Transformer Market Synopsis

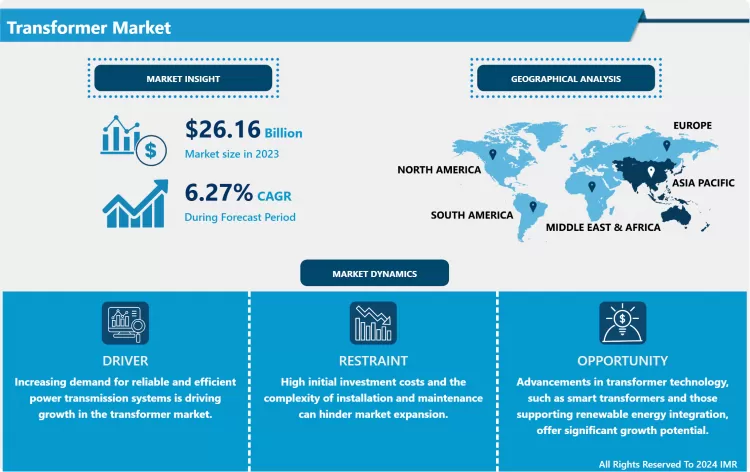

Transformer Market Size is Valued at USD 26.16 Billion in 2023 and is Projected to Reach USD 45.23 Billion by 2032, Growing at a CAGR of 6.27% From 2024-2032.

The transformer market is a critical component of the global electrical infrastructure because it concentrates on the development of devices that regulate voltage levels to ensure efficient and stable power distribution. Various industries, including manufacturing and utilities, employ a variety of types of transformers, including power, distribution, and specialty transformers. Growing demand for dependable electricity, infrastructure modernization, and the expansion of renewable energy sources are driving the market. These factors necessitate the development of more advanced transformer technologies to facilitate the efficient management of energy. As urbanization and industrialization advance, the integration of smart grid solutions and the upgrading of antiquated infrastructure become increasingly important, thereby further stimulating market growth. Furthermore, advancements in transformer design, including enhanced efficiency and reduced environmental impact, are influencing the future of the market.

- The transformer market is a critical segment of the global electrical equipment industry, responsible for converting voltage levels to enable efficient transmission and distribution of electricity. Power generation, transmission, and distribution systems use transformers as critical components in a variety of applications across the residential, commercial, and industrial sectors.

- A variety of factors, such as the growing demand for electricity, urbanization, and infrastructure development, impact the market, driving the demand for reliable and advanced transformer solutions. Technological advancements, such as high-efficiency models and smart transformers, are also influencing the market, offering enhanced performance and energy savings.

- Investments in smart grid technologies and renewable energy sources are driving the robust growth of the transformer market, according to recent trends. Modernizing existing grids in developed regions and expanding electricity infrastructure in emerging economies are critical factors that contribute to market growth.

- Furthermore, the growing emphasis on sustainability and energy efficiency is driving the adoption of innovative transformer technologies that enhance grid stability and reduce losses. Despite regulatory obstacles and high initial costs, the market is on the verge of sustained growth, buoyed by increasing global energy demand and technological advancements.

Transformer Market Trend Analysis

Increased Adoption of Smart Transformers

- The transformer market is currently experiencing a significant trend towards increased adoption of smart transformers. These sophisticated devices, which integrate digital technology and communication capabilities, enable real-time monitoring, automated control, and improved efficiency in electrical systems.

- Smart transformers enhance grid management by offering valuable data on power usage and system performance, resulting in reduced maintenance costs and increased reliability. Their ability to integrate with renewable energy sources and smart systems makes them an essential component of electrical infrastructure modernization.

- Grid stability and energy efficiency are driving the demand for smart transformers. We anticipate an increase in the adoption of these sophisticated transformers as utilities and industries strive to optimize their power networks and reduce operational expenses.

- Furthermore, advancements in IoT and AI technologies further enhance the capabilities of smart transformers, presenting opportunities for innovation and expanded market applications. This trend is indicative of the broader trend toward more sustainable and intelligent energy solutions.

Rising Demand for Renewable Energy Integration

- The rising demand for renewable energy integration is significantly impacting the transformer market. As countries and industries increasingly shift towards sustainable energy sources like wind, solar, and hydropower, the need for advanced transformer solutions that can efficiently manage and distribute this energy is growing.

- Transformers play a critical role in adapting the voltage levels and ensuring the reliable transmission of electricity from renewable sources to the grid. This demand for integration necessitates the development of transformers with enhanced capabilities, such as higher efficiency, improved reliability, and compatibility with diverse energy sources.

- The transformer market is experiencing a shift towards innovations that cater to the requirements of renewable energy systems. The focus is on designing transformers that support the integration of variable and intermittent renewable sources while maintaining grid stability.

- Additionally, advancements in smart grid technology and increased investments in renewable infrastructure are further driving the demand for sophisticated transformer solutions. The transformer market will continue to grow as the energy landscape changes to meet these evolving needs.

Transformer Market Segment Analysis:

Transformer Market Segmented on the basis of By End User, By Cooling Type, By Type, By Power Rating and By Insulation

By End User, Residential & Commercial segment is expected to dominate the market during the forecast period

- Based on the end user, we divide the transformer market into four sectors: industrial, residential, commercial, and utility. Transformers are essential in the utility sector for the transmission and distribution of electricity over long distances, thereby guaranteeing a consistent power supply to residences and businesses.

- The industrial sector also significantly depends on transformers to support large-scale operations, such as manufacturing and processing plants, where precise voltage regulation is necessary for machinery and equipment. Local distribution networks in the residential sector employ transformers to reduce high voltage levels, ensuring secure consumption in homes.

- Transformers are required in the commercial sector to power offices, retail centers, and other facilities. They are in charge of voltage regulation and power distribution to ensure the smooth operation of a variety of systems.

- We anticipate an increase in transformer demand in all these end-user segments as urbanization and infrastructure development continue to expand, driven by the demand for scalable, reliable, and efficient power solutions.

By Insulation, Dry Type segment held the largest share in 2023

- The transformer market divides the insulation type into two categories: dry-type and liquid-immersed transformers, each tailored for specific applications and environments. Dry-type transformers are optimal for indoor applications with limited space and where fire safety is a concern, as they utilize air as an insulating medium.

- Industrial and commercial environments frequently implement them due to their reduced maintenance requirements and diminished risk of leakage. In contrast, liquid-immersed transformers utilize insulating oil, which provides superior cooling and increased efficiency when managing larger loads. High-voltage applications and outdoor substations frequently employ these transformers due to their stringent cooling requirements.

- Regulatory standards, environmental conditions, and application requirements all contribute to the demand for each insulation type. The increasing emphasis on energy efficiency and reliability is driving advancements in both dry-type and liquid-immersed transformers. As industries and infrastructure projects expand, the demand for both types of transformers will continue to evolve, influenced by technological advancements and changing market demands.

Transformer Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- During the forecast period, we expect the Asia Pacific region to lead the global transformer market due to accelerated industrialization, urbanization, and increasing investments in infrastructure development. Significant contributors to this growth are the substantial energy requirements and ongoing upgrades to electrical infrastructures in countries such as China, India, and Japan.

- The region's extensive expansion of renewable energy initiatives and burgeoning power generation capacity further bolster the demand for advanced transformer technologies. Efficiency in power distribution and transformation is becoming increasingly important as civilizations in the Asia Pacific region continue to expand.

- Furthermore, the development of smart grid technologies and the improvement of transformer designs, particularly those that prioritize energy efficiency and reduced emissions, further enhance the market potential.

- We expect the growing emphasis on modernizing existing infrastructure and expanding electricity access in rural areas to sustain the region's dominance in the transformer market. Consequently, organizations are emphasizing the development of innovative solutions to satisfy the changing needs of the Asia Pacific market.

Active Key Players in the Transformer Market

- ABB Ltd.(Switzerland)

- Eaton Corporation plc (Ireland)

- Schneider Electric (France)

- Siemens AG (Germany)

- Crompton Greaves Ltd. (India)

- Mitsubishi Electric Corporation (Japan)

- Toshiba Corporation (Japan)

- Bharat Heavy Electricals Limited (India)

- Hyosung Power & Industrial Solutions (South Korea)

- SPX Transformer Solutions Inc. (U.S.)

- Others

|

Global Transformer Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 26.16 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.27% |

Market Size in 2032: |

USD 45.23 Bn. |

|

Segments Covered: |

By End User |

|

|

|

By Cooling Type |

|

||

|

By Type |

|

||

|

By Power Rating |

|

||

|

By Insulation |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Transformer Market by End User (2018-2032)

4.1 Transformer Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Utility

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Industrial

4.5 Residential & Commercial

Chapter 5: Transformer Market by Cooling Type (2018-2032)

5.1 Transformer Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Air-cooled

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Oil-cooled

Chapter 6: Transformer Market by Type (2018-2032)

6.1 Transformer Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Distribution Transformer

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Power Transformer

6.5 others

Chapter 7: Transformer Market by Power Rating (2018-2032)

7.1 Transformer Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Small

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Medium

7.5 Large

Chapter 8: Transformer Market by Insulation (2018-2032)

8.1 Transformer Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Dry Type

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Liquid Immersed

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Transformer Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 ABB LTD.(SWITZERLAND)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 EATON CORPORATION PLC (IRELAND)

9.4 SCHNEIDER ELECTRIC (FRANCE)

9.5 SIEMENS AG (GERMANY)

9.6 CROMPTON GREAVES LTD. (INDIA)

9.7 MITSUBISHI ELECTRIC CORPORATION (JAPAN)

9.8 TOSHIBA CORPORATION(JAPAN)

9.9 BHARAT HEAVY ELECTRICALS LIMITED (INDIA)

9.10 HYOSUNG POWER & INDUSTRIAL SOLUTIONS (SOUTH KOREA)

9.11 SPX TRANSFORMER SOLUTIONS INC. (U.S.)

9.12 OTHERS

9.13

Chapter 10: Global Transformer Market By Region

10.1 Overview

10.2. North America Transformer Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by End User

10.2.4.1 Utility

10.2.4.2 Industrial

10.2.4.3 Residential & Commercial

10.2.5 Historic and Forecasted Market Size by Cooling Type

10.2.5.1 Air-cooled

10.2.5.2 Oil-cooled

10.2.6 Historic and Forecasted Market Size by Type

10.2.6.1 Distribution Transformer

10.2.6.2 Power Transformer

10.2.6.3 others

10.2.7 Historic and Forecasted Market Size by Power Rating

10.2.7.1 Small

10.2.7.2 Medium

10.2.7.3 Large

10.2.8 Historic and Forecasted Market Size by Insulation

10.2.8.1 Dry Type

10.2.8.2 Liquid Immersed

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Transformer Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by End User

10.3.4.1 Utility

10.3.4.2 Industrial

10.3.4.3 Residential & Commercial

10.3.5 Historic and Forecasted Market Size by Cooling Type

10.3.5.1 Air-cooled

10.3.5.2 Oil-cooled

10.3.6 Historic and Forecasted Market Size by Type

10.3.6.1 Distribution Transformer

10.3.6.2 Power Transformer

10.3.6.3 others

10.3.7 Historic and Forecasted Market Size by Power Rating

10.3.7.1 Small

10.3.7.2 Medium

10.3.7.3 Large

10.3.8 Historic and Forecasted Market Size by Insulation

10.3.8.1 Dry Type

10.3.8.2 Liquid Immersed

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Transformer Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by End User

10.4.4.1 Utility

10.4.4.2 Industrial

10.4.4.3 Residential & Commercial

10.4.5 Historic and Forecasted Market Size by Cooling Type

10.4.5.1 Air-cooled

10.4.5.2 Oil-cooled

10.4.6 Historic and Forecasted Market Size by Type

10.4.6.1 Distribution Transformer

10.4.6.2 Power Transformer

10.4.6.3 others

10.4.7 Historic and Forecasted Market Size by Power Rating

10.4.7.1 Small

10.4.7.2 Medium

10.4.7.3 Large

10.4.8 Historic and Forecasted Market Size by Insulation

10.4.8.1 Dry Type

10.4.8.2 Liquid Immersed

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Transformer Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by End User

10.5.4.1 Utility

10.5.4.2 Industrial

10.5.4.3 Residential & Commercial

10.5.5 Historic and Forecasted Market Size by Cooling Type

10.5.5.1 Air-cooled

10.5.5.2 Oil-cooled

10.5.6 Historic and Forecasted Market Size by Type

10.5.6.1 Distribution Transformer

10.5.6.2 Power Transformer

10.5.6.3 others

10.5.7 Historic and Forecasted Market Size by Power Rating

10.5.7.1 Small

10.5.7.2 Medium

10.5.7.3 Large

10.5.8 Historic and Forecasted Market Size by Insulation

10.5.8.1 Dry Type

10.5.8.2 Liquid Immersed

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Transformer Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by End User

10.6.4.1 Utility

10.6.4.2 Industrial

10.6.4.3 Residential & Commercial

10.6.5 Historic and Forecasted Market Size by Cooling Type

10.6.5.1 Air-cooled

10.6.5.2 Oil-cooled

10.6.6 Historic and Forecasted Market Size by Type

10.6.6.1 Distribution Transformer

10.6.6.2 Power Transformer

10.6.6.3 others

10.6.7 Historic and Forecasted Market Size by Power Rating

10.6.7.1 Small

10.6.7.2 Medium

10.6.7.3 Large

10.6.8 Historic and Forecasted Market Size by Insulation

10.6.8.1 Dry Type

10.6.8.2 Liquid Immersed

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Transformer Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by End User

10.7.4.1 Utility

10.7.4.2 Industrial

10.7.4.3 Residential & Commercial

10.7.5 Historic and Forecasted Market Size by Cooling Type

10.7.5.1 Air-cooled

10.7.5.2 Oil-cooled

10.7.6 Historic and Forecasted Market Size by Type

10.7.6.1 Distribution Transformer

10.7.6.2 Power Transformer

10.7.6.3 others

10.7.7 Historic and Forecasted Market Size by Power Rating

10.7.7.1 Small

10.7.7.2 Medium

10.7.7.3 Large

10.7.8 Historic and Forecasted Market Size by Insulation

10.7.8.1 Dry Type

10.7.8.2 Liquid Immersed

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Transformer Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 26.16 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.27% |

Market Size in 2032: |

USD 45.23 Bn. |

|

Segments Covered: |

By End User |

|

|

|

By Cooling Type |

|

||

|

By Type |

|

||

|

By Power Rating |

|

||

|

By Insulation |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Transformer Market research report is 2024-2032.

ABB Ltd. (Switzerland), Eaton Corporation plc (Ireland), Schneider Electric (France), Siemens AG (Germany), Crompton Greaves Ltd. (India), Mitsubishi Electric Corporation (Japan), Toshiba Corporation (Japan), Bharat Heavy Electricals Limited (India), Hyosung Power & Industrial Solutions (South Korea), SPX Transformer Solutions Inc. (U.S.), Others

The Transformer Market is segmented into By End User (Utility, Industrial, Residential & Commercial), By Cooling Type (Air-cooled, Oil-cooled), By Type (Distribution Transformer, power Transformer, others), By Power Rating (Small, Medium, Large), By Insulation (Dry Type, Liquid Immersed). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A transformer is an electrical device that utilizes electromagnetic induction to facilitate the transfer of electrical energy between two or more circuits. Primary and secondary coils or windings wind around a core to form its composition. This configuration enables the conversion of voltage levels from high to low or vice versa. Transformers are indispensable in electrical power systems, as they facilitate the efficient transmission of electricity over extended distances by increasing the voltage for transmission and decreasing it for distribution to end consumers. Transformers help maintain a stable and dependable electrical supply by regulating voltage levels, reducing energy losses. Applications such as industrial processes, distribution networks, and power generation extensively employ them.

Transformer Market Size is Valued at USD 26.16 Billion in 2023, and is Projected to Reach USD 45.23 Billion by 2032, Growing at a CAGR of 6.27% From 2024-2032.