Formwork System Market Synopsis:

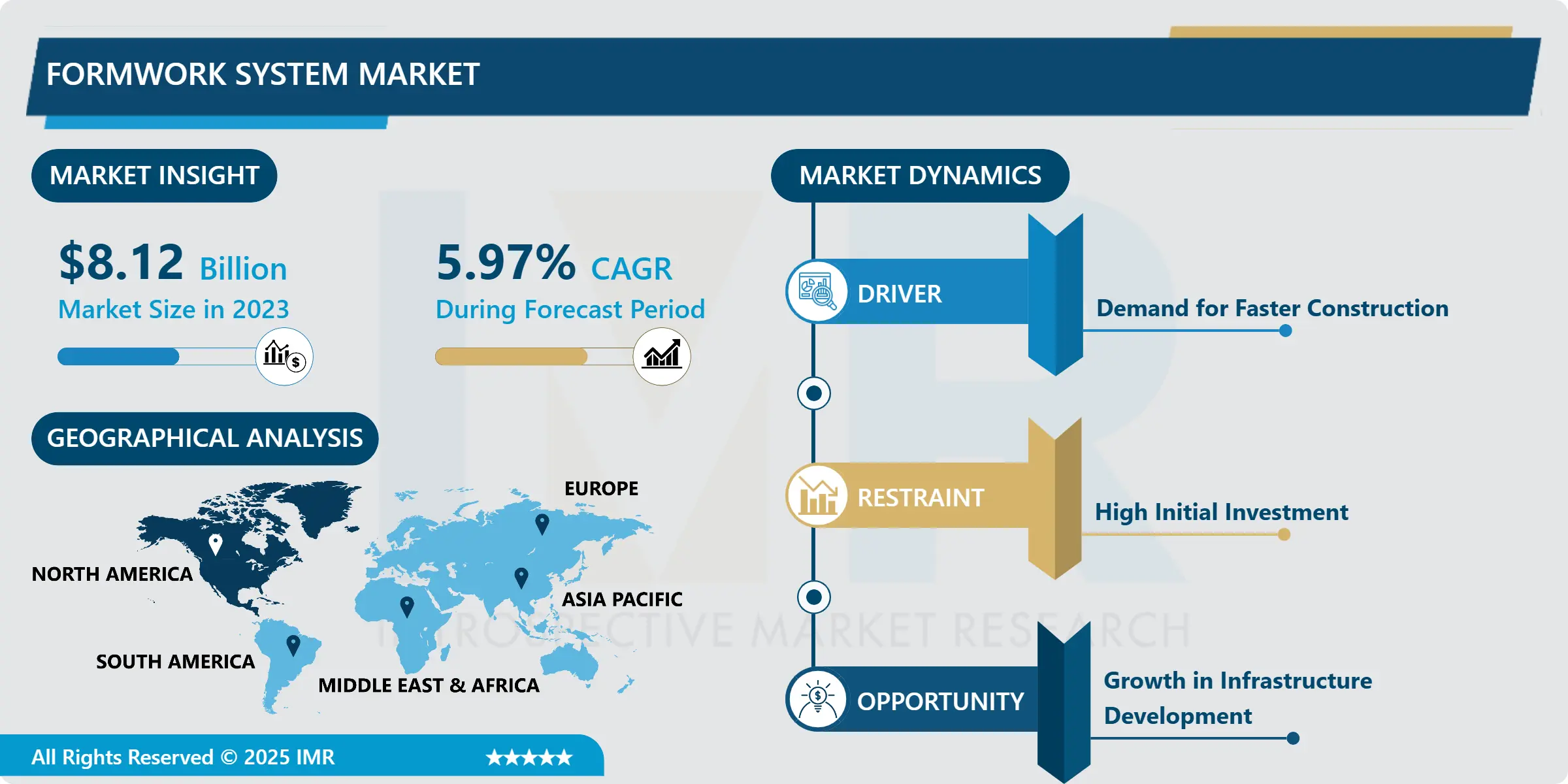

Formwork System Market Size Was Valued at USD 8.12 Billion in 2023, and is Projected to Reach USD 13.68 Billion by 2032, Growing at a CAGR of 5.97% From 2024-2032.

The formwork system market means the global consumption of the temporary or permanent mold used to contain concrete during construction. These systems give various forms to some load bearing parts such as walls, slabs and beams as the concrete gains its shape and strength. It is widely being implemented in construction ventures which include real estate, industrial as well as civil.

The formwork system market is segmented as the construction industry segment which is significant in the civil construction market due to the current rise in development of infrastructure and cities. So with the growing construction market in the international arena, the demand for formwork solutions has also grown significantly. Formworks are still utilized in construction to cast the concrete structures and to also support them for a certain period of time during the hardening period. The advancements in the large structure construction like commercial buildings, bridges, and roads will contribute to the high demands for formwork systems.

Because of the development of the many formwork systems over time the traditional timber formwork system has been modified in one way or the other. The formwork systems that are early in use were timber in nature but with increased technology and new products in the market we now have engineered and composite formwork systems. Material formworks that are engineered to be used are likely to be made of steel or aluminum since they form part of the components that require faster assembly and higher durability than the traditional methods of construction. Hybrid formwork is a general formwork with elements in both traditional and modern technological materials to achieve satisfactory cost and excellent performance. Another trend currently observable in the contemporary market area is the increased demand for lightweight and reusable formwork systems which are more cost effective than the traditional solutions but also possess a significantly lesser negative impact on the natural environment.

As the construction industry looks for safer ways to build and seeks to cut on the costs of labor and build faster the formwork system must also grow. In addition, the greater utilization of automatic or even robotic typified formwork solutions is seen to open a plethora of opportunities for growth. This has created a renewed drive for top-tier sustainable formwork solutions that can withstand this pressure while providing the application formwork requirements for large-scale constructions.

Formwork System Market Trend Analysis:

Advancements in Engineered and Hybrid Formwork Solutions

- It is majorly observed that the formwork system market has favored engineered and hybrid formworks systems. Although timber formwork is still in prevalent use, improved and more effective engineered formwork solutions from steel, aluminum and plastic materials are now appearing on the market. Some advantages associated with these systems include; Production time is reduced through assembling, Lower cost of labor, and higher product durability. Murdered formwork is widely used in large building and construction offers because it is able to address difficult and demanding projects.

- Another new trend in the market is hybrid formwork. Hybrid formwork solutions utilize both solid timber and engineered products as a more cost-friendly approach, while yielding desired durability and performance standard for more challenging construction projects. This trend should persist as developers search for versatile and conformable products to match with the particularities of a program or project. The growth in concerns for sustainable construction is also a factor impacting this shift of using these sophisticated form work technologies since they increase efficiency in material usage contributing to sustainable construction.

Growth in Infrastructure Development

- In this regards, the most promising area in formwork system market is the constant need for infrastructure development, in particularly in the developing countries. Because big nations today are adopting transportation system, energy structures, and urbanization, concrete forming systems have taken the limelight at large structures. Governments as well as private players are investing in construction of new bridges, highways and airports, which call for superior formworks to provide the needed safety, stability and efficiency in construction.

- The Asian-Pacific region and countries in Africa in particular seem to be the most active in going for infrastructure projects in their development blue prints. This is a major potential for companies operating in the formwork system market and one that allows them to market their solutions to areas with higher construction activity. Consequently, there will be increase in demand for sophisticated, sturdy and lightweight formworks as the related markets develop, posing long-term growth prospects to top players in the industry.

Formwork System Market Segment Analysis:

Formwork System Market is Segmented on the basis of Type, Material, Application, End User, and Region

By Type, Traditional Formwork segment is expected to dominate the market during the forecast period

- The formwork system market is segmented into three main types: The categories of formwork include traditional formwork, engineered formwork, as well as the half-and-half formwork. Timber based form work has been in use for many years in constriction throughout the world. It is still in extensive use primarily because of low first cost and easy procuring of the material. However, traditional formworks are sophisticated to handle, require more manpower and are not as durable as they are not ideal for large projects with more complexities.

- These two differs in the way that engineered formwork is for advanced solution to a project. These are often used through steel or aluminum and are stronger and more robust than other conventional methods of construction, and easier to install. Large scale application of engineered formwork is preferred in most of the commercial and industrial constructions where shape and strength requirements are stringent. Precast panels with conventional forming can include both classical materials and integrated engineered components; such a structure is optimal for price and performance. This makes it especially convenient for the developer who might desire flexibility and cost effective means, more so depending on the nature of the development project at hand that might be a simple or complex one.

By Application, Residential segment expected to held the largest share

- The formwork system market has application opportunities in the residential, commercial and industrial sectors, and infrastructure. Housing and utility construction more frequently implies the need for less massive formwork solutions related to foundations, walls, and floor slabs. Even nowadays traditional formwork is widespread in this segment, although productivity and cost-effective solutions for large-scale residential construction are shifting towards the application of engineered and hybrid formworks.

- The ever increasing need for commercial and industrial construction is putting pressure on developers, contractors and builders to develop sophisticated formwork solutions. These sectors need permanent and reusable formwork systems for the production of complicated body structure like office space, warehouse, and factories. These types of projects especially require engineered and hybrid formwork systems because of the strength and the load bearing capacity they possess. The additional structures like bridges, roads, and tunnels are also core drivers of the formwork system market, especially because the structures demand specific formwork system that could easily support their construction.

Formwork System Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America now takes the largest market share for the formwork system market. This can be attributed to the fact that the region has well-developed construction industry, there is high demand for construction infrastructure and the use of the new technologies. He added that advanced formwork systems have continuously been promoted in the U.S. and Canada through the investment which is being set on infrastructures such as transport systems, public facilities as well as energy projects. Another reason due to which this region is on the top is rising trend of sustainability and large numbers of major construction companies are also based in this area.

- Second, there is a well-developed construction community in North America that is composed of prominent players who can supply high-performance forms. This region also has high safety and quality standards regulations that steer the adoption of quality formwork systems in construction. The growing tendency toward shorter construction time and lower costs will contribute to the growth of demand for engineered and hybrid formwork systems to maintain North America’s dominance in the world.

Active Key Players in the Formwork System Market:

- Altrad Group (France)

- BEISSEL & WIRTH (Germany)

- Doka (Austria)

- Formwork Design & Engineering Ltd. (United Kingdom)

- Kiewit Corporation (United States)

- Linde Material Handling (Germany)

- Meva Formwork Systems (Germany)

- NOE-Schaltechnik GmbH (Germany)

- Outinord (Finland)

- PERI GmbH (Germany)

- RMD Kwikform (United Kingdom)

- Umdasch Group (Austria)

- Other Active Players

Key Industry Developments in the Formwork System Market:

- In January 2023, PERI Vertrieb Deutschland GmbH & Co. KG, a subsidiary of the PERI SE, a Germany-based formwork and scaffolding systems manufacturer, acquired Implenia Schalungsbau GmbH, a company specializing in smart services and complete solutions for formwork.

|

Formwork System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.12 Billion |

|

Forecast Period 2024-32 CAGR: |

5.97% |

Market Size in 2032: |

USD 13.68 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Formwork System Market by Type

4.1 Formwork System Market Snapshot and Growth Engine

4.2 Formwork System Market Overview

4.3 Traditional Formwork

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Traditional Formwork: Geographic Segmentation Analysis

4.4 Engineered Formwork

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Engineered Formwork: Geographic Segmentation Analysis

4.5 Hybrid Formwork

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Hybrid Formwork: Geographic Segmentation Analysis

Chapter 5: Formwork System Market by Material

5.1 Formwork System Market Snapshot and Growth Engine

5.2 Formwork System Market Overview

5.3 Wood

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Wood: Geographic Segmentation Analysis

5.4 Steel

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Steel: Geographic Segmentation Analysis

5.5 Aluminum

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Aluminum: Geographic Segmentation Analysis

5.6 Plastic

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Plastic: Geographic Segmentation Analysis

5.7 Concrete

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Concrete: Geographic Segmentation Analysis

Chapter 6: Formwork System Market by Application

6.1 Formwork System Market Snapshot and Growth Engine

6.2 Formwork System Market Overview

6.3 Residential

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Residential: Geographic Segmentation Analysis

6.4 Commercial

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Commercial: Geographic Segmentation Analysis

6.5 Industrial

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Industrial: Geographic Segmentation Analysis

6.6 Infrastructure

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Infrastructure: Geographic Segmentation Analysis

Chapter 7: Formwork System Market by End-User

7.1 Formwork System Market Snapshot and Growth Engine

7.2 Formwork System Market Overview

7.3 Construction Contractors

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Construction Contractors: Geographic Segmentation Analysis

7.4 Civil Engineering

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Civil Engineering: Geographic Segmentation Analysis

7.5 Real Estate Developers

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Real Estate Developers: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Formwork System Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 PERI GMBH (GERMANY)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 UMDASCH GROUP (AUSTRIA)

8.4 BEISSEL & WIRTH (GERMANY)

8.5 DOKA (AUSTRIA)

8.6 NOE-SCHALTECHNIK GMBH (GERMANY)

8.7 ALTRAD GROUP (FRANCE)

8.8 FORMWORK DESIGN & ENGINEERING LTD. (UNITED KINGDOM)

8.9 LINDE MATERIAL HANDLING (GERMANY)

8.10 MEVA FORMWORK SYSTEMS (GERMANY)

8.11 OUTINORD (FINLAND)

8.12 RMD KWIKFORM (UNITED KINGDOM)

8.13 KIEWIT CORPORATION (UNITED STATES)

8.14 OTHER ACTIVE PLAYERS

Chapter 9: Global Formwork System Market By Region

9.1 Overview

9.2. North America Formwork System Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Type

9.2.4.1 Traditional Formwork

9.2.4.2 Engineered Formwork

9.2.4.3 Hybrid Formwork

9.2.5 Historic and Forecasted Market Size By Material

9.2.5.1 Wood

9.2.5.2 Steel

9.2.5.3 Aluminum

9.2.5.4 Plastic

9.2.5.5 Concrete

9.2.6 Historic and Forecasted Market Size By Application

9.2.6.1 Residential

9.2.6.2 Commercial

9.2.6.3 Industrial

9.2.6.4 Infrastructure

9.2.7 Historic and Forecasted Market Size By End-User

9.2.7.1 Construction Contractors

9.2.7.2 Civil Engineering

9.2.7.3 Real Estate Developers

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Formwork System Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Type

9.3.4.1 Traditional Formwork

9.3.4.2 Engineered Formwork

9.3.4.3 Hybrid Formwork

9.3.5 Historic and Forecasted Market Size By Material

9.3.5.1 Wood

9.3.5.2 Steel

9.3.5.3 Aluminum

9.3.5.4 Plastic

9.3.5.5 Concrete

9.3.6 Historic and Forecasted Market Size By Application

9.3.6.1 Residential

9.3.6.2 Commercial

9.3.6.3 Industrial

9.3.6.4 Infrastructure

9.3.7 Historic and Forecasted Market Size By End-User

9.3.7.1 Construction Contractors

9.3.7.2 Civil Engineering

9.3.7.3 Real Estate Developers

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Bulgaria

9.3.8.2 The Czech Republic

9.3.8.3 Hungary

9.3.8.4 Poland

9.3.8.5 Romania

9.3.8.6 Rest of Eastern Europe

9.4. Western Europe Formwork System Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Type

9.4.4.1 Traditional Formwork

9.4.4.2 Engineered Formwork

9.4.4.3 Hybrid Formwork

9.4.5 Historic and Forecasted Market Size By Material

9.4.5.1 Wood

9.4.5.2 Steel

9.4.5.3 Aluminum

9.4.5.4 Plastic

9.4.5.5 Concrete

9.4.6 Historic and Forecasted Market Size By Application

9.4.6.1 Residential

9.4.6.2 Commercial

9.4.6.3 Industrial

9.4.6.4 Infrastructure

9.4.7 Historic and Forecasted Market Size By End-User

9.4.7.1 Construction Contractors

9.4.7.2 Civil Engineering

9.4.7.3 Real Estate Developers

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 Netherlands

9.4.8.5 Italy

9.4.8.6 Russia

9.4.8.7 Spain

9.4.8.8 Rest of Western Europe

9.5. Asia Pacific Formwork System Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Type

9.5.4.1 Traditional Formwork

9.5.4.2 Engineered Formwork

9.5.4.3 Hybrid Formwork

9.5.5 Historic and Forecasted Market Size By Material

9.5.5.1 Wood

9.5.5.2 Steel

9.5.5.3 Aluminum

9.5.5.4 Plastic

9.5.5.5 Concrete

9.5.6 Historic and Forecasted Market Size By Application

9.5.6.1 Residential

9.5.6.2 Commercial

9.5.6.3 Industrial

9.5.6.4 Infrastructure

9.5.7 Historic and Forecasted Market Size By End-User

9.5.7.1 Construction Contractors

9.5.7.2 Civil Engineering

9.5.7.3 Real Estate Developers

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Formwork System Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Type

9.6.4.1 Traditional Formwork

9.6.4.2 Engineered Formwork

9.6.4.3 Hybrid Formwork

9.6.5 Historic and Forecasted Market Size By Material

9.6.5.1 Wood

9.6.5.2 Steel

9.6.5.3 Aluminum

9.6.5.4 Plastic

9.6.5.5 Concrete

9.6.6 Historic and Forecasted Market Size By Application

9.6.6.1 Residential

9.6.6.2 Commercial

9.6.6.3 Industrial

9.6.6.4 Infrastructure

9.6.7 Historic and Forecasted Market Size By End-User

9.6.7.1 Construction Contractors

9.6.7.2 Civil Engineering

9.6.7.3 Real Estate Developers

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkey

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Formwork System Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Type

9.7.4.1 Traditional Formwork

9.7.4.2 Engineered Formwork

9.7.4.3 Hybrid Formwork

9.7.5 Historic and Forecasted Market Size By Material

9.7.5.1 Wood

9.7.5.2 Steel

9.7.5.3 Aluminum

9.7.5.4 Plastic

9.7.5.5 Concrete

9.7.6 Historic and Forecasted Market Size By Application

9.7.6.1 Residential

9.7.6.2 Commercial

9.7.6.3 Industrial

9.7.6.4 Infrastructure

9.7.7 Historic and Forecasted Market Size By End-User

9.7.7.1 Construction Contractors

9.7.7.2 Civil Engineering

9.7.7.3 Real Estate Developers

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Formwork System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.12 Billion |

|

Forecast Period 2024-32 CAGR: |

5.97% |

Market Size in 2032: |

USD 13.68 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||