Key Market Highlights

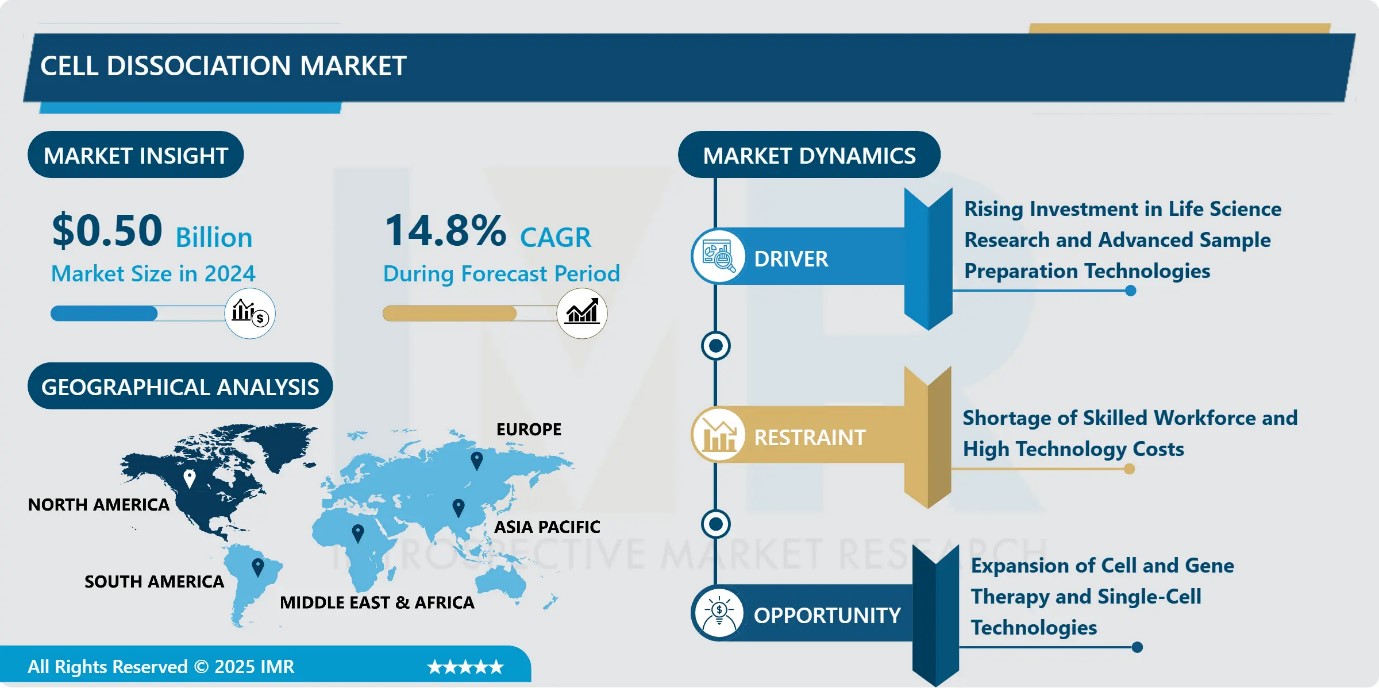

Cell Dissociation Market Size Was Valued at USD 0.50 Billion in 2024, and is Projected to Reach USD 2.28 Billion by 2035, Growing at a CAGR of 14.8% from 2025-2035.

- Market Size in 2024: USD 0.50 Billion

- Projected Market Size by 2035: USD 2.28 Billion

- CAGR (2025–2035): 14.8 %

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia-Pacific

- By End User: The Pharmaceutical and biotechnology segment is anticipated to lead the market by accounting for 27.4% of the market share throughout the forecast period.

- By Tissue Type: The Connective Tissue segment is expected to capture 38.8% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 33.2% of the market share during the forecast period.

- Active Players: Abcam Limited (U.K.), BD (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Claremont BioSolutions, LLC. (U.S.), Covaris, LLC. (U.S.), Danaher Corp. (U.S.), and Other Active Players.

Cell Dissociation Market Synopsis:

The cell dissociation market focuses on products and technologies designed to separate cells from tissues or culture surfaces while maintaining viability and functionality for research and therapeutic applications. This market has seen accelerated growth due to the critical role of cell dissociation in drug discovery, regenerative medicine, and cell-based therapeutics. The COVID-19 pandemic further boosted demand as cell culture technologies became essential for vaccine development and viral research. Increasing clinical trials, FDA approvals, and strategic collaborations by key players are driving market expansion. Innovations such as optimized tissue dissociation kits, portable dissociation devices, and automated workflows, along with rising government and private funding for stem cell research, are enhancing efficiency and enabling broader adoption in academic, clinical, and pharmaceutical settings.

Cell Dissociation Market Dynamics and Trend Analysis:

Cell Dissociation Market Growth Driver-Rising Investment in Life Science Research and Advanced Sample Preparation Technologies

- The growing emphasis on personalized medicine, precision diagnostics, and regenerative therapies is a key driver of the global cell lysis and dissociation market. Advances in single-cell analysis technologies such as single-cell RNA sequencing, flow cytometry, and gene-editing platforms require high-quality, viable cell suspensions, increasing demand for reliable dissociation and lysis solutions. Additionally, the rising adoption of cell-based therapies, including CAR-T and stem cell treatments, has elevated the need for gentle and standardized cell isolation methods. Expanding clinical research programs, biobanking initiatives, and automation in sample preparation further support market growth by enabling scalable, reproducible, and high-throughput cell processing across research and therapeutic applications.

Cell Dissociation Market Limiting Factor-Shortage of Skilled Workforce and High Technology Costs

- A key restraint affecting market growth is the limited availability of skilled personnel and the high cost of advanced instrumentation. Cell dissociation and culture processes require strict aseptic conditions, technical expertise, and precise handling of sensitive cell types, increasing the risk of contamination and variability when expertise is lacking. Additionally, fully automated and closed-system platforms involve substantial capital investment, making adoption difficult for smaller laboratories. High costs of specialized reagents, proprietary enzyme kits, and workflow maintenance further intensify financial pressure, particularly in emerging markets. Donor variability and evolving quality standards also complicate standardization and automation, slowing implementation and limiting broader market penetration.

Cell Dissociation Market Expansion Opportunity-Expansion of Cell and Gene Therapy and Single-Cell Technologies

- The rapid expansion of cell and gene therapy pipelines presents a strong growth opportunity for the market. Increasing regulatory approvals and a robust late-stage clinical pipeline are driving demand for standardized, GMP-grade cell processing and dissociation workflows that support large-scale, cost-efficient manufacturing. The shift toward allogeneic therapies further amplifies the need for scalable and automated platforms. In parallel, rising adoption of single-cell omics technologies is creating demand for high-viability, high-throughput cell preparation solutions. Advances in microfluidics, reversible tissue fixation, and AI-enabled analytics are reinforcing the need for reproducible protocols, particularly in oncology research, positioning advanced dissociation and processing technologies for sustained market growth.

Cell Dissociation Market Challenge and Risk-Variability, Regulatory Complexity, and Operational Challenges

- A major challenge in the market is the lack of standardized and reproducible cell dissociation workflows. Biological variability across tissues, cell types, and enzyme batches makes it difficult to implement universal protocols, leading to inconsistent cell yield, viability, and downstream performance. This variability complicates automation, slows regulatory validation, and hinders clinical-scale adoption. In parallel, stringent regulatory and ethical requirements governing human and animal tissues increase development timelines and compliance costs. Operational complexity further adds to the challenge, as effective dissociation requires skilled personnel to optimize enzymes, incubation conditions, and mechanical processing. High reagent and equipment costs, combined with limited infrastructure in developing regions, restrict broader adoption and slow market scalability.

Cell Dissociation Market Trend-Rising Biomanufacturing and Regenerative Medicine Applications

- The market is witnessing a strong trend driven by the expansion of biomanufacturing for personalized medicine and regenerative therapies. Increasing use of patient-derived organoids and point-of-care manufacturing models is boosting demand for compact, closed-system, and cleanroom-compatible processing technologies. Stricter regulatory scrutiny on reagent sourcing and traceability is further shaping purchasing decisions toward compliant suppliers. Simultaneously, the global scale-up of biopharmaceutical and recombinant therapeutics manufacturing, particularly mammalian cell–based biologics, is accelerating demand for upstream processing solutions. Growing adoption of cell dissociation techniques in stem cell therapy, tissue engineering, and organ transplantation underscores their critical role in ensuring cell quality, scalability, and regulatory compliance, supporting sustained market momentum.

Cell Dissociation Market Segment Analysis:

Cell Dissociation Market is segmented based on Product Type, Cell Type, Tissue Type, Application, Dissociation Method, End User, and Region

By End User, Pharmaceutical and biotechnology segment is expected to dominate the market with around 27.4% share during the forecast period.

- Pharmaceutical and biotechnology companies dominated the market in 2024, accounting for approximately 27.4% of total revenue, and are expected to remain the fastest-growing end-user segment. Their leadership is driven by robust investments in biopharmaceutical research, cell-based drug discovery, and personalized medicine. The rapidly expanding pipeline of cell and gene therapies including CAR-T therapies, stem cell–based treatments, and organoid research has increased demand for advanced cell dissociation technologies that optimize cell viability and functionality. In addition, biotech companies are investing heavily in scalable and automated dissociation methods to support clinical development and commercial production, reinforcing their dominant position in the market.

By Tissue Type, Connective Tissues is expected to dominate with close to 38.8% market share during the forecast period.

- By tissue type, connective tissue dominated the market in 2024, accounting for 38.8% of total share, driven by the availability of highly standardized and reproducible collagenase-based dissociation protocols widely used in liver and lung research. This consistency has enabled broad adoption across academic and clinical laboratories, reinforcing its market leadership. In parallel, tumor and organoid applications are exhibiting the fastest growth, supported by advanced electric-field-assisted dissociation workflows that achieve up to 95% tissue dissociation in under five minutes while maintaining high cell viability. Additionally, optimized mouse mammary tumor protocols now deliver nearly 90% viable cell recovery, enhancing the reliability of single-cell transcriptomic analyses.

Cell Dissociation Market Regional Insights:

North America region is estimated to lead the market with around 33.2% share during the forecast period.

- North America remains the leading region in the global market, accounting for over 37% of total revenue and increasing its share to nearly 33.2% in 2024. This dominance is driven by strong government funding, advanced clinical and laboratory infrastructure, and a high prevalence of chronic diseases such as cancer. Favorable regulatory frameworks, including FDA fast-track approvals for advanced therapies, further accelerate adoption.

- Significant investments in biomanufacturing capacity, workforce expansion, and reagent production strengthen the regional ecosystem. North America is important because it serves as a hub for innovation, early technology adoption, and commercialization, setting benchmarks that influence global market growth and regulatory standards.

Cell Dissociation Market Active Players:

- Abcam Limited (U.K.)

- BD (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Claremont BioSolutions, LLC. (U.S.

- Covaris, LLC. (U.S.)

- Danaher Corp. (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- HiMedia Laboratories (India)

- IDEX (U.S.)

- Miltenyi Biotec (Germany)

- Nuromics (U.S.)

- PAN-Biotech (Germany)

- Parr Instrument Company (U.S.)

- S2 Genomics, Inc. (U.S.)

- STEMCELL Technologies (Canada)

- Thermo Fisher Scientific (U.S)

- Other Active Players

Key Industry Developments in the Cell Dissociation Market:

- In June 2025, Thermo Fisher Scientific launched the Orbitrap Astral Zoom and Excedion Pro mass spectrometers at ASMS 2025.These systems are designed to deliver enhanced sensitivity, speed, and quantitative accuracy. The launch strengthens Thermo Fisher’s proteomics and advanced analytical workflow portfolio.It supports high-throughput research in life sciences, biopharma, and clinical applications.

- In May 2025, BD introduced the FACSDiscover A8 Cell Analyzer featuring real-time imaging and spectral flow cytometry. The platform enables deeper cellular insights by combining high-resolution imaging with multiparametric analysis. This innovation reinforces BD’s leadership in advanced cell analysis technologies.

Technological Landscape and Methodological Advances in Cell Dissociation for High-Viability Single-Cell Isolation and Scalable Therapeutic Applications

- The cell dissociation market is supported by a range of mechanical, enzymatic, and non-enzymatic technologies designed to efficiently separate cells from tissues or cell aggregates while preserving viability and functionality. Enzymatic dissociation methods, including collagenase, trypsin, and dispase, are widely used due to their effectiveness in degrading extracellular matrix components across diverse tissue types.

- Mechanical dissociation systems leverage shear forces, filtration, and automated homogenization to enable rapid and standardized processing, particularly for high-throughput workflows. Emerging technologies such as electric-field-assisted dissociation and microfluidic platforms are gaining traction for their ability to reduce processing time and minimize cellular stress. Advances in closed, automated, and scalable dissociation systems are further enhancing reproducibility, sterility, and compliance with GMP requirements, supporting applications in single-cell analysis, regenerative medicine, and cell and gene therapy manufacturing.

|

Cell Dissociation Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 0.50 Bn. |

|

Forecast Period 2025-32 CAGR: |

14.8% |

Market Size in 2035: |

USD 2.28 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Cell Type

|

|

||

|

By Tissue Type |

|

||

|

By Application |

|

||

|

By Dissociation Method |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Cell Dissociation Market by Product (2018-2035)

4.1 Cell Dissociation Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Instruments

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Reagents and Consumables

4.5 Enzymatic and Non-Enzymatic Dissociation Products

4.6 Instruments and Accessories

Chapter 5: Cell Dissociation Market by Cell Type (2018-2035)

5.1 Cell Dissociation Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Mammalian Cells

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Bacterial Cells

5.5 Yeast/Algae/Fungi

5.6 Plant Cells

5.7 Primary Cells

5.8 Stem Cells

5.9 Immortalized Cell Lines

Chapter 6: Cell Dissociation Market by Tissue Type (2018-2035)

6.1 Cell Dissociation Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Connective Tissue

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Epithelial Tissue

6.5 Muscular Tissue

6.6 and Others

Chapter 7: Cell Dissociation Market by Application (2018-2035)

7.1 Cell Dissociation Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Protein Isolation

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Nucleic Acid Isolation

7.5 Cell Organelle Isolation

7.6 Downstream Processing

7.7 Cancer Research

7.8 Regenerative Medicine

7.9 Drug Development

7.10 Tissue Engineering

Chapter 8: Cell Dissociation Market by Dissociation Method (2018-2035)

8.1 Cell Dissociation Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Tissue Dissociation and Cell Detachment

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

Chapter 9: Cell Dissociation Market by End User (2018-2035)

9.1 Cell Dissociation Market Snapshot and Growth Engine

9.2 Market Overview

9.3 Academic and Research Institutes

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 Hospitals and Diagnostic Laboratories

9.5 Cell Banks

9.6 Pharmaceutical and Biotechnology Companies

9.7 Contract Research Organizations

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Cell Dissociation Market Share by Manufacturer/Service Provider(2024)

10.1.3 Industry BCG Matrix

10.1.4 PArtnerships, Mergers & Acquisitions

10.2 ABCAM LIMITED (U.K.)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Recent News & Developments

10.2.10 SWOT Analysis

10.3 BD (U.S.)

10.4 BIO-RAD LABORATORIES

10.5 INC. (U.S.)

10.6 CLAREMONT BIOSOLUTIONS

10.7 LLC. (U.S.)

10.8 COVARIS

10.9 LLC. (U.S.)

10.10 DANAHER CORP. (U.S.)

10.11 F. HOFFMANN-LA ROCHE LTD. (SWITZERLAND)

10.12 HIMEDIA LABORATORIES (INDIA)

10.13 IDEX (U.S.)

10.14 MILTENYI BIOTEC (GERMANY)

10.15 NUROMICS (U.S.)

10.16 PAN-BIOTECH (GERMANY)

10.17 PARR INSTRUMENT COMPANY (U.S.)

10.18 S2 GENOMICS

10.19 INC. (U.S.)

10.20 STEMCELL TECHNOLOGIES (CANADA)

10.21 AND OTHER ACTIVE PLAYERS.

Chapter 11: Global Cell Dissociation Market By Region

11.1 Overview

11.2. North America Cell Dissociation Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecast Market Size by Country

11.2.4.1 US

11.2.4.2 Canada

11.2.4.3 Mexico

11.3. Eastern Europe Cell Dissociation Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecast Market Size by Country

11.3.4.1 Russia

11.3.4.2 Bulgaria

11.3.4.3 The Czech Republic

11.3.4.4 Hungary

11.3.4.5 Poland

11.3.4.6 Romania

11.3.4.7 Rest of Eastern Europe

11.4. Western Europe Cell Dissociation Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecast Market Size by Country

11.4.4.1 Germany

11.4.4.2 UK

11.4.4.3 France

11.4.4.4 The Netherlands

11.4.4.5 Italy

11.4.4.6 Spain

11.4.4.7 Rest of Western Europe

11.5. Asia Pacific Cell Dissociation Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecast Market Size by Country

11.5.4.1 China

11.5.4.2 India

11.5.4.3 Japan

11.5.4.4 South Korea

11.5.4.5 Malaysia

11.5.4.6 Thailand

11.5.4.7 Vietnam

11.5.4.8 The Philippines

11.5.4.9 Australia

11.5.4.10 New Zealand

11.5.4.11 Rest of APAC

11.6. Middle East & Africa Cell Dissociation Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecast Market Size by Country

11.6.4.1 Turkiye

11.6.4.2 Bahrain

11.6.4.3 Kuwait

11.6.4.4 Saudi Arabia

11.6.4.5 Qatar

11.6.4.6 UAE

11.6.4.7 Israel

11.6.4.8 South Africa

11.7. South America Cell Dissociation Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecast Market Size by Country

11.7.4.1 Brazil

11.7.4.2 Argentina

11.7.4.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

Chapter 13 Our Thematic Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

Chapter 14 Case Study

Chapter 15 Appendix

15.1 Sources

15.2 List of Tables and figures

15.3 Short Forms and Citations

15.4 Assumption and Conversion

15.5 Disclaimer

|

Cell Dissociation Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 0.50 Bn. |

|

Forecast Period 2025-32 CAGR: |

14.8% |

Market Size in 2035: |

USD 2.28 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Cell Type

|

|

||

|

By Tissue Type |

|

||

|

By Application |

|

||

|

By Dissociation Method |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||