Surgical Mesh Market Synopsis

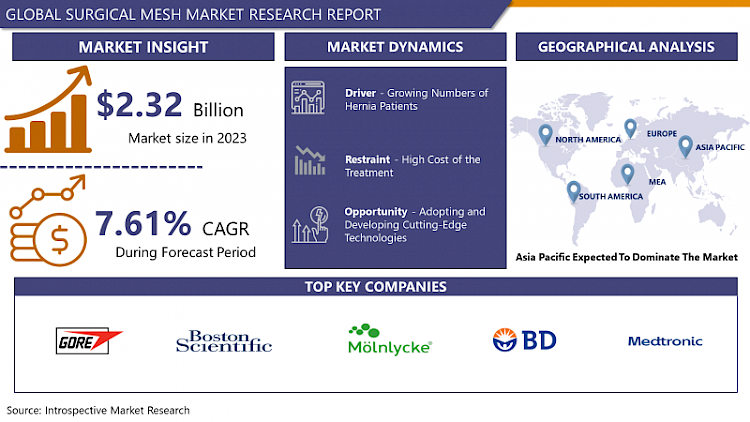

Surgical Mesh Market Size Was Valued at USD 2.32 Billion in 2023 and is Projected to Reach USD 4.48 Billion by 2032, Growing at a CAGR of 7.61% From 2024-2032

Surgical mesh could be defined as a medical device that is used in several surgeries as a material from synthetic materials or animal tissues with a view of offering support, additional layer or repair of tissues. This is for example in surgeries like pelvic organ prolapse repair, and treatment of stress urinary incontinence. The mesh is designed to be biocompatible, allowing it to integrate with surrounding tissues over time. Its use aims to strengthen weakened or damaged tissue, reduce recurrence rates, and promote faster healing. However, concerns have arisen regarding potential complications associated with certain types of surgical mesh, leading to ongoing debates and regulatory scrutiny in the medical community.

- There is emerging empirical evidence to support that the Surgical mesh market has been on an upward trend in the recent past by factors such as; Growing popularity for minimally invasive surgical operations; Rising incidence of diseases like hernia, pelvic organ prolapse and stress urinary incontinence. In this article risks and benefits of using surgical mesh include decrease in operative time, decrease length of hospital stay, and lower rate of recurrence than traditional surgery practices. Additional factors that have promoted the growth of the market include the progress in the construction of mesh through technological features such as the creation of slender and biomaterial meshes.

- At the same time, it is also important to note the threats that the global surgical mesh market has to deal with; these are mainly associated with safety concerns and regulatory aspects. Some of the issues that have been associated with specific kinds of meshes include mesh shrinkage, infection, and pain, with these concerns provoking the interest of the regulatory bodies and other healthcare givers. Thus, the shortcomings made manufacturers design better products that offer increased safety and effectiveness In the meantime, regulatory agencies also enhance updates on measures and guidelines for the use of surgical mesh. However, as mentioned in the previous sections, it is believed that the surgical mesh market will continue growing since the enhancement in the material used and the improved surgical procedures will help in achieving higher growth.

Surgical Mesh Market Trend Analysis

Increasing focus on biocompatible and bioabsorbable materials

- Since there have been complaints about the ligament of some synthetic mesh implants, especially the foreign material that remains in the body for a long time, there has been a desire to create meshes which can easily be metabolized in the body and therefore give rise to complications such as erosion and chronic inflammation. Mesh products that are produced from technology and thin and flexible medical materials such as absorbable polymer or collagen are a researching area of manufacturers. It follows the global trend toward the use of biodegradable medical devices and is indicative of medical companies’ desire to enhance the positions of patients and ensure more effective and secure surgeries with the use of mesh implants.

Development of innovative materials and technologies

- An upcoming trend in the surgical mesh market area is one that relates to the establishment of new and effective materials that will also help in minimizing the safety issues and enhance the patient satisfaction. Companies of mesh manufacturers that focus on developing new counterparts for research that can provide biocompatibility, light weight ness, flexibility and better mechanical strength should be in a vantage point. These advancements could lead to lowered incidences of mesh erosion, infection, and chronic pain that patients experience, improved patient satisfaction, and have some bearing on the cost of health effects of complications and revisions.

- However, what is also to be noted is that there is room for companies interested in undertaking more specific surgeries for customer needs were the surgical mesh market is concerned. Pertaining to mesh implants, manufacturing them to fit patient anatomy and the specific demands of the planned surgery can lead to better performance and less possibility of adverse effects. This could include using 3D printing or other imaging techniques to provide unique custom mesh materials that are individually suited to the patient in need, providing more compatible and precise outcomes.

Surgical Mesh Market Segment Analysis:

Surgical Mesh Market Segmented on the basis of Product type, application, and end-users.

By Type, Synthetic Surgical Meshes segment is expected to dominate the market during the forecast period

- Based on the type of surgical meshes, it has been highlighted that the synthetic surgical meshes segment shall continue to flourish in the surgical mesh market during the forecast period. Despite the differences in their chemical structure, they share similar characteristics, including high tensile strength and biocompatibility which renders them less susceptible to either mechanical failure or infection, primarily as a result of being made from polypropylene, PET and ePTFE respectively. These meshes have been approved for use in several different operations – for example, inguinal hernia repair, prolapse surgery, and the treatment of female stress urinary incontinence because they offer strong tissue support.

- Further, synthetic meshes are preferred due to their low cost and universal accessibility and ability to offer various sizes and types of meshes that may be required according to patient’s condition and surgery specifics. The subsequent availability of new technological preferences in the construction of synthetic mesh ranging from light innovated mesh, macroporous nature of the mesh give this surgical mesh a superior technological proficiency making them supreme in the market. However, certain kinds of synthetic meshes have been fraught with possible complications as mesh erosion and inflammatory reactions to the mesh which is why research is still deemed relevant to develop the segment with safer mesh products for the patient.

By Application, Hernia Repair segment is expected to held the largest share

- When considering the applications of surgical mesh, the global bucon market expects the market for hernia repair to emerge as the industry’s biggest application segment. To this effect, the following reasons can be credited for our findings: increased incidence of hernias across the world; the rising popularity of laparoscopic procedures; and the rising geriatric population who are more susceptible to the formation of hernias. Surgical mesh is a major component in these techniques and is employed principally for its function of providing stasis to the damaged abdominal cavity as well as a barrier against further recurrence of the same hernia and minimizing such hernias when they reoccur by offering better holding strength than the conventional means of stitching the site which allows for faster healing than sutures.

- The advancement of the mesh materials like the formulation of light tri-facial meshes though biocompatible positively influence the practice of mesh mediated hernia surgeries. Due to constant demand of a suitable and lasting solution for the hernia repair surgery coupled with the constant development on the surgical mesh type, design and production, the hernia repair segment shall continue to represent a large share in the surgical mesh market in the coming future.

Surgical Mesh Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The surgical mesh market for the Asia Pacific region is acquire a dependable dominating position in the forecasting period. Several reasons can be anticipated for this trend, including: This first, the regional has inflated health car expenses and infrastructural enhancement steadily especially in the Chinua India and Japan. This growth is driving up the need for enhanced medical solutions equipment and various procedures such as the implantation of surgical mesh.

- Besides, an increase in the number of aging people and the increase in the number of chronic diseases also led to other operations, including hernias and pelvic organ prolapse that also need surgical mesh, thus further increasing this demand. In addition, skilled labour is more easily available as compared to other developed countries for the healthcare industry and there is also an increasing realization among the patients of the advantages of undergoing a minimally invasive surgical procedure.

- Furthermore, health care trends and product development, along with further enhancement of such technologies, are envisaged to drive the regional market growth. Considering these factors, Asia Pacific is expected to create a significant opportunity within surgical mesh market and provide attractive opportunities for the players to increase their market footprint within the region and ride along with the growth of the healthcare Industry of this region.

Active Key Players in the Surgical Mesh Market

- W. L. Gore & Associates. Inc. (U.S)

- Boston Scientific Corporation (U.S)

- Mölnlycke Health Care AB (Sweden)

- Medical Devices Business Services, Inc. (U.S)

- BD (U.S)

- TEPHA INC. (U.S)

- Medtronic (Ireland)

- LifeCell International Pvt. Ltd. (India)

- B. Braun Melsungen AG (Germany)

- Betatech Medical (Turkey)

- Ethicon Inc (U.S)

- C.R. Bard, Inc (U.S)

- Atrium (U.S), and Other key Players

Key Industry Developments in the Surgical Mesh Market:

- In February 2022, Futura Surgicare Pvt. Ltd.'s Dolphin Mesh is a line of premium dual meshes utilized in laparoscopic tension-free hernia repairs and "tension-free" procedures.

- In August 2022, Ariste Medical's drug-embedded synthetic hernia mesh was granted 510(k) authorization by the United States Food and Drug Administration in order to reduce the risk of microbial colonization during implantation.

|

Global Surgical Mesh Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.32 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.61% |

Market Size in 2032: |

USD 4.48 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SURGICAL MESH MARKET BY PRODUCT TYPE (2017-2032)

- SURGICAL MESH MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SYNTHETIC SURGICAL MESHES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BIOSYNTHETIC SURGICAL MESHES

- BIOLOGIC SURGICAL MESHES

- HYBRID/COMPOSITE SURGICAL MESHES

- SURGICAL MESH MARKET BY APPLICATION (2017-2032)

- SURGICAL MESH MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HERNIA REPAIR

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- TRAUMATIC OR SURGICAL WOUNDS

- ABDOMINAL WALL RECONSTRUCTION

- FACIAL SURGERY

- SURGICAL MESH MARKET BY END-USER (2017-2032)

- SURGICAL MESH MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HOSPITALS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- AMBULATORY SURGICAL CENTERS

- CLINICS

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Surgical Mesh Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- W. L. GORE & ASSOCIATES. INC. (U.S)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- BOSTON SCIENTIFIC CORPORATION (U.S)

- MÖLNLYCKE HEALTH CARE AB (SWEDEN)

- MEDICAL DEVICES BUSINESS SERVICES, INC. (U.S)

- BD (U.S)

- TEPHA INC. (U.S)

- MEDTRONIC (IRELAND)

- LIFECELL INTERNATIONAL PVT. LTD. (INDIA)

- B. BRAUN MELSUNGEN AG (GERMANY)

- BETATECH MEDICAL (TURKEY)

- ETHICON INC (U.S)

- C.R. BARD, INC (U.S)

- ATRIUM (U.S)

- COMPETITIVE LANDSCAPE

- GLOBAL SURGICAL MESH MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Surgical Mesh Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.32 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.61% |

Market Size in 2032: |

USD 4.48 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SURGICAL MESH MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SURGICAL MESH MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SURGICAL MESH MARKET COMPETITIVE RIVALRY

TABLE 005. SURGICAL MESH MARKET THREAT OF NEW ENTRANTS

TABLE 006. SURGICAL MESH MARKET THREAT OF SUBSTITUTES

TABLE 007. SURGICAL MESH MARKET BY PRODUCT TYPE

TABLE 008. SYNTHETIC SURGICAL MESHES MARKET OVERVIEW (2016-2028)

TABLE 009. BIOSYNTHETIC SURGICAL MESHES MARKET OVERVIEW (2016-2028)

TABLE 010. BIOLOGIC SURGICAL MESHES MARKET OVERVIEW (2016-2028)

TABLE 011. HYBRID/COMPOSITE SURGICAL MESHES MARKET OVERVIEW (2016-2028)

TABLE 012. SURGICAL MESH MARKET BY APPLICATION

TABLE 013. HERNIA REPAIR MARKET OVERVIEW (2016-2028)

TABLE 014. TRAUMATIC OR SURGICAL WOUNDS MARKET OVERVIEW (2016-2028)

TABLE 015. ABDOMINAL WALL RECONSTRUCTION MARKET OVERVIEW (2016-2028)

TABLE 016. FACIAL SURGERY MARKET OVERVIEW (2016-2028)

TABLE 017. SURGICAL MESH MARKET BY END-USER

TABLE 018. HOSPITALS MARKET OVERVIEW (2016-2028)

TABLE 019. AMBULATORY SURGICAL CENTERS MARKET OVERVIEW (2016-2028)

TABLE 020. CLINICS MARKET OVERVIEW (2016-2028)

TABLE 021. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 022. NORTH AMERICA SURGICAL MESH MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 023. NORTH AMERICA SURGICAL MESH MARKET, BY APPLICATION (2016-2028)

TABLE 024. NORTH AMERICA SURGICAL MESH MARKET, BY END-USER (2016-2028)

TABLE 025. N SURGICAL MESH MARKET, BY COUNTRY (2016-2028)

TABLE 026. EUROPE SURGICAL MESH MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 027. EUROPE SURGICAL MESH MARKET, BY APPLICATION (2016-2028)

TABLE 028. EUROPE SURGICAL MESH MARKET, BY END-USER (2016-2028)

TABLE 029. SURGICAL MESH MARKET, BY COUNTRY (2016-2028)

TABLE 030. ASIA PACIFIC SURGICAL MESH MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 031. ASIA PACIFIC SURGICAL MESH MARKET, BY APPLICATION (2016-2028)

TABLE 032. ASIA PACIFIC SURGICAL MESH MARKET, BY END-USER (2016-2028)

TABLE 033. SURGICAL MESH MARKET, BY COUNTRY (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA SURGICAL MESH MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA SURGICAL MESH MARKET, BY APPLICATION (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA SURGICAL MESH MARKET, BY END-USER (2016-2028)

TABLE 037. SURGICAL MESH MARKET, BY COUNTRY (2016-2028)

TABLE 038. SOUTH AMERICA SURGICAL MESH MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 039. SOUTH AMERICA SURGICAL MESH MARKET, BY APPLICATION (2016-2028)

TABLE 040. SOUTH AMERICA SURGICAL MESH MARKET, BY END-USER (2016-2028)

TABLE 041. SURGICAL MESH MARKET, BY COUNTRY (2016-2028)

TABLE 042. W. L. GORE & ASSOCIATES. INC. (U.S): SNAPSHOT

TABLE 043. W. L. GORE & ASSOCIATES. INC. (U.S): BUSINESS PERFORMANCE

TABLE 044. W. L. GORE & ASSOCIATES. INC. (U.S): PRODUCT PORTFOLIO

TABLE 045. W. L. GORE & ASSOCIATES. INC. (U.S): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. BOSTON SCIENTIFIC CORPORATION (U.S): SNAPSHOT

TABLE 046. BOSTON SCIENTIFIC CORPORATION (U.S): BUSINESS PERFORMANCE

TABLE 047. BOSTON SCIENTIFIC CORPORATION (U.S): PRODUCT PORTFOLIO

TABLE 048. BOSTON SCIENTIFIC CORPORATION (U.S): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. MÖLNLYCKE HEALTH CARE AB (SWEDEN): SNAPSHOT

TABLE 049. MÖLNLYCKE HEALTH CARE AB (SWEDEN): BUSINESS PERFORMANCE

TABLE 050. MÖLNLYCKE HEALTH CARE AB (SWEDEN): PRODUCT PORTFOLIO

TABLE 051. MÖLNLYCKE HEALTH CARE AB (SWEDEN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. MEDICAL DEVICES BUSINESS SERVICES: SNAPSHOT

TABLE 052. MEDICAL DEVICES BUSINESS SERVICES: BUSINESS PERFORMANCE

TABLE 053. MEDICAL DEVICES BUSINESS SERVICES: PRODUCT PORTFOLIO

TABLE 054. MEDICAL DEVICES BUSINESS SERVICES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. INC. (U.S): SNAPSHOT

TABLE 055. INC. (U.S): BUSINESS PERFORMANCE

TABLE 056. INC. (U.S): PRODUCT PORTFOLIO

TABLE 057. INC. (U.S): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. BD (U.S): SNAPSHOT

TABLE 058. BD (U.S): BUSINESS PERFORMANCE

TABLE 059. BD (U.S): PRODUCT PORTFOLIO

TABLE 060. BD (U.S): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. TEPHA INC. (U.S): SNAPSHOT

TABLE 061. TEPHA INC. (U.S): BUSINESS PERFORMANCE

TABLE 062. TEPHA INC. (U.S): PRODUCT PORTFOLIO

TABLE 063. TEPHA INC. (U.S): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. MEDTRONIC (IRELAND): SNAPSHOT

TABLE 064. MEDTRONIC (IRELAND): BUSINESS PERFORMANCE

TABLE 065. MEDTRONIC (IRELAND): PRODUCT PORTFOLIO

TABLE 066. MEDTRONIC (IRELAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. LIFECELL INTERNATIONAL PVT. LTD. (INDIA): SNAPSHOT

TABLE 067. LIFECELL INTERNATIONAL PVT. LTD. (INDIA): BUSINESS PERFORMANCE

TABLE 068. LIFECELL INTERNATIONAL PVT. LTD. (INDIA): PRODUCT PORTFOLIO

TABLE 069. LIFECELL INTERNATIONAL PVT. LTD. (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. B. BRAUN MELSUNGEN AG (GERMANY): SNAPSHOT

TABLE 070. B. BRAUN MELSUNGEN AG (GERMANY): BUSINESS PERFORMANCE

TABLE 071. B. BRAUN MELSUNGEN AG (GERMANY): PRODUCT PORTFOLIO

TABLE 072. B. BRAUN MELSUNGEN AG (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. BETATECH MEDICAL (TURKEY): SNAPSHOT

TABLE 073. BETATECH MEDICAL (TURKEY): BUSINESS PERFORMANCE

TABLE 074. BETATECH MEDICAL (TURKEY): PRODUCT PORTFOLIO

TABLE 075. BETATECH MEDICAL (TURKEY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. ETHICON INC (U.S): SNAPSHOT

TABLE 076. ETHICON INC (U.S): BUSINESS PERFORMANCE

TABLE 077. ETHICON INC (U.S): PRODUCT PORTFOLIO

TABLE 078. ETHICON INC (U.S): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. C.R. BARD INC. (U.S): SNAPSHOT

TABLE 079. C.R. BARD INC. (U.S): BUSINESS PERFORMANCE

TABLE 080. C.R. BARD INC. (U.S): PRODUCT PORTFOLIO

TABLE 081. C.R. BARD INC. (U.S): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. ATRIUM (U.S): SNAPSHOT

TABLE 082. ATRIUM (U.S): BUSINESS PERFORMANCE

TABLE 083. ATRIUM (U.S): PRODUCT PORTFOLIO

TABLE 084. ATRIUM (U.S): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 085. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 086. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 087. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SURGICAL MESH MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SURGICAL MESH MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 012. SYNTHETIC SURGICAL MESHES MARKET OVERVIEW (2016-2028)

FIGURE 013. BIOSYNTHETIC SURGICAL MESHES MARKET OVERVIEW (2016-2028)

FIGURE 014. BIOLOGIC SURGICAL MESHES MARKET OVERVIEW (2016-2028)

FIGURE 015. HYBRID/COMPOSITE SURGICAL MESHES MARKET OVERVIEW (2016-2028)

FIGURE 016. SURGICAL MESH MARKET OVERVIEW BY APPLICATION

FIGURE 017. HERNIA REPAIR MARKET OVERVIEW (2016-2028)

FIGURE 018. TRAUMATIC OR SURGICAL WOUNDS MARKET OVERVIEW (2016-2028)

FIGURE 019. ABDOMINAL WALL RECONSTRUCTION MARKET OVERVIEW (2016-2028)

FIGURE 020. FACIAL SURGERY MARKET OVERVIEW (2016-2028)

FIGURE 021. SURGICAL MESH MARKET OVERVIEW BY END-USER

FIGURE 022. HOSPITALS MARKET OVERVIEW (2016-2028)

FIGURE 023. AMBULATORY SURGICAL CENTERS MARKET OVERVIEW (2016-2028)

FIGURE 024. CLINICS MARKET OVERVIEW (2016-2028)

FIGURE 025. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 026. NORTH AMERICA SURGICAL MESH MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. EUROPE SURGICAL MESH MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. ASIA PACIFIC SURGICAL MESH MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. MIDDLE EAST & AFRICA SURGICAL MESH MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. SOUTH AMERICA SURGICAL MESH MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Surgical Mesh Market research report is 2024-2032.

W. L. Gore & Associates. Inc. (U.S), Boston Scientific Corporation (U.S), Mölnlycke Health Care AB (Sweden), Medical Devices Business Services, Inc. (U.S), and Other Major Players.

The Surgical Mesh Market is segmented into Product Type, Application, End User and region. By Product Type, the market is categorized into Synthetic Surgical Meshes, Biosynthetic Surgical Meshes, Biologic Surgical Meshes, and Hybrid/Composite Surgical Meshes. By Application, the market is categorized into Hernia Repair, Traumatic or Surgical Wounds, Abdominal Wall Reconstruction, and Facial Surgery. By End Use, the market is categorized into Hospitals, Ambulatory Surgical Centers, Clinics, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Surgical mesh could be defined as a medical device that is used in several surgeries as a material from synthetic materials or animal tissues with a view of offering support, additional layer, or repair of tissues. This is for example in surgeries like herr, pelvic organ prolapse repair, and treatment of stress urinary incontinence. The mesh is designed to be biocompatible, allowing it to integrate with surrounding tissues over time. Its use aims to strengthen weakened or damaged tissue, reduce recurrence rates, and promote faster healing. However, concerns have arisen regarding potential complications associated with certain types of surgical mesh, leading to ongoing debates and regulatory scrutiny in the medical community.

Surgical Mesh Market Size Was Valued at USD 2.32 Billion in 2023 and is Projected to Reach USD 4.48 Billion by 2032, Growing at a CAGR of 7.61% From 2024-2032.