Glass Recycling Market Synopsis

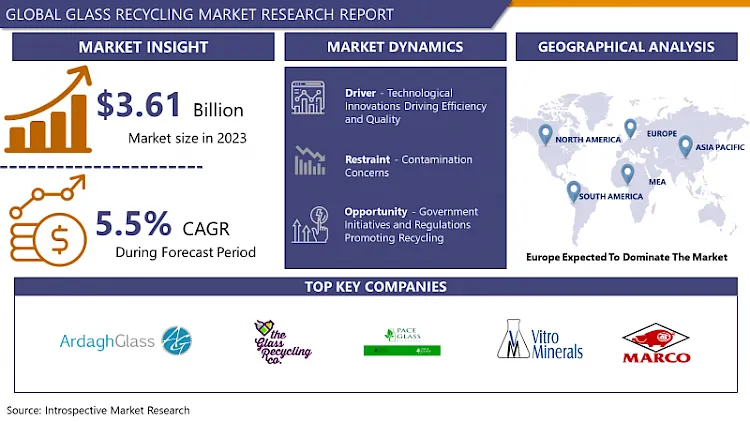

Glass Recycling Market Size Was Valued at USD 3.81 Billion in 2024, and is Projected to Reach USD 6.87 Billion by 2035, Growing at a CAGR of 5.5% From 2025-2035.

To be more exact, glass recycling comprises of the tasks of collecting, classifying (as well as sorting) and decreasing glass waste in form of a fresh products or material. This technology is used not only in breaking used glass products such as bottles, cans and jars, cleaning them to eliminate any contamination, but also in the melting of glass products to come up with new ones. Recycling glass aids the preservation of natural resources, saves on energy expenditures, and ensures that fewer sizable amounts of waste find their way to landfills or incinerators.

Although the glass recycling industry was in decline for most of the 19th century, its market has shown significant growth in recent years as there is a growing emphasis placed on reducing carbon footprint and creating a sustainable circular economy. Glass recycling consists of the process of collecting, sorting, processing, and reintroducing glass trash into new products which decrease the extraction of natural resources, limit water usage, and prevent the dumping of wastes in landfills. This market has a lead a lots of stakeholders: glass manufacturers, recycles, government agencies, ecologist and people.

While sustainability has emerged as an important factor, the main parameters of glass recycling market growth are the increasing demand for eco-friendly packaging solutions. Because glass is highly inert, sensitive to the penetration and used for its good food preservation properties glass is highly preferred for the packaging. Increasingly there arises a desire for products in recyclable materials like glass among the environmentally minded as their eco-consciousness rises. The said phenomenon has stimulated manufacturers to invest in high-tech facilities and implement green responsibilities to comply with ecological requirements of consumers and with a view of cutting down on their carbon footprint.

The government as a driving force demonstrates regulatory and promotional activities that accelerate the market of glass recycling. Lots of nations have this policy of recycling and reusing glass containers to minimize the amount of waste products that are made and also to maximize the utilization of the natural resources. Such regulations in almost all cases limit the number of producers and require them to pay a deposit for every unit sold, which is fortified by an EPR program supporting recycling targets. governments may offer grants, subsidies, and tax rebates to help the glass recycling operations and technology structure rise up.

A mass of the glass recycling industry was fostered by the application of innovations stemming from technology through enhanced efficiency and effectiveness. Innovations in the techniques of dismantling it, recycling it including the colored, laminated, and heat-resistant glass varieties have made glass recycling easy. The latest sorting mechanisms that depend on the sensors, AI, and robots help to sort glass into two categories, i.e., by glass coloring, diameter, and quality, and so, they improve the quality of the recovered cullet.

Glass Recycling Market Trend Analysis

Technological Innovations Driving Efficiency and Quality

- A wide array of technological advancements is proving to be an integral imperative in this regard, and this is particularly considering the fact that these technologies ensure quality and efficiency in the glass recycling industry. New sorting and separation technics, including optical scanners and eddy current separators are automating, and hence revolutionizing, the recycling processes by using high-tech equipment which can classify the glass by color, type, and quality. With more and more recent technologies recyclers can get the impurities out of the recycled glass and the quality will meet closely current days standards bringing up the value of the glass.

- Thus, the application of glass cleaning technologies like washing systems, detergents that are specially designed, imply the purification of the glass, gaining of certain quality it and making it suitable for multiple applications. the new trend is foreboding developments in logistics circles and data analysis to analyze routes, trim transportation costs and straighten work operations which eventually improve efficiency of glass recycling system.

Government Initiatives and Regulations Promoting Recycling

- Government initiatives and regulations play a pivotal role in promoting the glass recycling market. Becoming more prevalent in many countries are different policies promoting glass recycling because its environmental advantages are recognized globally. Such methods commonly feature the financial refunds which can be received in the form of tax breaks or subsidies by the manufacturers and residents that are engaged in the glass recovery procedure.

- Among the established regulations setting the minimal fraction of recycled glass in, e.g. packaging or building material products, another source of the demand comes. governments regularly make commitments to finance both the collection, sorting, and processing of recycled glass material, which greatly facilitates the essential recycling procedures. Through the establishment of a constructive regulation system and the provision of the necessary recycling infrastructure, which essentially leads to development, local governments play a crucial role in building the glass recycling market and so, by doing so, they help to reduce waste and preserve natural resources.

Glass Recycling Market Segment Analysis:

Glass Recycling Market is Segmented based on Source and Application.

By Source, Container segment is expected to dominate the market during the forecast period

- Container:We can further narrow down this category into glass bottled products which are used as containers for beverages, food, cosmetics, and medications. Assessment will include calculating Glass containers volumes recycled, marketing and educating consumer about importance of recycling, new innovations in container design intended to increase their recyclability as well as activities taken by beverage and packaging companies including promotion of glass recycling.

- Construction:The waste from construction activities which is manufactured from glass includes windows, doors, glass partitions, and glass facilities. The study would center on assessing the role that construction industry plays in glass waste, establishment of trends in building practices which favor glass recycling, obtaining of technology for processing construction glass for recycling and government policies that promote recycling of construction glass waste possible.

- Others With glass container being a small portion of total glass collected and recycled, other sources like automotive and electronics glasses, and glassware are included in the category. The analysis would identify the range of sources amongst this group, current trends of glass use in several sectors, assess the barriers to be overcome in collecting non-container glass for recycling, and determine the ways of increasing general knowledge of reuse and collection of this waste stream.

By Application , Glass Bottle & Containers segment held the largest share

- One the main features of glass recycling industry is the activities in a multitude of application fields that are crucial in environmental preservation strategies. In the beverage caps and containers market almost half of all products are glasses which are used to package goods in different categories of foods, beverages and other consumer products. By recycling glass containers and bottles, we not only place a check on the use of natural resources but also minimize the energy consumption and the greenhouse gas emissions required in prducing new glass from raw materials. This part of the market holds the ground because consumers realize how important recycling is and the issues of ecological effect, and this is why the government comes with a rule regulating enterprises to implement green packaging practices.

- Bulky fiber Glass are the third strut of the main market of glass Recycling. The industry sector namely, construction, transportation, aviation and electronics takes advantage of fiberglass due to its superior mechanical properties, high thermal insulation and resistance to corrosion. The recycling of glass into fiber glass not only helps to reduce the demand for virgin produced materials but also helps to minimise the generation of waste. Hence, promoting it as a green option in diverse industries will help improve the overall environmental footprint.

- Besides Plastics, concrete aggregates are another major recycling application of recycled glass. Utilization of crushed glass in concrete aggregates is multi-proven which involves enhancement of property, decreasing of weight and providing better insulation. Not only this, but the use of recycled glass as an aggregate in cement allows for the reduction in the sand and gravel demand which saves from finishing natural aggregates; as a consequence, the quarrying activity effects are minimized. This way has recently been growing in popularity, especially on the sites supporting the green building and environmentally sound engineering projects that are a high priority at present.

Glass Recycling Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast period

- For the near perspective, we expect Europe to dominate the glass recycling market. European countries stand ahead of others concerning sustainability and environmental consciousness for they have shown a strong trend towards improved waste recycling infrastructure and policies. The result of the region's willingness to apply the principles of circular economy, alongside the regulation of recycling and the introduction of various incentives, is a wonderful example of what glass recycling is made up of.

- And, by educating consumers better about why they need to recycle and their excess waste, the need for recycling is growing stronger across industries. the European Union's demanding waste management policies with landfill bans and collection targets have sparked the development of new investments in glass recycling infrastructure and technology.

Active Key Players in the Glass Recycling Market

- Ardagh(Europe)

- Shanghai Yanlongji(China)

- The Glass Recycling Company(South Africa)

- Spring Pool(US)

- Pace Glass(US)

- Vitro Minerals(Georgia)

- Marco Abrasives(US)

- Rumpke(US)

- Binder+Co(Austria)

- Owens Corning(US)

- Vetropack Holding(Europe)

- Other Active Players

Key Industry Developments in the Glass Recycling Market

- The investment of AUD$ 50 million was a kick-start for the recovery or sorting of glass by Visy(a leading company which produces packaging ,recycles or logistics).The announcement was in February 2024, in Melbourne, Victoria,Australia. The upgrades would more than double our capacity to recycle glass of as much as 200 000 tons a year, after which it doubles subsequently.

- In the month of February 2024, Thor Energy, a company that discards solar panels, announced its plan to install a US$ 344 million factory in Georgia It reduces need for raw materials, such as glass for solar panels, whose aim is decreasing the amount of waste to be recycled totalling one million solar panels per year, which is about 5 gigawatts of electricity annually.

|

Global Glass Recycling Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 3.81 Bn. |

|

Forecast Period 2025-35 CAGR: |

5.5 % |

Market Size in 2035: |

USD 6.87 Bn. |

|

Segments Covered: |

By Source |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Glass Recycling Market by Source (2018-2035)

4.1 Glass Recycling Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Container

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Construction

4.5 Others

Chapter 5: Glass Recycling Market by Application (2018-2035)

5.1 Glass Recycling Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Glass Bottle & Containers

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Fiber Glass

5.5 Concrete Aggregate

5.6 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Glass Recycling Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 SPS COMMERCE (THE U.S)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 TRUECOMMERCE (THE U.S)

6.4 MULESOFT(THE U.S)

6.5 IBM CORPORATION (THE U.S)

6.6 CLEO (THE U.S)

6.7 DATA MASONS SOFTWARE (THE U.S)

6.8 EDICOM(SPAIN)

6.9 CROSSINX (GERMANY)

6.10 INTERTRADE SYSTEMS (THE U.S)

6.11 COMARCH (POLAND)

6.12 THE DESCARTES SYSTEMS GROUP (CANADA) OTHERS MAJOR PLAYERS.

Chapter 7: Global Glass Recycling Market By Region

7.1 Overview

7.2. North America Glass Recycling Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Source

7.2.4.1 Container

7.2.4.2 Construction

7.2.4.3 Others

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Glass Bottle & Containers

7.2.5.2 Fiber Glass

7.2.5.3 Concrete Aggregate

7.2.5.4 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Glass Recycling Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Source

7.3.4.1 Container

7.3.4.2 Construction

7.3.4.3 Others

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Glass Bottle & Containers

7.3.5.2 Fiber Glass

7.3.5.3 Concrete Aggregate

7.3.5.4 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Glass Recycling Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Source

7.4.4.1 Container

7.4.4.2 Construction

7.4.4.3 Others

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Glass Bottle & Containers

7.4.5.2 Fiber Glass

7.4.5.3 Concrete Aggregate

7.4.5.4 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Glass Recycling Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Source

7.5.4.1 Container

7.5.4.2 Construction

7.5.4.3 Others

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Glass Bottle & Containers

7.5.5.2 Fiber Glass

7.5.5.3 Concrete Aggregate

7.5.5.4 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Glass Recycling Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Source

7.6.4.1 Container

7.6.4.2 Construction

7.6.4.3 Others

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Glass Bottle & Containers

7.6.5.2 Fiber Glass

7.6.5.3 Concrete Aggregate

7.6.5.4 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Glass Recycling Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Source

7.7.4.1 Container

7.7.4.2 Construction

7.7.4.3 Others

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Glass Bottle & Containers

7.7.5.2 Fiber Glass

7.7.5.3 Concrete Aggregate

7.7.5.4 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Glass Recycling Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 3.81 Bn. |

|

Forecast Period 2025-35 CAGR: |

5.5 % |

Market Size in 2035: |

USD 6.87 Bn. |

|

Segments Covered: |

By Source |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||