Veterinary Sterilization Container Key Market Highlights

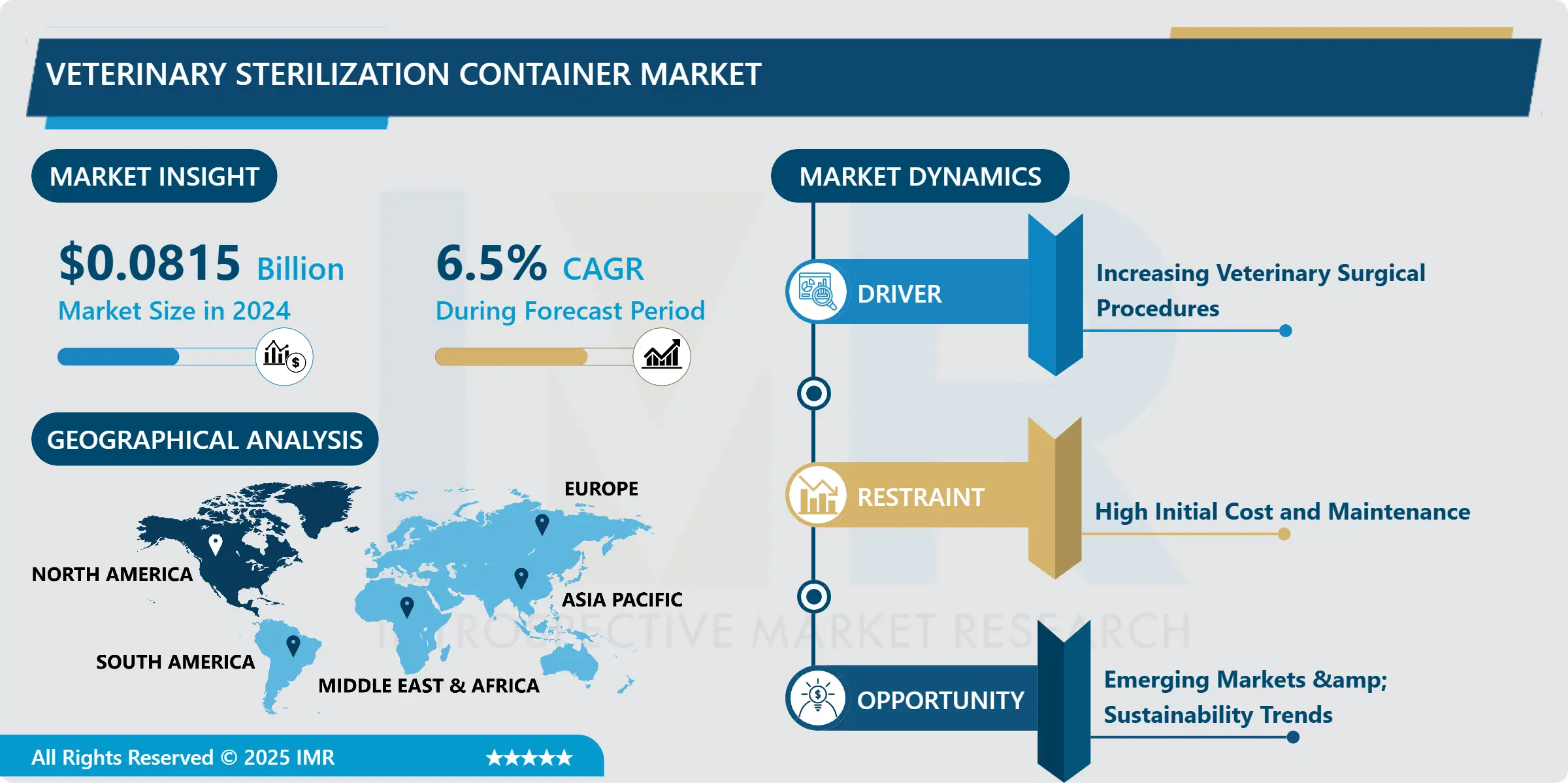

Veterinary Sterilization Container Market Size Was Valued at USD 0.0815 Billion in 2024, and is Projected to Reach USD 0.1642 Billion by 2035, Growing at a CAGR of 6.5% from 2025–2035.

- Market Size in 2024: USD 0.0815 Billion

- Projected Market Size by 2032: USD 0.1642 Billion

- CAGR (2025–2035): 6.5%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia-Pacific

- By Type: The Sterilization containers segment is anticipated to lead the market by accounting for 62-65% of the market share throughout the forecast period.

- By Material: The Aluminium segment is expected to capture 50-52% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 40-45% of the market share during the forecast period.

- Active Players: Ace Medical Company (South Korea), Aesculap, Inc. (part of B. Braun) (Germany/United States), B. Braun Melsungen AG (Germany), Case Medical, Inc. (United States), Dispomed Ltd. (Canada), Other Active Players

Veterinary Sterilization Container Market Synopsis:

The Veterinary Sterilization Container Market refers to the global industry focused on the design, manufacture, distribution, and sale of sterilization containers specifically used in veterinary medicine. These containers are essential tools for ensuring that surgical instruments and medical tools used in veterinary procedures are kept sterile, safe, and ready for reuse.

Veterinary Sterilization Container Market Dynamics and Trend Analysis:

Veterinary Sterilization Container Market Growth Driver - Increasing Veterinary Surgical Procedures

-

In recent years, there has been a noticeable rise in the number of surgeries performed in veterinary clinics and hospitals. This is mainly because more people are keeping pets, and owners are willing to spend more on their animals' health. Not only are pets like dogs and cats getting more attention, but there is also growing care for farm animals like cows, pigs, and horses. As a result, surgeries such as spaying and neutering, tumor removal, and orthopedic treatments are becoming more common in animals.

- With more surgeries being done, the need for safe, sterile tools has also increased. This is where sterilization containers come in. These containers are used to keep surgical instruments clean and free from germs until they are needed. Unlike disposable wraps that are thrown away after each use, sterilization containers can be used again and again, making them a reliable and eco-friendly option.

- There is also growing concern about infections that spread in clinics, especially those caused by drug-resistant bacteria. These infections can be dangerous for both animals and the people who care for them. To reduce the risk, many veterinary practices are improving their hygiene and sterilization methods. This has led to higher demand for sterilization containers, as they are known to provide better protection and cleanliness for surgical tools. In short, more animal surgeries and a focus on cleanliness are pushing the market for veterinary sterilization containers forward.

-

Veterinary Sterilization Container Market Limiting Factor - High Initial Cost and Maintenance

-

One of the main challenges in the veterinary sterilization container market is the high initial cost of the products. Most sterilization containers are made from strong materials like aluminum or stainless steel, which makes them durable and reusable. However, these materials also make the containers expensive to purchase, especially for small clinics or rural veterinary centers that have limited budgets. Buying a full set of containers can be a big investment for such facilities.

- In addition to the purchase cost, there are ongoing maintenance expenses. For example, the containers often have filters that need to be replaced regularly to keep them working properly. They also must be cleaned thoroughly and checked to ensure they are still safe to use. Some containers might not be compatible with all sterilization machines, which can create more issues or require additional equipment.

- Because of these costs, some veterinary clinics still choose to use disposable sterilization wraps. These wraps are cheaper in the short term and easier to use, even though they create more waste and may not be as reliable as containers. Over time, disposable products may end up costing more, but the lower upfront cost makes them more attractive to budget-conscious practices.

- Overall, the high price and maintenance needs of sterilization containers limit their adoption, especially in areas with fewer resources.

Veterinary Sterilization Container Market Expansion Opportunity - Emerging Markets & Sustainability Trends

-

The veterinary sterilization container market is expected to grow quickly in regions like Asia-Pacific and Latin America. These areas are seeing increased government spending on animal healthcare, better veterinary services, and a rise in pet ownership. Many of these countries also depend on farming and livestock, so keeping animals healthy is very important. As more surgeries and medical procedures are performed, the need for safe, sterile tools is rising. This creates a big opportunity for companies to offer sterilization containers in new and growing markets.

- At the same time, there is a global shift toward eco-friendly healthcare products. Many people and clinics want to reduce waste and use more sustainable solutions. Since sterilization containers can be reused many times, they are a better alternative to single-use wraps, which are often thrown away after one use. This makes containers a good option for clinics that care about both the environment and cost savings over time.

- There is also room for technological innovation. Some companies are starting to develop smart sterilization containers that include RFID tags. These can help track which instruments are inside, how often they’re used, and whether they’ve been properly sterilized. This technology can improve safety, efficiency, and record-keeping.

- Altogether, these trends create strong opportunities for growth in both emerging markets and advanced veterinary practices around the world.

Veterinary Sterilization Container Market Challenge and Risk - Regulatory Variability & Sterilization Method Compatibility

-

One of the biggest challenges in the veterinary sterilization container market is the lack of consistent regulations across different countries. Each country may have its own rules for how sterilization should be done and what standards products must meet. This makes it difficult for companies to sell the same product in every market. They often need to adjust their products or packaging, which adds time, cost, and effort to reach new customers.

- Another risk is that sterilization containers need to work with different types of sterilization methods such as steam, plasma, or ethylene oxide gas. If the wrong method is used with the wrong type of container, it can lead to incomplete sterilization. This means that instruments might still carry bacteria or viruses, putting animals at risk during surgery. Mistakes like this could lead to serious health problems, lawsuits, or damage to a clinic’s reputation.

- There’s also a growing issue with counterfeit or poor-quality products, especially in regions where clinics are trying to save money. These low-cost alternatives might not be properly tested or safe to use. If they fail during sterilization or do not protect instruments correctly, they can cause harm to animals and lead to a loss of trust in reliable brands.

- Altogether, these challenges make it important for manufacturers to focus on quality, compliance, and education when entering new or price-sensitive markets.

Veterinary Sterilization Container Market Segment Analysis:

Veterinary Sterilization Container Market is segmented based on Type, Application, End-Users, and Region

By Type, Veterinary Sterilization Container Segment is Expected to Dominate the Market During the Forecast Period

-

Sterilization containers are the main and most important product in the veterinary sterilization container market. These are strong, reusable boxes made from materials like aluminium or stainless steel. They are used to hold and protect surgical tools during the sterilization process and until the tools are ready to be used in surgery.

- Veterinary sterilization containers help keep instruments completely clean and germ-free, which is very important to avoid infections during animal surgeries. These containers are designed with secure lids, filters, and locks so that no bacteria or dust can get inside. They also allow steam or gas to enter during the sterilization process, which kills any harmful microorganisms.

- Compared to disposable wraps, sterilization containers offer many benefits. They are more durable, environmentally friendly, and can be used again and again, which saves money over time. Veterinary hospitals and clinics that perform regular surgeries prefer these containers because they are reliable and easy to organize.

- In recent years, the demand for sterilization containers has grown due to the rise in pet surgeries, better hygiene awareness, and the need to follow health regulations. Some new models even include smart tracking features like RFID tags to help clinics keep records and stay safe.

- In short, sterilization containers are essential tools in modern veterinary care and will continue to be the leading product in this growing market.

By Material, Veterinary Sterilization Container Segment Held the Largest Share in 2024

-

Aluminium is one of the most commonly used materials for making veterinary sterilization containers. In 2025, it is expected to hold around 50–52% of the market share, making it the leading material choice.

- Aluminium is popular because it is both lightweight and resistant to rust (corrosion). This makes it easy for veterinary staff to carry and handle, especially in busy clinics or mobile veterinary units that travel to different locations. It also holds up well to heat and repeated sterilization cycles, which is important for keeping surgical tools safe and clean. The market for aluminium sterilization containers is expected to grow at a steady rate of around 5.7% per year. As more veterinary procedures are performed and more clinics are opened, the demand for durable, reusable containers continues to rise.

- However, there is a new trend in some areas, especially in mobile veterinary services, where clinics are looking for even lighter options. This has led to a gradual shift toward composite materials or polymers that can offer similar benefits but weigh even less. Still, aluminium remains a trusted, cost-effective, and high-performance material, especially in traditional clinics and hospitals that rely on its strength and reliability.

- In summary, aluminium plays a major role in the veterinary sterilization container market and will continue to do so, even as new materials begin to emerge.

Veterinary Sterilization Container Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

-

North America is the largest and most developed market for veterinary sterilization containers. The region, especially the United States, is expected to hold about 45–46% of the global market share in 2025. This strong position is mainly because of the region’s high-quality veterinary services and a growing number of pet owners who are willing to spend more on animal health.

- Many veterinary hospitals and clinics in the U.S. and Canada use advanced medical tools and technologies. They follow strict rules and guidelines for cleaning and sterilizing surgical instruments. These rules help prevent infections and keep animals safe during treatment. Because of these high standards, most clinics prefer using durable, reusable containers made from aluminium or stainless steel instead of disposable wraps.

- Another reason for growth in this region is the availability of pet insurance, which helps more pet owners afford surgeries and treatments. This increases the need for proper sterilization of instruments.

- In addition, many clinics in North America are now adopting smart sterilization containers. These containers may include features like RFID tracking or digital tags, which help staff monitor sterilization cycles and manage tools more efficiently.

- Overall, North America will likely stay the leading region in this market due to its strong veterinary infrastructure, high spending, and early adoption of new technologies.

Veterinary Sterilization Container Market Active Players:

- Ace Medical Company (South Korea)

- Aesculap, Inc. (part of B. Braun) (Germany/United States)

- B. Braun Melsungen AG (Germany)

- Case Medical, Inc. (United States)

- Dispomed Ltd. (Canada)

- DRE Veterinary (Avante Health Solutions) (United States)

- Elcon Medical Instruments (Pakistan)

- Erbrich Instrumente GmbH (Germany)

- Euronda SpA (Italy)

- Fine Science Tools (United States/Canada/Germany)

- Harvard Apparatus (United States)

- Hillrom (part of Baxter International) (United States)

- IM3 Veterinary Dental Company (Australia)

- Integra LifeSciences (United States)

- Jewel Precision (United States)

- KLS Martin Group (Germany)

- Medline Industries, LP (United States)

- Midmark Corporation (United States)

- Movora (Vimian Group AB) (Sweden)

- Narang Medical Limited (India)

- Ritter Medical (Germany)

- Sklar Surgical Instruments (United States)

- SPiTZ Vet Care (Germany)

- SteriGenics International (United States)

- SteriKey (United States)

- Steris Animal Health (United States)

- Symmetry Surgical (United States)

- Tuttnauer (Israel)

- Veterinary Instrumentation (Vi) (United Kingdom)

- Wagner GmbH (Germany)

- Veterinary-Focused & Specialty Suppliers

- Other Active Players

|

Veterinary Sterilization Container Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 0.0815 Billion

|

|

Forecast Period 2025-35 CAGR: |

6.5 % |

Market Size in 2035: |

USD 0.1642 Billion |

|

Segments Covered: |

By Product type |

|

|

|

By Material

|

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Veterinary Sterilization Container Market by Product Type (2018-2035)

4.1 Veterinary Sterilization Container Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Sterilization

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Containers

4.5 Accessories

Chapter 5: Veterinary Sterilization Container Market by Material Type (2018-2035)

5.1 Veterinary Sterilization Container Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Stainless Steel

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Aluminium

5.5 Others

5.6 Plastic

5.7 Biodegradable

5.8 Recyclable

5.9 Paper

Chapter 6: Veterinary Sterilization Container Market by Product Type (2018-2035)

6.1 Veterinary Sterilization Container Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Kitchen Bags

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Trash Bags

6.5 Lawn and Leaf Bags

6.6 Pet Waste Bags

Chapter 7: Veterinary Sterilization Container Market by End-use (2018-2035)

7.1 Veterinary Sterilization Container Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Residential

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Commercial

7.5 Industrial

Chapter 8: Veterinary Sterilization Container Market by Thickness (2018-2035)

8.1 Veterinary Sterilization Container Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Light Duty

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Medium Duty

8.5 Heavy Duty

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Veterinary Sterilization Container Market Share by Manufacturer/Service Provider(2024)

9.1.3 Industry BCG Matrix

9.1.4 PArtnerships, Mergers & Acquisitions

9.2 ACE MEDICAL COMPANY (SOUTH KOREA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Recent News & Developments

9.2.10 SWOT Analysis

9.3 AESCULAP

9.4 INC. (PART OF B. BRAUN) (GERMANY/UNITED STATES)

9.5 B. BRAUN MELSUNGEN AG (GERMANY)

9.6 CASE MEDICAL

9.7 INC. (UNITED STATES)

9.8 DISPOMED LTD. (CANADA)

9.9 DRE VETERINARY (AVANTE HEALTH SOLUTIONS) (UNITED STATES)

9.10 ELCON MEDICAL INSTRUMENTS (PAKISTAN)

9.11 ERBRICH INSTRUMENTE GMBH (GERMANY)

9.12 EURONDA SPA (ITALY)

9.13 FINE SCIENCE TOOLS (UNITED STATES/CANADA/GERMANY)

9.14 HARVARD APPARATUS (UNITED STATES)

9.15 HILLROM (PART OF BAXTER INTERNATIONAL) (UNITED STATES)

9.16 IM3 VETERINARY DENTAL COMPANY (AUSTRALIA)

9.17 INTEGRA LIFESCIENCES (UNITED STATES)

9.18 JEWEL PRECISION (UNITED STATES)

9.19 KLS MARTIN GROUP (GERMANY)

9.20 MEDLINE INDUSTRIES

9.21 LP (UNITED STATES)

9.22 MIDMARK CORPORATION (UNITED STATES)

9.23 MOVORA (VIMIAN GROUP AB) (SWEDEN)

9.24 NARANG MEDICAL LIMITED (INDIA)

9.25 RITTER MEDICAL (GERMANY)

9.26 SKLAR SURGICAL INSTRUMENTS (UNITED STATES)

9.27 SPITZ VET CARE (GERMANY)

9.28 STERIGENICS INTERNATIONAL (UNITED STATES)

9.29 STERIKEY (UNITED STATES)

9.30 STERIS ANIMAL HEALTH (UNITED STATES)

9.31 SYMMETRY SURGICAL (UNITED STATES)

9.32 TUTTNAUER (ISRAEL)

9.33 VETERINARY INSTRUMENTATION (VI) (UNITED KINGDOM)

9.34 WAGNER GMBH (GERMANY)

9.35 VETERINARY-FOCUSED AND SPECIALTY SUPPLIERS

9.36 AND OTHER ACTIVE PLAYERS.

Chapter 10: Global Veterinary Sterilization Container Market By Region

10.1 Overview

10.2. North America Veterinary Sterilization Container Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecast Market Size by Country

10.2.4.1 US

10.2.4.2 Canada

10.2.4.3 Mexico

10.3. Eastern Europe Veterinary Sterilization Container Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecast Market Size by Country

10.3.4.1 Russia

10.3.4.2 Bulgaria

10.3.4.3 The Czech Republic

10.3.4.4 Hungary

10.3.4.5 Poland

10.3.4.6 Romania

10.3.4.7 Rest of Eastern Europe

10.4. Western Europe Veterinary Sterilization Container Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecast Market Size by Country

10.4.4.1 Germany

10.4.4.2 UK

10.4.4.3 France

10.4.4.4 The Netherlands

10.4.4.5 Italy

10.4.4.6 Spain

10.4.4.7 Rest of Western Europe

10.5. Asia Pacific Veterinary Sterilization Container Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecast Market Size by Country

10.5.4.1 China

10.5.4.2 India

10.5.4.3 Japan

10.5.4.4 South Korea

10.5.4.5 Malaysia

10.5.4.6 Thailand

10.5.4.7 Vietnam

10.5.4.8 The Philippines

10.5.4.9 Australia

10.5.4.10 New Zealand

10.5.4.11 Rest of APAC

10.6. Middle East & Africa Veterinary Sterilization Container Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecast Market Size by Country

10.6.4.1 Turkiye

10.6.4.2 Bahrain

10.6.4.3 Kuwait

10.6.4.4 Saudi Arabia

10.6.4.5 Qatar

10.6.4.6 UAE

10.6.4.7 Israel

10.6.4.8 South Africa

10.7. South America Veterinary Sterilization Container Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecast Market Size by Country

10.7.4.1 Brazil

10.7.4.2 Argentina

10.7.4.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

Chapter 12 Our Thematic Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Chapter 13 Case Study

Chapter 14 Appendix

12.1 Sources

12.2 List of Tables and figures

12.3 Short Forms and Citations

12.4 Assumption and Conversion

12.5 Disclaimer

|

Veterinary Sterilization Container Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 0.0815 Billion

|

|

Forecast Period 2025-35 CAGR: |

6.5 % |

Market Size in 2035: |

USD 0.1642 Billion |

|

Segments Covered: |

By Product type |

|

|

|

By Material

|

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||