Antioxidant Market Synopsis:

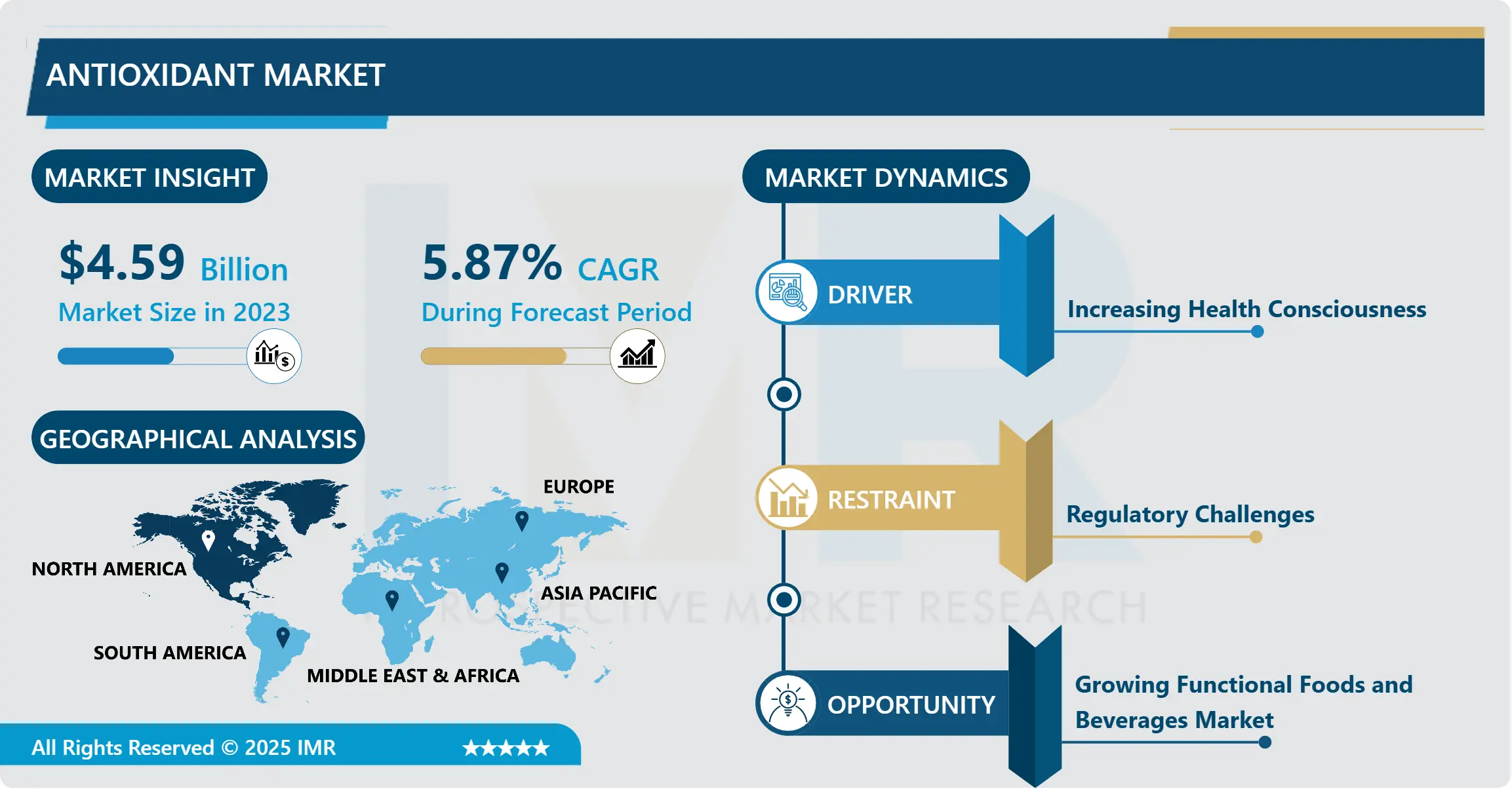

Antioxidant Market Size Was Valued at USD 4.59 Billion in 2023, and is Projected to Reach USD 7.64 Billion by 2032, Growing at a CAGR of 5.87% From 2024-2032.

The antioxidant industry is defined as a region within the food & beverages industry the cosmetics, pharmaceuticals and personal care market which deals with the usage of antioxidant products. Free radicals are responsible for causing damage to the body cells and creating oxidative stress and these substances being vitamins, minerals, enzymes, and plant-based compounds, help to eliminate free radicals from the body. Due to the consumer trend that is demanding natural and functional foods in every facet of life the need for antioxidants cannot be overemphasized as they serve as a health enhancer, shelf life and product quality enhancer. The antioxidants subdivided into synthetic and natural, the latter being demanded by the market due to the increasing trend toward clean label products.

There has been dynamic increase in the antioxidant market in the last few years due to the increase in awareness towards healthpholics among people. The world’s population is aging and develops chronic diseases like cardiovascular diseases, diabetes, and cancer making consumers look for preventive solutions and boosting the consumption of antioxidants. This has extended the market through an increase in the consumption of functional foods and beverages that are packed with antioxidants. Secondly, the growth in oxidation demand in the cosmetic and personal care sector has boosted market growth, because antioxidants are believed to maintain skin health and delay the aging process.

Geographically, the market is slowly coming into focus in developed as well as developing countries. North America has become the largest consummart and wellness market for antioxidants, especially USA. The same can be said to Europe since there’s growing health consciousness among consumers as well as pressure for natural and organic products. However, Asia-Pacific is also expected to show high growth in the antioxidant market due to higher middle-income class population, increasing disposable income, and growing consciousness among people of the benefits of antioxidants in China, India and Japan.

Antioxidant Market Trend Analysis:

The Shift Toward Natural Antioxidants

- One interesting trend that has been observed in the antioxidant market is the replace the synthetic ones with natural ones, as the end customers demand clean label products. With a focus on leading healthier lives, the global market is shifting its buying preferences towards food and beverages and personal care products which are not likely to contain any additives or preservatives. Cooperation, 2017 states that the global demand for natural materials which includes plant based and organic non-GMO based material is increasing the pressure on the manufacturers to tap into the antioxidant from fruits vegetables herbs and spices. These natural antioxidants like polyphenols, carotenoids, flavonoids are also on the rise due to several perceived health benefits out of its use and to factor the increase in clean and sustainable labelling.

- It also brings change due to the recent emerging negative effects related to the side effect of synthetic antioxidants, which has led to questions on the safety and efficiency of the substance. Customers are developing awareness on the danger that comes with synthetic compounds; and therefore, they are switching to natural products that are perceived to have more benefits. Furthermore, it was suggested that, unlike synthetic antioxidants, natural antioxidants not only act by means of free radical scavenging, but also provide some other health effects, for instance, anti-inflammatory, anti-aging, and skin rejuvenating effects. Some of these added benefits that make natural antioxidants more appealing are suitability in functional foods and intermediate in cosmetics, hence the increased uptake in the market.

Innovation in the Functional Foods and Beverages

- Another significant trend contributing to the antioxidant market has been even more apparent – the increasing client base is looking for functional nutritional products. While earlier consumers are satisfied with their food containing nutritional value, now customers want that extra plus point like boosting immunity, better digestion or for any specific skin ailment. With oxidation stresses and inflammation being such main characteristics, then antioxidants are at the core of these products. To meet this need, more manufacturers are enhancing functional products such as juice, smoothies, and teas with natural antioxidants to meet the needs of its audience that seek more functional products. This trend is even supported by the growing aspect of veganism which by default corresponds to the trend of getting antioxidant from plant sourced foods.

- The growth of veganism, and plant-based products has created a broader range of new applications of plant-derived antioxidants. These antioxidants which are found in foods of plant origin including fruits, vegetables, and herbs are being used in products to capture the market for natural sources organic food supplements. By persistently shifting their preferences toward healthy and sustainable products, consumers provide companies with a competitive edge when they launch antioxidant-packed functional food and drinks. Thus by choosing a path of development to the health and wellness market, these companies can become leaders within a fast growing segment providing consumers with higher added value products that are being demanded in the global economy.

Antioxidant Market Segment Analysis:

Antioxidant Market is Segmented on the basis of Type, Application, Distribution Channel, and Region.

By Type, Synthetic antioxidants segment is expected to dominate the market during the forecast period

- The antioxidant market is broadly divided into two types: organic and inorganic, and the natural and synthetic antioxidants. Synthetic antioxidants are human-made chemicals that help retard oxidation in foods, beverages, cosmetics and other products. These antioxidants include butylated hydroxy anisole (BHA) and butylated hydroxytoluene (BHT) that are affordable and which are used in processed foods, preservatives and many industrial uses. Although there are severe issues with these synthetic antioxidants controversies arise relating to the safety of their use, in as much as people are becoming more conscious in their demand for naturally occurring antioxidants.

- Natural antioxidants are obtained from natural products like fruits and vegetables, herbs, and spices. These are things such as Vitamin C, Vitamin E, polyphenol, flavonoid and carotenoids among others. Since consumers are increasingly willing to purchase organic, GMO-free food and personal care products, the need for natural antioxidants is growing rapidly. People associate natural antioxidants with being healthier, and better in some other ways such as having additional uses like fighting inflammation or the aging process and boosting the immune system. These changes are ushering a new shift in the market where manufacturers are looking at plant based and sustainable source to feed the demand of the natural health food.

By Application, Food & Beverages segment expected to held the largest share

- The food and beverages sector is by far one of the biggest consumers of antioxidants due to the need to prevent oxidation and extend shelf life. Food supplements such as packaged foods and fluids, snacks, dairy products, and oils use antioxidants for preservation, and for sustaining the food’s nutritional value. Furthermore, antioxidants are gradually included in functional foods and beverages enhancing their health-promoting properties including boost of immune system, regulation of skin condition and other aspects of human healthy condition. As consumers switch towards clean label products, natural antioxidants obtained from fruits, vegetables, and spices are preferred more in this segment.

- Antioxidants are also widely used in the sectors of pharmaceuticals and nutraceuticals to be added into supplements, vitamins or other health boosting products to help the body fight off any forms of oxidative stress or inflammation. In cosmetics and personal care, antioxidants are applied in formulations to avert skin damage from the environment, retard the aging process, and enhance skin health making it a useful substance in skincare products. The animal feeds use antioxidants to inhibit the oxidation of fats and enhance the nutritional value in animal feeds, especially among livestock and poultry products . In the same way, it is being used in other industrial sectors including the textile and the plastic industries for protection against deteriorating and for increasing the life span of products. These various applications play a role in the antioxidant market by expanding it in higher sectors.

Antioxidant Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The overall market of antioxidants is still predicted to be led by North America until 2023, with the overall market share of about 40-45%. Much of this is owed to the fact that consumers all around the world especially in the United States are more and more aware of the benefits of antioxidants in their bodies since they reduce cases of illnesses or diseases. This is further backed up by the rising trends identified in North America on functional foods, health supplements, and naturals used in foods, beverages, and personal care products industries. This is also a region of a strong health Jungle / wellness trend coupled with the increasing consumption of processed and convenience foods that need antioxidants to forestall spoilage and add shelf-life.

- Besides consumer demand, North America also enjoys manufacturer bases and much investment in research and development of antioxidants and their applications. Europe ranks second in consumption, influenced by similar health trends and increasing customer need for natural and clean-label products. At the same time, the Asia-Pacific region, where a large part of the population is becoming middle income and keep on raising their disposable income in future, is predicted to have the fastest market growth in the future. Since consumers are becoming more knowledgeable about the demand for antioxidant consumption in their countries such as China, India and japan this market is most likely to grow greatly thus providing a good chance to grow.

Active Key Players in the Antioxidant Market:

- Archer Daniels Midland Company (USA)

- BASF SE (Germany)

- Bayer AG (Germany)

- Chroma Dex Inc. (USA)

- DSM Nutritional Products (Switzerland)

- DuPont de Nemours, Inc. (USA)

- Evonik Industries AG (Germany)

- Food chem International Corporation (China)

- Guangzhou MINGTAI Technology Co. Ltd. (China)

- Kemin Industries (USA)

- Konica Minolta, Inc. (Japan)

- Naturex (France)

- Nutraceutical International Corporation (USA)

- Sabinsa Corporation (USA)

- Syngenta AG (Switzerland), and Other Active Players

|

Antioxidant Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.59 Billion |

|

Forecast Period 2024-32 CAGR: |

5.87% |

Market Size in 2032: |

USD 7.64 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Antioxidant Market by Type

4.1 Antioxidant Market Snapshot and Growth Engine

4.2 Antioxidant Market Overview

4.3 Synthetic Antioxidants

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Synthetic Antioxidants: Geographic Segmentation Analysis

4.4 Natural Antioxidants

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Natural Antioxidants: Geographic Segmentation Analysis

Chapter 5: Antioxidant Market by Application

5.1 Antioxidant Market Snapshot and Growth Engine

5.2 Antioxidant Market Overview

5.3 Food & Beverages

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Food & Beverages: Geographic Segmentation Analysis

5.4 Pharmaceuticals & Nutraceuticals

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Pharmaceuticals & Nutraceuticals: Geographic Segmentation Analysis

5.5 Cosmetics & Personal Care

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Cosmetics & Personal Care: Geographic Segmentation Analysis

5.6 Animal Feed

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Animal Feed: Geographic Segmentation Analysis

5.7 Others (e.g.

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Others (e.g.: Geographic Segmentation Analysis

5.8 textile

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 textile: Geographic Segmentation Analysis

5.9 plastics)

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 plastics): Geographic Segmentation Analysis

Chapter 6: Antioxidant Market by Distribution channel

6.1 Antioxidant Market Snapshot and Growth Engine

6.2 Antioxidant Market Overview

6.3 Direct Sales

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Direct Sales: Geographic Segmentation Analysis

6.4 Indirect Sales (Retail

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Indirect Sales (Retail: Geographic Segmentation Analysis

6.5 Online)

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Online): Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Antioxidant Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ARCHER DANIELS MIDLAND COMPANY (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BASF SE (GERMANY)

7.4 BAYER AG (GERMANY)

7.5 CHROMA DEX INC. (USA)

7.6 OTHER ACTIVE PLAYERS

Chapter 8: Global Antioxidant Market By Region

8.1 Overview

8.2. North America Antioxidant Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Synthetic Antioxidants

8.2.4.2 Natural Antioxidants

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Food & Beverages

8.2.5.2 Pharmaceuticals & Nutraceuticals

8.2.5.3 Cosmetics & Personal Care

8.2.5.4 Animal Feed

8.2.5.5 Others (e.g.

8.2.5.6 textile

8.2.5.7 plastics)

8.2.6 Historic and Forecasted Market Size By Distribution channel

8.2.6.1 Direct Sales

8.2.6.2 Indirect Sales (Retail

8.2.6.3 Online)

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Antioxidant Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Synthetic Antioxidants

8.3.4.2 Natural Antioxidants

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Food & Beverages

8.3.5.2 Pharmaceuticals & Nutraceuticals

8.3.5.3 Cosmetics & Personal Care

8.3.5.4 Animal Feed

8.3.5.5 Others (e.g.

8.3.5.6 textile

8.3.5.7 plastics)

8.3.6 Historic and Forecasted Market Size By Distribution channel

8.3.6.1 Direct Sales

8.3.6.2 Indirect Sales (Retail

8.3.6.3 Online)

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Antioxidant Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Synthetic Antioxidants

8.4.4.2 Natural Antioxidants

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Food & Beverages

8.4.5.2 Pharmaceuticals & Nutraceuticals

8.4.5.3 Cosmetics & Personal Care

8.4.5.4 Animal Feed

8.4.5.5 Others (e.g.

8.4.5.6 textile

8.4.5.7 plastics)

8.4.6 Historic and Forecasted Market Size By Distribution channel

8.4.6.1 Direct Sales

8.4.6.2 Indirect Sales (Retail

8.4.6.3 Online)

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Antioxidant Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Synthetic Antioxidants

8.5.4.2 Natural Antioxidants

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Food & Beverages

8.5.5.2 Pharmaceuticals & Nutraceuticals

8.5.5.3 Cosmetics & Personal Care

8.5.5.4 Animal Feed

8.5.5.5 Others (e.g.

8.5.5.6 textile

8.5.5.7 plastics)

8.5.6 Historic and Forecasted Market Size By Distribution channel

8.5.6.1 Direct Sales

8.5.6.2 Indirect Sales (Retail

8.5.6.3 Online)

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Antioxidant Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Synthetic Antioxidants

8.6.4.2 Natural Antioxidants

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Food & Beverages

8.6.5.2 Pharmaceuticals & Nutraceuticals

8.6.5.3 Cosmetics & Personal Care

8.6.5.4 Animal Feed

8.6.5.5 Others (e.g.

8.6.5.6 textile

8.6.5.7 plastics)

8.6.6 Historic and Forecasted Market Size By Distribution channel

8.6.6.1 Direct Sales

8.6.6.2 Indirect Sales (Retail

8.6.6.3 Online)

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Antioxidant Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Synthetic Antioxidants

8.7.4.2 Natural Antioxidants

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Food & Beverages

8.7.5.2 Pharmaceuticals & Nutraceuticals

8.7.5.3 Cosmetics & Personal Care

8.7.5.4 Animal Feed

8.7.5.5 Others (e.g.

8.7.5.6 textile

8.7.5.7 plastics)

8.7.6 Historic and Forecasted Market Size By Distribution channel

8.7.6.1 Direct Sales

8.7.6.2 Indirect Sales (Retail

8.7.6.3 Online)

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Antioxidant Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.59 Billion |

|

Forecast Period 2024-32 CAGR: |

5.87% |

Market Size in 2032: |

USD 7.64 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||