X-band Radar Market Synopsis:

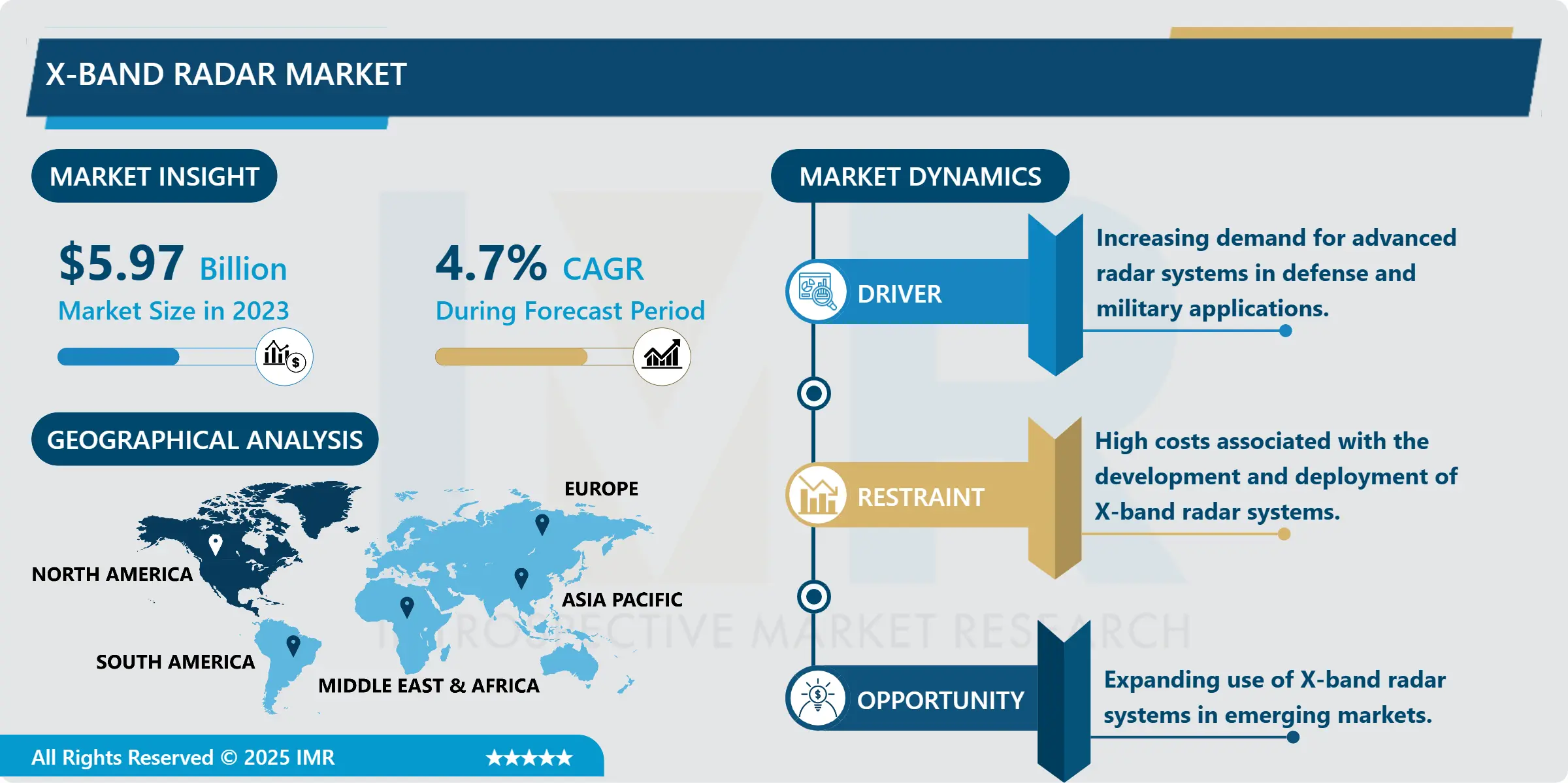

X-band Radar Market Size Was Valued at USD 5.97 Billion in 2023, and is Projected to Reach USD 9.03 Billion by 2032, Growing at a CAGR of 4.7% From 2024-2032.

X-band radar refer to radar systems that fall in the microwave band with frequency range between 8.0 GHz and 12.0 GHz. These radars are universal used for detection and tracking of targets where the facilities are needed, for instance in defence, weather control, maritime and aerospace. Because of the high resolution the X-band radar systems can give improved imagery and corresponding accurate data appropriate for identifying small objects, assessing changes in the environment and for safe usage of airspace and sea routes. These early detectors’ capabiolties to detect objects at short and long ranges have made them to be implemented greatly in both commercial, military, and scientific fields.

The market for X-band radar is growing rapidly because of the rising applications of radar systems in defense systems, aerospace, marine, and meteorological applications. These radars are especially used because in conditions of heavy rainfall or fog they can work in the same high resolution as under other conditions. X-band radar system is used in the defense sector for purposes of surveillance, target tracking and for missile system defense; in the commercial sector they are crucial in the maritime navigation, vehicle tracking and for environmental monitoring.

These advances include miniaturization and improvements in the processing power of the systems that make up an X Band radar system which has make the systems cheaper to produce. The ongoing growth of X-band radar applications in UAVs, airplanes, and ships urge the market expansion. The integration of artificial intelligence (AI) and machine learning (ML) with the X-band radar systems is helping to take the performance to another level, with accuracy in the detection of targets increasing together with the processing of large amounts of data in real time. This is generating new opportunities for the market in such sectors as defense and surveillance.

X-band Radar Market Trend Analysis:

Miniaturization and Integration with UAVs

- One of the major trends in X-band radar market is the trend to miniaturisation of radar systems and, thus, the possibility to integrate radar systems into small platforms like UAVs. This is mainly due to a growing need for surveillance as well as reconnaissance functions key in defense and homeland security uses. X-band imagers are miniaturized to be lightweight and power-efficient, which is important for implementing long endurance surveillance operations by the UAVs. In the development of UAVs, X-band radar systems are becoming more refined, specifically tailored to be applied to UAVs to demand change that calls for miniaturization of radar systems.

- There is another increasing trend in the X-band radar market, which is the connection of AI and ML technologies. The technologies are being applied to enhance the processing of Radar for data analysis; thus, making decisions real-time and improving the target acquisition identification. The skill to process vast amounts of data from radar systems within a short span of time has majoron consequential impacts in defense, security, and environmental tracking. During the ongoing advancements in AI and ML, X-band radar systems are becoming more proficient at capturing even the smallest targets or objects on the move and increasing both efficiency and capabilities on the field.

Increased Demand for X-Band Radars in Defense Applications

- Probably the most brilliant prospect in the context of the X-band radar market is the constantly growing need for radar systems on the defense and military side. The global community is increasingly paying attention to the development of surveillance and reconnaissance technologies in order to protect their national security due to rising geopolitical threat. X-band radar has many applications in early warning system application, missile command and control application and battlefield surveillance application. Market demand for enhanced radar technologies capable of controlling the velocity at which moving objects are perceived and addressed is likely to emerge from the defense industry, creating significant opportunities for radar makers.

X-band Radar Market Segment Analysis:

X-band Radar Market Segmented on the basis of Type, Application, and Region.

By Type, sea-based X-band radar segment is expected to dominate the market during the forecast period

- The new X-band radar segment the sea-based X-band radar segment has the potential to lead the X-band radar market during the course of the forecast period because of its application in naval defense, marine, and safety from ocean security and navigation point of view. X-band marine radars are popular in navy ships and marine oil and platforms for detection range, tracking the hostile targets and safe navigation in congested or adverse conditions. They produce clear images and are capable of tracking both slow moving and fairly small objects, thus making them suitable for defense as well as for commercial shipment at sea. The continual development of global trade and maritime traffic makes the need for reliable and modern sea-based X-band radar segments in this period the market driver.

By Application, government application segment expected to held the largest share

- The market for X-band radar is likely to dominate through the government application segment in terms of market size throughout the forecast period owing to the high demand for radar systems to support national defense, border security, and disaster relief. Many governments are procuring the X-band radar with the growing security and defense industry requirement of surveillance systems, threats identification, and missile defense systems. These radars are also applied for controlling of weather conditions for such events as hurricanes or tsunamis, providing people with early alerts about these problems. While growing geopolitical risks and greater need for secure networks will keep government uses as the largest segment of the X-band radar market.

X-band Radar Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- According to the analysis done, North America was the largest geographical market for X-band radar in 2023 with a market share of over 40 percent. Largely owing it to the United States of America, which has been especially prominent in defense budget and technological arsenal. A wide range of applications have the U.S. military in using the X-band radar systems in surveillance, missile defense, and control of air traffic. Furthermore, the U.S aerospace industry employs X-band radar for meteorological surveillance as well as for aircraft direction. The future additions of defense and aerospace technologies in North America will let the area retain its dominant role in the X-band radar market.

Active Key Players in the X-band Radar Market:

- Aselsan A.? (Turkey)

- BAE Systems (UK)

- Furuno Electric Co., Ltd. (Japan)

- Harris Corporation (USA)

- L3Harris Technologies (USA)

- Leonardo S.p.A (Italy)

- Lockheed Martin Corporation (USA)

- Mitsubishi Electric Corporation (Japan)

- Nihon Dempa Kogyo Co., Ltd. (Japan)

- Northrop Grumman Corporation (USA)

- Raytheon Technologies Corporation (USA)

- SAAB Group (Sweden)

- Selex ES (Italy)

- Sitael S.p.A (Italy)

- Thales Group (France)

- Other Active Players

|

X-band Radar Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.97 Billion |

|

Forecast Period 2024-32 CAGR: |

4.7% |

Market Size in 2032: |

USD 9.03 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: X-band Radar Market by Type

4.1 X-band Radar Market Snapshot and Growth Engine

4.2 X-band Radar Market Overview

4.3 sea-based X-band radar and mobile X-band radar)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 sea-based X-band radar and mobile X-band radar): Geographic Segmentation Analysis

4.4

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 : Geographic Segmentation Analysis

Chapter 5: X-band Radar Market by Application

5.1 X-band Radar Market Snapshot and Growth Engine

5.2 X-band Radar Market Overview

5.3 government application

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 government application: Geographic Segmentation Analysis

5.4 defense application

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 defense application: Geographic Segmentation Analysis

5.5 and commercial application)

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 and commercial application): Geographic Segmentation Analysis

5.6

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 : Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 X-band Radar Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 LOCKHEED MARTIN CORPORATION (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 NORTHROP GRUMMAN CORPORATION (USA)

6.4 RAYTHEON TECHNOLOGIES CORPORATION (USA)

6.5 THALES GROUP (FRANCE)

6.6 BAE SYSTEMS (UK)

6.7 OTHER ACTIVE PLAYERS

Chapter 7: Global X-band Radar Market By Region

7.1 Overview

7.2. North America X-band Radar Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Type

7.2.4.1 sea-based X-band radar and mobile X-band radar)

7.2.4.2

7.2.5 Historic and Forecasted Market Size By Application

7.2.5.1 government application

7.2.5.2 defense application

7.2.5.3 and commercial application)

7.2.5.4

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe X-band Radar Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Type

7.3.4.1 sea-based X-band radar and mobile X-band radar)

7.3.4.2

7.3.5 Historic and Forecasted Market Size By Application

7.3.5.1 government application

7.3.5.2 defense application

7.3.5.3 and commercial application)

7.3.5.4

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe X-band Radar Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Type

7.4.4.1 sea-based X-band radar and mobile X-band radar)

7.4.4.2

7.4.5 Historic and Forecasted Market Size By Application

7.4.5.1 government application

7.4.5.2 defense application

7.4.5.3 and commercial application)

7.4.5.4

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific X-band Radar Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Type

7.5.4.1 sea-based X-band radar and mobile X-band radar)

7.5.4.2

7.5.5 Historic and Forecasted Market Size By Application

7.5.5.1 government application

7.5.5.2 defense application

7.5.5.3 and commercial application)

7.5.5.4

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa X-band Radar Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Type

7.6.4.1 sea-based X-band radar and mobile X-band radar)

7.6.4.2

7.6.5 Historic and Forecasted Market Size By Application

7.6.5.1 government application

7.6.5.2 defense application

7.6.5.3 and commercial application)

7.6.5.4

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America X-band Radar Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Type

7.7.4.1 sea-based X-band radar and mobile X-band radar)

7.7.4.2

7.7.5 Historic and Forecasted Market Size By Application

7.7.5.1 government application

7.7.5.2 defense application

7.7.5.3 and commercial application)

7.7.5.4

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

X-band Radar Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.97 Billion |

|

Forecast Period 2024-32 CAGR: |

4.7% |

Market Size in 2032: |

USD 9.03 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||