Smart Pacifier Market Synopsis:

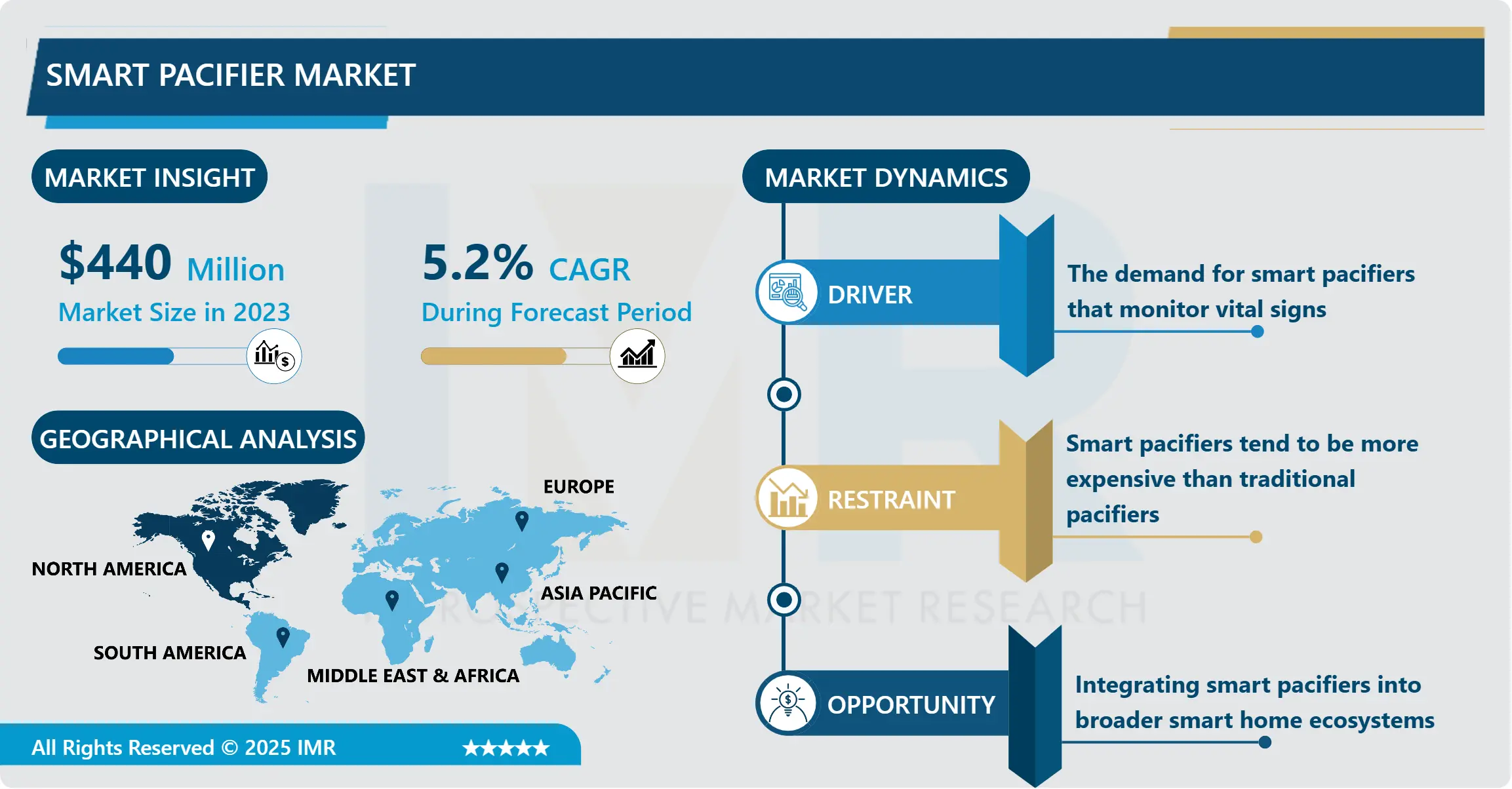

Smart Pacifier Market Size Was Valued at USD 440 Million in 2023, and is Projected to Reach USD 652 Million by 2032, Growing at a CAGR of 5.2% From 2024-2032.

Smart pacifier market means the industry that provides the products of pacifiers equipped with sophisticated technology for recording different parameters of a child’s state. These pacifiers come fitted with life monitoring devices in this case; it includes body temperature, heart rate and even sleep patterns and relaying this information to the parents or caretakers. Modern smart pacifiers also come with features that make them have Bluetooth or Wi-Fi enabled capacity through which the pacifiers can connect to a cellular application or another device which can monitor, provide alerts or analyse data. This technology provides the solution for parents who want to monitor their baby’s wellbeing and safety by tracking over the essential parameters.

The smart pacifier can be segmented as a fast-growing part of the baby care market due to the introduction of technologies into ordinary products. There is variety of pacifiers which are smart; they incorporate sensors to track other important vital signs including temperature, pulse rate, and even the sleeping cycles of the child and making it easy for the parents to track their newborn’s health status. Many of these pacifiers have extra functions for Bluetooth or Wi-Fi connection and are capable of connecting with the respective apps on mobiles or other devices to display real-time information and give notifications.

According to the research, the market for smart pacifiers is expected to grow rapidly in the coming years due to growing demand in emerging economies, innovation and increase in per capita income and bottle consciousness among the parents. North America and Europe have taken lead in the market due to high disposable income generated and awareness of the health monitoring technology. In these areas, consumers rely on technologically advanced baby care products with information feedback and ability to monitor the child’s vital signs all the time.

Smart Pacifier Market Trend Analysis

Personalized Health Insights and AI Integration

- The integration of AI in the smart pacifier is giving the practice of personalized health insights a new direction. Existing smart pacifiers are being integrated with new and enhanced algorithms and ML models to gain sizeable insights from sensor data which include temperature, heart rate, and sleep patterns. Based on this data, using AI parents receive individualistic health insights where the program will recommend to them the kind of health which is suitable for their baby. For instance, the AI might identify changes in a baby’s sleep pattern or can easily notice difference in the temperature or pulse rates that might be suggestive of an ailment like a temperature or UTI. These early signs can help parents prepare and avoid further complications within the health of the child.

- Moreover, skillful integration of AI leads to improved performance of smart pacifiers due to fundamental learning from the baby health information over time. In this case it means that the pacifier can be changed to match the needs of the child as grows to provide more accurate information. When the parent wants to be as specific as possible when it comes to managing the child’s needs, the idea of getting back data-based, personal suggestions sleep, feeding, health becomes rather alluring. The constant advancement of AI technology in the baby care sector ensures that smart pacifiers are able to offer more and more detailed and valuable information making them indispensable devices to the resourceful new age parents who want to give their babies the best care that is possibly available to them.

Integration with Smart Home Ecosystems

- Smart pacifiers themselves offer strong prospects for market expansion through compatibility with smart homes. As smart home technology continues to gain adoption, parents are finding ways on how to integrate their different baby care products including baby monitors, thermometer, smart crib and/or smart accessories for the crib on a single smart ecosystem, making the improvements as safe as possible for their infants. Such a combination allows smart pacifiers to provide parents with a wider range of opportunities for baby’s safety and care within existing ecosystems created by manufacturers. For example, a smart pacifier that can connect with a smart baby monitoring system to report heart rate or temperature or it can connect with a smart crib to monitor and modify the position or environment of baby based on its health information. This level of connectivity makes managing parent devices at this level easy, for instance, a parent will be able to monitor and operate the multiple baby care device from a single platform such a smartphone application or even a smart speaker.

- Additionally, smart pacifiers may be consolidated with other smart products, gadgets, and systems that compose smart home systems to create additional possibilities for automation and sharing of data. For instance, if the pacifier is learning that the baby is overheated, it may cause other devices to respond for example to turn off the air conditioning, automatically, or may signal the smart speaker the parent is using. It could also be the same with layer two where data flows directly where it can be shared with pediatricians, caregiver in real-time to advise or act on them appropriately. The degree of integration between baby care devices and smart home technologies is a powerful driver for the smart pacifier market and manufacturers capable of providing consumers with complete packages that address their both rational and emotional needs will be able to benefit from growing parent reliance on smart home technologies in the near future.

Smart Pacifier Market Segment Analysis:

Smart Pacifier Market is Segmented on the basis of type, application, end user and region.

By Type, Connectivity-enabled Pacifiers segment is expected to dominate the market during the forecast period

- Connectivity-enabled Pacifiers is expected to be the largest growing segment of the smart pacifier market throughout the forecast period due to growing customer preference for comfort, health monitoring, and continuous data tracking. With parents getting involved more into digital world and mastering new technologies, they are eager to purchase devices that enable them to control their baby’s health condition from a distance. Smart pacifiers which can be connected to mobile aps or smart devices through Bluetooth or Wi-Fi offer the opportunity to monitor temperature, heart rate, and even sleep through a mobile device for a parent who is out of their baby’s reach. Such a high degree of connection is a great security, particularly in case of parents and their babies who may feel anxious at their baby’s disposition during sleep or absence. In addition, as smart pacifiers are currently being connected to other related baby care products like monitors or smart cribs the overall idea of the connected experience is gaining more appeal for these smart solutions.

- Besides, more people are receiving smart home gadgets and smart phones, as a result, they are going to observe connectivity-enabled pacifiers. If smart home ecosystems remain popular, they will be desirable to have baby care products that are compatible with this system to work on the same network, so that they do not have to switch between systems. Some pacifiers use connectivity features to offer the chance to influence and regulate various aspects of baby’s milieu to set the temperature within a baby’s room, for instance, or to synchronize sleep data with other Healthy devices.

By Application, Health Monitoring segment expected to held the largest share

- The Health Monitoring application segment is anticipated to account for the largest market share of the Smart Pacifier market during the forecast period due to escalating parental concern about the baby’s health and well-being. The main purpose of a smart pacifier is health way monitoring activity during which the pacifiers are outfitted with sensors that can measure temperature, heart rate, and even sleep patterns. By being able to keep track of these indicators in real time parents are assured of their baby’s state of health in case anything is amiss the indicators are useful in early detection of any complications. So as the parents are gaining awareness and taking personal responsibility to look after the health of the child, there is an emerging market interest in baby care products which do not only serve a basic need to fulfill a function, but which would assist the parent or guardians to reduce or avoid a health problem before it develops.

- Moreover, rising tendency towards preventive healthcare coupled with early diagnosis is also putting forward huge demand for health monitoring functions in smart pacifiers. Incorporated with better sensors and connectivity with a mobile application, these pacifiers offer enough data to parents advising on probable medical conditions like fevers, infections, or respiratory problems that a parent might otherwise ignore.

Smart Pacifier Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is anticipated to have a more promising growth in the coming years in the smart pacifier market due to high adoption of advanced technologies, higher consumer awareness, health-consciousness and rising demand in baby care products market. North America is the most advanced region, and a steadily rising number of parents are incorporating smart baby care gadgets into their lives. In the region of North America, adoption and the popularity of smart homes and smart devices is substantiating to be the key driver for the smart pacifier market. With more and more households embracing smart products like smart speakers, baby monitors, and wearables, connected products like smart pacifiers that offer real-time health monitoring with data sharing with other applications on the smart phone are also on the rise. There is also a relatively strong per capita income in this area to also allow parents to spend on expensive high tech products and services to meet the care needs of their infants. Moreover, advancing stakes on child health, particularly relating to temperature control, sleeping, and early warning signs of potential health problems have made many parents to find the concept of pacifiers that track other relevant vital statistics attractive.

Active Key Players in the Smart Pacifier Market:

- BabyO2 (United States)

- BabySense (Israel)

- BlueSmart (United States)

- CAMP Mobile (South Korea)

- Emmzo (United States)

- Hatch Baby (United States)

- iHealth (United States)

- MAM Babyartikel GmbH (Austria)

- Nanit (United States)

- Nanit (United States)

- Owlet Baby Care (United States)

- Pacif-i (United Kingdom)

- Pip & Grow (United States)

- Snuza International (South Africa)

- The Baby's Brew (United States)

- VTech Communications, Inc. (Hong Kong)

- Wellness Tech (United States)

- Withings (France)

- Other Active Players

|

Smart Pacifier Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 440 Million |

|

Forecast Period 2024-32 CAGR: |

5.2% |

Market Size in 2032: |

USD 652 Million |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Smart Pacifier Market by Type

4.1 Smart Pacifier Market Snapshot and Growth Engine

4.2 Smart Pacifier Market Overview

4.3 Pacifiers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Pacifiers: Geographic Segmentation Analysis

4.4 Sleep Monitoring Pacifiers

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Sleep Monitoring Pacifiers: Geographic Segmentation Analysis

4.5 Connectivity-enabled Pacifiers)

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Connectivity-enabled Pacifiers): Geographic Segmentation Analysis

4.6

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 : Geographic Segmentation Analysis

Chapter 5: Smart Pacifier Market by Application

5.1 Smart Pacifier Market Snapshot and Growth Engine

5.2 Smart Pacifier Market Overview

5.3 Health Monitoring

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Health Monitoring: Geographic Segmentation Analysis

5.4 Parental Control

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Parental Control: Geographic Segmentation Analysis

5.5 Early Detection of Medical Conditions)

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Early Detection of Medical Conditions): Geographic Segmentation Analysis

5.6

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 : Geographic Segmentation Analysis

Chapter 6: Smart Pacifier Market by End User

6.1 Smart Pacifier Market Snapshot and Growth Engine

6.2 Smart Pacifier Market Overview

6.3 Parents of Newborns

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Parents of Newborns: Geographic Segmentation Analysis

6.4 Hospitals and Healthcare Institutions)

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Hospitals and Healthcare Institutions) : Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Smart Pacifier Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BABYO2 (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BABYSENSE (ISRAEL)

7.4 BLUESMART (UNITED STATES)

7.5 CAMP MOBILE (SOUTH KOREA)

7.6 EMMZO (UNITED STATES)

7.7 HATCH BABY (UNITED STATES)

7.8 IHEALTH (UNITED STATES)

7.9 MAM BABYARTIKEL GMBH (AUSTRIA)

7.10 NANIT (UNITED STATES)

7.11 OWLET BABY CARE (UNITED STATES)

7.12 PACIF-I (UNITED KINGDOM)

7.13 PIP & GROW (UNITED STATES)

7.14 OTHER ACTIVE PLAYERS

Chapter 8: Global Smart Pacifier Market By Region

8.1 Overview

8.2. North America Smart Pacifier Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Pacifiers

8.2.4.2 Sleep Monitoring Pacifiers

8.2.4.3 Connectivity-enabled Pacifiers)

8.2.4.4

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Health Monitoring

8.2.5.2 Parental Control

8.2.5.3 Early Detection of Medical Conditions)

8.2.5.4

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Parents of Newborns

8.2.6.2 Hospitals and Healthcare Institutions)

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Smart Pacifier Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Pacifiers

8.3.4.2 Sleep Monitoring Pacifiers

8.3.4.3 Connectivity-enabled Pacifiers)

8.3.4.4

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Health Monitoring

8.3.5.2 Parental Control

8.3.5.3 Early Detection of Medical Conditions)

8.3.5.4

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Parents of Newborns

8.3.6.2 Hospitals and Healthcare Institutions)

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Smart Pacifier Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Pacifiers

8.4.4.2 Sleep Monitoring Pacifiers

8.4.4.3 Connectivity-enabled Pacifiers)

8.4.4.4

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Health Monitoring

8.4.5.2 Parental Control

8.4.5.3 Early Detection of Medical Conditions)

8.4.5.4

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Parents of Newborns

8.4.6.2 Hospitals and Healthcare Institutions)

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Smart Pacifier Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Pacifiers

8.5.4.2 Sleep Monitoring Pacifiers

8.5.4.3 Connectivity-enabled Pacifiers)

8.5.4.4

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Health Monitoring

8.5.5.2 Parental Control

8.5.5.3 Early Detection of Medical Conditions)

8.5.5.4

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Parents of Newborns

8.5.6.2 Hospitals and Healthcare Institutions)

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Smart Pacifier Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Pacifiers

8.6.4.2 Sleep Monitoring Pacifiers

8.6.4.3 Connectivity-enabled Pacifiers)

8.6.4.4

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Health Monitoring

8.6.5.2 Parental Control

8.6.5.3 Early Detection of Medical Conditions)

8.6.5.4

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Parents of Newborns

8.6.6.2 Hospitals and Healthcare Institutions)

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Smart Pacifier Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Pacifiers

8.7.4.2 Sleep Monitoring Pacifiers

8.7.4.3 Connectivity-enabled Pacifiers)

8.7.4.4

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Health Monitoring

8.7.5.2 Parental Control

8.7.5.3 Early Detection of Medical Conditions)

8.7.5.4

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Parents of Newborns

8.7.6.2 Hospitals and Healthcare Institutions)

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Smart Pacifier Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 440 Million |

|

Forecast Period 2024-32 CAGR: |

5.2% |

Market Size in 2032: |

USD 652 Million |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||