Electrically Conductive Adhesives Market Synopsis:

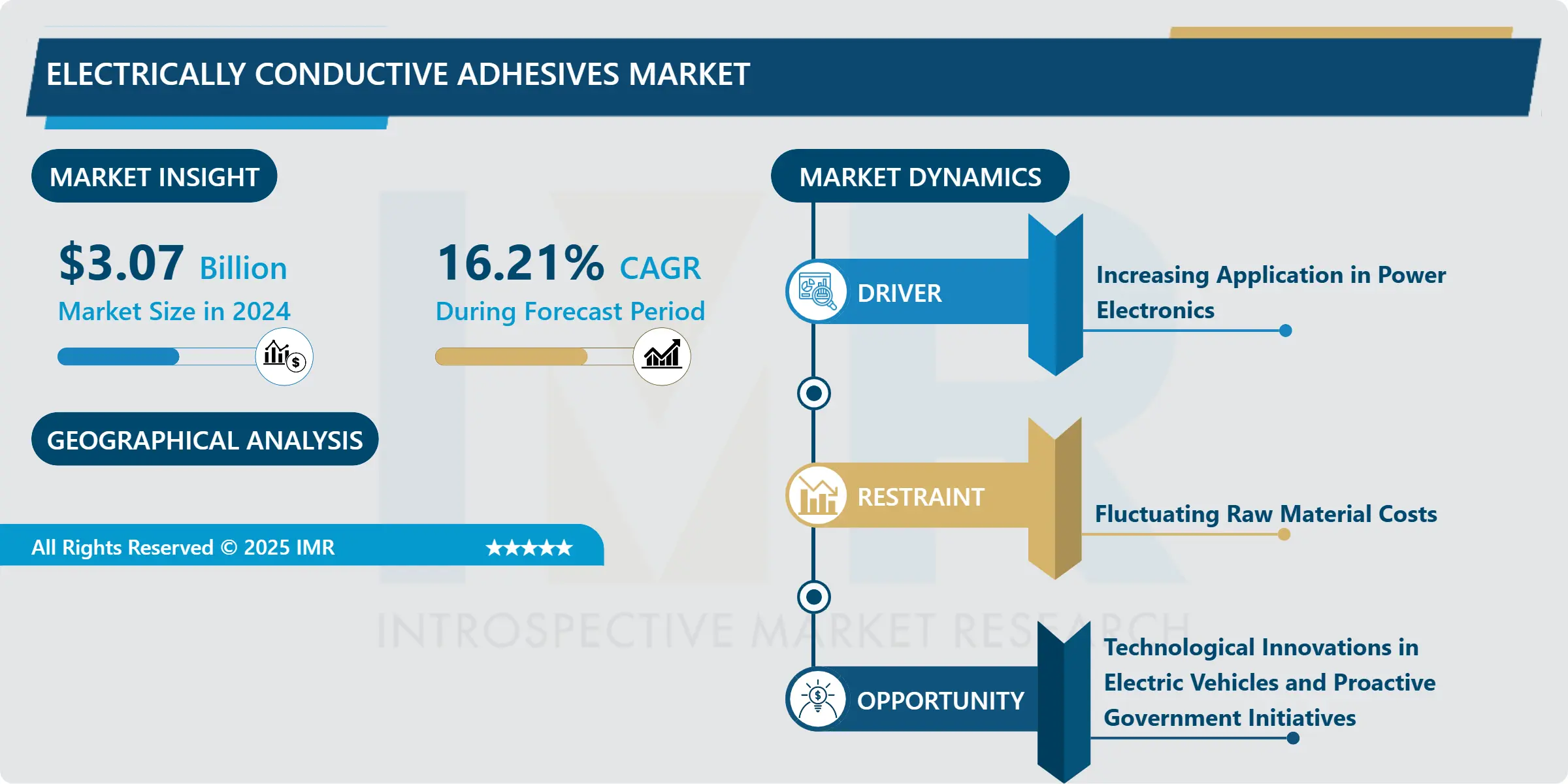

Global Electrically Conductive Adhesives Market Size Was Valued at USD 3.07 Billion In 2024 And Is Projected to Reach USD 10.21 Billion By 2032, Growing at A CAGR of 16.21% From 2025 To 2032.

Electrically conductive adhesives are generally employed in electronics applications where components must be held in place during electrical current can flow between them. Some common general such as anaerobic, cyanoacrylates, epoxies, and acrylic-based adhesives play as an electrical insulator depending on the space between components. Many supplies are good thermal conductivity to help in the thermal management of electronic components and heat sinks by directing heat away from sensitive components. As long as, there is no glue line control in some circumstances primarily when utilizing an anaerobic or cyanoacrylate adhesive and parts are effectively touching with adhesives filling in microscopic crevices, many electrical charges can still be changed due to there is adequate metal to metal contact.

Electronic components that are temperature-fragile cannot be cemented. This type of application necessitates the application of an electrically conductive adhesive alternative for solder. By the electrically conductive adhesive on a PCB with components mounted on both sides makes the assembly process easier and removes the possibility of components sliding off the underside when parts are soldered on the top. The usage of electrically conductive adhesive for a full electrical assembly removes the need for solder re-flow.

Electrically Conductive Adhesives Market Growth and Trend Analysis:

Drivers

Increasing Application in Power Electronics

- Electrically conductive adhesives (ECAs) are playing a crucial role in the rapidly advancing power electronics industry. These adhesives offer a reliable solution for electrical interconnection and structural bonding, especially in temperature-sensitive electronic assemblies where soldering might damage components. ECAs enable manufacturers to avoid high-heat soldering processes, which is essential in precision electronic devices such as semiconductors, sensors, and miniature circuit boards. With growing demand for efficient, compact, and high-performance electronics, especially in consumer gadgets and industrial systems, ECAs are becoming a preferred choice.

- Their ability to ensure conductivity, durability, and thermal management in advanced electronic assemblies continues to drive their adoption, supporting the ongoing evolution in smart devices, communication equipment, and power management systems.

Restraints:

Fluctuating Raw Material Costs

- One of the significant challenges in the electrically conductive adhesives market is the fluctuating prices of raw materials, such as silver, copper, and polymers. These materials are critical components in manufacturing ECAs, especially silver, which is often used to achieve high conductivity. Market volatility, supply chain disruptions, geopolitical tensions, and environmental regulations can all contribute to price instability.

- For manufacturers, this unpredictability affects production costs and profit margins, creating hurdles in pricing strategies and long-term planning. As a result, fluctuating raw material costs can deter smaller manufacturers from entering the market and may also impact the affordability of ECAs for end-users, thereby slowing overall market growth.

Opportunities:

Technological Innovations in Electric Vehicles and Proactive Government Initiatives

- The global shift toward electric vehicles (EVs) and increased government initiatives in clean energy and digitization are opening significant opportunities for the electrically conductive adhesives market. ECAs are integral to EV manufacturing, especially in battery packs, sensors, control units, and onboard electronics, due to their ability to offer strong electrical and thermal conductivity with structural integrity.

- Innovations such as flexible electronics and lightweight components in EVs further rely on adhesive technologies over traditional soldering. Additionally, government regulations encouraging greener technologies, along with incentives for EV production and adoption, are pushing manufacturers to invest in advanced conductive materials. This evolving landscape is expected to boost the demand for ECAs significantly in the coming years.

Electrically Conductive Adhesives Market Segment Analysis:

Electrically Conductive Adhesives Market is segmented based on Type, Application, and Region

By Type, Epoxy segment accounted for the largest share

-

With about 33.43% of the total revenue of the global electrically conductive adhesives market, in 2020. However, the acrylic segment is expected to witness the fastest CAGR over the forecast period. Epoxy-based electrically conductive adhesives (ECAs) are lead-free solder alternatives for attaching components and printed circuit board (PCB) interconnections. Electrically conductive silicone adhesives are a thixotropic, non-corrosive silicone paste filled with electrically conductive particles such as graphite, nickel-graphite, silver-plated glass, silver-plated nickel, silver-plated aluminum, silver-plated copper, or even pure silver. Owing to varying applications and the increasing demand for silicone-based ECAs from various end-user sectors, such as aerospace, telecom, consume, and others. The demand for the electrically conductive adhesives market is anticipated to grow in the forecast period.

Electrically Conductive Adhesives Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Asia-Pacific is expected to dominate the Electrically Conductive Adhesives (ECA) market over the forecast period, primarily due to the region's strong electronics manufacturing base and growing demand for advanced electronic devices. Countries like China, Japan, South Korea, and India are key contributors, with China leading as a global hub for consumer electronics and semiconductor production.

- The rising adoption of electric vehicles, investments in 5G infrastructure, and expanding renewable energy sectors are also fueling the need for ECAs in the region. Additionally, government support for clean energy technologies and digital transformation is encouraging further innovation and production, positioning Asia-Pacific as the most influential region in shaping the future growth of the ECA market.

Electrically Conductive Adhesives Market Active Players:

- 3M

- Aremco

- Creative Materials Inc.

- Dow

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- HITEK Electronic

- Materials Ltd

- Master Bond Inc.

- MG Chemicals

- Panadol-Elosol GmbH

- Parker Hannifin Corp.

- Permabond LLC

- Bostik

- Others Active players.

Key Industry Developments in the Reverse Flame Steam Boiler Market:

- In May 2023, Henkel announced the opening of its Application Center in Santa Clara, CA, designed to support product development for the company's high-tech customers in the Silicon Valley region. Equipped as a state-of-the-art facility, the Application Center will help expedite proof-of-concept initiatives for electronics advances.

- In January 2023, Parker Hannifin expanded its portfolio of products for electric vehicle manufacturers to include new Thermally Conductive (TC) adhesives and one-component (1K) low-density gap fillers to support their leading product offering of thermal management encapsulants, adhesives, and gap fillers.

|

Global Electrically Conductive Adhesives Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 3.07 Bn. |

|

Forecast Period 2025-32 CAGR: |

16.21% |

Market Size in 2032: |

USD 10.21 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Electrically Conductive Adhesives Market by Type (2018-2032)

4.1 Electrically Conductive Adhesives Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Epoxy

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Silicone

4.5 Polyurethane

4.6 Acrylic

4.7 Other

Chapter 5: Electrically Conductive Adhesives Market by Application (2018-2032)

5.1 Electrically Conductive Adhesives Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Automotive

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Aerospace & Defence

5.5 Consumer Electronics

5.6 Bioscience

5.7 Other

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Electrically Conductive Adhesives Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 PHILIPS HEALTHCARE (NETHERLANDS)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 GE HEALTHCARE (UNITED STATES)

6.4 MEDTRONIC (IRELAND)

6.5 SIEMENS HEALTHINEERS (GERMANY)

6.6 NIHON KOHDEN CORPORATION (JAPAN)

6.7 SCHILLER AG (SWITZERLAND)

6.8 MINDRAY MEDICAL INTERNATIONAL LIMITED (CHINA)

6.9 FUKUDA DENSHI CO. LTD. (JAPAN)

6.10 HILLROM (UNITED STATES)

6.11 CARDIOLINE SPA (ITALY)

6.12 EDAN INSTRUMENTS INC. (CHINA)

6.13 SPACELABS HEALTHCARE (UNITED STATES)

6.14 WELCH ALLYN (UNITED STATES)

6.15 ALIVECOR (UNITED STATES)

6.16 BIONET CO. LTD. (SOUTH KOREA)

6.17 QRS DIAGNOSTIC (UNITED STATES)

6.18 ZOLL MEDICAL CORPORATION (UNITED STATES)

6.19 NORAV MEDICAL (ISRAEL)

6.20 ECCOSUR (ARGENTINA)

6.21 DAWEI MEDICAL (CHINA)

6.22 GUANGDONG BIOLIGHT MEDITECH CO. LTD. (CHINA)

6.23 SUZUKEN CO. LTD. (JAPAN)

6.24 VECTRACOR INC. (UNITED STATES)

6.25 EKO DEVICES (UNITED STATES)

6.26 THERMO FISHER SCIENTIFIC (UNITED STATES)

6.27 AND OTHER ACTIVE PLAYERS

Chapter 7: Global Electrically Conductive Adhesives Market By Region

7.1 Overview

7.2. North America Electrically Conductive Adhesives Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Epoxy

7.2.4.2 Silicone

7.2.4.3 Polyurethane

7.2.4.4 Acrylic

7.2.4.5 Other

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Automotive

7.2.5.2 Aerospace & Defence

7.2.5.3 Consumer Electronics

7.2.5.4 Bioscience

7.2.5.5 Other

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Electrically Conductive Adhesives Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Epoxy

7.3.4.2 Silicone

7.3.4.3 Polyurethane

7.3.4.4 Acrylic

7.3.4.5 Other

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Automotive

7.3.5.2 Aerospace & Defence

7.3.5.3 Consumer Electronics

7.3.5.4 Bioscience

7.3.5.5 Other

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Electrically Conductive Adhesives Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Epoxy

7.4.4.2 Silicone

7.4.4.3 Polyurethane

7.4.4.4 Acrylic

7.4.4.5 Other

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Automotive

7.4.5.2 Aerospace & Defence

7.4.5.3 Consumer Electronics

7.4.5.4 Bioscience

7.4.5.5 Other

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Electrically Conductive Adhesives Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Epoxy

7.5.4.2 Silicone

7.5.4.3 Polyurethane

7.5.4.4 Acrylic

7.5.4.5 Other

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Automotive

7.5.5.2 Aerospace & Defence

7.5.5.3 Consumer Electronics

7.5.5.4 Bioscience

7.5.5.5 Other

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Electrically Conductive Adhesives Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Epoxy

7.6.4.2 Silicone

7.6.4.3 Polyurethane

7.6.4.4 Acrylic

7.6.4.5 Other

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Automotive

7.6.5.2 Aerospace & Defence

7.6.5.3 Consumer Electronics

7.6.5.4 Bioscience

7.6.5.5 Other

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Electrically Conductive Adhesives Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Epoxy

7.7.4.2 Silicone

7.7.4.3 Polyurethane

7.7.4.4 Acrylic

7.7.4.5 Other

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Automotive

7.7.5.2 Aerospace & Defence

7.7.5.3 Consumer Electronics

7.7.5.4 Bioscience

7.7.5.5 Other

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Electrically Conductive Adhesives Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 3.07 Bn. |

|

Forecast Period 2025-32 CAGR: |

16.21% |

Market Size in 2032: |

USD 10.21 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||