Spastic Paraplegia 50 Market Synopsis

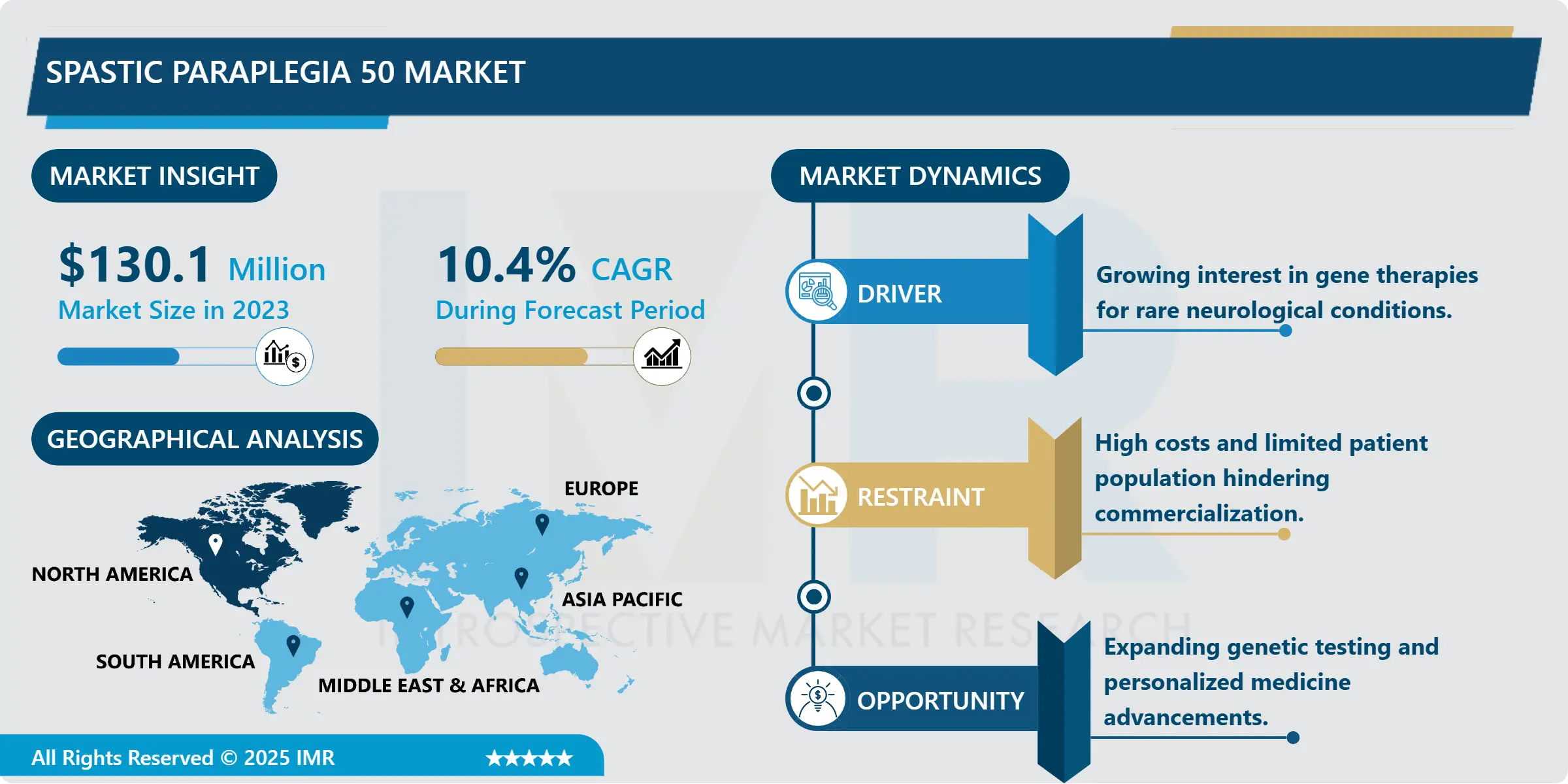

Spastic Paraplegia 50 Market Size Was Valued at USD 130.1 Million in 2023, and is Projected to Reach USD 316.7 Million by 2032, Growing at a CAGR of 10.4% From 2024-2032.

SPG 50; also known as Spastic Paraplegia 50 is a hereditary neurological disorder with symptoms including stiff, weak muscles in the legs, abnormal gait and incoordination. Depending on the course of the disease often called hereditary spastic paraplegias (HSPs), SPG50 is caused by mutations in the AP4M1 gene and manifests at an early age. This disorder significantly affects the abilities of affected individuals to move from one place to another, and also the quality of their lives, therefore requiring proper diagnosis, treatment, and management processes. The Global SPG50 market consists of research and treatment and support services to enhance the quality and extend the lifespan of the lives of people who are living with this disease.

It is important to understand that SPG50 market is a particular niche within the overall rare neurological disease market. Owing to the growing knowledge about gene therapies and due to emerging new market of gene therapy, the market interest is slowly shifting with increasing focus in research worldwide and pharma companies. Having a rare disease, the pace at market development in the case of SPG50 was slow, but the growing incidence of neurological disorders, as well as the focus on the development of orphan drugs, contribute to the intensification of interest for them. In addition, patients’ organizations and health care providers want education concerning the illness enhanced, increased investment in short-term relief for symptoms and long-term treatment.

The research and development in this area are mainly the focus on producing new treatment therapy that is Gene therapy and enzyme replacement therapy because they target the main cause of SPG50 that is genetic. However, because the patient base is small, it continues to be difficult for drugs and treatments to be commercially viable. Nevertheless, incentive-based regulatory, including that provided by the FDA and the EMA for orphan drugs, is still building up the more favorable development setting and encouraging the competition among the junior specialized biotech and the large pharmaceutical firms.

Spastic Paraplegia 50 Market Trend Analysis:

The Impact of Gene Therapy

- Use of gene therapy is rapidly becoming one of the key trends in managing SPG50 diseases. As gene therapies, the healthy genes will be transplanted into the nervous system for the purpose of managing the effects of mutations in SPG50 gene. These therapies hold the promise for respectively better, perhaps even curative, therapies and have thus been receiving a great deal of interest and funding within the field. Today, many of the large pharma companies as well as the biotechnology firms are in an active search for clinical trials that will define the effectiveness of the gene-related treatments; most of which are in the advanced stages. Despite these difficulties, gene therapy still seems to open a new, very promising chapter in the lives of SPG50 patients – from the difficulties associated with clinical trial phases to regulatory approval of this kind of treatment.

Expanding Diagnostic and Treatment Capabilities

- The SPG50 market is experiencing growth driven by the urgent need for improved diagnostic and treatment solutions. Early and accurate diagnosis is crucial for better outcomes, creating strong demand for advanced genetic testing methods. Technologies like Next-Generation Sequencing (NGS) have significantly enhanced the ability to detect SPG50 mutations early, expanding diagnostic capabilities and supporting timely intervention. As awareness and accessibility to genetic testing increase, the market for SPG50 treatments is also expected to grow. Continuous advancements in diagnostics not only improve patient prognosis but also open new opportunities for therapeutic development and expand the overall market potential.

Spastic Paraplegia 50 Market Segment Analysis:

Spastic Paraplegia 50 Market Segmented on the basis of type, route of administration, end user and region.

By Type, Medication segment is expected to dominate the market during the forecast period

- The Medication segment is believed to lead the SPG50 market over the course of the given period owing to the growing need for treating symptoms and curative intervention in HSP. Since there is no treatment for SPG50, medications are essential in decreasing muscle and joint tone, spasm, and pain that dramatically reduces the QoL of affected patients. The growth of surgical procedures and treatments for spasticity resulting from neurological disorders is likely to boost the growth of this segment with new drugs targeting spasticity, anti-spasticity medication, and pain control medications. Also, there is the increased corporate investment in research and development of better and more targeted medications for effective management of SPG50 and other diseases that forms this segment a strong market base.

By Route of Administration, Oral segment expected to held the largest share

- The Oral segment is expected to dominate the SPG50 market during the forecast period. This tendency is associated with simplicity of dosing and patient preference for systemic oral agents that do not require invasive procedures and can be taken for years. For SPG50, identification of drugs and necessity of their utilization has been developed to comprise of muscle relaxants and pain killers that help in preventing and palliating spasticity. Also, improvements made in the formulations of drugs that increases the content and efficiency of oral medicine has also boosted their market. This accompanied by better drug efficacy means oral route of administration is a preferred option for patients and physicians further underlining the leading position of SPG50’s treatment in the mentioned list.

Spastic Paraplegia 50 Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America will lead the SPG50 market during the forecast period, fueled by sophisticated healthcare infrastructure, robust research and development efforts, and a supportive regulatory landscape. Heavy government and private investment in rare disease research, coupled with extensive advocacy efforts, have increased funding for SPG50 research. High levels of awareness and the prevalence of genetic testing also facilitate early diagnosis and intervention for SPG50 patients. The region's forward-thinking healthcare policies, focus on early diagnosis, and ongoing backing for innovation make North America the premier market for SPG50 therapeutics and diagnostics.

Active Key Players in the Spastic Paraplegia 50 Market

- AstraZeneca (UK)

- Biogen (USA)

- BioMarin (USA)

- Genentech (USA)

- Ipsen (France)

- Johnson & Johnson (USA)

- Merck & Co. (USA)

- Novartis (Switzerland)

- Pfizer (USA)

- Roche (Switzerland)

- Sanofi (France)

- Sarepta Therapeutics (USA)

- Shire (USA)

- Takeda (Japan)

- Teva Pharmaceuticals (Israel)

- Other Active Players

|

Spastic Paraplegia 50 Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 130.1 Million |

|

Forecast Period 2024-32 CAGR: |

10.4 % |

Market Size in 2032: |

USD 316.7 Million |

|

Segments Covered: |

By Type |

|

|

|

By Route Of Administration |

|

||

|

End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Spastic Paraplegia 50 Market by Type

4.1 Spastic Paraplegia 50 Market Snapshot and Growth Engine

4.2 Spastic Paraplegia 50 Market Overview

4.3 Medication

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Medication: Geographic Segmentation Analysis

4.4 Physiotherapy

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Physiotherapy: Geographic Segmentation Analysis

4.5 Surgery

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Surgery: Geographic Segmentation Analysis

4.6 Assistive Devices

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Assistive Devices: Geographic Segmentation Analysis

4.7 Others)

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Others): Geographic Segmentation Analysis

4.8 Route of Administration (Oral

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Route of Administration (Oral: Geographic Segmentation Analysis

4.9 Injectable

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 Injectable: Geographic Segmentation Analysis

4.10 Topical

4.10.1 Introduction and Market Overview

4.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.10.3 Key Market Trends, Growth Factors and Opportunities

4.10.4 Topical: Geographic Segmentation Analysis

4.11 Others)

4.11.1 Introduction and Market Overview

4.11.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.11.3 Key Market Trends, Growth Factors and Opportunities

4.11.4 Others): Geographic Segmentation Analysis

4.12

4.12.1 Introduction and Market Overview

4.12.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.12.3 Key Market Trends, Growth Factors and Opportunities

4.12.4 : Geographic Segmentation Analysis

Chapter 5: Spastic Paraplegia 50 Market by End User

5.1 Spastic Paraplegia 50 Market Snapshot and Growth Engine

5.2 Spastic Paraplegia 50 Market Overview

5.3 Hospitals and Clinics

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Hospitals and Clinics: Geographic Segmentation Analysis

5.4 Rehab Centers

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Rehab Centers: Geographic Segmentation Analysis

5.5 Home Care Settings)

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Home Care Settings) : Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Spastic Paraplegia 50 Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 BIOGEN (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 NOVARTIS (SWITZERLAND)

6.4 PFIZER (USA)

6.5 SANOFI (FRANCE)

6.6 JOHNSON & JOHNSON (USA)

6.7 OTHER ACTIVE PLAYERS

Chapter 7: Global Spastic Paraplegia 50 Market By Region

7.1 Overview

7.2. North America Spastic Paraplegia 50 Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Type

7.2.4.1 Medication

7.2.4.2 Physiotherapy

7.2.4.3 Surgery

7.2.4.4 Assistive Devices

7.2.4.5 Others)

7.2.4.6 Route of Administration (Oral

7.2.4.7 Injectable

7.2.4.8 Topical

7.2.4.9 Others)

7.2.4.10

7.2.5 Historic and Forecasted Market Size By End User

7.2.5.1 Hospitals and Clinics

7.2.5.2 Rehab Centers

7.2.5.3 Home Care Settings)

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Spastic Paraplegia 50 Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Type

7.3.4.1 Medication

7.3.4.2 Physiotherapy

7.3.4.3 Surgery

7.3.4.4 Assistive Devices

7.3.4.5 Others)

7.3.4.6 Route of Administration (Oral

7.3.4.7 Injectable

7.3.4.8 Topical

7.3.4.9 Others)

7.3.4.10

7.3.5 Historic and Forecasted Market Size By End User

7.3.5.1 Hospitals and Clinics

7.3.5.2 Rehab Centers

7.3.5.3 Home Care Settings)

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Spastic Paraplegia 50 Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Type

7.4.4.1 Medication

7.4.4.2 Physiotherapy

7.4.4.3 Surgery

7.4.4.4 Assistive Devices

7.4.4.5 Others)

7.4.4.6 Route of Administration (Oral

7.4.4.7 Injectable

7.4.4.8 Topical

7.4.4.9 Others)

7.4.4.10

7.4.5 Historic and Forecasted Market Size By End User

7.4.5.1 Hospitals and Clinics

7.4.5.2 Rehab Centers

7.4.5.3 Home Care Settings)

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Spastic Paraplegia 50 Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Type

7.5.4.1 Medication

7.5.4.2 Physiotherapy

7.5.4.3 Surgery

7.5.4.4 Assistive Devices

7.5.4.5 Others)

7.5.4.6 Route of Administration (Oral

7.5.4.7 Injectable

7.5.4.8 Topical

7.5.4.9 Others)

7.5.4.10

7.5.5 Historic and Forecasted Market Size By End User

7.5.5.1 Hospitals and Clinics

7.5.5.2 Rehab Centers

7.5.5.3 Home Care Settings)

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Spastic Paraplegia 50 Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Type

7.6.4.1 Medication

7.6.4.2 Physiotherapy

7.6.4.3 Surgery

7.6.4.4 Assistive Devices

7.6.4.5 Others)

7.6.4.6 Route of Administration (Oral

7.6.4.7 Injectable

7.6.4.8 Topical

7.6.4.9 Others)

7.6.4.10

7.6.5 Historic and Forecasted Market Size By End User

7.6.5.1 Hospitals and Clinics

7.6.5.2 Rehab Centers

7.6.5.3 Home Care Settings)

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Spastic Paraplegia 50 Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Type

7.7.4.1 Medication

7.7.4.2 Physiotherapy

7.7.4.3 Surgery

7.7.4.4 Assistive Devices

7.7.4.5 Others)

7.7.4.6 Route of Administration (Oral

7.7.4.7 Injectable

7.7.4.8 Topical

7.7.4.9 Others)

7.7.4.10

7.7.5 Historic and Forecasted Market Size By End User

7.7.5.1 Hospitals and Clinics

7.7.5.2 Rehab Centers

7.7.5.3 Home Care Settings)

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Spastic Paraplegia 50 Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 130.1 Million |

|

Forecast Period 2024-32 CAGR: |

10.4 % |

Market Size in 2032: |

USD 316.7 Million |

|

Segments Covered: |

By Type |

|

|

|

By Route Of Administration |

|

||

|

End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||