Tuberculosis Drugs Market Synopsis:

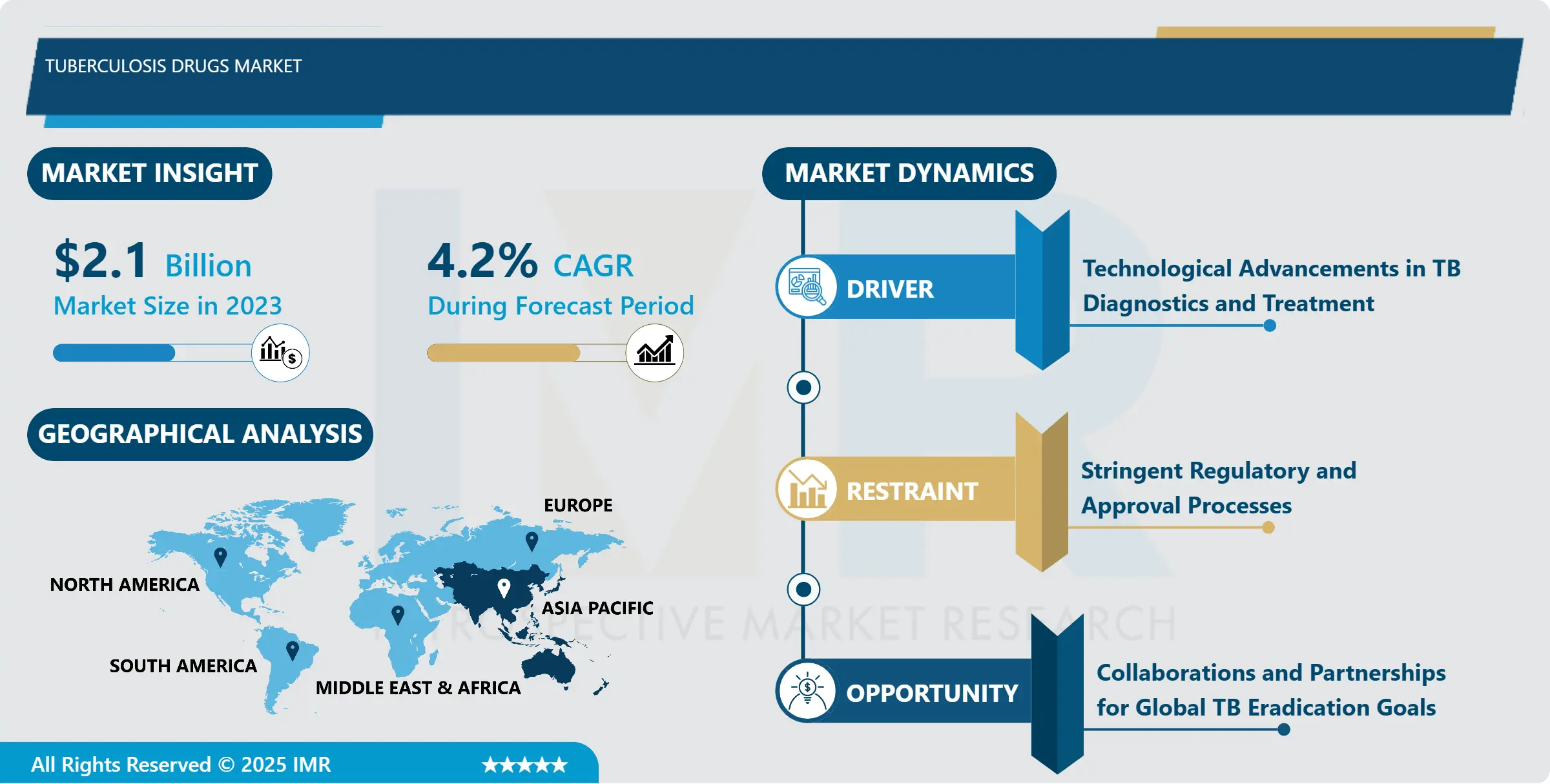

Tuberculosis Drugs Market Size Was Valued at USD 2.10 Billion in 2023, and is Projected to Reach USD 3.04 Billion by 2032, Growing at a CAGR of 4.20% From 2024-2032.

Tuberculosis Drugs Market means the worldwide industry of discovering, manufacturing, and selling anti-TB drugs which are used to heal tuberculosis, a bacterium disease caused by Mycobacterium tuberculosis. The market includes first-line therapy for new TB patients and second-line drugs for multi-drug-resistant TB patients and includes both active and latent TB states in different care settings.

The increasing number of tubercular patients globally is another factor that also fuels market growth. Preliminary WHO data revealed that TB ranks among the leading killers today and millions of people are falling ill with it every year, especially in the developing nations. This burden insists on progressive enhancement in therapeutic strategies as well as effective drug development portfolios for both normal and DR TB illnesses.

National and global entities are pursuing approaches for the prevention of TB including the WHO’s End TB Strategy. A) Organized funding, grants and awareness programs are pushing research and a enable access to cheap AFFORDABLE drugs. There is also evidence that health care cost is on the rise in most of the emerging markets especially in the Asian and African regions where; the accessibility Esz is getting improved towards the tuberculosis treatment Market.

Tuberculosis Drugs Market Trend Analysis:

Integration of Technology in TB Management

-

The increasing incidence of multidrug resistant (MDR) TB and extensively drug resistant (XDR) TB is affecting the strategic profile of this market. They are preparing second-line drugs and combination therapies as a result of high resistance in some drugs by HIV patients. New drug formulations and faster acting substances are coming into the discussion to address the resistant strains needs.

- Bionic solutions applied for patient management, for example digital adherence monitor and AI-supported diagnosis of TB, are already changing the field. Smart garments, applications for mobile devices and telemedicine have become effective tools to monitor compliance with treatment regimens and are effective in rural settings. Besides, it is improving tuberculosis treatment effectiveness and opening new opportunities for new market entrants.

Development of Novel Therapies

-

The level of investment in healthcare infrastructure in the emerging economies especially in Asia and Africa region remain a good growth opportunity. Better availability of diagnostic facilities and drug, and government payer-led activities targeting TB are the key unexplored opportunities. Pharmaceutical companies that are serving the cheaper locally manufactured treatments are well positioned to capture these markets.

- As highlighted in the findings above, TB presents the market with good prospects for the emergence of new therapeutic strategies. Several new products, such as short-course regimens, FDCs and vaccines, are helping to meet these needs. Current clinical trials for MDR and latent TB hold the key to the future growth and diversification of the key players operating in the market.

Tuberculosis Drugs Market Segment Analysis:

Tuberculosis Drugs Market Segmented on the basis of Drug Class, Disease Type, End-User, and Region.

By Drug Class, First-line Anti-Tuberculosis Drugs segment is expected to dominate the market during the forecast period

-

The tuberculosis (TB) treatment market is segmented into first-line and second-line anti-tuberculosis drugs. First-line drugs, including isoniazid, rifampicin, pyrazinamide, and ethambutol, are typically prescribed for newly diagnosed TB patients. These medications are the standard for treating drug-sensitive TB and are effective in the early stages of infection. In contrast, second-line drugs such as fluoroquinolones and injectable agents like kanamycin are used to treat drug-resistant TB, particularly multi-drug-resistant (MDR-TB) and extensively drug-resistant (XDR-TB) cases. These drugs are more potent but come with more side effects and longer treatment durations. The availability of both first-line and second-line therapies ensures comprehensive management across different levels of TB infection, resistance, and disease complexity.

By Disease Type, Active Tuberculosis segment expected to held the largest share

-

By disease type, active tuberculosis holds the largest share of the anti-tuberculosis drug market. This is due to the urgent need for treatment in symptomatic patients to control the spread of Mycobacterium tuberculosis, which is transmitted through the air. Active TB often requires immediate and prolonged therapy to ensure both cure and containment. Conversely, latent TB, where the bacteria remain dormant in the body without causing symptoms, is gaining attention for preventive treatment, especially among high-risk populations such as immunocompromised individuals. Rising global awareness and public health policies aimed at TB eradication are also contributing to increased detection and treatment of latent TB, further expanding the market’s therapeutic scope.

Tuberculosis Drugs Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

-

The tuberculosis drugs market of Asia Pacific region has the largest market share, owing to high incidence of disease and number of reported cases of tuberculosis each year. Current global TB incidence is distributed with higher rates seen in countries within the Indian Subcontinent including India, China, Indonesia and others. Socioeconomic factors as well as centralized population significantly dictate the market’s growth into the region.

- Tuberculosis elimination strategies and enhancing drug access through strengthened healthcare systems – Asian Pacific countries are leading this approach. Finally, domestic production sigma-towns coupled with international partners are promoting research and affordable remedies within the context of tuberculosis promoting it as a drug development

Active Key Players in the Tuberculosis Drugs Market

- Cipla Inc. (India)

- GlaxoSmithKline plc (United Kingdom)

- Johnson & Johnson (United States)

- Lupin Limited (India)

- Mylan N.V. (United States)

- Novartis AG (Switzerland)

- Otsuka Pharmaceutical (Japan)

- Pfizer Inc. (United States)

- Sandoz International GmbH (Germany)

- Sanofi (France)

- Other Active Players

|

Global Tuberculosis Drugs Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.10 Billion |

|

Forecast Period 2024-32 CAGR: |

4.20% |

Market Size in 2032: |

USD 3.04 Billion |

|

Segments Covered: |

By Drug Class |

|

|

|

By Disease Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Tuberculosis Drugs Market by Type

4.1 Tuberculosis Drugs Market Snapshot and Growth Engine

4.2 Tuberculosis Drugs Market Overview

4.3 Earth Pressure Balance Shield TBM

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Earth Pressure Balance Shield TBM: Geographic Segmentation Analysis

4.4 Slurry Shield TBM

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Slurry Shield TBM: Geographic Segmentation Analysis

4.5 Gripper TBM

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Gripper TBM: Geographic Segmentation Analysis

4.6 Open Face TBM

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Open Face TBM: Geographic Segmentation Analysis

4.7 Double Shield TBM

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Double Shield TBM: Geographic Segmentation Analysis

4.8 Others

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Others: Geographic Segmentation Analysis

Chapter 5: Tuberculosis Drugs Market by Diameter

5.1 Tuberculosis Drugs Market Snapshot and Growth Engine

5.2 Tuberculosis Drugs Market Overview

5.3 Below 5 meters

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Below 5 meters: Geographic Segmentation Analysis

5.4 5–9 meters

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 5–9 meters: Geographic Segmentation Analysis

5.5 above 9 meters

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 above 9 meters: Geographic Segmentation Analysis

Chapter 6: Tuberculosis Drugs Market by End User

6.1 Tuberculosis Drugs Market Snapshot and Growth Engine

6.2 Tuberculosis Drugs Market Overview

6.3 Transportation (Railway

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Transportation (Railway: Geographic Segmentation Analysis

6.4 Roadways

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Roadways: Geographic Segmentation Analysis

6.5 Metro)

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Metro): Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Tuberculosis Drugs Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 JOHNSON & JOHNSON (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 PFIZER INC. (UNITED STATES)

7.4 LUPIN LIMITED (INDIA)

7.5 CIPLA INC. (INDIA)

7.6 SANOFI (FRANCE)

7.7 NOVARTIS AG (SWITZERLAND)

7.8 MYLAN N.V. (UNITED STATES)

7.9 OTSUKA PHARMACEUTICAL (JAPAN)

7.10 GLAXOSMITHKLINE PLC (UNITED KINGDOM)

7.11 SANDOZ INTERNATIONAL GMBH (GERMANY)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Tuberculosis Drugs Market By Region

8.1 Overview

8.2. North America Tuberculosis Drugs Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Earth Pressure Balance Shield TBM

8.2.4.2 Slurry Shield TBM

8.2.4.3 Gripper TBM

8.2.4.4 Open Face TBM

8.2.4.5 Double Shield TBM

8.2.4.6 Others

8.2.5 Historic and Forecasted Market Size By Diameter

8.2.5.1 Below 5 meters

8.2.5.2 5–9 meters

8.2.5.3 above 9 meters

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Transportation (Railway

8.2.6.2 Roadways

8.2.6.3 Metro)

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Tuberculosis Drugs Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Earth Pressure Balance Shield TBM

8.3.4.2 Slurry Shield TBM

8.3.4.3 Gripper TBM

8.3.4.4 Open Face TBM

8.3.4.5 Double Shield TBM

8.3.4.6 Others

8.3.5 Historic and Forecasted Market Size By Diameter

8.3.5.1 Below 5 meters

8.3.5.2 5–9 meters

8.3.5.3 above 9 meters

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Transportation (Railway

8.3.6.2 Roadways

8.3.6.3 Metro)

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Tuberculosis Drugs Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Earth Pressure Balance Shield TBM

8.4.4.2 Slurry Shield TBM

8.4.4.3 Gripper TBM

8.4.4.4 Open Face TBM

8.4.4.5 Double Shield TBM

8.4.4.6 Others

8.4.5 Historic and Forecasted Market Size By Diameter

8.4.5.1 Below 5 meters

8.4.5.2 5–9 meters

8.4.5.3 above 9 meters

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Transportation (Railway

8.4.6.2 Roadways

8.4.6.3 Metro)

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Tuberculosis Drugs Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Earth Pressure Balance Shield TBM

8.5.4.2 Slurry Shield TBM

8.5.4.3 Gripper TBM

8.5.4.4 Open Face TBM

8.5.4.5 Double Shield TBM

8.5.4.6 Others

8.5.5 Historic and Forecasted Market Size By Diameter

8.5.5.1 Below 5 meters

8.5.5.2 5–9 meters

8.5.5.3 above 9 meters

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Transportation (Railway

8.5.6.2 Roadways

8.5.6.3 Metro)

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Tuberculosis Drugs Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Earth Pressure Balance Shield TBM

8.6.4.2 Slurry Shield TBM

8.6.4.3 Gripper TBM

8.6.4.4 Open Face TBM

8.6.4.5 Double Shield TBM

8.6.4.6 Others

8.6.5 Historic and Forecasted Market Size By Diameter

8.6.5.1 Below 5 meters

8.6.5.2 5–9 meters

8.6.5.3 above 9 meters

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Transportation (Railway

8.6.6.2 Roadways

8.6.6.3 Metro)

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Tuberculosis Drugs Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Earth Pressure Balance Shield TBM

8.7.4.2 Slurry Shield TBM

8.7.4.3 Gripper TBM

8.7.4.4 Open Face TBM

8.7.4.5 Double Shield TBM

8.7.4.6 Others

8.7.5 Historic and Forecasted Market Size By Diameter

8.7.5.1 Below 5 meters

8.7.5.2 5–9 meters

8.7.5.3 above 9 meters

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Transportation (Railway

8.7.6.2 Roadways

8.7.6.3 Metro)

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Tuberculosis Drugs Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.10 Billion |

|

Forecast Period 2024-32 CAGR: |

4.20% |

Market Size in 2032: |

USD 3.04 Billion |

|

Segments Covered: |

By Drug Class |

|

|

|

By Disease Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||