Automotive Drive Shaft Market Synopsis:

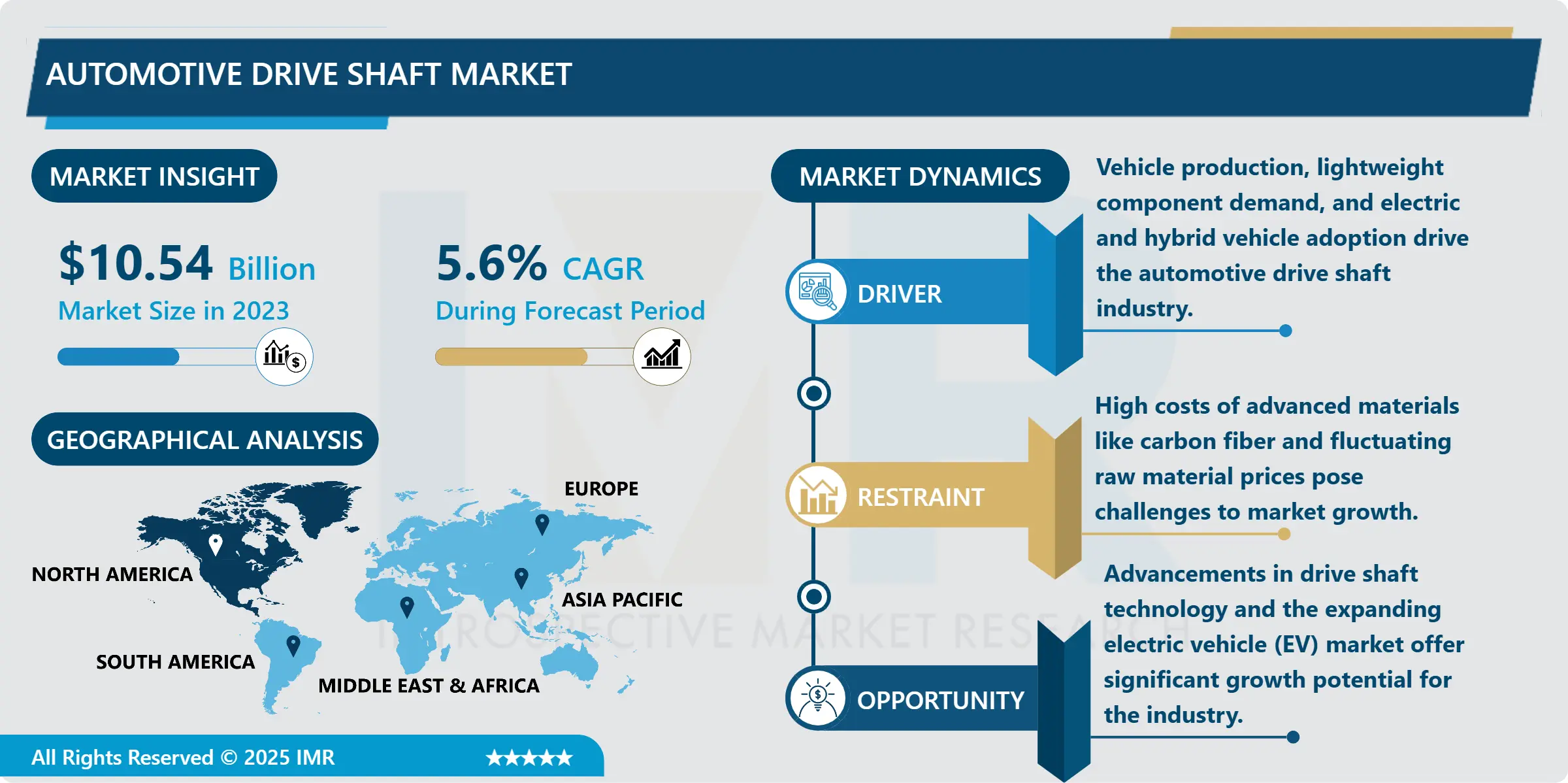

Automotive Drive Shaft Market Size Was Valued at USD 10.54 Billion in 2023, and is Projected to Reach USD 17.21 Billion by 2032, Growing at a CAGR of 5.60% From 2024-2032.

The Automotive Drive Shaft Market is about the manufacturing and selling of drive shafts, which are intermediary shafts in the transmission system of an automobile vehicle and transfer the power generated by the engine or the transmission to the wheels. Transmission shafts are vital for causing movement of vehicles and are of different types, one piece, two piece and slip in tube types depending with the type of vehicle and its performance. The market also encompasses passenger cars, commercial vehicles and off-road vehicles with increasing demand resulting from increasing vehicle manufacture and new drivetrain technologies.

The decrease of weight and increase of durability as key factors are among the key trends that are driving the drive shaft market forward, with reference to the materials used: carbon fiber and aluminum alloys, for instance. These materials help decrease the weight of vehicles, achieve better fuel economy, and ultimately increase performance; all of which majors on sustainability and efficiency, key concepts in modern automobiles. Further, availability of electric vehicles and hybrid vehicles is posing new challenges as these vehicles possess distinct drive shaft configuration and features such as higher torque outputs due to distinct powertrain system.

Asia-Pacific holds the largest market share because of the high car manufacturing and escalating automotive usage especially in the emerging markets of China, India and Japan. North America and Europe are also occupied a big market share due to the requirements for more advanced and high performance automobiles. But with unavoidable factors like rising cost of raw material and relatively steep manufacturing increased complexities, the growth could be an issue. All the same, there is a projection of a constant growth in the market more so by a growing number of vehicles in circulation, technological developments, and more specifically, rising concerns with the fuel efficiency, and sustainability.

Automotive Drive Shaft Market Trend Analysis:

Growing Adoption of Lightweight Drive Shafts

- The automotive industry’s push to enhance fuel efficiency and reduce emissions has led to a significant demand for lighter and more advanced drive shaft designs. As a result, manufacturers are increasingly turning to materials like carbon fiber and aluminum alloy to create drive shafts that not only reduce the overall weight of vehicles but also improve performance. These materials are especially beneficial as they contribute to lower rotational inertia, which enhances the vehicle's acceleration and handling.

- The growing emphasis on environmental sustainability, coupled with stricter global emission standards, has prompted automakers to incorporate lightweight drive shafts not only in luxury cars but also in regular and light commercial vehicles (LCVs). This shift not only helps manufacturers meet regulatory requirements but also offers consumers more fuel-efficient and eco-friendly vehicles. Ultimately, the use of advanced materials like carbon fiber and aluminum alloys is seen as a crucial step toward a greener, more efficient future in the automotive industry.

Rising Demand for Drive Shafts in Electric Vehicles (EVs)

- The widespread adoption of electric vehicles (EVs) and hybrid vehicles is driving significant advancements in drive shaft designs, particularly to meet the high power density demands of modern vehicles. These vehicles generate much greater torque loads compared to traditional internal combustion engine vehicles, requiring more robust and efficient drive shafts.

- Traditional automobile manufacturers have primarily focused on power and efficiency, but the rise of electric powertrains has led to a shift in design priorities. New-generation drive shafts are being engineered to handle the unique characteristics of electric and hybrid powertrains, which include higher torque delivery at lower RPMs. This evolution in drive shaft technology is expected to continue as the global EV market expands. As more vehicles transition to electric and hybrid systems, there will be a growing need for innovative drive shaft solutions that can efficiently handle the increased demands of these advanced powertrains. This trend presents vast opportunities for new technologies in drivetrain components.

Automotive Drive Shaft Market Segment Analysis:

Automotive Drive Shaft Market is Segmented on the basis of Drive Shaft Type, Design Type, Position Type, Vehicle Type, Sales Channel, and Region.

By Drive Shaft Type, One-Piece Drive Shaft segment is expected to dominate the market during the forecast period

- The automotive drive shaft can be categorized by drive shaft type; one-piece drive shaft, two-piece drive shaft, slip-in-tube drive shaft satisfies the required vehicle design and performance. Single-piece driveshafts are widely installed in passenger cars and it’s true that simple construction and lighter weights contribute significantly to fuel economy.

- In larger vehicles, the two-piece drive shafts are desired as it offers more power and better construction to manage more torque, and a larger distance from the axles. Slip-in-tube drive shafts are used for applications where flexibility is needed, as with the off-road and commercial vehicle kinds, because length changes can be made to adjust to loads and road conditions. Such a segmentation corresponds to modern needs for potential automotive designs and allows to achieve the maximum performance and operational reliability of the car of any class.

By Sales Channel, Aftermarket segment expected to held the largest share

- The Automotive Drive Shaft Market is grouped by sales channel into the OEMs and the aftermarket. OEMs continue to occupy most of the market due to adjusted parts customization in relation to vehicle models where drive shafts are used and due to their reliability and excellent performance. These components are embedded during the manufacturing process, especially in new vehicles production; which is further driven by increasing demand of both passanger and commercial vehicles.

- The aftermarket segment is comprised of original equipment manufacturer',{OEM}, parts and customers who require a replacement for their old vehicles or persons who wish to enhance the performance of their automobiles. It is encompassed by an increase in vehicle life-cycle along with the need for a cheaper solution especially within the developing states, where vehicle maintenance is highly valued. Both of them are essential for the market development; OEMs work on the differentiation of products, and the aftermarket is oriented on price sensitivity.

Automotive Drive Shaft Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Automotive drive shaft market will be strongest in North America during the forecast period due to a highly developed automobile manufacturing industry, demand for light trucks & SUVs, and increased concern for vehicle performance. Its utilization across electric and hybrid vehicle variants within the region has also fueled high demand for specialized drive shafts, which meets certain powertrain specifications.

- The market is dominated by North America owing to the presence of major automotive industries and with reference to technological aspect an advance drivetrain system is also found. This dominance is further complemented by increasing research and development spend on developing lightweight and efficient drive shafts for the ever-changing consumer and regulatory requirements.

Active Key Players in the Automotive Drive Shaft Market:

- GKN PLC (UK)

- Advanced Composite Products & Technology Inc. ACPT Inc. (US)

- American Axle & Manufacturing Holdings Inc. (US)

- Neapco Holdings LLC (US)

- Dana Holding Corporation (US)

- Yamada Manufacturing Co. Ltd. (Japan)

- Trelleborg AB (Sweden)

- NTN Corporation (Japan)

- Ifa Rotorion - Holding GmbH (Germany)

- The Timken Company (US), and Other Active Players

|

Automotive Drive Shaft Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.54 Billion |

|

Forecast Period 2024-32 CAGR: |

5.60% |

Market Size in 2032: |

USD 17.21 Billion |

|

Segments Covered: |

By Drive Shaft Type |

|

|

|

By Design Type |

|

||

|

By Position Type |

|

||

|

By Vehicle Type |

|

||

|

By Sales Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive Drive Shaft Market by Drive Shaft Type

4.1 Automotive Drive Shaft Market Snapshot and Growth Engine

4.2 Automotive Drive Shaft Market Overview

4.3 One-Piece Drive Shaft

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 One-Piece Drive Shaft: Geographic Segmentation Analysis

4.4 Two-Piece Drive Shaft

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Two-Piece Drive Shaft: Geographic Segmentation Analysis

4.5 Slip-in-Tube Drive Shaft

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Slip-in-Tube Drive Shaft: Geographic Segmentation Analysis

Chapter 5: Automotive Drive Shaft Market by Design Type

5.1 Automotive Drive Shaft Market Snapshot and Growth Engine

5.2 Automotive Drive Shaft Market Overview

5.3 Hollow Shaft

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Hollow Shaft: Geographic Segmentation Analysis

5.4 Solid Shaft

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Solid Shaft: Geographic Segmentation Analysis

Chapter 6: Automotive Drive Shaft Market by Position Type

6.1 Automotive Drive Shaft Market Snapshot and Growth Engine

6.2 Automotive Drive Shaft Market Overview

6.3 Rear Axle

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Rear Axle: Geographic Segmentation Analysis

6.4 Front Axle

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Front Axle: Geographic Segmentation Analysis

Chapter 7: Automotive Drive Shaft Market by Vehicle Type

7.1 Automotive Drive Shaft Market Snapshot and Growth Engine

7.2 Automotive Drive Shaft Market Overview

7.3 Passenger Vehicle

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Passenger Vehicle: Geographic Segmentation Analysis

7.4 Light Commercial Vehicle

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Light Commercial Vehicle: Geographic Segmentation Analysis

7.5 Heavy Commercial Vehicle

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Heavy Commercial Vehicle: Geographic Segmentation Analysis

Chapter 8: Automotive Drive Shaft Market by Sales Channel

8.1 Automotive Drive Shaft Market Snapshot and Growth Engine

8.2 Automotive Drive Shaft Market Overview

8.3 OEM

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 OEM: Geographic Segmentation Analysis

8.4 After

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 After: Geographic Segmentation Analysis

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Automotive Drive Shaft Market Share by Manufacturer (2023)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 GKN PLC (UK)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 ADVANCED COMPOSITE PRODUCTS & TECHNOLOGY INC. ACPT INC. (US)

9.4 AMERICAN AXLE & MANUFACTURING HOLDINGS INC. (US)

9.5 NEAPCO HOLDINGS LLC (US)

9.6 DANA HOLDING CORPORATION (US)

9.7 YAMADA MANUFACTURING CO. LTD. (JAPAN)

9.8 TRELLEBORG AB (SWEDEN)

9.9 NTN CORPORATION (JAPAN)

9.10 IFA ROTORION - HOLDING GMBH (GERMANY)

9.11 THE TIMKEN COMPANY (US)

9.12 OTHER ACTIVE PLAYERS

Chapter 10: Global Automotive Drive Shaft Market By Region

10.1 Overview

10.2. North America Automotive Drive Shaft Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By Drive Shaft Type

10.2.4.1 One-Piece Drive Shaft

10.2.4.2 Two-Piece Drive Shaft

10.2.4.3 Slip-in-Tube Drive Shaft

10.2.5 Historic and Forecasted Market Size By Design Type

10.2.5.1 Hollow Shaft

10.2.5.2 Solid Shaft

10.2.6 Historic and Forecasted Market Size By Position Type

10.2.6.1 Rear Axle

10.2.6.2 Front Axle

10.2.7 Historic and Forecasted Market Size By Vehicle Type

10.2.7.1 Passenger Vehicle

10.2.7.2 Light Commercial Vehicle

10.2.7.3 Heavy Commercial Vehicle

10.2.8 Historic and Forecasted Market Size By Sales Channel

10.2.8.1 OEM

10.2.8.2 After

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Automotive Drive Shaft Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By Drive Shaft Type

10.3.4.1 One-Piece Drive Shaft

10.3.4.2 Two-Piece Drive Shaft

10.3.4.3 Slip-in-Tube Drive Shaft

10.3.5 Historic and Forecasted Market Size By Design Type

10.3.5.1 Hollow Shaft

10.3.5.2 Solid Shaft

10.3.6 Historic and Forecasted Market Size By Position Type

10.3.6.1 Rear Axle

10.3.6.2 Front Axle

10.3.7 Historic and Forecasted Market Size By Vehicle Type

10.3.7.1 Passenger Vehicle

10.3.7.2 Light Commercial Vehicle

10.3.7.3 Heavy Commercial Vehicle

10.3.8 Historic and Forecasted Market Size By Sales Channel

10.3.8.1 OEM

10.3.8.2 After

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Automotive Drive Shaft Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By Drive Shaft Type

10.4.4.1 One-Piece Drive Shaft

10.4.4.2 Two-Piece Drive Shaft

10.4.4.3 Slip-in-Tube Drive Shaft

10.4.5 Historic and Forecasted Market Size By Design Type

10.4.5.1 Hollow Shaft

10.4.5.2 Solid Shaft

10.4.6 Historic and Forecasted Market Size By Position Type

10.4.6.1 Rear Axle

10.4.6.2 Front Axle

10.4.7 Historic and Forecasted Market Size By Vehicle Type

10.4.7.1 Passenger Vehicle

10.4.7.2 Light Commercial Vehicle

10.4.7.3 Heavy Commercial Vehicle

10.4.8 Historic and Forecasted Market Size By Sales Channel

10.4.8.1 OEM

10.4.8.2 After

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Automotive Drive Shaft Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By Drive Shaft Type

10.5.4.1 One-Piece Drive Shaft

10.5.4.2 Two-Piece Drive Shaft

10.5.4.3 Slip-in-Tube Drive Shaft

10.5.5 Historic and Forecasted Market Size By Design Type

10.5.5.1 Hollow Shaft

10.5.5.2 Solid Shaft

10.5.6 Historic and Forecasted Market Size By Position Type

10.5.6.1 Rear Axle

10.5.6.2 Front Axle

10.5.7 Historic and Forecasted Market Size By Vehicle Type

10.5.7.1 Passenger Vehicle

10.5.7.2 Light Commercial Vehicle

10.5.7.3 Heavy Commercial Vehicle

10.5.8 Historic and Forecasted Market Size By Sales Channel

10.5.8.1 OEM

10.5.8.2 After

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Automotive Drive Shaft Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By Drive Shaft Type

10.6.4.1 One-Piece Drive Shaft

10.6.4.2 Two-Piece Drive Shaft

10.6.4.3 Slip-in-Tube Drive Shaft

10.6.5 Historic and Forecasted Market Size By Design Type

10.6.5.1 Hollow Shaft

10.6.5.2 Solid Shaft

10.6.6 Historic and Forecasted Market Size By Position Type

10.6.6.1 Rear Axle

10.6.6.2 Front Axle

10.6.7 Historic and Forecasted Market Size By Vehicle Type

10.6.7.1 Passenger Vehicle

10.6.7.2 Light Commercial Vehicle

10.6.7.3 Heavy Commercial Vehicle

10.6.8 Historic and Forecasted Market Size By Sales Channel

10.6.8.1 OEM

10.6.8.2 After

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Automotive Drive Shaft Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By Drive Shaft Type

10.7.4.1 One-Piece Drive Shaft

10.7.4.2 Two-Piece Drive Shaft

10.7.4.3 Slip-in-Tube Drive Shaft

10.7.5 Historic and Forecasted Market Size By Design Type

10.7.5.1 Hollow Shaft

10.7.5.2 Solid Shaft

10.7.6 Historic and Forecasted Market Size By Position Type

10.7.6.1 Rear Axle

10.7.6.2 Front Axle

10.7.7 Historic and Forecasted Market Size By Vehicle Type

10.7.7.1 Passenger Vehicle

10.7.7.2 Light Commercial Vehicle

10.7.7.3 Heavy Commercial Vehicle

10.7.8 Historic and Forecasted Market Size By Sales Channel

10.7.8.1 OEM

10.7.8.2 After

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Automotive Drive Shaft Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.54 Billion |

|

Forecast Period 2024-32 CAGR: |

5.60% |

Market Size in 2032: |

USD 17.21 Billion |

|

Segments Covered: |

By Drive Shaft Type |

|

|

|

By Design Type |

|

||

|

By Position Type |

|

||

|

By Vehicle Type |

|

||

|

By Sales Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||