Key Market Highlights

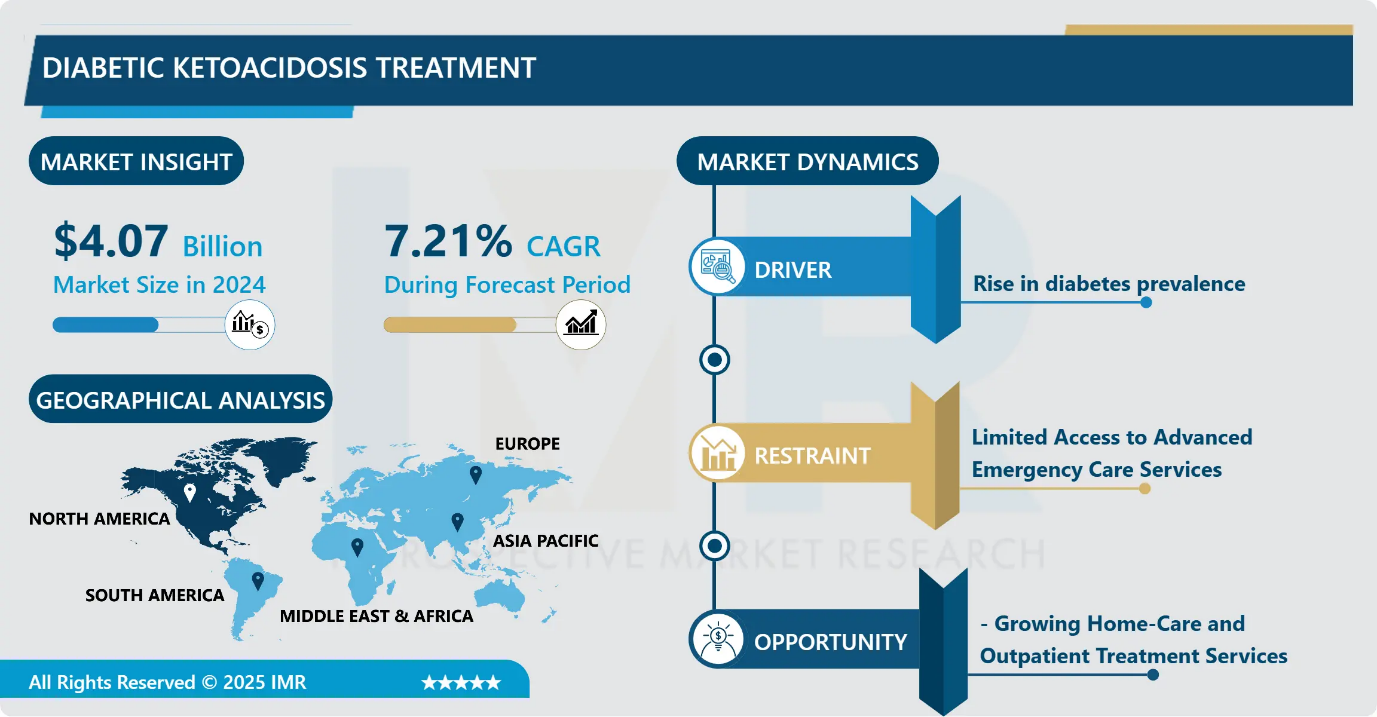

Diabetic Ketoacidosis Treatment Market Size Was Valued at USD 4.07 Billion in 2024, and is Projected to Reach USD 8.16 billion by 2035, Growing at a CAGR of 7.21% from 2025-2035.

- Market Size in 2024: USD 4.07 Billion

- Projected Market Size by 2035: USD 8.16 Billion

- CAGR (2025–2035): 7.21%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia-Pacific

- By End Users: The Hospital segment is anticipated to lead the market by accounting for 29.20% of the market share throughout the forecast period.

- By Treatment Type: The Insulin segment is expected to capture 32.56% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: Norh America region is projected to hold 29.07% of the market share during the forecast period.

- Active Players: Baxter International (USA), Eli Lilly and Company (USA), Fresenius Kabi (Germany), Merck & Co. (USA), Novo Nordisk (Denmark), Pfizer (USA), Sanofi (France), Wockhardt (India), Other Active Players

Diabetic Ketoacidosis Treatment Market Synopsis:

Diabetic Ketoacidosis (DKA) is a severe, life-threatening diabetes complication where the body lacks enough insulin, causing high blood sugar and a rapid breakdown of fat for fuel, leading to a dangerous buildup of acidic ketones in the blood, resulting in symptoms like extreme thirst, frequent urination, nausea, confusion, and fruity-smelling breath, requiring immediate medical treatment

Diabetic Ketoacidosis Treatment Market Dynamics and Trend Analysis:

Diabetic Ketoacidosis Treatment Market Growth Driver- Rise in diabetes prevalence

-

One major growth driver in the Diabetic Ketoacidosis (DKA) treatment market is the rapid rise in diabetes prevalence globally, especially among younger populations. With increasing cases of both Type 1 and uncontrolled Type 2 diabetes, more patients are experiencing acute metabolic complications like DKA, which directly increases the demand for timely treatment and advanced care solutions.

- Lifestyle changes, sedentary habits, poor dietary patterns, and rising obesity rates contribute significantly to this surge. As more individuals are diagnosed earlier and require emergency intervention, healthcare systems, clinics, and pharmaceutical companies are expanding treatment capacity. This growing patient base strongly fuels the need for effective DKA management and drives market growth.

Diabetic Ketoacidosis Treatment Market Limiting Factor- Limited Access to Advanced Emergency Care Services

-

A significant limiting factor in the Diabetic Ketoacidosis (DKA) treatment market is the limited availability of advanced emergency and critical-care facilities, especially in low- and middle-income regions. DKA requires immediate intervention with IV fluids, insulin infusion, and continuous monitoring, but many rural and under-resourced areas lack well-equipped hospitals, trained specialists, and reliable diagnostic support.

- As a result, delayed treatment leads to higher complication and mortality rates, reducing the adoption and effectiveness of advanced DKA therapies. Inadequate healthcare infrastructure, uneven distribution of medical resources, and affordability challenges restrict access to timely care, slowing market expansion despite rising disease prevalence.

Diabetic Ketoacidosis Treatment Market Expansion Opportunity- Growing Home-Care and Outpatient Treatment Services

-

A key expansion opportunity in the Diabetic Ketoacidosis (DKA) treatment market lies in home-care and outpatient treatment services. Advances in continuous glucose monitoring, rapid-acting insulin delivery systems, and telehealth platforms now make it possible to manage mild to moderate DKA cases outside hospitals safely.

- Expanding these patient-centric care models can reduce hospital burden, improve access in rural and semi-urban areas, and provide cost-effective solutions. Pharmaceutical and medical device companies can tap into this segment by offering portable treatment kits, remote monitoring tools, and training programs for caregivers, driving market growth while improving patient outcomes.

Diabetic Ketoacidosis Treatment Market Challenge and Risk- High Treatment Costs and Healthcare Disparities

-

A major challenge in the Diabetic Ketoacidosis (DKA) treatment market is the high cost of emergency care and advanced therapies, which limits accessibility for many patients, especially in developing regions. Managing DKA requires IV fluids, insulin infusion, electrolyte replacement, and continuous monitoring, often in ICU settings, making treatment expensive.

- Additionally, healthcare disparities including uneven distribution of hospitals, trained personnel, and diagnostic facilities pose risks to timely intervention. These factors can result in delayed treatment, higher complication rates, and reduced adoption of newer therapies, restricting market growth despite rising DKA incidence globally.

Diabetic Ketoacidosis Treatment Market Trend- Adoption of Advanced Continuous Glucose Monitoring (CGM) Systems

-

A prominent trend in the Diabetic Ketoacidosis (DKA) treatment market is the increasing use of advanced continuous glucose monitoring (CGM) systems. These devices allow real-time tracking of blood glucose levels, enabling early detection of hyperglycaemia and impending ketoacidosis, which helps prevent severe complications. Integration with insulin pumps and telehealth platforms further enhances patient management outside hospital settings.

- Growing awareness among patients and healthcare providers about the benefits of CGM, coupled with technological improvements and affordability, is driving adoption. This trend is shaping DKA treatment toward more proactive, personalized, and patient-centric care, improving outcomes and reducing hospital dependence.

Diabetic Ketoacidosis Treatment Market Segment Analysis:

Diabetic Ketoacidosis Treatment Market is segmented based on Treatment Type, Route of Administration, End-Users, and Region

By End Users Type, Hospitals segment is expected to dominate the market with around 29.20% share during the forecast period.

-

The End-User segment in Diabetic Ketoacidosis (DKA) treatment is growing mainly due to the rising burden of diabetes and increasing DKA cases, which is creating demand for treatment beyond traditional hospitals. While hospitals remain the primary care setting for emergency management, specialty diabetes clinics and home-care services are expanding rapidly because of improved awareness, early diagnosis, and the availability of advanced monitoring technologies such as CGM and rapid-acting insulin delivery.

- These innovations allow mild to moderate cases to be managed safely outside ICU or emergency rooms, reducing healthcare costs and hospital overcrowding. The shift toward patient-centric, convenient, and cost-effective care models is accelerating growth in these settings.

By Treatment type, Insulin Segment is expected to dominate with close to 32.56% market share during the forecast period.

-

Among the Treatment Type segments Fluid Replacement Therapy, Insulin Therapy, Electrolyte Replacement Therapy, and Supportive/Adjunctive Care the Insulin Therapy segment holds the largest and most commonly used share in Diabetic Ketoacidosis (DKA) treatment.

- This is because DKA results from a severe insulin deficiency leading to hyperglycaemia and ketone formation, making insulin the primary and essential therapy to stop ketogenesis, reduce blood glucose levels, and reverse acidosis. Insulin infusion is the first-line treatment in all clinical guidelines worldwide and is administered in nearly every DKA case across all severity levels. Additionally, IV insulin protocols are standardized, widely available, and supported by strong clinical evidence, driving its dominant use.

Diabetic Ketoacidosis Treatment Market Regional Insights:

North America region is estimated to lead the market with around 29.07% share during the forecast period.

-

North America holds the largest share because of a high prevalence of diabetes (both type 1 and type 2) driving frequent DKA cases, combined with a well-developed healthcare infrastructure that offers widespread access to emergency care, intensive-care units, and advanced insulin therapies.

- Standardized DKA management protocols, comprehensive reimbursement policies, and early adoption of cutting-edge technologies (e.g. automated insulin delivery, continuous glucose monitoring) further ensure timely diagnosis and effective treatment. High per-capita healthcare spending and strong presence of major pharmaceutical and medical-device companies in the region also reinforce its dominance in DKA treatment.

Diabetic Ketoacidosis Treatment Market Active Players:

- Baxter International (USA)

- Eli Lilly and Company (USA)

- Fresenius Kabi (Germany)

- Merck & Co. (USA)

- Novo Nordisk (Denmark)

- Pfizer (USA)

- Sanofi (France)

- Wockhardt (India)

- Other Active Players

Key Industry Developments in the Diabetic Ketoacidosis Treatment Market:

-

In June 2024 Baxter introduced an advanced balanced crystalloid solution (e.g. Plasma?Lyte) for critical?care use, beneficial for electrolyte and fluid management in DKA treatment.

- In March 2023, Eli?Lilly announced cutting the list price of its most prescribed insulins by about 70% Shortly after, Novo Nordisk announced plans to slash U.S. prices of several insulin products by up to 75%, effective Jan 1, 2024.

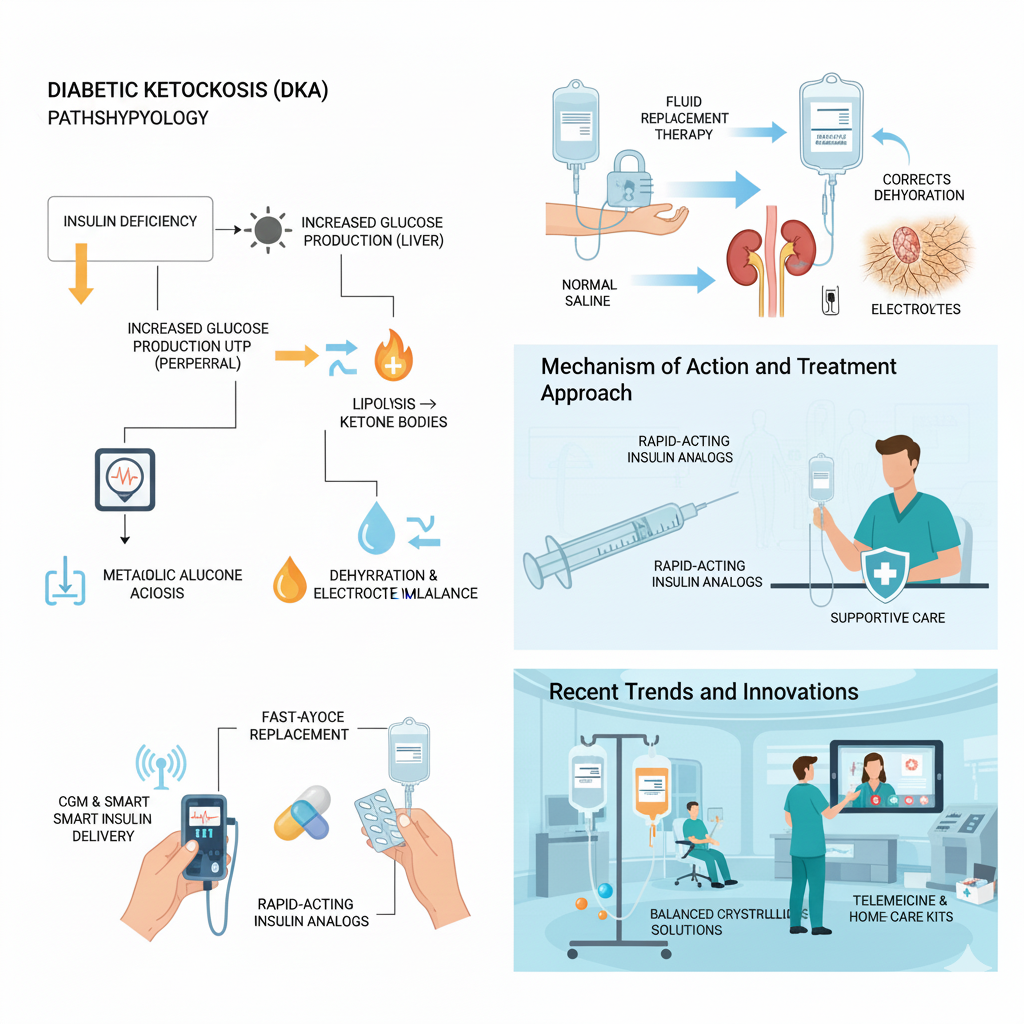

Diabetic Ketoacidosis: Mechanism and Therapeutic Approach

- Diabetic Ketoacidosis (DKA) is a life-threatening metabolic complication of diabetes characterized by hyperglycemia, ketosis, and metabolic acidosis. It occurs primarily due to a severe insulin deficiency (absolute or relative), leading to increased glucose production by the liver, impaired peripheral glucose uptake, and accelerated breakdown of fats into ketone bodies. These ketones accumulate, lowering blood pH and causing dehydration, electrolyte imbalances, and multi-organ stress.

Mechanism of Action and Treatment Approach:

- Treatment aims to reverse metabolic derangements, restore fluid-electrolyte balance, and correct hyperglycaemia.

- Insulin Therapy: Administered intravenously, insulin reduces hepatic glucose production and stops lipolysis, thereby halting ketone formation.

- Fluid Replacement Therapy: IV fluids (normal saline, balanced crystalloids) correct dehydration and improve renal perfusion for ketone excretion.

- Electrolyte Replacement: Potassium, phosphate, and sodium bicarbonate (in select cases) are supplemented to prevent cardiac and neuromuscular complications.

- Supportive/Adjunctive Care: Addresses infections, shock, or other precipitating factors.

- Timely management of DKA is critical to prevent cerebral edema, cardiac arrhythmias, and multi-organ failure, which can be fatal if untreated. Effective DKA care reduces hospital stay, mortality, and long-term complications.

Recent Trends and Innovations:

- Continuous Glucose Monitoring (CGM) & Smart Insulin Delivery Systems: Enable early detection and personalized insulin dosing, improving safety and reducing ICU dependency.

- Rapid-acting Insulin Analogs: Provide faster correction of hyperglycaemia and ketosis.

- Telemedicine & Home-Care Kits: Allow monitoring and early intervention in outpatient or rural settings.

- Balanced Crystalloids & Electrolyte Solutions: Innovations in IV fluids optimize electrolyte management, minimizing complications. These advancements collectively shift DKA treatment toward patient-centric, proactive, and technology-driven care, enhancing outcomes and accessibility.

|

Diabetic Ketoacidosis Treatment Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 4.07 Bn. |

|

Forecast Period 2025-35 CAGR: |

7.21% |

Market Size in 2035: |

USD 8.16 Bn. |

|

Segments Covered: |

By Treatment Type |

|

|

|

By End Users

|

|

||

|

By Route of Administration |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

Baxter International (USA), Eli Lilly and Company (USA), Fresenius Kabi (Germany), Merck & Co (USA), Novo Nordisk (Denmark), Pfizer (USA), Sanofi (France), Wockhardt (India), Other Active Players

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Diabetic Ketoacidosis Treatment Market by Treatment Type (2018-2035)

4.1 Diabetic Ketoacidosis Treatment Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Fluid Replacement Therapy

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Insulin Therapy

4.5 Electrolyte Replacement Therapy

4.6 Supportive / Adjunctive Care

Chapter 5: Diabetic Ketoacidosis Treatment Market by Route of Administration (2018-2035)

5.1 Diabetic Ketoacidosis Treatment Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Intravenous (IV)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Subcutaneous (SC)

5.5 Oral / Enteral

Chapter 6: Diabetic Ketoacidosis Treatment Market by End-User (2018-2035)

6.1 Diabetic Ketoacidosis Treatment Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Specialty Diabetes Clinics

6.5 Home Care / Telehealth

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Diabetic Ketoacidosis Treatment Market Share by Manufacturer/Service Provider(2024)

7.1.3 Industry BCG Matrix

7.1.4 PArtnerships, Mergers & Acquisitions

7.2 BAXTER INTERNATIONAL (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Recent News & Developments

7.2.10 SWOT Analysis

7.3 ELI LILLY AND COMPANY (USA)

7.4 FRESENIUS KABI (GERMANY)

7.5 MERCK & CO. (USA)

7.6 NOVO NORDISK (DENMARK)

7.7 PFIZER (USA)

7.8 SANOFI (FRANCE)

7.9 WOCKHARDT (INDIA)

7.10 OTHER ACTIVE PLAYERS

Chapter 8: Global Diabetic Ketoacidosis Treatment Market By Region

8.1 Overview

8.2. North America Diabetic Ketoacidosis Treatment Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecast Market Size by Country

8.2.4.1 US

8.2.4.2 Canada

8.2.4.3 Mexico

8.3. Eastern Europe Diabetic Ketoacidosis Treatment Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecast Market Size by Country

8.3.4.1 Russia

8.3.4.2 Bulgaria

8.3.4.3 The Czech Republic

8.3.4.4 Hungary

8.3.4.5 Poland

8.3.4.6 Romania

8.3.4.7 Rest of Eastern Europe

8.4. Western Europe Diabetic Ketoacidosis Treatment Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecast Market Size by Country

8.4.4.1 Germany

8.4.4.2 UK

8.4.4.3 France

8.4.4.4 The Netherlands

8.4.4.5 Italy

8.4.4.6 Spain

8.4.4.7 Rest of Western Europe

8.5. Asia Pacific Diabetic Ketoacidosis Treatment Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecast Market Size by Country

8.5.4.1 China

8.5.4.2 India

8.5.4.3 Japan

8.5.4.4 South Korea

8.5.4.5 Malaysia

8.5.4.6 Thailand

8.5.4.7 Vietnam

8.5.4.8 The Philippines

8.5.4.9 Australia

8.5.4.10 New Zealand

8.5.4.11 Rest of APAC

8.6. Middle East & Africa Diabetic Ketoacidosis Treatment Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecast Market Size by Country

8.6.4.1 Turkiye

8.6.4.2 Bahrain

8.6.4.3 Kuwait

8.6.4.4 Saudi Arabia

8.6.4.5 Qatar

8.6.4.6 UAE

8.6.4.7 Israel

8.6.4.8 South Africa

8.7. South America Diabetic Ketoacidosis Treatment Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecast Market Size by Country

8.7.4.1 Brazil

8.7.4.2 Argentina

8.7.4.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

Chapter 10 Our Thematic Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Chapter 11 Case Study

Chapter 12 Appendix

10.1 Sources

10.2 List of Tables and figures

10.3 Short Forms and Citations

10.4 Assumption and Conversion

10.5 Disclaimer

|

Diabetic Ketoacidosis Treatment Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 4.07 Bn. |

|

Forecast Period 2025-35 CAGR: |

7.21% |

Market Size in 2035: |

USD 8.16 Bn. |

|

Segments Covered: |

By Treatment Type |

|

|

|

By End Users

|

|

||

|

By Route of Administration |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

Baxter International (USA), Eli Lilly and Company (USA), Fresenius Kabi (Germany), Merck & Co (USA), Novo Nordisk (Denmark), Pfizer (USA), Sanofi (France), Wockhardt (India), Other Active Players

|

||