Global Blockchain in Insurance Market Overview

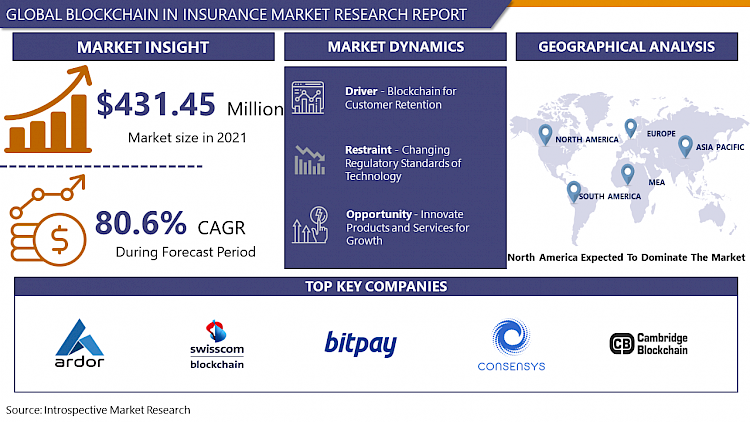

Global Blockchain In Insurance Market is projected at USD 431.45 Million in the year 2021 and is expected to reach USD 27,036.76 Million by 2028, with a CAGR of 80.6% over the analysis period.

Blockchain is a distributed ledger that holds a growing list of data records on decentralized servers that act as nodes. Each node has a complete copy of the Blockchain, a single shared source of truth. Nodes keep a copy of the ledger with the cryptocurrency through a process known as mining. Transactions are added to the ledger when a majority of nodes agree on the validity of the transaction. Blockchain is gaining popularity and acceptance in the banking, financial services, and insurance (BFSI) markets. The insurance industry is moving to open technology, open talent networks, and open information systems. In this case, Blockchain and Smart Contract solutions have the potential to completely automate the insurance market, while locking and unlocking funds, when regulatory conditions are met, risk dynamic assessment, and create conditions for new markets to develop. Over time, de-intermediation could take place as the new blockchain-powered peer-to-peer insurance market develops. Instead of relying on insurance intermediaries for financial security, customers will rely on technology-enabled transactions. Additionally, insurance companies operate in a highly competitive environment where individuals and businesses expect the best value and the best online experience. In the insurance industry, blockchain technology represents an opportunity for positive change and growth. Hence, the increased demand for blockchain in insurance is expected to drive the market.

Market Dynamics and factors for Blockchain in Insurance Market

Drivers

Blockchain for Customer Retention

One of the primary business goals of any insurance business is customer loyalty. Insurance companies are constantly looking for new ways to improve customer satisfaction and increase their customer orientation. For example, many insurance companies invest in loyalty programs that offer points-based benefits. Blockchain can facilitate this and even take it to the next level, enabling a platform that allows easy exchange of points between different loyalty programs - a loyalty exchange platform. virtual loyalty. Blockchains with smart contracts can be applied to provide consumers with low processing costs if underwriting and claims processing can be automated based on defined rules and the availability of reliable data sources. Payments to these covered consumers can be made when a claim is submitted. And then it can be easily paid for by accessing a verified database, thanks to smart rules that consider the user's profile on the social network, as well as changes to the user's account. markets can help predict possible fraud. Blockchain can also help leverage knowledge of customer preferences in real-time, allowing end users to "become moderators" of the platform. This gives customers the ability to redeem, such as airline points for restaurant points, which implies that customers can choose the reward that suits them best. This effectively increases their freedom of choice and provides a better approval platform for the insurer. Accordingly, this will contribute to the growth of Blockchain in the Insurance Market during the forecast period.

Restraints

Changing Regulatory Standards of Technology

Blockchain in insurance technology is under constant development. These advances affect the current regulatory standards. The use of technology is also affected due to this factor. Regulatory authorities find it difficult to cope with advancements in technology. With such technological advancements, regulatory bodies need to understand what the current regulations lack and how the rules can impact overall technology applications. Uncertainties in regulations remain a concern in the blockchain in the insurance market. At present, the lack of regulations is likely to restrain the adoption of blockchain technology in most application areas, such as financial services, telecom, government, and retail. The adoption of blockchain technology in the insurance vertical is affected by uncertain regulations and the lack of common standards for drafting the transactions of cryptocurrencies on blockchain technology.

Opportunity

Innovate Products and Services for Growth

We see three ways blockchain can facilitate the growth of insurance companies: improve customer engagement, enable product offering that benefits emerging markets, and enable the growth of IoT-related insurance products. The potential that blockchain offers in these areas is fundamental in its use as a distributed and trusted platform for customer-controlled personal data, peer-to-peer (P2P) insurance, and contracts. smart co. Customer participation. An important lever for improving customer engagement through blockchain lies in the area of personal data. Customers' fear of losing control of their data as soon as it is transferred to a company and their frustration with having to repeat data entry processes can be resolved with a client-controlled blockchain to verify identity data (see KYC use case) or medical/health data. Personal data does not need to be stored on the blockchain; it remains on the user's device. Only its verification, for example through a doctor and related transactions (for example, an examination taking place on a certain date) is recorded in the blockchain. Here, scale is key to realizing the benefits of blockchain, as it requires a sufficient number of stakeholders to reuse verified data.

Challenges

Technology Limitations in Terms of the Scalability and Security

Due to consensus-based confirmation mechanisms and continuous copies, as well as the increasing amount of data stored (defined as immutable), the scalability of the blockchain system is a challenge. While there are newer blockchain implementations that have fewer performance limitations, high-speed/high volume transactions, real-time data collection, and high-volume data storage are not areas. blockchain's intentions. Recent incidents have shown that in a blockchain ecosystem, new types of attacks are emerging. These are much less understood and, therefore, less mitigated than what happens in conventional database architectures.

Segmentation Analysis of Blockchain in the Insurance Market

By Type, Public Blockchain dominates the Blockchain in Insurance Market. Owing to shared networks being typically focused on online hacker attacks, public blockchains are targeted at maintaining a high level of security standards. One of the key draws for any public blockchain enterprise is true decentralization. A public blockchain is a multi-tenant environment where the computing space is shared with several other clients. Various government bodies over the globe are integrating conventional systems with cloud technologies in the current day. The demand for public blockchain is high as it offers cost competitiveness to enterprises.

By Application, the Smart Contract segment is expected to dominate the Blockchain in the insurance market. Customers and insurers should use blockchain-powered smart contracts to manage claims in a transparent, timely, and verifiable manner for efficient claims handling. more streamlined, and improved customer experience. A smart contract is a type of insurance contract or insurance that pays when specific predefined criteria are met. Smart contracts are stored in a decentralized environment with no manipulation or intermediaries, which means they can only be settled on the blockchain with complete transparency and no involvement of the People. In addition to improved transparency, smart contracts offer various additional benefits, such as faster payments, cheaper administrative costs, and lower insurance premiums due to the absence of third parties.

Regional Analysis of Blockchain in the Insurance Market

North America is anticipated to dominate the insurance industry due to the early adoption of blockchain technology, the majority of institutions have invested in Blockchain insurance technology due to its many advantages. The revenue growth in the North American market is mainly due to the region's increasing investment in blockchain technology and the rapid development of management solutions to enable data security, prevent cyberattacks. and ensure the security and privacy of Data. Furthermore, the introduction of advanced and premium features in technology is creating greater demand in this region. The blockchain insurance market in North America is expected to witness strong revenue growth during the forecast period due to the presence of major players in the industry in the region including Oracle, Microsoft, BlockCypher Inc, Circle Internet Financial Limited, IBM Corporation, BitPay, and ConsenSys.

Developing economies in the Asia-Pacific region offer unprecedented opportunities to test low-cost innovations and open regulatory frameworks for blockchain technology in the insurance market. Emerging economies in the Asia-Pacific region represent an unprecedented opportunity to test low-cost innovations and the open regulatory framework of blockchain technology in the insurance industry. As insurers are expected to increasingly rely on the growing adoption of IoT for data collection in emerging economies, blockchain-based implementations could significantly increase their effectiveness. overall process and allows insurers to capture sensory information in a secure environment. and anti-forgery methods. For example, ICICI Lombard uses AI in health insurance claims to identify any fraud. All authenticated and stamped transactions are difficult to modify and can be verified using AI for real-time settlement. For example, China, despite tough regulations imposed on some crypto-related activities, is now moving forward on its own with a vision of integrating blockchain technology into state plans. and even included it in the thirteenth plan, the five-year plan, which includes a government development roadmap from 2016 to 2020.

The Europe region is expected to grow at a significant growth rate during the forecast period. The European Insurance and Occupation Pensions Authority (EIOPA) published a Feedback Statement on blockchain and smart contracts in insurance. The document provides a high-level summary of the responses received from stakeholders during a public consultation on the topic as well as EIOPA’s reactions to them. The region will contribute to high profitability and demand in the forecast period. Growing high investment in R&D, the launch of the advanced and high-end features in the technology will attract more demand in this region.

Covid 19 Impact Analysis on Blockchain in Insurance Market

The COVID-19 crisis continues to have a significant impact on individuals, societies, businesses, and the broader economy worldwide. The insurance sector was not spared its impact, but insurers responded quickly to the crisis. As the broader economy recovers and responds to the pandemic, insurers will face several challenges, but will also see new opportunities in the medium to long term. Solution companies are expanding their geographic presence and services to capture more market share in the Asia Pacific due to the growing impact of COVID-19 on business growth. Enterprises are adopting advanced real-time security platforms to improve insurance policy-related processes, increasing the need for solutions in lockdown. Companies are applying advanced technology services for fraud detection and hedging to all insurance transactions. The growing demand for digitalization in the insurance industry is also prompting solution providers to increase investment to deliver cutting-edge solutions to consumers during COVID-19.

Top Key Players Covered Blockchain in Insurance Market

- Ardor

- Adnovum

- Swisscom Blockchain

- Applied Blockchain

- Algorythmix

- Auxesis Group

- AWS

- Bitfury

- BitPay

- BlockCypher

- BTL Group

- Cambridge Blockchain

- ChainThat

- Circle

- ConsenSys

- Digital Asset Holdings

- Earthport

- Everledger

- Factom

- Guardtime

- IBM

- iXLedger

- Microsoft

- Oracle and other major players.

Key industry development in the Blockchain in Insurance Market

In 2022, Beazley, a specialist insurer, declared the introduction of a new Directors' & Officers' liability (D&O) insurance product designed specifically for cryptocurrency businesses.

In 2022, Covinsure, according to Zetrix, will offer insurance using blockchain technology and cryptocurrency as a payout. Zetrix has simplified the process of getting insured by requiring only a passport and a Zetrix wallet.

In November 2020, Tata Consultancy Services (TCS), the largest multinational IT services, consulting, and business solutions company, teamed up with B3i Services AG, a global industry-led blockchain initiative, to design, develop, and release ecosystem innovations for the insurance industry based on distributed ledger technology (DLT).

|

Global Blockchain in Insurance Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 431.45 Mn. |

|

Forecast Period 2022-28 CAGR: |

80.6% |

Market Size in 2028: |

USD 27,036.76 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Blockchain in Insurance Market by Type

5.1 Blockchain in Insurance Market Overview Snapshot and Growth Engine

5.2 Blockchain in Insurance Market Overview

5.3 Private Blockchain

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Private Blockchain: Grographic Segmentation

5.4 Public Blockchain

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Public Blockchain: Grographic Segmentation

5.5 Consortium Blockchain

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Consortium Blockchain: Grographic Segmentation

Chapter 6: Blockchain in Insurance Market by Application

6.1 Blockchain in Insurance Market Overview Snapshot and Growth Engine

6.2 Blockchain in Insurance Market Overview

6.3 GRC Management

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 GRC Management: Grographic Segmentation

6.4 Death and Claims Management

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Death and Claims Management: Grographic Segmentation

6.5 Fraud Detection

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Fraud Detection: Grographic Segmentation

6.6 Payments

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Payments: Grographic Segmentation

6.7 Smart contracts

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2016-2028F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Smart contracts: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Blockchain in Insurance Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Blockchain in Insurance Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Blockchain in Insurance Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 ARDOR

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 ADNOVUM

7.4 SWISSCOM BLOCKCHAIN

7.5 APPLIED BLOCKCHAIN

7.6 ALGORYTHMIX

7.7 AUXESIS GROUP

7.8 AWS

7.9 BITFURY

7.10 BITPAY

7.11 BLOCKCYPHER

7.12 BTL GROUP

7.13 CAMBRIDGE BLOCKCHAIN

7.14 CHAINTHAT

7.15 CIRCLE

7.16 CONSENSYS

7.17 DIGITAL ASSET HOLDINGS

7.18 EARTHPORT

7.19 EVERLEDGER

7.20 FACTOM

7.21 GUARDTIME

7.22 IBM

7.23 IXLEDGER

7.24 MICROSOFT

7.25 ORACLE

7.26 OTHER MAJOR PLAYERS

Chapter 8: Global Blockchain in Insurance Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Type

8.2.1 Private Blockchain

8.2.2 Public Blockchain

8.2.3 Consortium Blockchain

8.3 Historic and Forecasted Market Size By Application

8.3.1 GRC Management

8.3.2 Death and Claims Management

8.3.3 Fraud Detection

8.3.4 Payments

8.3.5 Smart contracts

Chapter 9: North America Blockchain in Insurance Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Private Blockchain

9.4.2 Public Blockchain

9.4.3 Consortium Blockchain

9.5 Historic and Forecasted Market Size By Application

9.5.1 GRC Management

9.5.2 Death and Claims Management

9.5.3 Fraud Detection

9.5.4 Payments

9.5.5 Smart contracts

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe Blockchain in Insurance Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Private Blockchain

10.4.2 Public Blockchain

10.4.3 Consortium Blockchain

10.5 Historic and Forecasted Market Size By Application

10.5.1 GRC Management

10.5.2 Death and Claims Management

10.5.3 Fraud Detection

10.5.4 Payments

10.5.5 Smart contracts

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific Blockchain in Insurance Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Private Blockchain

11.4.2 Public Blockchain

11.4.3 Consortium Blockchain

11.5 Historic and Forecasted Market Size By Application

11.5.1 GRC Management

11.5.2 Death and Claims Management

11.5.3 Fraud Detection

11.5.4 Payments

11.5.5 Smart contracts

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa Blockchain in Insurance Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Private Blockchain

12.4.2 Public Blockchain

12.4.3 Consortium Blockchain

12.5 Historic and Forecasted Market Size By Application

12.5.1 GRC Management

12.5.2 Death and Claims Management

12.5.3 Fraud Detection

12.5.4 Payments

12.5.5 Smart contracts

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America Blockchain in Insurance Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Private Blockchain

13.4.2 Public Blockchain

13.4.3 Consortium Blockchain

13.5 Historic and Forecasted Market Size By Application

13.5.1 GRC Management

13.5.2 Death and Claims Management

13.5.3 Fraud Detection

13.5.4 Payments

13.5.5 Smart contracts

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Blockchain in Insurance Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 431.45 Mn. |

|

Forecast Period 2022-28 CAGR: |

80.6% |

Market Size in 2028: |

USD 27,036.76 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BLOCKCHAIN IN INSURANCE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BLOCKCHAIN IN INSURANCE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BLOCKCHAIN IN INSURANCE MARKET COMPETITIVE RIVALRY

TABLE 005. BLOCKCHAIN IN INSURANCE MARKET THREAT OF NEW ENTRANTS

TABLE 006. BLOCKCHAIN IN INSURANCE MARKET THREAT OF SUBSTITUTES

TABLE 007. BLOCKCHAIN IN INSURANCE MARKET BY TYPE

TABLE 008. PRIVATE BLOCKCHAIN MARKET OVERVIEW (2016-2028)

TABLE 009. PUBLIC BLOCKCHAIN MARKET OVERVIEW (2016-2028)

TABLE 010. CONSORTIUM BLOCKCHAIN MARKET OVERVIEW (2016-2028)

TABLE 011. BLOCKCHAIN IN INSURANCE MARKET BY APPLICATION

TABLE 012. GRC MANAGEMENT MARKET OVERVIEW (2016-2028)

TABLE 013. DEATH AND CLAIMS MANAGEMENT MARKET OVERVIEW (2016-2028)

TABLE 014. FRAUD DETECTION MARKET OVERVIEW (2016-2028)

TABLE 015. PAYMENTS MARKET OVERVIEW (2016-2028)

TABLE 016. SMART CONTRACTS MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA BLOCKCHAIN IN INSURANCE MARKET, BY TYPE (2016-2028)

TABLE 018. NORTH AMERICA BLOCKCHAIN IN INSURANCE MARKET, BY APPLICATION (2016-2028)

TABLE 019. N BLOCKCHAIN IN INSURANCE MARKET, BY COUNTRY (2016-2028)

TABLE 020. EUROPE BLOCKCHAIN IN INSURANCE MARKET, BY TYPE (2016-2028)

TABLE 021. EUROPE BLOCKCHAIN IN INSURANCE MARKET, BY APPLICATION (2016-2028)

TABLE 022. BLOCKCHAIN IN INSURANCE MARKET, BY COUNTRY (2016-2028)

TABLE 023. ASIA PACIFIC BLOCKCHAIN IN INSURANCE MARKET, BY TYPE (2016-2028)

TABLE 024. ASIA PACIFIC BLOCKCHAIN IN INSURANCE MARKET, BY APPLICATION (2016-2028)

TABLE 025. BLOCKCHAIN IN INSURANCE MARKET, BY COUNTRY (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA BLOCKCHAIN IN INSURANCE MARKET, BY TYPE (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA BLOCKCHAIN IN INSURANCE MARKET, BY APPLICATION (2016-2028)

TABLE 028. BLOCKCHAIN IN INSURANCE MARKET, BY COUNTRY (2016-2028)

TABLE 029. SOUTH AMERICA BLOCKCHAIN IN INSURANCE MARKET, BY TYPE (2016-2028)

TABLE 030. SOUTH AMERICA BLOCKCHAIN IN INSURANCE MARKET, BY APPLICATION (2016-2028)

TABLE 031. BLOCKCHAIN IN INSURANCE MARKET, BY COUNTRY (2016-2028)

TABLE 032. ARDOR: SNAPSHOT

TABLE 033. ARDOR: BUSINESS PERFORMANCE

TABLE 034. ARDOR: PRODUCT PORTFOLIO

TABLE 035. ARDOR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. ADNOVUM: SNAPSHOT

TABLE 036. ADNOVUM: BUSINESS PERFORMANCE

TABLE 037. ADNOVUM: PRODUCT PORTFOLIO

TABLE 038. ADNOVUM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. SWISSCOM BLOCKCHAIN: SNAPSHOT

TABLE 039. SWISSCOM BLOCKCHAIN: BUSINESS PERFORMANCE

TABLE 040. SWISSCOM BLOCKCHAIN: PRODUCT PORTFOLIO

TABLE 041. SWISSCOM BLOCKCHAIN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. APPLIED BLOCKCHAIN: SNAPSHOT

TABLE 042. APPLIED BLOCKCHAIN: BUSINESS PERFORMANCE

TABLE 043. APPLIED BLOCKCHAIN: PRODUCT PORTFOLIO

TABLE 044. APPLIED BLOCKCHAIN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. ALGORYTHMIX: SNAPSHOT

TABLE 045. ALGORYTHMIX: BUSINESS PERFORMANCE

TABLE 046. ALGORYTHMIX: PRODUCT PORTFOLIO

TABLE 047. ALGORYTHMIX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. AUXESIS GROUP: SNAPSHOT

TABLE 048. AUXESIS GROUP: BUSINESS PERFORMANCE

TABLE 049. AUXESIS GROUP: PRODUCT PORTFOLIO

TABLE 050. AUXESIS GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. AWS: SNAPSHOT

TABLE 051. AWS: BUSINESS PERFORMANCE

TABLE 052. AWS: PRODUCT PORTFOLIO

TABLE 053. AWS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. BITFURY: SNAPSHOT

TABLE 054. BITFURY: BUSINESS PERFORMANCE

TABLE 055. BITFURY: PRODUCT PORTFOLIO

TABLE 056. BITFURY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. BITPAY: SNAPSHOT

TABLE 057. BITPAY: BUSINESS PERFORMANCE

TABLE 058. BITPAY: PRODUCT PORTFOLIO

TABLE 059. BITPAY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. BLOCKCYPHER: SNAPSHOT

TABLE 060. BLOCKCYPHER: BUSINESS PERFORMANCE

TABLE 061. BLOCKCYPHER: PRODUCT PORTFOLIO

TABLE 062. BLOCKCYPHER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. BTL GROUP: SNAPSHOT

TABLE 063. BTL GROUP: BUSINESS PERFORMANCE

TABLE 064. BTL GROUP: PRODUCT PORTFOLIO

TABLE 065. BTL GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. CAMBRIDGE BLOCKCHAIN: SNAPSHOT

TABLE 066. CAMBRIDGE BLOCKCHAIN: BUSINESS PERFORMANCE

TABLE 067. CAMBRIDGE BLOCKCHAIN: PRODUCT PORTFOLIO

TABLE 068. CAMBRIDGE BLOCKCHAIN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. CHAINTHAT: SNAPSHOT

TABLE 069. CHAINTHAT: BUSINESS PERFORMANCE

TABLE 070. CHAINTHAT: PRODUCT PORTFOLIO

TABLE 071. CHAINTHAT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. CIRCLE: SNAPSHOT

TABLE 072. CIRCLE: BUSINESS PERFORMANCE

TABLE 073. CIRCLE: PRODUCT PORTFOLIO

TABLE 074. CIRCLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. CONSENSYS: SNAPSHOT

TABLE 075. CONSENSYS: BUSINESS PERFORMANCE

TABLE 076. CONSENSYS: PRODUCT PORTFOLIO

TABLE 077. CONSENSYS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. DIGITAL ASSET HOLDINGS: SNAPSHOT

TABLE 078. DIGITAL ASSET HOLDINGS: BUSINESS PERFORMANCE

TABLE 079. DIGITAL ASSET HOLDINGS: PRODUCT PORTFOLIO

TABLE 080. DIGITAL ASSET HOLDINGS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. EARTHPORT: SNAPSHOT

TABLE 081. EARTHPORT: BUSINESS PERFORMANCE

TABLE 082. EARTHPORT: PRODUCT PORTFOLIO

TABLE 083. EARTHPORT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. EVERLEDGER: SNAPSHOT

TABLE 084. EVERLEDGER: BUSINESS PERFORMANCE

TABLE 085. EVERLEDGER: PRODUCT PORTFOLIO

TABLE 086. EVERLEDGER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. FACTOM: SNAPSHOT

TABLE 087. FACTOM: BUSINESS PERFORMANCE

TABLE 088. FACTOM: PRODUCT PORTFOLIO

TABLE 089. FACTOM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. GUARDTIME: SNAPSHOT

TABLE 090. GUARDTIME: BUSINESS PERFORMANCE

TABLE 091. GUARDTIME: PRODUCT PORTFOLIO

TABLE 092. GUARDTIME: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. IBM: SNAPSHOT

TABLE 093. IBM: BUSINESS PERFORMANCE

TABLE 094. IBM: PRODUCT PORTFOLIO

TABLE 095. IBM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. IXLEDGER: SNAPSHOT

TABLE 096. IXLEDGER: BUSINESS PERFORMANCE

TABLE 097. IXLEDGER: PRODUCT PORTFOLIO

TABLE 098. IXLEDGER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 098. MICROSOFT: SNAPSHOT

TABLE 099. MICROSOFT: BUSINESS PERFORMANCE

TABLE 100. MICROSOFT: PRODUCT PORTFOLIO

TABLE 101. MICROSOFT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 101. ORACLE: SNAPSHOT

TABLE 102. ORACLE: BUSINESS PERFORMANCE

TABLE 103. ORACLE: PRODUCT PORTFOLIO

TABLE 104. ORACLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 104. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 105. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 106. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 107. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BLOCKCHAIN IN INSURANCE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BLOCKCHAIN IN INSURANCE MARKET OVERVIEW BY TYPE

FIGURE 012. PRIVATE BLOCKCHAIN MARKET OVERVIEW (2016-2028)

FIGURE 013. PUBLIC BLOCKCHAIN MARKET OVERVIEW (2016-2028)

FIGURE 014. CONSORTIUM BLOCKCHAIN MARKET OVERVIEW (2016-2028)

FIGURE 015. BLOCKCHAIN IN INSURANCE MARKET OVERVIEW BY APPLICATION

FIGURE 016. GRC MANAGEMENT MARKET OVERVIEW (2016-2028)

FIGURE 017. DEATH AND CLAIMS MANAGEMENT MARKET OVERVIEW (2016-2028)

FIGURE 018. FRAUD DETECTION MARKET OVERVIEW (2016-2028)

FIGURE 019. PAYMENTS MARKET OVERVIEW (2016-2028)

FIGURE 020. SMART CONTRACTS MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA BLOCKCHAIN IN INSURANCE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE BLOCKCHAIN IN INSURANCE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC BLOCKCHAIN IN INSURANCE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA BLOCKCHAIN IN INSURANCE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA BLOCKCHAIN IN INSURANCE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Blockchain in Insurance Market research report is 2022-2028.

Ardor, Adnovum, Swisscom Blockchain, Applied Blockchain, Algorythmix, Auxesis Group, AWS, Bitfury, BitPay, BlockCypher, BTL Group, Cambridge Blockchain, ChainThat, Circle, ConsenSys, Digital Asset Holdings, Earthport, Everledger, Factom, Guardtime, IBM, iXLedger, Microsoft, Oracle and other major players.

The Blockchain in Insurance Market is segmented into Type, Application, and region. By Type, the market is categorized into Private Blockchain, Public Blockchain, Consortium Blockchain. By Application, the market is categorized into GRC management, Death and Claims Management, Fraud Detection, Payments, Smart contracts. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Blockchain is a distributed ledger that holds a growing list of data records on decentralized servers that act as nodes. Each node has a complete copy of the Blockchain, a single shared source of truth. Nodes keep a copy of the ledger with the cryptocurrency through a process known as mining.

Global Blockchain In Insurance Market is projected at USD 431.45 Million in the year 2021 and is expected to reach USD 27,036.76 Million by 2028, with a CAGR of 80.6% over the analysis period.