Key Market Highlights

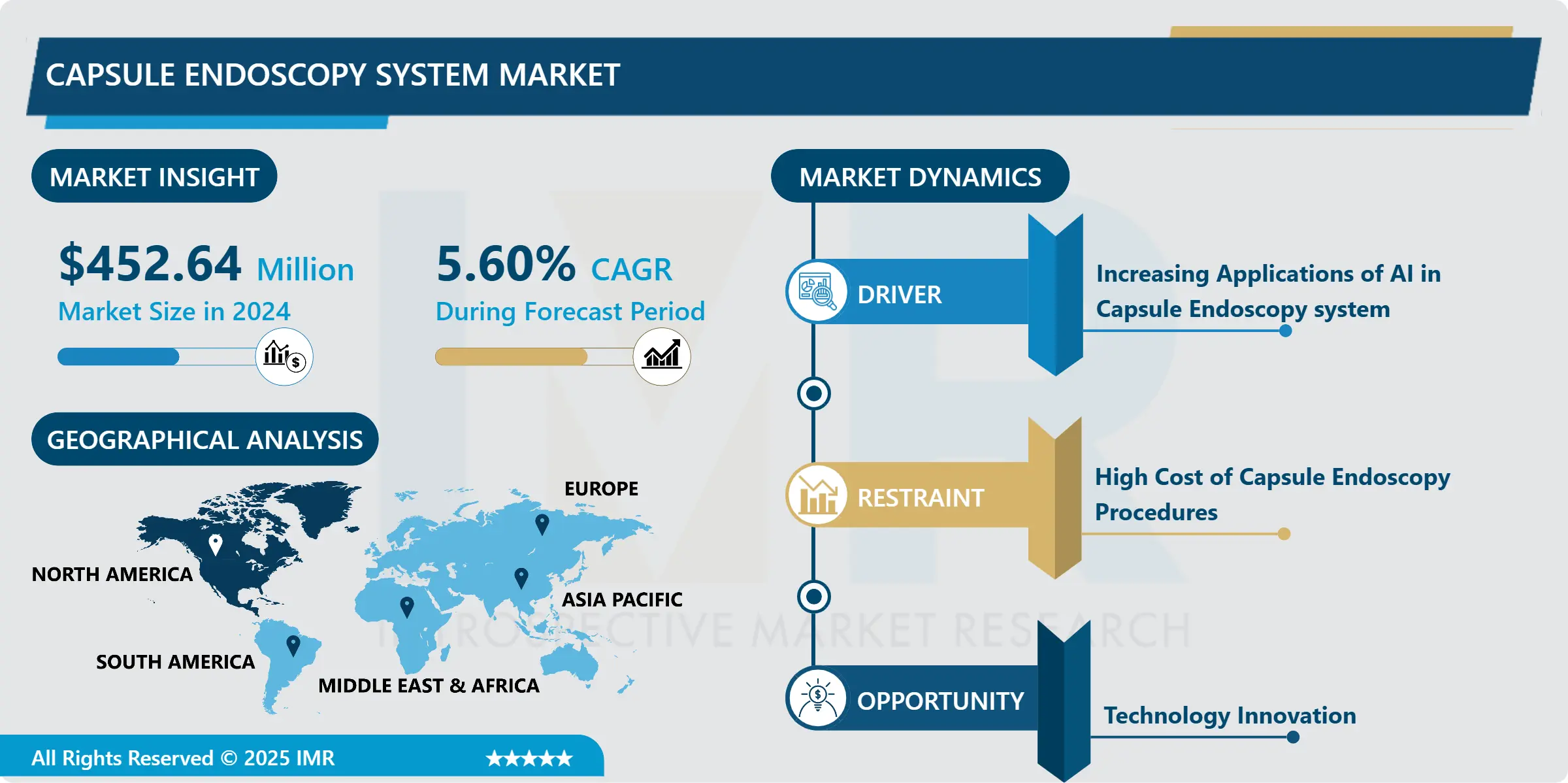

Capsule Endoscopy System Market Size Was Valued at USD 452.64 Million in 2024, and is Projected to Reach USD 816.32 Million by 2035, Growing at a CAGR of 5.60% from 2025-2035.

- Market Size in 2024: USD 452.64 Million

- Projected Market Size by 2035: USD 816.32 Million

- CAGR (2025–2035): 5.60%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia

- By Type: The Capsule Endoscope Workstations segment is anticipated to lead the market by accounting for 59% of the market share throughout the forecast period.

- By Product: The Product Small Bowel Capsule segment is expected to capture 37% of the market share, thereby maintaining its dominance over the forecast period.

- By End Users: Hospitals segment is expected to dominate with close to 32% market share during the forecast period.

- By Application: Obscure gastrointestinal bleeding is expected to dominate with close to 35% of the market share during the forecast period.

- By Region: North America region is projected to hold 36% of the market share during the forecast period.

- Active Players: Boston Scientific Corporation, Chongqing Jinshan Science & Technology (Group) Co., Ltd., Fujifilm Holdings Corporation, Medtronic plc, Olympus Corporation and Other Active Players

Capsule Endoscopy System Market Synopsis:

A capsule endoscopy system is a non-invasive diagnostic procedure that utilizes a tiny wireles camera, encapsulated within a pill-shaped capsule, to capture images of the digestive tract. This capsule, measuring approximately the size of a large vitamin, is equipped with a light source and a high-resolution camera capable of transmitting thousands of images per second to a data recorder worn around the waist.

Capsule endoscopy is a non-invasive procedure that doesn't require incisions or sedation, making it more comfortable and patient friendly. It allows for a comprehensive examination of the small intestine, an often-inaccessible area. Patients can move around during the procedure, reducing anxiety and enhancing comfort. Capsule endoscopy is generally considered safe with minimal risks.

The market for capsule endoscopy systems is growing due to their effectiveness and patient-friendly nature. Advancements like 360-degree imaging improve diagnostic precision, enabling timely detection of gastrointestinal disorders, early intervention, and improved patient outcomes. As medical professionals increasingly adopt this technology, it continues to transform the gastrointestinal diagnostics landscape.

Capsule Endoscopy System Market Dynamics and Trend Analysis:

Capsule Endoscopy System Market Growth Driver - Increasing Applications of AI in Capsule Endoscopy system

-

One of the primary applications of artificial intelligence (AI) in medicine for the detection of tumours and oesophageal dysplasia. More recently, researchers have begun employing AI to detect small-bowel (SB) lesions by training models on large image datasets.

- These AI-driven CADe systems play a key role in identifying and diagnosing disorders of the small intestine. Such advancements demonstrate how AI can improve diagnostic workflows for gastrointestinal (GI) conditions by delivering faster and more precise interpretation of the extensive image data generated through capsule endoscopy (CE).

Capsule Endoscopy System Market Limiting Factor - Major Constraints Affecting Capsule Endoscopy Market Performance

-

The capsule endoscopy market faces major constraints due to high device and procedure costs and technological challenges such as short battery life and incomplete GI tract visualization. These issues reduce diagnostic reliability and make adoption difficult, especially in regions with weak healthcare infrastructure or cost-sensitive patient populations.

- Additional limitations include the inability to perform biopsies or therapeutic interventions, the risk of capsule retention in patients with strictures, and inconsistent interpretation of imaging results. Regulatory hurdles, technical malfunctions, and competition from advanced endoscopic procedures further restrict widespread clinical acceptance and slow overall market growth.

Capsule Endoscopy System Market Expansion Opportunity - Strategic Opportunities Driving Capsule Endoscopy Market Expansion

-

The capsule endoscopy market is set to expand as AI-driven image interpretation, longer battery life, and enhanced imaging capabilities become more widely integrated. Growing clinical preference for non-invasive diagnostic tools and broader use of capsules for small-bowel, colonic, and oesophageal evaluations create strong opportunities for manufacturers to introduce advanced, high-performance systems across global healthcare markets.

- Increasing rates of gastrointestinal disorders, aging populations, and improved access to healthcare services in emerging regions offer substantial room for market growth. Enhancements in reimbursement policies, rising practitioner awareness, and partnerships between device makers and medical institutions are expected to further accelerate adoption, positioning capsule endoscopy as a vital solution in future GI diagnostic pathways

Capsule Endoscopy System Market Challenge and Risk - Diagnostic Gaps, Retention Risks, and Cost Pressures Challenging Market Expansion

-

The market faces several challenges, including technological restrictions such as limited battery life, incomplete GI visualization, and the inability to perform therapeutic procedures or biopsies. These limitations can reduce diagnostic accuracy and make capsule endoscopy less suitable for complex clinical cases, affecting adoption in advanced healthcare settings.

- Key market risks include the possibility of capsule retention in patients with strictures, inconsistent interpretation of imaging data, and the high cost of devices and procedures. Regulatory delays, reimbursement uncertainties, and competition from traditional or advanced endoscopic methods further add to market volatility, influencing long-term growth prospects.

Capsule Endoscopy System Market Segment Analysis:

Capsule Endoscopy System Market is segmented based on Type, Product, Application, End-Users, and Region

By End-User, Hospitals segment is expected to dominate with close to 32% market share during the forecast Period

-

Hospitals are the most dominant segment in the healthcare market due to their critical role and continuous integration of innovative technologies. They demand advanced medical equipment, electronic health records, telemedicine solutions, and diagnostic tools. The focus on patient-centric care, efficiency improvements, and accurate diagnostics drives hospitals to invest in technological innovations.

- The ongoing digital transformation, including artificial intelligence in diagnostics and robotics in surgeries, solidifies hospitals as the primary beneficiaries of technological advancements. As the healthcare industry evolves, hospitals continue to embrace innovative solutions.

By Product, the Small Bowel Capsule segment is expected to dominate with close to 37% market share during the forecast period

-

The small bowel capsule remains the most widely adopted product type due to its essential role in diagnosing conditions that are difficult to visualize through conventional endoscopy. It is the primary choice for evaluating the small intestine, making it a preferred tool for detecting obscure gastrointestinal bleeding, Crohn’s disease, celiac disease, and small-bowel tumours. Its strong clinical relevance drives consistent demand across healthcare settings.

- The rising number of patients presenting with unexplained abdominal symptoms and iron-deficiency anaemia further supports the dominance of the small bowel capsule. Its ability to provide complete and detailed imaging of the entire small intestine without sedation or invasive procedures makes it highly valuable in routine diagnostics. Technological improvements, including high-resolution cameras, wider viewing angles, extended battery life, and AI-based lesion detection, continue to enhance accuracy and ease of use.

Capsule Endoscopy System Market Regional Insights:

North America is Expected to Dominate the Market with close to 36% Over the Forecast period

-

North America is the most dominant market region due to its robust technological infrastructure, extensive research and development capabilities, and high adoption across industries. The region is home to numerous technology hubs, fostering innovation and attracting top talent. Major tech giants and start-ups contribute to North America's dominance by pushing boundaries. The well-established healthcare, finance, and information technology sectors also play pivotal roles in sustaining its market dominance.

- North America's market dominance is attributed to government support, favourable regulatory frameworks, and a culture that values technological innovation. The region's investment in emerging technologies like artificial intelligence, biotechnology, and renewable energy solidifies its position as a driving force in shaping various industries' futures. This dominance is largely due to its forward-thinking approach, resource abundance, and conducive ecosystem

Capsule Endoscopy System Market Active Players:

- AnX Robotica (U.S.)

- Boston Scientific Corporation (U.S)

- Chongqing Jinshan Science & Technology (Group) Co., Ltd. (China)

- Check Cap (Israel)

- CapsoVision (U.S)

- Fujifilm Holdings Corporation (Japan)

- IntroMedic Co., Ltd. (South Korea)

- Interscope, Inc. (U.S.)

- Medtronic plc (Ireland)

- Northside Gastroenterology Endoscopy Center, LLC (U.S.)

- Olympus Corporation (Japan)

- RF System Lab Co., Ltd. (Japan)

- Shangxian Minimal Invasive Inc. (China)

- Other Active Players

Key Industry Developments in the Capsule Endoscopy System Market:

- In April 2025, JINSHAN introduced Vue Smart, an AI-powered solution transforming capsule endoscopy diagnostics with faster, more precise image analysis. Built with clinician input and optimized for OMOM systems, Vue Smart reduces reading time to minutes, enhances lesion detection, and improves workflow efficiency setting a new standard for accurate, patient-centred GI diagnosis across clinical settings.

- In January 2025, CapsoVision proudly announced a significant milestone in capsule endoscopy with the FDA clearance of its flagship CapsoCam Plus® for paediatric patients aged two and above. This advancement marks an important step forward in delivering safe, non-invasive, and patient-friendly gastrointestinal diagnostics for children. By offering a comfortable alternative to traditional endoscopy procedures, CapsoVision continues to demonstrate its commitment to innovation, clinical excellence, and expanding access to advanced digestive health technologies for young patients and their families.

Modern Wireless Capsule Endoscopy: Technology, AI, and Clinical Applications

Wireless capsule endoscopy (WCE), also called video capsule endoscopy (VCE), is a minimally invasive technology for examining the gastrointestinal (GI) tract. Approved by the FDA in 2001, CE allows direct visualization of areas of the GI tract that are difficult to reach with traditional endoscopy, such as the small intestine. A typical CE system includes a small, swallowable capsule equipped with a camera, battery, light source, and wireless transmitter, along with sensors and a data recorder that store images for later analysis.

Modern capsules are approximately 26 × 11 mm and capture images at 2 frames per second with a 156° angle of view, allowing continuous monitoring for 8–12 hours as the capsule moves naturally through the GI tract. Over the years, technological improvements have increased battery life, reduced size, and added more precise navigation capabilities, making CE safer, more efficient, and more user-friendly.

Early CE systems relied on passive movement and small batteries, limiting working time and diagnostic coverage. Recent innovations have addressed these challenges:

- Power sources: Lithium-ion polymer batteries, self-powered systems, edible electronics, and wireless energy transfer.

- Active movement: Shape-memory alloys, micromotors, and magnetic control now allow precise capsule navigation.

- Communication: Ultra-wideband (UWB) and intrabody communication (IBC) enable faster, low-power data transfer.

- Positioning: Hybrid methods combining video, magnetic, and RF data enhance location accuracy.

These advancements not only improve diagnostic accuracy but also enable future therapeutic applications such as targeted drug delivery, tissue sampling, and coagulation.

Diseases Commonly Evaluated by CE:

- Obscure gastrointestinal bleeding

- Suspected Crohn’s disease

- Small bowel tumours

- Iron-deficiency anaemia

- Celiac disease

- Colon polyps (≥6 mm, ≥1 cm)

- Barrett’s oesophagus

- Upper GI varices

Small Bowel: CE is particularly effective for small bowel evaluation, outperforming traditional push enteroscopy (diagnostic yield 28%) and offering results comparable or superior to CT enteroclysis and MRI. Common uses include:

-

Obscure gastrointestinal bleeding (diagnostic yield 35–73%)

- Suspected Crohn’s disease (50–71%)

- Small bowel tumours (4–8.9%)

- Iron-deficiency anaemia (25.7–45%)

- Celiac disease (sensitivity 89%, specificity 95%)

The capsule provides continuous high-quality imaging, enabling detection of inflammatory, vascular, or neoplastic lesions. In patients with suspected Crohn’s disease, CE has similar or higher diagnostic accuracy than conventional colonoscopy and imaging methods. Capsule retention is rare (0.75% overall) but higher in Crohn’s disease (5–13%) or obstruction (up to 21%). The PillCam™ Patency Capsule can safely reduce retention rates to 0.39–0.51% in high-risk patients

Colon: CE is also useful for colon assessment, particularly in patients who cannot undergo conventional colonoscopy. Sensitivity and specificity for detecting polyps ≥6 mm are 81% and 93%, respectively, and for polyps ≥1 cm, sensitivity is 80% and specificity 97%. Adequate bowel preparation is crucial, as poor preparation can render up to 35% of studies inconclusive.

Upper GI Tract: While not a replacement for conventional endoscopy, CE can aid in the evaluation of Barrett’s oesophagus (sensitivity 77%, specificity 86%) and upper GI bleeding. Detection of oesophageal varices is less reliable (sensitivity 76%, specificity 64%), requiring additional studies for confirmation.

Recent innovations are expanding CE beyond diagnosis into therapeutic applications:

- Microbiota Sampling: Smart capsules can collect site-specific intestinal samples, providing more accurate spatial gut microbiome data than faecal or traditional biopsy samples.

- Targeted Drug Delivery: Devices like Ranipill can deliver drugs directly to the small intestine, using pH-sensitive coatings and self-inflating mechanisms.

- Haemostasis: Inflatable capsules have demonstrated the ability to stop GI bleeding mechanically, with balloon pressures of 46 mmHg and a longitudinal force tolerance of 1.46 N.

- Obesity Management: The Vibrating Ingestible Bioelectronic Stimulator (VIBES) pill can stimulate satiety receptors, reducing food intake in animal studies.

- Precision Navigation: Magnetically controlled and battery-driven capsules allow exact positioning for sampling or therapy.

Capsule endoscopy is rapidly evolving into a multifunctional platform. Future CE devices are expected to combine imaging, tissue or microbiota sampling, targeted drug delivery, haemostasis, and obesity treatment in a single device. AI integration and precise locomotion control will allow personalized GI assessment, expand microbiome research, and provide minimally invasive therapy. CE is poised to become a comprehensive tool for gastrointestinal care, bridging diagnosis and treatment while minimizing patient discomfort.

|

Capsule Endoscopy System Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 452.64 Mn. |

|

Forecast Period 2025-35 CAGR: |

5.60% |

Market Size in 2035: |

USD 816.32 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Product |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Capsule Endoscopy System Market by Type (2018-2035)

4.1 Capsule Endoscopy System Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Capsule Endoscope Workstations and Recorders

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

Chapter 5: Capsule Endoscopy System Market by Product (2018-2035)

5.1 Capsule Endoscopy System Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Oesophageal Capsule

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Small Bowel Capsule

5.5 Colon Capsule

Chapter 6: Capsule Endoscopy System Market by Application (2018-2035)

6.1 Capsule Endoscopy System Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Obscure Gastrointestinal Bleeding

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Crohn’s Disease

6.5 Small Intestine Tumour

Chapter 7: Capsule Endoscopy System Market by End -User (2018-2035)

7.1 Capsule Endoscopy System Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Diagnostic Laboratories

7.5 Specialty Clinics

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Capsule Endoscopy System Market Share by Manufacturer/Service Provider(2024)

8.1.3 Industry BCG Matrix

8.1.4 PArtnerships, Mergers & Acquisitions

8.2 ANX ROBOTICA (U.S.)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Recent News & Developments

8.2.10 SWOT Analysis

8.3 BOSTON SCIENTIFIC CORPORATION (U.S)

8.4 CHONGQING JINSHAN SCIENCE & TECHNOLOGY (GROUP) CO.

8.5 LTD. (CHINA)

8.6 CHECK CAP (ISRAEL)

8.7 CAPSOVISION (U.S)

8.8 FUJIFILM HOLDINGS CORPORATION (JAPAN)

8.9 INTROMEDIC CO.

8.10 LTD. (SOUTH KOREA)

8.11 INTERSCOPE

8.12 INC. (U.S.)

8.13 MEDTRONIC PLC (IRELAND)

8.14 NORTHSIDE GASTROENTEROLOGY ENDOSCOPY CENTER

8.15 LLC (U.S.)

8.16 OLYMPUS CORPORATION (JAPAN)

8.17 RF SYSTEM LAB CO.

8.18 LTD. (JAPAN)

8.19 SHANGXIAN MINIMAL INVASIVE INC. (CHINA)

8.20 OTHER ACTIVE PLAYERS

Chapter 9: Global Capsule Endoscopy System Market By Region

9.1 Overview

9.2. North America Capsule Endoscopy System Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecast Market Size by Country

9.2.4.1 US

9.2.4.2 Canada

9.2.4.3 Mexico

9.3. Eastern Europe Capsule Endoscopy System Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecast Market Size by Country

9.3.4.1 Russia

9.3.4.2 Bulgaria

9.3.4.3 The Czech Republic

9.3.4.4 Hungary

9.3.4.5 Poland

9.3.4.6 Romania

9.3.4.7 Rest of Eastern Europe

9.4. Western Europe Capsule Endoscopy System Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecast Market Size by Country

9.4.4.1 Germany

9.4.4.2 UK

9.4.4.3 France

9.4.4.4 The Netherlands

9.4.4.5 Italy

9.4.4.6 Spain

9.4.4.7 Rest of Western Europe

9.5. Asia Pacific Capsule Endoscopy System Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecast Market Size by Country

9.5.4.1 China

9.5.4.2 India

9.5.4.3 Japan

9.5.4.4 South Korea

9.5.4.5 Malaysia

9.5.4.6 Thailand

9.5.4.7 Vietnam

9.5.4.8 The Philippines

9.5.4.9 Australia

9.5.4.10 New Zealand

9.5.4.11 Rest of APAC

9.6. Middle East & Africa Capsule Endoscopy System Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecast Market Size by Country

9.6.4.1 Turkiye

9.6.4.2 Bahrain

9.6.4.3 Kuwait

9.6.4.4 Saudi Arabia

9.6.4.5 Qatar

9.6.4.6 UAE

9.6.4.7 Israel

9.6.4.8 South Africa

9.7. South America Capsule Endoscopy System Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecast Market Size by Country

9.7.4.1 Brazil

9.7.4.2 Argentina

9.7.4.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

Chapter 11 Our Thematic Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 12 Analyst Viewpoint and Conclusion

Chapter 13 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Chapter 14 Case Study

Chapter 15 Appendix

11.1 Sources

11.2 List of Tables and figures

11.3 Short Forms and Citations

11.4 Assumption and Conversion

11.5 Disclaimer

|

Capsule Endoscopy System Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 452.64 Mn. |

|

Forecast Period 2025-35 CAGR: |

5.60% |

Market Size in 2035: |

USD 816.32 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Product |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||