Coated Fabrics Market Synopsis:

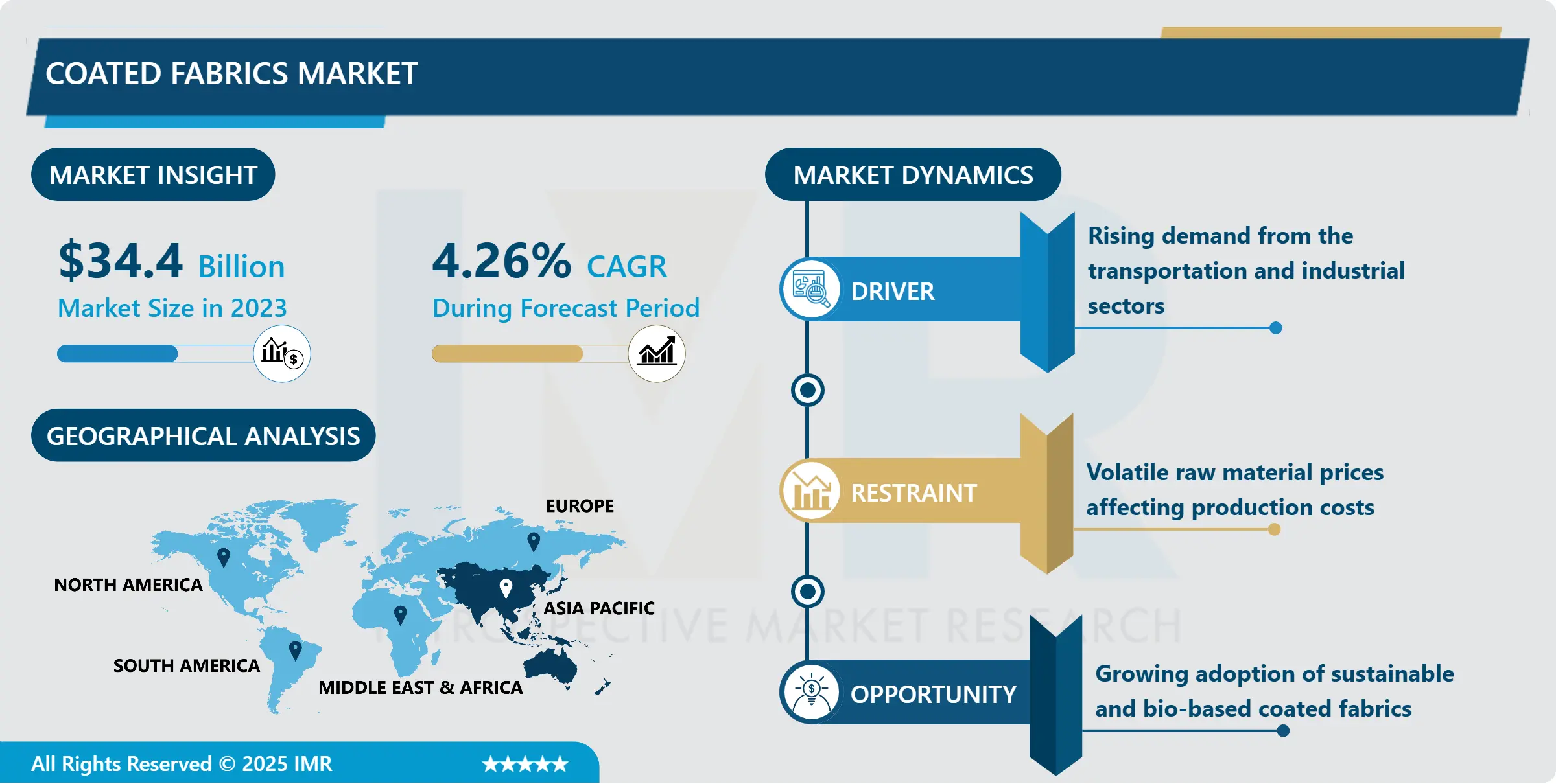

Coated Fabrics Market Size Was Valued at USD 34.4 Billion in 2023, and is Projected to Reach USD 50.4 Billion by 2032, Growing at a CAGR of 4.26% From 2024-2032.

The coated fabrics market means another segment of textile industries, which applies some materials such as polymer, rubber and others on fabrics with purpose of improving the characteristic feature of fabrics, which include water proofing, wear resistance, UV Sun protection and flame retardant properties. These fabrics are often applied in various sectors of the carrying industry, protective wearage, furnishing, industrial processing, and building. Incorporating the use of advanced coating processes, coated fabrics exhibit multiple utility, appearance and service features making them ideal in industries that call for tougher accessories and materials with specific characteristics that meet certain industry standards. The application of these fabrics is in fulfilling the need to provide performance textiles for such applications at the same time as there is a global shift towards higher value offerings, improved sustainability, and new technologies in manufacturing.

Coated fabrics market is growing at a good pace across the world because of increasing applications in various sectors. Transportation continues to be a popular category where coated fabrics are applied for automotive applications of interiors, air bags and seats, as well as tarpaulins. With the growing population and increasing level of car usage as well as the emergence of many centers of automotive production in various developing countries there has been growing market for coated fabric. In addition, increased concern by the government authorities on the safety of workers and the use of fire resistant materials has promoted their use in protective clothing and other industries. The market also stands to benefit from new developments in the field of coatings, in relations to fabricating the material to become stronger, chemically resistant or better able to handle weather conditions.

Another vital factor is the increase of infrastructure projects globally which has helped a great extent to the coated fabrics used in construction applications, roofing, and awning. As much as some environmental issues set in, today manufacturers are aiming for the production of eco-friendly coated fabrics that utilize bio polymers and recyclable material. Therefore, major players in the market have made park of R & D to solve the need of environmentally friendly products that are demanded globally and are produced to acceptable standards. Overall these dynamics put the coated fabrics market on a trajectory of steady growth over the duration of the forecast period.

Coated Fabrics Market Trend Analysis:

Sustainability Driving Innovation

-

The growth of sustainability and interest in environmentally friendly production of products is one of the most evident trends on the coated fabrics market. As the consumers grow to be more conversitive with the impacts that they have on their environment and due to the legal requirements towards environmentalism, manufacturers are designing their products to be more friendly by incorporating water soluble polymers and water borne coatings.

- The advancement of new coated fabrics, which can use post-consumer recycled materials and still be durably and functionally effective is underway. They are also embracing more efficient methods of processing and painting such as digital coating technologies that eliminate the wastage and permit accuracy in coverage. It is relevant to international trends of sustainable development and promotes coated fabrics as the industry’s key trend for the future.

Expansion in Emerging Markets

-

The coated fabrics market has more potential in the growth regions, mainly in Asia Pacific and Latin American countries. These regions consist of rapidly developing urbanisation infrastructure, industrialisation hence there is an increasing demand for high performance coated fabrics.

- The expanding middle-class group in these areas continues to fuel automotive and furniture industries, which in turn, is positively impacting the market. These governments are also concerned with worker protection and infrastructure upgrade introducing new opportunities for coated fabrics in architectural and safety apparel segments. Through these opportunities, manufacturing industry is able to advance its positioning and expand on the latent growth prospects of the markets.

Coated Fabrics Market Segment Analysis:

Coated Fabrics Market is Segmented on the basis of Product, application, and Region.

By Product, Polymer Coated Fabric segment is expected to dominate the market during the forecast period

-

Polymer coated fabric is expected to among the highest growth in the coated fabric industry over the forecast period because of its multiple application and mechanical characteristics. These fabrics are coated with polymers including PVC, PU, and polyethylene that offer an unmatchable waterproofing, chemical and abrasive resistance. This is because of the versatility of rollers in their use in the transport industry, the industrial markets as well as the furniture manufacturing industries. The transport industry, especially the automotive, uses polymer coated fabric for car interiors, air bag and seat upholstery due to the light weight and quality.

- The improvement in technology concerning polymer coatings has enabled fabric manufacturers to incorporate other properties such as flame retardant and UV protection, get a tick from safety standards of various industries. This segment also follows less cost and has the flexibility to provide solutions for all kinds of end-use applications. Due to the current concerns in consumer preferences, manufacturers are contemplating using bio-based polymers in making of their products hence encouraging innovation within this category.

By Application, Transportation segment expected to held the largest share

-

It forms the largest share in the coated fabrics market because of its application in automotive, railways, marine and aerospace transport units and parts. Coated fabrics are used in air bags, seats, headliners and convertible roofs in automotive industries because of their durability, appearance and safety standards. The growth in light weight and fuel efficiency vehicles also fuels coated fabrics market because they aid weight shedding across car frames.

- The increase in world trade and transport requirements have enhanced demand of coated fabrics for tarpaulin, truck covers and containers to transport merchandise safely. It also used in aerospace & marine applications for weather & flame resistance. As a result of recent advancements in the transportation industry particularly in the developing countries, demand for the coated fabrics in this segment is expected to increase in the next few years.

Coated Fabrics Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

-

The Asia-Pacific accounted for the largest share of the coated fabrics market. This dominance is due to high industrialization, urbanisation and infrastructural development that has been realised across countries such as China, India and south Asian nations.

- As large manufacturing nation and automobile market, China is of especial consumption interest to this market. Third, rising expenditures on the transport service and the construction industry also enhance the region’s dominance even more. Policies that seek to encourage local assemblies and a relatively low cost of production draw global players into the Asia-Pacific region. The increasing population of this region and the increasing disposable income also help in the consumption interest in related application areas, such as furniture and automotive.

Active Key Players in the Coated Fabrics Market:

- Abbott Industries (USA)

- ACH Foam Technologies (USA)

- Cooley Group (USA)

- ContiTech AG (Germany)

- Dickson Coatings (France)

- Haartz Corporation (USA)

- Low & Bonar (UK)

- Morbern Inc. (Canada)

- Omnova Solutions (USA)

- Seaman Corporation (USA)

- Serge Ferrari Group (France)

- Sioen Industries NV (Belgium)

- Spradling International Inc. (USA)

- SRF Limited (India)

- Trelleborg AB (Sweden), and Other Active Players

|

Global Coated Fabrics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 34.4 Billion |

|

Forecast Period 2024-32 CAGR: |

4.26% |

Market Size in 2032: |

USD 50.4 Billion |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Coated Fabrics Market by Product

4.1 Coated Fabrics Market Snapshot and Growth Engine

4.2 Coated Fabrics Market Overview

4.3 Polymer Coated Fabric

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Polymer Coated Fabric: Geographic Segmentation Analysis

4.4 Rubber Coated Fabric

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Rubber Coated Fabric: Geographic Segmentation Analysis

4.5 Fabric Backed Wall Coverings

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Fabric Backed Wall Coverings: Geographic Segmentation Analysis

Chapter 5: Coated Fabrics Market by Application

5.1 Coated Fabrics Market Snapshot and Growth Engine

5.2 Coated Fabrics Market Overview

5.3 Transportation

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Transportation: Geographic Segmentation Analysis

5.4 Protective Clothing

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Protective Clothing: Geographic Segmentation Analysis

5.5 Industrial

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Industrial: Geographic Segmentation Analysis

5.6 Furniture

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Furniture: Geographic Segmentation Analysis

5.7 Other

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Other: Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Coated Fabrics Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ABBOTT INDUSTRIES (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ACH FOAM TECHNOLOGIES (USA)

6.4 COOLEY GROUP (USA)

6.5 CONTITECH AG (GERMANY)

6.6 DICKSON COATINGS (FRANCE)

6.7 HAARTZ CORPORATION (USA)

6.8 LOW & BONAR (UK)

6.9 MORBERN INC. (CANADA)

6.10 OMNOVA SOLUTIONS (USA)

6.11 SEAMAN CORPORATION (USA)

6.12 SERGE FERRARI GROUP (FRANCE)

6.13 SIOEN INDUSTRIES NV (BELGIUM)

6.14 SPRADLING INTERNATIONAL INC. (USA)

6.15 SRF LIMITED (INDIA)

6.16 TRELLEBORG AB (SWEDEN)

6.17 OTHER ACTIVE PLAYERS

Chapter 7: Global Coated Fabrics Market By Region

7.1 Overview

7.2. North America Coated Fabrics Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Product

7.2.4.1 Polymer Coated Fabric

7.2.4.2 Rubber Coated Fabric

7.2.4.3 Fabric Backed Wall Coverings

7.2.5 Historic and Forecasted Market Size By Application

7.2.5.1 Transportation

7.2.5.2 Protective Clothing

7.2.5.3 Industrial

7.2.5.4 Furniture

7.2.5.5 Other

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Coated Fabrics Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Product

7.3.4.1 Polymer Coated Fabric

7.3.4.2 Rubber Coated Fabric

7.3.4.3 Fabric Backed Wall Coverings

7.3.5 Historic and Forecasted Market Size By Application

7.3.5.1 Transportation

7.3.5.2 Protective Clothing

7.3.5.3 Industrial

7.3.5.4 Furniture

7.3.5.5 Other

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Coated Fabrics Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Product

7.4.4.1 Polymer Coated Fabric

7.4.4.2 Rubber Coated Fabric

7.4.4.3 Fabric Backed Wall Coverings

7.4.5 Historic and Forecasted Market Size By Application

7.4.5.1 Transportation

7.4.5.2 Protective Clothing

7.4.5.3 Industrial

7.4.5.4 Furniture

7.4.5.5 Other

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Coated Fabrics Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Product

7.5.4.1 Polymer Coated Fabric

7.5.4.2 Rubber Coated Fabric

7.5.4.3 Fabric Backed Wall Coverings

7.5.5 Historic and Forecasted Market Size By Application

7.5.5.1 Transportation

7.5.5.2 Protective Clothing

7.5.5.3 Industrial

7.5.5.4 Furniture

7.5.5.5 Other

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Coated Fabrics Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Product

7.6.4.1 Polymer Coated Fabric

7.6.4.2 Rubber Coated Fabric

7.6.4.3 Fabric Backed Wall Coverings

7.6.5 Historic and Forecasted Market Size By Application

7.6.5.1 Transportation

7.6.5.2 Protective Clothing

7.6.5.3 Industrial

7.6.5.4 Furniture

7.6.5.5 Other

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Coated Fabrics Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Product

7.7.4.1 Polymer Coated Fabric

7.7.4.2 Rubber Coated Fabric

7.7.4.3 Fabric Backed Wall Coverings

7.7.5 Historic and Forecasted Market Size By Application

7.7.5.1 Transportation

7.7.5.2 Protective Clothing

7.7.5.3 Industrial

7.7.5.4 Furniture

7.7.5.5 Other

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Coated Fabrics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 34.4 Billion |

|

Forecast Period 2024-32 CAGR: |

4.26% |

Market Size in 2032: |

USD 50.4 Billion |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||