Space Sensor Market Synopsis

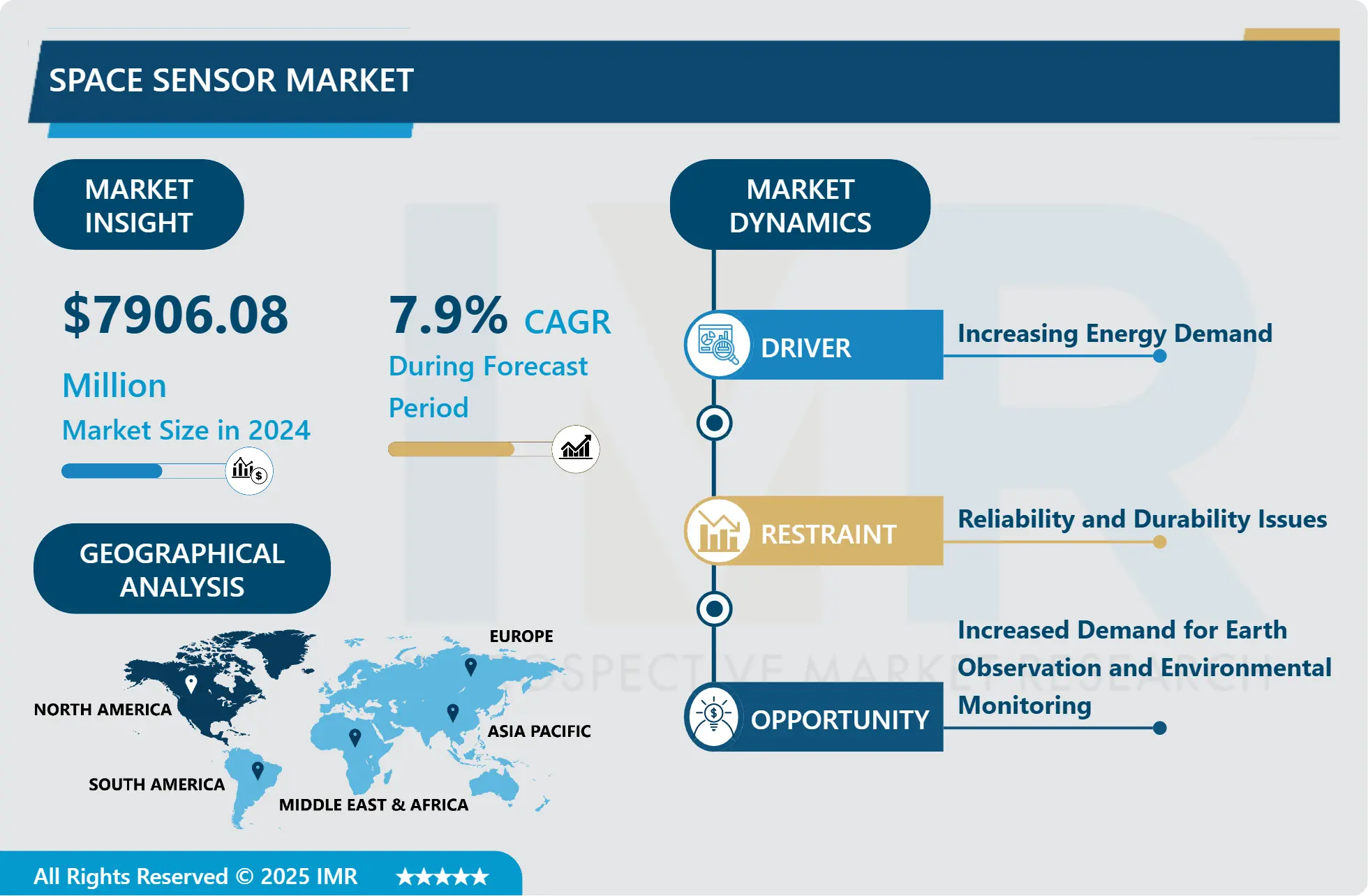

Space Sensor Market Size Was Valued at USD 7906.08 Million in 2024, and is Projected to Reach USD 14525.56 Million by 2032, Growing at a CAGR of 7.9% From 2025-2032.

Space sensors are crucial in aviation as they can be utilized to track gas levels and verify that those aboard a spacecraft are at the appropriate concentration. Space sensors provide astronauts with data about the spacecraft's environment and the outer atmosphere. Efficient space sensors will guarantee the safety of astronauts and aid in scientific exploration and investigation of the earth and the atmosphere.

The main goal of sensor tasking is to optimize either the number of objects being tracked in a given period or a total score. Each item can be given a priority index or score to show its importance in relation to others. For example, items that have been observed a few times may be given more importance when they are within view of the specific sensors. The significance and importance of space for both civilian and military uses have grown substantially over the past few years.

The rise in the quantity of spacecrafts orbiting Earth is having an effect on the safe functioning of these vehicles. Numerous countries see space as a battleground where military activities will become more significant in upcoming conflicts. Because of this, there has been a significant increase in the demand for SSA data and predictive space situational awareness for SDA activities. The optimal way to secure a spacecraft in orbit around Earth is by constantly monitoring its immediate surroundings using various optical sensors combined in a SSA sensor suite.

Carbon monoxide (CO) detection is vital for a range of applications, including aeronautics. A primary concern on a manned spacecraft is the condition of the atmosphere. Another essential gas that must be monitored is oxygen. Oxygen is crucial for the health, safety, and performance of human beings. Sufficient oxygen levels ensure the safety and productivity of the astronauts. Monitoring and ensuring healthy CO2 levels on a spacecraft is not an easy task. It is vital to control the levels of Carbon Dioxide in an enclosed environment, specifically a spacecraft where windows cannot be opened for a breath of fresh air.

Space Sensor Market Trend Analysis

Space Sensor Market Growth Driver- Growing Popularity of Quantum Sensors and Nano Technology

- Advanced technologies promise to enhance the capabilities of space sensors, making them more precise, efficient, and versatile. Quantum sensors are able to catch up on even the smallest variations in physical variables like acceleration, magnetic fields, and gravitational fields. They are therefore perfect for uses requiring incredibly accurate measurements. These sensors' high level of accuracy is made possible by the application of quantum entanglement and superposition, which is essential for scientific research, navigation, and location.

- The precision of positioning, navigation, and timing (PNT) systems which are critical to the operation and synchronisation of spacecraft can be greatly increased by quantum sensors. These sensors can help with planetary exploration and celestial body research by providing a highly precise map of gravitational fields. Quantum magnetometers offer precise information on magnetic fields that is helpful for navigation and scientific study.

- Nanotechnology involves the manipulation of matter at the atomic or molecular scale, leading to the creation of materials and devices with novel properties. Nanotechnology enables the development of smaller, lighter sensors. This is particularly advantageous for space missions, where reducing payload weight is critical to lowering launch costs and increasing the efficiency of spacecraft.

Space Sensor Market Opportunity- Increased Demand for Earth Observation and Environmental Monitoring

- The market for space sensors is expanding rapidly and offering a plethora of opportunities due to the growing need for environmental monitoring and Earth observation. For the purpose of gathering comprehensive and precise data on a range of environmental factors, such as urbanisation, deforestation, natural catastrophes, and climate change, advanced space sensors are essential.

- To monitor and lessen the effects of climate change, governments, international organisations, and private businesses are making significant investments in Earth observation satellites fitted with advanced sensors. Natural disasters like hurricanes, floods, and wildfires can be better predicted and managed because to the high-resolution photos and real-time data these sensors give. Also, changes in land use, crop health, and soil moisture, they promote sustainable agricultural practices.

- The integration of advanced technologies like hyperspectral imaging, synthetic aperture radar (SAR), and thermal infrared sensors enhances the capability to track environmental changes with unprecedented precision. As global environmental concerns intensify, the demand for comprehensive and reliable Earth observation data continues to rise, making the development and deployment of advanced space sensors a critical and lucrative market opportunity.

Space Sensor Market Segment Analysis:

Space Sensor Market is Segmented on The Basis of Type, Platform, Application, End-Users and Region

By Type, Optical Sensor segment is expected to dominate the market during the forecast period

- Optical sensor is a vital part of the space sensor industry. Optic fibre sensors are perfect for space applications where weight and space constraints are crucial since they are substantially lighter and more compact than traditional sensors. When it comes to identifying different physical factors like temperature, pressure, strain, and chemical composition, these sensors provide excellent sensitivity and accuracy. Electromagnetic interference (EMI), which is common in space conditions, cannot affect optical fibres. They can therefore send data with confidence and no chance of signal deterioration.

- Satellites, space stations, and spacecraft are all monitored for structural integrity using optical sensors. They guarantee the reliability and safety of space constructions by detecting and measuring strain, stress, and deformations. These sensors are vital for tracking environmental parameters that affect equipment and astronaut safety, like temperature, pressure, and humidity, both inside and outside the spacecraft. Optical sensors are essential to navigation and guidance systems because they provide accurate information for spacecraft orientation, positioning, and movement control.

- Optical remote sensing makes use of visible, near infrared and short-wave infrared sensors to form images of the earth’s surface by detecting the solar radiation reflected from targets on the ground4 (Passive Remote Sensing). Natural and synthetic materials reflect and absorb light differently at different wavelengths which allow objects to be differentiated by their spectral reflectance signatures.

By End-User, Defense segment held the largest share of 2024

- Space sensing was use to innovation in response to potential threats such as hypersonic weapons, which pose significant risks to missile warning, tracking, and defence capabilities. These sensors play a critical role in enhancing national security by detecting and tracking high-speed threats and ensuring timely defensive measures.

- Satellites equipped with advanced sensors are also crucial for military and security missions, including intelligence, surveillance, and reconnaissance (ISR), which help verify compliance with arms control agreements and monitor global security conditions. Persistent worldwide activity monitoring is made possible by space-based ISR capabilities, which also supply vital information for military operations, threat assessment, and strategic planning. These sensors support intelligence collection, adversary movement tracking, and treaty compliance verification.

- Advanced, precise, and robust sensors have been developed as a result of ongoing innovation in sensor technology. These developments improve defence systems' capabilities and increase their efficacy in identifying and neutralising threats. In order to improve their military prowess and counter new threats, several nations are raising their defence budgets. To strengthen national security, this involves making large investments in space-based sensor systems.

Space Sensor Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America dominates the space sensor market, driven by its robust aerospace and defence industries, significant government investments, and a strong presence of leading technology companies. The United States, in particular, is at the forefront due to substantial funding from agencies like NASA, the Department of Defence (DoD), and the National Oceanic and Atmospheric Administration (NOAA). These organizations spearhead numerous space missions and projects that rely heavily on advanced space sensor technologies.

- Also, the presence of major aerospace and defence contractors, such as Lockheed Martin, Northrop Grumman, and Raytheon Technologies, fosters a thriving ecosystem for innovation and development in space sensors. The region's emphasis on addressing national security concerns, such as missile defence and space situational awareness, further accelerates the demand for sophisticated sensors.

- North America's commitment to leading global space exploration efforts and advancing Earth observation capabilities ensures a continuous drive for cutting-edge sensor technologies. The integration of advanced technologies like artificial intelligence, machine learning, and quantum sensing into space sensor applications exemplifies the region's leadership and innovation in this critical sector.

- The global market for space-based smart sensors and electronics exhibits significant regional variations, with North America leading the charge, followed by Europe and the Asia-Pacific. North America dominates the market by accounting for 624.1 million USD. This leading position can be attributed to the significant investment in space technology and research by both government and private sectors, especially in the United States.

Space Sensor Market Key Player

- Lockheed Martin Corporation (USA)

- Northrop Grumman Corporation (USA)

- Raytheon Technologies Corporation (USA)

- Boeing Defense, Space & Security (USA)

- Thales Alenia Space (France)

- BAE Systems plc (United Kingdom)

- L3Harris Technologies (USA)

- Honeywell International Inc. (USA)

- Sierra Nevada Corporation (USA)

- SpaceX (USA)

- Ball Aerospace & Technologies Corp. (USA)

- Maxar Technologies (USA)

- Israel Aerospace Industries Ltd. (IAI) (Israel)

- Leonardo S.p.A. (Italy)

- QinetiQ Group plc (United Kingdom)

- Teledyne Technologies Incorporated (USA)

- FLIR Systems (USA)

- Harris Corporation (USA)

- OHB SE (Germany)

- Rafael Advanced Defense Systems (Israel)

- Rheinmetall AG (Germany)

- The Aerospace Corporation (USA)

- Surrey Satellite Technology Limited (SSTL) (United Kingdom)

- Astro Digital (USA)

- Rocket Lab (USA)

- Planet Labs Inc. (USA) and other Active Players.

Key Industry Developments in the Space Sensor Market:

- In March 2024, AGENIUM Space signed a long-term partnership to supply AI solutions to SIMERA Sense. The collaboration includes a technological partnership to design an image processing ground segment pipeline with artificial intelligence (AI) solutions customised to Simera Sense’s xScape product line to enable end-to-end products.

- In Jan 2024, Lockheed Martin, NVIDIA Demonstrate AI-Driven Digital Twin With Potential To Advance Predictive Forecasting. the project achieved a significant milestone, demonstrating one of NOAA’s critical data pipelines – sea surface temperatures – to highlight multi-sensor fusion from satellite and model data along with short term temperature anomalies.

|

Global Space Sensor Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 7906.08 Million |

|

Forecast Period 2025-32 CAGR: |

7.9 % |

Market Size in 2032: |

USD 14525.56 Million |

|

Segments Covered: |

By Type |

|

|

|

By Platform |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Space Sensor Market by Type (2018-2032)

4.1 Space Sensor Market Snapshot and Growth Engine

4.2 Market Overview

4.3 IMU Sensors

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 GPS Sensors

4.5 Star Sensors

4.6 Optical Sensors

4.7 Synthetic Aperture Radar Sensors

4.8 Others {Temperature Sensors

4.9 Vibration Sensors

4.10 Pressure Sensors

4.11 Gas Sensors}

Chapter 5: Space Sensor Market by Platform (2018-2032)

5.1 Space Sensor Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Satellites

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Capsules/Cargos

5.5 Interplanetary Spacecraft & Probes

5.6 Rovers/Spacecraft Landers

5.7 Launch Vehicle

Chapter 6: Space Sensor Market by Application (2018-2032)

6.1 Space Sensor Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Attitude & orbit control system

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Command & data handling system

6.5 Telemetry tracking and command

6.6 Thermal system

6.7 Propellent feed system

6.8 Others {Rocket motors

6.9 Surface mobility and navigation system

6.10 Berthing and Docking system

6.11 Robotic arm/Manipulator system

6.12 Thrust vector control system

6.13 Engine valve control system

6.14 Solar array drive mechanism}

Chapter 7: Space Sensor Market by End-User (2018-2032)

7.1 Space Sensor Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Civil

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Défense

7.5 Commercial

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Space Sensor Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 LOCKHEED MARTIN CORPORATION (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 NORTHROP GRUMMAN CORPORATION (USA)

8.4 RAYTHEON TECHNOLOGIES CORPORATION (USA)

8.5 BOEING DEFENSE

8.6 SPACE & SECURITY (USA)

8.7 THALES ALENIA SPACE (FRANCE)

8.8 BAE SYSTEMS PLC (UNITED KINGDOM)

8.9 L3HARRIS TECHNOLOGIES (USA)

8.10 HONEYWELL INTERNATIONAL INC. (USA)

8.11 SIERRA NEVADA CORPORATION (USA)

8.12 SPACEX (USA)

8.13 BALL AEROSPACE & TECHNOLOGIES CORP. (USA)

8.14 MAXAR TECHNOLOGIES (USA)

8.15 ISRAEL AEROSPACE INDUSTRIES LTD. (IAI) (ISRAEL)

8.16 LEONARDO S.P.A. (ITALY)

8.17 QINETIQ GROUP PLC (UNITED KINGDOM)

8.18 TELEDYNE TECHNOLOGIES INCORPORATED (USA)

8.19 FLIR SYSTEMS (USA)

8.20 HARRIS CORPORATION (USA)

8.21 OHB SE (GERMANY)

8.22 RAFAEL ADVANCED DEFENSE SYSTEMS (ISRAEL)

8.23 RHEINMETALL AG (GERMANY)

8.24 THE AEROSPACE CORPORATION (USA)

8.25 SURREY SATELLITE TECHNOLOGY LIMITED (SSTL) (UNITED KINGDOM)

8.26 ASTRO DIGITAL (USA)

8.27 ROCKET LAB (USA)

8.28 PLANET LABS INC. (USA) AND OTHER MAJOR PLAYERS.

Chapter 9: Global Space Sensor Market By Region

9.1 Overview

9.2. North America Space Sensor Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 IMU Sensors

9.2.4.2 GPS Sensors

9.2.4.3 Star Sensors

9.2.4.4 Optical Sensors

9.2.4.5 Synthetic Aperture Radar Sensors

9.2.4.6 Others {Temperature Sensors

9.2.4.7 Vibration Sensors

9.2.4.8 Pressure Sensors

9.2.4.9 Gas Sensors}

9.2.5 Historic and Forecasted Market Size by Platform

9.2.5.1 Satellites

9.2.5.2 Capsules/Cargos

9.2.5.3 Interplanetary Spacecraft & Probes

9.2.5.4 Rovers/Spacecraft Landers

9.2.5.5 Launch Vehicle

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Attitude & orbit control system

9.2.6.2 Command & data handling system

9.2.6.3 Telemetry tracking and command

9.2.6.4 Thermal system

9.2.6.5 Propellent feed system

9.2.6.6 Others {Rocket motors

9.2.6.7 Surface mobility and navigation system

9.2.6.8 Berthing and Docking system

9.2.6.9 Robotic arm/Manipulator system

9.2.6.10 Thrust vector control system

9.2.6.11 Engine valve control system

9.2.6.12 Solar array drive mechanism}

9.2.7 Historic and Forecasted Market Size by End-User

9.2.7.1 Civil

9.2.7.2 Défense

9.2.7.3 Commercial

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Space Sensor Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 IMU Sensors

9.3.4.2 GPS Sensors

9.3.4.3 Star Sensors

9.3.4.4 Optical Sensors

9.3.4.5 Synthetic Aperture Radar Sensors

9.3.4.6 Others {Temperature Sensors

9.3.4.7 Vibration Sensors

9.3.4.8 Pressure Sensors

9.3.4.9 Gas Sensors}

9.3.5 Historic and Forecasted Market Size by Platform

9.3.5.1 Satellites

9.3.5.2 Capsules/Cargos

9.3.5.3 Interplanetary Spacecraft & Probes

9.3.5.4 Rovers/Spacecraft Landers

9.3.5.5 Launch Vehicle

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Attitude & orbit control system

9.3.6.2 Command & data handling system

9.3.6.3 Telemetry tracking and command

9.3.6.4 Thermal system

9.3.6.5 Propellent feed system

9.3.6.6 Others {Rocket motors

9.3.6.7 Surface mobility and navigation system

9.3.6.8 Berthing and Docking system

9.3.6.9 Robotic arm/Manipulator system

9.3.6.10 Thrust vector control system

9.3.6.11 Engine valve control system

9.3.6.12 Solar array drive mechanism}

9.3.7 Historic and Forecasted Market Size by End-User

9.3.7.1 Civil

9.3.7.2 Défense

9.3.7.3 Commercial

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Space Sensor Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 IMU Sensors

9.4.4.2 GPS Sensors

9.4.4.3 Star Sensors

9.4.4.4 Optical Sensors

9.4.4.5 Synthetic Aperture Radar Sensors

9.4.4.6 Others {Temperature Sensors

9.4.4.7 Vibration Sensors

9.4.4.8 Pressure Sensors

9.4.4.9 Gas Sensors}

9.4.5 Historic and Forecasted Market Size by Platform

9.4.5.1 Satellites

9.4.5.2 Capsules/Cargos

9.4.5.3 Interplanetary Spacecraft & Probes

9.4.5.4 Rovers/Spacecraft Landers

9.4.5.5 Launch Vehicle

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Attitude & orbit control system

9.4.6.2 Command & data handling system

9.4.6.3 Telemetry tracking and command

9.4.6.4 Thermal system

9.4.6.5 Propellent feed system

9.4.6.6 Others {Rocket motors

9.4.6.7 Surface mobility and navigation system

9.4.6.8 Berthing and Docking system

9.4.6.9 Robotic arm/Manipulator system

9.4.6.10 Thrust vector control system

9.4.6.11 Engine valve control system

9.4.6.12 Solar array drive mechanism}

9.4.7 Historic and Forecasted Market Size by End-User

9.4.7.1 Civil

9.4.7.2 Défense

9.4.7.3 Commercial

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Space Sensor Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 IMU Sensors

9.5.4.2 GPS Sensors

9.5.4.3 Star Sensors

9.5.4.4 Optical Sensors

9.5.4.5 Synthetic Aperture Radar Sensors

9.5.4.6 Others {Temperature Sensors

9.5.4.7 Vibration Sensors

9.5.4.8 Pressure Sensors

9.5.4.9 Gas Sensors}

9.5.5 Historic and Forecasted Market Size by Platform

9.5.5.1 Satellites

9.5.5.2 Capsules/Cargos

9.5.5.3 Interplanetary Spacecraft & Probes

9.5.5.4 Rovers/Spacecraft Landers

9.5.5.5 Launch Vehicle

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Attitude & orbit control system

9.5.6.2 Command & data handling system

9.5.6.3 Telemetry tracking and command

9.5.6.4 Thermal system

9.5.6.5 Propellent feed system

9.5.6.6 Others {Rocket motors

9.5.6.7 Surface mobility and navigation system

9.5.6.8 Berthing and Docking system

9.5.6.9 Robotic arm/Manipulator system

9.5.6.10 Thrust vector control system

9.5.6.11 Engine valve control system

9.5.6.12 Solar array drive mechanism}

9.5.7 Historic and Forecasted Market Size by End-User

9.5.7.1 Civil

9.5.7.2 Défense

9.5.7.3 Commercial

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Space Sensor Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 IMU Sensors

9.6.4.2 GPS Sensors

9.6.4.3 Star Sensors

9.6.4.4 Optical Sensors

9.6.4.5 Synthetic Aperture Radar Sensors

9.6.4.6 Others {Temperature Sensors

9.6.4.7 Vibration Sensors

9.6.4.8 Pressure Sensors

9.6.4.9 Gas Sensors}

9.6.5 Historic and Forecasted Market Size by Platform

9.6.5.1 Satellites

9.6.5.2 Capsules/Cargos

9.6.5.3 Interplanetary Spacecraft & Probes

9.6.5.4 Rovers/Spacecraft Landers

9.6.5.5 Launch Vehicle

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Attitude & orbit control system

9.6.6.2 Command & data handling system

9.6.6.3 Telemetry tracking and command

9.6.6.4 Thermal system

9.6.6.5 Propellent feed system

9.6.6.6 Others {Rocket motors

9.6.6.7 Surface mobility and navigation system

9.6.6.8 Berthing and Docking system

9.6.6.9 Robotic arm/Manipulator system

9.6.6.10 Thrust vector control system

9.6.6.11 Engine valve control system

9.6.6.12 Solar array drive mechanism}

9.6.7 Historic and Forecasted Market Size by End-User

9.6.7.1 Civil

9.6.7.2 Défense

9.6.7.3 Commercial

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Space Sensor Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 IMU Sensors

9.7.4.2 GPS Sensors

9.7.4.3 Star Sensors

9.7.4.4 Optical Sensors

9.7.4.5 Synthetic Aperture Radar Sensors

9.7.4.6 Others {Temperature Sensors

9.7.4.7 Vibration Sensors

9.7.4.8 Pressure Sensors

9.7.4.9 Gas Sensors}

9.7.5 Historic and Forecasted Market Size by Platform

9.7.5.1 Satellites

9.7.5.2 Capsules/Cargos

9.7.5.3 Interplanetary Spacecraft & Probes

9.7.5.4 Rovers/Spacecraft Landers

9.7.5.5 Launch Vehicle

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Attitude & orbit control system

9.7.6.2 Command & data handling system

9.7.6.3 Telemetry tracking and command

9.7.6.4 Thermal system

9.7.6.5 Propellent feed system

9.7.6.6 Others {Rocket motors

9.7.6.7 Surface mobility and navigation system

9.7.6.8 Berthing and Docking system

9.7.6.9 Robotic arm/Manipulator system

9.7.6.10 Thrust vector control system

9.7.6.11 Engine valve control system

9.7.6.12 Solar array drive mechanism}

9.7.7 Historic and Forecasted Market Size by End-User

9.7.7.1 Civil

9.7.7.2 Défense

9.7.7.3 Commercial

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Space Sensor Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 7906.08 Million |

|

Forecast Period 2025-32 CAGR: |

7.9 % |

Market Size in 2032: |

USD 14525.56 Million |

|

Segments Covered: |

By Type |

|

|

|

By Platform |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||