Global Fiberglass Geogrid Market Overview

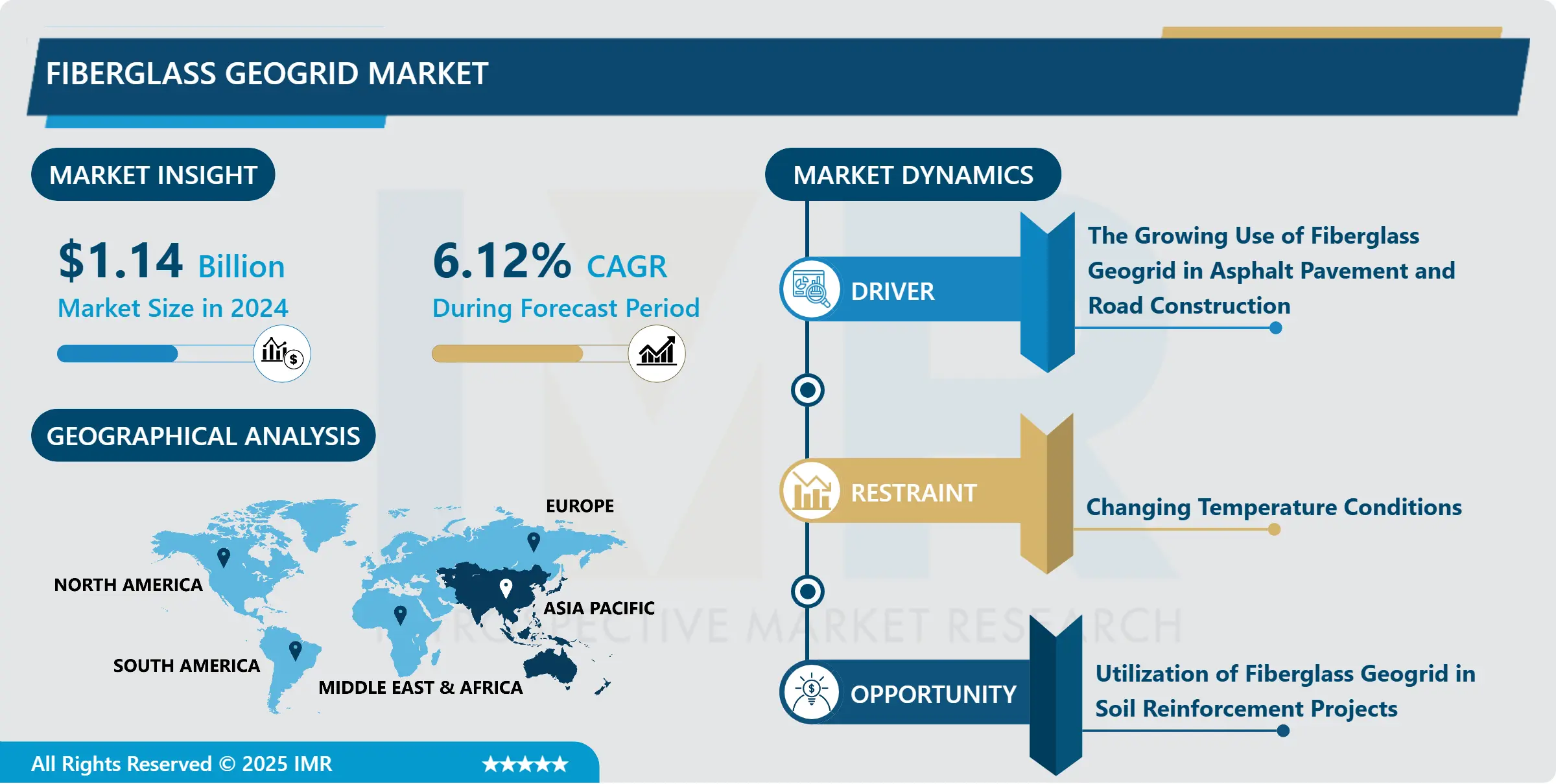

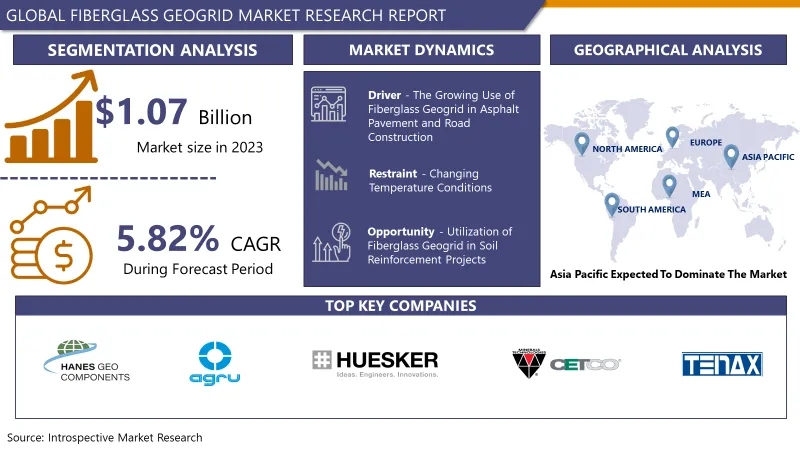

Fiberglass Geogrid Market Size Was Valued at USD 1.47 Billion in 2024, and is Projected to Reach USD 2.19 Billion by 2035, Growing at a CAGR of 6.12 % From 2025-2035.

Fiberglass geogrid is a new kind of geosynthetic fabric. It is crafted from fiberglass filament. This product adopts a particular woven technique. It is covered with a unique solution. Fiberglass geogrid has robust tension and It has a large bearing capability of the floor and prolongs the provider existence of the road. This fabric has excessive tensile electricity and is correctly put on a resistant performance. It is appropriate for the reinforcement of gentle soil, cement, concrete, asphalt, and so on. Compared with metal-plastic geogrid, fiberglass geogrid has higher warmness resistance. This fabric is characterized via way of means of wonderful thermal stability. It plays nicely below excessive temperature.

Fiberglass geogrid has long time structural stability. It is appropriate for everlasting projects. Fiberglass geogrid is appreciably utilized in asphalt pavement, soil stabilization, and embankment reinforcement. It can efficaciously save the floor from cracking and subsiding. Applying this product can lessen the overlay thickness of asphalt, thus, fiberglass geogrid can significantly lessen the development price and undertaking.

Market Dynamics and Factors of Fiberglass Geogrid Market

Fiberglass Geogrid Market Drivers:

- The growing use of fiberglass geogrid in asphalt pavement and road construction activity creates high demand in the construction sector. Fiberglass Geogrid Composite Geotextile Fabric gives enhanced loading capacity of road construction. Composite Geogrid to Improve Carrying Capacity in road construction used to stabilize soils that need both reinforcement and separation between granular base and fine soil. Geo-composite binds tightly to the soil to be reinforced, separates different types of soil, and ensures an effective filtering effect. The composite geogrid is created by combining non-woven geotextiles with fiberglass geogrids. Adhesion to polypropylene- polyester geotextile seam bond or fiberglass geogrid. With high tensile strength and excellent tear and tear protection, these new composite building materials are often used in water protection, road construction, construction.

- Fiberglass Geogrid provides a versatile trait that is driving the market globally. Fiberglass Geogrids can improve the structural integrity of soil on roads, walls, and embankments by strengthening and confining fillers and distributing load forces. Fiberglass Geogrids are the answer for planners, developers, and building contractors facing the challenges of sloping floors and soft surfaces. The Fiberglass Geogrid helps the floor stand at virtually any angle in grade separation applications. For retaining wall and embankment applications, Fiberglass geogrids can be combined with various façade elements to achieve the aesthetics needed for any project. Geogrids support the construction of access roads, highways, shores, embankments, and structures that previously required the use of expensive superstructures or pile driving methods on weak substructures. Geogrids are also used in basic reinforcement applications to reduce aggregate thickness requirements and longer performance of the road quality.

Fiberglass Geogrid Market Restraints:

- Fiberglass Geogrid reacts poorly to low temperatures reducing the tensile strength of the geogrid. The decrease in temperature caused a lessening in the elongation at failure. Also, the interlaminar shearing test showed a 20% weakening in the fiber particles of the Fiberglass geogrid. In Extremely cold regions Fiberglass Geogrid can perform poorly in any application which makes it a restraining factor for the use in a particular region.

Fiberglass Geogrid Market Opportunities:

- Utilization of Fiberglass Geogrid in soil reinforcement projects tremendous opportunity in the coming years. The function and use of Fiberglass Geogrids are of primary concern in soil reinforcement under roads, under structures, and behind retaining walls. Fiberglass Geogrids are the most important geosynthetics with unique characteristics, features, and applications compared to other geosynthetics. Fiberglass Geogrids are made with large openings or openings made of polymers such as polypropylene, polyethylene, and polyester. Fiberglass Geogrids are made from high-strength reinforcing mesh that is available in rolls of various sizes and thicknesses. The bottom can penetrate the opening and the two materials engage and join. Geogrid gives the wall great strength and durability and prevents it from breaking and acts as resistant to biodegradable and naturally occurring chemicals, alkalis, and acids.

Fiberglass Geogrid Market Challenges:

- Volatile prices of polyesters and polypropylenes due to fluctuations in crude oil prices can impede product demand. Lack of training and unskilled civil and structural engineers, as well as patent restrictions and typical product specifications, are expected to impede the growth of the fiberglass geogrid market. Lack of know-how and R & D activities in developing countries can reduce the scope of geogrids in these countries. However, increased awareness of product benefits and increased demand for quality-guaranteed designs are expected to create opportunities for market participants during the forecast period.

Fiberglass Geogrid Market Segmentation

Segmentation Analysis of Fiberglass Geogrid Market

- By Type, Biaxial Tension is the dominating in the fiberglass geogrid market. Biaxial tensile tension in the fiberglass geogrid is made from a high-end polymer that provides high bearing capacity at stable aperture side. Biaxial Fiberglass geogrids have high strength both vertically and horizontally. It is made through a process of extrusion, sheet metal forming, stamping, and stretching. The biaxial fiberglass geogrid has a good bearing capacity. It can improve soil structure and prevent soil erosion. This product is widely used to prevent reflections and fatigue cracks on the road. The 2-axis geogrid can effectively improve long-term underground durability and significantly reduce road maintenance costs. The twin-axis geogrid has excellent resistance to long-term deterioration. Biaxial Tension based fiberglass geogrid provides suitable applications including reinforcement, wall reinforcement, soil stabilization, slope stabilization, and other permanent bearing foundation. Thus, high demand in the growing construction sector boosts the Fiberglass Geogrid Market.

- By Application, Railroad is the dominating in the application segment of Fiberglass Geogrid Market. Fiberglass geogrids are widely used in the construction of subways, railroads, and highways to reinforce soft ground, segmented retaining walls, embankments, and substructures. Fiberglass geogrids are often used to reinforce asphalt pavements, stabilize soil, and reinforce embankments, and also used as an upgraded secondary geogrid. The growing popularity of polymer-based product use in construction and industrial application considering the high tensile strength and versatility in a variety of sectors creates hyped for such products in the industry. Thus, major companies investing heavily into research into polymer-based products such as Fiberglass geogrid. Such demand from various verticals of the industry boosted the growth of the Fiberglass Geogrid Market.

Regional Analysis of Fiberglass Geogrid Market

- The Asia Pacific is the dominating region in the Fiberglass Geogrid Market. The Asia Pacific occupies the largest manufacturing industry of polymer-based products used in various applications. China is the largest manufacturer and leading exporter of fiberglass geogrid which has clientele in Asia, Australia, Europe, North America, and some countries in South America. India is one second leading country in terms of manufacturing and use of Fiberglass geogrid due to the vast railroad network across the country and utilization in construction and supplementary industrial projects supported by the government. Japan, South Kora, the Philippines, and Indonesia hold substantial manufacturing of the Fiberglass Geogrid which supply's to the global market.

- North America is has seen significant growth in the utilization of Fiberglass Geogrid and expected to project upward growth in the Fiberglass Geogrid Market. The United States is the largest importer of Fiberglass Geogrid as well as other types of geogrid which are generally sourced from China and India. Vast utilization of fiberglass geogrid into asphalt pavement reinforcement, soil stabilization, and embankment reinforcement in United States, Canada which reflects on the superior road infrastructure across the country. fiberglass geogrid provides robustness and long life to the road infrastructure making it a highly demanding material in North America. Also, Use of fiberglass geogrid in soil reinforcement and stabilization in high wind regions making it a suitable choice of material in the United States has boosted the global Fiberglass Geogrid Market.

Players Covered in Fiberglass Geogrid Market are:

- Hanes Geo Components

- Agru America Inc

- Belton Industries Inc

- Husker Synthetic GmbH

- Cetco

- Ace Geosynthetics

- Tenax

- Asahi-Kasei Geotech and other major players.

Key Industry Developments In Fiberglass Geogrid Market

- February 2021, the leading producer of Saint Gobain, ADFORS GlasGrid is utilized in between tram tracks in Moskevska Street, Prague, Czech Republic. The ADFORS GlasGrid offers long-time anti-crack protection in superior repairs with the use of resin asphalt layer as a top layer and was introduced the first time in the Czech Republic.

- In May 2024, Knauf Insulation, Inc. unveiled Knauf Performance+, its new line of HVAC fiberglass insulation. Certified asthma & allergy friendly® and formaldehyde-free, it's a breakthrough in indoor air quality. Nathan Walker, SVP Sales, Marketing and Innovation, highlighted Knauf's commitment to innovation and sustainability, citing their use of bio-based ECOSE® binder and status as GREENGUARD-certified pioneers.

|

Global Fiberglass Geogrid Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.14 Bn. |

|

Forecast Period 2025-35 CAGR: |

6.12% |

Market Size in 2035: |

USD 2.19 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Fiberglass Geogrid Market by Type (2018-2032)

4.1 Fiberglass Geogrid Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Biaxial Tension

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Uniaxial Tension

Chapter 5: Fiberglass Geogrid Market by Application (2018-2032)

5.1 Fiberglass Geogrid Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Road & Pavement

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Railroads

5.5 Drainage Systems

5.6 Containment & Waste Water

5.7 Soil Reinforcement & Erosion

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Fiberglass Geogrid Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 CAT PUMPS (U.S.)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 PENTAIR (U.S.)

6.4 FLOWSERVE CORPORATION (U.S.)

6.5 XYLEM INC. (U.S.)

6.6 FRANKLIN ELECTRIC COINC. (U.S.)

6.7 BAKER HUGHES COMPANY (U.S.)

6.8 MAXIMATOR GMBH (GERMANY)

6.9 SEEPEX GMBH (GERMANY)

6.10 ATLAS COPCO AB (SWEDEN)

6.11 GRUNDFOS (DENMARK)

6.12 ANDRITZ AG (AUSTRIA)

6.13 COMET S.P.A. (ITALY)

6.14 SULZER LTD (SWITZERLAND)

6.15 EBARA CORPORATION (JAPAN)

6.16 TSURUMI MANUFACTURING COLTD. (JAPAN)

6.17 KSB LIMITED (INDIA)

6.18 KIRLOSKAR BROTHERS LIMITED (INDIA)

6.19

Chapter 7: Global Fiberglass Geogrid Market By Region

7.1 Overview

7.2. North America Fiberglass Geogrid Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Biaxial Tension

7.2.4.2 Uniaxial Tension

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Road & Pavement

7.2.5.2 Railroads

7.2.5.3 Drainage Systems

7.2.5.4 Containment & Waste Water

7.2.5.5 Soil Reinforcement & Erosion

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Fiberglass Geogrid Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Biaxial Tension

7.3.4.2 Uniaxial Tension

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Road & Pavement

7.3.5.2 Railroads

7.3.5.3 Drainage Systems

7.3.5.4 Containment & Waste Water

7.3.5.5 Soil Reinforcement & Erosion

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Fiberglass Geogrid Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Biaxial Tension

7.4.4.2 Uniaxial Tension

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Road & Pavement

7.4.5.2 Railroads

7.4.5.3 Drainage Systems

7.4.5.4 Containment & Waste Water

7.4.5.5 Soil Reinforcement & Erosion

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Fiberglass Geogrid Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Biaxial Tension

7.5.4.2 Uniaxial Tension

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Road & Pavement

7.5.5.2 Railroads

7.5.5.3 Drainage Systems

7.5.5.4 Containment & Waste Water

7.5.5.5 Soil Reinforcement & Erosion

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Fiberglass Geogrid Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Biaxial Tension

7.6.4.2 Uniaxial Tension

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Road & Pavement

7.6.5.2 Railroads

7.6.5.3 Drainage Systems

7.6.5.4 Containment & Waste Water

7.6.5.5 Soil Reinforcement & Erosion

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Fiberglass Geogrid Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Biaxial Tension

7.7.4.2 Uniaxial Tension

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Road & Pavement

7.7.5.2 Railroads

7.7.5.3 Drainage Systems

7.7.5.4 Containment & Waste Water

7.7.5.5 Soil Reinforcement & Erosion

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Fiberglass Geogrid Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.14 Bn. |

|

Forecast Period 2025-35 CAGR: |

6.12% |

Market Size in 2035: |

USD 2.19 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||