Warehouse Order Picking Software Market Synopsis

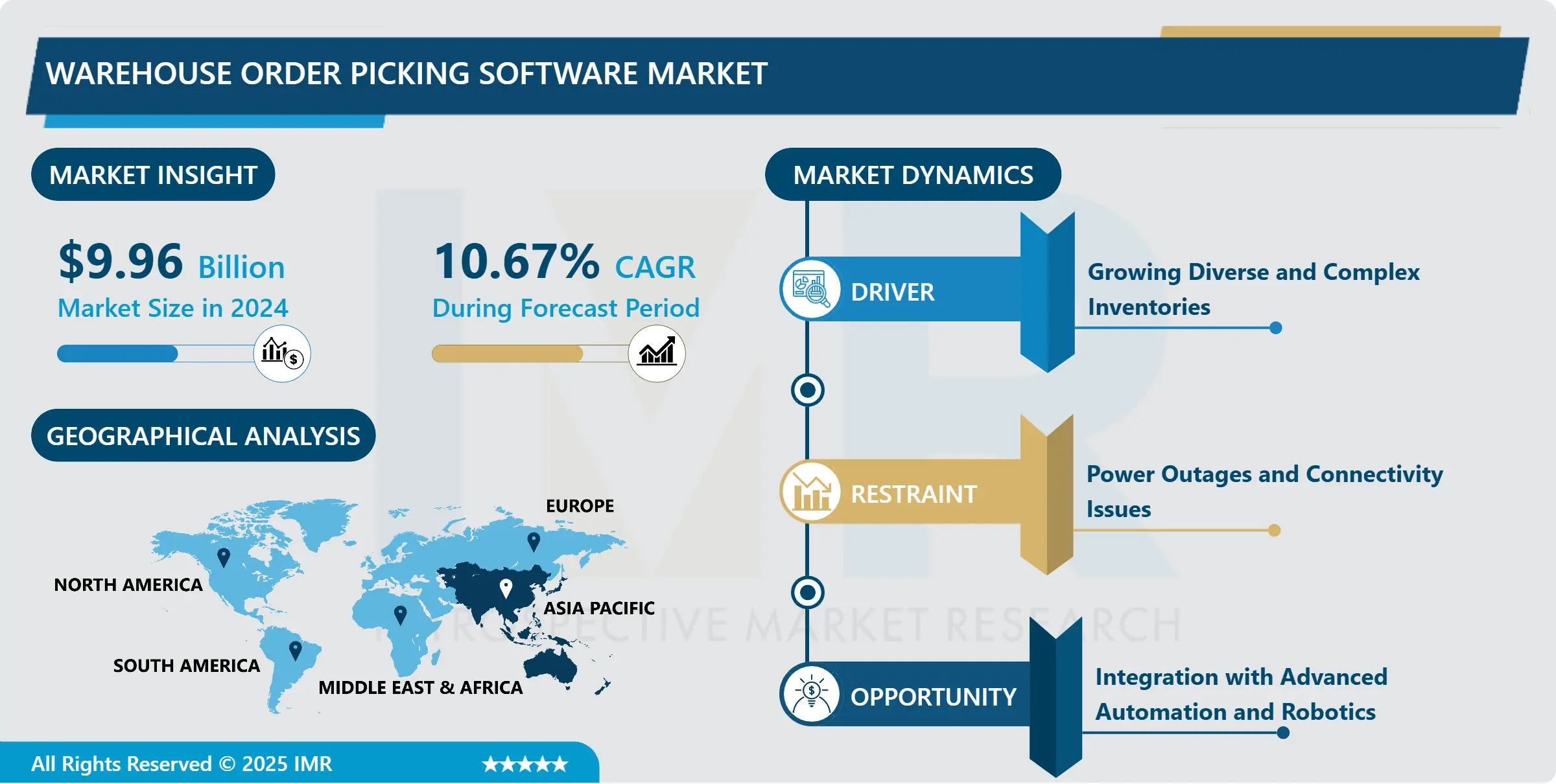

Warehouse Order Picking Software Market Size Was Valued at USD 9.96 Billion in 2024 and is Projected to Reach USD 22.41 Billion by 2032, Growing at a CAGR of 10.67% From 2025-2032.

Warehouse Order Picking Software is a technology solution that improves the process of picking items from a warehouse or distribution center. Typical features include inventory management, order routing, real-time location tracking, and picking route optimization. The software aims to increase efficiency, accuracy, and speed in fulfilling customer orders by providing warehouse workers with the information and tools they need to pick items quickly and accurately.

Warehouse Order Picking Software may include barcode scanning to identify items, pick-to-light or pick-to-voice functionality for hands-free picking, and integration with warehouse management systems (WMS) or enterprise resource planning (ERP) systems for seamless order processing. Some advanced solutions may use artificial intelligence (AI) and machine learning to analyze historical data and predict the best picking routes or inventory replenishment needs.

The growing complexity of warehouse operations, combined with the need for accuracy in order fulfillment, has increased the market for Warehouse Order Picking Software. Manual picking procedures become ineffective and costly as warehouses manage multiple order types and handle a higher volume of SKUs.

The growing formation of technology such as barcode scanning, pick-to-light systems, and RFID (radio-frequency identification) tracking into Warehouse Order Picking Software is propelling market expansion. These technologies allow for faster and more accurate picking processes by providing warehouse workers with real-time information and guidance on the location of items to be picked.

Warehouse Order Picking Software Market Trend Analysis

Growing Diverse and Complex Inventories

- Businesses expanding their product offerings and target to diverse customer demands, also warehouses are faced with handling an increasingly broad range of stock-keeping units (SKUs). Manual picking methods struggle to keep up with this complexity, resulting in inefficiencies and errors in order fulfilment. Warehouse order picking software addresses this issue by offering sophisticated tools for managing different SKU types, locations, and picking strategies, resulting in optimal selection and streamlined processes. ?

- Additionally, the need for increased operational efficiency and productivity causes up demand for warehouse order-picking software. Manual picking methods frequently result in time-consuming processes and errors, which can cause delays and customer dissatisfaction. Warehouse order picking software automates and optimizes picking processes, resulting in fewer errors and shorter fulfillment times.

- The integration of advanced technologies such as barcode scanning, pick-to-light systems, and RFID tracking into warehouse order-picking software is moving the market forward. These technologies allow for real-time inventory tracking, accurate item identification, and efficient picking route optimization. Warehouses that use such technologies can improve the accuracy and speed of order fulfillment, resulting in higher customer satisfaction.

Integration with Advanced Automation and Robotics

- Warehouses are constantly improving their picking procedures as e-commerce expands and consumer demand for precise and quick order fulfillment increases. To accomplish this, warehouse order-picking software is required. It uses sophisticated algorithms and optimization strategies to prioritize orders, decrease picking routes, and reduce errors, all of which boost output and customer satisfaction.

- With the increasing use of robots, drones, and other automated systems in warehouses, there is a demand for intelligent software solutions that can organize and optimize the interaction between humans and machines. Warehouse order-picking software can use automated algorithms to automatically allocate tasks to humans and robots based on factors such as order volume, SKU characteristics, and warehouse layout, allowing for seamless collaboration and increased efficiency.

- The need for scalable and adaptable solutions that can change with changing business requirements and operational environments is driving the growth of the warehouse order-picking software market. Software that can easily adapt to these changes without affecting ongoing operations is needed as warehouses grow, diversify the products they offer, or adopt new picking techniques.

Warehouse Order Picking Software Market Segment Analysis:

Warehouse Order Picking Software Market is Segmented on the basis of Type, Deployment Model, Picking System, Application and Region

By Type, Barcode scanning/RFID picking segment is expected to dominate the market during the forecast period

- Barcode scanning and RFID technology are becoming widely used in warehouse operations, which improves inventory visibility and accuracy, lowers error rates, and increases order fulfillment efficiency. Real-time tracking of inventory movements is made possible by these technologies, which help warehouses allocate resources and pick routes more efficiently, increasing productivity and lowering costs.

- Modern warehouse order-picking software solutions use barcode scanning and RFID technology to automate data capture processes, streamline order-picking workflows, and provide real-time inventory levels and locations. As warehouses attempt to improve operational efficiency and customer responsiveness, demand for robust barcode scanning/RFID picking solutions is expected to remain high, driving the growth of this segment.

- Barcode scanning/RFID picking solutions are appropriate for a variety of warehouse environments and industries due to their scalability and versatility. These technologies provide adaptable and customizable solutions that can accommodate different inventory types, picking strategies, and business needs, ranging from small-scale warehouses to large distribution centers.

By Application, the E-commerce segment is expected to dominate the market during the forecast period

- The exponential growth of e-commerce has resulted in an unprecedented increase in order volume and demand for efficient order fulfillment solutions. Online retailers struggle to meet customer expectations for quick and accurate deliveries, making advanced warehouse order-picking software essential for optimizing picking processes, reducing errors, and improving overall operational efficiency.

- The increasing competition in the e-commerce industry requires businesses to invest in advanced technologies to gain a competitive advantage. Warehouse order-picking software makes it possible for e-commerce companies to streamline their fulfillment operations, shorten order processing times, and improve order accuracy, resulting in increased customer satisfaction and loyalty.

- The scalability and flexibility of modern warehouse order-picking software make it ideal for achieving the dynamic and rapidly changing needs of e-commerce businesses, such as seasonal fluctuations in demand and SKU diversity. The growing trend of omnichannel retailing, where retailers seamlessly integrate online and offline sales channels, drives the adoption of warehouse order-picking software in the e-commerce sector.

Warehouse Order Picking Software Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Asia Pacific is poised for rapid growth, due to the region's growing e-commerce industry, which has increased demand for advanced order fulfillment solutions. Consumers are increasingly turning to online shopping and e-commerce, while businesses are modernizing warehouse operations and improving order-picking efficiency. This increased demand for efficient order-picking solutions is driving the adoption of warehouse order-picking software throughout the Asia-Pacific region.

- Manufacturing activities continue to thrive in China, India, Japan, South Korea, and Southeast Asian countries such as Vietnam, Thailand, and Indonesia, creating a growing demand for automated warehouse solutions to support production and distribution operations. Warehouse order picking software allows manufacturers to optimize inventory management, improve order accuracy, and improve overall operational efficiency, resulting in its widespread adoption throughout Asia Pacific's manufacturing industry.

- The growing emphasis on technological innovation and digital transformation initiatives across industries in Asia Pacific is expected to dominate the Warehouse Order Picking Software Market. This trend is expected to drive sustained demand for warehouse order-picking software in Asia Pacific, contributing to the region's status as the world's fastest-growing market.

Warehouse Order Picking Software Market Top Key Players:

- ShipBob (US)

- HandiFox (US)

- SKUSavvy (US)

- Shipedge (US)

- Manhattan Associates (US)

- Inyxa (US)

- eoStar (US)

- K-Store (UK)

- Voxware (US)

- ASC Software (US)

- bMobile route mobile software (US)

- Kentucky (US)

- Cirrus Tech (US)

- iVision (US)

- Lightning Pick (US)

- Lucas Systems (US)

- Veeqo (UK)

- Scandit (Switzerland)

- ABB Group (Switzerland)

- Boltrics (Netherlands)

- TGW Group (Austria)

- Iptor (Sweden)

- Euclid Labs (Italy)

- Increff (India)

- Calidus LLC (UAE)

- Other Active Players

Key Industry Developments in the Warehouse Order Picking Software Market:

- In February 2024, BEUMER GROUP is pleased to announce the acquisition of FAM Group, a leading supplier of conveyor systems and loading technology. This strategic acquisition significantly enhances BEUMER GROUP's expertise in conveying and loading solutions, particularly for bulk material transport. By integrating FAM Group's innovative technologies and solutions, BEUMER GROUP aims to strengthen its market position and deliver even greater value to its customers in the logistics and materials handling sectors.

- In April 2023, Barcodes, Inc. is excited to announce the launch of its new portfolio of Automated Mobile Robots (AMR) designed for warehousing fulfillment and manufacturing applications. This innovative offering enables businesses to implement intelligent automation effortlessly, ensuring a quick return on investment. Furthermore, a strategic partnership with SVT Robotics will streamline deployment processes, simplifying the complexities often associated with automation and robotics implementations.

|

Global Warehouse Order Picking Software Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 9.96 Bn. |

|

Forecast Period 2025-32 CAGR: |

10.67 % |

Market Size in 2032: |

USD 22.41 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment Mode |

|

||

|

By Picking System |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Warehouse Order Picking Software Market by Type (2018-2032)

4.1 Warehouse Order Picking Software Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Barcode scanning/RFID picking

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Paper-based picking

4.5 Voice-directed picking

4.6 Pick-to-light

Chapter 5: Warehouse Order Picking Software Market by Deployment Mode (2018-2032)

5.1 Warehouse Order Picking Software Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cloud-based

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 On-premise

Chapter 6: Warehouse Order Picking Software Market by Picking System (2018-2032)

6.1 Warehouse Order Picking Software Market Snapshot and Growth Engine

6.2 Market Overview

6.3 wave picking

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 batch picking

6.5 zone picking

Chapter 7: Warehouse Order Picking Software Market by Application (2018-2032)

7.1 Warehouse Order Picking Software Market Snapshot and Growth Engine

7.2 Market Overview

7.3 E-Commerce

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Construction

7.5 Retail

7.6 Transportation & Logistics

7.7 Healthcare

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Warehouse Order Picking Software Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 SABRE (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 SHR WINDSURFER (US)

8.4 GALILEO GDS (US)

8.5 WORLDSPAN GDS. (US)

8.6 CENDYN (US)

8.7 GUESTCENTRIC CRS (US)

8.8 BLUE SKY BOOKING (CANADA)

8.9 AMADEUS (SPAIN)

8.10 FLIGHTSLOGIC (NORWAY)

8.11 VERTICAL BOOKING (ITALY)

8.12 CLOCK SOFTWARE (UK)

8.13 SITEMINDER (AUSTRALIA)

8.14 ANMSOFT (INDIA)

8.15 BIRDRES (INDIA)

8.16 TRAWEX. (INDIA)

8.17 TRAVELOPRO (INDIA)

8.18 WEBCRS (INDIA)

8.19 PROVAB TECHNOSOFT PVT. LTD (INDIA)

8.20 ABACUS (SINGAPORE)

8.21 KIU SYSTEM SOLUTIONS (URUGUAY)

8.22

Chapter 9: Global Warehouse Order Picking Software Market By Region

9.1 Overview

9.2. North America Warehouse Order Picking Software Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Barcode scanning/RFID picking

9.2.4.2 Paper-based picking

9.2.4.3 Voice-directed picking

9.2.4.4 Pick-to-light

9.2.5 Historic and Forecasted Market Size by Deployment Mode

9.2.5.1 Cloud-based

9.2.5.2 On-premise

9.2.6 Historic and Forecasted Market Size by Picking System

9.2.6.1 wave picking

9.2.6.2 batch picking

9.2.6.3 zone picking

9.2.7 Historic and Forecasted Market Size by Application

9.2.7.1 E-Commerce

9.2.7.2 Construction

9.2.7.3 Retail

9.2.7.4 Transportation & Logistics

9.2.7.5 Healthcare

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Warehouse Order Picking Software Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Barcode scanning/RFID picking

9.3.4.2 Paper-based picking

9.3.4.3 Voice-directed picking

9.3.4.4 Pick-to-light

9.3.5 Historic and Forecasted Market Size by Deployment Mode

9.3.5.1 Cloud-based

9.3.5.2 On-premise

9.3.6 Historic and Forecasted Market Size by Picking System

9.3.6.1 wave picking

9.3.6.2 batch picking

9.3.6.3 zone picking

9.3.7 Historic and Forecasted Market Size by Application

9.3.7.1 E-Commerce

9.3.7.2 Construction

9.3.7.3 Retail

9.3.7.4 Transportation & Logistics

9.3.7.5 Healthcare

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Warehouse Order Picking Software Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Barcode scanning/RFID picking

9.4.4.2 Paper-based picking

9.4.4.3 Voice-directed picking

9.4.4.4 Pick-to-light

9.4.5 Historic and Forecasted Market Size by Deployment Mode

9.4.5.1 Cloud-based

9.4.5.2 On-premise

9.4.6 Historic and Forecasted Market Size by Picking System

9.4.6.1 wave picking

9.4.6.2 batch picking

9.4.6.3 zone picking

9.4.7 Historic and Forecasted Market Size by Application

9.4.7.1 E-Commerce

9.4.7.2 Construction

9.4.7.3 Retail

9.4.7.4 Transportation & Logistics

9.4.7.5 Healthcare

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Warehouse Order Picking Software Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Barcode scanning/RFID picking

9.5.4.2 Paper-based picking

9.5.4.3 Voice-directed picking

9.5.4.4 Pick-to-light

9.5.5 Historic and Forecasted Market Size by Deployment Mode

9.5.5.1 Cloud-based

9.5.5.2 On-premise

9.5.6 Historic and Forecasted Market Size by Picking System

9.5.6.1 wave picking

9.5.6.2 batch picking

9.5.6.3 zone picking

9.5.7 Historic and Forecasted Market Size by Application

9.5.7.1 E-Commerce

9.5.7.2 Construction

9.5.7.3 Retail

9.5.7.4 Transportation & Logistics

9.5.7.5 Healthcare

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Warehouse Order Picking Software Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Barcode scanning/RFID picking

9.6.4.2 Paper-based picking

9.6.4.3 Voice-directed picking

9.6.4.4 Pick-to-light

9.6.5 Historic and Forecasted Market Size by Deployment Mode

9.6.5.1 Cloud-based

9.6.5.2 On-premise

9.6.6 Historic and Forecasted Market Size by Picking System

9.6.6.1 wave picking

9.6.6.2 batch picking

9.6.6.3 zone picking

9.6.7 Historic and Forecasted Market Size by Application

9.6.7.1 E-Commerce

9.6.7.2 Construction

9.6.7.3 Retail

9.6.7.4 Transportation & Logistics

9.6.7.5 Healthcare

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Warehouse Order Picking Software Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Barcode scanning/RFID picking

9.7.4.2 Paper-based picking

9.7.4.3 Voice-directed picking

9.7.4.4 Pick-to-light

9.7.5 Historic and Forecasted Market Size by Deployment Mode

9.7.5.1 Cloud-based

9.7.5.2 On-premise

9.7.6 Historic and Forecasted Market Size by Picking System

9.7.6.1 wave picking

9.7.6.2 batch picking

9.7.6.3 zone picking

9.7.7 Historic and Forecasted Market Size by Application

9.7.7.1 E-Commerce

9.7.7.2 Construction

9.7.7.3 Retail

9.7.7.4 Transportation & Logistics

9.7.7.5 Healthcare

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Warehouse Order Picking Software Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 9.96 Bn. |

|

Forecast Period 2025-32 CAGR: |

10.67 % |

Market Size in 2032: |

USD 22.41 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment Mode |

|

||

|

By Picking System |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||