Veterinary Diagnostic Imaging Market Synopsis:

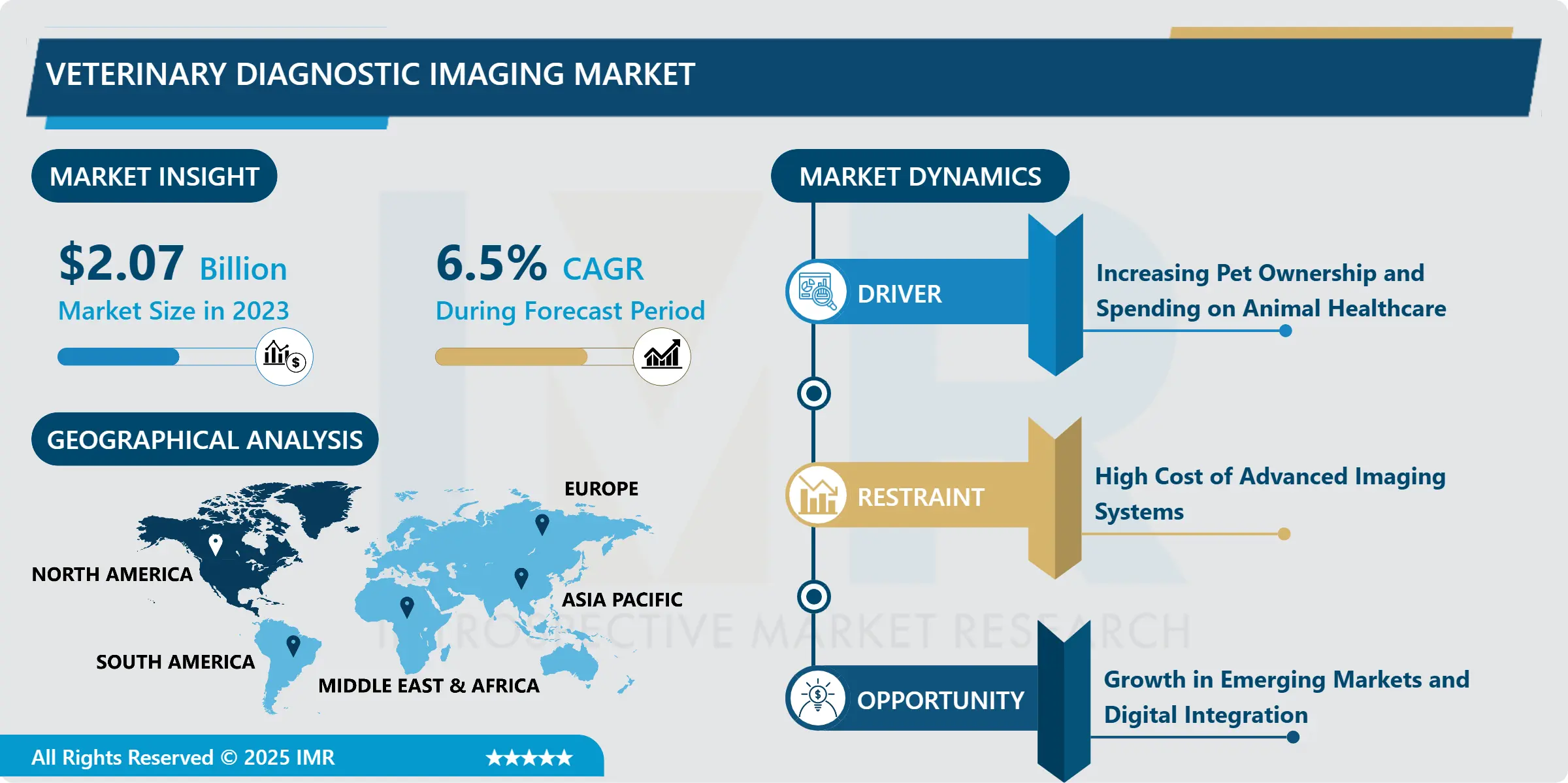

Veterinary Diagnostic Imaging Market Size Was Valued at USD 2.07 Billion in 2023, and is Projected to Reach USD 3.62 Billion by 2032, Growing at a CAGR of 6.5% From 2024-2032.

The Veterinary Diagnostic Imaging Market refers to the creation, manufacturing, and marketing of state-of-art imaging devices, applications, and diagnostic equipment for veterinary use. The mentioned imaging solutions can be applied in analysing, controlling, and managing diseases ailing animals such as our pets, farm animals, and other wildlife. The technologies in this market include ultrasound, X-ray, MRI, and CT scans which help the veterinarians to diagnose ranging from multiple diseases, injuries and internal health conditions that enhances the quality of management in animal health.

The major factors which led to the growth of Veterinary Diagnostic Imaging Market include rising population of pets across the globe, awareness regarding animal health and the need for suitable diagnostic techniques. The small animals are known to be receiving the bulk of food as pet owners seek to enhance their pets’ preventive health care costs while livestock and agriculture industries are realizing the significance of animal health and productivity. These factors have pushed the use of tools for diagnosis such as the ultrasound, radiography and the computed tomography (CT) since it facilitates quicker and accurate diagnose by the veterinarians. There is a particularly high demand for functional imaging in developed regions because veterinary practices are gradually acquiring innovative diagnostic tools. Still, there are great up surges in the developing region contributing to increasing the likelihood of investments in veterinary structure and increasing the expanding systems of cattle.

In addition, the solutions have become more portable, cheap, and easy to use due to progression in technology, meaning that a greater number of veterinary practices and mobile practices can implement the identified solutions. The trend toward using digital imaging, through which more accurate and diverse diagnostic information is obtained, is also among the major growth factors in the market. Because veterinarians use these tools more frequently to provide high-technology diagnostic services, the Veterinary Diagnostic Imaging industry is expected to expand and develop new technology; there will be an increasing need for faster and more accurate diagnostic tools.

Veterinary Diagnostic Imaging Market Trend Analysis:

Rise in Portable and Handheld Diagnostic Imaging Devices

-

Veterinary diagnostic imaging market is a rapidly transforming market that now has a major preference for portable and handheld imaging equipment. Such portable imaging systems include ultrasound and X-ray equipment that can be carried to the animals thus reducing the frequent transfer of the animals to image centers. This mobility is unique for the rural or distant area surgeons where they have to work where they have scarce access to well-equipped clinics. Consequently, since portable devices allow veterinarians to obtain fast and accurate diagnostics, portable devices are now an important tool for decision making in critical cases.

- This is due the need to embrace portable diagnostic equipment’s that are lighter, smaller and are operated by batteries to fit in various situations. They are making sophisticated imaging technologies available across different veterinary practices thus enabling more client veterinarian to deliver complex diagnostic imaging services on site or at a small specialized clinic. With increased portability as the trend for the industry, the Veterinary Diagnostic Imaging Market is expected to expand considerably in the future, with developments targeting more convenient, easier to use and affordable diagnostics creating more opportunities for veterinarians all around the world.

Expansion in Emerging Markets and Telemedicine Integration

-

The latest opportunity being the expansion of Veterinary Diagnostic Imaging in emerging countries such as the Asian, Latin American, the Middle East. These areas, with increasing rates of livestock farming and dog and cat ownership particularly, have benefited from an explosion in the need for veterinary care. Better health consciousness of animals along with the requirement to deal with growing diseases in animals has bolstered the use of innovative diagnostic equipment. Most prominent in areas experiencing urbanization, these clinics are now adopting the very best in imaging equipment in order to help address the increasing needs of the market. Therefore the market being so desperate for better diagnostic procedures that are faster, the veterinary diagnostic imaging market in these regions is likely to expand.

- However, the adoption of telemedicine solutions in veterinary care is progressing even faster, due to which enhancements are needed regarding imaging techniques. Telemedicine is helpful because it enables a veterinarian from a distant or isolated practice to immediately reach out for another opinion from expert practitioners or quickly send diagnostic images. There is particularly great importance, and novelty, in the areas where there are specific veterinary imaging services that cannot always be provided in digital form. The current increase in telemedicine availability and the continually growing need for therapeutics for animals makes this a perfect chance for manufacturers to offer affordable imaging devices suitable for the digital environment. This will not only improve the diagnosis’s ability but also create other revenue streams as even more veterinary practices incorporate these technologies to serve a growing client base.

Veterinary Diagnostic Imaging Market Segment Analysis:

Veterinary Diagnostic Imaging Market Segmented based on Product Type, Application, End User, and Region.

By Product Type, x-ray segment is expected to dominate the market during the forecast period

-

The Veterinary Diagnostic Imaging Market can be analysed based on the type of products available in the market which includes, X-ray systems, ultrasound systems, MRI systems, CT systems, endoscopy systems, and others. X-ray imaging is till date one of the most commonly used techniques that provide fast and inexpensive approaches toward diagnosing bone fractures, infections and some soft tissue disorders. Another popular technique is ultrasound which is employed in the diagnosis of diseases of soft tissues, organs and blood vessels, and used for diagnostics of organs and abdomen in small animals as well as in livestock. MRI and CT scans are gradually being considered due to the high level of image details, therefore they are important for most complicated diagnosis specifically in neuro and musculoskeletal procedures.

- The last segment is endoscopy that entails non-invasive techniques to examine inner reproductive systems in animals, trachea, oesophagus, stomach and intestines among others. Finally, the “others” category also covers newer and advanced technologies that have emerged lately such as optical coherence tomography and nuclear imaging which equip new diagnostic capacities; particularly in complicated and most particularly cases. These imaging techniques help veterinarians detect diseases early and plan appropriate treatments, and as more and more veterinary practices incorporate new technologies into their work, expand the growth and specialization of the market.

By Application, orthopedic segment expected to held the largest share

-

The Veterinary Diagnostic Imaging Market is categorized based on the application areas which include orthopedic and cardiological, neurological, oncological, abdominal, and others. One of the most common usage is fracture diagnosis, joint disorders, and bone diseases in pets and agriculture animals. Cardiological imaging is also important for decisions making on the current status of the heart and blood flow; though ultrasound and X-ray tests are not invasive they are very useful in the diagnosis of heart illness. Neurological imaging is gradually becoming more valuable as veterinarians require more precise diagnostic tools used for diseases of the nervous system including tumours of the brain, epilepsy, and diseases of the spinal cord, which mainly employ MRI and computer tomography for detailed brain and spinal scans.

- Oncology imaging is another area that is experiencing steady growth this is due to the emerging high rate of cancer incidences among animals: CT, MRI and X-ray are used to diagnose and monitor tumours in different animals. Ultrasonic and X-ray scanning of the abdominal organs, such as the liver, kidneys and intestines is routinely done to determine the cause of pain or discomfort in the abdomen and digestive tracts. The rest of the cases are grouped in the “others.” This group is the least populated of all of the categories of applications; however, it comprises reproductive imaging for animals in term of breeding and pregnancy, as well as dermal imaging for diagnosing skin diseases or tumour. With the continued growth of veterinary diagnostic imaging, these various uses further improve veterinarians’ capacity to diagnose and treat various ailments thereby fuelling the growth of the market.

Veterinary Diagnostic Imaging Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America continues to be the largest market for Veterinary Diagnostic Imaging Market in 2023 owing to factors such as; high incidence of pet ownership, well-developed veterinary healthcare services, and availability of leading diagnostic imaging technologies. Especially, the United States has the market share of 35 % of the entire world; this is due to high disposable income levels, having good healthcare’s facilities and increased need of advanced diagnostic equipment in the country. There is well established veterinary care network in this region that helps quick adoption of advanced imaging technologies that help veterinarians in diagnosing various health disorders in animals. To improve the standards of animal healthcare organizations have worked to increase the demand for imaging equipment and thus making North America the largest and most profitable market for veterinary diagnostic equipment.

- Besides that, constant technological advancements in imaging and simple and inexpensive friendly policies of the government also support fragmented specialization of North America. Pets has become valued more and as people take them for yearly check-ups the need for enhanced equipment to help diagnose diseases early has grown rapidly. Therefore, there will be continuous need for better imaging equipment as pet owners and veterinaries seek ways of preventing diseases instead of treating them. Hence, North America will most probably continue to dominate the Veterinary Diagnostic Imaging Market, owing to ongoing innovations in technology, as well as the constant funding for pet care, including diagnostic imaging tools.

Active Key Players in the Veterinary Diagnostic Imaging Market:

-

Agfa-Gevaert N.V. (Belgium)

- Carestream Health, Inc. (United States)

- Clarius Mobile Health Corp. (Canada)

- Fujifilm Holdings Corporation (Japan)

- GE Healthcare (United States)

- Hallmarq Veterinary Imaging Ltd. (United Kingdom)

- IDEXX Laboratories, Inc. (United States)

- IMV Technologies Group (France)

- Koninklijke Philips N.V. (Netherlands)

- MinXray, Inc. (United States)

- Samsung Medison Co., Ltd. (South Korea)

- Siemens Healthiness AG (Germany)

- Other Active Players

|

Global Veterinary Diagnostic Imaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.07 Billion |

|

Forecast Period 2024-32 CAGR: |

6.5 % |

Market Size in 2032: |

USD 3.62 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Animal Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Veterinary Diagnostic Imaging Market by Product Type

4.1 Veterinary Diagnostic Imaging Market Snapshot and Growth Engine

4.2 Veterinary Diagnostic Imaging Market Overview

4.3 X-ray

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 X-ray: Geographic Segmentation Analysis

4.4 Ultrasound

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Ultrasound: Geographic Segmentation Analysis

4.5 MRI (Magnetic Resonance Imaging)

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 MRI (Magnetic Resonance Imaging): Geographic Segmentation Analysis

4.6 CT (Computed Tomography)

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 CT (Computed Tomography): Geographic Segmentation Analysis

4.7 Endoscopy

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Endoscopy: Geographic Segmentation Analysis

4.8 Others (e.g.

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Others (e.g.: Geographic Segmentation Analysis

4.9 optical coherence tomography

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 optical coherence tomography: Geographic Segmentation Analysis

4.10 nuclear imaging))

4.10.1 Introduction and Market Overview

4.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.10.3 Key Market Trends, Growth Factors and Opportunities

4.10.4 nuclear imaging)): Geographic Segmentation Analysis

4.11

4.11.1 Introduction and Market Overview

4.11.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.11.3 Key Market Trends, Growth Factors and Opportunities

4.11.4 : Geographic Segmentation Analysis

Chapter 5: Veterinary Diagnostic Imaging Market by Application

5.1 Veterinary Diagnostic Imaging Market Snapshot and Growth Engine

5.2 Veterinary Diagnostic Imaging Market Overview

5.3 Orthopedic

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Orthopedic: Geographic Segmentation Analysis

5.4 Cardiological

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Cardiological: Geographic Segmentation Analysis

5.5 Neurological

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Neurological: Geographic Segmentation Analysis

5.6 Oncology

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Oncology: Geographic Segmentation Analysis

5.7 Abdominal Imaging

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Abdominal Imaging: Geographic Segmentation Analysis

5.8 Others (e.g.

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Others (e.g.: Geographic Segmentation Analysis

5.9 reproductive

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 reproductive: Geographic Segmentation Analysis

5.10 dermatological))

5.10.1 Introduction and Market Overview

5.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.10.3 Key Market Trends, Growth Factors and Opportunities

5.10.4 dermatological)): Geographic Segmentation Analysis

5.11

5.11.1 Introduction and Market Overview

5.11.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.11.3 Key Market Trends, Growth Factors and Opportunities

5.11.4 : Geographic Segmentation Analysis

Chapter 6: Veterinary Diagnostic Imaging Market by End User

6.1 Veterinary Diagnostic Imaging Market Snapshot and Growth Engine

6.2 Veterinary Diagnostic Imaging Market Overview

6.3 Veterinary Clinics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Veterinary Clinics: Geographic Segmentation Analysis

6.4 Animal Hospitals

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Animal Hospitals: Geographic Segmentation Analysis

6.5 Research Institutes

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Research Institutes: Geographic Segmentation Analysis

6.6 Diagnostic Laboratories)

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Diagnostic Laboratories) : Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Veterinary Diagnostic Imaging Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 IDEXX LABORATORIES INC.

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 GE HEALTHCARE

7.4 SAMSUNG MEDISON CO. LTD.

7.5 FUJIFILM HOLDINGS CORPORATION

7.6 AND ESAOTE S.P.A

7.7 OTHER ACTIVE PLAYERS

Chapter 8: Global Veterinary Diagnostic Imaging Market By Region

8.1 Overview

8.2. North America Veterinary Diagnostic Imaging Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product Type

8.2.4.1 X-ray

8.2.4.2 Ultrasound

8.2.4.3 MRI (Magnetic Resonance Imaging)

8.2.4.4 CT (Computed Tomography)

8.2.4.5 Endoscopy

8.2.4.6 Others (e.g.

8.2.4.7 optical coherence tomography

8.2.4.8 nuclear imaging))

8.2.4.9

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Orthopedic

8.2.5.2 Cardiological

8.2.5.3 Neurological

8.2.5.4 Oncology

8.2.5.5 Abdominal Imaging

8.2.5.6 Others (e.g.

8.2.5.7 reproductive

8.2.5.8 dermatological))

8.2.5.9

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Veterinary Clinics

8.2.6.2 Animal Hospitals

8.2.6.3 Research Institutes

8.2.6.4 Diagnostic Laboratories)

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Veterinary Diagnostic Imaging Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product Type

8.3.4.1 X-ray

8.3.4.2 Ultrasound

8.3.4.3 MRI (Magnetic Resonance Imaging)

8.3.4.4 CT (Computed Tomography)

8.3.4.5 Endoscopy

8.3.4.6 Others (e.g.

8.3.4.7 optical coherence tomography

8.3.4.8 nuclear imaging))

8.3.4.9

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Orthopedic

8.3.5.2 Cardiological

8.3.5.3 Neurological

8.3.5.4 Oncology

8.3.5.5 Abdominal Imaging

8.3.5.6 Others (e.g.

8.3.5.7 reproductive

8.3.5.8 dermatological))

8.3.5.9

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Veterinary Clinics

8.3.6.2 Animal Hospitals

8.3.6.3 Research Institutes

8.3.6.4 Diagnostic Laboratories)

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Veterinary Diagnostic Imaging Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product Type

8.4.4.1 X-ray

8.4.4.2 Ultrasound

8.4.4.3 MRI (Magnetic Resonance Imaging)

8.4.4.4 CT (Computed Tomography)

8.4.4.5 Endoscopy

8.4.4.6 Others (e.g.

8.4.4.7 optical coherence tomography

8.4.4.8 nuclear imaging))

8.4.4.9

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Orthopedic

8.4.5.2 Cardiological

8.4.5.3 Neurological

8.4.5.4 Oncology

8.4.5.5 Abdominal Imaging

8.4.5.6 Others (e.g.

8.4.5.7 reproductive

8.4.5.8 dermatological))

8.4.5.9

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Veterinary Clinics

8.4.6.2 Animal Hospitals

8.4.6.3 Research Institutes

8.4.6.4 Diagnostic Laboratories)

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Veterinary Diagnostic Imaging Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product Type

8.5.4.1 X-ray

8.5.4.2 Ultrasound

8.5.4.3 MRI (Magnetic Resonance Imaging)

8.5.4.4 CT (Computed Tomography)

8.5.4.5 Endoscopy

8.5.4.6 Others (e.g.

8.5.4.7 optical coherence tomography

8.5.4.8 nuclear imaging))

8.5.4.9

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Orthopedic

8.5.5.2 Cardiological

8.5.5.3 Neurological

8.5.5.4 Oncology

8.5.5.5 Abdominal Imaging

8.5.5.6 Others (e.g.

8.5.5.7 reproductive

8.5.5.8 dermatological))

8.5.5.9

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Veterinary Clinics

8.5.6.2 Animal Hospitals

8.5.6.3 Research Institutes

8.5.6.4 Diagnostic Laboratories)

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Veterinary Diagnostic Imaging Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product Type

8.6.4.1 X-ray

8.6.4.2 Ultrasound

8.6.4.3 MRI (Magnetic Resonance Imaging)

8.6.4.4 CT (Computed Tomography)

8.6.4.5 Endoscopy

8.6.4.6 Others (e.g.

8.6.4.7 optical coherence tomography

8.6.4.8 nuclear imaging))

8.6.4.9

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Orthopedic

8.6.5.2 Cardiological

8.6.5.3 Neurological

8.6.5.4 Oncology

8.6.5.5 Abdominal Imaging

8.6.5.6 Others (e.g.

8.6.5.7 reproductive

8.6.5.8 dermatological))

8.6.5.9

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Veterinary Clinics

8.6.6.2 Animal Hospitals

8.6.6.3 Research Institutes

8.6.6.4 Diagnostic Laboratories)

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Veterinary Diagnostic Imaging Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product Type

8.7.4.1 X-ray

8.7.4.2 Ultrasound

8.7.4.3 MRI (Magnetic Resonance Imaging)

8.7.4.4 CT (Computed Tomography)

8.7.4.5 Endoscopy

8.7.4.6 Others (e.g.

8.7.4.7 optical coherence tomography

8.7.4.8 nuclear imaging))

8.7.4.9

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Orthopedic

8.7.5.2 Cardiological

8.7.5.3 Neurological

8.7.5.4 Oncology

8.7.5.5 Abdominal Imaging

8.7.5.6 Others (e.g.

8.7.5.7 reproductive

8.7.5.8 dermatological))

8.7.5.9

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Veterinary Clinics

8.7.6.2 Animal Hospitals

8.7.6.3 Research Institutes

8.7.6.4 Diagnostic Laboratories)

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Veterinary Diagnostic Imaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.07 Billion |

|

Forecast Period 2024-32 CAGR: |

6.5 % |

Market Size in 2032: |

USD 3.62 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Animal Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||