Teleradiology Market Synopsis:

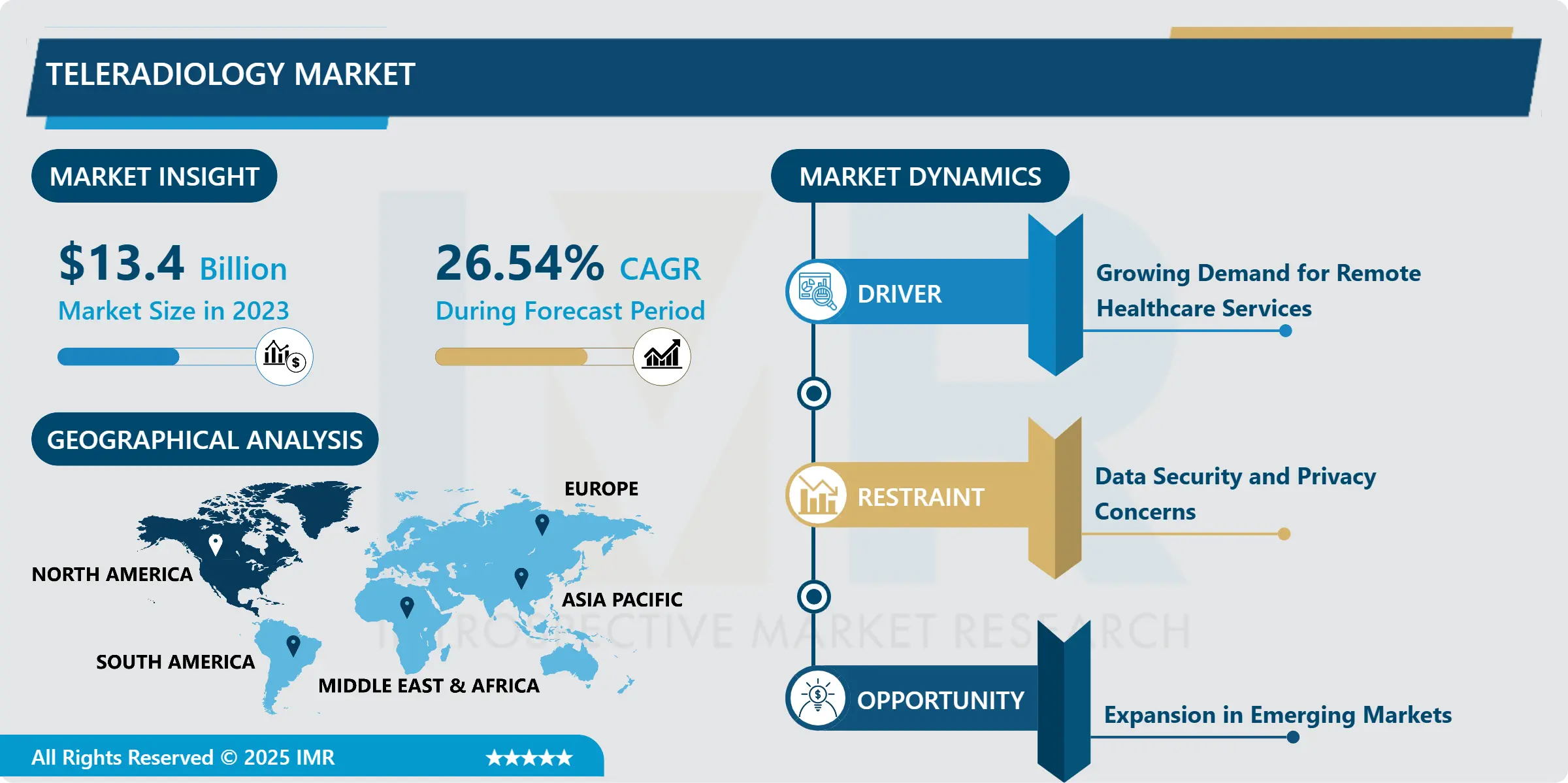

Teleradiology Market Size Was Valued at USD 13.40 Billion in 2023, and is Projected to Reach USD 111.47 Billion by 2032, Growing at a CAGR of 26.54% From 2024-2032.

Teleradiology may be defined as the transmission of images for diagnosis and interpretation purposes of imaging studies or digital modalities including X-rays, CT scan, MRI etc. This technology enables provide of imaging data delivery and access in a healthcare setting architecture whether in a Hospital, clinic or other remote Healthcare Delivery Point.

The teleradiology market has shown growth trends in the recent past due to the enhancement in the technical telecommunication and the need for the improved … In light of current global trends of improving health care delivery and patient care, teleradiology provides a solution to allow the health care givers to access the radiological reports from any part of the world. This capability is particularly important in areas underserved and/or geographically distanced from radiologist input. Additionally, chronic diseases and a growing population of people aged 60 and over also guarantees the steady growth of demand for radiological services, which makes healthcare institutions turn to teleradiology solutions for the better management of patient queues.

Teleradiology has also found a boost during the COVID-19 pandemic as healthcare systems shifted to the remote model for safer operations. Essentially, regulatory alterations and the quest for better or enhanced delivery of care have also provided significant stimulus to the teleradiology solutions. Therefore, such strategies and frameworks previously outlined enhance stakeholder healthcare providers to invest in digital imaging, telehealth, and teleradiology systems. As seen from the factors above, rising integration between healthcare facilities and teleradiology service providers should also foster the growth of the market since this will improve on resource utilization and management of patient related services.

Teleradiology Market Trend Analysis:

Integration of Artificial Intelligence

-

Extension of artificial intelligence (AI) within teleradiology is a novel shift that is present in health care. AI algorithms expand the functionality of image analysis by helping a radiologist identify pathology, increase diagnostic reliability, and decrease the time needed to review images. Radiologists can improve efficiency, while referring to results to the ordering physicians occurs faster which, in total, is always beneficial for the patient. Also, AI can prioritize data processing and help in categorizing cases by their severity levels where vital information should be attended to near completion, which is significance in emergency departments.

- With further advancement in AI technology, more possibilities of their utilization in teleradiology practice will appear, including utilization of functional AI procedures like automated image analysis and prognosis analytics. These advancements can also help people, in making right decisions about their health issues and treatment procedures. The increase in the use of AI by the healthcare industry and the continuous innovation in technologies support this trend making the teleradiology market have a positive and effective to enhance the delivery of healthcare needs.

Expansion in Emerging Markets

-

Current information reveals that developing nations can be a promising market in the teleradiology business. Emerging and Developing; With the increased rate of growth in the economy of these regions, the need for better and improved health facilities is well on demand. Several countries are rising their healthcare facilities hence increasing their demand for accurate diagnosis and other related services such as teleradiology. As the result teleradiology companies can solve the problem of the lack of specialized radiology services on these markets by building partnerships with the local healthcare suppliers.

- Furthermore, it is Africa’s high growth of chronic diseases, the emergence of new diseases, and its growing population are also increasing the demand for better diagnostics. Through teleradiology, patients in far flung areas may not see the doctor personally but they will receive their diagnosis and treatment plans as soon as possible. Those businesses that will seize this chance stand to benefit from the opportunity to establish themselves as market leaders within these markets as they seek to deliver on bespoke teleradiology solutions that address the balanced needs of both healthcare providers and end consumers.

Teleradiology Market Segment Analysis:

Teleradiology Market is Segmented on the basis of Imaging Technique, component, application End User and Region.

By Imaging Technique, CT (Computed Tomography) segment is expected to dominate the market during the forecast period

-

The teleradiology market is segmented into various imaging techniques, including X-ray, computed tomography (CT), ultrasound, magnetic resonance imaging (MRI), nuclear imaging, fluoroscopy, and mammography. The computed tomography (CT) segment holds the largest market share, driven by its wide range of applications in cardiology, oncology, neurology, and musculoskeletal imaging.

- The growing need for effective and early diagnosis, technological advancements, and digitalization in medical imaging are key factors fueling the growth of this segment. The World Health Organization reports CT scans are performed globally each year. CT scans are increasingly favored due to their ability to prevent exploratory surgeries and their crucial role in improving cancer diagnosis and treatment, making them a preferred choice over other imaging techniques in clinical practice.

By Application, Neurology segment expected to held the largest share

-

Teleradiology is an essential component of almost every medical specialty and is used in oncologic imaging, neuroradiology, musculoskeletal radiology, cardiovascular and thoracic radiology, and gastrointestinal radiology. In oncology, teleradiology can lead to optimal time delivery of reports to the oncologists which is crucial for cancer diagnosis and follow-up. Likewise, in neurology the means of sharing and analyzing brain images means faster diagnosis and treatment planning in such diseases. This is especially important in orthopedics, where teleradiology allows for second opinions from consultants about the patients’ bone and joint images and their subsequent management as well as use in surgical planning.

- More also, teleradiology is revolutionising cardiology and gastroenterology as patient’s imaging customary such as echocardiogram or abdominal ultrasounds can be done through consultation by remote professionals. This capability enables healthcare practitioner’s specialisation while not limiting a patient’s access to such expertise by location thus increasing the probability of the patient receiving quality health care. While specific imaging efficacies grow in the teleradiology market, its functions in those roles will progress, benefit patients, and enhance healthcare.

Teleradiology Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America holds the largest share of the market for teleradiology service at the present time owing to the improved health care facilities progressing adoption of teleradiology service. Its health field, especially in the United States of America, has been relatively developed to cater for the increasing needs of its people with well-focused on the roles of technology in delivering healthcare services. Teleradiology has become a very important part of this system as the delivery of health care needs to become efficient and accessible to specialist services and increase operational effectiveness. Rise in adoption of digital health solutions as well as an increased understanding of teleradiology solutions in the region is helping to drive growth of the market.

- Moreover, legal backing and fact that market has some key participants in the teleradiology segment also boosts the North America market. The region has seen a rise in the number of contracts between healthcare organisations and teleradiology service vendors which has enhanced the incorporation of imaging solutions into telemedicine technologies. Due to its focus on tele-services in health care, North America will continue to dominate the teleradiology market, dictating trends for the other global regions.

Active Key Players in the Teleradiology Market

-

Agfa HealthCare (Belgium)

- Canon Medical Systems (Japan)

- Fujifilm Medical Systems (Japan)

- GE Healthcare (USA)

- Mednax (USA)

- Nighthawk Radiology Services (USA)

- Philips Healthcare (Netherlands)

- Radiology Partners (USA)

- Radspher (USA)

- Siemens Healthineers (Germany)

- TeleRadiology Solutions (USA)

- vRad (USA)

- Other Active Players.

Key Industry Developments in the Teleradiology Market:

-

In March 2024, RamSoft, a supplier of cloud-based RIS/PACS radiology solutions catering to imaging centers and teleradiology providers announced that Premier Radiology Services has entered into a 5-year agreement to utilize RamSoft’s OmegaAI and cloud-based PowerServer PACS platform across its network of over 1,000 teleradiology locations.

- In October 2023, IMAGE Information Systems in collaboration with Aycan Medical Systems launched a new version of the iQ-ROUTER. These iQ-ROUTER, is a medical imaging router is designed to transfer medical images between different healthcare systems.

- In October 2023, Rology, an AI-assisted teleradiology platform in the Middle East and Africa received approval for their teleradiology platform from the USA Food and Drug Administration (FDA).

|

Global Teleradiology Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 13.40 Billion |

|

Forecast Period 2024-32 CAGR: |

26.54% |

Market Size in 2032: |

USD 111.47 Billion |

|

Segments Covered: |

By Imaging Technique |

|

|

|

By Component |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Teleradiology Market by Imaging Technique

4.1 Teleradiology Market Snapshot and Growth Engine

4.2 Teleradiology Market Overview

4.3 X-ray

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 X-ray: Geographic Segmentation Analysis

4.4 CT

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 CT : Geographic Segmentation Analysis

4.5 Computed Tomography MRI Magnetic Resonance Imaging Ultrasound

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Computed Tomography MRI Magnetic Resonance Imaging Ultrasound: Geographic Segmentation Analysis

4.6 Nuclear Imaging

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Nuclear Imaging: Geographic Segmentation Analysis

Chapter 5: Teleradiology Market by Component

5.1 Teleradiology Market Snapshot and Growth Engine

5.2 Teleradiology Market Overview

5.3 Hardware

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Hardware: Geographic Segmentation Analysis

5.4 Software

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Software: Geographic Segmentation Analysis

5.5 Services

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Services: Geographic Segmentation Analysis

5.6

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 : Geographic Segmentation Analysis

Chapter 6: Teleradiology Market by Application

6.1 Teleradiology Market Snapshot and Growth Engine

6.2 Teleradiology Market Overview

6.3 Oncology

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Oncology: Geographic Segmentation Analysis

6.4 Neurology

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Neurology: Geographic Segmentation Analysis

6.5 Orthopedics

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Orthopedics: Geographic Segmentation Analysis

6.6 Cardiology

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Cardiology: Geographic Segmentation Analysis

6.7 Gastroenterology

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Gastroenterology: Geographic Segmentation Analysis

Chapter 7: Teleradiology Market by End-User

7.1 Teleradiology Market Snapshot and Growth Engine

7.2 Teleradiology Market Overview

7.3 Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Hospitals: Geographic Segmentation Analysis

7.4 Diagnostic Imaging Centers

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Diagnostic Imaging Centers: Geographic Segmentation Analysis

7.5 Specialty Clinics

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Specialty Clinics: Geographic Segmentation Analysis

7.6 Research and Academic Institutions)

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Research and Academic Institutions) : Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Teleradiology Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 RADIOLOGY PARTNERS (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 VRAD (USA)

8.4 MEDNAX (USA)

8.5 TELERADIOLOGY SOLUTIONS (USA)

8.6 RADSPHER (USA)

8.7 NIGHTHAWK RADIOLOGY SERVICES (USA)

8.8 SIEMENS HEALTHINEERS (GERMANY)

8.9 AGFA HEALTHCARE (BELGIUM)

8.10 OTHER ACTIVE PLAYERS

Chapter 9: Global Teleradiology Market By Region

9.1 Overview

9.2. North America Teleradiology Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Imaging Technique

9.2.4.1 X-ray

9.2.4.2 CT

9.2.4.3 Computed Tomography MRI Magnetic Resonance Imaging Ultrasound

9.2.4.4 Nuclear Imaging

9.2.5 Historic and Forecasted Market Size By Component

9.2.5.1 Hardware

9.2.5.2 Software

9.2.5.3 Services

9.2.5.4

9.2.6 Historic and Forecasted Market Size By Application

9.2.6.1 Oncology

9.2.6.2 Neurology

9.2.6.3 Orthopedics

9.2.6.4 Cardiology

9.2.6.5 Gastroenterology

9.2.7 Historic and Forecasted Market Size By End-User

9.2.7.1 Hospitals

9.2.7.2 Diagnostic Imaging Centers

9.2.7.3 Specialty Clinics

9.2.7.4 Research and Academic Institutions)

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Teleradiology Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Imaging Technique

9.3.4.1 X-ray

9.3.4.2 CT

9.3.4.3 Computed Tomography MRI Magnetic Resonance Imaging Ultrasound

9.3.4.4 Nuclear Imaging

9.3.5 Historic and Forecasted Market Size By Component

9.3.5.1 Hardware

9.3.5.2 Software

9.3.5.3 Services

9.3.5.4

9.3.6 Historic and Forecasted Market Size By Application

9.3.6.1 Oncology

9.3.6.2 Neurology

9.3.6.3 Orthopedics

9.3.6.4 Cardiology

9.3.6.5 Gastroenterology

9.3.7 Historic and Forecasted Market Size By End-User

9.3.7.1 Hospitals

9.3.7.2 Diagnostic Imaging Centers

9.3.7.3 Specialty Clinics

9.3.7.4 Research and Academic Institutions)

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Teleradiology Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Imaging Technique

9.4.4.1 X-ray

9.4.4.2 CT

9.4.4.3 Computed Tomography MRI Magnetic Resonance Imaging Ultrasound

9.4.4.4 Nuclear Imaging

9.4.5 Historic and Forecasted Market Size By Component

9.4.5.1 Hardware

9.4.5.2 Software

9.4.5.3 Services

9.4.5.4

9.4.6 Historic and Forecasted Market Size By Application

9.4.6.1 Oncology

9.4.6.2 Neurology

9.4.6.3 Orthopedics

9.4.6.4 Cardiology

9.4.6.5 Gastroenterology

9.4.7 Historic and Forecasted Market Size By End-User

9.4.7.1 Hospitals

9.4.7.2 Diagnostic Imaging Centers

9.4.7.3 Specialty Clinics

9.4.7.4 Research and Academic Institutions)

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Teleradiology Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Imaging Technique

9.5.4.1 X-ray

9.5.4.2 CT

9.5.4.3 Computed Tomography MRI Magnetic Resonance Imaging Ultrasound

9.5.4.4 Nuclear Imaging

9.5.5 Historic and Forecasted Market Size By Component

9.5.5.1 Hardware

9.5.5.2 Software

9.5.5.3 Services

9.5.5.4

9.5.6 Historic and Forecasted Market Size By Application

9.5.6.1 Oncology

9.5.6.2 Neurology

9.5.6.3 Orthopedics

9.5.6.4 Cardiology

9.5.6.5 Gastroenterology

9.5.7 Historic and Forecasted Market Size By End-User

9.5.7.1 Hospitals

9.5.7.2 Diagnostic Imaging Centers

9.5.7.3 Specialty Clinics

9.5.7.4 Research and Academic Institutions)

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Teleradiology Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Imaging Technique

9.6.4.1 X-ray

9.6.4.2 CT

9.6.4.3 Computed Tomography MRI Magnetic Resonance Imaging Ultrasound

9.6.4.4 Nuclear Imaging

9.6.5 Historic and Forecasted Market Size By Component

9.6.5.1 Hardware

9.6.5.2 Software

9.6.5.3 Services

9.6.5.4

9.6.6 Historic and Forecasted Market Size By Application

9.6.6.1 Oncology

9.6.6.2 Neurology

9.6.6.3 Orthopedics

9.6.6.4 Cardiology

9.6.6.5 Gastroenterology

9.6.7 Historic and Forecasted Market Size By End-User

9.6.7.1 Hospitals

9.6.7.2 Diagnostic Imaging Centers

9.6.7.3 Specialty Clinics

9.6.7.4 Research and Academic Institutions)

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Teleradiology Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Imaging Technique

9.7.4.1 X-ray

9.7.4.2 CT

9.7.4.3 Computed Tomography MRI Magnetic Resonance Imaging Ultrasound

9.7.4.4 Nuclear Imaging

9.7.5 Historic and Forecasted Market Size By Component

9.7.5.1 Hardware

9.7.5.2 Software

9.7.5.3 Services

9.7.5.4

9.7.6 Historic and Forecasted Market Size By Application

9.7.6.1 Oncology

9.7.6.2 Neurology

9.7.6.3 Orthopedics

9.7.6.4 Cardiology

9.7.6.5 Gastroenterology

9.7.7 Historic and Forecasted Market Size By End-User

9.7.7.1 Hospitals

9.7.7.2 Diagnostic Imaging Centers

9.7.7.3 Specialty Clinics

9.7.7.4 Research and Academic Institutions)

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Teleradiology Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 13.40 Billion |

|

Forecast Period 2024-32 CAGR: |

26.54% |

Market Size in 2032: |

USD 111.47 Billion |

|

Segments Covered: |

By Imaging Technique |

|

|

|

By Component |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||