Epoxy Resin Market Synopsis

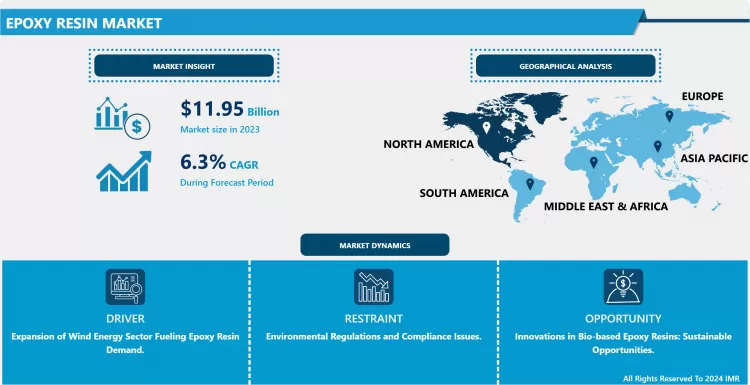

Epoxy Resin Market Size is Valued at USD 11.95 Billion in 2023, and is Projected to Reach USD 19.49 Billion by 2032, Growing at a CAGR of 6.30% From 2024-2032.

The worldwide industry that produces, distributes, and uses epoxy resins—adaptable polymers renowned for their robust adhesion, chemical resistance, and durability—is referred to as the epoxy resin market. These resins are widely used in many different industries, including the paint and coating, adhesive, composite, electronics, building, and automotive sectors. The market is expected to grow due to the growing need for high-performance, lightweight materials as well as their rising uses in developing sectors like healthcare and renewable energy.

- The primary factor that fuels the epoxy resin market includes the demand from the various end-use industries which include paints and coating, adhesive, composite, electronics and electrical, and construction. The factors such as advancement in technology in the automotive and aerospace industries is one of the factors that has boosted the market. Also, the increased construction activity due to up gradation of infrastructure and urbanization has led to increase in demand of epoxy resins in flooring, coating and adhesives. Furthermore, the development of new epoxy formulations like water borne and powder coating are again providing a steady impetus to the market’s growth.

- Regionally, Asia Pacific holds the largest share of the epoxy resin market because of increased industrial and urban growth in the region’s countries such as China, India, and Japan. A prominent manufacturing sector as well as the rising trend of construction sectors have the potential to bolster the market in the region. North America and Europe also remain significant markets due to elements such as automotive manufacturers’ demand for lightweight solutions and environmental rules that encourage the use of green coatings and adhesion solutions. In general, the epoxy resin market is expected to have further advancement anchored on new product advancement and rising uses in numerous sectors of the global market.

Epoxy Resin Market Trend Analysis

From Construction to Electronics, A Deep Dive into the Epoxy Resin Market

- Global epoxy resin market is growing at a very good rate due to their demand in several segments like paints and coatings, adhesive, electronic and automotive industries. Some of the factors that could have led to this growth are; Increase construction activities across the globe especially in the developing nations, and the continuous use of epoxy resins in the production of hard<|reserved_special_token_274|> and lightweight composites. Besides, the increasing novelty and improvement of technologies present in epoxy resin formulations are improving their characteristics to make them eligible for new markets.

- Additionally, the existing strict laws concerning materials and products that are considered as environment friendly and sustainable are influencing the markets. So, the demand for bio-based and waterborne epoxy resins are on the rise to fulfil these regulations and the increasing trend of green products among consumers. Region-wise, Asia Pacific is expected to progress as a major market for epoxy resins due to the increased industrialization, infra development, and booming renewable energy industry. North America and Europe remain key regions for demand supported by higher end-user sectors’ consumption and sustained research work on product development and environmentally friendly solutions.

Strategic Insights into the Growing Epoxy Resin Market

- Thus, the global epoxy resin market has vast opportunities intensifying its use due to its flexibility in different sectors. Epoxy resins are widely used in constructions especially in the flooring, coatings, adhesives and in structures where repairs are needed because of its durability and its almost impermeability to chemicals. They can be used in the construction of various products through a process known as epoxying and hence, the increasing construction activities across the world and particularly in the emerging nations are driving the uptake of epoxy resins. Also, the automotive and aerospace industries employ epoxy resins in manufacturing light weight composite materials thus increasing fuel efficiency and lowering emissions, thus driving the market.

- In the electrical and electronics sector the chief and important use is applied towards encapsulation and insulating of electrical and electronics parts enhancing the durabilities of the devices. This is because of the rapid developments nearly all electronic devices and the increasing usage of electric automobiles which needs epoxy resins that have improved thermal and electrical conducts. However, a growth sector for epoxy resins is the wind energy fabrication industry for wind turbine blades due to the strength to weight and corrosion properties. Thus, as more renewable energy projects are developed across the globe, the epoxy resins market will record increased demand indicated by the opportunities for growth and diversification currently available in the global market.

Epoxy Resin Market Segment Analysis:

Epoxy Resin Market Segmented on the basis of type, application, and end-users.

By Type, Liquid Epoxy Resin segment is expected to dominate the market during the forecast period

- Thus, the epoxy resin market comprises different types of products such as, liquid epoxy resins, employed in paints and coatings, adhesives and composites owing to its convenience to handle and versatility. Stylish epoxy resins are widely applied in structural adhesives and electrical laminates because they possess both high mechanical strength and chemical resistance. Some of the new epoxy resins include solution epoxy resins which are comparatively flexible and possess good solvent compatibility that is used in specialty coatings as well as electronics. There are others like powder epoxy resins which apply to uses for example in corrosion and powder coatings, this goes to show that epoxy resin forms are steady changing to fit new needs of the markets they serve.

By Application, Paints & Coatings segment held the largest share in 2024

- Thus, it is evident that the epoxy resin market consists of a rich variety of applications in various major fields. Coatings and paints is another large segment, utilize epoxy resins as its core product for anti-corrosive properties and decorative coatings. Thus, adhesives and sealants are primary consumers of epoxy resins due to their good bonding characteristic, and widely used in automotive industries and aerospace industries as well as construction.

- Furthermore, epoxy resins are indispensable in the composite materials market since they involve lightweight structure and increase the durability of auto parts, marine, and sports equipment. The electronics and electrical segment uses epoxy resins to provide insulation and encapsulation of parts in different electronic gadgets and semiconductor application. In addition, epoxy resins are also used for manufacturing of wind energy applications: turbine blades owing to its superior strength and weather resistance enhances the efficient energy output. Used in construction and in many other areas, epoxy resins are still in active development and on the way to broaden the sphere of their application owing to their outstanding characteristics and several stages of development.

Epoxy Resin Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The demand and application of epoxy resin in North American is enormous and versatile and hence the need to establish a strong and diverse market for epoxy resins in the region. It includes mature industries, high focus on research and development within the region that enhances new products developments and improvement in technology used in epoxy resin formulation. `With regards to the end-use segments, the United States and Canada have rigid environmental standards that encourage use of epoxy resins that emit low VOC and possess high durability in construction and automotive segments. Furthermore, the developed manufacturing structure and end-user industries in North America are also ideal for the overall growth of the epoxy resin market.

- Players in the epoxy resins market of North America are leading multinational firms and some regional firms which meet the industry specific concerns. Certain dynamics are at the center of the market, where corporations make efforts to diversify products offering and improve distribution channels with the aim at better leveraging opportunities in various sectors which include those involving renewable energy and sophisticated electronics. Furthermore, higher spending in construction industries along with constantly rising applications of epoxy resin in automotive industry due to lightweight materials trend is expected to continue the positive growth rates in the epoxy resin market in North America in the forecast period.

Active Key Players in the Epoxy Resin Market

- 3M (United States)

- Aditya Birla Management Corporation Pvt. Ltd. (India)

- Atul Ltd (India)

- BASF SE (Germany)

- Solvay (Belgium)

- Huntsman International LLC (United States)

- KUKDO CHEMICAL CO., LTD. (South Korea)

- Olin Corporation (United States)

- Sika AG (Switzerland)

- NAN YA PLASTICS CORPORATION (Taiwan)

- Jiangsu Sanmu Group Co., Ltd. (China)

- Jubail Chemical Industries LLC (Saudi Arabia)

- China Petrochemical & Chemical Corporation (SINOPEC) (China)

- Hexion (United States)

- Kolon Industries, Inc. (South Korea)

- Techstorm (United States)

- NAGASE & CO., LTD. (Japan) and Other Active Players

|

Global Epoxy Resin Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 11.95 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.30 % |

Market Size in 2032: |

USD 19.49 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Epoxy Resin Market by Type (2018-2032)

4.1 Epoxy Resin Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Liquid Epoxy Resin

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Solid Epoxy Resin

4.5 Solution Epoxy Resin

4.6 Others

Chapter 5: Epoxy Resin Market by Application (2018-2032)

5.1 Epoxy Resin Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Paints & Coatings

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Adhesives & Sealants

5.5 Composites

5.6 Electrical & Electronics

5.7 Wind Energy

5.8 Construction

5.9 Others

Chapter 6: Epoxy Resin Market by End User (2018-2032)

6.1 Epoxy Resin Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Building & Construction

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Automotive & Transportation

6.5 Electrical & Electronics

6.6 Aerospace

6.7 Marine

6.8 Wind Energy

6.9 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Epoxy Resin Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 3M (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ADITYA BIRLA MANAGEMENT CORPORATION PVT. LTD. (INDIA)

7.4 ATUL LTD (INDIA)

7.5 BASF SE (GERMANY)

7.6 SOLVAY (BELGIUM)

7.7 HUNTSMAN INTERNATIONAL LLC (UNITED STATES)

7.8 KUKDO CHEMICAL COLTD. (SOUTH KOREA)

7.9 OLIN CORPORATION (UNITED STATES)

7.10 SIKA AG (SWITZERLAND)

7.11 NAN YA PLASTICS CORPORATION (TAIWAN)

7.12 JIANGSU SANMU GROUP COLTD. (CHINA)

7.13 JUBAIL CHEMICAL INDUSTRIES LLC (SAUDI ARABIA)

7.14 CHINA PETROCHEMICAL & CHEMICAL CORPORATION (SINOPEC) (CHINA)

7.15 HEXION (UNITED STATES)

7.16 KOLON INDUSTRIES INC. (SOUTH KOREA)

7.17 TECHSTORM (UNITED STATES)

7.18 NAGASE & COLTD. (JAPAN)

Chapter 8: Global Epoxy Resin Market By Region

8.1 Overview

8.2. North America Epoxy Resin Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Liquid Epoxy Resin

8.2.4.2 Solid Epoxy Resin

8.2.4.3 Solution Epoxy Resin

8.2.4.4 Others

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Paints & Coatings

8.2.5.2 Adhesives & Sealants

8.2.5.3 Composites

8.2.5.4 Electrical & Electronics

8.2.5.5 Wind Energy

8.2.5.6 Construction

8.2.5.7 Others

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Building & Construction

8.2.6.2 Automotive & Transportation

8.2.6.3 Electrical & Electronics

8.2.6.4 Aerospace

8.2.6.5 Marine

8.2.6.6 Wind Energy

8.2.6.7 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Epoxy Resin Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Liquid Epoxy Resin

8.3.4.2 Solid Epoxy Resin

8.3.4.3 Solution Epoxy Resin

8.3.4.4 Others

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Paints & Coatings

8.3.5.2 Adhesives & Sealants

8.3.5.3 Composites

8.3.5.4 Electrical & Electronics

8.3.5.5 Wind Energy

8.3.5.6 Construction

8.3.5.7 Others

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Building & Construction

8.3.6.2 Automotive & Transportation

8.3.6.3 Electrical & Electronics

8.3.6.4 Aerospace

8.3.6.5 Marine

8.3.6.6 Wind Energy

8.3.6.7 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Epoxy Resin Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Liquid Epoxy Resin

8.4.4.2 Solid Epoxy Resin

8.4.4.3 Solution Epoxy Resin

8.4.4.4 Others

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Paints & Coatings

8.4.5.2 Adhesives & Sealants

8.4.5.3 Composites

8.4.5.4 Electrical & Electronics

8.4.5.5 Wind Energy

8.4.5.6 Construction

8.4.5.7 Others

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Building & Construction

8.4.6.2 Automotive & Transportation

8.4.6.3 Electrical & Electronics

8.4.6.4 Aerospace

8.4.6.5 Marine

8.4.6.6 Wind Energy

8.4.6.7 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Epoxy Resin Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Liquid Epoxy Resin

8.5.4.2 Solid Epoxy Resin

8.5.4.3 Solution Epoxy Resin

8.5.4.4 Others

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Paints & Coatings

8.5.5.2 Adhesives & Sealants

8.5.5.3 Composites

8.5.5.4 Electrical & Electronics

8.5.5.5 Wind Energy

8.5.5.6 Construction

8.5.5.7 Others

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Building & Construction

8.5.6.2 Automotive & Transportation

8.5.6.3 Electrical & Electronics

8.5.6.4 Aerospace

8.5.6.5 Marine

8.5.6.6 Wind Energy

8.5.6.7 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Epoxy Resin Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Liquid Epoxy Resin

8.6.4.2 Solid Epoxy Resin

8.6.4.3 Solution Epoxy Resin

8.6.4.4 Others

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Paints & Coatings

8.6.5.2 Adhesives & Sealants

8.6.5.3 Composites

8.6.5.4 Electrical & Electronics

8.6.5.5 Wind Energy

8.6.5.6 Construction

8.6.5.7 Others

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Building & Construction

8.6.6.2 Automotive & Transportation

8.6.6.3 Electrical & Electronics

8.6.6.4 Aerospace

8.6.6.5 Marine

8.6.6.6 Wind Energy

8.6.6.7 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Epoxy Resin Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Liquid Epoxy Resin

8.7.4.2 Solid Epoxy Resin

8.7.4.3 Solution Epoxy Resin

8.7.4.4 Others

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Paints & Coatings

8.7.5.2 Adhesives & Sealants

8.7.5.3 Composites

8.7.5.4 Electrical & Electronics

8.7.5.5 Wind Energy

8.7.5.6 Construction

8.7.5.7 Others

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Building & Construction

8.7.6.2 Automotive & Transportation

8.7.6.3 Electrical & Electronics

8.7.6.4 Aerospace

8.7.6.5 Marine

8.7.6.6 Wind Energy

8.7.6.7 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Epoxy Resin Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 11.95 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.30 % |

Market Size in 2032: |

USD 19.49 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Epoxy Resin Market research report is 2024-2032.

3M (United States), Aditya Birla Management Corporation Pvt. Ltd. (India), Atul Ltd (India), BASF SE (Germany), Solvay (Belgium), Huntsman International LLC (United States), KUKDO CHEMICAL CO., LTD. (South Korea), Olin Corporation (United States), Sika AG (Switzerland), NAN YA PLASTICS CORPORATION (Taiwan), Jiangsu Sanmu Group Co., Ltd. (China), Jubail Chemical Industries LLC (Saudi Arabia), China Petrochemical & Chemical Corporation (SINOPEC) (China), Hexion (United States), Kolon Industries, Inc. (South Korea), Techstorm (United States), NAGASE & CO., LTD. (Japan). and Other Major Players.

The Epoxy Resin Market is segmented into by Type (Liquid Epoxy Resin, Solid Epoxy Resin, Solution Epoxy Resin, Others), By Application (Paints & Coatings, Adhesives & Sealants, Composites, Electrical & Electronics, Wind Energy, Construction, Others), End-User (Building & Construction, Automotive & Transportation, Electrical & Electronics, Aerospace, Marine, Wind Energy, Others). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The worldwide industry that produces, distributes, and uses epoxy resins—adaptable polymers renowned for their robust adhesion, chemical resistance, and durability—is referred to as the epoxy resin market. These resins are widely used in many different industries, including the paint and coating, adhesive, composite, electronics, building, and automotive sectors. The market is expected to grow due to the growing need for high-performance, lightweight materials as well as their rising uses in developing sectors like healthcare and renewable energy.

Epoxy Resin Market Size is Valued at USD 11.95 Billion in 2024, and is Projected to Reach USD 19.49 Billion by 2032, Growing at a CAGR of 6.30% From 2024-2032.