Global Unattended Ground Sensors Market Overview

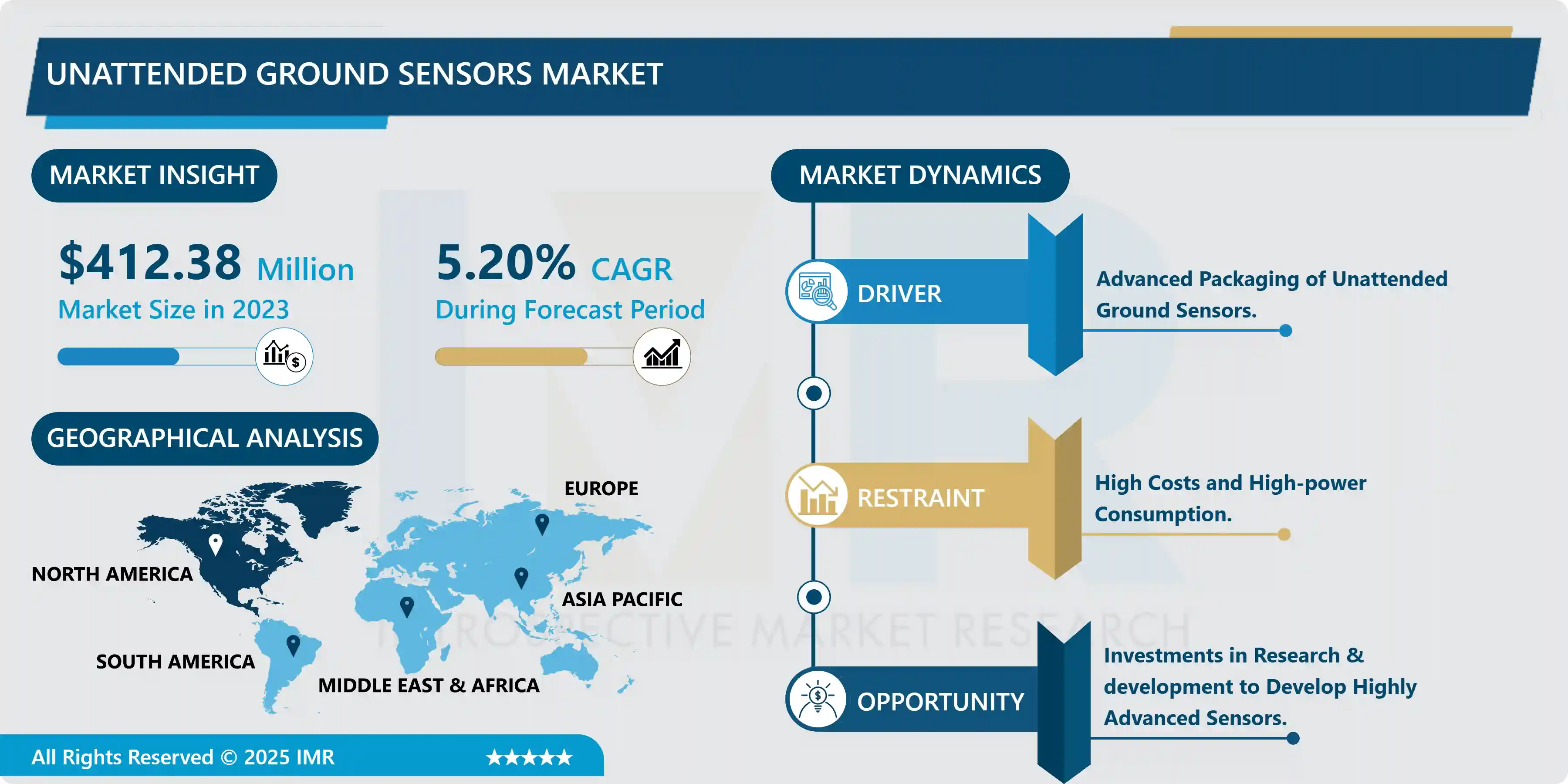

Unattended Ground Sensors Market Size Was Valued at USD 412.38 million in 2023, and is Projected to Reach USD 650.79 million by 2032, Growing at a CAGR of 5.20% From 2024-2032.

Unattended Ground Sensors (UGS) are compact, covert devices designed to detect, monitor, and identify activities on the ground, such as the movement of vehicles and individuals. They are typically equipped with seismic sensors and can automatically collect data, interpret it, and transmit it to a receiver. Key features often include rechargeable batteries, radio communication, GPS receivers, and anti-tamper alarms. UGS can be integrated into broader systems with processing capabilities and communication networks, and can also interface with alarm panels or other third-party systems for enhanced monitoring and alerting.

The global Unattended Ground Sensors (UGS) market is experiencing significant growth, propelled by rising needs for advanced security and monitoring solutions across multiple sectors. UGS are increasingly utilized for various applications including perimeter defense, industrial monitoring, and military intelligence gathering. They offer a cost-effective and efficient way to monitor borders, pipelines, and secure facilities, as well as provide remote sensing in industrial settings and support tactical operations in military contexts.

Technological advancements are a major driver of market expansion, with modern UGS offering improved data collection, processing, and communication capabilities. The integration of features like rechargeable batteries, radios, GPS receivers, and anti-tamper alarms enhances their functionality and reliability. These sensors are often part of larger systems, linked to processing units and communication networks, which can be connected to alarm panels and other third-party systems for comprehensive surveillance.

Geographically, North America and Europe are leading markets due to substantial defense investments and industrial applications. Meanwhile, regions like Asia-Pacific and the Middle East are emerging as important markets, driven by increased security concerns and industrial growth. The market is expected to continue evolving with further innovations in sensor technology, expanding its role in modern surveillance and defense strategies.

Market Dynamics and Key Factors in Unattended Ground Sensors Market:

Drivers:

- Unattended ground sensors perform various functions such as detection of the remote target, border patrol, perimeter defense, surveillance, and situational awareness. Moreover, the unattended ground sensors are small in size, robust, and are expected to last for longer periods in the field after deployment. Additionally, they are capable of transmitting target details to a remote operator. Unattended ground sensors are designed to locally analyze the information of the target, including detection, tracking, classification, and identification. In addition, they are also utilized for reporting battle damage assessment (BDA) in standoff strike scenarios thus, stimulating the expansion of the unattended ground sensors market during the forecast period.

- Furthermore, advanced packaging of unattended ground sensors, in addition to self-location and alignment of sensors, greatly increases their performance potential for deployment. Sensor fusion facility at the device level greatly boosts the probability of detection and probability of correct identification of target over range. A network of unattended ground sensors that utilizes multiple sensor technologies can precisely identify and locate battlefield targets. In addition, they can perform valuable BDA by monitoring activities before and after each attack thus encouraging the development of unattended ground sensors market in the forecast period.

- Countries such as India, the United States, and China are increasing the usage of unattended ground sensors to monitor harsh environmental locations and to prevent trespassing on border lines. The U.S military has deployed tens of thousands of unattended ground sensors around Afghanistan and Iraq, forming electronic perimeters around combat outposts and keeping regular checks on remote locations. With the usage of these devices, military personnel can monitor the largest possible area with the smallest number of troops thus, propelling the growth of the market throughout the forecast.

Restraints:

- Unattended ground sensors can be deployed in a given environment by many different techniques. Miniaturization and cost reduction of components is the main priority, to facilitate packaging of unattended ground sensors into artillery projectiles, large deployment from an airborne platform or a launched canister, or hand placement. Artillery and air deployment requires the electronics incorporated in unattended ground sensors to be highly robust, shock-resistant, and weatherproof, if it doesn't satisfy the mentioned qualities, then deployment of unattended ground sensors may not be as great as expected thus, hampering the expansion of unattended ground sensors market during the forecast period.

- Typical unattended ground sensors have limited ranges of identification and detection. Additionally, these limitations are attributed to noise in the background or weather and diurnal changes. Moreover, to assure continuous monitoring of detected targets, customer needs to deploy multiple unattended ground sensors devices in the vicinity of one another thus, increasing the cost of installation. The high-power consumption and the high cost involved in maintenance are some vital factors restricting the wide usage of unattended ground sensors. Furthermore, to deploy these devices there is a need for professionals as setting up unattended ground sensors is complicated, and a single blunder can affect the functionality of the device thus, restricting the development of unattended ground sensors market in the forecast period.

Opportunities:

- The demand for an increase in the operational life of the unattended ground sensors is stimulating market players to invest in research and development activities to develop highly advanced sensors. Moreover, managing power efficiently in sensors can extend the life expectancy of unattended ground sensors beyond that of normal continuous operation. For instance, the electronics can be designed to monitor the environment for every few seconds which will require minimum power and once a target has been spotted, the unattended ground sensors could power themselves up for normal real-time surveillance operations thus, offering opportunities for the market players.

Market Segmentation

Segmentation of Unattended Ground Sensors Market:

- Depending on sensor type, a seismic segment is expected to lead the unattended ground sensors market in the forecast period. Seismic unattended ground sensors and processing units can be buried completely underground, making them undetectable to intruders while keeping the environment intact. Moreover, seismic devices are impenetrable and cannot be climbed over or sabotaged without triggering a threat signal thus, driving the expansion of this segment. The seismic segment is expected to reach US$ 180.2 million by the end of the forecast period.

- Depending on deployment mode, the manual segment is predicted to dominate the market during the forecast period. Deploying unattended ground sensors manually helps the user in adjusting the sensor devices according to the need. Manual deployment of sensors meets all the requirements of the customers such as coverage, connectivity, and lifetime expectancy of the equipment thus, strengthening the manual deployment of unattended ground sensors.

- Depending on end-users, the security segment is forecasted to lead the expansion of the unattended ground sensors market throughout the forecast period. With the growing need to secure international borders and to prevent trespassing, several governments are deploying unattended ground sensors across international borders. Moreover, in wartime to have battlefield transparency on the military activities of the enemy troops these sensors are state-of-the-art innovations. The growing expenditure on the military and defense sectors is the main factor propelling the development of this segment.

Regional Analysis of Unattended Ground Sensors Market:

- The North American region is anticipated to have the highest share of the unattended ground sensors market during the forecast period. The United States of America and Canada are the two major countries that play a prominent role in driving the growth of the market in this region. The USA's expenditure on military activities is the most by any country. The USA has allotted US$ 778 Billion for the defense sector in 2021, and Canada has allocated nearly US$ 23 Billion in the same fiscal year thus, stimulating the expansion of the market in this region.

- The European region is forecasted to have the second-highest share of the unattended ground sensors market in the forecast period. Countries such as the UK, France, Germany, and Italy are the main contributors that are developing the market in this region as these countries spend most on the research and development activities for military and warfare. The rise in the terrorists' activities and illegal migration has compelled the countries in this region to opt for more advanced technologies such as seismic unattended ground sensors to prevent these illegal activities. Moreover, countries such as the UK, Germany, France, and Italy disbursed 59.2, 52.8, 52.7, and 28.9 (all figures in US$) billion respectively for defense activities, therefore, strengthening the development of unattended ground sensors market throughout the forecast.

- The Asia-Pacific region is anticipated to grow at the highest significant growth rate during the forecast period. The growing demand for upgraded devices to safeguard the international boundaries without risking the lives of human sources is the essential cause fueling the growth of the unattended ground sensors market in this region. China, followed by India, are the prominent consumers of unattended ground sensors attributed to the rising terrorists' activities and the border disputes.

Players Covered in Unattended Ground Sensors Market are :

- Applied Research Associate Inc.

- Cobham PLC

- Raytheon Company

- Domo Tactical Communications (DTC)

- Leonardo SpA

- McQ Inc.

- Elbit Systems Ltd.

- L3 Technologies Inc.

- Prust Holding BV

- Northrop Grumman Corporation

- Textron Systems

- Thales Group

- Lockheed Martin Corporation

- BERTIN INSTRUMENTS

- Exensor Technology AB

- BAE Systems

- DRS Technologies Inc.

- SAAB AB

- QinetiQ Group

- General Dynamics Mission Systems

- Harris Corporation and other major players.

Key Industry Developments in Unattended Ground Sensors Market:

- In April 2024, Applied Research Associates, Inc. (ARA) announced the launch of Pathfinder on the Tactical Assault Kit (TAK). Pathfinder, a wireless unattended ground sensor, was designed to offer early warnings of trespassing. The integration with TAK included an enhanced user interface (UI), simplifying the placement and management of sensors globally. Pathfinder was showcased alongside other ARA technologies at FIDAE 2024 in Santiago, Chile,

- In January 2024, EPE Trusted to Protect, in collaboration with Bertin Exensor, was awarded a contract by the New Zealand Ministry of Defence. EPE delivered the Flexnet Unattended Ground Sensor (UGS) system, designed by Bertin Exensor, to enhance the New Zealand Defence Force's (NZDF) Reconnaissance and Surveillance (R&S) capabilities under the Networked Enabled Army (NEA) Programme. The contract provided the New Zealand Army personnel with a scalable, modular sensing platform that offered real-time situational awareness, early warning, and threat identification. This system enhanced commanders’ ability to make informed, rapid decisions and take necessary actions. EPE also delivered local specialist training and ongoing support.

|

Global Unattended Ground Sensors Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 412.38 Mn. |

|

Forecast Period 2023-32 CAGR: |

5.20% |

Market Size in 2032: |

USD 650.79Mn. |

|

Segments Covered: |

By Sensor Type |

|

|

|

By Deployment Model |

|

||

|

By End-users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Unattended Ground Sensors Market by Sensor (2018-2032)

4.1 Unattended Ground Sensors Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Type

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Seismic

4.5 Acoustic

4.6 Magnetic

4.7 Infrared

Chapter 5: Unattended Ground Sensors Market by Deployment (2018-2032)

5.1 Unattended Ground Sensors Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Model

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Manually

5.5 Air-delivered

Chapter 6: Unattended Ground Sensors Market by End-users (2018-2032)

6.1 Unattended Ground Sensors Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Security

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Public

6.5 Military

6.6 Critical Infrastructure

6.7 Industrial

6.8 Commercial

6.9 Other Facilities

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Unattended Ground Sensors Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 L'ORÉAL S.A. (FRANCE)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 KAO CORPORATION (JAPAN)

7.4 HENKEL AG & CO. KGAA (GERMANY)

7.5 REVLON INC. (US)

7.6 COTY INC. (UK)

7.7 ESTÉE LAUDER COMPANIES INC. (US)

7.8 COMBE INCORPORATED (US)

7.9 HOYU CO. LTD (JAPAN)

7.10 GODREJ CONSUMER PRODUCTS LIMITED (INDIA)

7.11 DAVINES S.P.A. (ITALY)

7.12 AND OTHERS KEY PLAYERS.

Chapter 8: Global Unattended Ground Sensors Market By Region

8.1 Overview

8.2. North America Unattended Ground Sensors Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Sensor

8.2.4.1 Type

8.2.4.2 Seismic

8.2.4.3 Acoustic

8.2.4.4 Magnetic

8.2.4.5 Infrared

8.2.5 Historic and Forecasted Market Size by Deployment

8.2.5.1 Model

8.2.5.2 Manually

8.2.5.3 Air-delivered

8.2.6 Historic and Forecasted Market Size by End-users

8.2.6.1 Security

8.2.6.2 Public

8.2.6.3 Military

8.2.6.4 Critical Infrastructure

8.2.6.5 Industrial

8.2.6.6 Commercial

8.2.6.7 Other Facilities

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Unattended Ground Sensors Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Sensor

8.3.4.1 Type

8.3.4.2 Seismic

8.3.4.3 Acoustic

8.3.4.4 Magnetic

8.3.4.5 Infrared

8.3.5 Historic and Forecasted Market Size by Deployment

8.3.5.1 Model

8.3.5.2 Manually

8.3.5.3 Air-delivered

8.3.6 Historic and Forecasted Market Size by End-users

8.3.6.1 Security

8.3.6.2 Public

8.3.6.3 Military

8.3.6.4 Critical Infrastructure

8.3.6.5 Industrial

8.3.6.6 Commercial

8.3.6.7 Other Facilities

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Unattended Ground Sensors Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Sensor

8.4.4.1 Type

8.4.4.2 Seismic

8.4.4.3 Acoustic

8.4.4.4 Magnetic

8.4.4.5 Infrared

8.4.5 Historic and Forecasted Market Size by Deployment

8.4.5.1 Model

8.4.5.2 Manually

8.4.5.3 Air-delivered

8.4.6 Historic and Forecasted Market Size by End-users

8.4.6.1 Security

8.4.6.2 Public

8.4.6.3 Military

8.4.6.4 Critical Infrastructure

8.4.6.5 Industrial

8.4.6.6 Commercial

8.4.6.7 Other Facilities

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Unattended Ground Sensors Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Sensor

8.5.4.1 Type

8.5.4.2 Seismic

8.5.4.3 Acoustic

8.5.4.4 Magnetic

8.5.4.5 Infrared

8.5.5 Historic and Forecasted Market Size by Deployment

8.5.5.1 Model

8.5.5.2 Manually

8.5.5.3 Air-delivered

8.5.6 Historic and Forecasted Market Size by End-users

8.5.6.1 Security

8.5.6.2 Public

8.5.6.3 Military

8.5.6.4 Critical Infrastructure

8.5.6.5 Industrial

8.5.6.6 Commercial

8.5.6.7 Other Facilities

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Unattended Ground Sensors Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Sensor

8.6.4.1 Type

8.6.4.2 Seismic

8.6.4.3 Acoustic

8.6.4.4 Magnetic

8.6.4.5 Infrared

8.6.5 Historic and Forecasted Market Size by Deployment

8.6.5.1 Model

8.6.5.2 Manually

8.6.5.3 Air-delivered

8.6.6 Historic and Forecasted Market Size by End-users

8.6.6.1 Security

8.6.6.2 Public

8.6.6.3 Military

8.6.6.4 Critical Infrastructure

8.6.6.5 Industrial

8.6.6.6 Commercial

8.6.6.7 Other Facilities

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Unattended Ground Sensors Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Sensor

8.7.4.1 Type

8.7.4.2 Seismic

8.7.4.3 Acoustic

8.7.4.4 Magnetic

8.7.4.5 Infrared

8.7.5 Historic and Forecasted Market Size by Deployment

8.7.5.1 Model

8.7.5.2 Manually

8.7.5.3 Air-delivered

8.7.6 Historic and Forecasted Market Size by End-users

8.7.6.1 Security

8.7.6.2 Public

8.7.6.3 Military

8.7.6.4 Critical Infrastructure

8.7.6.5 Industrial

8.7.6.6 Commercial

8.7.6.7 Other Facilities

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Unattended Ground Sensors Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 412.38 Mn. |

|

Forecast Period 2023-32 CAGR: |

5.20% |

Market Size in 2032: |

USD 650.79Mn. |

|

Segments Covered: |

By Sensor Type |

|

|

|

By Deployment Model |

|

||

|

By End-users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||