Global Smart Textiles Market Overview

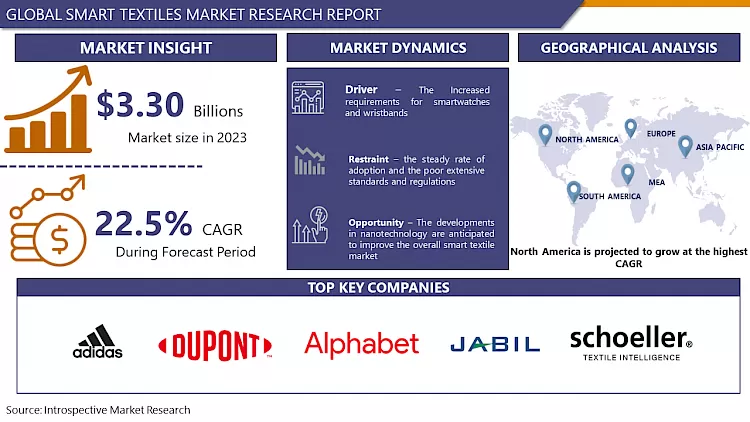

The Global Smart Textiles market was valued at USD 3.30 billion in 2023 and is expected to reach USD 20.50 billion by the year 2032, Growing at a CAGR of 22.5% From 2024-2032.

Textiles are referred to as any item that is being developed by fibers or threads into fabric. It is mainly manufactured from natural fibers, animal or vegetable origin. With time and technological developments, textiles have developed from being a simple piece of cloth or fabric to something that can be functional, beautiful, and responsive all at the same time. These very performing impart these textiles the names such as Smart Textiles, e-textiles (electronic textiles), intelligent textiles, or Functional Fabrics. Additionally, smart textiles use heat, electrical, chemical, magnetic, or other detection systems to sense electrical, magnetic, thermal, mechanical, temperature, or chemical changes in the environment. Moreover, smart textiles are anticipated to highly benefit from the gaining popularity and incorporation of electronic wearables.

Smart textiles provide healthcare professionals with the technology to interconnect with patients. Wireless health monitoring functions are also implanted into fabrics that assist monitor functions of vital organs such as the heart, skin, and lungs through continuous tracking of body temperature, breathing, heart rate, and other physiological parameters. Comparable to other consumer industries, the global textile industry constitutes one of the poor-influenced industries owing to the pandemic. Moreover, textiles and clothing being labor-intensive will feel additional pressure to follow strict norms that make sure worker safety and also a rich quality of products. A return to growth will therefore be led by the move towards automated machines, constancy to attentive export quality norms; target on production efficiency as well as energy efficiency, and constitutional ability to build quality during production. The widespread availability of effective vaccines however has the potential to stimulate the recovery period. Amidst the COVID-19 crisis, the global market for Smart Textiles projected at US$1.8 Billion in the year 2020, is estimated to gain a revised size of US$5.9 Billion by 2026, during the forecasting period.

Market Dynamics And Factors For The Smart Textiles Market

Drivers:

The key driving factors for the smart textile market are the increased requirements for smartwatches and wristbands, the rise in the growth rate of low-cost smart wireless sensor networks, the growing demand for enlightened gadgets with developed functions, and the miniaturization of electronic components. Moreover, the demand for sports and fitness utilizations is anticipated to see growth, which will further turn the demand for smart fabrics as they raise the comfort level for the user and remove the application of heavy equipment. The development of the latest technologies including artificial intelligence (AI) and the Internet of Things (IoT) has reshaped the textile industry. The latest smart garments are being produced integrated with AI, Bluetooth Low Energy (BLE), edge computing, and cloud data, which can monitor and communicate the wearer's information, including heart rate, perspiration, calorie count, temperature, blood pressure. AI can approach and collect historical and real-time operational data and offers insights, which can improve the wearer's efficiency.

Furthermore, medical applications, which recorded a significant growth rate and are expected to grow faster than the global average, will further improve the smart textile market. Smart fabrics can analyze physiological parameters such as temperature, heart rate, and blood pressure. The problems concerning power supply are expected to turn the requirements for energy harvesting.

Restraints:

The major hampering factors for the growth of the smart textiles market are the steady rate of adoption and the poor extensive standards and regulations. Similarity issues and the high cost of production of these textiles are also some of the factors influencing the growth of the smart textiles market. Smart textiles are highly complex and need high-end materials. There are many key operations of the textile industry are printing, neutralizing, bleaching, dyeing, scouring, mercerizing, de-sizing, and finishing. These operations lead to the discharge of high-level toxic emissions that contaminate soil, as well as groundwater, cause air, and surface water pollution. Therefore, the perfect cost-price balance has been difficult to acquire.

Opportunities:

The developments in nanotechnology are anticipated to improve the overall smart textile market. Incorporating nanotechnology into fabrics assist to change or improve the properties such as fire resistance, monitoring, and electronic capability. This textile has many utilizations in the health and military sectors. For instance, lightweight uniforms that can discover the lightweight battle suits, blood flow in the body, uniforms that can change the color to match the surrounding, and others. Western European countries, the US, and Japan are funding the R&D of nanomaterial-based smart textiles.

Market Segmentation

Segmentation Analysis of Smart Textiles Market:

Based on Type, the active/ultra-smart textiles segment has the maximum market share over the forecast period. Active/ultra-smart textiles are implemented with electronic components such as sensors and actuators, which can sense and react to stimuli. They are utilized to make outfits used by defense personnel, sportspersons, firefighting teams, and other professionals. The application of textile-based products can be more comfortable when the textile can react to the environment.

Based on Function, the sensing segment is anticipated to hold maximum market share owing to smart textiles finding applications in the military, medical, sports, and aerospace sectors, where sensing and monitoring are already utilized and would only be made more efficient if integrated with textiles.

Based on Application, the military and defense segments are anticipated to hold a significant market size of the smart textiles market over the forecast period. Smart textiles for military applications provide various features such as advanced insulation properties and ballistics protection, as well as are made from waterproof fabric, while some are capable of health monitoring and equipped with GPS, sensors, and motion trackers.

Regional Analysis of Smart Textiles Market:

North America is the leading region in the worldwide smart textiles market and this is projected to persist shortly. Smart fabrics are in high demand in multiple industries within the United States. Industries such as healthcare, military and defense, sports and fitness, and automotive all heavily rely on these ground-breaking textiles. The region experiences market growth due to the increased demand.

Leading smart textile manufacturers have a strong presence in North America. DuPont, Gentherm, Sensoria, Alphabet, and Jabil, all based in the US, are important players in advancing smart textile technology. Their presence and dedication to research and development play a major role in North America's dominance in the market. The smart textiles market thrives in North America due to the high demand and presence of innovative manufacturers. However, it is important to highlight that areas like Asia-Pacific are showing promising growth prospects, and the global smart textiles market is expected to experience increased competition ahead.

Players Covered in Smart Textiles Market are:

- Adidas AG (Germany)

- DuPont de Nemours Inc.(US)

- Alphabet (US)

- International Fashion Machines Inc.(U.S.)

- Jabil (US)

- Texas Instruments Incorporated. (US)

- Sensoria Inc. (U.S.)

- Intelligent Clothing Ltd. (U.K.)

- Schoeller Textiles AG (Switzerland)

- Interactive Wear AG (Germany)

- Ohmatex A/S (Denmark)

- Textronics

- Design Systems (I) Pvt. Ltd. (U.S.)

- Google Inc. (U.S.)

- Vista Medical Ltd. (Canada)

- Gentherm Incorporated (U.S.)

- AIQ Smart Clothing (Taiwan)

- Outlast Technologies (US)

- Hexoskin (Canada) and other Major Players.

Key Industry Developments In Smart Textiles Market

- In April 2024, NC State researchers unveiled a groundbreaking fabric-based touch sensor, merging 3D embroidery with machine learning. Powered by friction, the triboelectric device integrates seamlessly into clothing, offering touch control for electronic devices. Machine learning algorithms enhance gesture recognition, boosting accuracy for intuitive interaction. This innovation signals promising strides in wearable electronics, hinting at a future where our garments seamlessly interface with technology.

- In March 2024, London-based outerwear brand Vollebak launched the Firefly Jacket, featuring color-shifting membranes for day-to-night adaptability. Infused with phosphorescent and fluorescent compounds, the jacket changes hues from copper to glow-in-the-dark green. Fully seam-sealed with waterproof zips and velcro cuffs, it's designed for any condition. Complete with storm-flap-protected pockets, it's now available on Vollebak's official website.

|

Global Smart Textiles Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.30 Bn. |

|

Forecast Period 2024-32 CAGR: |

22.5% |

Market Size in 2032: |

USD 20.50 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Function |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Smart Textiles Market by Type (2018-2032)

4.1 Smart Textiles Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Passive

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Active/Ultra-smart

Chapter 5: Smart Textiles Market by Function (2018-2032)

5.1 Smart Textiles Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Sensing

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Energy Harvesting

5.5 Thermoelectricity

5.6 Luminescent

5.7 Other

Chapter 6: Smart Textiles Market by Application (2018-2032)

6.1 Smart Textiles Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Military & Defense

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Healthcare

6.5 Entertainment

6.6 Automotive

6.7 Sports & Fitness

6.8 Other

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Smart Textiles Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 THERMO FISHER SCIENTIFIC INC. (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ABBOTT LABORATORIES (US)

7.4 BD (BECTON

7.5 DICKINSON AND COMPANY) (US)

7.6 QUIDEL CORPORATION (US)

7.7 LUMINEX CORPORATION (US)

7.8 BIO-RAD LABORATORIES INC. (US)

7.9 HOLOGIC INC. (US)

7.10 DANAHER CORPORATION (US)

7.11 SA SCIENTIFIC LTD. (US)

7.12 PRINCETON BIOMEDITECH CORPORATION (US)

7.13 GEN-PROBE INCORPORATED (US)

7.14 BIOFIRE DIAGNOSTICS

7.15 LLC (US)

7.16 MERIDIAN BIOSCIENCE INC. (US)

7.17 SEKISUI DIAGNOSTICS LLC (US)

7.18 CEPHEID (US)

7.19 GENMARK DIAGNOSTICS INC. (US)

7.20 ALTONA DIAGNOSTICS GMBH (GERMANY)

7.21 QIAGEN N.V. (GERMANY)

7.22 SIEMENS HEALTHINEERS AG (GERMANY)

7.23 RANDOX LABORATORIES LTD. (UK)

7.24 MOLOGIC LTD. (UNITED KINGDOM) DIASORIN S.P.A. (ITALY)

7.25 F. HOFFMANN-LA ROCHE LTD. (SWITZERLAND)

7.26 ROCHE DIAGNOSTICS (SWITZERLAND)

7.27 SYSMEX CORPORATION (JAPAN)

7.28

Chapter 8: Global Smart Textiles Market By Region

8.1 Overview

8.2. North America Smart Textiles Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Passive

8.2.4.2 Active/Ultra-smart

8.2.5 Historic and Forecasted Market Size by Function

8.2.5.1 Sensing

8.2.5.2 Energy Harvesting

8.2.5.3 Thermoelectricity

8.2.5.4 Luminescent

8.2.5.5 Other

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Military & Defense

8.2.6.2 Healthcare

8.2.6.3 Entertainment

8.2.6.4 Automotive

8.2.6.5 Sports & Fitness

8.2.6.6 Other

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Smart Textiles Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Passive

8.3.4.2 Active/Ultra-smart

8.3.5 Historic and Forecasted Market Size by Function

8.3.5.1 Sensing

8.3.5.2 Energy Harvesting

8.3.5.3 Thermoelectricity

8.3.5.4 Luminescent

8.3.5.5 Other

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Military & Defense

8.3.6.2 Healthcare

8.3.6.3 Entertainment

8.3.6.4 Automotive

8.3.6.5 Sports & Fitness

8.3.6.6 Other

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Smart Textiles Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Passive

8.4.4.2 Active/Ultra-smart

8.4.5 Historic and Forecasted Market Size by Function

8.4.5.1 Sensing

8.4.5.2 Energy Harvesting

8.4.5.3 Thermoelectricity

8.4.5.4 Luminescent

8.4.5.5 Other

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Military & Defense

8.4.6.2 Healthcare

8.4.6.3 Entertainment

8.4.6.4 Automotive

8.4.6.5 Sports & Fitness

8.4.6.6 Other

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Smart Textiles Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Passive

8.5.4.2 Active/Ultra-smart

8.5.5 Historic and Forecasted Market Size by Function

8.5.5.1 Sensing

8.5.5.2 Energy Harvesting

8.5.5.3 Thermoelectricity

8.5.5.4 Luminescent

8.5.5.5 Other

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Military & Defense

8.5.6.2 Healthcare

8.5.6.3 Entertainment

8.5.6.4 Automotive

8.5.6.5 Sports & Fitness

8.5.6.6 Other

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Smart Textiles Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Passive

8.6.4.2 Active/Ultra-smart

8.6.5 Historic and Forecasted Market Size by Function

8.6.5.1 Sensing

8.6.5.2 Energy Harvesting

8.6.5.3 Thermoelectricity

8.6.5.4 Luminescent

8.6.5.5 Other

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Military & Defense

8.6.6.2 Healthcare

8.6.6.3 Entertainment

8.6.6.4 Automotive

8.6.6.5 Sports & Fitness

8.6.6.6 Other

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Smart Textiles Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Passive

8.7.4.2 Active/Ultra-smart

8.7.5 Historic and Forecasted Market Size by Function

8.7.5.1 Sensing

8.7.5.2 Energy Harvesting

8.7.5.3 Thermoelectricity

8.7.5.4 Luminescent

8.7.5.5 Other

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Military & Defense

8.7.6.2 Healthcare

8.7.6.3 Entertainment

8.7.6.4 Automotive

8.7.6.5 Sports & Fitness

8.7.6.6 Other

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Smart Textiles Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.30 Bn. |

|

Forecast Period 2024-32 CAGR: |

22.5% |

Market Size in 2032: |

USD 20.50 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Function |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Smart Textiles Market research report is 2022-2028.

Adidas AG (Germany), DuPont de Nemours Inc. (US), Alphabet (US), International Fashion Machines Inc. (U.S.), Jabil (US), Texas Instruments Incorporated. (US), Sensoria Inc. (U.S.), Intelligent Clothing Ltd. (U.K.), Schoeller Textiles AG (Switzerland), Interactive Wear AG (Germany), Ohmatex A/S (Denmark), Textronics, Design Systems (I) Pvt. Ltd. (U.S.), Google Inc. (U.S.), Vista Medical Ltd. (Canada), Gentherm Incorporated (U.S.), AIQ Smart Clothing (Taiwan), Outlast Technologies (US), Hexoskin (Canada), and other major players.

The Smart Textiles Market is segmented into Type, Function, Application, and region. By Type, the market is categorized into Passive, Active/Ultra-Smart. By Function the market is categorized into Sensing, Energy Harvesting, Thermoelectricity, Luminescent, and Other. By Application, the market is categorized into Military & Defense, Healthcare, Entertainment, Automotive, Sports & Fitness, and Other. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Textiles are referred to as any item that is being developed by fibers or threads into fabric. It is mainly manufactured from natural fibers, animal or vegetable origin. With time and technological developments, textiles have developed from being a simple piece of cloth or fabric to something that can be functional, beautiful, and responsive all at the same time. These very performing impart these textiles the names such as Smart Textiles, e-textiles (electronic textiles), intelligent textiles, or Functional Fabrics.

The Global Smart Textiles market was valued at USD 3.30 billion in 2023 and is expected to reach USD 20.50 billion by the year 2032, Growing at a CAGR of 22.5% From 2024-2032.