Key Market Highlights

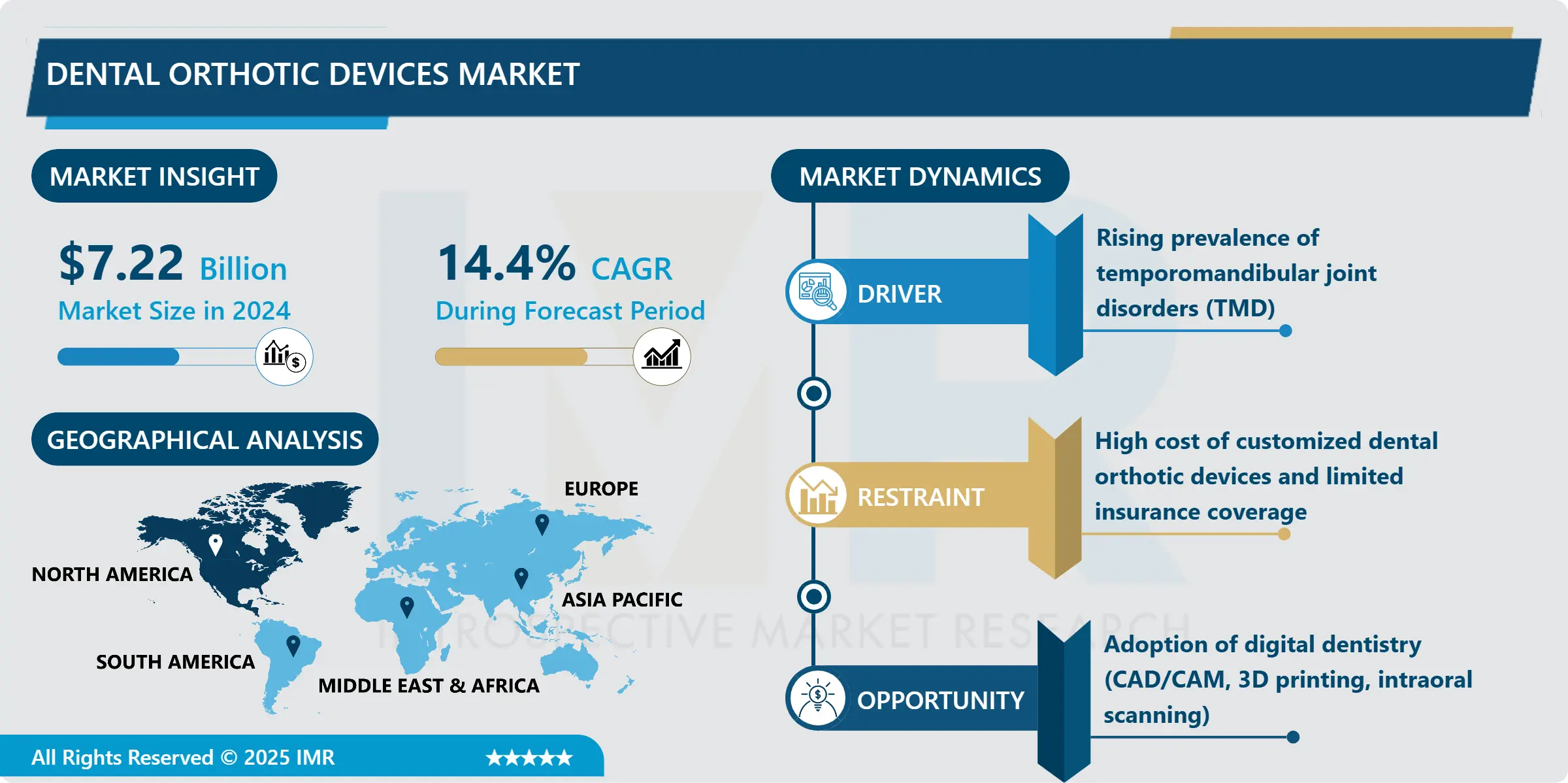

Dental Orthotic Devices Market Size Was Valued at USD 7.22 billion in 2024, and is Projected to Reach USD 31.71 billion by 2035, Growing at a CAGR of 14.4% from 2025-2035.

- Market Size in 2024: USD 7.22 billion

- Projected Market Size by 2035: USD 31.71 billion

- CAGR (2025–2035): 14.4%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia-Pacific

- By Type: The Anterior Repositioning Dental Orthotic Devices segment is anticipated to lead the market by accounting for 36% of the market share throughout the forecast period.

- By Segment 2: The Hospital pharmacies segment is expected to capture 42% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 38% of the market share during the forecast period.

- Active Players: 3M Company (USA), Align Technology, Inc. (USA), Angelalign (China), Bicon, LLC (USA), BioHorizons IPH, Inc. (USA), Other Active Players

Dental Orthotic Devices Market Synopsis:

Dental orthotic devices such as occlusal splints, bite planes, stabilization and anterior repositioning appliances are used to treat conditions like temporomandibular joint disorder (TMD), bruxism, sleep apnea, and occlusal misalignments.

Dental Orthotic Devices Market Dynamics and Trend Analysis:

Dental Orthotic Devices Market Growth Driver – Rising prevalence of temporomandibular joint disorders (TMD)

-

One of the main reasons the dental orthotic devices market is growing is the rising number of people suffering from temporomandibular joint disorders (TMD), bruxism (teeth grinding), and sleep apnea. These conditions affect millions of people around the world and are becoming more common due to factors like high stress levels, poor posture, and jaw misalignment.

- TMD affects the joint that connects the jawbone to the skull and can cause pain, difficulty chewing, and jaw clicking or locking. In the United States alone, over 10 million people are affected by TMD every year. Similarly, bruxism, or nighttime teeth grinding, is also widespread and often linked to anxiety and sleep disorders. Sleep apnea, which causes breathing to stop temporarily during sleep, is another condition that is being diagnosed more often and is sometimes treated with dental orthotic devices.

- As more people are becoming aware of these issues, especially through increased health education and access to dental care, the demand for non-surgical treatment options is rising. Dental orthotic devices like stabilization splints, night guards, and mandibular advancement devices are proving to be effective, affordable, and comfortable solutions. These devices help relieve pain, prevent further damage to teeth, and improve sleep quality. With growing awareness and better diagnostic tools, more people are turning to dental orthotics, making this a key driver of market growth.

Dental Orthotic Devices Market Limiting Factor - High cost of customized dental orthotic devices and limited insurance coverage

-

A major factor that limits the growth of the dental orthotic devices market is the high cost of customized devices and the lack of insurance coverage in many regions. Dental orthotic devices, especially those used for treating conditions like TMJ disorders or sleep apnea, are often custom-made for each patient. These devices can cost anywhere between $500 to over $2,000, depending on the material used, the level of customization, and the dental clinic’s pricing.

- For many patients, especially those in developing countries or from low-income backgrounds, this cost can be too high. In some cases, these devices are considered non-essential or cosmetic by insurance companies, and as a result, they are not fully covered under health insurance plans unless the condition is considered medically necessary. Even in countries with advanced healthcare systems, reimbursement is often limited or not available at all.

- This financial barrier prevents many people from seeking treatment, even when they are experiencing serious symptoms such as jaw pain, headaches, or disrupted sleep. As a result, the high cost and limited insurance coverage slow down the adoption of dental orthotic devices, especially in markets where affordability and healthcare access are already challenges. To overcome this limitation, more affordable manufacturing methods and better insurance support will be needed in the future.

Dental Orthotic Devices Market Expansion Opportunity - Adoption of digital dentistry (CAD/CAM, 3D printing, intraoral scanning)

-

The adoption of digital dentistry is creating new opportunities for the dental orthotic devices market. Technologies such as CAD/CAM (computer-aided design and manufacturing), 3D printing, and intraoral scanning are changing how dental devices are made. These tools make it possible to produce dental orthotics like splints, night guards, and bite plates with much greater accuracy, speed, and efficiency.

- Traditionally, making a custom dental device involved messy impressions, manual lab work, and long waiting times. Now, with digital scanning, dentists can take accurate digital impressions in minutes. These scans can be used to design devices with CAD software, which are then manufactured using 3D printers or milling machines. This process allows for mass customization, meaning each device is tailored to the patient while keeping production fast and costs lower.

- Another major development is the rise of tele-dentistry and online impression kits. Companies like Smile Direct Club and Clear Correct offer services where patients can order impression kits, take molds at home, and receive custom devices without visiting a dental office. This direct-to-consumer model is growing quickly, especially among tech-savvy or cost-conscious users.

- Overall, digital dentistry is making dental orthotic treatment more accessible, affordable, and patient-friendly, opening up exciting growth opportunities for the market across both developed and emerging regions.

Dental Orthotic Devices Market Challenge and Risk - Low awareness and underdiagnosis in emerging markets

-

One of the biggest challenges facing the dental orthotic devices market is low awareness and underdiagnosis, especially in emerging markets like Asia-Pacific, Latin America, and Africa. While the number of people suffering from conditions such as jaw disorders and sleep apnea is rising in these regions, many remain unaware that effective treatment options like dental orthotic devices even exist.

- This lack of awareness is often linked to limited access to trained dental professionals and insufficient healthcare infrastructure. In rural or low-income areas, dental clinics are either too far away or under-equipped. Many general healthcare providers may also overlook or misdiagnose conditions like TMD or bruxism, leading to delayed or no treatment at all.

- Public education about these conditions is minimal, and as a result, many people do not seek help until the symptoms become severe. This contributes to a growing treatment gap in these regions.

- Additionally, as online health products become more popular, there’s a rising risk of patients turning to self-fitted or over-the-counter dental devices from e-commerce sites. Without professional supervision, these devices may not fit properly or may even cause harm, leading to pain, worsened symptoms, or a loss of trust in dental products.

- To overcome this challenge, more public health campaigns, better dental training programs, and stronger regulation of online dental products are urgently needed in developing regions.

Dental Orthotic Devices Market Segment Analysis:

Dental Orthotic Devices Market is segmented based on Type, Application, End-Users, and Region

By Type, Dental Orthotic Devices Segment is Expected to Dominate the Market During the Forecast Period

-

Anterior Repositioning Dental Orthotic Devices are a special type of mouth appliance used mainly to treat temporomandibular joint (TMJ) disorders. The TMJ is the joint that connects your jaw to your skull and helps you talk, chew, and yawn. When this joint is not working properly, it can cause pain, clicking sounds, headaches, and difficulty opening or closing the mouth.

- These devices work by gently shifting the lower jaw forward into a better position. This helps take pressure off the jaw joint and surrounding muscles. By doing so, it allows the joint to heal and function more smoothly. Many people with TMJ problems find great relief after using anterior repositioning devices, especially when the condition is caused by a misaligned bite or jaw movement problems.

- They are often custom-made by dentists after a proper diagnosis. Patients usually wear them at night or during specific parts of the day, depending on the severity of their symptoms. Over time, these devices can help reduce joint clicking, relieve muscle tension, and improve how the upper and lower teeth fit together.

- While not a permanent fix, anterior repositioning dental orthotics are an effective, non-surgical option for managing TMJ disorders. When combined with lifestyle changes, physical therapy, or stress management, they can greatly improve a person’s comfort and jaw function.

By Application, Dental Orthotic Devices Segment Held the Largest Share in 2024

-

Hospital pharmacies play an important role in the distribution of dental orthotic devices, especially for patients with more serious or medically complex conditions. These pharmacies are located within hospitals or large medical centers and are closely linked to hospital-based dental and maxillofacial units. They usually handle prescriptions from specialists who treat conditions like severe temporomandibular joint (TMJ) disorders, sleep apnea, or other oral health issues that require professional supervision.

- Unlike over-the-counter options available in retail or online pharmacies, the devices provided through hospital pharmacies are often custom-made and prescribed by dental professionals after a full evaluation. These include anterior repositioning devices, mandibular advancement devices, and bite planes that are specifically designed for the patient’s condition.

- Because of the complex nature of the cases they handle, hospital pharmacies are especially useful for patients who may need ongoing monitoring, adjustments, or additional treatments. This is common in situations where the dental issue is linked to other health problems, such as facial trauma, jaw surgery recovery, or severe bruxism.

- Although they may not be the largest distribution channel in terms of volume, hospital pharmacies provide a critical service for high-need patients. Their role ensures that patients receive the right device, proper fitting, and expert guidance, which helps improve treatment success and patient safety.

Dental Orthotic Devices Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

-

North America is the largest and most important market for dental orthotic devices. This region includes countries like the United States and Canada, where people have better access to dental care and are more aware of oral health problems. Many people in North America suffer from conditions like TMJ disorders, bruxism (teeth grinding), and sleep apnea, which are the main reasons for using dental orthotic devices.

- One of the biggest reasons for the strong market in this region is the presence of many leading dental companies, such as Align Technology, 3M, and Dentsply Sirona, which are all based in the U.S. These companies invest in research and technology to make better, more comfortable, and more effective devices.

- In North America, dental clinics often use advanced technologies like 3D printing, CAD/CAM systems, and digital scanners. These tools help dentists create custom-made devices faster and more accurately. People in this region are also more likely to visit dentists regularly, which increases the use of these devices.

- Health awareness is high, and many insurance plans cover dental treatments, which also helps market growth. The U.S., in particular, leads the region in terms of both sales and innovation. As a result, North America is expected to stay the top market for dental orthotic devices in the coming years.

Dental Orthotic Devices Market Active Players:

- 3M Company (USA)

- Align Technology, Inc. (USA)

- Angelalign (China)

- Bicon, LLC (USA)

- BioHorizons IPH, Inc. (USA)

- BioMers (Unknown – likely South Korea or France)

- Carestream Dental LLC (USA)

- Clarus Company (USA)

- ClearCorrect (USA)

- Danaher Corporation (USA)

- Dentaurum Group (Germany)

- Dentsply Sirona Inc. (USA)

- EZ SMILE (China)

- First Lab Direct Ltd (UK or Australia)

- GC Corporation (Japan)

- Geniova (Italy)

- Glidewell Laboratories / Glidewell Dental (USA)

- Henry Schein, Inc. (USA)

- Ivoclar Vivadent AG (Liechtenstein)

- Nobel Biocare Services AG (Sweden/USA)

- Osstem Implant Co., Ltd. (South Korea)

- Patterson Companies, Inc. (USA)

- Planmeca Oy (Finland)

- Septodont Holding (France)

- Shofu Dental Corporation (Japan)

- Southern Cross Dental (Australia)

- Straumann Group (Switzerland)

- Ultradent Products, Inc. (USA)

- Vatech Co., Ltd. (South Korea)

- Zimmer Biomet Holdings, Inc. (USA)

- Other Active Players

|

Dental Orthotic Devices Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 7.22 billion |

|

Forecast Period 2025-35 CAGR: |

14.4 % |

Market Size in 2035: |

USD 31.71 billion |

|

Segments Covered: |

By Type |

|

|

|

By Application

|

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Dental Orthotic Devices Market by Types (2018-2035)

4.1 Dental Orthotic Devices Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Anterior Repositioning Dental Orthotic Devices

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Anterior Bite Plane Dental Orthotic Devices

4.5 Posterior Bite Plane Dental Orthotic Devices

4.6 Others

Chapter 5: Dental Orthotic Devices Market by Application (2018-2035)

5.1 Dental Orthotic Devices Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hospital Pharmacies

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Retail Pharmacies

5.5 Online Pharmacies

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Dental Orthotic Devices Market Share by Manufacturer/Service Provider(2024)

6.1.3 Industry BCG Matrix

6.1.4 PArtnerships, Mergers & Acquisitions

6.2 3M COMPANY (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Recent News & Developments

6.2.10 SWOT Analysis

6.3 ALIGN TECHNOLOGY

6.4 INC. (USA)

6.5 ANGELALIGN (CHINA)

6.6 BICON

6.7 LLC (USA)

6.8 BIOHORIZONS IPH

6.9 INC. (USA)

6.10 BIOMERS (UNKNOWN – LIKELY SOUTH KOREA OR FRANCE)

6.11 CARESTREAM DENTAL LLC (USA)

6.12 CLARUS COMPANY (USA)

6.13 CLEARCORRECT (USA)

6.14 DANAHER CORPORATION (USA)

6.15 DENTAURUM GROUP (GERMANY)

6.16 DENTSPLY SIRONA INC. (USA)

6.17 EZ SMILE (CHINA)

6.18 FIRST LAB DIRECT LTD (UK OR AUSTRALIA)

6.19 GC CORPORATION (JAPAN)

6.20 GENIOVA (ITALY)

6.21 GLIDEWELL LABORATORIES / GLIDEWELL DENTAL (USA)

6.22 HENRY SCHEIN

6.23 INC. (USA)

6.24 IVOCLAR VIVADENT AG (LIECHTENSTEIN)

6.25 NOBEL BIOCARE SERVICES AG (SWEDEN/USA)

6.26 OSSTEM IMPLANT CO.

6.27 LTD. (SOUTH KOREA)

6.28 PATTERSON COMPANIES

6.29 INC. (USA)

6.30 PLANMECA OY (FINLAND)

6.31 SEPTODONT HOLDING (FRANCE)

6.32 SHOFU DENTAL CORPORATION (JAPAN)

6.33 SOUTHERN CROSS DENTAL (AUSTRALIA)

6.34 STRAUMANN GROUP (SWITZERLAND)

6.35 ULTRADENT PRODUCTS

6.36 INC. (USA)

6.37 VATECH CO.

6.38 LTD. (SOUTH KOREA)

6.39 ZIMMER BIOMET HOLDINGS

6.40 INC. (USA)

6.41 AND OTHER ACTIVE PLAYERS.

Chapter 7: Global Dental Orthotic Devices Market By Region

7.1 Overview

7.2. North America Dental Orthotic Devices Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecast Market Size by Country

7.2.4.1 US

7.2.4.2 Canada

7.2.4.3 Mexico

7.3. Eastern Europe Dental Orthotic Devices Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecast Market Size by Country

7.3.4.1 Russia

7.3.4.2 Bulgaria

7.3.4.3 The Czech Republic

7.3.4.4 Hungary

7.3.4.5 Poland

7.3.4.6 Romania

7.3.4.7 Rest of Eastern Europe

7.4. Western Europe Dental Orthotic Devices Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecast Market Size by Country

7.4.4.1 Germany

7.4.4.2 UK

7.4.4.3 France

7.4.4.4 The Netherlands

7.4.4.5 Italy

7.4.4.6 Spain

7.4.4.7 Rest of Western Europe

7.5. Asia Pacific Dental Orthotic Devices Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecast Market Size by Country

7.5.4.1 China

7.5.4.2 India

7.5.4.3 Japan

7.5.4.4 South Korea

7.5.4.5 Malaysia

7.5.4.6 Thailand

7.5.4.7 Vietnam

7.5.4.8 The Philippines

7.5.4.9 Australia

7.5.4.10 New Zealand

7.5.4.11 Rest of APAC

7.6. Middle East & Africa Dental Orthotic Devices Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecast Market Size by Country

7.6.4.1 Turkiye

7.6.4.2 Bahrain

7.6.4.3 Kuwait

7.6.4.4 Saudi Arabia

7.6.4.5 Qatar

7.6.4.6 UAE

7.6.4.7 Israel

7.6.4.8 South Africa

7.7. South America Dental Orthotic Devices Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecast Market Size by Country

7.7.4.1 Brazil

7.7.4.2 Argentina

7.7.4.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

Chapter 9 Our Thematic Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Chapter 10 Case Study

Chapter 11 Appendix

11.1 Sources

11.2 List of Tables and figures

11.3 Short Forms and Citations

11.4 Assumption and Conversion

11.5 Disclaimer

|

Dental Orthotic Devices Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 7.22 billion |

|

Forecast Period 2025-35 CAGR: |

14.4 % |

Market Size in 2035: |

USD 31.71 billion |

|

Segments Covered: |

By Type |

|

|

|

By Application

|

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||