

8.6.5.5 Food & Beverages

8.6.5.6 Pharmaceuticals

8.6.5.7 Others (Marine

8.6.5.8 Residential)

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Commercial

8.6.6.2 Industrial

8.6.6.3 Residential

8.6.6.4 Automotive

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Green Refrigerants Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Natural Refrigerants

8.7.4.2 Synthetic Refrigerants

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 HVAC & Refrigeration

8.7.5.2 Commercial Refrigeration

8.7.5.3 Industrial Refrigeration

8.7.5.4 Automotive Air Conditioning

8.7.5.5 Food & Beverages

8.7.5.6 Pharmaceuticals

8.7.5.7 Others (Marine

8.7.5.8 Residential)

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Commercial

8.7.6.2 Industrial

8.7.6.3 Residential

8.7.6.4 Automotive

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Green Refrigerants Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 24.20 Billion |

|

Forecast Period 2024-32 CAGR: |

7.9% |

Market Size in 2032: |

USD 47.98 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||