Global Digital Twin Technology Market Overview

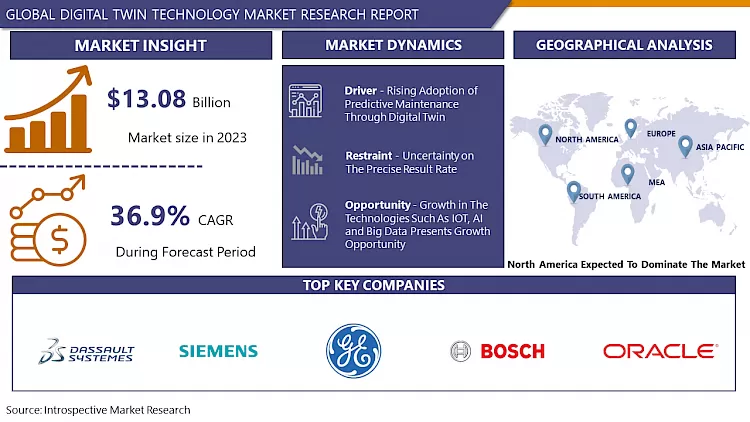

Digital Twin Technology Market Size Was Valued at USD 13.08 Billion in 2023 and is Projected to Reach USD 220.92 Billion by 2032, Growing at a CAGR of 36.9% From 2024-2032.

Digital Twin technology creates virtual replicas of physical objects, systems, or processes to mirror real-world behaviour in real time. It is crucial in Industry 4.0, marked by automation, data exchange, and connectivity in the industrial revolution.

- Digital twins are essential in multiple sectors, providing numerous advantages. In manufacturing and industry, predictive maintenance is utilized to minimize downtime and costs, streamline processes for better efficiency, and maintain quality assurance by avoiding defects.

- In the healthcare industry, digital twins are utilized to develop personalized treatment plans and test medical devices through patient-specific models. In aerospace and defense, system health is monitored and flight conditions are simulated to enhance performance and safety.

- Digital twins are utilized in smart cities to enhance urban planning and resource management, as well as to optimize energy systems and incorporate renewable sources. The automotive sector employs digital twins to enhance vehicle performance and manage fleets.

- The digital twins improve decision-making by providing real-time data and predictive analytics, resulting in cost savings, higher efficiency, enhanced safety, customized experiences, accelerated innovation, sustainability, and data-driven operations.

Market Dynamics And Factors For Digital Twin Technology Market

Drivers:

Rising Adoption of Predictive Maintenance Through Digital Twin

Because malfunctions, outages, and downtime can cause significant costs for any firm, predictive maintenance has become more important in a variety of industries. By taking the appropriate action and using effective maintenance planning, such an unforeseen interruption can be prevented. Digital twin adoption can alter this failure situation and reduce maintenance and manufacturing expenses within a set time frame. When a product is being developed, sensors are attached to it to produce data that can be used in simulations to predict defective circumstances. This allows professionals to analyze maintenance processes, including testing under all kinds of potential fault conditions. As a result, businesses are implementing digital twin solutions to make the transition to digitally driven asset management. Additionally, a digital twin analyses previous data or compares it to similar production systems to estimate component failure, if any, and expected wear on parts.

Restraints:

Uncertainty on The Precise Result Rate

The risk of misrepresenting the item or system they wish to reproduce using this technology is the main worry shared by the majority of business owners that are interested in this technology. Because it is unclear how precise the twin is in comparison to its physical counterpart. The majority of business owners who are interested in experimenting with digital twins also have doubts about the overall correctness of the simulation that the technology would create. Companies must first realize that the precision and realism of the simulations will only depend on how well the digital twin model was created before they can describe how accurate they would be.

Opportunity:

Growth in The Technologies Such As IoT, AI, and Big Data Presents Growth Opportunity

The usage of IoT for business changes has grown significantly over time. With more companies across several industry sectors striving to digitize their processes and operations, this trend is expanding. As a result, the virtual and physical worlds are rapidly approaching their point of confluence, and digital twins are essential to this development. Businesses are now noticing the advantages of networked company operations and the time savings that come with implementing these technologies. The twin becomes full the more the technologies are interwoven, creating a digital thread that standardizes the entire process and produces the best results. As a result, there is a growing need for digital twin technology among corporate organizations to enhance current business processes and test various ideas in a controlled environment without affecting the final product. Nearly 40% of IoT platform suppliers are predicted to incorporate platforms and tools for creating digital twins in the upcoming years. It is rather simple to reuse, retrain, and adjust a digital twin to the current context. Thus, allowing AI with the digital twin can increase productivity by repeatedly using technology. AI can analyze and interpret the data collected by the digital twin's IoT sensors, spot anomalies, and keep learning and finding mistakes. As a result, an AI-based digital twin can be utilized to enhance functionality and give developers important new information.

Segmentation Analysis of Digital Twin Technology Market

By Type, Process digital twin dominates the type segment in Digital Twin Technology Market. The Process Digital Twin optimizes not just the machinery but the entire production process through the use of mixed reality, artificial intelligence, and high-performance computers. Process performance analysis is made easier by high-performance computers. Additionally, different supply chain businesses can all simultaneously access the same virtual model from any location. Manufacturers can use mixed reality capabilities with the Process Digital Twin, just like they can with the Product Digital Twin. However, with a Process Digital Twin, manufacturers can use immersive holograms to work in both virtual and real worlds at the same time. To represent the complete system and the connections between its components, these holograms receive data from various stages of the process. Manufacturers may create an immersive virtual representation of what is happening throughout the whole production floor by combining cognitive data and artificial intelligence from individual components. With an "85% reduction in workers' idle time when they collaborate with robots," this work environment facilitates true machine-to-machine-to-people collaboration (M2M2P).

By Technology, Artificial Intelligence is expected to dominate the Digital Twin Technology Market. For speedier product design and development, AI has become essential technology. Emulators are now essential for creating complicated interfaces and environments, from the earliest stages of chipset design or circuit layout to end-product validation. These emulators also referred to as "digital twins," are a digital representation of a procedure, a setting, or a protocol that can act as a "known good signal." A digital twin can be a straightforward signal generator, a comprehensive protocol generator, or an entire environment emulation in test terms. Developers may quickly generate a far wider set of test scenarios using digital twins to check their product before it is released. High-performance digital twins generally have in-built AI engines for debugging and testing new product designs for regression. Therefore, the integration of such combined technologies in the industry can push the growth of the market.

By End User Industry, The automotive and transport dominates the Digital Twin Technology Market. This can be attributed to the adoption of Electric Vehicles (EVs), lean adoption, and the rising usage of simulation technologies. The incorporation of digital twin technology in the automotive sector helps engineers capture operational and behavioral data of the vehicle, thereby facilitating further enhancements in automobile design and optimizing costs. Upcoming trends in the automobile industry, including autonomous and connected vehicles, shared mobility, and electrification, are also expected to increase the adoption of this technology. For Instance, a New development tool launched by Amazon Web Services for tracking automobile fleets and creating digital twins that aggregate their changing output in manufacturing facilities, construction sites, and other physical assets.

Regional Analysis of Digital Twin Technology Market

North America dominates the Digital Twin Technology Market. The digital twin and associated technologies were widely adopted in North America, which is a significant hub for technical advancements. The demand for and awareness of digital twin solutions is also increased by the presence of significant digital twin providers in the area, including General Electric, Bentley Systems, IBM, Amazon Web Services, and Oracle. These suppliers are making groundbreaking advancements and developing technologies that are further getting integrated into digital twins. For instance, General Electric (US) upgraded Proficy CSense, its on-premises analytics program, in August 2021. To pinpoint issues, determine their underlying causes, forecast performance in the future, and automate actions, the program makes use of process digital twins and AI and machine learning technology. There are significant automotive & transportation, aerospace, chemical, energy & utilities, and food & beverage firms in the US, and North America has a developed ecosystem for digital twin activities. To increase performance effectiveness and lower total operational costs, these sectors are replacing outdated systems with cutting-edge solutions, which is fueling the expansion of the digital twin technology market in this area.

Asia Pacific region is growing at a swift pace in Digital Twin Technology Market. Digital twin technologies are increasingly being adopted by organizations in this region as a result of technological advancements in many industries and business processes. The need to embrace digital solutions in product development processes to reduce downtime and the expanding potential of consumers to spend on digital solutions to thrive in competitive markets are the primary drivers of this market's growth. Manufacturing industries in China, India, Japan, South Korea, and other industrial processes are increasing their venture capital investment to implement twin technologies. The region's abundance of industries, including those in the automotive and transportation, manufacturing, energy, and utility sectors, among others, is also projected to support market growth. China is the nation that adopts technology the fastest. The manufacturing sector in China accounts for 28.7% of worldwide manufacturing, according to the United Nations Statistics Division, which presents a wide scope of implementation of Digital Twin in manufacturing facilities. Such cluster-based opportunities in the Asia Pacific are expected to boost the digital twin technologies market.

Top Key Players Covered In Digital Twin Technology Market

- Ansys (United States)

- Azure (United States)

- ABB Group (Switzerland)

- Amazon Web Services, Inc. (United States)

- Siemens Ag

- Dassault Systèmes Se

- Ptc Inc.

- Robert Bosch Gmbh

- Ibm Corporation

- Oracle Corporation

- General Electric

- Sap Se And Other Major Players.

Key Industry Development In The Digital Twin Technology Market

- In May 2024, Ontrak Inc (NASDAQ: OTRK) launched its new Mental Health Digital Twin (MHDT) technology, combining human empathy with data-driven insights to offer personalized care for those with mental health challenges. The MHDT creates a virtual representation of each individual in the Ontrak Program, utilizing data from various sources to provide predictive insights and personalized recommendations through the Advanced Engagement System. This technology enables care teams to make informed decisions and deliver targeted interventions, revolutionizing precision mental health care delivery.

- In February 2024, The Indian government launched the 'Sangam: Digital Twin' initiative, seeking interest from industry leaders, innovators, MSMEs, start-ups, academia, and forward-thinkers to participate. Spearheaded by the Department of Telecommunications, the program aims to revolutionize infrastructure planning and design using 5G, IoT, AR/VR, AI, AI native 6G, 'Digital Twin', and advanced computational technologies.

|

Global Digital Twin Technology Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 13.08 Bn. |

|

Forecast Period 2024-32 CAGR: |

36.9% |

Market Size in 2032: |

USD 220.92 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By End Users Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Digital Twin Technology Market by Type (2018-2032)

4.1 Digital Twin Technology Market Snapshot and Growth Engine

4.2 Market Overview

4.3 System Digital Twin

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Product Digital Twin

4.5 Process Digital Twin

Chapter 5: Digital Twin Technology Market by Technology (2018-2032)

5.1 Digital Twin Technology Market Snapshot and Growth Engine

5.2 Market Overview

5.3 IOT

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Extended Reality (XR)

5.5 Cloud

5.6 Artificial Intelligence

Chapter 6: Digital Twin Technology Market by End Users Industry (2018-2032)

6.1 Digital Twin Technology Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Aerospace

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Automotive & Transportation

6.5 Healthcare

6.6 Infrastructure

6.7 Energy & Utilities

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Digital Twin Technology Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AMERICAN CRYSTAL SUGAR COMPANY

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ARCHER DANIELS MIDLAND COMPANY

7.4 ASSOCIATED BRITISH FOOD PLC (UK)

7.5 COSAN SA INDUSTRIAL E COMERCIO (BRAZIL)

7.6 E.I.D PARRY LIT (INDIA)

7.7 ILLOVO SUGAR (SOUTH AFRICA)

7.8 LOUIS DREYFUS HOLDING BV (AMSTERDAM)

7.9 MITR PHOL SUGAR CORPORATION LIT (THAILAND)

7.10 NORDZUCKER GROUP AG (GERMANY)

7.11 SHREE RENUKA SUGAR LTD (INDIA)

7.12 SUEDZUCKER AG (GERMANY)

7.13 CARGILL INC. (USA)

7.14 TATE & LYLE PLC (UK)

7.15 WILMAR INTERNATIONAL LIMITED (SINGAPORE)

7.16 SUGAR AUSTRALIA (AUSTRALIA)

7.17 RUDOLF WILD GMBH & CO. KG (GERMANY)

7.18 TEREOS INTERNACINAL SA (BRAZIL)

7.19

Chapter 8: Global Digital Twin Technology Market By Region

8.1 Overview

8.2. North America Digital Twin Technology Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 System Digital Twin

8.2.4.2 Product Digital Twin

8.2.4.3 Process Digital Twin

8.2.5 Historic and Forecasted Market Size by Technology

8.2.5.1 IOT

8.2.5.2 Extended Reality (XR)

8.2.5.3 Cloud

8.2.5.4 Artificial Intelligence

8.2.6 Historic and Forecasted Market Size by End Users Industry

8.2.6.1 Aerospace

8.2.6.2 Automotive & Transportation

8.2.6.3 Healthcare

8.2.6.4 Infrastructure

8.2.6.5 Energy & Utilities

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Digital Twin Technology Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 System Digital Twin

8.3.4.2 Product Digital Twin

8.3.4.3 Process Digital Twin

8.3.5 Historic and Forecasted Market Size by Technology

8.3.5.1 IOT

8.3.5.2 Extended Reality (XR)

8.3.5.3 Cloud

8.3.5.4 Artificial Intelligence

8.3.6 Historic and Forecasted Market Size by End Users Industry

8.3.6.1 Aerospace

8.3.6.2 Automotive & Transportation

8.3.6.3 Healthcare

8.3.6.4 Infrastructure

8.3.6.5 Energy & Utilities

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Digital Twin Technology Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 System Digital Twin

8.4.4.2 Product Digital Twin

8.4.4.3 Process Digital Twin

8.4.5 Historic and Forecasted Market Size by Technology

8.4.5.1 IOT

8.4.5.2 Extended Reality (XR)

8.4.5.3 Cloud

8.4.5.4 Artificial Intelligence

8.4.6 Historic and Forecasted Market Size by End Users Industry

8.4.6.1 Aerospace

8.4.6.2 Automotive & Transportation

8.4.6.3 Healthcare

8.4.6.4 Infrastructure

8.4.6.5 Energy & Utilities

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Digital Twin Technology Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 System Digital Twin

8.5.4.2 Product Digital Twin

8.5.4.3 Process Digital Twin

8.5.5 Historic and Forecasted Market Size by Technology

8.5.5.1 IOT

8.5.5.2 Extended Reality (XR)

8.5.5.3 Cloud

8.5.5.4 Artificial Intelligence

8.5.6 Historic and Forecasted Market Size by End Users Industry

8.5.6.1 Aerospace

8.5.6.2 Automotive & Transportation

8.5.6.3 Healthcare

8.5.6.4 Infrastructure

8.5.6.5 Energy & Utilities

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Digital Twin Technology Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 System Digital Twin

8.6.4.2 Product Digital Twin

8.6.4.3 Process Digital Twin

8.6.5 Historic and Forecasted Market Size by Technology

8.6.5.1 IOT

8.6.5.2 Extended Reality (XR)

8.6.5.3 Cloud

8.6.5.4 Artificial Intelligence

8.6.6 Historic and Forecasted Market Size by End Users Industry

8.6.6.1 Aerospace

8.6.6.2 Automotive & Transportation

8.6.6.3 Healthcare

8.6.6.4 Infrastructure

8.6.6.5 Energy & Utilities

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Digital Twin Technology Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 System Digital Twin

8.7.4.2 Product Digital Twin

8.7.4.3 Process Digital Twin

8.7.5 Historic and Forecasted Market Size by Technology

8.7.5.1 IOT

8.7.5.2 Extended Reality (XR)

8.7.5.3 Cloud

8.7.5.4 Artificial Intelligence

8.7.6 Historic and Forecasted Market Size by End Users Industry

8.7.6.1 Aerospace

8.7.6.2 Automotive & Transportation

8.7.6.3 Healthcare

8.7.6.4 Infrastructure

8.7.6.5 Energy & Utilities

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Digital Twin Technology Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 13.08 Bn. |

|

Forecast Period 2024-32 CAGR: |

36.9% |

Market Size in 2032: |

USD 220.92 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By End Users Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Digital Twin Technology Market research report is 2024-2032.

Siemens AG, Dassault Systèmes SE, PTC, Inc., Robert Bosch GmbH, IBM Corporation, Oracle Corporation, General Electric, SAP SE and other major players.

The Digital Twin Technology Market is segmented into Type, Technology, End User Industry and region. By Type, the market is categorized into System Digital Twin, Product Digital Twin, Process Digital Twin. By Technology, the market is categorized into IOT, Extended Reality (XR), Cloud, Artificial Intelligence. By End User Industry, the market is categorized into Aerospace, Automotive & Transportation, Healthcare, Infrastructure, Energy & Utilities. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Virtual duplicates of real-world objects are known as digital twins. Due to the technology's ability to boost the productivity of the current system, decrease operational costs, and shorten time to market, it is employed in a wide range of end-use industries. By combining simulation software and other computer-based tools to build a fictitious model of a dynamic process, product, or service, digital twin technology can record, control, and monitor it.

Digital Twin Technology Market Size Was Valued at USD 13.08 Billion in 2023 and is Projected to Reach USD 220.92 Billion by 2032, Growing at a CAGR of 36.9% From 2024-2032.