Green Mining Market Synopsis

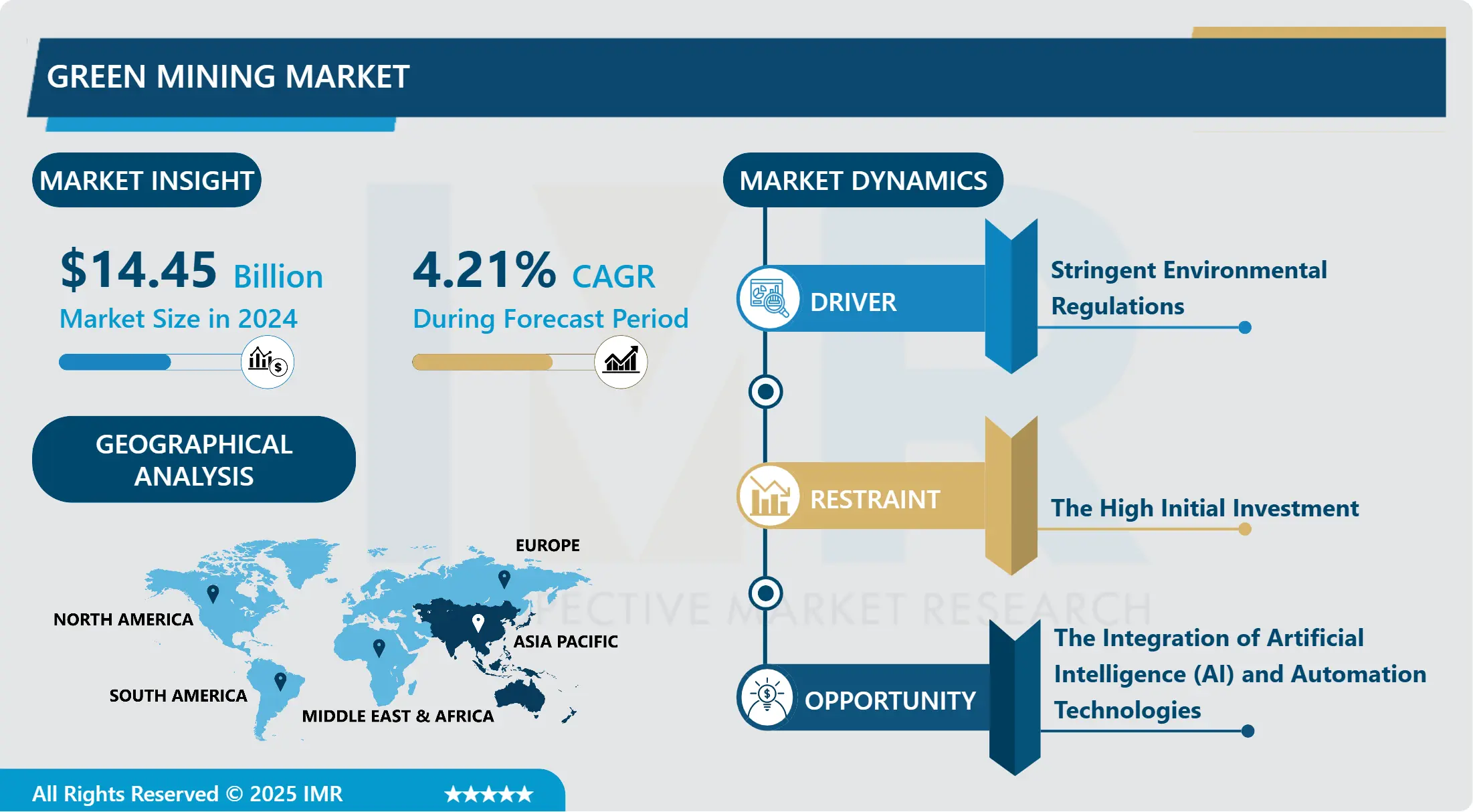

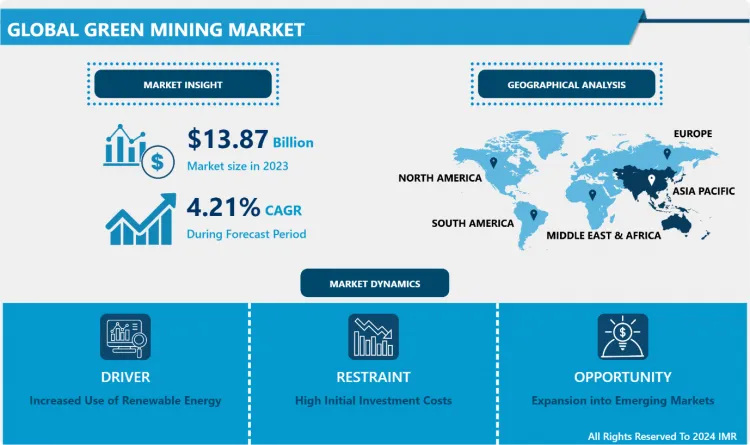

Green Mining Market Size Was Valued at USD 14.45 Billion in 2024, and is Projected to Reach USD 20.10 Billion by 2032, Growing at a CAGR of 4.21% From 2025-2032.

The green mining market is indeed one market that is completely committed to the idea of responsible mining that is eco friendly. There are certain goals, which include eliminating destructive ant environment cumulative impacts, decreasing greenhouse gas emissions and reasonable use of mined materials to support mining operations’ economic profitability.

The green mining market, therefore, becomes the key segment in the mining industry setting as shareholders tap into environmentally sustainable practices. This movement covers the mitigation of the negative effects of mining and exploration activities, the optimization on the use of resources and energy. Innovative mining methods that hitherto were in use also harm the environment through loss of physical features, pollutions of water and release of carbon. In light of these challenges, the green mining initiative strives to revitalize mining activity through higher levels of technology integration that reduces the amount of waste co-produced with valuable ores, improves the efficiency of the extraction process and reduces its environmental impact. The adoption of renewable energy particularly solar and wind energy in mines is shown below as a way of realising on these goals. Furthermore, organizations are using technologies those remove toxic metals from minerals through biological methods like bioleaching and hydrometallurgy, which are more environment friendly than traditional techniques.

But the ideas embodied in the green mining market are not limited by the minimization of negative impacts and can open up promising new horizons related to such segments as responsible sourcing and ethical standards. This also includes rights at work, social connections and species diversifications. With awareness of environmental issues on the part of the consumers and investors rising, mining actors grow pressured to speak about sustainability. Such movement is backed by regulations that promote eco friendly activities and CSR programs. In addition, globalization and its effects on the mining business increases the direct and indirect reprocessing of finished and unused products or materials to coincide with the ever-developing circular economy. For this reason, mining enterprises are seeking new strategies to consider metals and minerals recycling that can help to create longer useful life cycles for current materials. The rising need for critical minerals, including those used in renewable energy technologies and electric vehicles, also provide a priority for the sustainable extraction and use of those materials.

Altogether, the green mining market is a novel strategy of mining thought to capture mineral reserves while paying regard to the impacts of the human undertaking on the environment. This paper will argue that there is immense potential for the enhancement of efficiency and social responsibility of the mining industry through the adoption of new technologies and best practices in sustainable mining. It also shows how this movement is needed because the problems stated in the video are environmental issues and how it fits with the emerging concept of sustainability in various industries now. With time the green mining sector still has the opportunity to change the mining industry by providing a means of developing mineral resources in a responsible and sustainable manner for future generations. Business that have adopted programs on green mining will be better to face such challenges, meet consumers demand and market opportunities with focused on sustainable environment.

Green Mining Market Trend Analysis

Green Mining Market Growth Driver- Increased Use of Renewable Energy

- Moreover, one of the growing trends for the green mining market is the raising application of renewable energy in the mining process. Currently, many miners are moving from fossil fuels such as oil, natural gas and coal to renewable energy like, solar and wind power for the company activities. This shift is also useful in minimizing greenhouse gas emission while at the same time resulting in saving cost in the long run. From the use of renewable energy, mining companies are able to acquire stable energy costs, decrease resource dependence on non-renewable energy sources, and meet international concerns on sustainability.

- The use of renewable energy sources in mining is also motivated by technologies used in industries, and policies adopted by the government of the country where the mining is done. Storing electrical power in batteries means that accurate array sizing becomes feasible for remote mining areas as battery storage technologies advance. Moreover, availability of legal standards and monetary motivators also help organizations in developing their interest in the issues of renewable energy sources. This trend is expected to persist and determine the future of sustainable mining and concomitantly reduce the biophysical impacts.

Green Mining Market Limiting Factor- Expansion into Emerging Markets

- The green mining market has vast potential in young markets with high demand for resources that can be developed through diversity.. Mineral resources and mining is prevalent in the Africa, Latin American countries and some parts of Asia which countries are recently experiencing a dramatic increase in mining activities. These are ASIA PACIFIC regions and other areas where mining is active as the development of these regions call for increased attention toward sustainable mines to avoid vitiating natural resources and the people in those areas. Such resources are integrated into emerging markets for green mining technologies, and also provide competition advantage to companies towards sustainable mining. However, as development of these regions escalates there is an increasing need to adopt and implement sound mining techniques that will avoid the negative impacts on environment and the people.• Embracing green mining technologies in emerging markets are consistent with the global sustainability drive a plus for companies that embrace the technology.lity goals.h as Africa, Latin America, and parts of Asia are rich in mineral resources and are witnessing a surge in mining activities. As these regions develop, the need for sustainable mining practices becomes even more critical to prevent environmental degradation and ensure the well-being of local communities.

- Investing in green mining technologies in emerging markets not only aligns with global sustainability efforts but also provides a competitive advantage for companies. That is why, it is important to start making changes in the mining industry from now, the practices will receive social approval of the communities and become the best example of reasonable mining solutions. This opportunity is especially valuable given the growing global trend of customers making decisions to only buy eco-friendly products.

Green Mining Market Segment Analysis:

Green Mining Market Segmented based on Type, Technology, and Region.

By Type, Surface Mining segment is expected to dominate the market during the forecast period

- Surface Mining is a major segment in the green mining market oriented at the extraction of minerals on the earth’s surface. This method has undergone a radical transformation incorporating sustainable practices that are environmentally friendly. Technologies include the modern means of excavations, which cause little disturbance to the land and erosion is controlled. However, the process of reclaiming the land once the mining process is complete is also increasing in practice in order to revive the affected land and bring increases the number of living organisms of the land.

- The Underground Mining also holds significant market share in the Global Green mining market. This method is normally perceived to have less effects than surface mining, this is because it does not have a very disruptive effect on the top layer. Nevertheless, there are challenges associated with underground mining, for example, water management challenge, energy challenge, etc. Adoption of pro-environment friendly technologies as well as adopting electrical powered equipment and extensive integration of automation is another inevitable strategies aimed at cutting emissions and energy use. Firms that specialize in safe underground mining are well placed to address tightening legal standards plus increasing customer desire for ethically produced ores.

By Technology , Power Reduction segment held the largest share in 2024

- Power Reduction is one of the major areas in the green mining market, whose main concern is reduction of energy use in mining activities. This makes mining firms very interested in solutions to rein in energy consumption as costs continue to climb and rules develop into more stringent. Realization of energy reduction requires the application of energy conservation measures and the enhancement of organizational procedures. Businesses are also sourcing for other sources of energy including solar and wind to power their operations hence, they have a significantly low operating costs and the impacts of their activities on the environment are low.

- Emission Reduction is another major use case factor on which the green mining market relies heavily. With growing public and governmental concern for the environment, there has been growing interest among the mining industry in reducing the levels of emissions from its activities. This comprise uptake of cleaner technologies, optimizing transport arrangements, and sound management of wastes. Thus, the optimization of emission reduction not only serves the regulatory requirements of business but also has the social desirability to appeal to ‘green’ consumers and shareholders.

Green Mining Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The green mining market is presently being led by the Asia-Pacific region due to the increasing rate of industrialization in a country like China, India as well as the booming demand for resources in Australia. Currently, China being among the global largest producers of minerals is seeking to adopt green technologies in mining with a view of mitigating on the identified environmentally sensitive impacts of mining. These include the increased regulation of mining projects and the integration of environmentally responsible practices by the Chinese government which create numerous growth opportunities for the green mining solutions.

- Also for the same reason that the mining of Australia is moving forward towards the green mining concept because here the mining industry has begun to look at the sustainable direction. The industry in Australia is embracing sustainable technologies and approaches in the extraction and processing of minerals, in order to elaborate new developments for the extraction and processing of minerals and to reduce the negative consequences to the surroundings. With the region increasingly adopting green mining initiatives, it is poised to lead the global market setting a pace in terms of impact.

Active Key Players in the Green Mining Market

- Rio Tinto (UK)

- BHP Group (Australia)

- Vale S.A. (Brazil)

- Glencore (Switzerland)

- Anglo American plc (UK)

- Barrick Gold Corporation (Canada)

- Newmont Corporation (USA)

- Freeport-McMoRan Inc. (USA)

- Teck Resources Limited (Canada)

- China Shenhua Energy Company Limited (China)

- Others Active Player

Key Industry Developments in the Green Mining Market

- In February 2024, Anglo American announced that its Barro Alto nickel mines and Minas-Rio iron ore in Brazil had been evaluated according to the Initiative for Responsible Mining Assurance's (IRMA) mining standard. The mines have successfully achieved the IRMA 75 standard of performance, which demonstrates the company's commitment to sustainability and transparency in its pursuit of responsible metal production.

- In February 2024, Petrobras and ArcelorMittal Brazil signed a MoU to explore beneficial business models in the low-carbon economy. This extensive collaboration is based on collaborations identified in a joint study to develop a Carbon Capture and Storage (CCS) hub in the state of Espírito Santo.

|

Global Green Mining Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 14.45 Bn. |

|

Forecast Period 2025-32 CAGR: |

4.21% |

Market Size in 2032: |

USD 20.10 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Green Mining Market by Type (2018-2032)

4.1 Green Mining Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Surface Mining

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Underground Mining

Chapter 5: Green Mining Market by Application (2018-2032)

5.1 Green Mining Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Power Reduction

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Emission Reduction

5.5 Water Reduction

5.6 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Green Mining Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 CANOPY GROWTH CORPORATION (CANADA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 APHRIA INC. (CANADA)

6.4 VIVO MARIJUANA INC. (CANADA)

6.5 ORGANIGRAM HOLDING INC. (CANADA)

6.6 AURORA MARIJUANA INC. (CANADA)

6.7 THE GREEN ORGANIC DUTCHMAN (CANADA)

6.8 ATLAS GROWERS (CANADA)

6.9 MARICANN GROUP INC. (CANADA)

6.10 TILRAY INC. (CANADA)

6.11 TERRA TECH CORP. (US)

6.12 STENOCARE A/S (DENMARK)

6.13 HEXO CORP. (CANADA)

6.14 MEDICAL CANNABIS INC. (US)

6.15 ALEPHSANA GMBH (GERMANY)

6.16 TIKUN OLAM LTD. (ISRAEL)

6.17 CANNABIS SCIENCE INC. (US)

Chapter 7: Global Green Mining Market By Region

7.1 Overview

7.2. North America Green Mining Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Surface Mining

7.2.4.2 Underground Mining

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Power Reduction

7.2.5.2 Emission Reduction

7.2.5.3 Water Reduction

7.2.5.4 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Green Mining Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Surface Mining

7.3.4.2 Underground Mining

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Power Reduction

7.3.5.2 Emission Reduction

7.3.5.3 Water Reduction

7.3.5.4 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Green Mining Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Surface Mining

7.4.4.2 Underground Mining

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Power Reduction

7.4.5.2 Emission Reduction

7.4.5.3 Water Reduction

7.4.5.4 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Green Mining Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Surface Mining

7.5.4.2 Underground Mining

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Power Reduction

7.5.5.2 Emission Reduction

7.5.5.3 Water Reduction

7.5.5.4 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Green Mining Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Surface Mining

7.6.4.2 Underground Mining

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Power Reduction

7.6.5.2 Emission Reduction

7.6.5.3 Water Reduction

7.6.5.4 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Green Mining Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Surface Mining

7.7.4.2 Underground Mining

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Power Reduction

7.7.5.2 Emission Reduction

7.7.5.3 Water Reduction

7.7.5.4 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Green Mining Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 14.45 Bn. |

|

Forecast Period 2025-32 CAGR: |

4.21% |

Market Size in 2032: |

USD 20.10 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||