Aromatherapy Market Synopsis

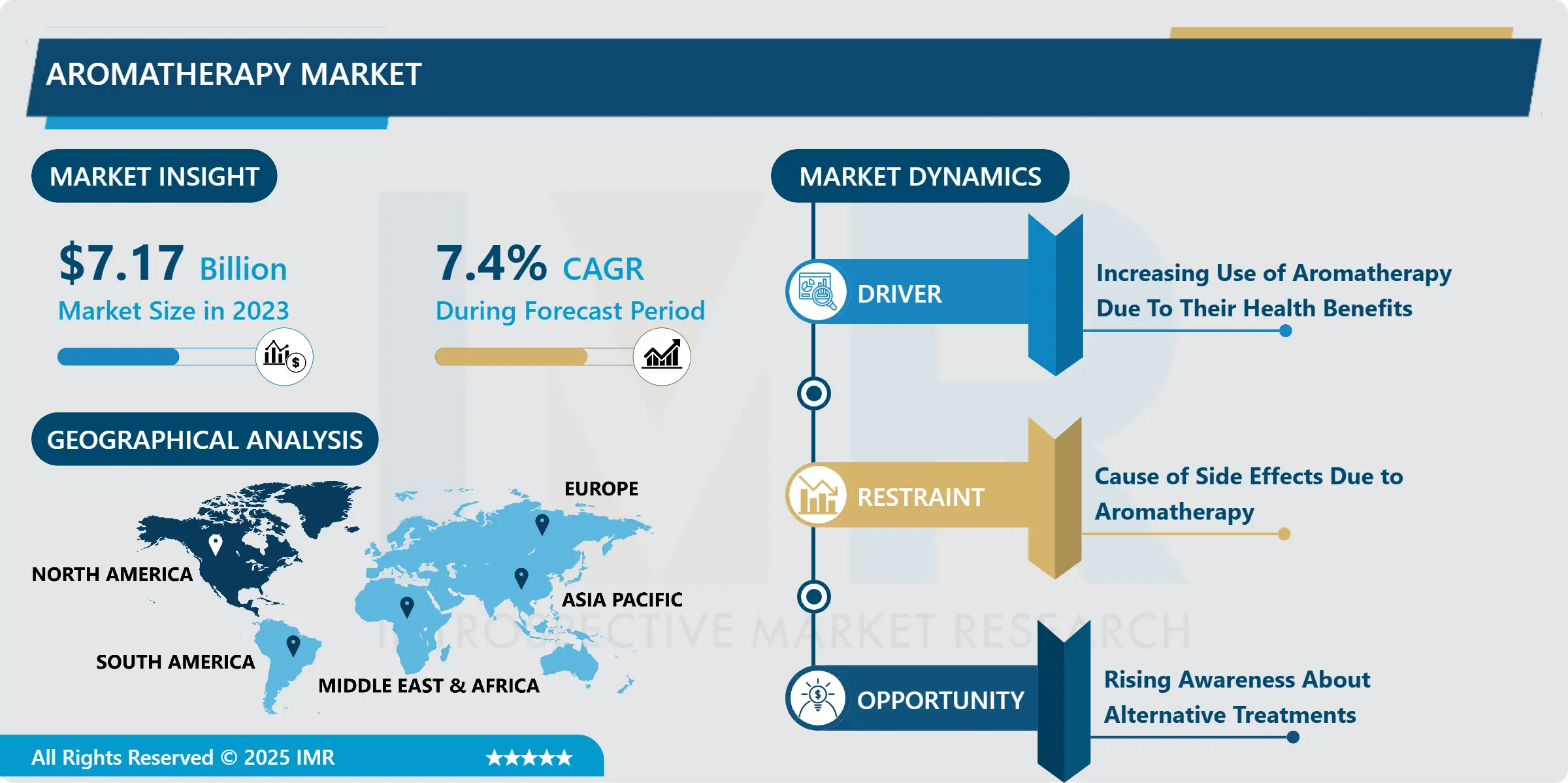

The global market for Aromatherapy estimated at USD 7.17 Billion in the year 2023, is anticipated to reach a revised size of USD 13.63 Billion by 2032, growing at a CAGR of 7.4% over the period 2024-2032.

Aromatherapy is the practice of using essential oils for therapeutic benefit. Aromatherapy has been used for centuries. When inhaled, the scent molecules in essential oils travel from the olfactory nerves directly to the brain and especially impact the amygdala, the emotional center of the brain.

Experts think aromatherapy activates areas in your nose called smell receptors, which send messages through your nervous system to your brain. The oils may activate certain areas of your brain, like your limbic system, which plays a role in your emotions. They could also have an impact on your hypothalamus, which may respond to the oil by creating feel-good brain chemicals like serotonin.

The use of essential oils for therapeutic, spiritual, hygienic, and ritualistic purposes goes back to ancient civilizations including the Indians, Chinese, Egyptians, Greeks, and Romans who used them in cosmetics, perfumes, and drugs. Oils were used for aesthetic pleasure and in the beauty industry. They were a luxury item and a means of payment.

Aromatherapy is generally safe. Essential oils can cause side effects, though. Some can irritate your eyes, skin, or mucous membranes in your nose. Aroma therapists, people who specialize in the practice of aromatherapy, utilize blends of supposedly therapeutic essential oils that can be used as a topical application, massage, inhalation, or water immersion

The Aromatherapy Market Trend Analysis

Increasing Use of Aromatherapy Due To Their Health Benefits

- Aromatherapy is used in a wide range of settings, from health spas to hospitals, to treat a variety of conditions. In general, it seems to relieve pain, improve mood, and promote a sense of relaxation. Several essential oils, including lavender, rose, orange, bergamot, lemon, sandalwood, and others, have been shown to relieve anxiety, stress, and depression.

- Several clinical studies suggest that when essential oils (particularly rose, lavender, and frankincense) were used by qualified midwives, pregnant women felt less anxiety and fear, had a stronger sense of well-being, and had less need for pain medications during delivery.? Many women also report that peppermint oil relieves nausea and vomiting during labor.

- Preliminary studies suggest aromatherapy may be an effective approach for post-operative nausea. Other studies suggest aromatherapy in conjunction with massage can help reduce symptoms of colic in infants.?

Essential oils are oils that contain the “essence” of a plant, such as its aroma or flavor. The global demand for essential oils increased between 2018 and 2021; from around 226.9 kilotons to 290.6 kilotons.

Rising Awareness About Alternative Treatments

- 'Aromatherapy' is one of the most actively growing forms of alternative medicine combining massage with counseling and a nice odor. Most clients suffer from some kind of stress-related disorder and aromatherapy encourages the healing process largely through relaxation and the relief of stress.

- Hospitals, hospices, and homes for the elderly and those who are physically or mentally challenged all struggle with stress daily. Nurses who want to be near their patients and doctors who can refer patients with stress-related disorders who don't respond to conventional medications both welcome aromatherapy.

- Studies have shown that essential oils have an effect on brainwaves and can also alter behavior. Most of the effects of the oils may be probably transmitted through the brain via the olfactory system. Used professionally and safely, aromatherapy can be of great benefit as an adjunct to conventional medicine or used simply as an alternative.

- The actual mode of action of essential oils in vivo is still far from known, although it is strong in vitro evidence that essential oils can act as an antimicrobial or antioxidant agent or have a pharmacological effect on various tissues.

Segmentation Analysis of The Aromatherapy Market

Aromatherapy market segments cover the Type, Application, Mode Of Delivery, Distribution Channel, and End-Users. By Application, the Relaxation segment is Anticipated to Dominate the Market Over the Forecast period.

- All such products have a calming effect that helps maintain mental equilibrium. People choose these therapies because of the pervasive trend of natural remedies, which is in line with the rising concerns about managing their stress.

- Lavender is one of the most popular essential oils for beginners and aromatherapy experts alike. As one of the several essential oils with anxiolytic, or anti-anxiety, properties, lavender can create an overall calming effect.

- In a 2013 study, aromatherapy using a 3 percent lavender oil spray on clothing was shown to reduce workplace stress. Lavender emits a floral, aromatic scent and has many uses. You can add a few drops to a diffuser, apply it directly to your skin, or combine it with other products or oils.

Regional Analysis of The Aromatherapy Market

North America is Expected to Dominate the Market Over the Forecast Period.

- In the United States, it is estimated that 62% of adults have used some form of complementary or alternative therapy in the last 12?months, although adult use specifically of essential oils or aromatherapy is unknown. A recent Swiss study estimated that 10.7% of patients with chronic low back pain used aromatherapy and rated it a 4.2 out of a 10-point scale for usefulness.

- In this study of US clinicians interested in integrative medicine, nearly all clinicians used integrative therapies for themselves and their families (92.6%) and recommended them to patients (96.8%). However, only 61% personally used aromatherapy for themselves or their families, and only 11.5% had any kind of clinician-oriented education on essential oils

- Due to rising levels of disposable income, rising consumer demand for natural products, rising rates of lifestyle diseases, and rising rates of skin issues. Furthermore, it is anticipated that the trend will be further supported by the rise in R&D initiatives and the prevalence of chronic illnesses, Aromatherapy market is growing in North America

- Due to its established healthcare system, a growing understanding of the advantages of complementary therapies, and high healthcare spending in developed economies like the U.S. and Canada, North America dominates the global aromatherapy market.

Covid-19 Impact Analysis on Aromatherapy Market

Due to the COVID-19 pandemic, the market for essential oils is predicted to grow more rapidly globally. Increased consumer interest in using aromatherapy to protect their mental health and combat pandemic situations is what led to this growth. Patients are given jasmine and sandalwood essential oils to help them deal with stress, sadness, and depression. Since the main symptoms of COVID-19 are cough, cold, and fever, using aromatherapy to treat these conditions is anticipated to have a positive effect on the mark. Besides that negatively impacted by COVID-19, this market. To contain the COVID-19 pandemic outbreak, the government imposed lockdown and social segregation restrictions, which caused several manufacturing operations to cease operations, supply chain disruptions, stunted business growth, technology event cancellations, halted new developments, and negatively impacted overall production and sales, restricting the industry's growth.

Top Key Players Covered in The Aromatherapy Market

- Doterra(U.S.)

- Young Living Essential Oils (U.S.)

- Isagenix Worldwide Inc. (U.S.)

- Eden Gardens (India)

- Florihana (France)

- Cargill, Incorporated (U.S.)

- Sensient Technologies Corporation (U.S.)

- Mountain Rose Herbs (U.S.)

- Plant Therapy Essential Oils (U.S.)

- Rocky Mountain Oils LLC. (U.S.)

- Biolandes (France)

- Stadler Form (Switzerland)

- Hubmar (U.S)

- Symrise (Germany)

Key Industry Developments in the Aromatherapy Market

- In January 2024, P&G introduced Romance & Desire, designed to kindle the flames of connection and set an intimate ambiance throughout any space.

- In November 2021, Rose Herbs announced the opening of the new Mountain Rose Aroma Bar. With two paramount locations, through superior, ethically sourced essential oils and customized aromatherapy products, this first-of-its-kind essential oil market aims to stimulate the senses.

- In December 2020, Young Living announced that its Young Living Essential Oils Aromatic Plant Herbarium (YLAH) has been officially registered with the New York Botanical Garden. The YLAH is a crucial resource for the storage and study of botanical specimens, particularly those from aromatic plants.

- In October 2020, Backyard poultry owners want wholesome, natural feeds that support their birds' health, preserve the quality of their eggs, and keep their coops clean. By incorporating essential oils into its Nutrena® Naturewise® poultry feeds, Cargill is meeting this demand. The natural essential oils improve egg weight, size, and production while also improving palatability and providing a fresh aroma straight from the bag.

|

Global Aromatherapy Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.17 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.4% |

Market Size in 2032: |

USD 13.63 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Mode of Delivery |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Aromatherapy Market by Product Type (2018-2032)

4.1 Aromatherapy Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Consumables

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Equipment

Chapter 5: Aromatherapy Market by Mode of Delivery (2018-2032)

5.1 Aromatherapy Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Topical Application

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Direct Inhalation

5.5 Aerial Diffusion

Chapter 6: Aromatherapy Market by Application (2018-2032)

6.1 Aromatherapy Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Relaxation

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Pain Management

6.5 Skin and Hair Care

6.6 Others

Chapter 7: Aromatherapy Market by Distribution Channel (2018-2032)

7.1 Aromatherapy Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Direct Distribution

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 E-commerce

7.5 Supermarkets and Hypermarkets

7.6 Specialty Stores

7.7 Others

Chapter 8: Aromatherapy Market by End Users (2018-2032)

8.1 Aromatherapy Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Hospitals and Clinics

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Yoga and Meditation Centers

8.5 Spa and Wellness Centers

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Aromatherapy Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 ILLINOIS TOOL WORKS INC. (U.S.)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 AERO SPECIALTIES INC. (U.S.)

9.4 ITW GSE (U.S.)

9.5 TEXTRON GSE (U.S.)

9.6 JBT CORPORATION (U.S.)

9.7 AERO SPECIALTIES INC. (U.S.)

9.8 GATE GSE (U.S.)

9.9 OSHKOSH CORPORATION (U.S.)

9.10 CURTIS INSTRUMENTS INC. (U.S.)

9.11 TRONAIR (U.S.)

9.12 TLD (CANADA)

9.13 MALLAGHAN (UK)

9.14 AND

Chapter 10: Global Aromatherapy Market By Region

10.1 Overview

10.2. North America Aromatherapy Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Product Type

10.2.4.1 Consumables

10.2.4.2 Equipment

10.2.5 Historic and Forecasted Market Size by Mode of Delivery

10.2.5.1 Topical Application

10.2.5.2 Direct Inhalation

10.2.5.3 Aerial Diffusion

10.2.6 Historic and Forecasted Market Size by Application

10.2.6.1 Relaxation

10.2.6.2 Pain Management

10.2.6.3 Skin and Hair Care

10.2.6.4 Others

10.2.7 Historic and Forecasted Market Size by Distribution Channel

10.2.7.1 Direct Distribution

10.2.7.2 E-commerce

10.2.7.3 Supermarkets and Hypermarkets

10.2.7.4 Specialty Stores

10.2.7.5 Others

10.2.8 Historic and Forecasted Market Size by End Users

10.2.8.1 Hospitals and Clinics

10.2.8.2 Yoga and Meditation Centers

10.2.8.3 Spa and Wellness Centers

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Aromatherapy Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Product Type

10.3.4.1 Consumables

10.3.4.2 Equipment

10.3.5 Historic and Forecasted Market Size by Mode of Delivery

10.3.5.1 Topical Application

10.3.5.2 Direct Inhalation

10.3.5.3 Aerial Diffusion

10.3.6 Historic and Forecasted Market Size by Application

10.3.6.1 Relaxation

10.3.6.2 Pain Management

10.3.6.3 Skin and Hair Care

10.3.6.4 Others

10.3.7 Historic and Forecasted Market Size by Distribution Channel

10.3.7.1 Direct Distribution

10.3.7.2 E-commerce

10.3.7.3 Supermarkets and Hypermarkets

10.3.7.4 Specialty Stores

10.3.7.5 Others

10.3.8 Historic and Forecasted Market Size by End Users

10.3.8.1 Hospitals and Clinics

10.3.8.2 Yoga and Meditation Centers

10.3.8.3 Spa and Wellness Centers

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Aromatherapy Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Product Type

10.4.4.1 Consumables

10.4.4.2 Equipment

10.4.5 Historic and Forecasted Market Size by Mode of Delivery

10.4.5.1 Topical Application

10.4.5.2 Direct Inhalation

10.4.5.3 Aerial Diffusion

10.4.6 Historic and Forecasted Market Size by Application

10.4.6.1 Relaxation

10.4.6.2 Pain Management

10.4.6.3 Skin and Hair Care

10.4.6.4 Others

10.4.7 Historic and Forecasted Market Size by Distribution Channel

10.4.7.1 Direct Distribution

10.4.7.2 E-commerce

10.4.7.3 Supermarkets and Hypermarkets

10.4.7.4 Specialty Stores

10.4.7.5 Others

10.4.8 Historic and Forecasted Market Size by End Users

10.4.8.1 Hospitals and Clinics

10.4.8.2 Yoga and Meditation Centers

10.4.8.3 Spa and Wellness Centers

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Aromatherapy Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Product Type

10.5.4.1 Consumables

10.5.4.2 Equipment

10.5.5 Historic and Forecasted Market Size by Mode of Delivery

10.5.5.1 Topical Application

10.5.5.2 Direct Inhalation

10.5.5.3 Aerial Diffusion

10.5.6 Historic and Forecasted Market Size by Application

10.5.6.1 Relaxation

10.5.6.2 Pain Management

10.5.6.3 Skin and Hair Care

10.5.6.4 Others

10.5.7 Historic and Forecasted Market Size by Distribution Channel

10.5.7.1 Direct Distribution

10.5.7.2 E-commerce

10.5.7.3 Supermarkets and Hypermarkets

10.5.7.4 Specialty Stores

10.5.7.5 Others

10.5.8 Historic and Forecasted Market Size by End Users

10.5.8.1 Hospitals and Clinics

10.5.8.2 Yoga and Meditation Centers

10.5.8.3 Spa and Wellness Centers

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Aromatherapy Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Product Type

10.6.4.1 Consumables

10.6.4.2 Equipment

10.6.5 Historic and Forecasted Market Size by Mode of Delivery

10.6.5.1 Topical Application

10.6.5.2 Direct Inhalation

10.6.5.3 Aerial Diffusion

10.6.6 Historic and Forecasted Market Size by Application

10.6.6.1 Relaxation

10.6.6.2 Pain Management

10.6.6.3 Skin and Hair Care

10.6.6.4 Others

10.6.7 Historic and Forecasted Market Size by Distribution Channel

10.6.7.1 Direct Distribution

10.6.7.2 E-commerce

10.6.7.3 Supermarkets and Hypermarkets

10.6.7.4 Specialty Stores

10.6.7.5 Others

10.6.8 Historic and Forecasted Market Size by End Users

10.6.8.1 Hospitals and Clinics

10.6.8.2 Yoga and Meditation Centers

10.6.8.3 Spa and Wellness Centers

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Aromatherapy Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Product Type

10.7.4.1 Consumables

10.7.4.2 Equipment

10.7.5 Historic and Forecasted Market Size by Mode of Delivery

10.7.5.1 Topical Application

10.7.5.2 Direct Inhalation

10.7.5.3 Aerial Diffusion

10.7.6 Historic and Forecasted Market Size by Application

10.7.6.1 Relaxation

10.7.6.2 Pain Management

10.7.6.3 Skin and Hair Care

10.7.6.4 Others

10.7.7 Historic and Forecasted Market Size by Distribution Channel

10.7.7.1 Direct Distribution

10.7.7.2 E-commerce

10.7.7.3 Supermarkets and Hypermarkets

10.7.7.4 Specialty Stores

10.7.7.5 Others

10.7.8 Historic and Forecasted Market Size by End Users

10.7.8.1 Hospitals and Clinics

10.7.8.2 Yoga and Meditation Centers

10.7.8.3 Spa and Wellness Centers

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Aromatherapy Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.17 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.4% |

Market Size in 2032: |

USD 13.63 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Mode of Delivery |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||