Smart Syringe Market Synopsis:

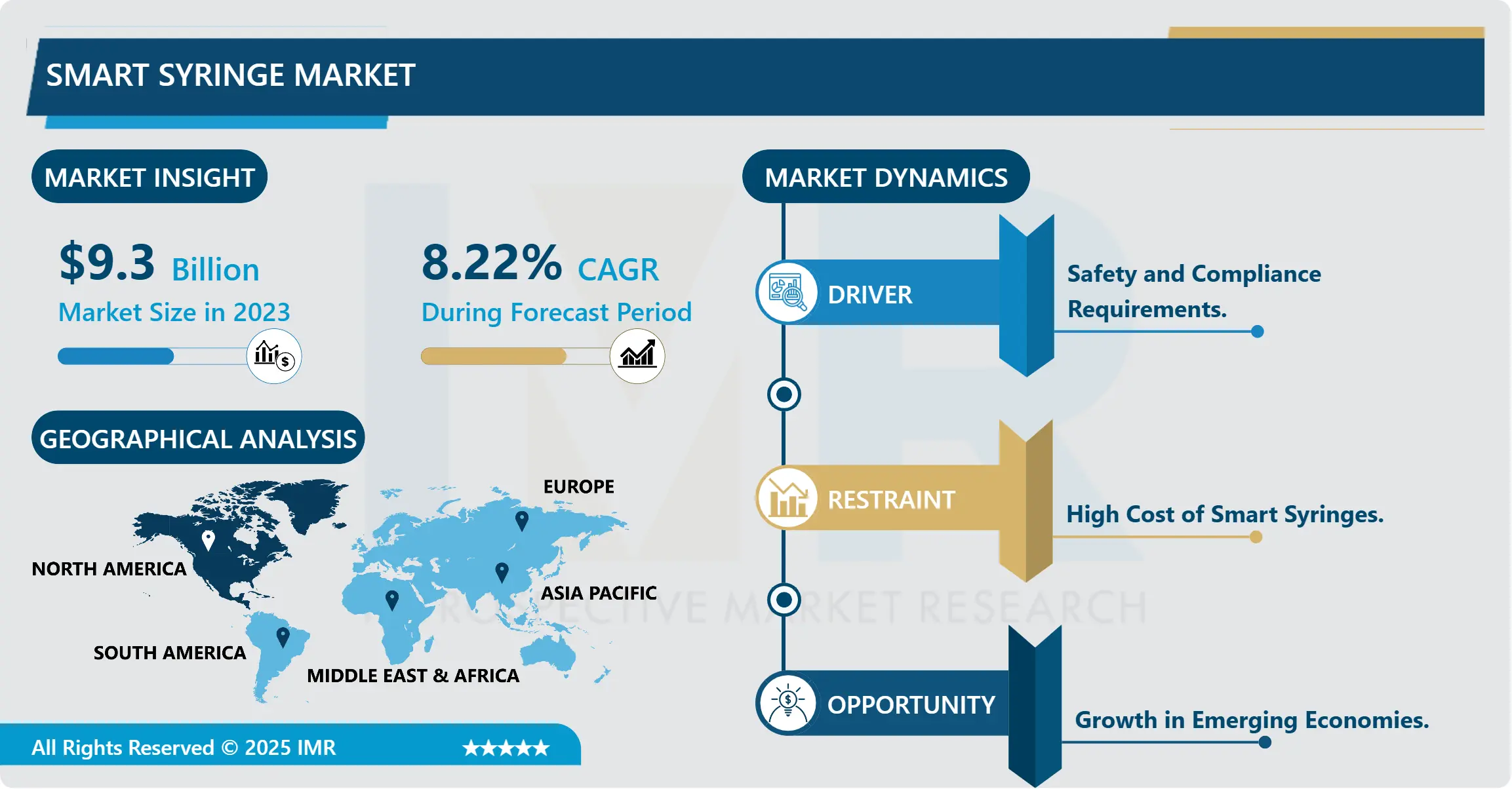

Smart Syringe Market Size Was Valued at USD 9.3 Billion in 2023, and is Projected to Reach USD 18.9 Billion by 2032, Growing at a CAGR of 8.22% From 2024-2032.

The Smart Syringe Market refers to products including novel syringes that aim to minimize common drawbacks of ordinary syringes, including but not limited to needlestick injury or incorrect usage and reuse. Design elements of these syringes include auto-disable mechanisms; passive retraction; and dose delivery indicator that improve patient and healthcare worker safety as well as meet the increasingly higher government standards; particularly with reference to healthcare and diagnostics. All these innovations are targeting to enhance overall health safety, minimizing waste, and preventing contaminant, hence becoming highly significant tool in medical use across the world.

The expanded future of the Smart Syringe Market was observed in recent years as the public have become more conscious of the prevention of needle borne diseases, stringent regulatory policies and increased development in healthcare technologies. Head of states globally are demanding health care facilities to adopt smart syringes to prevent conveying of infections, more so when delivering vaccines and other medicines. The increasing investment in the health care system and rising patient safety consciousness make the use of these state-of-the-art syringes popular, which opens up a large demand for this product. In addition, higher disposable income and healthcare spending among the populace in the emerging economies is acting as a driver to the market growth.

Also, the development of new technologies has helped the manufacturers produce some features in the syringes like auto-disable, tracking and easy disposal that would be of benefits to the healthcare professional and patient. By changing market trends from luxurious, safe, and eco-friendly syringes the Smart Syringe Market will expand in healthcare facilities. Secondly, there has been an increased use of safe, single-use syringe technologies by the COVID-19 mass immunization programs increasing market demand and future growth prospects.

Smart Syringe Market Trend Analysis:

Rising Adoption of Safe Injection Practices

- National Ministries of Health and healthcare stakeholders are enhancing measures that endeavours to promotes safer injecting practices and prevent occurrences of infectious diseases. Currently, single-use syringes, self-disabling syringes, auto-retractable smart syringes have been adopted through enhanced technology to reduce contamination and needle-stick injuries among the practitioners. Such trend is supported by international organizations for health, including the World Health Organization (WHO), which published guidelines to propose the use of smart syringes in immunization and other general clinical procedures to prevent infection.

- Also, the rise in the adoption of these safety protocols, as well as individual nations, there grows the need for the smart syringe systems that are able to uniquely track and monitor the administration of the particular dose. The main reason why this trend is so important is that it allows to track and control medical procedures even in cases of vaccination and in areas with limited access. The application of such smart technologies in the syringes is believed that it would change the way drugs and vaccines are administered, as well as safer, efficient, and trackable.

Expanding Use of Smart Syringes in Emerging Economies

- The Smart Syringe Market has numerous opportunities for the emerging economies because of factors such as, growing healthcare expenditure, enhanced awareness among patients, and favourable policies. In Asia-Pacific, for instance, Latin America, and some parts of Africa, governments are putting a lot of capital into a healthcare system and addressing patient safety. The slow transition to complex healthcare systems in these countries has now led to a significant need for smart syringe technology to reduce needle stick incidence and contamination concerns. This is made doubly beneficial with the backing of global organizations in pushing the use of safer injection practices in developing countries.

- Furthermore, as the health care institutions in these areas are get more funding, there is need to obtain advance medical instruments such as the smart syringes to support the safe injection campaign and the vaccination. Increasing focus towards attainment of Universal Health Coverage and managing of preventable diseases has occurred in expanded demand for Safe, Reliable and User-friendly injection systems in turn precipitating for long-term market growth in Smart Syringe across the Emerging Nations.

Smart Syringe Market Segment Analysis:

Smart Syringe Market Segmented on the basis of type, application, end user, and region.

By Type, Passive Safety Syringes segment is expected to dominate the market during the forecast period

- The Passive Safety Syringes segment for Smart Syringe Market is again expected to exhibit the highest market share during the forecasting period due to the safety locked syringes which are harmless and do not need any further manipulation or triggering mechanisms. These syringes are specifically designed to self-adjust or self-disable as soon as they are used and that makes them also ideal for those large health facilities where efficiency and safety are key. Health care workers given a choice opt for passive safety syringes because they engage less effort to meet safety standards especially when mass immunization programs, accident surgeries are being administered. And the growing support of the regulation meant to enhance safe injection practices, Arts, and increased awareness of needlestick safety will continue to boost passive safety syringes utilization extending the segment growth in the market.

By Age Group, Adults segment expected to held the largest share

- By age group, the Adults segment is expected to hold the largest share of the smart syringes market. This dominance is driven by the high prevalence of chronic conditions such as diabetes, cardiovascular diseases, and respiratory disorders among adults, which require frequent and safe medication administration. The demand for smart syringes is fueled by their ability to enhance safety, reduce the risk of needlestick injuries, and ensure accurate dosage delivery. Additionally, the growing emphasis on adult vaccination programs and the need for efficient treatment management further support the widespread adoption of smart syringes within the adult patient population, increasing market growth.

Smart Syringe Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is expected to remain the largest market among all the regions during 2023. However, the United States forms a significant portion of the market share which is approximated to be equal to the world market share mainly because of widespread use of smart syringes in hospitals and healthcare facilities in the country. The concern with prevention of needle stick injuries, combined with intense research activity and the application of the contagious dollars results in the leadership position of this region in the global market. Further, the backing from health organizations and government guidelines has strengthened the use of smart syringes in North America making it the market leader.

Active Key Players in the Smart Syringe Market

- AdvaCare Pharma (USA)

- BD (Becton, Dickinson and Company) (USA)

- Cardinal Health (USA)

- Gerresheimer AG (Germany)

- Medtronic (Ireland)

- Merit Medical Systems (USA)

- Nipro Corporation (Japan)

- Novo Nordisk (Denmark)

- Pfizer (USA)

- Phillips-Medisize (USA)

- Retractable Technologies, Inc. (USA)

- Smith’s Medical (USA)

- Terumo Corporation (Japan)

- Unilife Corporation (Australia)

- VanishPoint (USA)

- Other Active Players

|

Smart Syringe Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.3 Billion |

|

Forecast Period 2024-32 CAGR: |

8.22% |

Market Size in 2032: |

USD 18.9 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Smart Syringe Market by Type

4.1 Smart Syringe Market Snapshot and Growth Engine

4.2 Smart Syringe Market Overview

4.3 Passive Safety Syringes

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Passive Safety Syringes: Geographic Segmentation Analysis

4.4 Active Safety Syringes

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Active Safety Syringes: Geographic Segmentation Analysis

4.5 and Auto-disable Syringes)

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 and Auto-disable Syringes): Geographic Segmentation Analysis

4.6 Age Group (Adults and Paediatrics)

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Age Group (Adults and Paediatrics): Geographic Segmentation Analysis

4.7

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 : Geographic Segmentation Analysis

Chapter 5: Smart Syringe Market by End User

5.1 Smart Syringe Market Snapshot and Growth Engine

5.2 Smart Syringe Market Overview

5.3 Hospitals and HMOs)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Hospitals and HMOs) : Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Smart Syringe Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 BD (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 MEDTRONIC (IRELAND)

6.4 TERUMO CORPORATION (JAPAN)

6.5 SMITHS MEDICAL (USA)

6.6 CARDINAL HEALTH (USA)

6.7 OTHER ACTIVE PLAYERS

Chapter 7: Global Smart Syringe Market By Region

7.1 Overview

7.2. North America Smart Syringe Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Type

7.2.4.1 Passive Safety Syringes

7.2.4.2 Active Safety Syringes

7.2.4.3 and Auto-disable Syringes)

7.2.4.4 Age Group (Adults and Paediatrics)

7.2.4.5

7.2.5 Historic and Forecasted Market Size By End User

7.2.5.1 Hospitals and HMOs)

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Smart Syringe Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Type

7.3.4.1 Passive Safety Syringes

7.3.4.2 Active Safety Syringes

7.3.4.3 and Auto-disable Syringes)

7.3.4.4 Age Group (Adults and Paediatrics)

7.3.4.5

7.3.5 Historic and Forecasted Market Size By End User

7.3.5.1 Hospitals and HMOs)

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Smart Syringe Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Type

7.4.4.1 Passive Safety Syringes

7.4.4.2 Active Safety Syringes

7.4.4.3 and Auto-disable Syringes)

7.4.4.4 Age Group (Adults and Paediatrics)

7.4.4.5

7.4.5 Historic and Forecasted Market Size By End User

7.4.5.1 Hospitals and HMOs)

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Smart Syringe Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Type

7.5.4.1 Passive Safety Syringes

7.5.4.2 Active Safety Syringes

7.5.4.3 and Auto-disable Syringes)

7.5.4.4 Age Group (Adults and Paediatrics)

7.5.4.5

7.5.5 Historic and Forecasted Market Size By End User

7.5.5.1 Hospitals and HMOs)

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Smart Syringe Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Type

7.6.4.1 Passive Safety Syringes

7.6.4.2 Active Safety Syringes

7.6.4.3 and Auto-disable Syringes)

7.6.4.4 Age Group (Adults and Paediatrics)

7.6.4.5

7.6.5 Historic and Forecasted Market Size By End User

7.6.5.1 Hospitals and HMOs)

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Smart Syringe Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Type

7.7.4.1 Passive Safety Syringes

7.7.4.2 Active Safety Syringes

7.7.4.3 and Auto-disable Syringes)

7.7.4.4 Age Group (Adults and Paediatrics)

7.7.4.5

7.7.5 Historic and Forecasted Market Size By End User

7.7.5.1 Hospitals and HMOs)

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Smart Syringe Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.3 Billion |

|

Forecast Period 2024-32 CAGR: |

8.22% |

Market Size in 2032: |

USD 18.9 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||