Data Center Fire Detection and Suppression Market Synopsis

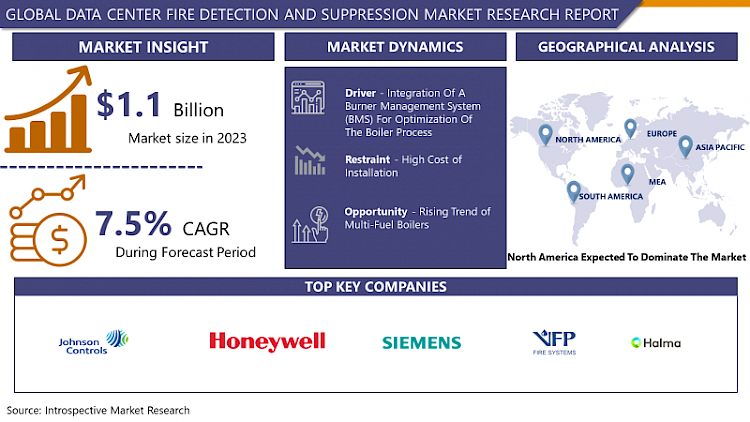

Data Center Fire Detection and Suppression Market Size Was Valued at USD 1.1 Billion in 2023 and is Projected to Reach USD 2.1 Billion by 2032, Growing at a CAGR of 7.5% From 2024-2032.

Data Center Fire Detection and Suppression entails the systems and technologies used to prevent fire occurrence within the data center and if it occurs, it brings under control. These systems are important in protecting the valuable information and tools, and making certain that the firm remains functional. They commonly featured improved smoke detector systems, fire alarms, and fire extinguishing tools that are clean agents or gaseous substances. Data center fire detection and suppression are essential in minimizing and preventing the occurrence of fires, which led to immense data loss and high costs of downtime. These systems help in quick action and prevent extensive damage by identifying fires in their initial stages and uses suitable extinguishing mechanisms that do not pose any threats to valuable electrical appliances.

Data centers are planned and built for mission critical purposes to process data from consumers and business end-users. Telecommunication broadband connectivity or fiber optic cables interfaced with satellites or satellites link the data centers with customers and companies. They include IT assets like servers, storage, networks and links to process and store users data. They also have power and cooling infrastructures to provide end users highly available, reliable and scalable services. Construction of data centers can cost anywhere from thousands to billions of dollars depending on their location, size, and capacity.

- Fire detection and suppression systems are configured and incorporated in data centers to counter fire break out within the facility data floor area, technical zones, and support plant. Recently the fire incidents have caused outages in data centers leading to downtime which has prompted investment in these systems in data centers. Data center operators are incorporating fire suppression systems in a bid to provide the facility with the best form of protection. In the context of fire protection in a data center it is possible to differentiate the rack, room, and building levels. Some standards have been set by the National Fire Protection Association for data center operators around the world. These standards are effective in enabling several facilities with different architectural layouts receive protection for their systems against the dangers of fire.

- On the account of increasing demands and challenges within data centers, and the necessity of protecting these essential infrastructures against fire-related threats, the Global Data Center Fire Detection and Suppression Market have seen considerable growth. As the complexity of the data stored in data centers continues to grow, proper and precise detection of fire and getting ready to extinguish it is of great significance. The following factors enshrine this market –Higher regulatory standards for the implementation of appropriate fire safety measures and, an increased use of innovative solutions to counter the threats that may occur.

- Moreover, more complex layout of data center architectures in terms of expanded sizes has also contributed to the need for advanced fire detectable and extinguishable infrastructures. Such solutions consist of a scale of uniques including early warning mechanisms, new age suppression chemicals and smart monitoring tools that give quick and accurate responses to fire occurrences. Furthermore, the increase in knowledge among enterprises concerning the potential adversative impact of data center fire occurrences may lead to investment in protective devices to enhance the market impetus. Unquestionably, the need to secure the world’s data centers shall persist as more organizations rely on the facilities as the nervous systems of their operations The Global Data Center Fire Detection and Suppression Market shall therefore, remain on an upward trajectory in the foreseeable future.

Data Center Fire Detection and Suppression Market Trend Analysis

Rising fire incidences at data center facilities

- This is due to the rising fire incidences at data center facilities across the globe and the need to adopt more sensitive smoke detection system and a quick-fire suppression mechanism to prevent fire breakouts and for protection of IT equipments. For example, in November 2020, Global Switch Sydney data center had a power blackout as an effect of a false alarm that triggered the fire suppression and detection systems installed at the computing facility.

- To ensure that such circumstances do not occur, data center operators must pay attention in detailling the appropriate fire suppression and detection systems depending on the needs of the said facility. Some of the vendors providing fire and safety systems are also coming out with new products in terms of minimizing the possibilities of equipment failure. The operators could control the fire systems from the comfort of their desks. There is an increase in construction activities for hyperscale data centers and hence the industry requires fire suppression and detection systems with latest technological features to safeguard their data assets which is expected to bolster the market growth.

Growth in the rack power density

- The rise in the rack power density has led to the evolution of solutions such as a rack-level UPS system and various electricity feeds on racks and facility configurations. Indeed, most of the large and mega data center possess power infrastructure that can support as much as 50 kW of rack density. This installation will also grow further with the new data center projects and create the future demand on power infrastructure solutions in the forecast period.

- On average, the AI workload requires significantly higher energy consumption compared to numerous modern data center power densities per rack that currently stand at 7 kW on the average. Some applications consume more than 30 kW/rack, pushing up rack power density. The specifications for higher rack power density facilities should include equipments for heat and smoke detection and facilities for rapid fire suppression if there is an outbreak of fire or smoke to prevent incidences of fire. This has led to the deployment of over and above fire and safety solutions in a market expected to experience growth.

Data Center Fire Detection and Suppression Market Segment Analysis:

Data Center Fire Detection and Suppression Market is segmented based on Fire Safety Systems, and Deployment Locations.

By Fire Safety Systems, fire suppression systems segment is expected to dominate the market during the forecast period

- Depending on the type of fire safety systems, the global data center fire detection and suppression market is segmented into fire detection and fire suppression systems.

- The fire suppression systems segment leads the global market and is anticipated to have a CAGR of 7 percent. This is estimated to grow an average of 45% over the forecast period. The simplest form of extinguishing is the wet pipe sprinkler system. Where pipes are always full of water, one of the possibilities includes false discharge and water leaks or pipe failure. Hence, this system is typically not recommended to be implemented in data centers. Moreover, such occurrences can harm the physical assets or negatively affect service delivery. Therefore, to counteract these problems, welded pipe systems are used, however, mechanical pipe connections are still detected in many existing industrial facilities. Currently data center operators use two types of water based fire suppression methods known as single and double interlock systems.

- Also, the rising cases of data center outages that have been attributed to fire based incidents have made it compulsory for operator’s data centers to go for the procurement of fire based suppression systems. This has led to the expansion of the market through the construction of data center facilities across the world. The construction of hyperscale facilities will also serve as a strong driving force for the market, with core and shell development incorporating these systems throughout the development of the project.

- Fire detectors are important elements of the fire and safety systems used in data center premises. These detectors include sensors that are used to measure the density of the smoke and sound a loud alarm when the density of the smoke is beyond a given limit. There is a wide range of smoke detection methods available, which can be implemented in data centers to produce an initial alarm of fire. The methods of smoke detection generally encompass entities such as spot-type smoke detection, air-aspirating smoke detection, or both. Currently, the most popular approach used in data center is the spot-type smoke detection which is easy to install and less costly.

By Deployment Locations, technical space/room level segment held the largest share in 2023

- The technical space/room level segment takes the largest market share and is predicted to have a CAGR of 7 percent. The New Zealand’s defence budget is expected to grow at a compounded rate of 61% during the forecast period. Room-level fire protection mostly acts on server rooms and data halls. It may even be an on-premise data center facility or simply a data center.

- At the room level the National Fire Protection Association NFPA has established several standard, rules and regulations. The NFPA 75 is the one which defines protection from fire for cables computer equipment and other items. The requirements, addressed in this standard, are basic and pertain to protection of IT infrastructure and areas from fire or its by-products like smoke, corrosion and heat. Furthermore, the revised version of the standard draws extra attention in determining the effect to the use of containment cooling by data center operators. Hence, the sprinkler systems require modification to ensure that they pose protection over other areas that embrace confined aisles.

Data Center Fire Detection and Suppression Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Currently, North America is the largest global data center fire detection and suppression market and is expected to grow at a CAGR of 6%. to 36% in the forecasting period, according to the obtained results. Satellites or Telecommunication broadband connectivity link the data centre with the customer and the company through the fiber optic cables. The geographical area is strategic and plays the role of an incumbent in the market of technological innovations within the data center industry. The major leaders operating in North America market include Facebook, Google, Microsoft, AWS, Equinix, Digital Realty, Compass Datacenters, Cologix, Vantage Data Centers, NTT Global Data Centers, QTS Realty Trust, CoreSite Realty, CyrusOne, and Switch. In addition, the US is the pioneer country of the North American region. The need for fire suppression systems has also increased because there has been a rise in the use of data centers in various organizations.

Active Key Players in the Data Center Fire Detection and Suppression Market

- Johnson Controls International plc

- Honeywell International Inc.

- Siemens AG

- VFP Fire Systems, Inc.

- Halma plc

- Hochiki America Corporation

- Fike Corporation

- Gentex Corporation

- Bosch Sicherheitssysteme GmbH

- Minimax GmbH

- Other Key Players

Key Industry Developments in the Data Center Fire Detection and Suppression Market:

- On the 14th of April 2022, Johnson Controls announced the acquisition Xcell Misting Ltd, a renowned fire protection organization that designs and deploys efficient fire protection systems and solutions.

- In November 2022, Sdiptech AB (publ) bought shares in the firms Patol Ltd. and Linesense Fire Detection Ltd. for productions and systems of fire protection.

|

Global Data Center Fire Detection and Suppression Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.1 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.5% |

Market Size in 2032: |

USD 2.1 Bn. |

|

Segments Covered: |

By Fire Safety Systems |

|

|

|

By Deployment Locations |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Fire Systems

3.2 By Deployment

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Data Center Fire Detection and Suppression Market by Fire Systems

5.1 Data Center Fire Detection and Suppression Market Overview Snapshot and Growth Engine

5.2 Data Center Fire Detection and Suppression Market Overview

5.3 Fire Suppression

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Fire Suppression: Geographic Segmentation

5.4 Fire Detection

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Fire Detection: Geographic Segmentation

Chapter 6: Data Center Fire Detection and Suppression Market by Deployment

6.1 Data Center Fire Detection and Suppression Market Overview Snapshot and Growth Engine

6.2 Data Center Fire Detection and Suppression Market Overview

6.3 In Cabinet Level

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 In Cabinet Level: Geographic Segmentation

6.4 Technical Space/Room Level

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Technical Space/Room Level: Geographic Segmentation

6.5 Other Building Space/Level

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Other Building Space/Level: Geographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Data Center Fire Detection and Suppression Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Data Center Fire Detection and Suppression Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Data Center Fire Detection and Suppression Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 HONEYWELL INTERNATIONAL INC

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 DANFOSS A/S

7.4 SIEMENS AG

7.5 JOHNSON CONTROLS

7.6 ROBERT BOSCH GMBH

7.7 HALMA PLC

7.8 HOCHIKI CORPORATION

7.9 CANNON FIRE PROTECTION LTD

7.10 THE CHEMOURS COMPANY

7.11 MINIMAX GMBH & CO KG

7.12 CARRIER GLOBAL CORPORATION

7.13 FIKE CORPORATION

7.14 AMEREX CORPORATION

7.15 FIREFLEX SYSTEMS INC

7.16 VICTAULIC COMPANY

7.17 OTHER MAJOR PLAYERS

Chapter 8: Global Data Center Fire Detection and Suppression Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Fire Systems

8.2.1 Fire Suppression

8.2.2 Fire Detection

8.3 Historic and Forecasted Market Size By Deployment

8.3.1 In Cabinet Level

8.3.2 Technical Space/Room Level

8.3.3 Other Building Space/Level

Chapter 9: North America Data Center Fire Detection and Suppression Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Fire Systems

9.4.1 Fire Suppression

9.4.2 Fire Detection

9.5 Historic and Forecasted Market Size By Deployment

9.5.1 In Cabinet Level

9.5.2 Technical Space/Room Level

9.5.3 Other Building Space/Level

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe Data Center Fire Detection and Suppression Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Fire Systems

10.4.1 Fire Suppression

10.4.2 Fire Detection

10.5 Historic and Forecasted Market Size By Deployment

10.5.1 In Cabinet Level

10.5.2 Technical Space/Room Level

10.5.3 Other Building Space/Level

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific Data Center Fire Detection and Suppression Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Fire Systems

11.4.1 Fire Suppression

11.4.2 Fire Detection

11.5 Historic and Forecasted Market Size By Deployment

11.5.1 In Cabinet Level

11.5.2 Technical Space/Room Level

11.5.3 Other Building Space/Level

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa Data Center Fire Detection and Suppression Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Fire Systems

12.4.1 Fire Suppression

12.4.2 Fire Detection

12.5 Historic and Forecasted Market Size By Deployment

12.5.1 In Cabinet Level

12.5.2 Technical Space/Room Level

12.5.3 Other Building Space/Level

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America Data Center Fire Detection and Suppression Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Fire Systems

13.4.1 Fire Suppression

13.4.2 Fire Detection

13.5 Historic and Forecasted Market Size By Deployment

13.5.1 In Cabinet Level

13.5.2 Technical Space/Room Level

13.5.3 Other Building Space/Level

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Data Center Fire Detection and Suppression Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.1 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.5% |

Market Size in 2032: |

USD 2.1 Bn. |

|

Segments Covered: |

By Fire Safety Systems |

|

|

|

By Deployment Locations |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- DATA CENTER FIRE DETECTION AND SUPPRESSION MARKET BY FIRE SAFETY SYSTEMS (2017-2032)

- DATA CENTER FIRE DETECTION AND SUPPRESSION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FIRE DETECTION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FIRE SUPPRESSION

- DATA CENTER FIRE DETECTION AND SUPPRESSION MARKET BY DEPLOYMENT LOCATIONS (2017-2032)

- DATA CENTER FIRE DETECTION AND SUPPRESSION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- IN-CABINET LEVEL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- TECHNICAL SPACE/ROOM LEVEL

- OTHER SPACE/BUILDING LEVEL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Data Center Fire Detection and Suppression Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- JOHNSON CONTROLS INTERNATIONAL PLC

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- HONEYWELL INTERNATIONAL INC.

- SIEMENS AG

- VFP FIRE SYSTEMS, INC.

- HALMA PLC

- HOCHIKI AMERICA CORPORATION

- FIKE CORPORATION

- GENTEX CORPORATION

- BOSCH SICHERHEITSSYSTEME GMBH

- MINIMAX GMBH

- COMPETITIVE LANDSCAPE

- GLOBAL DATA CENTER FIRE DETECTION AND SUPPRESSION MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Fire Safety Systems

- Historic And Forecasted Market Size By Deployment Locations

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

Frequently Asked Questions :

The forecast period in the Data Center Fire Detection and Suppression Market research report is 2024-2032.

Johnson Controls International plc Honeywell International Inc. Siemens AG VFP Fire Systems, Inc. Halma plc Hochiki America Corporation Fike Corporation Gentex Corporation Bosch Sicherheitssysteme GmbH Minimax GmbH, and Other Major Players..

The Data Center Fire Detection and Suppression Market is segmented into fire safety systems, deployment locations, and regions. By fire safety systems, the market is categorized into fire detection and fire suppression. By deployment locations, the market is categorized into In-Cabinet Level, Technical space/room level, and other space/building level. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Data Center Fire Detection and Suppression encompasses the management systems and technologies used to address fire dangers in data center facilities. These systems are essential as they help in protecting valuable information, equipment, and the functionality of any business. These tend to incorporate features such as enhanced forms of smoke detection, fire alarms, as well as fire extinguishing products containing clean agents, or inert gases. The usage of Fire Detection and Suppression Systems is vital in managing severe cases of data loss and system halts resulting from fires. These systems are fast and do not adversely affect the delicate electronics in the building as they quickly respond and extinguish the fire at the earliest stage possible.

Data Center Fire Detection and Suppression Market Size Was Valued at USD 1.1 Billion in 2023 and is Projected to Reach USD 2.1 Billion by 2032, Growing at a CAGR of 7.5% From 2024-2032.