4 4-Dichlorodiphenyl Sulfone (DCDPS) Market Overview

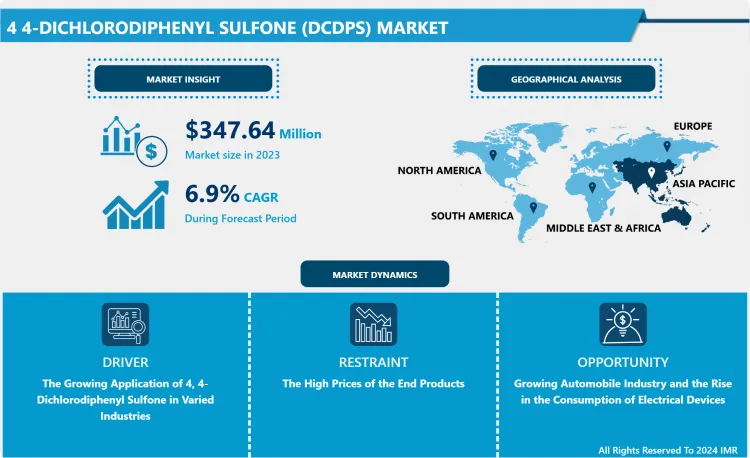

4 4-Dichlorodiphenyl Sulfone (DCDPS) Market Size Was Valued at USD 371.63 Million In 2024 And Is Projected to Reach USD 774.22 Million By 2035, Growing at A CAGR of 6.9% From 2025-2035.

4,4-Dichlorodiphenyl Sulfone (DCDPS), is a monomer utilized for the production of polysulfones (PES) through various polymerization methods. 4,4-Dichlorodiphenyl Sulfone (DCDPS) derived polysulfones have unique characteristics such as high transparency and high-temperature performance which makes them suitable replacements for glass and metals in a wide range of automotive, aerospace, medical, and consumer products. Moreover, DCDPS, or 4,4-Dichlorodiphenyl Sulfone (DCDPS), is a solid organic compound having molecular formula (C12H8Cl2O2S) and is in crystal or powder form. In addition, it is white. The rapid urbanization and the growing usage of electrical equipment, medical devices, and automobiles have compelled manufacturers to adopt polysulfones to decrease the stress on the natural sources of metals.

4,4-dichloro diphenyl sulfone (DCDPS) is essential as a starting material required for the production of polysulfones and polyethersulfones. Polysulfones and polyethersulfones are a family of thermoplastics called engineering plastics and are utilized in applications operating at high temperatures. Moreover, polysulfones are incorporated to manufacture medical equipment (nebulizers and dialysis components), automobile parts (steering column lock switches, relay insulators, and pistons), appliances (Coffee makers, humidifiers, and microwave ovens), and electrical devices (television components and capacitor film) thus, the wide usage of polysulfones is spurring the development of the market in the forecast period.

_Market.webp)

Market Dynamics And Key Factors In 4,4-Dichlorodiphenyl Sulfone (DCDPS) Market

Drivers:

- High transparency, high-temperature performance, lightweight, and the capability to replace material are the unique features offered by 4,4-Dichlorodiphenyl Sulfone (DCDPS) and its derivative. Moreover, when utilized in composites for automotive, 4,4?-Dichlorodiphenyl Sulfone (DCDPS) helps create light-weighting. Light weighting is a trending concept in the automotive industry that emphasizes manufacturing vehicles that are not heavy. In addition, utilization of lightweight materials such as engineered plastics puts less strain on the engine thus, optimizing handling and better gas mileage. Furthermore, this benefit can also be applied within the Electro Mobility (or e-Mobility) industry thus, strengthening the expansion of the 4,4-Dichlorodiphenyl Sulfone (DCDPS) Market during the forecast period.

- 4,4?-Dichlorodiphenyl Sulfone (DCDPS) is the prominent monomer for polysulfones that are utilized in composites in aerospace that helps in reducing weight and enhances thermostability. DCDPS is incorporated in structural components within the aerospace industry. Polysulfones are used over steel parts, or aluminum as the material is substantially lighter and durable. Moreover, usage of high-performance thermoplastics in aviation can significantly reduce costs and extend flight range thus, supporting the development of the 4,4-Dichlorodiphenyl Sulfone (DCDPS) Market in the forecast period.

- Dapsone-derived product of diphenyl sulfone is active against a broad spectrum of bacteria, majorly employed for its actions against Mycobacterium leprae, and is administered as part of the multidrug systematic plan in the treatment of all forms of leprosy. Furthermore, it has a role as an antimalarial, a leprostatic drug, an anti-infective agent, and an anti-inflammatory drug. Furthermore, Dichlorodiphenyltrichloroethane (DDT), a derivative of DCDPS is a potent insecticide for the Musca nebulo, a common Indian housefly. DCDPS are also been utilized in reactive dyes in the textile industry, and for such applications, 4,4'- Dichlorodiphenyl sulfone that is substantially free of 2,4' and 3,4' Dichlorodiphenyl sulfone is required thus, the wide applications of DCDPS are promoting the expansion of 4,4-Dichlorodiphenyl Sulfone (DCDPS) Market over the projected period.

Restraints:

- The high prices of the end products obtained by the polymerization of 4,4-Dichlorodiphenyl Sulfone (DCDPS) are the main factor restraining the growth of the market in the forecast period. The process involved in the manufacturing of polysulfones is sophisticated and requires multiple processes to obtain the pure form. Moreover, the decomposition of polysulfones is difficult and it may end up in the oceans, harming the natural flora and fauna of the environment thus, restricting the usage of 4,4-Dichlorodiphenyl Sulfone (DCDPS) during the forecast period.

Opportunities:

- The growing automobile industry and the rise in the consumption of electrical devices is a profitable opportunity for the market players involved in the production of 4,4-Dichlorodiphenyl Sulfone (DCDPS) and its derivative. Moreover, the growing technological advancement to reduce the weight of aircraft and automobiles to increase their life expectancy and durability is stimulating automobile manufacturers to incorporate the usage of DCDPS. The growing population and the rise in disease outbreaks have forced governments to enhance the healthcare sector thus, the utilization of polysulfones in manufacturing medical devices has increased. Furthermore, the rise in the per capita income has resulted in the increased expenditure on consumer appliances such as coffee machines, humidifiers, microwave ovens, and televisions. Moreover, the growing fundings for research activities to develop more advanced polysulfones and polyethersulfones by governments and private organizations is offering lucrative opportunities for the market players.

Segmentation Analysis of 4,4-Dichlorodiphenyl Sulfone (DCDPS) Market:

By Grade, Industry segment is likely to command almost 57.40% share during the upcoming years.

-

The industry segment is anticipated to have the highest share of the market during the forecast period. The rapid growth in the automotive, and aerospace industry has forced manufacturers to find alternative ways to reduce the weight of the vehicles without tampering with their strength. Moreover, the derivatives of 4,4-Dichlorodiphenyl Sulfone (DCDPS) such as polysulfones and polyethersulfones are utilized for the manufacturing of lightweight and thermoplastic components that are incorporated in vehicles and airplanes. Furthermore, polysulfones provide durability and rigidity akin to steel and aluminum which can be utilized to manufacture electrical and other household appliances, thus stimulating the growth of the industry segment in the forecast period.

By Application, Engineered Plastics segment is likely to command almost 38.40% share during the upcoming years.

- The engineered plastics segment is expected to lead the market in the projected period. The growing usage of electrical appliances, automobiles, and medical equipment has put a strain on the natural sources of steel and aluminum. The usage of polysulfones to manufacture components that can replace steel is rising. Polysulfones are resistant to high temperatures thus, making them suitable alternatives for the production of specific components of electrical, medical, and automotive devices. Moreover, lightweight engineered plastics incorporated in automobiles reduced the strain on the engine and provides better gas mileage as well improved handling thus, driving the expansion of this segment in the estimated timespan.

Regional Analysis of 4,4-Dichlorodiphenyl Sulfone (DCDPS) Market:

By Region, Asia-pacific region is estimated to lead the market with around 31.22% share during the forecast period.

- The growing usage of DCDPS in the automotive, electrical, and electronics industries is the main factor driving the expansion of the market in this region. China is estimated to be the largest market and India is forecasted to be the fastest-growing country in this region. Moreover, the rise in the manufacturing of semiconductors and the increasing exports of consumer appliances is further stimulating the development of the 4,4-Dichlorodiphenyl Sulfone (DCDPS) Market in this region. Furthermore, one of the vital usages of DCDPS made by the countries in this region is for the treatment of leprosy.

- The European region is expected to show a significant growth rate attributed to the large presence of the automobile industry. Germany is the major country contributing to the expansion of the 4,4-Dichlorodiphenyl Sulfone (DCDPS) Market in this region. Moreover, many premium car manufacturing companies are headquartered in Germany. The growing usage of DCDPS as engineered plastic to reduce the weight of the vehicles is accelerating the growth of the market in this region.

- The North American region is forecasted to show a positive growth rate due to the advancement in automobile technology to manufacture lightweight vehicles. The advancement in aviation technology and the increasing usage of electronic devices are further strengthening the expansion of the market in this region.

Players Covered in 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market are:

- Aarti Industries Ltd. (India)

- Atul Ltd (India)

- Banchem Intermediates (India)

- Jiujiang Zhongxing Medicine Chemical Co. Ltd.

- Solvay S.A (Belgium)

- TCI Chemicals Private Limited (India)

- Nantong VolantChem Corp. (China)

- Huai'an Shengli Materials Co. Ltd. (China)

- Vertellus Holdings Inc. (US)

- BASF SE (Germany)

- Jiangmen Youju (China)

- Sino Polymer (China) and Others major players.

Recent Developments In 4,4-Dichlorodiphenyl Sulfone (DCDPS) Market

- In 2025, Indian manufacturers and exporters (notably Ganesh Polychem and several Vapi/ Gujarat intermediates producers) continued to expand commercial outreach — with supplier listings and company pages reinforcing India’s role as a significant DCDPS export hub to global polysulfone and pharma makers.

- In 2024, Atul Ltd. (India) reported DCDPS as a core product in its chemical portfolio and cited volume growth in its annual disclosures, signalling stronger industrial-grade demand from downstream polymer customers.

(Source: https://www.ganeshpolychem.com/)

(Source: https://www.atul.co.in/)

|

4 4-Dichlorodiphenyl Sulfone (DCDPS) Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 371.63 Mn. |

|

Forecast Period 2025-35 CAGR: |

6.90% |

Market Size in 2035: |

USD 774.22 Mn. |

|

Segments Covered: |

By Grade |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market by Region (2018-2032)

4.1 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market Snapshot and Growth Engine

4.2 Market Overview

4.3 North America (U.S.

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Canada

4.5 Mexico)

4.6 Europe (Germany

4.7 U.K.

4.8 France

4.9 Italy

4.10 Russia

4.11 Spain

4.12 Rest of Europe)

4.13 Asia-Pacific (China

4.14 India

4.15 Japan

4.16 Singapore

4.17 Australia

4.18 New Zealand

4.19 Rest of APAC)

4.20 Middle East & Africa (Turkey

4.21 Saudi Arabia

4.22 Iran

4.23 UAE

4.24 Africa

4.25 Rest of MEA)

4.26 South America (Brazil

4.27 Argentina

4.28 Rest of SA)

Chapter 5: Company Profiles and Competitive Analysis

5.1 Competitive Landscape

5.1.1 Competitive Benchmarking

5.1.2 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market Share by Manufacturer (2024)

5.1.3 Industry BCG Matrix

5.1.4 Heat Map Analysis

5.1.5 Mergers and Acquisitions

5.2 STMICROELECTRONICS NV (SWITZERLAND)

5.2.1 Company Overview

5.2.2 Key Executives

5.2.3 Company Snapshot

5.2.4 Role of the Company in the Market

5.2.5 Sustainability and Social Responsibility

5.2.6 Operating Business Segments

5.2.7 Product Portfolio

5.2.8 Business Performance

5.2.9 Key Strategic Moves and Recent Developments

5.2.10 SWOT Analysis

5.3 EATON CORPORATION PLC. (IRELAND)

5.4 GENERAL ELECTRIC COMPANY (US)

5.5 EPCOS AG (GERMANY)

5.6 FAIRCHILD SEMICONDUCTOR INTERNATIONAL INC. (US)

5.7 LARSEN & TURBO (INDIA)

5.8 APFC PANELS MANUFACTURERS INCLUDE ABB LTD. (SWITZERLAND)

5.9 CROMPTON GREAVES LTD. (INDIA)

5.10 GENERAL ELECTRIC (U.S.)

5.11 SCHNEIDER ELECTRIC (FRANCE)

5.12 TEXAS INSTRUMENTS INC. (US)

5.13 ON SEMICONDUCTOR CORPORATION (U.S.)

5.14 STMICROELECTRONICS (SWITZERLAND)

5.15 AND OTHERS MAJOR PLAYERS

Chapter 6: Global 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market By Region

6.1 Overview

6.2. North America 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market

6.2.1 Key Market Trends, Growth Factors and Opportunities

6.2.2 Top Key Companies

6.2.3 Historic and Forecasted Market Size by Segments

6.2.4 Historic and Forecasted Market Size by Region

6.2.4.1 North America (U.S.

6.2.4.2 Canada

6.2.4.3 Mexico)

6.2.4.4 Europe (Germany

6.2.4.5 U.K.

6.2.4.6 France

6.2.4.7 Italy

6.2.4.8 Russia

6.2.4.9 Spain

6.2.4.10 Rest of Europe)

6.2.4.11 Asia-Pacific (China

6.2.4.12 India

6.2.4.13 Japan

6.2.4.14 Singapore

6.2.4.15 Australia

6.2.4.16 New Zealand

6.2.4.17 Rest of APAC)

6.2.4.18 Middle East & Africa (Turkey

6.2.4.19 Saudi Arabia

6.2.4.20 Iran

6.2.4.21 UAE

6.2.4.22 Africa

6.2.4.23 Rest of MEA)

6.2.4.24 South America (Brazil

6.2.4.25 Argentina

6.2.4.26 Rest of SA)

6.2.5 Historic and Forecast Market Size by Country

6.2.5.1 US

6.2.5.2 Canada

6.2.5.3 Mexico

6.3. Eastern Europe 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market

6.3.1 Key Market Trends, Growth Factors and Opportunities

6.3.2 Top Key Companies

6.3.3 Historic and Forecasted Market Size by Segments

6.3.4 Historic and Forecasted Market Size by Region

6.3.4.1 North America (U.S.

6.3.4.2 Canada

6.3.4.3 Mexico)

6.3.4.4 Europe (Germany

6.3.4.5 U.K.

6.3.4.6 France

6.3.4.7 Italy

6.3.4.8 Russia

6.3.4.9 Spain

6.3.4.10 Rest of Europe)

6.3.4.11 Asia-Pacific (China

6.3.4.12 India

6.3.4.13 Japan

6.3.4.14 Singapore

6.3.4.15 Australia

6.3.4.16 New Zealand

6.3.4.17 Rest of APAC)

6.3.4.18 Middle East & Africa (Turkey

6.3.4.19 Saudi Arabia

6.3.4.20 Iran

6.3.4.21 UAE

6.3.4.22 Africa

6.3.4.23 Rest of MEA)

6.3.4.24 South America (Brazil

6.3.4.25 Argentina

6.3.4.26 Rest of SA)

6.3.5 Historic and Forecast Market Size by Country

6.3.5.1 Russia

6.3.5.2 Bulgaria

6.3.5.3 The Czech Republic

6.3.5.4 Hungary

6.3.5.5 Poland

6.3.5.6 Romania

6.3.5.7 Rest of Eastern Europe

6.4. Western Europe 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market

6.4.1 Key Market Trends, Growth Factors and Opportunities

6.4.2 Top Key Companies

6.4.3 Historic and Forecasted Market Size by Segments

6.4.4 Historic and Forecasted Market Size by Region

6.4.4.1 North America (U.S.

6.4.4.2 Canada

6.4.4.3 Mexico)

6.4.4.4 Europe (Germany

6.4.4.5 U.K.

6.4.4.6 France

6.4.4.7 Italy

6.4.4.8 Russia

6.4.4.9 Spain

6.4.4.10 Rest of Europe)

6.4.4.11 Asia-Pacific (China

6.4.4.12 India

6.4.4.13 Japan

6.4.4.14 Singapore

6.4.4.15 Australia

6.4.4.16 New Zealand

6.4.4.17 Rest of APAC)

6.4.4.18 Middle East & Africa (Turkey

6.4.4.19 Saudi Arabia

6.4.4.20 Iran

6.4.4.21 UAE

6.4.4.22 Africa

6.4.4.23 Rest of MEA)

6.4.4.24 South America (Brazil

6.4.4.25 Argentina

6.4.4.26 Rest of SA)

6.4.5 Historic and Forecast Market Size by Country

6.4.5.1 Germany

6.4.5.2 UK

6.4.5.3 France

6.4.5.4 The Netherlands

6.4.5.5 Italy

6.4.5.6 Spain

6.4.5.7 Rest of Western Europe

6.5. Asia Pacific 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market

6.5.1 Key Market Trends, Growth Factors and Opportunities

6.5.2 Top Key Companies

6.5.3 Historic and Forecasted Market Size by Segments

6.5.4 Historic and Forecasted Market Size by Region

6.5.4.1 North America (U.S.

6.5.4.2 Canada

6.5.4.3 Mexico)

6.5.4.4 Europe (Germany

6.5.4.5 U.K.

6.5.4.6 France

6.5.4.7 Italy

6.5.4.8 Russia

6.5.4.9 Spain

6.5.4.10 Rest of Europe)

6.5.4.11 Asia-Pacific (China

6.5.4.12 India

6.5.4.13 Japan

6.5.4.14 Singapore

6.5.4.15 Australia

6.5.4.16 New Zealand

6.5.4.17 Rest of APAC)

6.5.4.18 Middle East & Africa (Turkey

6.5.4.19 Saudi Arabia

6.5.4.20 Iran

6.5.4.21 UAE

6.5.4.22 Africa

6.5.4.23 Rest of MEA)

6.5.4.24 South America (Brazil

6.5.4.25 Argentina

6.5.4.26 Rest of SA)

6.5.5 Historic and Forecast Market Size by Country

6.5.5.1 China

6.5.5.2 India

6.5.5.3 Japan

6.5.5.4 South Korea

6.5.5.5 Malaysia

6.5.5.6 Thailand

6.5.5.7 Vietnam

6.5.5.8 The Philippines

6.5.5.9 Australia

6.5.5.10 New Zealand

6.5.5.11 Rest of APAC

6.6. Middle East & Africa 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market

6.6.1 Key Market Trends, Growth Factors and Opportunities

6.6.2 Top Key Companies

6.6.3 Historic and Forecasted Market Size by Segments

6.6.4 Historic and Forecasted Market Size by Region

6.6.4.1 North America (U.S.

6.6.4.2 Canada

6.6.4.3 Mexico)

6.6.4.4 Europe (Germany

6.6.4.5 U.K.

6.6.4.6 France

6.6.4.7 Italy

6.6.4.8 Russia

6.6.4.9 Spain

6.6.4.10 Rest of Europe)

6.6.4.11 Asia-Pacific (China

6.6.4.12 India

6.6.4.13 Japan

6.6.4.14 Singapore

6.6.4.15 Australia

6.6.4.16 New Zealand

6.6.4.17 Rest of APAC)

6.6.4.18 Middle East & Africa (Turkey

6.6.4.19 Saudi Arabia

6.6.4.20 Iran

6.6.4.21 UAE

6.6.4.22 Africa

6.6.4.23 Rest of MEA)

6.6.4.24 South America (Brazil

6.6.4.25 Argentina

6.6.4.26 Rest of SA)

6.6.5 Historic and Forecast Market Size by Country

6.6.5.1 Turkiye

6.6.5.2 Bahrain

6.6.5.3 Kuwait

6.6.5.4 Saudi Arabia

6.6.5.5 Qatar

6.6.5.6 UAE

6.6.5.7 Israel

6.6.5.8 South Africa

6.7. South America 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market

6.7.1 Key Market Trends, Growth Factors and Opportunities

6.7.2 Top Key Companies

6.7.3 Historic and Forecasted Market Size by Segments

6.7.4 Historic and Forecasted Market Size by Region

6.7.4.1 North America (U.S.

6.7.4.2 Canada

6.7.4.3 Mexico)

6.7.4.4 Europe (Germany

6.7.4.5 U.K.

6.7.4.6 France

6.7.4.7 Italy

6.7.4.8 Russia

6.7.4.9 Spain

6.7.4.10 Rest of Europe)

6.7.4.11 Asia-Pacific (China

6.7.4.12 India

6.7.4.13 Japan

6.7.4.14 Singapore

6.7.4.15 Australia

6.7.4.16 New Zealand

6.7.4.17 Rest of APAC)

6.7.4.18 Middle East & Africa (Turkey

6.7.4.19 Saudi Arabia

6.7.4.20 Iran

6.7.4.21 UAE

6.7.4.22 Africa

6.7.4.23 Rest of MEA)

6.7.4.24 South America (Brazil

6.7.4.25 Argentina

6.7.4.26 Rest of SA)

6.7.5 Historic and Forecast Market Size by Country

6.7.5.1 Brazil

6.7.5.2 Argentina

6.7.5.3 Rest of SA

Chapter 7 Analyst Viewpoint and Conclusion

7.1 Recommendations and Concluding Analysis

7.2 Potential Market Strategies

Chapter 8 Research Methodology

8.1 Research Process

8.2 Primary Research

8.3 Secondary Research

|

4 4-Dichlorodiphenyl Sulfone (DCDPS) Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 371.63 Mn. |

|

Forecast Period 2025-35 CAGR: |

6.90% |

Market Size in 2035: |

USD 774.22 Mn. |

|

Segments Covered: |

By Grade |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||