Triptorelin Market Synopsis

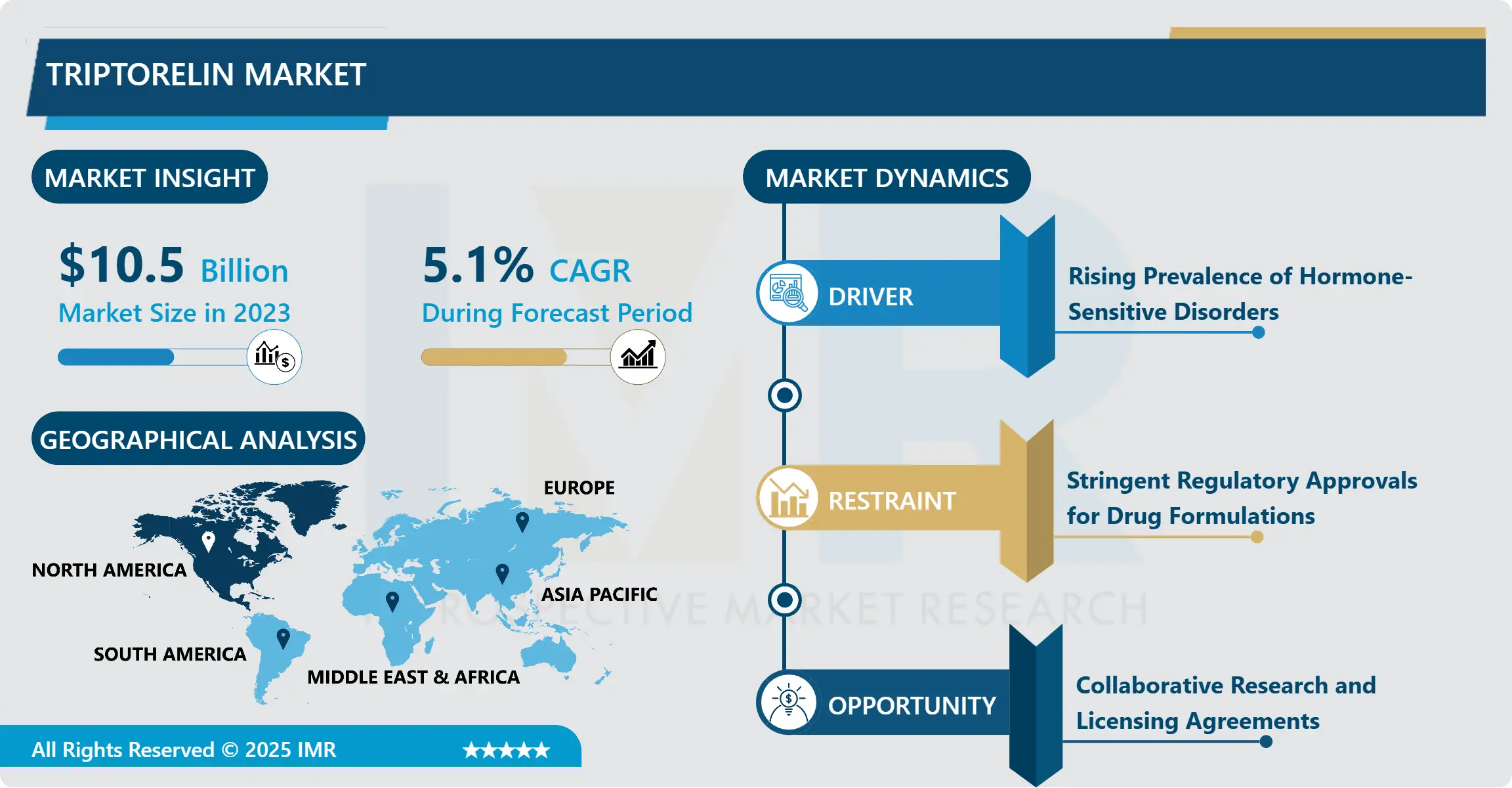

Triptorelin Market Size Was Valued at USD 10.50 Billion in 2023, and is Projected to Reach USD 16.42 Billion by 2032, Growing at a CAGR of 5.10% From 2024-2032.

Triptorelin is an analogue of GnRH hormone indicated for the management of hormone-dependent disorders including prostate carcinoma, endometriosis, and CPP. It act through modulating the secretions of hormones in order to suppress some hormones making it useful both in oncologic practice or endocrinologic practice.

Hormone sensitive diseases such as prostate cancer, endometriosis and others have been on the rise thus driving the Triptorelin market. Contemporary data showed that prostate cancer is still one of the most frequently diagnosed male neoplasms with increasing incidence caused by increased vigilance and the implementation of early detection programs. Similarly, endometriosis an illness that affects millions of women around the globe fosters the market for treatments using Triptorelin as the first-line therapy.

Further, new technologies of drug delivery such as the extended-release formulations have also prolonged patient drug compliance and thus more adoption of the medicine. Increased spending on health care around the world and especially in currently developing nations where the population demography is inclined towards the older age group sensitive to hormone related diseases will augur well for the market.

Triptorelin Market Trend Analysis:

Expanding Therapeutic Applications

-

Labeled uses and applications for Triptorelin to further ameliorate include advanced formulation including extended-release injectable that can enhance Triptorelin’s therapeutic impact and patient compliance. Such changes are intended to administer the drugs less frequently implying that the medications are equally effective, and enabling patients suffering frequent and lifelong diseases access the medications.

- Aside from the standard uses, Triptorelin is being considered in the management of miscellaneous diseases and as chemoprotective agent in cancer patients who are candidates for chemotherapeutic agents they need to reduce gonadal function. This expansion of therapeutic indications increases its market opportunity and promotes additional innovation.

Collaborations and Licensing Agreements

-

There are many growth opportunities in newly developing areas such as Asia-Pacific and Latin America where healthcare facilities are still being developed, people’s average income is rising, and awareness of hormone-related diseases is still growing. These regions’ governments also spend money in cancer treatment; this widens up the reach of Triptorelin treatments.

- The collaborations of the pharmaceutical firms in the development and distribution of Triptorelin especially to the remote areas present a good business opportunities. Thus, these partnerships can improve production efficiencies, realise cost savings and formulate strategies to expand market share in some some thin, cut-throat markets.

Triptorelin Market Segment Analysis:

Triptorelin Market Segmented on the basis of Type, Application, Distribution Channel, and Region.

By Type, Triptorelin Acetate segment is expected to dominate the market during the forecast period

-

The Triptorelin market is segmented into Triptorelin Acetate and Triptorelin Pamoate. Pamoate form of Triptorelin is widely used because of its longer active life and usefulness in prostate cancer and other diseases that require long term use of GnRH antagonist. Nonetheless, the possibility cannot be completely ruled out and, therefore, Triptorelin Acetate still has its potential in case of special therapeutic demands and particular clinical situations.

By Application, Prostate Cancer segment expected to held the largest share

-

Triptorelin has uses in the treatment of Prostate Cancer, Endometriosis, Central Precocious Puberty, Uterine Fibroids and it has Other Uses as well. The largest market share is owned by Prostate cancer since the drug has been proven effective in the treatment of the condition. Others include endometriosis, and central precocious puberty among other indications that create demand as awareness and early diagnosis increase across the world.

Triptorelin Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America currently has the largest share of the Triptorelin market, it is expected to be between 35 – 40%. The domination of the region can also be explained by the highest incidence of prostate cancer, as well as the availability of a highly developed health care system, allowing the timely diagnosis of the disease. The presence of reimbursement policies for the hormone-related therapies also adds up to the population using Triptorelin in region.

- Furthermore, a high research activity in the pharmaceutical sector and the key market players’ concentration in the United States and Canada guarantee constant innovation as well as availability of Triptorelin. The variations in demography of North America population; advanced age, high disposable income, coupled with increased health consciousness, fuels the growth of the market.

Active Key Players in the Triptorelin Market:

- Debiopharm Group (Switzerland)

- Dr. Reddy's Laboratories (India)

- Ferring Pharmaceuticals (Switzerland)

- Ipsen (France)

- Novartis AG (Switzerland)

- Pfizer Inc. (United States)

- Sanofi (France)

- Sun Pharmaceutical Industries (India)

- Takeda Pharmaceutical Company (Japan)

- Teva Pharmaceuticals (Israel)

- Other Active Players

|

Global Triptorelin Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.50 Billion |

|

Forecast Period 2024-32 CAGR: |

5.10% |

Market Size in 2032: |

USD 16.42 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Triptorelin Market by Technology

4.1 Triptorelin Market Snapshot and Growth Engine

4.2 Triptorelin Market Overview

4.3 Adaptive Cruise Control (ACC)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Adaptive Cruise Control (ACC): Geographic Segmentation Analysis

4.4 Autonomous Emergency Braking (AEB)

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Autonomous Emergency Braking (AEB): Geographic Segmentation Analysis

4.5 Lane Keep Assist (LKA)

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Lane Keep Assist (LKA): Geographic Segmentation Analysis

4.6 Blind Spot Warning (BSW)

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Blind Spot Warning (BSW): Geographic Segmentation Analysis

4.7 Global Positioning System (GPS)

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Global Positioning System (GPS): Geographic Segmentation Analysis

Chapter 5: Triptorelin Market by Application

5.1 Triptorelin Market Snapshot and Growth Engine

5.2 Triptorelin Market Overview

5.3 Heavy Trucks

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Heavy Trucks: Geographic Segmentation Analysis

5.4 Light Commercial Vehicles (LCVs)

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Light Commercial Vehicles (LCVs): Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Triptorelin Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 IPSEN (FRANCE)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 FERRING PHARMACEUTICALS (SWITZERLAND)

6.4 DEBIOPHARM GROUP (SWITZERLAND)

6.5 TEVA PHARMACEUTICALS (ISRAEL)

6.6 SUN PHARMACEUTICAL INDUSTRIES (INDIA)

6.7 NOVARTIS AG (SWITZERLAND)

6.8 DR. REDDY'S LABORATORIES (INDIA)

6.9 PFIZER INC. (UNITED STATES)

6.10 SANOFI (FRANCE)

6.11 TAKEDA PHARMACEUTICAL COMPANY (JAPAN)

6.12 OTHER ACTIVE PLAYERS

Chapter 7: Global Triptorelin Market By Region

7.1 Overview

7.2. North America Triptorelin Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Technology

7.2.4.1 Adaptive Cruise Control (ACC)

7.2.4.2 Autonomous Emergency Braking (AEB)

7.2.4.3 Lane Keep Assist (LKA)

7.2.4.4 Blind Spot Warning (BSW)

7.2.4.5 Global Positioning System (GPS)

7.2.5 Historic and Forecasted Market Size By Application

7.2.5.1 Heavy Trucks

7.2.5.2 Light Commercial Vehicles (LCVs)

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Triptorelin Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Technology

7.3.4.1 Adaptive Cruise Control (ACC)

7.3.4.2 Autonomous Emergency Braking (AEB)

7.3.4.3 Lane Keep Assist (LKA)

7.3.4.4 Blind Spot Warning (BSW)

7.3.4.5 Global Positioning System (GPS)

7.3.5 Historic and Forecasted Market Size By Application

7.3.5.1 Heavy Trucks

7.3.5.2 Light Commercial Vehicles (LCVs)

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Triptorelin Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Technology

7.4.4.1 Adaptive Cruise Control (ACC)

7.4.4.2 Autonomous Emergency Braking (AEB)

7.4.4.3 Lane Keep Assist (LKA)

7.4.4.4 Blind Spot Warning (BSW)

7.4.4.5 Global Positioning System (GPS)

7.4.5 Historic and Forecasted Market Size By Application

7.4.5.1 Heavy Trucks

7.4.5.2 Light Commercial Vehicles (LCVs)

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Triptorelin Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Technology

7.5.4.1 Adaptive Cruise Control (ACC)

7.5.4.2 Autonomous Emergency Braking (AEB)

7.5.4.3 Lane Keep Assist (LKA)

7.5.4.4 Blind Spot Warning (BSW)

7.5.4.5 Global Positioning System (GPS)

7.5.5 Historic and Forecasted Market Size By Application

7.5.5.1 Heavy Trucks

7.5.5.2 Light Commercial Vehicles (LCVs)

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Triptorelin Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Technology

7.6.4.1 Adaptive Cruise Control (ACC)

7.6.4.2 Autonomous Emergency Braking (AEB)

7.6.4.3 Lane Keep Assist (LKA)

7.6.4.4 Blind Spot Warning (BSW)

7.6.4.5 Global Positioning System (GPS)

7.6.5 Historic and Forecasted Market Size By Application

7.6.5.1 Heavy Trucks

7.6.5.2 Light Commercial Vehicles (LCVs)

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Triptorelin Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Technology

7.7.4.1 Adaptive Cruise Control (ACC)

7.7.4.2 Autonomous Emergency Braking (AEB)

7.7.4.3 Lane Keep Assist (LKA)

7.7.4.4 Blind Spot Warning (BSW)

7.7.4.5 Global Positioning System (GPS)

7.7.5 Historic and Forecasted Market Size By Application

7.7.5.1 Heavy Trucks

7.7.5.2 Light Commercial Vehicles (LCVs)

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Triptorelin Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.50 Billion |

|

Forecast Period 2024-32 CAGR: |

5.10% |

Market Size in 2032: |

USD 16.42 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||