Credit Risk Assessment Market Synopsis:

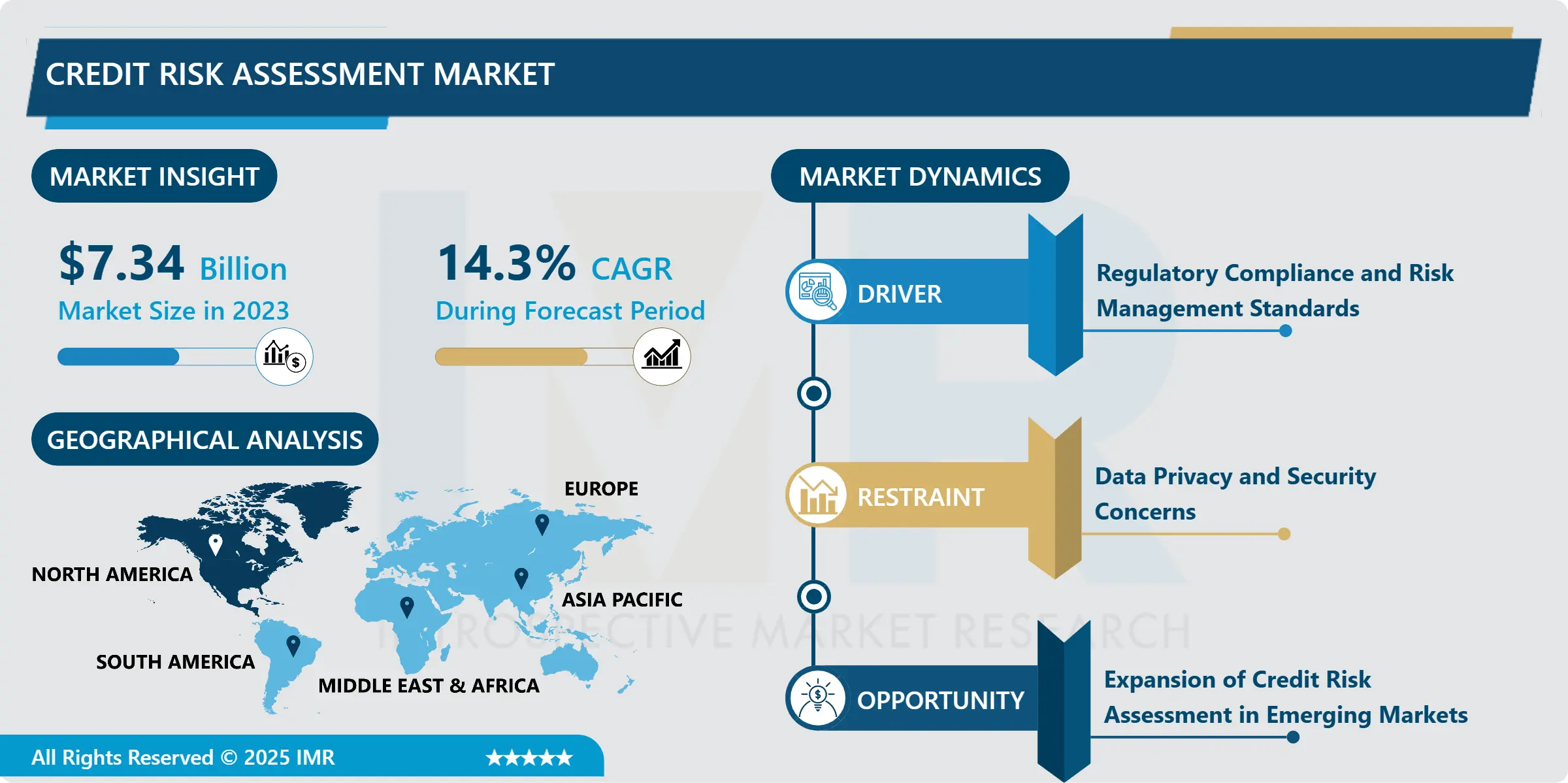

Credit Risk Assessment Market Size Was Valued at USD 7.34 Billion in 2023, and is Projected to Reach USD 24.44 Billion by 2032, Growing at a CAGR of 14.3% From 2024-2032.

Credit Risk Assessment Market is an organization that specializes in assessing and the possible risk involved where borrowers are unable to pay their dues. Credit risk measurement tools, methodologies outline the ability of an institution, lender or investor to assess the likelihood of a default by a borrower or the possibility of the key terms of a loan or credit obligations not being honoured default risk. Credit risk All solutions that measure, monitor and correctly mitigate credit risk.

The Credit Risk Assessment industry is being propelled by the growing requirement of financial institutions to assess the creditworthiness of borrowers more correctly. More efficient management of risk tools have been in demand in retail and corporate sectors as lending activities keep moving forward. It is largely because of the advent of new technologies such as AI and ML that have resulted in revolutionary changes in assessing these qualities and enable predictive modeling and real-time analysis. They help institutions get more precise in assessing the credit risks, that ultimately contributes to reducing the number of defaults and delinquency.

Furthermore, growing complexity in financial products, increased cross-border lending, and regulatory pressures all emphasize establishing robust risk assessment frameworks. As an example, Basel III regulations require banks to develop more stringent risk management practices. Consequently, there is a high need for integrated solutions that can provide holistic risk analysis of financial services. Risk management tools have also become much more advanced with the evolution of the global financial market in terms of incorporating data analytics, automated decision-making and scenario testing.

Another reason is the growing demand for customized financial products. Lenders and institutions seek customized risk assessments that match a risk profile specifically designed to an individual client's needs. The market for credit scoring, fraud detection, and debt collection continue to develop continuously. In addition, growing digital lending platforms, peer-to-peer lending, and fintech applications have posed new challenges and opportunities for the development of such assessments of credit risk.

Credit Risk Assessment Market Trend Analysis:

AI and Machine Learning Integration in Credit Risk Assessment

-

The integration of AI and ML in credit risk assessment is a trend that is rewriting the scripts of the market. These technologies enable increasingly accurate, faster, and more efficient risk analysis by processing large amounts of data from sources such as varied markets, applications, or personnel. More so, predictive analytics coupled with AI models enables the institution's forecasting on the possibility of loan default that allows them to make data-driven decisions. Machine learning algorithms also enable models to learn and iteratively refine the credit risk model over time by using new data.

- Additionally, AI and ML can refine the personalization of credit risk assessments. Since these technologies analyse diverse data sets including non-traditional data sources like social media activity and transaction history, they can provide a more holistic view of a borrower's creditworthiness. Improving access to credit emerged in the wake of this trend, especially for individuals with limited credit history, thereby expanding lending opportunities within the maintenance of risk management standards.

Expansion of Credit Risk Assessment in Emerging Markets

-

Emerging markets present a highly significant growth opportunity to the Credit Risk Assessment Market. Several countries in Asia, Africa, and Latin America are growing economically, and this growth develops access to credit very positively. However, there is a challenge regarding the regions-to-countries in these three continents facing inadequate credit data and underdeveloped credit risk management frameworks. Reliable credit risk assessment tools are now on high demand as lending volumes increase, ensuring financial stability.

- Financial institutions in emerging markets are now embracing sophisticated risk management solutions that rely on AI, ML, and big data analytics. Increasingly, it is becoming more important because emerging markets become more integrated into global financial systems. With such modernization of financial infrastructure continuing in regions, the chasm in creditworthiness evaluation of creditworthiness continues to provide an opportunity for credit risk assessment solutions. Credit risk assessment solutions can help in the proper assessment of creditworthiness, promote financial inclusion, and help reduce the risk of defaults.

Credit Risk Assessment Market Segment Analysis:

Credit Risk Assessment Market is Segmented on the basis of Component, Risk Type, Deployment Mode, Organization Size, Application, End User, and Region.

By Risk Type, Credit Risk segment is expected to dominate the market during the forecast period

-

During the forecast period, the Credit Risk segment is expected to dominate the market by risk type. Credit risk remains the most critical due to its direct link to the likelihood of a debtor defaulting on loans or other financial obligations. It significantly impacts financial institutions, investors, and lenders, as defaults can lead to substantial losses. Moreover, counterparty risk, a subset of credit risk, is particularly important in financial transactions and corporate lending. When one party in a transaction fails to meet its obligations, it can trigger a chain reaction of losses across interconnected markets. With increasing complexity in global financial systems, effective management of credit risk has become essential to maintaining stability and minimizing exposure. As a result, the demand for advanced risk assessment and mitigation solutions in this segment continues to grow rapidly.

By Application, Credit Scoring segment expected to held the largest share

-

By application, the Credit Scoring segment is expected to hold the largest share in the Credit Risk Assessment Market. Credit scoring plays a crucial role in evaluating the creditworthiness of individuals and businesses, helping lenders make informed decisions. As the demand for consumer and business loans grows, financial institutions increasingly rely on advanced credit scoring models to assess potential risk and prevent defaults. These models analyze various data points, including credit history, payment behavior, and financial stability, to predict the likelihood of repayment. The adoption of AI and machine learning technologies has further enhanced the accuracy and speed of credit scoring systems. Consequently, this segment is witnessing significant growth, driven by the need for efficient, data-driven credit risk evaluation.

Credit Risk Assessment Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America currently leads the way in Credit Risk Assessment Market, primarily because of the vast maturity of the financial infrastructure and regulatory environment across the region. Large financial institutions, fintech startups, and credit bureaus are based out of the United States and Canada, which has enforced advanced credit risk management solutions everywhere. Regulatory frameworks and policies like the Dodd-Frank Act and Basel III have also boosted the demand for more robust credit risk assessments.

- Adoption of AI and machine learning in North America has handed financial institutions sleek tools to fine-tune risk assessment models. This advancement has equally fueled the growth of the market in the region since institutions constantly seek innovative methods of managing credit risk efficaciously. The propensity for financial stability as well as advancements in technology embedded in the region ensure that North America will remain atop of the global Credit Risk Assessment Market.

Active Key Players in the Credit Risk Assessment Market:

- FICO (United States)

- Experian (United Kingdom)

- Equifax (United States)

- TransUnion (United States)

- Moody's Analytics (United States)

- S&P Global (United States)

- Dun & Bradstreet (United States)

- AIG (United States)

- SAS Institute Inc. (United States)

- Wolters Kluwer (Netherlands)

- VantageScore Solutions (United States)

- CRIF (Italy)

- Other Active Players

|

Global Credit Risk Assessment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.34 Billion |

|

Forecast Period 2024-32 CAGR: |

14.3% |

Market Size in 2032: |

USD 24.44 Billion |

|

Segments Covered: |

By Component |

|

|

|

By Risk Type |

|

||

|

By Deployment Mode |

|

||

|

By End User |

|

||

|

By Organization Size |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Credit Risk Assessment Market by Component

4.1 Credit Risk Assessment Market Snapshot and Growth Engine

4.2 Credit Risk Assessment Market Overview

4.3 Solutions

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Solutions: Geographic Segmentation Analysis

4.4 Services

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Services: Geographic Segmentation Analysis

Chapter 5: Credit Risk Assessment Market by Risk Type

5.1 Credit Risk Assessment Market Snapshot and Growth Engine

5.2 Credit Risk Assessment Market Overview

5.3 Credit Risk

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Credit Risk: Geographic Segmentation Analysis

5.4 Counterparty Risk

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Counterparty Risk: Geographic Segmentation Analysis

5.5 Risk

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Risk: Geographic Segmentation Analysis

5.6 Operational Risk

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Operational Risk: Geographic Segmentation Analysis

Chapter 6: Credit Risk Assessment Market by Deployment Mode

6.1 Credit Risk Assessment Market Snapshot and Growth Engine

6.2 Credit Risk Assessment Market Overview

6.3 On-premises

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 On-premises: Geographic Segmentation Analysis

6.4 Cloud-based

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Cloud-based: Geographic Segmentation Analysis

Chapter 7: Credit Risk Assessment Market by End User

7.1 Credit Risk Assessment Market Snapshot and Growth Engine

7.2 Credit Risk Assessment Market Overview

7.3 Banks

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Banks: Geographic Segmentation Analysis

7.4 Insurance Companies

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Insurance Companies: Geographic Segmentation Analysis

7.5 Investment Firms

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Investment Firms: Geographic Segmentation Analysis

7.6 Retailers

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Retailers: Geographic Segmentation Analysis

7.7 Other

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Other: Geographic Segmentation Analysis

Chapter 8: Credit Risk Assessment Market by Organization Size

8.1 Credit Risk Assessment Market Snapshot and Growth Engine

8.2 Credit Risk Assessment Market Overview

8.3 Large Enterprises

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Large Enterprises: Geographic Segmentation Analysis

8.4 Small and Medium Enterprises (SMEs)

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Small and Medium Enterprises (SMEs): Geographic Segmentation Analysis

Chapter 9: Credit Risk Assessment Market by Application

9.1 Credit Risk Assessment Market Snapshot and Growth Engine

9.2 Credit Risk Assessment Market Overview

9.3 Credit Scoring

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.3.3 Key Market Trends, Growth Factors and Opportunities

9.3.4 Credit Scoring: Geographic Segmentation Analysis

9.4 Credit Monitoring

9.4.1 Introduction and Market Overview

9.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.4.3 Key Market Trends, Growth Factors and Opportunities

9.4.4 Credit Monitoring: Geographic Segmentation Analysis

9.5 Loan Underwriting

9.5.1 Introduction and Market Overview

9.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.5.3 Key Market Trends, Growth Factors and Opportunities

9.5.4 Loan Underwriting: Geographic Segmentation Analysis

9.6 Debt Collection

9.6.1 Introduction and Market Overview

9.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.6.3 Key Market Trends, Growth Factors and Opportunities

9.6.4 Debt Collection: Geographic Segmentation Analysis

9.7 Fraud Detection

9.7.1 Introduction and Market Overview

9.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.7.3 Key Market Trends, Growth Factors and Opportunities

9.7.4 Fraud Detection: Geographic Segmentation Analysis

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Credit Risk Assessment Market Share by Manufacturer (2023)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 FICO (UNITED STATE)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 EXPERIAN (UNITED KINGDOM)

10.4 EQUIFAX (UNITED STATES)

10.5 TRANSUNION (UNITED STATES)

10.6 MOODY'S ANALYTICS (UNITED STATES)

10.7 S&P GLOBAL (UNITED STATES)

DUN & BRADSTREET (UNITED STATES)

10.8 AIG (UNITED STATES)

10.9 SAS INSTITUTE INC. (UNITED STATES)

10.10 WOLTERS KLUWER (NETHERLANDS)

10.11 VANTAGESCORE SOLUTIONS (UNITED STATES)

10.12 CRIF (ITALY)

10.13 OTHER ACTIVE PLAYERS

Chapter 11: Global Credit Risk Assessment Market By Region

11.1 Overview

11.2. North America Credit Risk Assessment Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size By Component

11.2.4.1 Solutions

11.2.4.2 Services

11.2.5 Historic and Forecasted Market Size By Risk Type

11.2.5.1 Credit Risk

11.2.5.2 Counterparty Risk

11.2.5.3 Risk

11.2.5.4 Operational Risk

11.2.6 Historic and Forecasted Market Size By Deployment Mode

11.2.6.1 On-premises

11.2.6.2 Cloud-based

11.2.7 Historic and Forecasted Market Size By End User

11.2.7.1 Banks

11.2.7.2 Insurance Companies

11.2.7.3 Investment Firms

11.2.7.4 Retailers

11.2.7.5 Other

11.2.8 Historic and Forecasted Market Size By Organization Size

11.2.8.1 Large Enterprises

11.2.8.2 Small and Medium Enterprises (SMEs)

11.2.9 Historic and Forecasted Market Size By Application

11.2.9.1 Credit Scoring

11.2.9.2 Credit Monitoring

11.2.9.3 Loan Underwriting

11.2.9.4 Debt Collection

11.2.9.5 Fraud Detection

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Credit Risk Assessment Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size By Component

11.3.4.1 Solutions

11.3.4.2 Services

11.3.5 Historic and Forecasted Market Size By Risk Type

11.3.5.1 Credit Risk

11.3.5.2 Counterparty Risk

11.3.5.3 Risk

11.3.5.4 Operational Risk

11.3.6 Historic and Forecasted Market Size By Deployment Mode

11.3.6.1 On-premises

11.3.6.2 Cloud-based

11.3.7 Historic and Forecasted Market Size By End User

11.3.7.1 Banks

11.3.7.2 Insurance Companies

11.3.7.3 Investment Firms

11.3.7.4 Retailers

11.3.7.5 Other

11.3.8 Historic and Forecasted Market Size By Organization Size

11.3.8.1 Large Enterprises

11.3.8.2 Small and Medium Enterprises (SMEs)

11.3.9 Historic and Forecasted Market Size By Application

11.3.9.1 Credit Scoring

11.3.9.2 Credit Monitoring

11.3.9.3 Loan Underwriting

11.3.9.4 Debt Collection

11.3.9.5 Fraud Detection

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Credit Risk Assessment Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size By Component

11.4.4.1 Solutions

11.4.4.2 Services

11.4.5 Historic and Forecasted Market Size By Risk Type

11.4.5.1 Credit Risk

11.4.5.2 Counterparty Risk

11.4.5.3 Risk

11.4.5.4 Operational Risk

11.4.6 Historic and Forecasted Market Size By Deployment Mode

11.4.6.1 On-premises

11.4.6.2 Cloud-based

11.4.7 Historic and Forecasted Market Size By End User

11.4.7.1 Banks

11.4.7.2 Insurance Companies

11.4.7.3 Investment Firms

11.4.7.4 Retailers

11.4.7.5 Other

11.4.8 Historic and Forecasted Market Size By Organization Size

11.4.8.1 Large Enterprises

11.4.8.2 Small and Medium Enterprises (SMEs)

11.4.9 Historic and Forecasted Market Size By Application

11.4.9.1 Credit Scoring

11.4.9.2 Credit Monitoring

11.4.9.3 Loan Underwriting

11.4.9.4 Debt Collection

11.4.9.5 Fraud Detection

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Credit Risk Assessment Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size By Component

11.5.4.1 Solutions

11.5.4.2 Services

11.5.5 Historic and Forecasted Market Size By Risk Type

11.5.5.1 Credit Risk

11.5.5.2 Counterparty Risk

11.5.5.3 Risk

11.5.5.4 Operational Risk

11.5.6 Historic and Forecasted Market Size By Deployment Mode

11.5.6.1 On-premises

11.5.6.2 Cloud-based

11.5.7 Historic and Forecasted Market Size By End User

11.5.7.1 Banks

11.5.7.2 Insurance Companies

11.5.7.3 Investment Firms

11.5.7.4 Retailers

11.5.7.5 Other

11.5.8 Historic and Forecasted Market Size By Organization Size

11.5.8.1 Large Enterprises

11.5.8.2 Small and Medium Enterprises (SMEs)

11.5.9 Historic and Forecasted Market Size By Application

11.5.9.1 Credit Scoring

11.5.9.2 Credit Monitoring

11.5.9.3 Loan Underwriting

11.5.9.4 Debt Collection

11.5.9.5 Fraud Detection

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Credit Risk Assessment Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size By Component

11.6.4.1 Solutions

11.6.4.2 Services

11.6.5 Historic and Forecasted Market Size By Risk Type

11.6.5.1 Credit Risk

11.6.5.2 Counterparty Risk

11.6.5.3 Risk

11.6.5.4 Operational Risk

11.6.6 Historic and Forecasted Market Size By Deployment Mode

11.6.6.1 On-premises

11.6.6.2 Cloud-based

11.6.7 Historic and Forecasted Market Size By End User

11.6.7.1 Banks

11.6.7.2 Insurance Companies

11.6.7.3 Investment Firms

11.6.7.4 Retailers

11.6.7.5 Other

11.6.8 Historic and Forecasted Market Size By Organization Size

11.6.8.1 Large Enterprises

11.6.8.2 Small and Medium Enterprises (SMEs)

11.6.9 Historic and Forecasted Market Size By Application

11.6.9.1 Credit Scoring

11.6.9.2 Credit Monitoring

11.6.9.3 Loan Underwriting

11.6.9.4 Debt Collection

11.6.9.5 Fraud Detection

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Credit Risk Assessment Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size By Component

11.7.4.1 Solutions

11.7.4.2 Services

11.7.5 Historic and Forecasted Market Size By Risk Type

11.7.5.1 Credit Risk

11.7.5.2 Counterparty Risk

11.7.5.3 Risk

11.7.5.4 Operational Risk

11.7.6 Historic and Forecasted Market Size By Deployment Mode

11.7.6.1 On-premises

11.7.6.2 Cloud-based

11.7.7 Historic and Forecasted Market Size By End User

11.7.7.1 Banks

11.7.7.2 Insurance Companies

11.7.7.3 Investment Firms

11.7.7.4 Retailers

11.7.7.5 Other

11.7.8 Historic and Forecasted Market Size By Organization Size

11.7.8.1 Large Enterprises

11.7.8.2 Small and Medium Enterprises (SMEs)

11.7.9 Historic and Forecasted Market Size By Application

11.7.9.1 Credit Scoring

11.7.9.2 Credit Monitoring

11.7.9.3 Loan Underwriting

11.7.9.4 Debt Collection

11.7.9.5 Fraud Detection

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

|

Global Credit Risk Assessment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.34 Billion |

|

Forecast Period 2024-32 CAGR: |

14.3% |

Market Size in 2032: |

USD 24.44 Billion |

|

Segments Covered: |

By Component |

|

|

|

By Risk Type |

|

||

|

By Deployment Mode |

|

||

|

By End User |

|

||

|

By Organization Size |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||