Anti-Foaming Agent Market Synopsis:

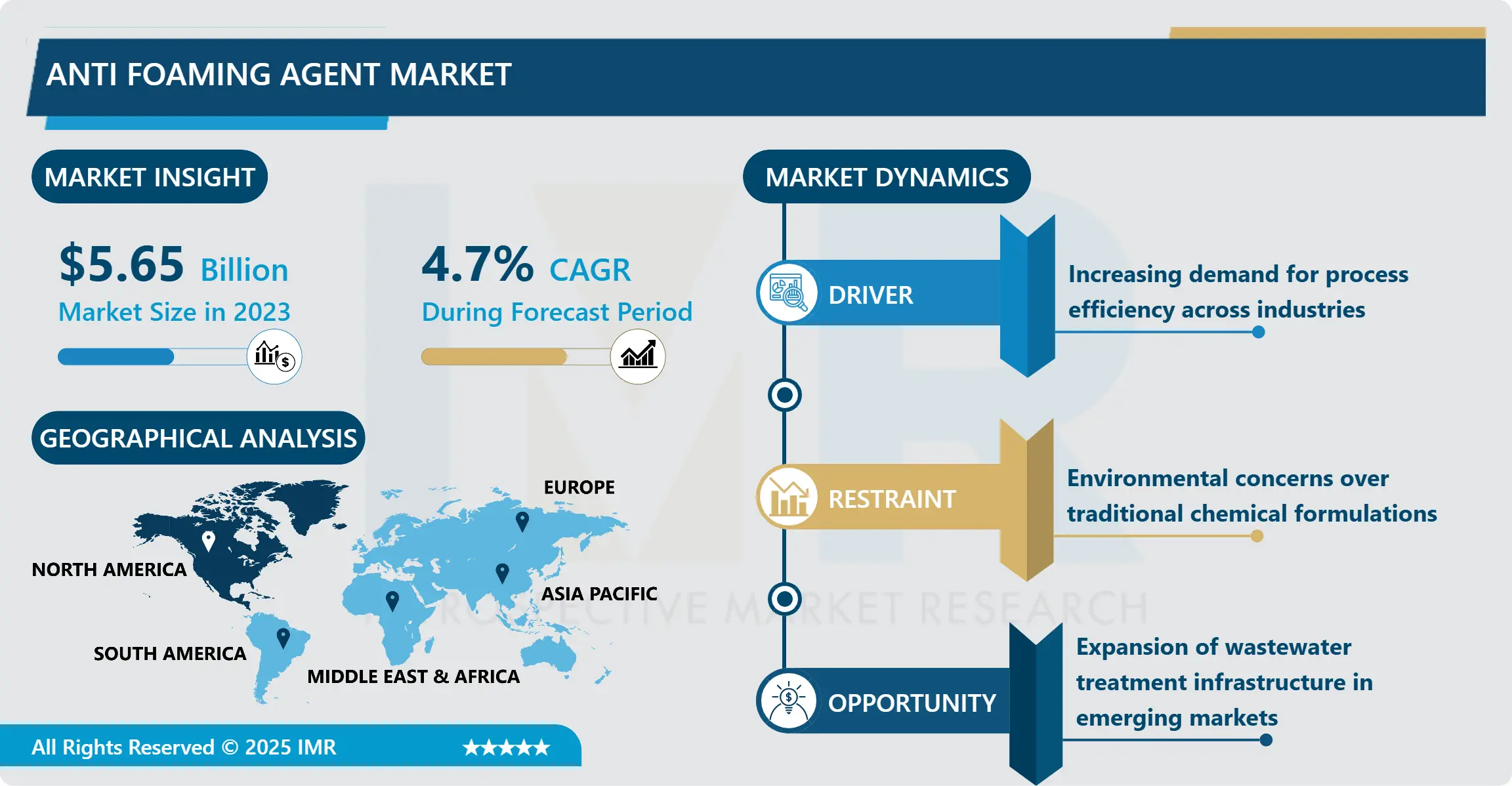

Anti-Foaming Agent Market Size Was Valued at USD 5.65 Billion in 2023, and is Projected to Reach USD 8.54 Billion by 2032, Growing at a CAGR of 4.7% From 2024-2032.

Anti-Foaming Agent Market refers to the manufacture and application of chemical compounds that are employed to suppress the formation of foam in a process. These agents exist in several forms such as silicone-based, oil-based products, and water-based products, and are indispensable in enhancing functionality in functions that include those in the food industries, the pharmaceutical sector, paint and coating industries, and those responsible for wastewater treatment

The Anti-Foaming Agent Market has grown greatly over the last couple of years mainly because of the rising importance that various industries have put on efficiency through foam control. Foam in molded or processed plastics results in lost production time, low machinery performance, and poor quality of the resultant product. Anti-foaming agents solve these problems in one of two ways, namely, by quickly dismantling the foam or by discouraging the formation of foam in the first place. The rising need of high-performance and low-cost inputs in food processing, paper, and pulp, chemical industries, etc has been a major factor for market growth.

The focus on preserving the environment and industrial norms has augmented the need for cost-effective as well as biodegradable anti-foaming agents. Business entities have been experiencing high investment in the research and development department to come up with formulations that closely perform than the existing products while at the same time incorporating compliance to various environmental standards. The use of advanced anti-foaming agents in maturing industries like biotechnology and renewable energy has opened new avenues in the industry making it a crucial part of various industries

Anti-Foaming Agent Market Trend Analysis:

Shift Towards Eco-Friendly Anti-Foaming Agents.

-

The importance of environmental factors has emerged as a major issue for industries, major changes have occurred in the use of environmentally friendly and bio-degradable anti-foaming agents. Conventional preparations had compounds that might harm the environment; thus, regulatory agencies set limitations to acceptable concentrations.

- Manufacturers are inventing eco-friendly products based on biological and bio-degradable materials. These are slowly becoming more popular more so among industries such as the food processing industries and the pharmaceutical industries since they need to adhere to safer environmental laws. The use of green agents is not only essential to abide by the laws, yet also to respond to current global trends advocating for sustainable economy and environmental consideration toward production.

Growing Demand in Wastewater Treatment

-

New industrial development opportunities of the wastewater treatment business constitute a star growth opportunity for the anti-foaming agent business. As more and more people move into metropolitan areas, industries develop and countries enforce strict laws on the environment, the demand for good water treatment systems has grown all over the world.

- Aeration as well as biologic treatment of wastewater in some cases leads to foam formation which becomes a nuisance to the working of some wastewater treatment plants. Anti-foam aids prevent foam and guarantee non-stop operations together with environmental compliance. Consumption has been significantly reported by emerging economies meaning the market for anti-foaming agents’ manufacturers is NY. The addition of new formulations that seek to deliver high performance in water treatment systems has the effect of supercharging this growth potential.

Anti-Foaming Agent Market Segment Analysis:

Anti-Foaming Agent Market is Segmented on the basis of Type, Application, End User, and Region.

By Type, Silicone-based segment is expected to dominate the market during the forecast period

-

The Silicone-Based segment is expected to remain the largest consumer in the anti-foaming agent throughout the forecast period owing to the better functional characteristics. Probably the most efficient class of released foam control agents is silicone-based agents that are useful in such industries as chemical production, food processing, and water treatment.

- Due to their high performance in high and low temperatures, and resistant to acidic and alkaline conditions, they are recommended for use in competitive and rigorous manufacturing sectors. Further, these agents have a long-lasting performance and they possess a low surface tension to effectively burst the foam. The increasing use of silicone-based agents in industries where accuracy and reliability is desired explains why they are leading the market.

By Application, the Food processing segment is expected to held the largest share

-

The Food Processing segment will constitute the largest share of the anti-foaming agent market because foam formation is especially problematic in beverage production, dairy products, and processed foods. Foam can be problematic in many manufacturing processes and can impact on the texture, quality and other physical properties of the final product.

- Anti-foaming agents contribute to smooth operations because they counter established foam in mixing, fermenting as well as bottling activities. This has due to the increasing usage of convenience food and beverage products while at the same time observing the high standard food safety standards have led to use of food-grade Anti-Foaming agents. This segment has also benefited from manufacturers’ concentrating on formulations that are safe for food contact yet productive, driving the evolution of the global market.

Anti-Foaming Agent Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America is projected to lead the global Anti-Foaming Agent Market throughout the forecast era due to its established calendar of industrial players and effective regulatory policies. Certain specific end-use industries like food and beverages, pharmaceuticals, and wastewater treatment are some of the key consumers of anti-foaming agents in the region.

- Availability of sophisticated manufacturing capacity and more importantly adherence to processes of running operations effectively has also played a big role. The height of contribution comes from the United States, mainly by the solid industrial structure and the orientation towards environment-friendly products to implement anti-foaming agents.

- The focus in the region on technological application results in the creation of enhanced formulas to fit individual industry needs. The many attempts to introduce fresh measures to meet the increasing environmental challenges in the form of wastewater treatment have also been central to overall market development. In addition, there has been an increasing trend towards green chemicals in the North American region which has seen the use of biodegradable sustainable anti-foaming agents takes root making North America a market leader in this area.

Active Key Players in the Anti-Foaming Agent Market:

- Air Products and Chemicals, Inc. (USA)

- BASF SE (Germany)

- Buckman Laboratories International, Inc. (USA)

- Clariant AG (Switzerland)

- Croda International Plc (UK)

- Dow Inc. (USA)

- Elementis Plc (UK)

- Elkem ASA (Norway)

- Evonik Industries AG (Germany)

- Kemira Oyj (Finland)

- Momentive Performance Materials Inc. (USA)

- Munzing Chemie GmbH (Germany)

- Shin-Etsu Chemical Co., Ltd. (Japan)

- Solvay S.A. (Belgium)

- Wacker Chemie AG (Germany), and Other Active Players

|

Anti-Foaming Agent Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.65 Billion |

|

Forecast Period 2024-32 CAGR: |

4.7 % |

Market Size in 2032: |

USD 8.54 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By end User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Anti Foaming Agent Market by Type

4.1 Anti Foaming Agent Market Snapshot and Growth Engine

4.2 Anti Foaming Agent Market Overview

4.3 Water Based Oil Based Silicone Alkyd Based Others

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Water Based Oil Based Silicone Alkyd Based Others: Geographic Segmentation Analysis

Chapter 5: Anti Foaming Agent Market by Application

5.1 Anti Foaming Agent Market Snapshot and Growth Engine

5.2 Anti Foaming Agent Market Overview

5.3 Adhesives Coatings Detergents Wood Pulp Food Processing others

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Adhesives Coatings Detergents Wood Pulp Food Processing others: Geographic Segmentation Analysis

Chapter 6: Anti Foaming Agent Market by End User

6.1 Anti Foaming Agent Market Snapshot and Growth Engine

6.2 Anti Foaming Agent Market Overview

6.3 Oil and gas Paint and coatings Food and Beverages Pharmaceuticals Textile Others

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Oil and gas Paint and coatings Food and Beverages Pharmaceuticals Textile Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Anti Foaming Agent Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AIR PRODUCTS AND CHEMICALS INC. (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BASF SE (GERMANY)

7.4 BUCKMAN LABORATORIES INTERNATIONAL INC. (USA)

7.5 CLARIANT AG (SWITZERLAND)

7.6 CRODA INTERNATIONAL PLC (UK)

7.7 DOW INC. (USA)

7.8 ELEMENTIS PLC (UK)

7.9 ELKEM ASA (NORWAY)

7.10 EVONIK INDUSTRIES AG (GERMANY)

7.11 KEMIRA OYJ (FINLAND)

7.12 MOMENTIVE PERFORMANCE MATERIALS INC. (USA)

7.13 MUNZING CHEMIE GMBH (GERMANY)

7.14 SHIN-ETSU CHEMICAL CO. LTD. (JAPAN)

7.15 SOLVAY S.A. (BELGIUM)

7.16 WACKER CHEMIE AG (GERMANY)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Anti Foaming Agent Market By Region

8.1 Overview

8.2. North America Anti Foaming Agent Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Water Based Oil Based Silicone Alkyd Based Others

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Adhesives Coatings Detergents Wood Pulp Food Processing others

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Oil and gas Paint and coatings Food and Beverages Pharmaceuticals Textile Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Anti Foaming Agent Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Water Based Oil Based Silicone Alkyd Based Others

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Adhesives Coatings Detergents Wood Pulp Food Processing others

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Oil and gas Paint and coatings Food and Beverages Pharmaceuticals Textile Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Anti Foaming Agent Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Water Based Oil Based Silicone Alkyd Based Others

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Adhesives Coatings Detergents Wood Pulp Food Processing others

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Oil and gas Paint and coatings Food and Beverages Pharmaceuticals Textile Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Anti Foaming Agent Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Water Based Oil Based Silicone Alkyd Based Others

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Adhesives Coatings Detergents Wood Pulp Food Processing others

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Oil and gas Paint and coatings Food and Beverages Pharmaceuticals Textile Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Anti Foaming Agent Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Water Based Oil Based Silicone Alkyd Based Others

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Adhesives Coatings Detergents Wood Pulp Food Processing others

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Oil and gas Paint and coatings Food and Beverages Pharmaceuticals Textile Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Anti Foaming Agent Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Water Based Oil Based Silicone Alkyd Based Others

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Adhesives Coatings Detergents Wood Pulp Food Processing others

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Oil and gas Paint and coatings Food and Beverages Pharmaceuticals Textile Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Anti-Foaming Agent Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.65 Billion |

|

Forecast Period 2024-32 CAGR: |

4.7 % |

Market Size in 2032: |

USD 8.54 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By end User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||