Green Ammonia Market Synopsis

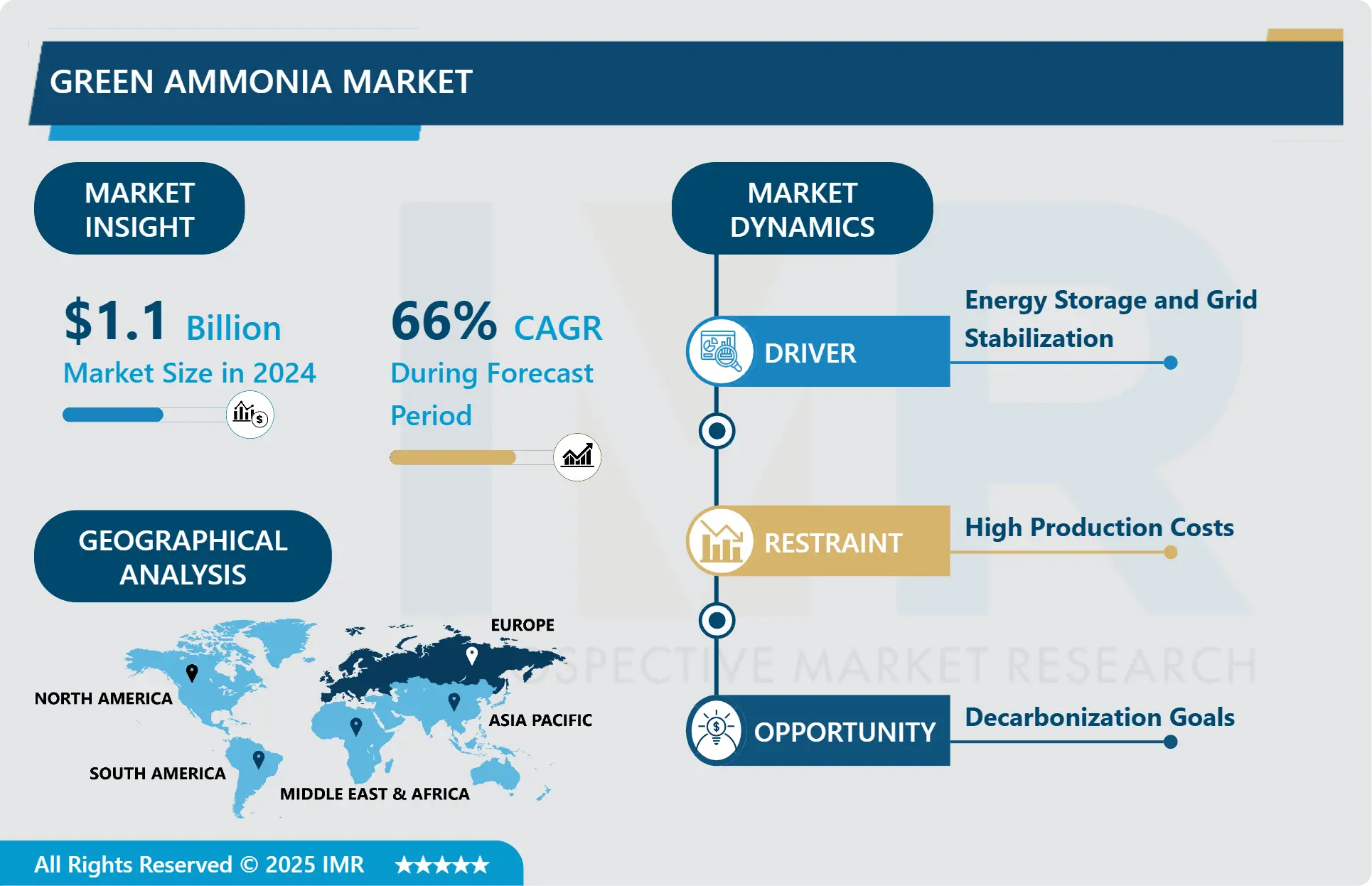

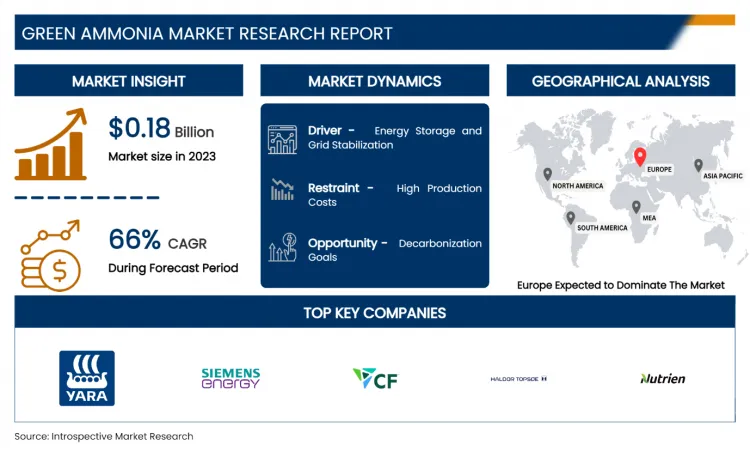

Green Ammonia Market Size Was Valued at USD 1.1 Billion in 2024, and is Projected to Reach USD 63.42 Billion by 2032, Growing at a CAGR of 66% From 2025-2032.

The green ammonia advertise is quickly developing as a imperative component of the worldwide move towards feasible vitality arrangements. Green ammonia is delivered through the electrolysis of water utilizing renewable vitality sources, coming about in a carbon-neutral item that has broad applications over different segments.

The showcase is driven by the pressing ought to decarbonize conventional ammonia generation strategies, which are profoundly carbon-intensive, and the developing accentuation on feasible agribusiness, vitality capacity, and hydrogen transport.

As nations endeavor to meet their climate targets, ventures in green ammonia advances and foundation are expanding, making a energetic scene for development. In terms of generation advances, soluble water electrolysis (Amazement) right now rules the green ammonia showcase due to its cost-effectiveness and development.

In any case, proton trade film (PEM) and strong oxide electrolysis (SOE) are picking up consideration for their proficiency and flexibility to fluctuating renewable vitality inputs. As mechanical headways proceed, these strategies may end up more competitive, growing the in general capacity and diminishing costs related with green ammonia generation. The transaction between these advances will play a pivotal part in forming the market's future direction.

The end-use applications of green ammonia are differing, with mechanical feedstock for fertilizers right now taking the lead. In any case, the potential for green ammonia to serve as a clean fuel for transportation and a medium for vitality capacity and control era is gathering critical intrigued. As the worldwide request for feasible vitality arrangements proceeds to rise, the green ammonia showcase is balanced for significant development. This move not only bolsters decarbonization endeavours but moreover improves vitality security and cultivates development in different businesses, situating green ammonia as a foundation of long-haul vitality scene.

Green Ammonia Market Trend Analysis

Green Ammonia Market Growth Driver- Energy Storage and Grid Stabilization

- Decarbonization objectives are a key driver behind the move to green ammonia, as worldwide endeavours to combat climate alter heightening. Ordinary ammonia generation, which depends on normal gas through the Haber-Bosch prepare, may be An exceedingly carbon-intensive operation, contributing altogether to worldwide CO? outflows. In reaction, governments, businesses, and universal organizations are progressively setting driven carbon decrease targets, pointing for net-zero emanations by mid-century. Green ammonia delivered utilizing renewable vitality sources such as wind, sun powered, and hydropower, offers a carbon-neutral elective. This adjusts with decarbonization procedures by dispensing with the dependence on fossil fills and radically diminishing the carbon impression related with ammonia generation. As countries prioritize these objectives, green ammonia is anticipated to play a essential part in divisions like horticulture, vitality capacity, and hydrogen transport, encourage quickening the move towards a feasible, low-carbon economy.

Green Ammonia Market Opportunity- Decarbonization Goals

- Green ammonia plays a significant part in vitality capacity and network stabilization, particularly in tending to the challenges postured by irregular renewable vitality sources like sun powered and wind. These renewable sources are frequently erratic, with periods of overproduction (when vitality supply surpasses request) and underproduction (when vitality era is inadequately). Green ammonia can act as a medium for long-term vitality capacity by changing over abundance renewable vitality into ammonia by means of electrolysis. This put away ammonia can at that point be utilized when renewable vitality era is moo or amid crest request periods.

- By reconverting ammonia into power through combustion or fuel cells, it offers a adaptable and dependable vitality supply. Moreover, ammonia's capacity to be put away and transported over long separations includes to its utility in adjusting framework operations, making it a basic component in a future vitality framework overwhelmed by renewables. Its potential to stabilize frameworks makes a difference avoid power outages and guarantees a more flexible, dependable vitality foundation.

Green Ammonia Market Segment Analysis:

Green Ammonia market is segmented on the basis of Capacity, Technology, End-Use.

By Technology, Alkaline Water Electrolysis Segment Is Expected to Dominate the Market During the Forecast Period

- Alkaline Water Electrolysis is the most dominant technology due to its maturity, lower cost, and extensive use in industrial hydrogen production. AWE has been in use for decades and operates at lower temperatures, making it reliable and well-suited for large-scale applications. It uses a liquid electrolyte (potassium hydroxide) to separate hydrogen and oxygen from water, and it is considered more energy-efficient in its current form compared to PEM and SOE.

- However, Proton Exchange Membrane electrolysis, which uses a solid polymer membrane, is gaining traction due to its ability to operate at higher current densities and its potential for faster dynamic responses, making it more suitable for integration with intermittent renewable energy sources like solar and wind. PEM technology is still more expensive than AWE but offers advantages in compactness and flexibility.

- On the other hand, Solid Oxide Electrolysis operates at much higher temperatures and efficiencies, producing hydrogen at a lower electricity cost. However, it is still in the developmental stage and not yet as commercially viable as AWE and PEM.

- While AWE remains dominant due to its commercial availability and cost-effectiveness, the growing advancements in PEM and SOE suggest that the future of green ammonia production may see increased competition between these technologies as the market scales.

By End Use, Industrial Feedstock Segment Held the Largest Share In 2024

- Within the green ammonia advertise, industrial feedstock remains the dominant end-use application. Ammonia may be a basic component within the generation of fertilizers, especially in horticulture, where it is utilized to synthesize nitrogen-based fertilizers. Around 80% of the worldwide ammonia supply is expended by the farming segment. As green ammonia offers a economical, carbon-free elective to ordinarily created ammonia, its appropriation in fertilizer generation is anticipated to quicken due to the rising request for economical cultivating hones and nourishment security.

- Whereas mechanical feedstock right now leads the advertise, transportation and control era are rising as significant future applications. Green ammonia is being investigated as a zero-carbon fuel, especially for shipping, because it can be utilized specifically in combustion motors or fuel cells. Its tall vitality thickness and ease of capacity make it reasonable for long-distance sea transport.

- In control era, green ammonia holds guarantee as a fuel for warm control plants and in hydrogen-based vitality frameworks. Ammonia can be burned specifically in turbines or used as a hydrogen carrier, making it a flexible choice for decarbonizing vitality lattices. In any case, these segments are still within the early stages of improvement compared to mechanical feedstock, where the request is quicker and more well-established.

Green Ammonia Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast Period

- Europe is currently dominating the green ammonia market, and there are several key reasons for this leadership. European nations, particularly Germany, the Netherlands, and the Nordic countries, have committed to ambitious renewable energy targets and stringent carbon emission regulations, making green ammonia an attractive solution for decarbonizing industries like agriculture, transportation, and power generation.

- The European Union’s hydrogen strategy further accelerates the shift to green ammonia, particularly through investments in hydrogen-based technologies, which are crucial for ammonia production. This strong regulatory framework, combined with governmental support for sustainable solutions, has led to Europe becoming the most significant shareholder in green ammonia production and adoption. Additionally, Europe’s existing ammonia plants are transitioning from natural gas-based to green ammonia production using renewable energy, further solidifying the region's dominance in the global market.

Green Ammonia Market Active Players

- Yara International (Norway)

- Siemens Energy (Germany)

- CF Industries (USA)

- Haldor Topsøe (Denmark)

- Nutrien (Canada)

- Air Products and Chemicals (USA)

- Mitsubishi Heavy Industries (Japan)

- BASF (Germany)

- IHI Corporation (Japan)

- OCI Nitrogen (Netherlands)

- H2U (Australia)

- EnviTec Biogas AG (Germany)

- Linde (UK)

- thyssenkrupp (Germany)

- Acron Group (Russia)

- BayoTech (USA)

- Amonix (USA)

- RWE AG (Germany)

- Fertiglobe (UAE)

- Green Ammonia Technologies (USA)

- Topsoe (Denmark)

- MAN Energy Solutions (Germany)

- ENGIE (France)

- Nel Hydrogen (Norway)

- ITM Power (UK)

- Other Active Players

Key Industry Developments in the Green Ammonia Market:

- In July 2024, Egypt has signed $33 billion deals with companies like BP, Masdar, and Germany's DAI for green ammonia projects. One project, worth $11 billion, will involve a green ammonia plant in East Port Said, while another, worth $14 billion, will involve a plant in Ain Sukhna Port, Green ammonia and hydrogen are seen as essential for the energy transition.

- In July 2024, State-run SJVN Green Energy (SGEL) is constructing one of the world's largest green ammonia production facilities This facility is expected to supply 4.5 gigawatts of renewable energy to AM Green Ammonia Holdings. AM Green's target of producing 5 million tonnes per annum (mtpa) of green ammonia represents a fifth of India's target for green hydrogen production under the country's National Green Hydrogen Mission and 10% of Europe's target for green hydrogen imports by 2030

|

Global Green Ammonia Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.1 Bn. |

|

Forecast Period 2025-32 CAGR: |

66 % |

Market Size in 2032: |

USD 63.42 Bn. |

|

Segments Covered: |

By Capacity |

|

|

|

By Technology |

|

||

|

By End-Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Green Ammonia Market by Capacity (2018-2032)

4.1 Green Ammonia Market Snapshot and Growth Engine

4.2 Market Overview

4.3 High

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Medium

4.5 Low

Chapter 5: Green Ammonia Market by Technology (2018-2032)

5.1 Green Ammonia Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Alkaline Water Electrolysis

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Proton Exchange Membrane

5.5 Solid Oxide Electrolysis

Chapter 6: Green Ammonia Market by End-Use (2018-2032)

6.1 Green Ammonia Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Transportation

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Power Generation

6.5 Industrial Feedstock

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Green Ammonia Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 YARA INTERNATIONAL (NORWAY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SIEMENS ENERGY (GERMANY)

7.4 CF INDUSTRIES (USA)

7.5 HALDOR TOPSØE (DENMARK)

7.6 NUTRIEN (CANADA)

7.7 AIR PRODUCTS AND CHEMICALS (USA)

7.8 MITSUBISHI HEAVY INDUSTRIES (JAPAN)

7.9 BASF (GERMANY)

7.10 IHI CORPORATION (JAPAN)

7.11 OCI NITROGEN (NETHERLANDS)

7.12 H2U (AUSTRALIA)

7.13 ENVITEC BIOGAS AG (GERMANY)

7.14 LINDE (UK)

7.15 THYSSENKRUPP (GERMANY)

7.16 ACRON GROUP (RUSSIA)

7.17 BAYOTECH (USA)

7.18 AMONIX (USA)

7.19 RWE AG (GERMANY)

7.20 FERTIGLOBE (UAE)

7.21 GREEN AMMONIA TECHNOLOGIES (USA)

7.22 TOPSOE (DENMARK)

7.23 MAN ENERGY SOLUTIONS (GERMANY)

7.24 ENGIE (FRANCE)

7.25 NEL HYDROGEN (NORWAY)

7.26 ITM POWER (UK)

Chapter 8: Global Green Ammonia Market By Region

8.1 Overview

8.2. North America Green Ammonia Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Capacity

8.2.4.1 High

8.2.4.2 Medium

8.2.4.3 Low

8.2.5 Historic and Forecasted Market Size by Technology

8.2.5.1 Alkaline Water Electrolysis

8.2.5.2 Proton Exchange Membrane

8.2.5.3 Solid Oxide Electrolysis

8.2.6 Historic and Forecasted Market Size by End-Use

8.2.6.1 Transportation

8.2.6.2 Power Generation

8.2.6.3 Industrial Feedstock

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Green Ammonia Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Capacity

8.3.4.1 High

8.3.4.2 Medium

8.3.4.3 Low

8.3.5 Historic and Forecasted Market Size by Technology

8.3.5.1 Alkaline Water Electrolysis

8.3.5.2 Proton Exchange Membrane

8.3.5.3 Solid Oxide Electrolysis

8.3.6 Historic and Forecasted Market Size by End-Use

8.3.6.1 Transportation

8.3.6.2 Power Generation

8.3.6.3 Industrial Feedstock

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Green Ammonia Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Capacity

8.4.4.1 High

8.4.4.2 Medium

8.4.4.3 Low

8.4.5 Historic and Forecasted Market Size by Technology

8.4.5.1 Alkaline Water Electrolysis

8.4.5.2 Proton Exchange Membrane

8.4.5.3 Solid Oxide Electrolysis

8.4.6 Historic and Forecasted Market Size by End-Use

8.4.6.1 Transportation

8.4.6.2 Power Generation

8.4.6.3 Industrial Feedstock

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Green Ammonia Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Capacity

8.5.4.1 High

8.5.4.2 Medium

8.5.4.3 Low

8.5.5 Historic and Forecasted Market Size by Technology

8.5.5.1 Alkaline Water Electrolysis

8.5.5.2 Proton Exchange Membrane

8.5.5.3 Solid Oxide Electrolysis

8.5.6 Historic and Forecasted Market Size by End-Use

8.5.6.1 Transportation

8.5.6.2 Power Generation

8.5.6.3 Industrial Feedstock

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Green Ammonia Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Capacity

8.6.4.1 High

8.6.4.2 Medium

8.6.4.3 Low

8.6.5 Historic and Forecasted Market Size by Technology

8.6.5.1 Alkaline Water Electrolysis

8.6.5.2 Proton Exchange Membrane

8.6.5.3 Solid Oxide Electrolysis

8.6.6 Historic and Forecasted Market Size by End-Use

8.6.6.1 Transportation

8.6.6.2 Power Generation

8.6.6.3 Industrial Feedstock

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Green Ammonia Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Capacity

8.7.4.1 High

8.7.4.2 Medium

8.7.4.3 Low

8.7.5 Historic and Forecasted Market Size by Technology

8.7.5.1 Alkaline Water Electrolysis

8.7.5.2 Proton Exchange Membrane

8.7.5.3 Solid Oxide Electrolysis

8.7.6 Historic and Forecasted Market Size by End-Use

8.7.6.1 Transportation

8.7.6.2 Power Generation

8.7.6.3 Industrial Feedstock

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Green Ammonia Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.1 Bn. |

|

Forecast Period 2025-32 CAGR: |

66 % |

Market Size in 2032: |

USD 63.42 Bn. |

|

Segments Covered: |

By Capacity |

|

|

|

By Technology |

|

||

|

By End-Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||