Ethoxyquin Market Synopsis:

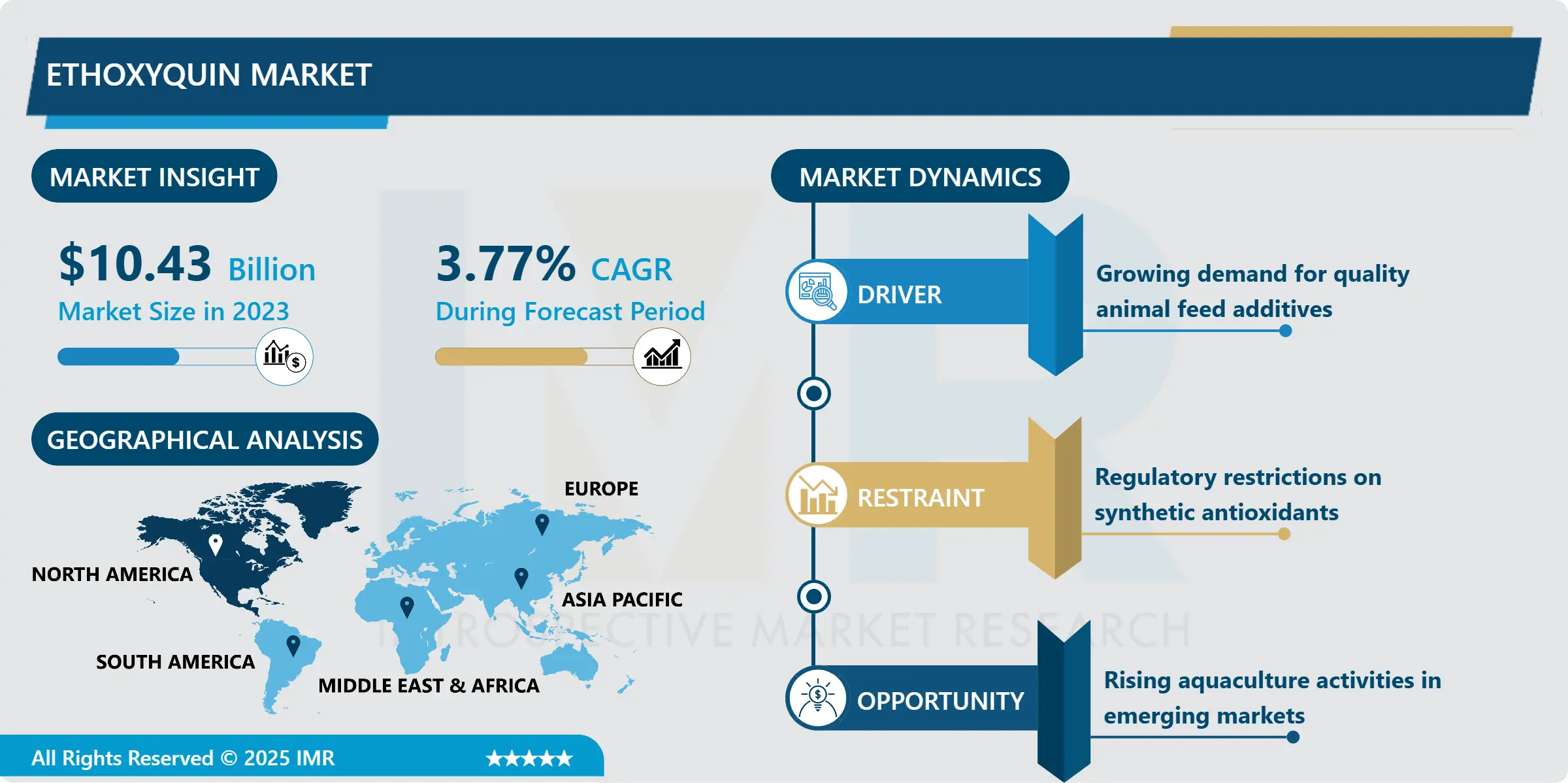

Ethoxyquin Market Size Was Valued at USD 10.43 Billion in 2023, and is Projected to Reach USD 14.55 Billion by 2032, Growing at a CAGR of 3.77 % From 2024-2032.

The Ethoxyquin Market is centered on ethoxyquin, which is a synthetic antioxidant chemical that finds application as a feed antioxidant in animal feeds and pet foods, as well as in industrial uses. Ethoxyquin increases the shelf life and nutritional value of the products and is, therefore, used widely in many industries.

The Ethoxyquin Market has steadily grown up over the years because of its importance in the nutrition and preservation of animal feed. Since demand for quality animal protein is on the rise in the global market, the necessity of feed preservation techniques has recently become quite crucial. Ethoxyquin, which has been effective in eradicating spoilage resulting from oxidation has gained popularity from feed makers. In addition, increase in the consciousness level of the antioxidant to retain the quality of feeds has also helped in boosting the market.

Therefore, other than being used in animal feed, ethoxyquin has proved useful in other industries such as formulators of pesticides and in processing of fish meal, hence it demand is experienced in the various industries. However, market witnesses challenges by regulatory authorities to approve synthetic antioxidants to enhance safety issues calling on manufacturers for other solutions as well as quality matters.

Ethoxyquin Market Trend Analysis:

Rising Demand for Natural Alternatives

- The market for natural alternatives to Ethoxyquin is witnessing growth as industries seek safer, more sustainable solutions. These alternatives are gaining traction in sectors such as pet food, animal nutrition, and agriculture, where consumers and manufacturers are increasingly prioritizing non-synthetic preservatives. Regulatory pressure and consumer demand for clean-label products are key factors influencing this shift.

- Natural preservatives, such as rosemary extract, tocopherols, and ascorbic acid, are being explored to replace Ethoxyquin in various applications. This move aligns with the broader trend of embracing eco-friendly ingredients and reducing reliance on artificial chemicals. As awareness about the potential health risks of synthetic additives continues to rise, the transition to natural alternatives is expected to reshape the market, providing new opportunities for businesses that prioritize innovation and consumer health.

Emerging Markets for Aquaculture Feed

-

The expanding aquaculture sector presents a growing demand for high-quality feeds to support sustainable fish farming practices. As aquaculture operations scale to meet the rising global seafood consumption, the need for effective preservation and antioxidant solutions becomes critical. Ethoxyquin, a well-known antioxidant, plays a vital role in extending the shelf life of aquaculture feeds, preventing the oxidation of essential ingredients and preserving nutritional integrity. Its application in fishmeal and feed formulations helps to maintain feed quality, ensuring optimal growth rates and minimizing losses.

- In emerging markets where aquaculture is rapidly developing, the increasing focus on efficient feed formulations presents a strong growth opportunity for the ethoxyquin market. As these regions prioritize food security and resource optimization, the use of antioxidants such as ethoxyquin aligns with their goals of enhancing feed efficiency and sustainability. The expansion of aquaculture in these markets is expected to accelerate the adoption of innovative feed preservatives, fostering a favorable environment for ethoxyquin market growth.

Ethoxyquin Market Segment Analysis:

Ethoxyquin Market is Segmented on the basis of Grade, Application, End User, and Region

By Grade, the Feed Grade segment is expected to dominate the market during the forecast period

-

The Feed Grade segment is projected to maintain a leading position in the Ethoxyquin market throughout the forecast period. This dominance can be attributed to its extensive use as an antioxidant in animal feed to preserve nutrient quality and extend shelf life. Ethoxyquin is widely incorporated into poultry, aquaculture, and livestock feed formulations to prevent the oxidation of fats and fat-soluble vitamins. Its role in maintaining feed stability supports consistent animal growth performance and product quality across intensive farming operations.

- Rising demand for efficient feed preservation solutions across global animal husbandry sectors continues to support the expansion of the Feed Grade segment. Regulatory acceptance and cost-effectiveness further enhance its appeal in commercial feed applications. As producers seek reliable additives to ensure feed integrity in varying storage and transportation conditions, the use of Ethoxyquin in feed formulations remains a preferred solution. Market participants operating in animal nutrition are expected to focus on this segment for product positioning and volume growth.

By Application, the Animal feed segment is expected to hold the largest share

-

The animal feed segment is projected to dominate the ethoxyquin market, reflecting widespread use of this antioxidant in livestock nutrition. Ethoxyquin plays a key role in preserving feed quality by preventing the oxidation of fats and fat-soluble vitamins. Its use helps maintain nutritional value during storage and distribution, making it a preferred additive for feed manufacturers. High demand from poultry, aquaculture, and livestock producers continues to support steady consumption across global markets.

- Feed stability remains a critical factor for producers aiming to maintain performance and feed conversion rates in animals. Ethoxyquin's efficiency in enhancing shelf life and reducing spoilage aligns with the operational needs of large-scale farms and feed mills. Regulatory approvals for ethoxyquin use in various regions further reinforce its position in commercial feed formulations. Market participants are investing in consistent supply and quality assurance to meet ongoing demand from industrial-scale feed operations.

Ethoxyquin Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America is in a strong position to take the largest stake of Ethoxyquin Market due to the pre-existing animal feed and aquaculture markets. Particularly, the United States has been pointed as one of the most important sources of negative environmental impact, due to its high level of mechanized agriculture, and intensive production of meat and dairy products. The improvement of feed quality in the Southeast Asian area to correspond with the increase in demand for animal protein has triggered the use of ethoxyquin in feed operations.

- Besides the animal feed industry, the North American market benefited from manufacturing organizations and research institutes. The quality and safety policies of the region also provide a guarantee of high-quality production of ethoxyquin thus enhancing the region's leadership. Moreover, increasing the production of the aquaculture industry businesses in Canada and Mexico to support the market augments the development of the ethoxyquin market in North America.

Active Key Players in the Ethoxyquin Market:

- Archer Daniels Midland Company (USA)

- BASF SE (Germany)

- Cargill, Incorporated (USA)

- Chaitanya Chemicals (India)

- Chemipro Kasei Kaisha, Ltd. (Japan)

- Dupont Nutrition & Biosciences (USA)

- Impextraco NV (Belgium)

- Kemin Industries, Inc. (USA)

- Lanxess (Germany)

- Merck KGaA (Germany)

- Novus International (USA)

- Nutreco N.V. (Netherlands)

- Perstorp Holding AB (Sweden)

- Royal DSM N.V. (Netherlands)

- Sumitomo Chemical Co., Ltd. (Japan)

- Other key Players

|

Global Ethoxyquin Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.43 Billion |

|

Forecast Period 2024-32 CAGR: |

3.77 % |

Market Size in 2032: |

USD 14.55 Billion |

|

Segments Covered: |

By Grade |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Ethoxyquin Market by Grade

4.1 Ethoxyquin Market Snapshot and Growth Engine

4.2 Ethoxyquin Market Overview

4.3 Feed Grade Food Grade

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Feed Grade Food Grade: Geographic Segmentation Analysis

Chapter 5: Ethoxyquin Market by Application

5.1 Ethoxyquin Market Snapshot and Growth Engine

5.2 Ethoxyquin Market Overview

5.3 Animal Feed Food and Beverage Pharmaceutical and Personal Care

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Animal Feed Food and Beverage Pharmaceutical and Personal Care: Geographic Segmentation Analysis

Chapter 6: Ethoxyquin Market by End User

6.1 Ethoxyquin Market Snapshot and Growth Engine

6.2 Ethoxyquin Market Overview

6.3 Food Processors Animal Feed Manufacturers Pharmaceutical Companies

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Food Processors Animal Feed Manufacturers Pharmaceutical Companies: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Ethoxyquin Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ARCHER DANIELS MIDLAND COMPANY (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BASF SE (GERMANY)

7.4 CARGILL INCORPORATED (USA)

7.5 CHAITANYA CHEMICALS (INDIA)

7.6 CHEMIPRO KASEI KAISHA

7.7 LTD. (JAPAN)

7.8 DUPONT NUTRITION & BIOSCIENCES (USA)

7.9 IMPEXTRACO NV (BELGIUM)

7.10 KEMIN INDUSTRIES INC. (USA)

7.11 LANXESS (GERMANY)

7.12 MERCK KGAA (GERMANY)

7.13 NOVUS INTERNATIONAL (USA)

7.14 NUTRECO N.V. (NETHERLANDS)

7.15 PERSTORP HOLDING AB (SWEDEN)

7.16 ROYAL DSM N.V. (NETHERLANDS)

7.17 SUMITOMO CHEMICAL CO. LTD. (JAPAN)

7.18 OTHER ACTIVE PLAYERS

Chapter 8: Global Ethoxyquin Market By Region

8.1 Overview

8.2. North America Ethoxyquin Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Grade

8.2.4.1 Feed Grade Food Grade

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Animal Feed Food and Beverage Pharmaceutical and Personal Care

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Food Processors Animal Feed Manufacturers Pharmaceutical Companies

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Ethoxyquin Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Grade

8.3.4.1 Feed Grade Food Grade

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Animal Feed Food and Beverage Pharmaceutical and Personal Care

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Food Processors Animal Feed Manufacturers Pharmaceutical Companies

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Ethoxyquin Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Grade

8.4.4.1 Feed Grade Food Grade

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Animal Feed Food and Beverage Pharmaceutical and Personal Care

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Food Processors Animal Feed Manufacturers Pharmaceutical Companies

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Ethoxyquin Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Grade

8.5.4.1 Feed Grade Food Grade

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Animal Feed Food and Beverage Pharmaceutical and Personal Care

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Food Processors Animal Feed Manufacturers Pharmaceutical Companies

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Ethoxyquin Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Grade

8.6.4.1 Feed Grade Food Grade

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Animal Feed Food and Beverage Pharmaceutical and Personal Care

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Food Processors Animal Feed Manufacturers Pharmaceutical Companies

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Ethoxyquin Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Grade

8.7.4.1 Feed Grade Food Grade

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Animal Feed Food and Beverage Pharmaceutical and Personal Care

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Food Processors Animal Feed Manufacturers Pharmaceutical Companies

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Ethoxyquin Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.43 Billion |

|

Forecast Period 2024-32 CAGR: |

3.77 % |

Market Size in 2032: |

USD 14.55 Billion |

|

Segments Covered: |

By Grade |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||