Global Target Drone Market Overview

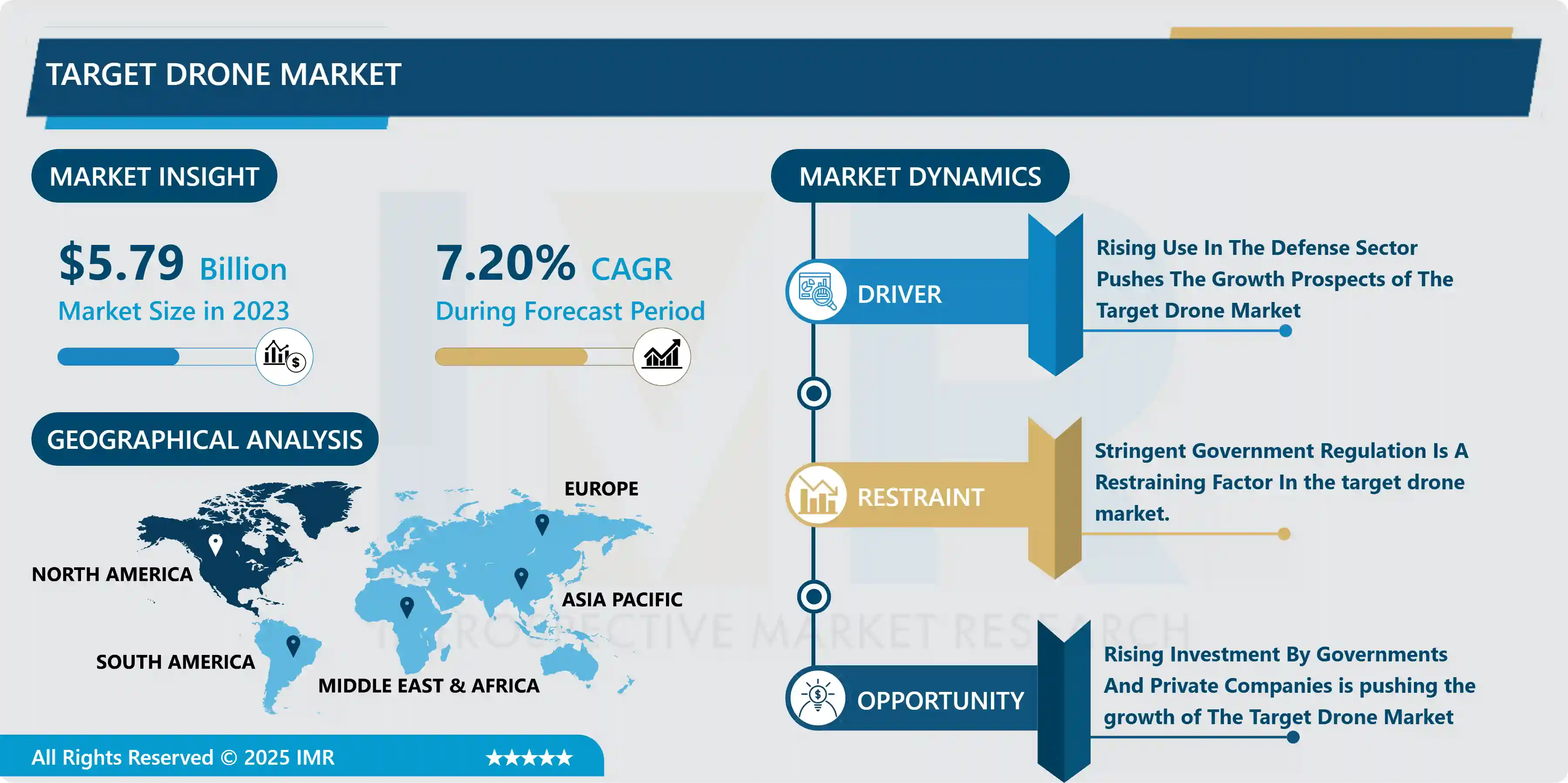

Global Target Drone Market Size Was Valued at USD 5.79 billion In 2023 And Is Projected to Reach USD 10.82 billion By 2032, Growing at A CAGR of 7.20% From 2024 to 2032.

Target drones are a subclass of remote-controlled unmanned aerial vehicles (UAVs) that are used for weapon system testing and evaluation, counter-artillery operations, and anti-aircraft crew training in the real world. It ensures the dependability, performance, and cost-effectiveness of a wide range of weaponry, training, and roles, and so contributes to an increase in war readiness among the country's defense forces. Target drones come in a variety of shapes and sizes, but the core components (battery, micro-motor, controller, sensors) are all essentially the same. Drones are made with smartphone parts, thus investing in them for the past ten years has resulted in lower drone prices and greater availability for consumers and enterprises.

Target drones can be thought of as cellphones with the ability to fly or move around. Unlike most fintech advances, such as large data and payment improvements, the usage of drones is a valuable mix of mobile phone hardware and internet connectivity. Based on reasons such as the rise of piracy, transnational terrorism, insurrection, and smuggling, the general goal of the market for unmanned aerial vehicles, which are, in essence, administration, with an emphasis on actual weather, education, and training. As a result, a growing number of countries are adopting unmanned aerial vehicles, as well as their education and training programs. The whole target market for unmanned aerial vehicles is likely to grow during the forecasted period.

Market Dynamics And Factors For Target Drone Market

Drivers:

Rising Use In The Defense Sector Pushing The Growth Prospects of The Target Drone Market

- In recent years, global military spending has increased at an exponential rate. The Stockholm International Peace Research Institute (SIPRI) estimates that global military spending will reach $1,981 billion in 2020, up 2.6 percent from the previous year. In 2020, military spending accounted for 2.4 percent of the worldwide gross domestic product. As a result, the use of contemporary defense systems, such as target drone systems and similar technology, has increased as global military spending has increased. Increased military and defense spending around the world makes target drone system technology easier to execute. Furthermore, advances in weaponry and attacking capabilities around the world have sparked a spike in demand for governments to modernize and deploy advanced defensive infrastructure to counter threats and offensive strikes from foreign countries. As a result, increased defense spending is likely to open up new opportunities for the target drone market to flourish during the forecast period.

Restraints:

Stringent Government Regulation Is A Restraining Factor In Target Drone Market

- FAA regulations not only fail to address the practical reality of drone dangers, but they also unnecessarily limit the technology's potential benefits. The FAA's line-of-sight rule, in particular, has squandered the opportunity for huge commercial and public-safety gains. This restriction discourages technology behemoths like Amazon and Google from investing domestically20, driving innovation, testing, and investment in drones to other countries, displacing millions of jobs and billions of dollars. The FAA's regulation structure further restricts a wide range of applications that have proven to be beneficial to enterprises, scientific research, and disaster response on a global scale.

Opportunities:

Rising Investment By Governments And Private Companies Pushing The Growth of The Target Drone Market

- China, Israel, and the United States account for the majority of investments and well-funded businesses within the market, however, each country has a distinct area of focus. Target Drone Market accounted for 36% of North American consumer target drone sales last year. US firms, on the other hand, are concentrating on building specialized commercial hardware solutions or end-to-end software for commercial applications, while Israel has been at the forefront of military application development. With Tel Aviv-based Airobotics, Israeli drone startups are now leading the way in autonomous solutions for businesses. The race to develop advanced commercial solutions has been led by US enterprises and startups, aided by the developed local industry and demand for business analytics. As a result, Chinese enterprises will gain a firmer foothold in the commercial sector in the following year, using their manufacturing, hardware solutions, and internal market development competencies.

Challenges:

The Lack of Trained Drone Operators Is A Major Challenge

- The market is severely constrained by a scarcity of competent pilots who can fly current target drones at high speeds and collect reliable data. This component is widespread not only in the defense sector but also in the commercial sector. While target drones are extremely useful for providing military personnel with realistic battle scenario training, there is a severe global scarcity of skilled drone operators.

Segmentation Analysis of Target Drone Market

- By Engine Type, the Turbojet engine segment is expected to be dominated in the Target Drone Market. Turbojet engines are being widely used in target drones in recent years. It provides great dependability, high fuel efficiency, low thrust-to-weight ratio, lengthy duration of operation and storage in aircraft, and small scope of routine maintenance. The North American market has seen major growth in terms of the development of the target drone market with newly emerging companies and favorable government regulation. Kratos California manufacturing unit produces the BQM-167A, the US Air Force's (USAF) only subscale aerial target platform, and the BQM-177A, a subsonic aerial target used by the US Navy to simulate sea-skimming cruise missiles. Kratos' development of target drones is progressing by adopting the turbojet engine adoption target drone. It has also affected the United States Air Forces' work on tactical jet-powered unmanned air vehicles (UAVs) which is propelling the target drone market.

- By Platform, Arial target is expected to be dominating the Target Drone Market. Unmanned aerial targets (UATs) are unmanned aerial vehicles (UAVs) used in the development and testing of military systems, as well as in educating military troops on threat identification and destruction tests of both anti-aircraft systems and piloted combat aircraft. The behavior of these unmanned vehicles is modeled like that of real aerial threats. Due to their unique capacity to replicate and simulate actual threats with the help of various payloads such as passive and active radar augmentation, infrared augmentation, and others, aerial targets are expected to dominate the worldwide target drone market.

- By End Use, the Defense segment dominates the Target drone market. Due to a strong focus on military modernization operations aimed at improving combat training and increasing staff efficiency and performance. In that regard, Airbus offers a full range of target systems providing realistic and cost-effective training for ground-based and naval Air Defense and Air-to-Air Combat, encompassing towed aerial targets, direct aerial targets, and surface targets. Target drones from Airbus have statistics such as 2,700 missions performed and 1,700+ direct targets deployed which has become one of the leading companies in the target drone market.

Regional Analysis of Target Drone Market

- North America dominates the Target Drone Market. In North America, the United States plays a prominent role to develop the target drone market. Increased defense spending, expanding acceptance and spending on the use of unmanned aerial vehicles in the defense sector, and the existence of several established businesses providing target drones for military weapon simulation and testing are all factors leading to growth in the North American area. Aero targets International, The Boeing Company, Griffon Aerospace, and Kratos Defense & Security Solutions, Inc. are just a few of the well-known target drone companies based in North America. In addition, many North American businesses are attempting to increase the effectiveness of their various target drone business units. Kratos Defense & Security Solutions, Inc reported that its "Unmanned Systems Division" had obtained a contract worth roughly US$ 38 million for unmanned aerial drone aircraft.

- The Asia Pacific is expected to be a swiftly growing region in Target Drones Market. In the Indo-Pacific, the target drone development is growing. The desire to produce indigenous armed drones spread across Asia after the success of drones on numerous battlefields. Pakistan, Turkey, Iran, Russia, Taiwan, and India are all working on armed drones. Armed drones were being used by 39 countries as of late 2020, five of which were from the Asia-Pacific area. Target drones appeared to be one of the most cost-effective ways to maintain a military presence, especially in the tumultuous South and East China seas. Although marine UAV technology has not yet caught up to that of aerial drones, countries such as the United States, the United Kingdom, and Russia are already looking to the water for UAV development. In addition, Indo-Pacific countries began depending on unmanned systems for maritime operations, such as monitoring China's activities and keeping an eye on piracy and transnational criminal activity. Hence, the Asia Pacific region is expected to grow exponentially during the forecasted period.

Players Covered in Target Drone Market are

- The Boeing Company (US)

- QinetiQ Group plc (UK)

- Northrop Grumman Corporation (US)

- Kratos Defense & Security Solutions Inc. (the US)

- Airbus Group(Netherlands)

- Lockheed Martin Corporation (US)

- Leonardo S.p.A. (Italy)

- BSK Defense S.A. (Greece)

- Air Affairs Australia Pty Ltd (Australia)

- Saab AB (Sweden)

- AeroTargets International LLC (US)

- L3 ASV (UK)

- BAE Systems (UK)

- Raytheon (US)

- General Dynamics Corporation (US)

- Almaz-Antey (Russia)

- Thales (France)

- Embention (Spain)

- Griffon Aerospace (US)

- Denel Dynamics (South Africa) and other major players.

Key Industry Developments In Target Drone Market

- In August 2023, The Department of Defence, Australia, chose Lockheed Martin Corporation as its strategic partner to oversee AIR6500 Phase 1 (AIR6500-1). The Australian Defence Force (ADF) will receive the Joint Air Battle Management System (JABMS) from AIR6500-1, which will serve as the innovative architecture at the heart of the ADF's upcoming Integrated Air and Missile Defence (IAMD) capability. This will help the company to gain more order proposals from the clients.

- In February 2023, The U.S. Marine Corps awarded Northrop Grumman Corporation (NYSE: NOC) the initial production and operations contract for the Next Generation Handheld Targeting System (NGHTS). NGHTS is a compact targeting system that provides advanced precision targeting and is capable of operation in GPS-denied environments.

|

Target Drone Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market size in 2023: |

USD 5.79 Bn. |

|

Forecast Period 2024–32 CAGR: |

7.20% |

Market size in 2032: |

USD 10.82 Bn. |

|

Segments Covered: |

By Engine Type |

|

|

|

By Platform |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Target Drone Market by Engine Type (2018-2032)

4.1 Target Drone Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Internal Combustion Engine

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Jet Engine

4.5 Others

Chapter 5: Target Drone Market by Platform (2018-2032)

5.1 Target Drone Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Aerial Targets

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Ground Targets

5.5 Underwater Targets

5.6 Sea Surface Targets

Chapter 6: Target Drone Market by End Users (2018-2032)

6.1 Target Drone Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Defense

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Homeland Security

6.5 Commercial

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Target Drone Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BASF S.A. (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BRASKEM (BRAZIL)

7.4 CARDIA BIOPLASTICS (AUSTRALIA)

7.5 NOVOMANT SPA (ITALY)

7.6 METABOLIX INC. (US)

7.7 INNOVIA FILMS (UK)

7.8 BIOME TECHNOLOGIES PLC (UK)

7.9 FKUR KUNSTSTOFF GMBH (GERMANY)

7.10 GREEN DOT BIOPLASTICS (US)

7.11 GOOD NATURED PRODUCTS INC. (CANADA)

7.12 NATUREWORKS LLC (US)

7.13 CORBION PURAC (NETHERLANDS)

7.14 PURAC (NETHERLANDS)

Chapter 8: Global Target Drone Market By Region

8.1 Overview

8.2. North America Target Drone Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Engine Type

8.2.4.1 Internal Combustion Engine

8.2.4.2 Jet Engine

8.2.4.3 Others

8.2.5 Historic and Forecasted Market Size by Platform

8.2.5.1 Aerial Targets

8.2.5.2 Ground Targets

8.2.5.3 Underwater Targets

8.2.5.4 Sea Surface Targets

8.2.6 Historic and Forecasted Market Size by End Users

8.2.6.1 Defense

8.2.6.2 Homeland Security

8.2.6.3 Commercial

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Target Drone Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Engine Type

8.3.4.1 Internal Combustion Engine

8.3.4.2 Jet Engine

8.3.4.3 Others

8.3.5 Historic and Forecasted Market Size by Platform

8.3.5.1 Aerial Targets

8.3.5.2 Ground Targets

8.3.5.3 Underwater Targets

8.3.5.4 Sea Surface Targets

8.3.6 Historic and Forecasted Market Size by End Users

8.3.6.1 Defense

8.3.6.2 Homeland Security

8.3.6.3 Commercial

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Target Drone Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Engine Type

8.4.4.1 Internal Combustion Engine

8.4.4.2 Jet Engine

8.4.4.3 Others

8.4.5 Historic and Forecasted Market Size by Platform

8.4.5.1 Aerial Targets

8.4.5.2 Ground Targets

8.4.5.3 Underwater Targets

8.4.5.4 Sea Surface Targets

8.4.6 Historic and Forecasted Market Size by End Users

8.4.6.1 Defense

8.4.6.2 Homeland Security

8.4.6.3 Commercial

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Target Drone Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Engine Type

8.5.4.1 Internal Combustion Engine

8.5.4.2 Jet Engine

8.5.4.3 Others

8.5.5 Historic and Forecasted Market Size by Platform

8.5.5.1 Aerial Targets

8.5.5.2 Ground Targets

8.5.5.3 Underwater Targets

8.5.5.4 Sea Surface Targets

8.5.6 Historic and Forecasted Market Size by End Users

8.5.6.1 Defense

8.5.6.2 Homeland Security

8.5.6.3 Commercial

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Target Drone Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Engine Type

8.6.4.1 Internal Combustion Engine

8.6.4.2 Jet Engine

8.6.4.3 Others

8.6.5 Historic and Forecasted Market Size by Platform

8.6.5.1 Aerial Targets

8.6.5.2 Ground Targets

8.6.5.3 Underwater Targets

8.6.5.4 Sea Surface Targets

8.6.6 Historic and Forecasted Market Size by End Users

8.6.6.1 Defense

8.6.6.2 Homeland Security

8.6.6.3 Commercial

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Target Drone Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Engine Type

8.7.4.1 Internal Combustion Engine

8.7.4.2 Jet Engine

8.7.4.3 Others

8.7.5 Historic and Forecasted Market Size by Platform

8.7.5.1 Aerial Targets

8.7.5.2 Ground Targets

8.7.5.3 Underwater Targets

8.7.5.4 Sea Surface Targets

8.7.6 Historic and Forecasted Market Size by End Users

8.7.6.1 Defense

8.7.6.2 Homeland Security

8.7.6.3 Commercial

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Target Drone Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market size in 2023: |

USD 5.79 Bn. |

|

Forecast Period 2024–32 CAGR: |

7.20% |

Market size in 2032: |

USD 10.82 Bn. |

|

Segments Covered: |

By Engine Type |

|

|

|

By Platform |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||