Caoutchouc Market Key Highlights

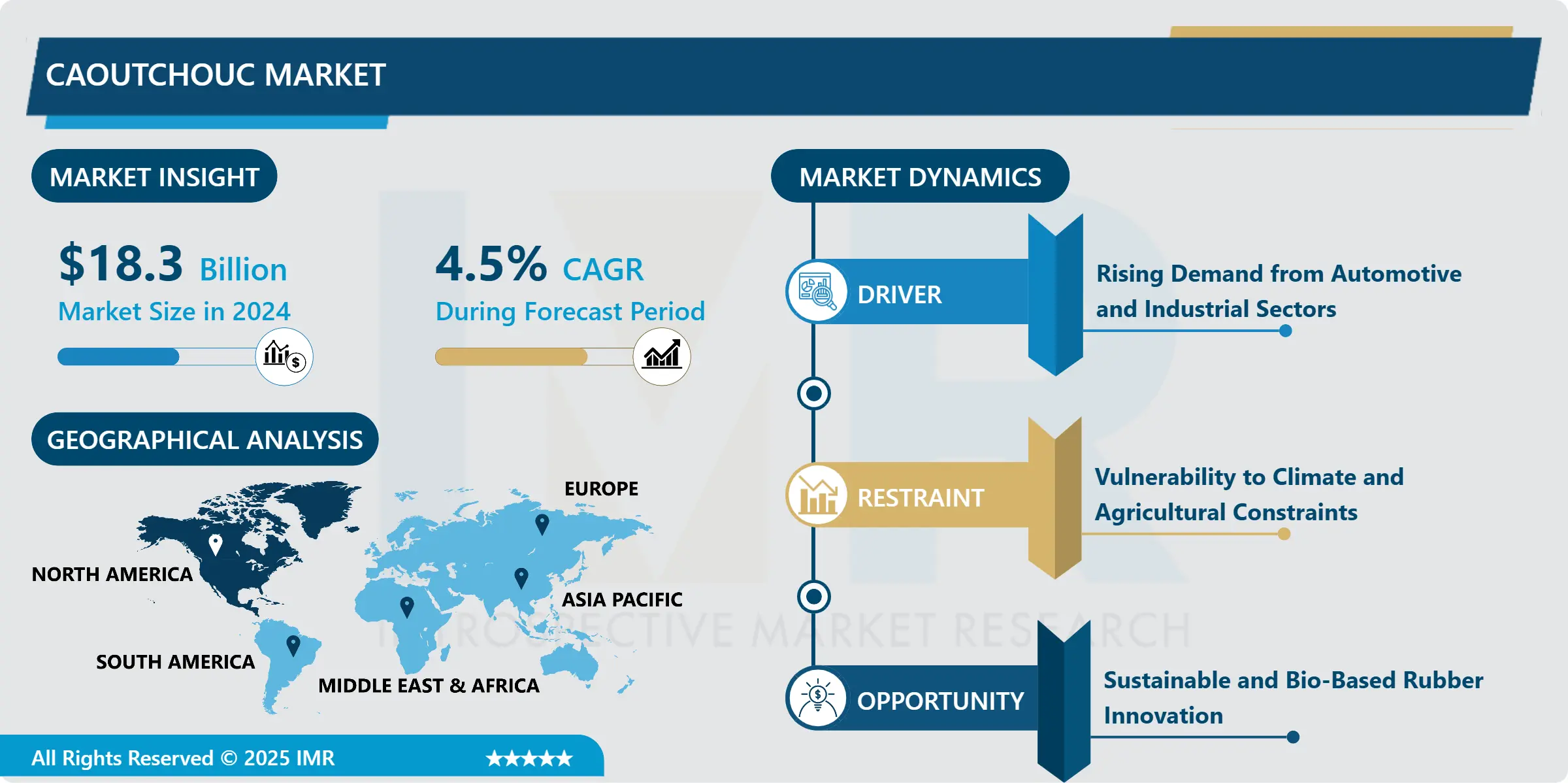

Caoutchouc Market Size Was Valued at USD 18.3 Billion in 2024, and is Projected to Reach USD 29.7 Billion by 2035, Growing at a CAGR of 4.5% from 2025-2035.

- Market Size in 2024: USD 18.3 Billion

- Projected Market Size by 2035: USD 29.7 Billion

- CAGR (2025–2035): 4.5%

- Leading Market in 2024: Asia-Pacific

- Fastest-Growing Market: Asia-Pacific

- By Type: The natural rubber segment is anticipated to lead the market by accounting for 60% of the market share throughout the forecast period.

- By Application: The rubber segment is expected to capture 67% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: Asia pacific region is projected to hold 70% of the market share during the forecast period.

- Active Players: Apcotex Industries Ltd. (India), Bridgestone Corporation (Japan), China Hainan Rubber Industry Group Co., Ltd. (China), Continental AG (Germany), Daewoo International Corporation (South Korea), Other Active Players

Caoutchouc Market Synopsis:

The caoutchouc market, also known as the natural rubber market, plays a vital role in global manufacturing and trade. Caoutchouc is a natural material harvested from rubber trees, mainly found in tropical regions like Thailand, Indonesia, Vietnam, and Malaysia. It is a key raw material used in the production of tires, belts, hoses, seals, gloves, and many other industrial and consumer products.

Caoutchouc Market Dynamics and Trend Analysis:

Caoutchouc Market Growth Driver - Rising Demand from Automotive and Industrial Sectors

- The caoutchouc market is growing mainly because of its high demand in the automotive and industrial sectors. Caoutchouc, also known as natural rubber, is a key material used in making tires. It is also used to produce many other important car parts, like belts, hoses, seals, and gaskets.

- As the number of vehicles being made and sold increases especially in countries like China, India, and other parts of Asia the need for natural rubber is also rising. More people are buying cars and more factories are producing them. This pushes up the demand for natural rubber, which is a key ingredient in many parts of a vehicle.

- Apart from the automotive industry, natural rubber is also widely used in the industrial sector. It plays a big role in the production of machines, tools, and construction equipment. It helps reduce vibrations, resist wear and tear, and improve safety and performance in industrial tools.

- In the healthcare industry, caoutchouc is used to make gloves, medical tubes, and other soft rubber equipment. The demand for these products is growing due to rising health awareness and safety standards. All of this means that natural rubber remains an important material. As these industries grow, the demand for caoutchouc will continue to increase globally.

Caoutchouc Market Limiting Factor - Vulnerability to Climate and Agricultural Constraints

- Caoutchouc, or natural rubber, comes from rubber trees that grow mostly in Southeast Asia, in countries like Thailand, Indonesia, and Malaysia. Since it is a plant-based product, its production depends a lot on nature and farming conditions. One major problem is the weather. Natural rubber trees need the right amount of rain and sunlight to grow well. Too much rain can cause flooding, while too little can lead to drought. Climate change is making weather patterns more unpredictable, which affects how much rubber farmers can produce each year.

- Another issue is plant disease. Rubber trees are at risk of diseases like leaf blight, which can damage the trees and lower the amount of rubber they produce. If the trees get sick, farmers may lose part of their harvest, which reduces supply. Labor shortage is also a problem. Tapping rubber trees is a manual job that requires skilled workers. In some areas, fewer people are choosing to work on rubber farms, making it harder to keep up production.

- Finally, environmental laws and land-use rules are limiting how much land can be used to grow rubber. Governments want to protect forests and reduce pollution, so they are careful about how and where rubber trees can be planted. These factors make the caoutchouc market vulnerable and can affect supply and prices.

Caoutchouc Market Expansion Opportunity - Sustainable and Bio-Based Rubber Innovation

- There is a growing focus on making rubber production more sustainable and environmentally friendly. One major step in this direction is the development of rubber blends mixing natural rubber with synthetic materials. These blends can offer better performance, use fewer resources, and last longer.

- Researchers and companies are also investing more in finding alternative sources of rubber. For example, some are working with plants like guayule and dandelions, which can also produce rubber but grow in different climates. This helps reduce the pressure on traditional rubber trees and spreads out the supply.

- Another important area of improvement is in how natural rubber is harvested. New techniques and tools are being tested to collect latex more efficiently. This can help farmers get more rubber from each tree, while also protecting the environment and reducing waste.

- The demand for eco-friendly and safe rubber is also increasing in industries like healthcare, aerospace, and consumer products. These industries need rubber that is soft, durable, and non-allergenic. Sustainable rubber fits these needs and supports global efforts to reduce pollution and protect nature.

- As the world looks for greener solutions, innovation in sustainable and bio-based rubber offers great opportunities for the caoutchouc market to grow in smarter and more responsible ways.

Caoutchouc Market Challenge and Risk - Volatility in Raw Material Prices and Global Trade Disruptions

- The caoutchouc (natural rubber) market faces many challenges because of changing prices and global trade problems. The price of natural rubber often goes up and down. These changes can happen due to political tensions between countries, changes in trade laws, or unexpected events like the COVID-19 pandemic. For example, during the pandemic, port closures and shipping delays made it hard to move rubber across borders, causing supply shortages and price spikes.

- Natural rubber also faces tough competition from synthetic rubber, which is made from petroleum-based chemicals. Synthetic rubber can be cheaper to produce and easier to supply in large quantities. When natural rubber prices rise, many manufacturers switch to synthetic options, which hurts demand for caoutchouc.

- Environmental concerns add another layer of difficulty. Growing rubber trees often requires clearing forests, which can lead to deforestation and harm the environment. This creates pressure from governments and environmental groups to reduce the environmental impact of rubber farming. There is also growing focus on the carbon footprint caused by rubber production and transportation.

- All of these factors price instability, trade disruptions, cheaper alternatives, and environmental pressures create risks and challenges for the natural rubber market. These issues can limit growth and make it harder for producers to plan for the future.

Caoutchouc Market Segment Analysis:

Caoutchouc Market is segmented based on Type, Application, End-Users, and Region

By Type, caoutchouc Segment is Expected to Dominate the Market During the Forecast Period

- In the caoutchouc market, natural rubber is the most widely used type and currently holds the largest share. This is mainly because of its strong demand in tire manufacturing. Natural rubber has special qualities like flexibility, strength, and resistance to wear, which makes it perfect for making tires. Almost every vehicle, from bicycles to trucks, uses tires made with natural rubber.

- Besides tires, natural rubber is also used in many industrial applications. It is used to make things like conveyor belts, hoses, gaskets, and seals. These products are important in factories, construction, and machinery, where rubber helps absorb shock, reduce noise, and improve safety.

- Natural rubber is also preferred in some medical and consumer products, such as gloves, balloons, and elastic bands, because it is soft, stretchable, and safe for the skin.

- Although synthetic rubber is growing in use, many manufacturers still prefer natural rubber because it is biodegradable and made from renewable sources like rubber trees. It is especially popular in regions like Asia-Pacific, where both production and usage are high. As industries like automotive and construction continue to grow, the need for natural rubber is expected to stay strong, keeping it as the leading type in the global caoutchouc market.

By Application, Caoutchouc Segment Held the Largest Share in 2024

- The caoutchouc (natural rubber) market is divided into different segments based on how the rubber is used. The main applications include tires, belts and hoses, and a variety of other rubber products.

- Among these, tires hold the largest share of the market. This is because natural rubber is a key material used to make tires for cars, trucks, buses, motorcycles, and even airplanes. As more people around the world buy vehicles and more cars are being produced especially in fast-growing countries like China and India the demand for natural rubber in tire production continues to rise. Rubber gives tires the flexibility, strength, and grip needed for safe driving.

- Belts and hoses are also important applications for caoutchouc. These rubber parts are used in engines and machines to transfer power, move fluids, and connect systems. You can find them in cars, factories, construction machines, and household appliances. Rubber is chosen for these parts because it can bend without breaking, handle pressure, and last a long time.

- Other uses of caoutchouc include gloves, footwear, seals, gaskets, and medical items. These products also help support the market. As industries grow and technology improves, the need for caoutchouc in all these applications is expected to stay strong or even increase in the coming years.

Caoutchouc Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- In North America, especially in the United States, the demand for caoutchouc (natural rubber) is strong but most of it is imported. The region does not produce much natural rubber locally because the climate is not suitable for rubber tree farming. As a result, North America depends heavily on global supply chains, mainly sourcing rubber from countries in Southeast Asia.

- The U.S. uses a large amount of natural rubber in industries like tire manufacturing, where it's essential for making durable and high-performance tires. The automotive sector is a key driver of this demand.

- In addition, healthcare is another major user of caoutchouc. Hospitals and clinics rely on rubber for making gloves, tubing, and other medical products. The aerospace industry also uses natural rubber in seals, vibration control systems, and specialized components that need flexibility and strength.

- At the same time, North America is also investing in alternatives. Due to rising prices and supply risks, companies are exploring synthetic rubber and bio-based materials that can be made locally. These alternatives can reduce reliance on imports and help meet environmental goals. In short, while North America is a big consumer of caoutchouc, its future strategy includes both using imports and developing more sustainable and local alternatives.

Caoutchouc Market Active Players:

- Apcotex Industries Ltd. (India)

- Bridgestone Corporation (Japan)

- China Hainan Rubber Industry Group Co., Ltd. (China)

- Continental AG (Germany)

- Daewoo International Corporation (South Korea)

- Felda Global Ventures Holdings Berhad (FGV) (Malaysia)

- Firestone Natural Rubber Company (USA)

- Goodyear Tire & Rubber Company (USA)

- Halcyon Agri Corporation Limited (Singapore)

- Hutchinson SA (France)

- Jiangsu General Science Technology Co., Ltd. (China)

- Kraton Corporation (USA)

- Kurian Abraham Pvt. Ltd. (KAPL) (India)

- Makrubber Products Pvt. Ltd. (India)

- Malaysian Rubber Board (MRB) (Malaysia)

- Michelin Group (France)

- Phoenix Rubber Products Co. Ltd. (Thailand)

- Polimeros y Derivados S.A. de C.V. (Mexico)RCMA Group (Singapore)

- Rubberex Corporation (M) Berhad (Malaysia)

- Sime Darby Plantation Berhad (Malaysia)

- Sinochem International Corporation (China)

- Southland Rubber Group (Thailand)

- Sri Trang Agro-Industry Public Company Ltd. (Thailand)

- T.L. Sourcing (India)

- Thai Rubber Latex Group Public Company Ltd. (Thailand)

- Unitex Rubber Co. Ltd. (Thailand)

- Vietnam Rubber Group (VRG) (Vietnam)

- Von Bundit Co. Ltd. (Thailand)

- Yunnan Natural Rubber Industry Co., Ltd. (China)

- Other Active Players

|

Caoutchouc Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 18.3 Billion |

|

Forecast Period 2025-35 CAGR: |

4.5 % |

Market Size in 2035: |

USD 29.7 Billion

|

|

Segments Covered: |

By Type |

|

|

|

By Application

|

|

||

|

By Product Form |

|

||

|

By Property |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Caoutchouc Market by Type (2018-2035)

4.1 Caoutchouc Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Natural Rubber

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Synthetic Rubber

Chapter 5: Caoutchouc Market by Application (2018-2035)

5.1 Caoutchouc Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Tires

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Belts and Hoses

Chapter 6: Caoutchouc Market by Product Form (2018-2035)

6.1 Caoutchouc Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Sheets

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Crumb Rubber

Chapter 7: Caoutchouc Market by Property Characteristics (2018-2035)

7.1 Caoutchouc Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Temperature Resistance

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Weather Resistance

Chapter 8: Caoutchouc Market by End-Use Industry (2018-2035)

8.1 Caoutchouc Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Automotive

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Construction

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Caoutchouc Market Share by Manufacturer/Service Provider(2024)

9.1.3 Industry BCG Matrix

9.1.4 PArtnerships, Mergers & Acquisitions

9.2 APCOTEX INDUSTRIES LTD. (INDIA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Recent News & Developments

9.2.10 SWOT Analysis

9.3 BRIDGESTONE CORPORATION (JAPAN)

9.4 CHINA HAINAN RUBBER INDUSTRY GROUP CO.

9.5 LTD. (CHINA)

9.6 CONTINENTAL AG (GERMANY)

9.7 DAEWOO INTERNATIONAL CORPORATION (SOUTH KOREA)

9.8 FELDA GLOBAL VENTURES HOLDINGS BERHAD (FGV) (MALAYSIA)

9.9 FIRESTONE NATURAL RUBBER COMPANY (USA)

9.10 GOODYEAR TIRE & RUBBER COMPANY (USA)

9.11 HALCYON AGRI CORPORATION LIMITED (SINGAPORE)

9.12 HUTCHINSON SA (FRANCE)

9.13 JIANGSU GENERAL SCIENCE TECHNOLOGY CO.

9.14 LTD. (CHINA)

9.15 KRATON CORPORATION (USA)

9.16 KURIAN ABRAHAM PVT. LTD. (KAPL) (INDIA)

9.17 MAKRUBBER PRODUCTS PVT. LTD. (INDIA)

9.18 MALAYSIAN RUBBER BOARD (MRB) (MALAYSIA)

9.19 MICHELIN GROUP (FRANCE)

9.20 PHOENIX RUBBER PRODUCTS CO. LTD. (THAILAND)

9.21 POLIMEROS Y DERIVADOS S.A. DE C.V. (MEXICO)

9.22 RCMA GROUP (SINGAPORE)

9.23 RUBBEREX CORPORATION (M) BERHAD (MALAYSIA)

9.24 SIME DARBY PLANTATION BERHAD (MALAYSIA)

9.25 SINOCHEM INTERNATIONAL CORPORATION (CHINA)

9.26 SOUTHLAND RUBBER GROUP (THAILAND)

9.27 SRI TRANG AGRO-INDUSTRY PUBLIC COMPANY LTD. (THAILAND)

9.28 T.L. SOURCING (INDIA)

9.29 THAI RUBBER LATEX GROUP PUBLIC COMPANY LTD. (THAILAND)

9.30 UNITEX RUBBER CO. LTD. (THAILAND)

9.31 VIETNAM RUBBER GROUP (VRG) (VIETNAM)

9.32 VON BUNDIT CO. LTD. (THAILAND)

9.33 YUNNAN NATURAL RUBBER INDUSTRY CO.

9.34 LTD. (CHINA)

9.35 AND OTHER ACTIVE PLAYERS.

Chapter 10: Global Caoutchouc Market By Region

10.1 Overview

10.2. North America Caoutchouc Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecast Market Size by Country

10.2.4.1 US

10.2.4.2 Canada

10.2.4.3 Mexico

10.3. Eastern Europe Caoutchouc Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecast Market Size by Country

10.3.4.1 Russia

10.3.4.2 Bulgaria

10.3.4.3 The Czech Republic

10.3.4.4 Hungary

10.3.4.5 Poland

10.3.4.6 Romania

10.3.4.7 Rest of Eastern Europe

10.4. Western Europe Caoutchouc Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecast Market Size by Country

10.4.4.1 Germany

10.4.4.2 UK

10.4.4.3 France

10.4.4.4 The Netherlands

10.4.4.5 Italy

10.4.4.6 Spain

10.4.4.7 Rest of Western Europe

10.5. Asia Pacific Caoutchouc Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecast Market Size by Country

10.5.4.1 China

10.5.4.2 India

10.5.4.3 Japan

10.5.4.4 South Korea

10.5.4.5 Malaysia

10.5.4.6 Thailand

10.5.4.7 Vietnam

10.5.4.8 The Philippines

10.5.4.9 Australia

10.5.4.10 New Zealand

10.5.4.11 Rest of APAC

10.6. Middle East & Africa Caoutchouc Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecast Market Size by Country

10.6.4.1 Turkiye

10.6.4.2 Bahrain

10.6.4.3 Kuwait

10.6.4.4 Saudi Arabia

10.6.4.5 Qatar

10.6.4.6 UAE

10.6.4.7 Israel

10.6.4.8 South Africa

10.7. South America Caoutchouc Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecast Market Size by Country

10.7.4.1 Brazil

10.7.4.2 Argentina

10.7.4.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

Chapter 12 Our Thematic Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Chapter 13 Case Study

Chapter 14 Appendix

12.1 Sources

12.2 List of Tables and figures

12.3 Short Forms and Citations

12.4 Assumption and Conversion

12.5 Disclaimer

|

Caoutchouc Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 18.3 Billion |

|

Forecast Period 2025-35 CAGR: |

4.5 % |

Market Size in 2035: |

USD 29.7 Billion

|

|

Segments Covered: |

By Type |

|

|

|

By Application

|

|

||

|

By Product Form |

|

||

|

By Property |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||