Spoolable Pipes Market Overview

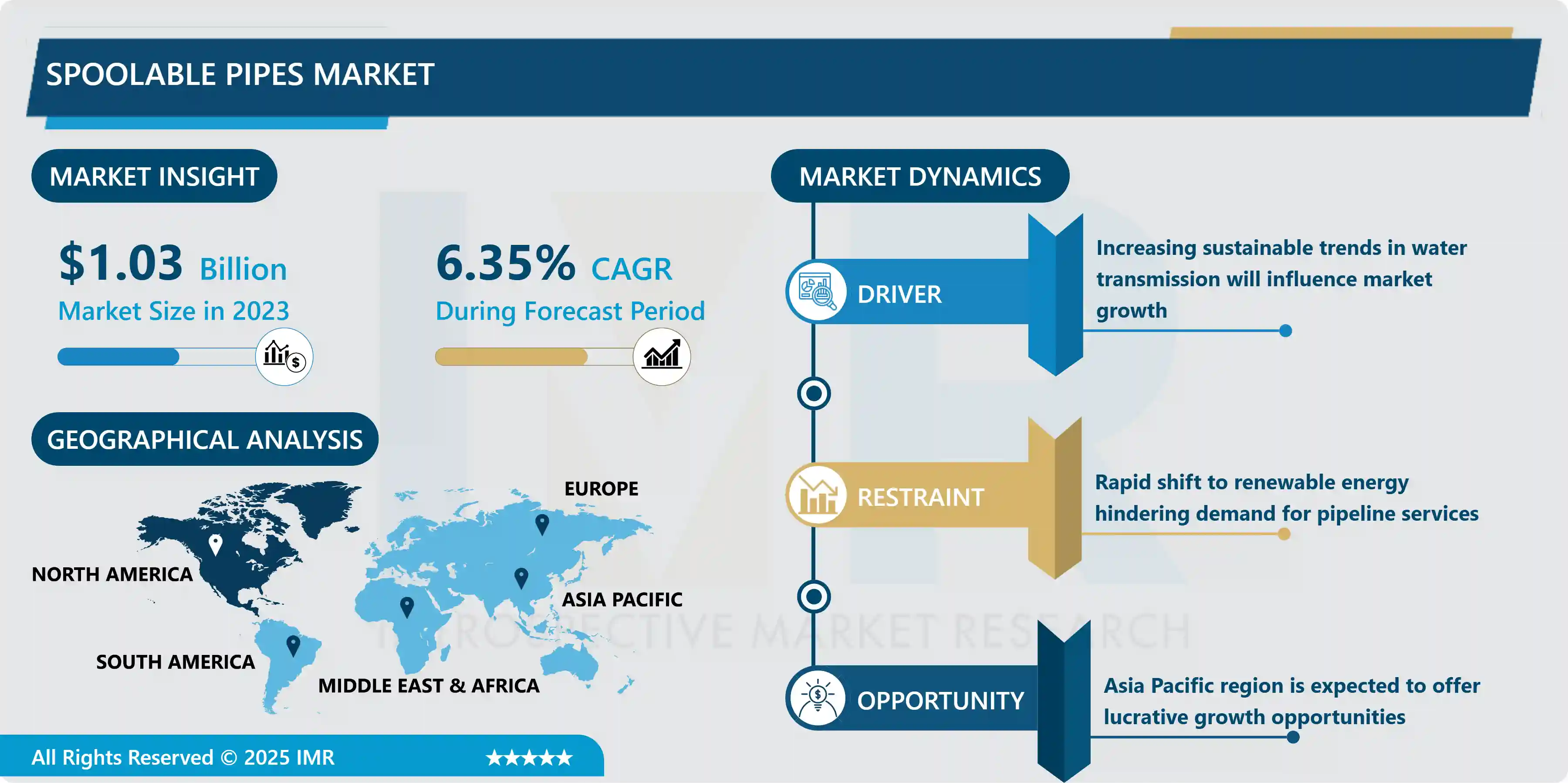

Spoolable Pipes Market is expected to grow from USD 1.03 billion in 2023 to USD 1.80 billion by 2032, at a CAGR of 6.35% during the forecast period (2024-2032).

Spoolable Pipes offers great interest in the oil and gas industry. It offers well-known advantages such as high resistance to internal and external corrosion, low roughness, high fatigue resistance, reduced maintenance costs, and improved flow rates. Another important advantage is that the pipe can be wound into a continuous pipe section, which makes it easy to transport and install. This simplifies the yard and achieves a high installation rate because there are no X-rays or welding. Over the last five years, the performance of spoolable tubes (materials, manufacturing, quality control) has improved dramatically. As many real vendors have proven, spoolable markets are very important. However, different products exhibit important different performance in terms of materials and applications such as maximum pressure and maximum temperature. For this reason, proper evaluation is required before using these materials in demanding environments. The spoolable pipe market includes both spoolable composite pipe (SCP) and reinforced thermoplastic tubes (RTP). Despite short-term fluctuations in demand for coiled tubes caused by subsidence rigs or wells, the long-term business outlook appears to have good growth potential over the next five years.

Market Dynamics And Factors For Spoolable Pipes Market

Drivers:

- Spoolable Pipes have already demonstrated a proven track record of being used in a variety of applications in a variety of industries and already widely used to transport different types of water, these pipes are increasingly being used in the oil and gas industry, and it can be beneficial to have strength, lightweight, and no corrosion issues. The benefits of composite tubes outweigh the increased material costs, as they are easy to transport and install and require little maintenance and inspection. Available in a variety of material types, the use of composite tubes is expected to continue to increase as a spoolable and flexible use of composite pipes looks set to continue rising.

- The problem of corrosion is exacerbated by the increase in oil recovery from mature oil fields. For example, using water injection technology makes hydrocarbons acidic and the production fluids in the pipeline become more corrosive over time. This is an increasingly complex challenge for operators seeking to increase production and profits while counteracting the potentially devastating consequences of corrosion with relatively ineffective and expensive inhibitors. The rapid development and use of thermoplastic composite pipes (TCP) are increasing to counter the inherent drawbacks of steel pipes include corrosion, fatigue, and weight. Today, a variety of offshore applications are growing, including lines for applications such as flow lines, risers, bypasses, expansion coils, chemical injections, methanol injections, gas lifts, wellbore access, choke-and-kill, decommissioning, and intervention.

- Systems designed to mitigate corrosion by pumping corrosion inhibitors must have an uptime of over 90% to be effective. In some regions, this is rarely achieved. For example, Asian operators may have only 50% of their corrosion protection system uptime. Increasing this uptime requires a continuous supply of chemicals, working pumps, and available power to various platforms. All of these work in harsh offshore environments. Usually, every month, corrosion inhibitors are lost and the design life of the pipeline is lost by one year.

Restraints:

- Currently, the Majority of the oil and gas projects as well as chemical injections, methanol injections use steel-based or carbon steel pipelines for oil, gas, or chemical transportation. Due to fairly new technology is being used in spoolable pipes such as material and method of manufacturing is highly underrated and lack of awareness of alternative for set standardized pipes, spoolable pipes have low demand. However, due to cost efficiency and the number of elements that have superiority over steel pipes, the Spoolable pipes market is likely to grow during the forecasted period.

Opportunities:

- Systems designed to mitigate corrosion by pumping corrosion inhibitors must have an uptime of over 90% to be effective. In some regions, this is rarely achieved. For example, Asian operators may have only 50% of their corrosion protection system uptime. Increasing this uptime requires a continuous supply of chemicals, working pumps, and available power to various platforms. All of these work in harsh offshore environments. Usually, every month, corrosion inhibitors are lost and the design life of the pipeline is lost by one year. Therefore, it presents a tremendous opportunity for the integration of spoolable thermoplastic pipes in such environments. Offshore oil and gas applications can utilize the benefits of the elemental attributes of thermoplastic spoolable pipes. Recently, Baker Hughes has launched new composite flexible pipes for onshore pipeline solutions. Baker Hughes is a multinational company having a stronghold in oil industry solutions which have explored the alternative for steel pipes. A gradual shift in the adoption of spoolable pipes further presents a bright opportunity in the multi-industry.

Segmentation Analysis of Spoolable Pipes Market

- By Type, Thermoplastic is dominating in the type segment of the Spoolable Pipes Market. The TCP (Composite Thermoplastic Pipe) system uses thermoplastic materials to provide strength and rigidity to pipes. These tubes are fully glued and usually come with a polymer inner liner, a fiber-reinforced polymer laminate, and a protective outer jacket. This outer clad layer can be coated to provide additional properties such as UV resistance depending on the application. Due to such robust elements provided in the spoolable pipes which can satisfy the highest standard used in oil and gas as well as chemical industry, it presents high growth prospects for the particular segment in the market.

- By Material, Fiberglass plastic is dominating the spoolable pipes market. Fiberglass plastic pipes are a spoolable product consisting of an inner thermoplastic pressure barrier reinforced by high-strength glass fibers embedded in an epoxy matrix. Intended for corrosive-gathering and injection applications, including general and sour produced fluids and gases, Fiberglass plastic can handle approx. Pressures up to 2,500 psi and temperatures up to 180 °F in hydrocarbon applications. A wear-resistant exterior layer provides excellent damage resistance during handling and installation. Fiberglass plastic material is one of the highly used materials in manufacturing spoolable pipes. Therefore, the large demand for fiberglass-made spoolable pipes is driving the growth of the market.

- By Application, Offshore application is expected to dominate the market during the forecasted period. There are many uses for composite pipes, including the oil and gas industry, which can replace expensive corrosion-resistant metals such as titanium and two-phase stainless-steel pipes. Currently, a large number of existing oil and gas companies are moving towards nonmetallic pipes for the oil and gas transportation solution which can provide a substitute for traditional subsea pipes. Also, there is a large number of offshore winds to hydrogen projects is being set up on various coastlines which required flexible pipeline solutions to transport the generated hydrogen to the onshore station via subsea pipes. The use of spoolable pipes at the offshore sites reduces corrosion and improves the life of the pipes. Thermoplastic pipes manufacturers are focusing on pushing the trend and capitalizing on the opportunity in the industry which has created a buzz in Spoolable Pipes Market.

Regional Analysis of Spoolable Pipes Market

- North America is dominating the Spoolable Pipes Market. According to the Energy Information Administration (EIA), oil demand in the United States is very high. This country is one of the five largest crude oil-producing countries in the world. In 2018, approximately 68% of total US oil production came from five states such as Texas 40.5%, North Dakota 11.5%, New Mexico 6.3%, Oklahoma 5.0%, and Alaska 4.5%. Also, North America comprises the oil and gas companies such as Baker Hughes, NOV Inc, Flexsteel Pipeline Technologies Inc. These companies have a stronghold in the market to provide spoolable pipeline solutions in various applications having clientele globally. The growing trend of flexible and cost-efficient pipeline solutions propelling the North America Market.

- The Middle East is expected to register substantial growth during the forecasted period. A large number of oils producing companies situated in middle eastern countries have the highest oil production output in the world. To transport such oil volume, efficient and seamless pipeline system required, most of the companies prefer, steel or carbon steel blend pipelines due to the unavailability of the alternatives. It also presents durability issues due to corrosion of the steel pipes if it is not functional throughout, therefore, a growing number of manufacturers of the spoolable pipes and growing reach of such companies are expected to revolutionize the pipeline solution which is cost-efficient in the middle east.

Top Key Players Covered In Spoolable Pipes Market

- Changchun Gaoxiang Special Pipes Co. Ltd.

- Dalian Yingyu Co. Limited

- Flexpipe Inc.

- Flexsteel Pipeline Technologies Inc.

- H.A.T. Flex

- National Oilwell Varco

- Pipelife International Gmbh

- Polyflow LLC.

- Shandong Juye Jugong Hose Industry Co. Ltd.

- Victrex PLC

- Baker Hughes

- Strohm, and other major players.

Key Industry Developments In Spoolable Pipes Market

- In November 2023, Baker Hughes launched a new portfolio of Python Pipes that can reduce installation time by more than 55%, helping it achieve lifetime carbon emission reductions of up to 74%, and costs of maintenance savings of more than 75%, resulting in more efficient and consistent operations. In addition, the Python Pipe division offers the only spoolable, non-metallic 8-inch RTP material on the market and innovative co-extruded liner technology that makes it suitable for harsh and sensitive conditions.

- In January 2023, Cactus, Inc. announced the acquisition of FlexSteel Technologies Holdings, Inc., a market-leading manufacturer of spoolable pipe technologies. This move strengthens Cactus' standing as a leading producer of specialized technologies and helps achieve cost savings by using the combined company's infrastructure to supply specialized products to a larger customer base.

|

Spoolable Pipes Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data : |

2017 to 2023 |

Market Size in 2023: |

USD 1.03 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.35% |

Market Size in 2032: |

USD 1.80 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Spoolable Pipes Market by Type (2018-2032)

4.1 Spoolable Pipes Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Thermoplastic

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Thermosets

Chapter 5: Spoolable Pipes Market by Material (2018-2032)

5.1 Spoolable Pipes Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Fiber-Glass Reinforced Plastics

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 High-Density Polyethylene

5.5 Polyvinyl Chloride

5.6 Polypropylene

Chapter 6: Spoolable Pipes Market by Application (2018-2032)

6.1 Spoolable Pipes Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Onshore

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Offshore

6.5 Downhole

6.6 Other

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Spoolable Pipes Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 UIPATH

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SOLVEXIA

7.4 MITSUBISHI ELECTRIC CORPORATION

7.5 ALLERIN TECH PVT. LTDWIPRO LIMITED

7.6 CATALYTIC INCAPPIAN

7.7 TATA CONSULTANCY SERVICES LTDONEGLOBE LLC

7.8 AUTOMATION ANYWHERE INC

7.9 JK TECH

7.10 VURAM TECHNOLOGIES

7.11 IBM

7.12 ORACLE AND OTHERS MAJOR PLAYERS

Chapter 8: Global Spoolable Pipes Market By Region

8.1 Overview

8.2. North America Spoolable Pipes Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Thermoplastic

8.2.4.2 Thermosets

8.2.5 Historic and Forecasted Market Size by Material

8.2.5.1 Fiber-Glass Reinforced Plastics

8.2.5.2 High-Density Polyethylene

8.2.5.3 Polyvinyl Chloride

8.2.5.4 Polypropylene

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Onshore

8.2.6.2 Offshore

8.2.6.3 Downhole

8.2.6.4 Other

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Spoolable Pipes Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Thermoplastic

8.3.4.2 Thermosets

8.3.5 Historic and Forecasted Market Size by Material

8.3.5.1 Fiber-Glass Reinforced Plastics

8.3.5.2 High-Density Polyethylene

8.3.5.3 Polyvinyl Chloride

8.3.5.4 Polypropylene

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Onshore

8.3.6.2 Offshore

8.3.6.3 Downhole

8.3.6.4 Other

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Spoolable Pipes Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Thermoplastic

8.4.4.2 Thermosets

8.4.5 Historic and Forecasted Market Size by Material

8.4.5.1 Fiber-Glass Reinforced Plastics

8.4.5.2 High-Density Polyethylene

8.4.5.3 Polyvinyl Chloride

8.4.5.4 Polypropylene

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Onshore

8.4.6.2 Offshore

8.4.6.3 Downhole

8.4.6.4 Other

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Spoolable Pipes Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Thermoplastic

8.5.4.2 Thermosets

8.5.5 Historic and Forecasted Market Size by Material

8.5.5.1 Fiber-Glass Reinforced Plastics

8.5.5.2 High-Density Polyethylene

8.5.5.3 Polyvinyl Chloride

8.5.5.4 Polypropylene

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Onshore

8.5.6.2 Offshore

8.5.6.3 Downhole

8.5.6.4 Other

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Spoolable Pipes Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Thermoplastic

8.6.4.2 Thermosets

8.6.5 Historic and Forecasted Market Size by Material

8.6.5.1 Fiber-Glass Reinforced Plastics

8.6.5.2 High-Density Polyethylene

8.6.5.3 Polyvinyl Chloride

8.6.5.4 Polypropylene

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Onshore

8.6.6.2 Offshore

8.6.6.3 Downhole

8.6.6.4 Other

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Spoolable Pipes Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Thermoplastic

8.7.4.2 Thermosets

8.7.5 Historic and Forecasted Market Size by Material

8.7.5.1 Fiber-Glass Reinforced Plastics

8.7.5.2 High-Density Polyethylene

8.7.5.3 Polyvinyl Chloride

8.7.5.4 Polypropylene

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Onshore

8.7.6.2 Offshore

8.7.6.3 Downhole

8.7.6.4 Other

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Spoolable Pipes Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data : |

2017 to 2023 |

Market Size in 2023: |

USD 1.03 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.35% |

Market Size in 2032: |

USD 1.80 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||