ATM Managed Services Market Synopsis:

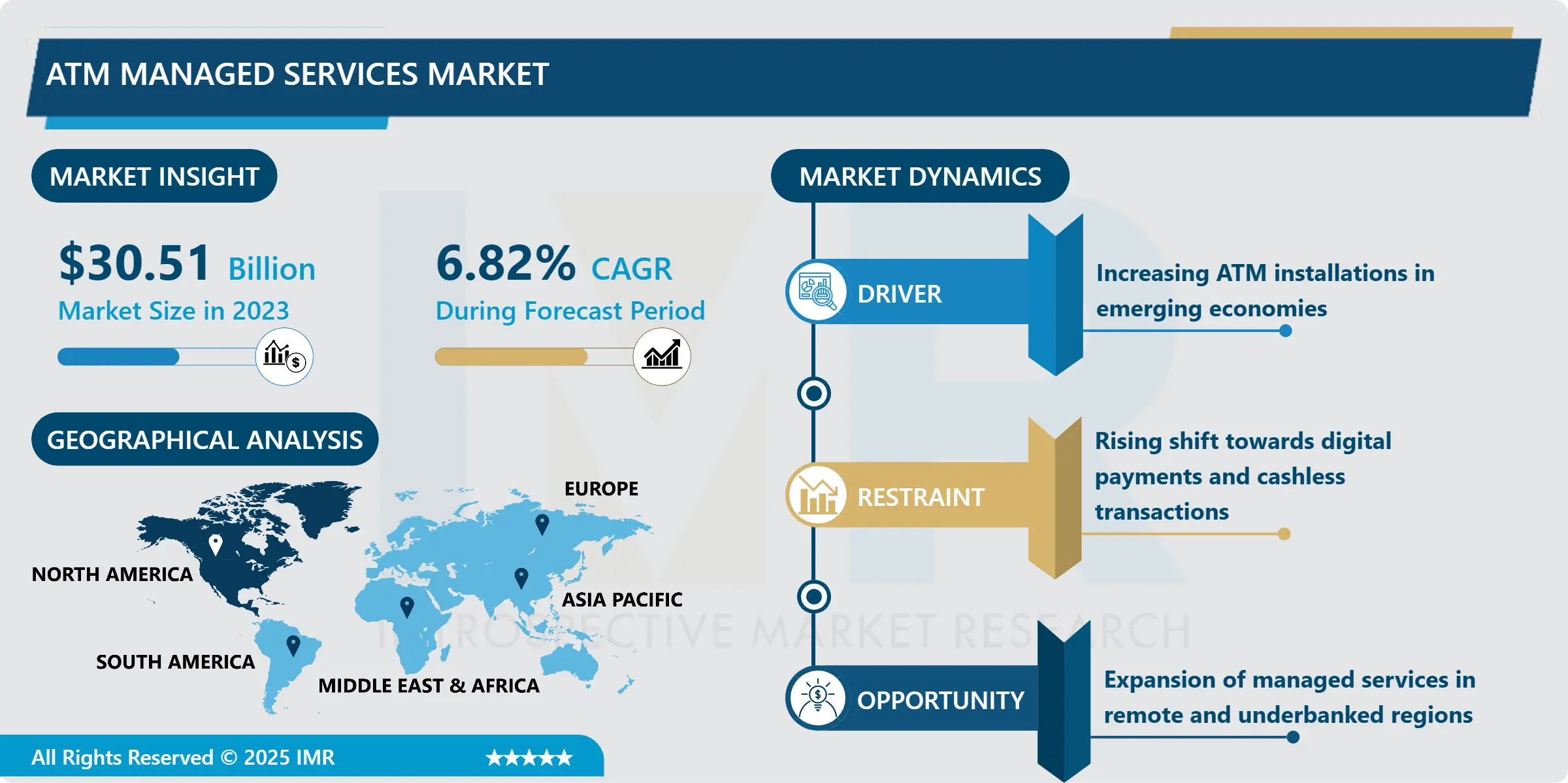

ATM Managed Services Market Size Was Valued at USD 30.51 Billion in 2023, and is Projected to Reach USD 55.25 Billion by 2032, Growing at a CAGR of 6.82% From 2024-2032.

ATM managed services market is focused on the outsourcing of various services meant to facilitate proper operation and bring maximum levels of effectiveness to the automatized teller machines (ATMs). They include cash, currency, transaction, ATM, software and hardware service, cash management, service, and security services. Outsourcing these services to companies specialized in it allows banks and other financial entities to keep performing their primary tasks, while guaranteeing customers a permanently available ATM without interruptions. This market is vital in improving operational performance, streamlining expenses and satisfying more clients on a desire for speedy and safe monetary dealings. As operations of banking continue to go online, the use of managed services in supporting ATM remains essential.

The market of ATM managed services has been showing repeated growth in the recent past and this is because more and more banks and financial institutes are now outsourcing important operational tasks. Given the continued rise of ATM as the major point of contact for cash withdrawals as well as other banking services, proper working of the terminals is crucial. A well-coordinated MSP essentially provides unique services that include cash logistics, more so in updating software and performing preventive maintenance to avoid cases of service interruption through solving all related issues. Furthermore, the growth in usage of higher level ATMs with multiple services is leading to a consistent good demand of value-added managed services.

This is also coupled with the trend towards outsourcing across regions, especially in the global market amongst other emerging issues. These regions are increasingly experiencing expansion of self-service solutions including ATMs to address under-banked populations, which compel demand for low-cost service delivery. Also, managed service providers use advanced technologies such as artificial intelligence, IoT, and predictive analytics to improve the ATM’s functionality and security, which would continue to drive the market. However, the sector has been experiencing the following hurdles including rise in the number of cashless society and digital transactions may affect the flow of atms in some areas.

ATM Managed Services Market Trend Analysis:

Integration of Advanced Security Solutions in ATM Managed Services

-

The integration of advanced security solutions is a key driver propelling growth in the ATM managed services market. As cyber threats and physical security risks escalate, banks and financial institutions are increasingly outsourcing ATM operations to managed service providers equipped with cutting-edge security technologies. These include real-time surveillance systems, biometric authentication, anti-skimming devices, end-to-end encryption, and AI-powered fraud detection tools.

- Such solutions not only protect customer data and assets but also ensure compliance with evolving regulatory standards. The rising need to safeguard ATMs against both digital and physical attacks has made robust security a top priority, prompting financial institutions to invest in managed services that offer 24/7 monitoring and rapid response capabilities. This heightened focus on security is expected to drive sustained demand for comprehensive, tech-driven ATM management solutions across the globe.

Rising Demand for Managed Services in Emerging Markets

-

Huge potential for ATM managed services from emerging economies. In some emerging markets, such as Asian-Pacific, Middle Eastern, and African, developments in financial inclusion as well as enhancing banking and access points to deploy ATMs. These markets mostly have a relatively high number of individuals without bank accounts and mainly use ATMs as the main point of financial services.

- Though MSPs have the opportunities to thrive and take advantage of this growth to deliver affordable solutions that can suit the above areas including remote geographic points and different currencies. Also, the agricultural value adding and other services sectors are experiencing innovations, through collaborations between the financial institutions in these areas and the service providers.

ATM Managed Services Market Segment Analysis:

ATM Managed Services Market is Segmented on the basis of ATM Type, Service Type, Location, and Region.

By ATM Type, Conventional ATM and Bank ATM segment is expected to dominate the market during the forecast period

-

The growing number of Traditional & Conventional ATMs along with Bank ATMs are expected to continue their dominance into the ATM managed services market throughout the forecast period. Bank.cards, the all–in–one essentials, enable services such as cash withdrawal, balance inquiry and mini statements and are familiar ATM types located in both urban and rural areas with unmatchable services. Capable of self-funding this segment, quick cash acquisition, efficient software implementation, and strong security demands managed service providers’ retention by this segment.

- Bank operated ATMs specifically the new multifunctional machines are also becoming popular because of the additional services it offers including checking depositing, making loan repayments or account transfers. These ATMs needs special type of maintenance and management services, so this open up a very good market for the service providers. The continued usage in developed as well as the emerging markets shows the significance of These products in the day’s advancement of this segment.

By Service Type, ATM Replenishment and Currency Management segment expected to held the largest share

-

The ATM replenishment and currency management segment is the largest segment of the cash logistics market and should continue to dominate the market in the forecast period. These services are very important to cover the continuity of the ATM and provide satisfaction to the customer. Whereas ATM replenishment refers to timely resupply of cash to ensure the ATM is running so that it does not run out of cash, currency management is an element of cash processing where the operational costs of the cash are significantly reduced through proper planning of the manner in which the cash is managed. Through such issues like forecasting, these processes are normally handled by managed service providers using different techniques which make the operation to be efficient.

- The enhancement of operating more complicated cash flow in the areas with high needs leads to the demand for professional currency management services. This segment also accrues from improvements in technology, including monitoring of service, and route organization, which enhance efficient delivery of the services at a lesser amount of investments. The consistent concentration on the optimization of cash deficit and the protection of transactions for specific companies will remain one of the primary determinatives of this segment.

ATM Managed Services Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

According to the research, in 2023 the Asia-Pacific region will remain the largest in the ATM managed services market and will account for about 37% of the global market. This dominance is due to high ATM density, the rising banking system and increased use of cash in countries like India, China and Indonesia.

- Very often, thanks to the government’s financial inclusion programs and the intense urbanization of rural areas, there is an increase in deposits and the number of ATMs, therefore, the need for space for managed services. Further, the consumption of superior technologies and the strategic alliances between banks and managed service providers are enhancing the market position of Asia-Pacific.

Active Key Players in the ATM Managed Services Market:

-

AGS Transact Technologies (India)

- ATM Solutions (South Africa)

- Brink's Inc. (USA)

- Cardtronics (USA)

- CMS Info Systems (India)

- Diebold Nixdorf (USA)

- Euronet Worldwide (USA)

- FIS Global (USA)

- Fujitsu (Japan)

- GRG Banking (China)

- Hitachi-Omron Terminal Solutions (Japan)

- KAL ATM Software (UK)

- NCR Corporation (USA)

- Prosegur Cash (Spain)

- Wincor Nixdorf (Germany), and Other Active Players

|

Global ATM Managed Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 30.51 Billion |

|

Forecast Period 2024-32 CAGR: |

6.82% |

Market Size in 2032: |

USD 55.25 Billion |

|

Segments Covered: |

By ATM Type |

|

|

|

By Service Type |

|

||

|

By Location |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: ATM Managed Services Market by ATM Type

4.1 ATM Managed Services Market Snapshot and Growth Engine

4.2 ATM Managed Services Market Overview

4.3 Conventional ATM and Bank ATM

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Conventional ATM and Bank ATM: Geographic Segmentation Analysis

4.4 White Label ATM

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 White Label ATM: Geographic Segmentation Analysis

4.5 Brown Label ATM

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Brown Label ATM: Geographic Segmentation Analysis

4.6 Cash Dispenser

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Cash Dispenser: Geographic Segmentation Analysis

4.7 Smart ATM

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Smart ATM: Geographic Segmentation Analysis

4.8 Others

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Others: Geographic Segmentation Analysis

Chapter 5: ATM Managed Services Market by Service Type

5.1 ATM Managed Services Market Snapshot and Growth Engine

5.2 ATM Managed Services Market Overview

5.3 ATM Replenishment and Currency Management

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 ATM Replenishment and Currency Management: Geographic Segmentation Analysis

5.4 Network Management

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Network Management: Geographic Segmentation Analysis

5.5 Security Management

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Security Management: Geographic Segmentation Analysis

5.6 Incident Management

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Incident Management: Geographic Segmentation Analysis

5.7 Others

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Others: Geographic Segmentation Analysis

Chapter 6: ATM Managed Services Market by Location

6.1 ATM Managed Services Market Snapshot and Growth Engine

6.2 ATM Managed Services Market Overview

6.3 Onsite ATMs

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Onsite ATMs: Geographic Segmentation Analysis

6.4 Offsite ATMs

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Offsite ATMs: Geographic Segmentation Analysis

6.5 Worksite ATMs

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Worksite ATMs: Geographic Segmentation Analysis

6.6 Mobile ATMs

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Mobile ATMs: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 ATM Managed Services Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AGS TRANSACT TECHNOLOGIES (INDIA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ATM SOLUTIONS (SOUTH AFRICA)

7.4 BRINK'S INC. (USA)

7.5 CARDTRONICS (USA)

7.6 CMS INFO SYSTEMS (INDIA)

7.7 DIEBOLD NIXDORF (USA)

7.8 EURONET WORLDWIDE (USA)

7.9 FIS GLOBAL (USA)

7.10 FUJITSU (JAPAN)

7.11 GRG BANKING (CHINA)

7.12 HITACHI-OMRON TERMINAL SOLUTIONS (JAPAN)

7.13 KAL ATM SOFTWARE (UK)

7.14 NCR CORPORATION (USA)

7.15 PROSEGUR CASH (SPAIN)

7.16 WINCOR NIXDORF (GERMANY)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global ATM Managed Services Market By Region

8.1 Overview

8.2. North America ATM Managed Services Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By ATM Type

8.2.4.1 Conventional ATM and Bank ATM

8.2.4.2 White Label ATM

8.2.4.3 Brown Label ATM

8.2.4.4 Cash Dispenser

8.2.4.5 Smart ATM

8.2.4.6 Others

8.2.5 Historic and Forecasted Market Size By Service Type

8.2.5.1 ATM Replenishment and Currency Management

8.2.5.2 Network Management

8.2.5.3 Security Management

8.2.5.4 Incident Management

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size By Location

8.2.6.1 Onsite ATMs

8.2.6.2 Offsite ATMs

8.2.6.3 Worksite ATMs

8.2.6.4 Mobile ATMs

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe ATM Managed Services Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By ATM Type

8.3.4.1 Conventional ATM and Bank ATM

8.3.4.2 White Label ATM

8.3.4.3 Brown Label ATM

8.3.4.4 Cash Dispenser

8.3.4.5 Smart ATM

8.3.4.6 Others

8.3.5 Historic and Forecasted Market Size By Service Type

8.3.5.1 ATM Replenishment and Currency Management

8.3.5.2 Network Management

8.3.5.3 Security Management

8.3.5.4 Incident Management

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size By Location

8.3.6.1 Onsite ATMs

8.3.6.2 Offsite ATMs

8.3.6.3 Worksite ATMs

8.3.6.4 Mobile ATMs

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe ATM Managed Services Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By ATM Type

8.4.4.1 Conventional ATM and Bank ATM

8.4.4.2 White Label ATM

8.4.4.3 Brown Label ATM

8.4.4.4 Cash Dispenser

8.4.4.5 Smart ATM

8.4.4.6 Others

8.4.5 Historic and Forecasted Market Size By Service Type

8.4.5.1 ATM Replenishment and Currency Management

8.4.5.2 Network Management

8.4.5.3 Security Management

8.4.5.4 Incident Management

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size By Location

8.4.6.1 Onsite ATMs

8.4.6.2 Offsite ATMs

8.4.6.3 Worksite ATMs

8.4.6.4 Mobile ATMs

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific ATM Managed Services Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By ATM Type

8.5.4.1 Conventional ATM and Bank ATM

8.5.4.2 White Label ATM

8.5.4.3 Brown Label ATM

8.5.4.4 Cash Dispenser

8.5.4.5 Smart ATM

8.5.4.6 Others

8.5.5 Historic and Forecasted Market Size By Service Type

8.5.5.1 ATM Replenishment and Currency Management

8.5.5.2 Network Management

8.5.5.3 Security Management

8.5.5.4 Incident Management

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size By Location

8.5.6.1 Onsite ATMs

8.5.6.2 Offsite ATMs

8.5.6.3 Worksite ATMs

8.5.6.4 Mobile ATMs

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa ATM Managed Services Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By ATM Type

8.6.4.1 Conventional ATM and Bank ATM

8.6.4.2 White Label ATM

8.6.4.3 Brown Label ATM

8.6.4.4 Cash Dispenser

8.6.4.5 Smart ATM

8.6.4.6 Others

8.6.5 Historic and Forecasted Market Size By Service Type

8.6.5.1 ATM Replenishment and Currency Management

8.6.5.2 Network Management

8.6.5.3 Security Management

8.6.5.4 Incident Management

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size By Location

8.6.6.1 Onsite ATMs

8.6.6.2 Offsite ATMs

8.6.6.3 Worksite ATMs

8.6.6.4 Mobile ATMs

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America ATM Managed Services Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By ATM Type

8.7.4.1 Conventional ATM and Bank ATM

8.7.4.2 White Label ATM

8.7.4.3 Brown Label ATM

8.7.4.4 Cash Dispenser

8.7.4.5 Smart ATM

8.7.4.6 Others

8.7.5 Historic and Forecasted Market Size By Service Type

8.7.5.1 ATM Replenishment and Currency Management

8.7.5.2 Network Management

8.7.5.3 Security Management

8.7.5.4 Incident Management

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size By Location

8.7.6.1 Onsite ATMs

8.7.6.2 Offsite ATMs

8.7.6.3 Worksite ATMs

8.7.6.4 Mobile ATMs

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global ATM Managed Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 30.51 Billion |

|

Forecast Period 2024-32 CAGR: |

6.82% |

Market Size in 2032: |

USD 55.25 Billion |

|

Segments Covered: |

By ATM Type |

|

|

|

By Service Type |

|

||

|

By Location |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||