Bleaching Agent Market Synopsis:

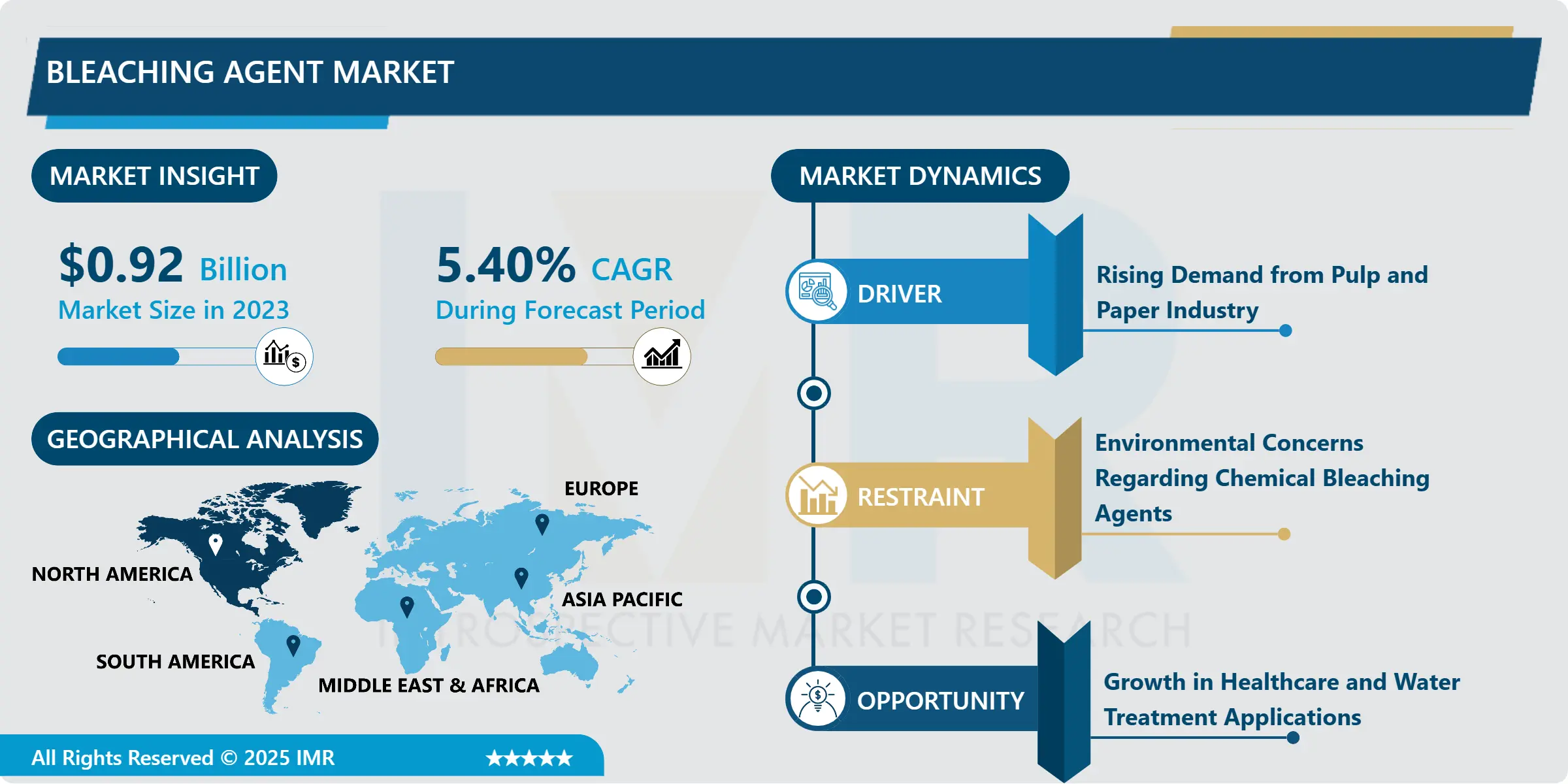

Bleaching Agent Market Size Was Valued at USD 0.92 Billion in 2023, and is Projected to Reach USD 1.48 Billion by 2032, Growing at a CAGR of 5.40% From 2024-2032.

Bleaching agent global industry refers to the business that deals with manufacturing and selling of chemicals that are used to make materials such as fabrics, paper, and detergents lose their colour. Such agents are widely utilized in such sectors as pulp and paper, textile as well as healthcare sectors and are made of chlorine-based, oxygen-based and peroxide-based products.

The market for bleaching agents is slowly showing constant growth due to the various possibilities of its usage in different fields. This is especially so because the sector that is most affected, or rather the sector that continues to experience healthy demand is the pulp and the paper industry due to the new-found proclivity for paper products. Bleaching agents play important roles in production of white and pure papers;

At the same time, these agents are used for textile whitening in the textile industry, increasing its application in fashion and textile industries and home decorations. This strong industrial demand has made it a valued market in the global chemical industry market. In the consumer segment bleaching agents are a necessity in home care products as well as in personal care products. Organic solvents and chlorine and oxygen-based bleach formulations are common, due to increasing consumer concern for cleanliness and sanitation. As for environmental issues, global concerns are playing their part by pushing overtures towards creating ‘green’ bleaching agents.

Bleaching Agent Market Trend Analysis

Eco-Friendly and Sustainable Bleaching Agents

- It is important to note that there is a shift in the bleaching agent market because of the new requirement for sustainability which is greening of solutions. Customers and businesses are engrossed in the environmental impact of chemical bleaching agents are therefore searching for more environmentally friendly option. Another type, oxygen-based bleaches an example being hydrogen peroxide, are slowly becoming popular since they arepyxnosable into water and oxygen. These agents are experiencing use across manufacturing segments including textiles and cleaning; consistent with global trends toward environmentally friendlier uses.

- Biotechnological advancements are adding to the innovation of new green bleaching agents in all respects. High efficiency enzyme based formulation is replacing conventional chemicals to bolster a powerful bleaching agent without using the rigid chemicals. Finally, favourable legal requirements encouraging low-toxicity and biodegradability of products are forcing manufacturers to search for green chemistry. This change is not only making bleaching processes less damaging to the environment but also improving market viability in this sector since businesses are focusing on the implementation of sustainable technologies to answer emerging consumer and industrial needs.

Expanding Applications in Healthcare and Sanitation

- The current trend that is evident with the use of the bleaching agent market is most evident within the healthcare sector since goods require sterilization regularly. Chlorine containing and oxygen containing bleaching agents are used mostly in hospitals and clinics in order to disinfect medical instruments, surfaces, and general environment. The pandemic that hit the world with COVID-19 deepened the appreciation of the efficacy of disinfectants hence saw the demand for these agents increase.

- In the sectors of sanitation, washing and cleaning, bleaching agents are on the rise being used in the water treatment processes to kill all the bad bacteria and other things that harm the population by providing safe water. As the world moves towards purification and sanitation of water especially in the developing world there is need for good bleaching agents. In order to effect appropriate changes and meet the public health requirements most countries are today developing large infrastructure for water treatment. This shift presents good business prospects especially to the market players especially in the EMs because there is high demand of effective sanitation systems to enhance health standards.

Bleaching Agent Market Segment Analysis:

Bleaching Agent Market is Segmented on the basis of Product Type, Application, End Use, and Region

By Product Type, chlorine bleach segment is expected to dominate the market during the forecast period

- The bleaching agent market is divided according to the type of products which major categories include chlorine bleach, oxygen bleach, peroxide bleach and few other special types of bleaching agents are enzyme bleaching agents. Chlorine bleach will often be used in uses such as house hold uses, industrial washing and water treatment as it has strong functions of bleaching or disinfecting. It is particularly most influential in the pulp and paper industrial in the process of bleaching papers. This is because oxygen bleach which includes hydrogen peroxide is becoming more popular to use due to environmental effects since it only breaks down into water and oxygen unlike chlorine. This type is commonly used in the textile and laundries industries where very soft washing agents are required.

- Other important segment is the peroxide bleach as this is known to perform the bleaching function properly but without the use of chlorine. It is widely used both in industrial and domestic purposes, in the manufacturing of textile and paper, and in disinfectants. The market also observes the emergence of other forms of bleaching products such as enzymatic bleaches which are becoming more popular due to their effectiveness, for instance in formulation of detergents. Some of these agents may exhibit high bleaching performance at a reduced rate of pollution hence could be preferred in green product synthesis in each industry.

By Application, textiles segment expected to held the largest share

- The bleaching agent market is divided according to the types of products with chlorine bleach, oxygen bleach, peroxide bleach, and several kinds of other rare types like enzyme bleach. Chlorine bleach’s major uses include cleaning compounds for home and industrial use, decolorizing agents for water treatment. It is most frequently used in the pulp and paper industry for bleaching of the paper products. Hydrogen peroxide oxygen bleach, for example, is preferred because of its environmental beneficial nature since it will disintegrate into water and oxygen. This type is common in the textile and the laundry industries, where less severe bleaching products are preferred.

- Peroxide bleach is the other significant segment here notable for powerful bleaching function but without chlorine’s aggressiveness. They often apply it both in industry and at home, in the manufacture of Textiles and papers, and also in disinfectants. The market also witnesses other forms of bleaching agents such as enzyme bleaches that are gradually being adopted in the market especially in such applications as detergents. These agents can effectively bleach with fewer negative effects and are ideal candidates for development lean products in several industries.

Bleaching Agent Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The global bleaching agent market was led by North America, this is the leadership which is experienced due to the presence of centre industries like a pulp and the paper, textile, and industries using Household cleaning agents which requires bleaching agents intensively. In this case, the United States is particularly important as many manufacturers and an advanced industrial base allowing extended usage of bleaching agents are located in this country. This is supported by consumption trends of the consumers in the region and technological development in industrial uses of the market.

- There is also a strong regulatory environment in North America for the active promotion of eco-friendly and sustainable approaches to bleaching including the usage of bleaching agents. These regulations promote appropriate technological change in the generation of better bleaching agents without health, ecological, and economic hazards, which is consistent with the direction toward sustainability. Further, committed expenditure in health sector and more importantly in water treatment sector leads to a continuous need for bleaching agents in the realm of disinfection and sanitization. In conjunction, these aspects thereby strengthen the position of North America as the market leader in the future years of the global bleaching agent business.

Active Key Players in the Bleaching Agent Market

- Aditya Birla Chemicals (India)

- Akzo Nobel N.V. (Netherlands)

- Arkema S.A. (France)

- Ashland Inc. (USA)

- BASF SE (Germany)

- Clariant AG (Switzerland)

- Dow Inc. (USA)

- DuPont (USA)

- Evonik Industries AG (Germany)

- Gujarat Alkalies and Chemicals Limited (India)

- Huntsman Corporation (USA)

- Kemira Oyj (Finland)

- Mitsubishi Gas Chemical Company, Inc. (Japan)

- Solvay S.A. (Belgium)

- Other Active Players

|

Bleaching Agent Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.92 Billion |

|

Forecast Period 2024-32 CAGR: |

5.40% |

Market Size in 2032: |

USD 1.48 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Bleaching Agent Market by Product Type

4.1 Bleaching Agent Market Snapshot and Growth Engine

4.2 Bleaching Agent Market Overview

4.3 Chlorine Bleach

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Chlorine Bleach: Geographic Segmentation Analysis

4.4 Oxygen Bleach

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Oxygen Bleach: Geographic Segmentation Analysis

4.5 Peroxide Bleach

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Peroxide Bleach: Geographic Segmentation Analysis

4.6 Other Types (e.g.

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Other Types (e.g.: Geographic Segmentation Analysis

4.7 enzyme-based bleaches)

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 enzyme-based bleaches): Geographic Segmentation Analysis

Chapter 5: Bleaching Agent Market by Application

5.1 Bleaching Agent Market Snapshot and Growth Engine

5.2 Bleaching Agent Market Overview

5.3 Pulp & Paper

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Pulp & Paper: Geographic Segmentation Analysis

5.4 Textiles

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Textiles: Geographic Segmentation Analysis

5.5 Household Cleaning

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Household Cleaning: Geographic Segmentation Analysis

5.6 Water Treatment

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Water Treatment: Geographic Segmentation Analysis

5.7 Healthcare & Sanitation

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Healthcare & Sanitation: Geographic Segmentation Analysis

5.8 Other Applications (e.g.

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Other Applications (e.g.: Geographic Segmentation Analysis

5.9 food processing

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 food processing: Geographic Segmentation Analysis

5.10 laundry

5.10.1 Introduction and Market Overview

5.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.10.3 Key Market Trends, Growth Factors and Opportunities

5.10.4 laundry: Geographic Segmentation Analysis

Chapter 6: Bleaching Agent Market by End User

6.1 Bleaching Agent Market Snapshot and Growth Engine

6.2 Bleaching Agent Market Overview

6.3 Industrial

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Industrial: Geographic Segmentation Analysis

6.4 Residential

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Residential: Geographic Segmentation Analysis

6.5 Commercial

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Commercial: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Bleaching Agent Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AKZO NOBEL N.V.

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ASHLAND INC.

7.4 BASF SE

7.5 CLARIANT AG

7.6 DOW INC

7.7 OTHER ACTIVE PLAYERS

Chapter 8: Global Bleaching Agent Market By Region

8.1 Overview

8.2. North America Bleaching Agent Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product Type

8.2.4.1 Chlorine Bleach

8.2.4.2 Oxygen Bleach

8.2.4.3 Peroxide Bleach

8.2.4.4 Other Types (e.g.

8.2.4.5 enzyme-based bleaches)

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Pulp & Paper

8.2.5.2 Textiles

8.2.5.3 Household Cleaning

8.2.5.4 Water Treatment

8.2.5.5 Healthcare & Sanitation

8.2.5.6 Other Applications (e.g.

8.2.5.7 food processing

8.2.5.8 laundry

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Industrial

8.2.6.2 Residential

8.2.6.3 Commercial

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Bleaching Agent Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product Type

8.3.4.1 Chlorine Bleach

8.3.4.2 Oxygen Bleach

8.3.4.3 Peroxide Bleach

8.3.4.4 Other Types (e.g.

8.3.4.5 enzyme-based bleaches)

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Pulp & Paper

8.3.5.2 Textiles

8.3.5.3 Household Cleaning

8.3.5.4 Water Treatment

8.3.5.5 Healthcare & Sanitation

8.3.5.6 Other Applications (e.g.

8.3.5.7 food processing

8.3.5.8 laundry

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Industrial

8.3.6.2 Residential

8.3.6.3 Commercial

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Bleaching Agent Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product Type

8.4.4.1 Chlorine Bleach

8.4.4.2 Oxygen Bleach

8.4.4.3 Peroxide Bleach

8.4.4.4 Other Types (e.g.

8.4.4.5 enzyme-based bleaches)

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Pulp & Paper

8.4.5.2 Textiles

8.4.5.3 Household Cleaning

8.4.5.4 Water Treatment

8.4.5.5 Healthcare & Sanitation

8.4.5.6 Other Applications (e.g.

8.4.5.7 food processing

8.4.5.8 laundry

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Industrial

8.4.6.2 Residential

8.4.6.3 Commercial

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Bleaching Agent Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product Type

8.5.4.1 Chlorine Bleach

8.5.4.2 Oxygen Bleach

8.5.4.3 Peroxide Bleach

8.5.4.4 Other Types (e.g.

8.5.4.5 enzyme-based bleaches)

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Pulp & Paper

8.5.5.2 Textiles

8.5.5.3 Household Cleaning

8.5.5.4 Water Treatment

8.5.5.5 Healthcare & Sanitation

8.5.5.6 Other Applications (e.g.

8.5.5.7 food processing

8.5.5.8 laundry

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Industrial

8.5.6.2 Residential

8.5.6.3 Commercial

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Bleaching Agent Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product Type

8.6.4.1 Chlorine Bleach

8.6.4.2 Oxygen Bleach

8.6.4.3 Peroxide Bleach

8.6.4.4 Other Types (e.g.

8.6.4.5 enzyme-based bleaches)

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Pulp & Paper

8.6.5.2 Textiles

8.6.5.3 Household Cleaning

8.6.5.4 Water Treatment

8.6.5.5 Healthcare & Sanitation

8.6.5.6 Other Applications (e.g.

8.6.5.7 food processing

8.6.5.8 laundry

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Industrial

8.6.6.2 Residential

8.6.6.3 Commercial

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Bleaching Agent Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product Type

8.7.4.1 Chlorine Bleach

8.7.4.2 Oxygen Bleach

8.7.4.3 Peroxide Bleach

8.7.4.4 Other Types (e.g.

8.7.4.5 enzyme-based bleaches)

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Pulp & Paper

8.7.5.2 Textiles

8.7.5.3 Household Cleaning

8.7.5.4 Water Treatment

8.7.5.5 Healthcare & Sanitation

8.7.5.6 Other Applications (e.g.

8.7.5.7 food processing

8.7.5.8 laundry

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Industrial

8.7.6.2 Residential

8.7.6.3 Commercial

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Bleaching Agent Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.92 Billion |

|

Forecast Period 2024-32 CAGR: |

5.40% |

Market Size in 2032: |

USD 1.48 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||