Tokenization Market Overview

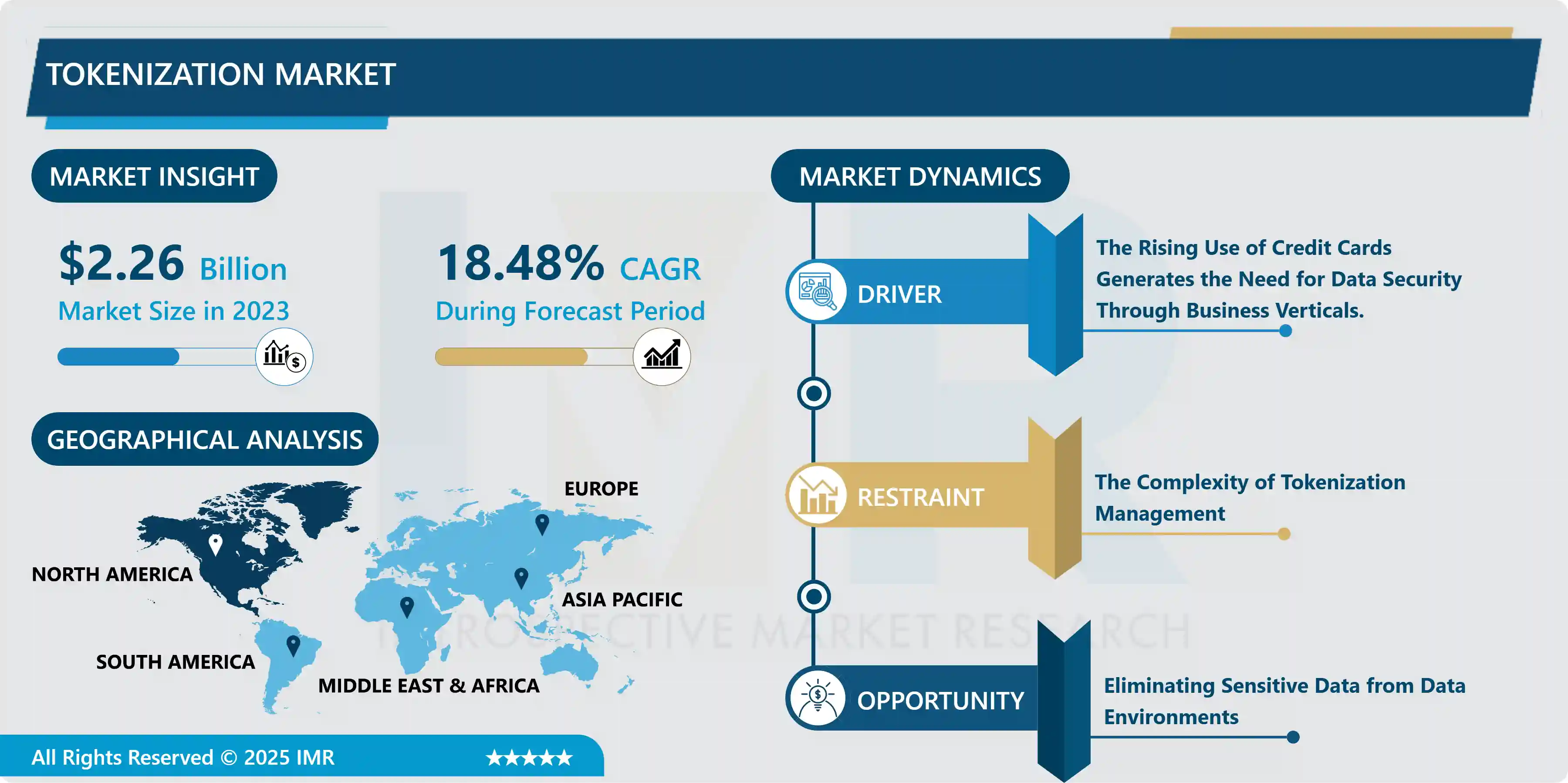

The Tokenization Market size was valued at USD 2.26 Billion in 2023 and is projected to reach USD 10.4 Billion by 2032, registering a CAGR of 18.48% from 2023 to 2032.

Tokenization is the conversion of sensitive data into non-sensitive tokens that may be used in a database or internal system without being exposed to the public. By replacing sensitive data with an irrelevant value of the same length and format as the original, tokenization may be used to protect it. After then, the tokens are sent to an organization's internal systems for usage, while the original data is stored in a token vault. Unlike encrypted data, tokenized data is impenetrable and irreversible. This distinction is crucial: tokens cannot be restored to their original form since the token and its original number have no mathematical relationship. To put it another way, a token is a piece of data that acts as a stand-in for a more valuable piece of data. The need for payment security grew in tandem with the amount of credit card fraud events. Contactless payments and tokenization-as-a-service approaches are two examples of payment security components. During the projected period, such factors are likely to fuel market growth.

Market Dynamics and Factors For Tokenization:

Drivers

The rising use of credit cards generates the need for data security through business verticals.

- Tokenization protects companies from the financial consequences of data theft. Even if there is a breach, there is no user personal data to grab. Credit card tokenization assists online businesses in improving data security from the moment of data capture through storage by removing credit card details from POS devices and internal systems. Tokenization of data protects credit card and bank account details in a virtual vault, allowing businesses to safely send data across wireless networks. Organizations must employ a payment gateway to safely store sensitive data for tokenization to be effective. A payment gateway is a merchant service that allows direct payments or credit card processing and is provided by an e-commerce application service provider. This gateway securely saves credit card information and creates a random token.

Growing need for data security against cyber breaches

- The rising number of data breaches has fueled the need for secure payment gateways, which is one of the key factors driving demand for tokenization solutions. According to the Identity Theft Resource Center (ITRC), data breaches surged by 44.7 percent in the United States. In 2018, there were 367 data breaches reported in the medical and healthcare industries. Credit and debit card information was found in nearly 20% of breaches, up nearly 6% from the previous year. Counterfeit cards account for around 37% of all credit card fraud in the United States. As the number of data breaches rises, so does the amount of money lost as a result of them. Since the last 4 years, demand for data security in the banking and insurance sector has increased. The need for a robust platform and secured transaction system call for tokenization to ensure the safe handling of customer data. As a result, the need for tokenization has increased largely which is expected to propel the market in coming years.

Restraints

- Tokenization works by creating tokens and storing the real values of credit and debit cards in token vaults. The complexity of tokenization management is growing as storage space becomes more limited. The usage of online payments has increased dramatically since the emergence of COVID-19. Because of the rising reliance on internet payment methods, these channels have become a favored target for cybercriminals. To perform successful real-time screening after tokenization, it is necessary to understand and evaluate numerous parameters surrounding each transaction as part of an optimized fraud rule set. This involves the preservation of the Bank Identification Number (BIN), which specifies the issuer, card type, and country of issuance.

Opportunities

- The process of exchanging sensitive data for an irreversible, non-sensitive placeholder called a token and safely retaining the original, sensitive data outside of the organization's internal systems is known as cloud-based tokenization. Traditional on-premises tokenization might be more expensive and difficult to incorporate. It also decreases the risk and compliance scope of a company by eliminating sensitive data from its data environments. Additionally, by employing format- and/or length-preserving tokens as placeholders for the original, sensitive data, enterprises may safeguard that data without losing its value or the agility of current business operations.

Challenge

- Technology is only as useful as the people who utilize it. The technology will not deliver actual value if employees do not submit data or pull the appropriate reports. Simplifying what have become exceedingly complex organizational cultures throughout the sector will aid in the adoption of dependability and digitalization. Leadership supports the beliefs and behaviors required for organizational reliability by developing a training program for all workers, which aids talent retention and corporate success. Training should include the principles of dependability, the link between reliability and maintenance and operations, and how to utilize tokenization technologies to assure data security and compliance standards.

Market Segmentation

- By Type, Solution is dominating segment in the Tokenization Market. The solution segment is growing swiftly in all verticals as online payments have risen in the last 3 years from large enterprises to small and medium scale businesses. To ensure a safe payment gateway and full-proof system, tokenization has been adopted by many new and existing firms. Cardholder data, including magnetic swipe data, key account numbers, and cardholder information can be protected using tokenization technologies. Companies can more easily comply with industry regulations and secure customer information. For HIPAA-covered instances, enterprises can employ tokenization solutions. Healthcare businesses can better comply with HIPAA laws by replacing a tokenized value for electronically protected health information (ePHI) and non-public personal information (NPPI). Therefore, Tokenization solutions are expected to propel the market growth during the forecasted period.

- By Deployment, on cloud is dominating in the Tokenization Market. Cloud deployment is developing rapidly in the tokenization industry. SMEs are increasingly turning to cloud deployment options because they allow them to focus on their core skills rather than on payment infrastructure. Using cloud-based solutions, businesses can dramatically reduce their software, hardware, storage, and technical staffing costs. Tokenization and encryption are often employed to safeguard data stored in cloud services or apps. To safeguard various types of data and fulfill different legal standards, an organization may utilize tokenization, or a mix of both, depending on the use case. For example, McAfee CASB uses an irreversible one-way mechanism to tokenize user identifying information and obscure company identification on-premises. Tokenization is being used to safeguard data stored in cloud services as more data flows to the cloud. Most importantly, if a government agency issues a subpoena for cloud data, the service provider can only disclose encrypted or tokenized information, with no method to decrypt the original data. When a cybercriminal acquires access to data saved on a computer, the same thing happens.

- By End-User Industry, the BFSI industry vertical is expected to hold the largest share of the global market. Tokenization solutions have gained immense popularity and a higher rate of adoption in the BFSI vertical, as it deals with money. The vertical displays a large number of financial transactions, which become an attractive target for cybercriminals. Increasing fraudulent activities emerging in the BFSI vertical is another major factor driving the demand for tokenization. Tokenization is extremely important in the banking business. For example, the PAN (Primary Account Number) should never be stored on a database. As a result, a token or surrogate PAN is commonly used to represent the PAN. The current EMV tokenization trend is for ALL transaction data to become tokens! Not simply the PAN or card information. The use of credit card data for fraudulent online web purchases is known as card-not-present (CNP) fraud. The PAN, expiration date, cardholder name, and CVV / CVC are examples of such information. These details are frequently obtained through breaking into merchant databases that are unencrypted and unsecured. Tokenization prohibits businesses from retaining card data while allowing them to save the token, which is worthless to hackers. Hence, Tokenization is expected to strengthen the BFSI sector during the forecasted period.

Regional Analysis of Tokenization Market

- North America is the dominating region in the tokenization solution market, owing to the earliest adoption of advanced technology in the payment gateway industry. Most of the tokenization solution vendors are American-based, hence accounting for the major portion of the revenue of the tokenization solution market. The adoption of cloud technology is the highest in the region, a vital reason for the growing adoption of tokenization solutions. The region is also the home of all the major e-commerce major companies, where the adoption of tokenization solutions is highest. The significant growth of the retail and e-commerce industry in the region is further estimated to grow the tokenization solution market. BFSI sector has also shown healthy growth in the region. The highest adoption of blockchain technology in the region is estimated to further expand the tokenization solution market significantly.

- The Asia Pacific is the second-fastest-growing region in the Tokenization Market. In the Asia Pacific, China is forecast to reach an estimated market size of US$476.3 Million in the year 2026 trailing a CAGR of 23.7% through the analysis period. The regional market is also benefiting from the rapid growth of e-commerce, as well as the widespread usage of smartphones to make online payments and access a variety of services such as government services, online gaming, and digital information. Government efforts to combat financial fraud, as well as the introduction of tough legislation to increase cyber-security, are credited with driving growth in the Asia-Pacific area.

- Contactless payments are assisting end-users and businesses in moving away from wire transfer services, which is one of the most abused media by cybercriminals. Across general, contactless payments are gaining increasing momentum in Europe. According to research released by Gemalto, 90 percent of Europe's corporate leaders have already invested in contactless payment systems. One of the key issues driving the need for tokenization in Europe is the increasing number of data breaches and financial scams.

Players Covered in Tokenization market are :

- American Express Company

- AsiaPay Limited

- Bluefin Payment Systems LLC

- Card link

- Fiserv Inc.

- Futurex LP

- HelpSystems LLC

- HST Campinas SP

- IntegraPay

- Marqeta Inc.

- Mastercard Inc.

- MeaWallet AS

- Micro Focus International plc

- Paragon Payment Solutions

- Sequent Software Inc.

- Shift4 Payments LLC

- Sygnum Bank AG

- Thales TCT

- TokenEx LLC

- VeriFone Inc.

- Visa Inc. and other major players.

Key Developments of Tokenization Market

In November 2024, Tether, the leading company in the digital asset industry, unveiled "Hadron by Tether," a groundbreaking platform for simplifying the tokenization of various assets, including stocks, bonds, and loyalty points. Leveraging a decade of expertise, Hadron offers an intuitive solution for issuing and managing digital tokenized assets with a focus on security, compliance, and user experience. The platform empowers institutions, fund managers, and private companies to explore new investment avenues while maintaining full control over their tokens.

|

Tokenization Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.26 Bn. |

|

Forecast Period 2023-32 CAGR: |

18.48% |

Market Size in 2032: |

USD 10.4 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Tokenization Market by Type (2018-2032)

4.1 Tokenization Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Solution

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Services

Chapter 5: Tokenization Market by Deployment (2018-2032)

5.1 Tokenization Market Snapshot and Growth Engine

5.2 Market Overview

5.3 On-Premise

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cloud

Chapter 6: Tokenization Market by End User (2018-2032)

6.1 Tokenization Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Retail & E-commerce

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Transportation & Logistics

6.5 BFSI

6.6 IT & Telecommunications

6.7 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Tokenization Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 F. HOFFMANN-LA ROCHE LTD (SWITZERLAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 MERCK & CO. INC. . (US)

7.4 GILEAD SCIENCES INC. . (US)

7.5 ABBVIE INC. (US)

7.6 BRISTOL MYERS SQUIBB COMPANY (US)

7.7 DICERNA PHARMACEUTICALS (US)

7.8 ARBUTUS PHARMA (US)

7.9 NOVARTIS AG (SWITZERLAND)

7.10 ASTRAZENECA (UK)

7.11 BAYER AG (GERMANY)

7.12 OTHER KEY PLAYERS

Chapter 8: Global Tokenization Market By Region

8.1 Overview

8.2. North America Tokenization Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Solution

8.2.4.2 Services

8.2.5 Historic and Forecasted Market Size by Deployment

8.2.5.1 On-Premise

8.2.5.2 Cloud

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Retail & E-commerce

8.2.6.2 Transportation & Logistics

8.2.6.3 BFSI

8.2.6.4 IT & Telecommunications

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Tokenization Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Solution

8.3.4.2 Services

8.3.5 Historic and Forecasted Market Size by Deployment

8.3.5.1 On-Premise

8.3.5.2 Cloud

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Retail & E-commerce

8.3.6.2 Transportation & Logistics

8.3.6.3 BFSI

8.3.6.4 IT & Telecommunications

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Tokenization Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Solution

8.4.4.2 Services

8.4.5 Historic and Forecasted Market Size by Deployment

8.4.5.1 On-Premise

8.4.5.2 Cloud

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Retail & E-commerce

8.4.6.2 Transportation & Logistics

8.4.6.3 BFSI

8.4.6.4 IT & Telecommunications

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Tokenization Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Solution

8.5.4.2 Services

8.5.5 Historic and Forecasted Market Size by Deployment

8.5.5.1 On-Premise

8.5.5.2 Cloud

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Retail & E-commerce

8.5.6.2 Transportation & Logistics

8.5.6.3 BFSI

8.5.6.4 IT & Telecommunications

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Tokenization Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Solution

8.6.4.2 Services

8.6.5 Historic and Forecasted Market Size by Deployment

8.6.5.1 On-Premise

8.6.5.2 Cloud

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Retail & E-commerce

8.6.6.2 Transportation & Logistics

8.6.6.3 BFSI

8.6.6.4 IT & Telecommunications

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Tokenization Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Solution

8.7.4.2 Services

8.7.5 Historic and Forecasted Market Size by Deployment

8.7.5.1 On-Premise

8.7.5.2 Cloud

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Retail & E-commerce

8.7.6.2 Transportation & Logistics

8.7.6.3 BFSI

8.7.6.4 IT & Telecommunications

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Tokenization Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.26 Bn. |

|

Forecast Period 2023-32 CAGR: |

18.48% |

Market Size in 2032: |

USD 10.4 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||