Fecal Incontinence Market Synopsis

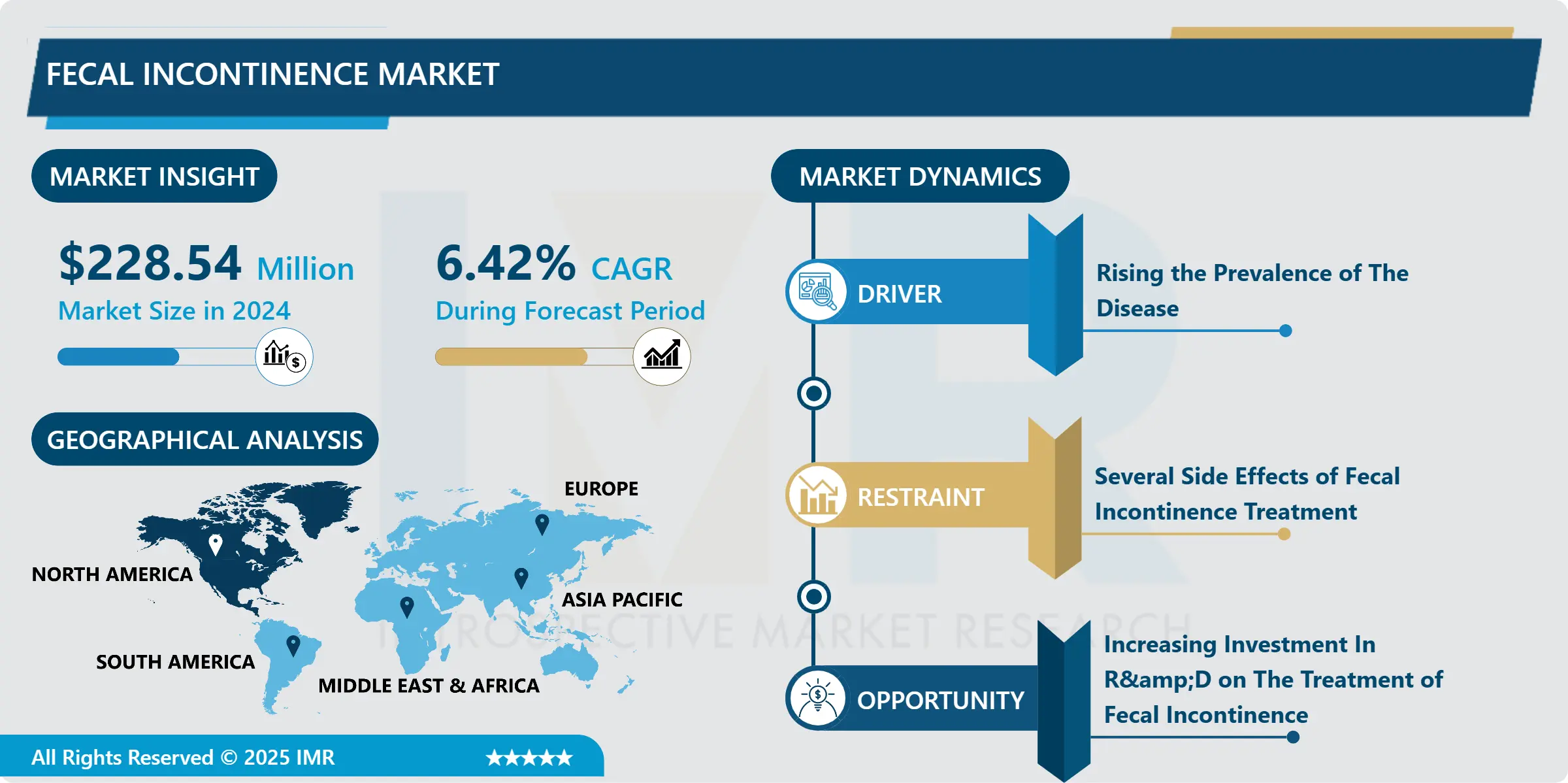

Fecal Incontinence Market Size Was Valued at USD 228.54 Million in 2024 and is Projected to Reach USD 453.12 Million by 2035, Growing at a CAGR of 6.42% From 2025-2035.

The fecal incontinence market is the subset of the medical industry that deals with the medical condition known as fecal incontinence where people lose voluntary bowel movements with the concomitant leakage of stool. It focuses on a wide range of treatment modalities, including those that support the patient's symptoms and health. This lead market consists of pharmaceuticals including antidiarrheal and bowel regulators drugs as well as anal plugs and bowel management systems which form the hardware. On the other hand, part of this market sector is also surgical methods which can rebuild the sphincter and perform nerve stimulation procedures. As the number of fecal incontinence cases is rapidly growing, the advancements in treatment approaches, as well as the increasing health budgets, all contribute greatly to the continuous growth of this market. However, there might be obstacles like stigmatization and a knowledge gap concerning treatment avenues impeding openings to the market sectors. Ultimately, the fecal incontinence market is responsible for providing the degree of aid that people are looking for when assaulted by this disabling condition.

Fecal incontinence is given meaning as a product range for the fixed techniques and therapies aiming at the urinary control disorder. The market, in turn, consists of all the therapeutic equipment - medications, gear, and surgeries.

Worldwide occurrence of fecal incontinence is the factor the market size is dependent on, the population of elderly is particularly vulnerable to it. In essence, we are forecasting the continuation of our gains in the markets in the light of aging populations and growth in understanding of the treatments available.

Conventional methods used in the treatment of fecal incontinence comprise medication, nerve stimulation of the sacrum, food modification, and muscle training of the pelvic floor. Once again, the operations like sphincterplasty and even sacral nerve stimulation are at the same time reasonable approaches as well. In addition to this, there is up-in-time development of novel technologies as biofeedback therapy and injectable bulking agents.

There are wide-ranging actors which compete to create their unique brands by developing multi-option assortments for general sanitation management. Medical device manufacturers who manufacture urinary incontinence products and equipment as well as pharmaceutical companies that develop drugs and therapeutic interventions come to mind as examples.

Healthcare market factors such as product efficacy, safety, cost, and patient specifics define competition dynamics.

Though the discovery of improved therapeutic options has been made, the problem of analysis and treatment of fecal incontinence is not efficient and represents a difficult situation for both doctors and patients.

Discriminatory attitude and scarcity of awareness are two trickiest barriers that a suffering individual has to confront while seeking treatment. Granted, potentials for the market growth exist through heightened awareness campaigns, technological enhancement, and participants’ partnerships involving healthcare for dispensing the most efficient drugs, and increasing patients’ status of living.

Fecal Incontinence Market Trend Analysis:

Rising Demand for Minimally Invasive Procedures

- Patients with fecal incontinence frequently prefer minimally invasive procedures over conventional surgical interventions due to their reduced pain, shorter recovery periods, and decreased risk of complications. Because of this, more and more people who are suffering from fecal incontinence are asking for treatments that don't involve surgery, such as sacral nerve stimulation (SNS) and injectable bulking agents.

- Further advancements in medical devices and technologies have facilitated the proliferation of minimally invasive therapeutic alternatives for fecal incontinence. One example of this is sacral nerve stimulation (SNS), which involves inserting a small device under the skin. This improves bowel control and offers a minimally invasive alternative to more extensive surgical procedures.

- In terms of efficacy and safety, minimally invasive procedures for fecal incontinence have demonstrated positive clinical outcomes. Clinical studies have shown that treatments for fecal incontinence episodes, such as SNS and injectable bulking agents, substantially reduce episodes and improve the quality of life of patients with minimal discomfort and side effects.

- As the demand for minimally invasive procedures rises, fecal incontinence market participants will have the opportunity to expand their operations. Pharmaceutical firms that develop injectable bulking agents and medical device manufacturers that produce SNS devices have the potential to benefit from the increasing prevalence of these technologies. Furthermore, healthcare providers who offer minimally invasive remedies may appeal to a greater number of patients who are in search of alternatives to conventional surgical procedures.

Personalized Medicine & Biomarker Discovery

- Personalized medicine approaches in fecal incontinence involve identifying biomarkers or genetic factors that can help tailor diagnosis and treatment strategies to individual patients. By understanding the underlying causes and mechanisms of fecal incontinence in each patient, healthcare providers can offer more targeted and effective therapies, leading to improved outcomes.

- Ongoing research efforts aim to identify biomarkers associated with fecal incontinence, such as genetic variations, inflammatory markers, or changes in the gut microbiome. These biomarkers can aid in the early detection, diagnosis, and monitoring of fecal incontinence, allowing for more precise interventions and personalized treatment plans.

- Biomarker discovery in fecal incontinence may lead to the development of targeted therapies designed to address specific underlying causes or mechanisms of the condition. For example, medications targeting neurotransmitter imbalances or inflammatory pathways identified through biomarker research could offer more tailored treatment options for patients with fecal incontinence.

- The integration of personalized medicine and biomarker discovery into the fecal incontinence market presents opportunities for pharmaceutical companies, diagnostic companies, and healthcare providers. Companies involved in biomarker discovery and diagnostic testing may develop innovative tools and assays for identifying biomarkers associated with fecal incontinence, while pharmaceutical companies may invest in the development of targeted therapies based on these discoveries.

Fecal Incontinence Market Regional Insights:

North America is expected to hold a major share of the market in terms of revenue.

- North America, particularly the United States, has one of the highest levels of healthcare spending globally. This enables greater access to advanced medical treatments and therapies, including those for fecal incontinence.

- The population in North America is aging, with a significant proportion of individuals over the age of 65. Fecal incontinence is more prevalent among the elderly population, driving the demand for products and treatments to manage this condition.

- The region is known for its strong emphasis on healthcare innovation and technological advancements. This has led to the development of advanced medical devices, diagnostic tools, and treatment modalities for fecal incontinence, contributing to the market's growth.

- North America boasts well-developed healthcare infrastructure, including hospitals, clinics, and research facilities. This facilitates the diagnosis, treatment, and management of fecal incontinence, further driving market growth.

Active Key Players in the Fecal Incontinence Market

- Coloplast A/S (Denmark)

- Hollister Incorporated (USA)

- Medtronic plc (USA)

- B. Braun Melsungen AG (Germany)

- ConvaTec Group PLC (UK)

- C.R. Bard, Inc. (USA)

- Johnson & Johnson (USA)

- Acorda Therapeutics, Inc. (USA)

- Systagenix Wound Management (UK)

- Elekta AB (Sweden)

- Kimberly-Clark Corporation (USA)

- Purdue Pharma L.P. (USA)

- Ferring Pharmaceuticals (Switzerland)

- Boston Scientific Corporation (USA)

- AbbVie Inc. (USA), and Other Active Players.

|

Fecal Incontinence Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 228.54 Mn. |

|

Forecast Period 2025-35 CAGR: |

6.42% |

Market Size in 2035: |

USD 453.12 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Fecal Incontinence Market by Type (2018-2035)

4.1 Fecal Incontinence Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Mild Fecal Incontinence

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Moderate Fecal Incontinence

4.5 Severe Fecal Incontinence

Chapter 5: Fecal Incontinence Market by Application (2018-2035)

5.1 Fecal Incontinence Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Men

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Women

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Fecal Incontinence Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 INTEL CORPORATION (U.S.)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 TWILIO (U.S.)

6.4 QUALCOMM TECHNOLOGIES(U.S.)

6.5 AT&T INC (U.S.)

6.6 VERIZON WIRELESS (U.S.)

6.7 SIERRA WIRELESS (CANADA)

6.8 ROGERS COMMUNICATIONS (CANADA)

6.9 VODAFONE GROUP (UNITED KINGDOM)

6.10 SEQUANS COMMUNICATIONS SA (FRANCE)

6.11 DEUTSCHE TELEKOM (GERMANY)

6.12 NOKIA CORPORATION (FINLAND)

6.13 ERICSSON CORPORATION (SWEDEN)

6.14 HUAWEI TECHNOLOGIES COLTD (CHINA)

6.15 SAMSUNG GROUP (SOUTH KOREA)

6.16 MEDIATEK INC. (TAIWAN)

6.17 U-BLOX HOLDING AG (SWITZERLAND)

6.18 CHINA UNICOM (CHINA)

6.19 CHINA TELECOM CORPORATION LIMITED (CHINA)

6.20 ETISALAT CORPORATION (UNITED ARAB EMIRATES)

6.21 SONY SEMICONDUCTOR ISRAEL LTD. (ISRAEL)

Chapter 7: Global Fecal Incontinence Market By Region

7.1 Overview

7.2. North America Fecal Incontinence Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Mild Fecal Incontinence

7.2.4.2 Moderate Fecal Incontinence

7.2.4.3 Severe Fecal Incontinence

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Men

7.2.5.2 Women

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Fecal Incontinence Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Mild Fecal Incontinence

7.3.4.2 Moderate Fecal Incontinence

7.3.4.3 Severe Fecal Incontinence

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Men

7.3.5.2 Women

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Fecal Incontinence Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Mild Fecal Incontinence

7.4.4.2 Moderate Fecal Incontinence

7.4.4.3 Severe Fecal Incontinence

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Men

7.4.5.2 Women

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Fecal Incontinence Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Mild Fecal Incontinence

7.5.4.2 Moderate Fecal Incontinence

7.5.4.3 Severe Fecal Incontinence

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Men

7.5.5.2 Women

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Fecal Incontinence Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Mild Fecal Incontinence

7.6.4.2 Moderate Fecal Incontinence

7.6.4.3 Severe Fecal Incontinence

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Men

7.6.5.2 Women

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Fecal Incontinence Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Mild Fecal Incontinence

7.7.4.2 Moderate Fecal Incontinence

7.7.4.3 Severe Fecal Incontinence

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Men

7.7.5.2 Women

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Fecal Incontinence Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 228.54 Mn. |

|

Forecast Period 2025-35 CAGR: |

6.42% |

Market Size in 2035: |

USD 453.12 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||