Smart Inhalers Market Synopsis:

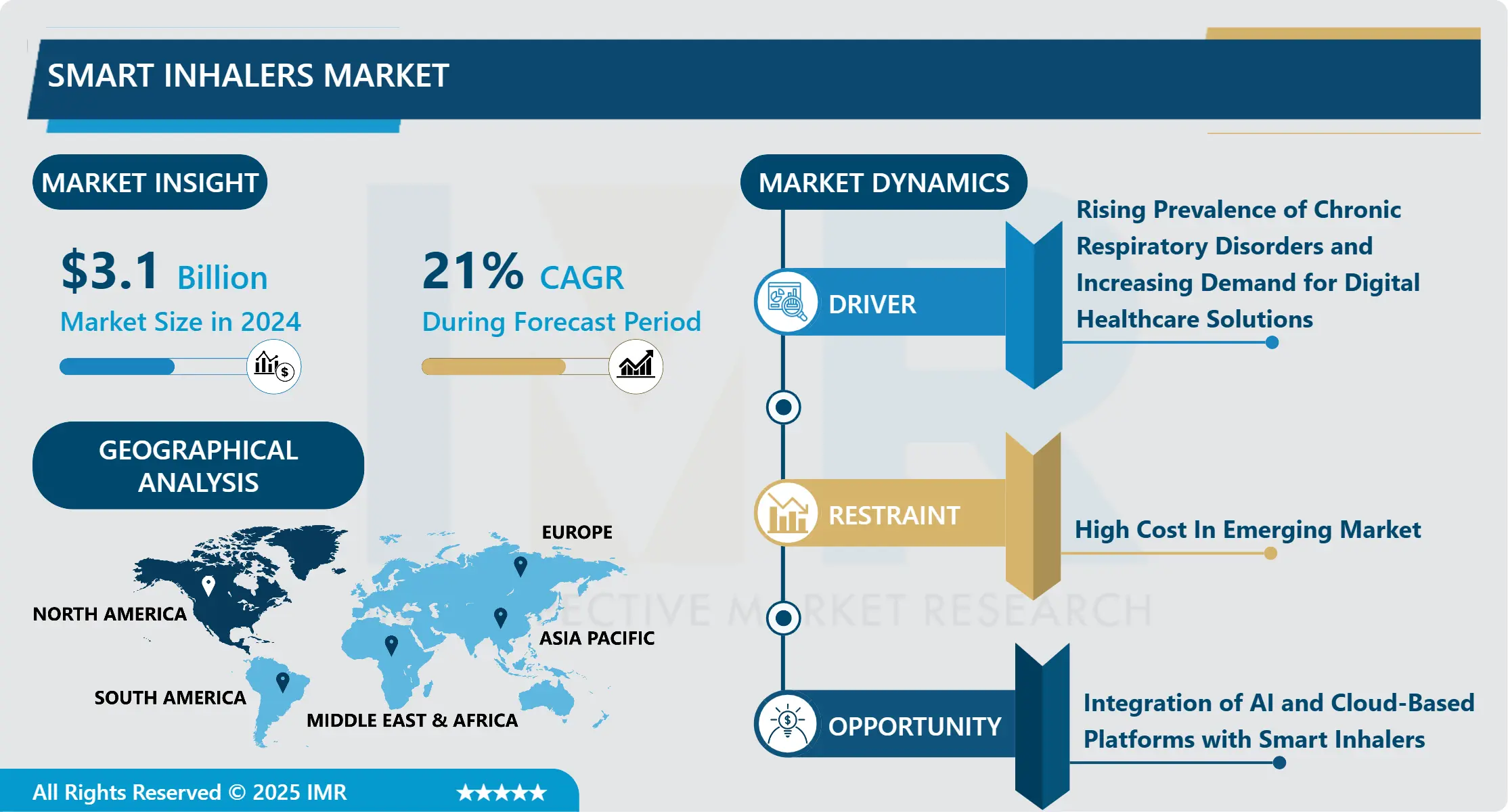

Smart Inhalers Market Size Was Valued at USD 3.1 Billion in 2024 and is Projected to Reach USD 14.24 Billion by 2032, Growing at a CAGR of 21% from 2025-2032.

Smart inhalers represent a transformative leap in respiratory care technology. These devices combine traditional inhalation mechanisms with digital sensors that record usage patterns, medication adherence, and even environmental conditions. This innovation is reshaping how asthma, chronic obstructive pulmonary disease (COPD), and other respiratory conditions are managed. By enhancing medication tracking and providing real-time feedback to patients and healthcare professionals, smart inhalers are reducing hospitalization rates, improving health outcomes, and lowering long-term treatment costs.

With respiratory disorders affecting over 500 million people globally and compliance to medication regimens remaining a persistent challenge, smart inhalers are quickly gaining traction as a proactive tool in chronic disease management. The increasing penetration of smartphones, advancements in the Internet of Medical Things (IoMT), and growing interest in personalized medicine further drive demand. Governments and healthcare organizations across North America and Europe are actively promoting the adoption of such technologies through reimbursement programs and eHealth initiatives, which is bolstering market growth.

Smart Inhalers Market Growth and Trend Analysis:

Smart Inhalers Market Growth Driver- Rising Prevalence of Chronic Respiratory Disorders and Increasing Demand for Digital Healthcare Solutions

-

The global prevalence of asthma and COPD is escalating due to rising pollution levels, urbanization, and increasing tobacco usage. According to the WHO, over 3 million people die annually from COPD alone. Managing these diseases demands strict medication adherence a critical area where smart inhalers are proving vital. Equipped with Bluetooth-enabled sensors, these devices automatically record the time and dosage of each use, reducing reliance on patient memory and significantly improving compliance.

- In parallel, the integration of digital technologies into healthcare infrastructure is expanding rapidly. Remote patient monitoring and telemedicine adoption surged during the COVID-19 pandemic and continue to shape post-pandemic healthcare delivery. Smart inhalers feed directly into this trend, allowing physicians to access real-time data, detect anomalies early, and intervene promptly. This dual advantage of improved patient outcomes and cost reduction is attracting insurance providers and healthcare institutions to invest in smart inhaler programs.

Smart Inhalers Market Limiting Factor- High Cost and Limited Reimbursement Policies in Emerging Markets

-

Despite their advantages, smart inhalers remain significantly more expensive than traditional inhalers. High costs associated with advanced sensors, app development, and data integration create pricing challenges, particularly in price-sensitive and developing economies. In many low- and middle-income countries, even basic healthcare access remains a challenge making the adoption of smart technology slow and uneven.

- Additionally, limited awareness and lack of universal reimbursement frameworks pose barriers. While countries like the US and the UK are gradually integrating digital health reimbursement codes, most developing markets lack standardized health coverage policies for such devices. This restricts large-scale rollout and adoption, especially outside of urban centres. Moreover, data privacy concerns and regulatory hurdles in managing patient information digitally present operational challenges for manufacturers and healthcare providers alike.

Smart Inhalers Market Expansion Opportunity- Integration of AI and Cloud-Based Platforms with Smart Inhalers

-

Artificial intelligence and cloud computing are expected to revolutionize smart inhaler functionality in the coming years. AI-enabled platforms can analyze patient data from inhalers to identify early warning signs of exacerbations, predict hospitalization risk, and deliver personalized intervention strategies. Cloud integration allows this data to be instantly accessible to healthcare professionals, caregivers, and even pharmaceutical companies developing patient-specific treatment plans.

- Start-ups and established med-tech firms are increasingly investing in these technologies to offer AI-powered health dashboards, real-time alerts, and behavioural nudges to improve adherence. For example, machine learning algorithms can personalize inhaler reminders based on the patient’s history, geography, and even local air quality data. Such advancements not only enhance treatment precision but also open up opportunities for value-based healthcare models and remote clinical trials, particularly in decentralized healthcare environments.

Smart Inhalers Market Challenge Barrier- Regulatory Hurdles and Concerns Around Data Security and Interoperability

-

Smart inhalers deal with sensitive health data, making them subject to stringent regulations under HIPAA, GDPR, and other national frameworks. Ensuring compliance across multiple jurisdictions is a significant challenge, especially as data often moves across borders via cloud infrastructure. Additionally, the lack of interoperability between different devices and electronic health record (EHR) systems restricts seamless integration, limiting the utility of smart inhalers in multi-provider ecosystems.

- Further complicating adoption is the issue of patient consent and trust. Concerns over who owns the data, how it’s shared, and whether it could be monetized or misused deter some users and healthcare providers. Startups and tech developers must invest heavily in cybersecurity, data encryption, and user education to build robust platforms that earn the confidence of stakeholders. These issues, if unaddressed, could slow down market penetration despite strong product efficacy.

Smart Inhalers Market Segment Analysis:

Smart Inhalers Market is segmented based on Type, By Indication, End-Users, and Region

By Type, Metered Dose Inhalers (MDIs) Segment is Expected to Dominate the Market During the Forecast Period

-

The Metered Dose Inhalers (MDIs) segment is anticipated to dominate the smart inhalers market during the forecast period due to several key advantages that make these devices highly favourable among patients and healthcare providers alike. MDIs are widely adopted in the treatment of asthma and chronic obstructive pulmonary disease (COPD) because of their affordability, ease of use, and long-standing clinical acceptance. Their established presence in the respiratory care market provides a strong foundation for the integration of smart technologies. Incorporating digital sensors into MDIs is relatively straightforward, enabling many companies to develop compatible add-on modules that transform traditional inhalers into smart, data-driven devices without significantly altering the existing inhaler structure.

- COPD is the third leading cause of death globally, affecting 390 million people, with more than 3.2 million deaths annually.

- Furthermore, MDIs are particularly effective for pediatric and geriatric patients, who often require consistent and reliable medication delivery mechanisms. The compact design, dose consistency, and familiarity of MDIs make them an ideal platform for digital upgrades, helping to enhance medication adherence and improve health outcomes in a user-friendly and cost-effective manner.

By Indication, Asthma Segment Held the Largest Share of 56% in 2024

-

Asthma, affecting over 262 million people globally, stands as the most common condition treated with smart inhalers, making this application segment the largest in the market. The high prevalence of asthma across all age groups, particularly among children and the elderly, drives the demand for more effective and user-friendly management tools. Smart inhalers play a crucial role by offering real-time data tracking and medication reminders, which significantly improve adherence to prescribed therapies. This, in turn, reduces the frequency of asthma attacks, emergency room visits, and hospitalizations, easing the overall burden on healthcare systems.

- Moreover, smart inhalers are gaining increasing adoption in pediatric asthma care, enabling caregivers and medical professionals to remotely monitor young patients both at home and in educational settings. These connected devices provide timely alerts and detailed usage insights, enhancing treatment outcomes and giving parents and healthcare providers greater confidence in managing childhood asthma.

Smart Inhalers Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

-

North America, led by the United States, commands the largest share of the global smart inhaler market due to its advanced healthcare infrastructure, strong digital health policies, and significant R&D investments. The region also benefits from a large base of tech-savvy consumers and healthcare providers who are receptive to new medical technologies.

- The U.S. FDA has approved multiple smart inhaler devices in recent years, and reimbursement coverage for digital health tools has seen notable progress. Collaborations between hospitals, insurers, and digital health startups are further enhancing the adoption landscape. Moreover, the rising burden of chronic respiratory diseases, driven by factors such as urban pollution and increasing obesity rates, continues to propel demand.

- In Canada and Mexico, smart inhaler penetration is increasing due to government eHealth initiatives, public-private partnerships, and growing consumer awareness. However, regulatory clarity and cost remain limiting factors outside major metropolitan areas.

Smart Inhalers Market Active Players:

-

Adherium (New Zealand)

- Amiko Digital Health Limited (UK),

- AstraZeneca (UK)

- Boehringer Ingelheim GmbH (Germany)

- Cognita Labs (United States),

- Cohero Health (United States)

- FindAir (Poland),

- GlaxoSmithKline plc (UK)

- H&T Presspart (Germany)

- Novartis AG (Switzerland)

- OPKO Health, Inc. (United States)

- Propeller Health (United States)

- Sensirion AG (Switzerland),

- Teva Pharmaceutical Industries Ltd (Israel)

- Vectura Group plc (UK)

- Other Active Players

Key Industry Developments in the Smart Inhalers Market:

-

In September 2024, Pharmaceutical giants GSK and AstraZeneca announced initiatives to reduce the carbon footprint of their inhalers. GSK plans to update the propellant in its Ventolin inhaler, potentially reducing its carbon footprint by over 40%. AstraZeneca aims to lower the emissions of its Breztri inhaler by using a new propellant, which could cut 20% of its greenhouse gas emissions. These moves align with international regulations and increased pressure to curb hydrofluorocarbon usage.

- In April 2024, AstraZeneca launched its new AI-enabled smart inhaler platform in collaboration with digital health firm Huma. The platform leverages machine learning to predict asthma attacks and optimise treatment regimens, further strengthening AstraZeneca's position in the respiratory care segment.

|

Global Smart Inhalers Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 3.1 Bn. |

|

Forecast Period 2025-32 CAGR: |

21% |

Market Size in 2032: |

USD 14.24 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Indication |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge Barrier |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Smart Inhalers Market by Type (2018-2032)

4.1 Smart Inhalers Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Dry Powder Inhalers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Metered Dose Inhalers

Chapter 5: Smart Inhalers Market by By Indication (2018-2032)

5.1 Smart Inhalers Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Asthma

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 COPD

Chapter 6: Smart Inhalers Market by End-User (2018-2032)

6.1 Smart Inhalers Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Homecare

6.5 Clinics

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Smart Inhalers Market Share by Manufacturer/Service Provider(2024)

7.1.3 Industry BCG Matrix

7.1.4 PArtnerships, Mergers & Acquisitions

7.2 ADHERIUM (NEW ZEALAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Recent News & Developments

7.2.10 SWOT Analysis

7.3 AMIKO DIGITAL HEALTH LIMITED (UK)

7.4 ASTRAZENECA (UK)

7.5 BOEHRINGER INGELHEIM GMBH (GERMANY)

7.6 COGNITA LABS (UNITED STATES)

7.7 COHERO HEALTH (UNITED STATES)

7.8 FINDAIR (POLAND)

7.9 GLAXOSMITHKLINE PLC (UK)

7.10 H&T PRESSPART (GERMANY)

7.11 NOVARTIS AG (SWITZERLAND)

7.12 OPKO HEALTH

7.13 INC. (UNITED STATES)

7.14 PROPELLER HEALTH (UNITED STATES)

7.15 SENSIRION AG (SWITZERLAND)

7.16 TEVA PHARMACEUTICAL INDUSTRIES LTD (ISRAEL)

7.17 VECTURA GROUP PLC (UK)

7.18 OTHER ACTIVE PLAYERS

Chapter 8: Global Smart Inhalers Market By Region

8.1 Overview

8.2. North America Smart Inhalers Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecast Market Size by Country

8.2.4.1 US

8.2.4.2 Canada

8.2.4.3 Mexico

8.3. Eastern Europe Smart Inhalers Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecast Market Size by Country

8.3.4.1 Russia

8.3.4.2 Bulgaria

8.3.4.3 The Czech Republic

8.3.4.4 Hungary

8.3.4.5 Poland

8.3.4.6 Romania

8.3.4.7 Rest of Eastern Europe

8.4. Western Europe Smart Inhalers Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecast Market Size by Country

8.4.4.1 Germany

8.4.4.2 UK

8.4.4.3 France

8.4.4.4 The Netherlands

8.4.4.5 Italy

8.4.4.6 Spain

8.4.4.7 Rest of Western Europe

8.5. Asia Pacific Smart Inhalers Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecast Market Size by Country

8.5.4.1 China

8.5.4.2 India

8.5.4.3 Japan

8.5.4.4 South Korea

8.5.4.5 Malaysia

8.5.4.6 Thailand

8.5.4.7 Vietnam

8.5.4.8 The Philippines

8.5.4.9 Australia

8.5.4.10 New Zealand

8.5.4.11 Rest of APAC

8.6. Middle East & Africa Smart Inhalers Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecast Market Size by Country

8.6.4.1 Turkiye

8.6.4.2 Bahrain

8.6.4.3 Kuwait

8.6.4.4 Saudi Arabia

8.6.4.5 Qatar

8.6.4.6 UAE

8.6.4.7 Israel

8.6.4.8 South Africa

8.7. South America Smart Inhalers Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecast Market Size by Country

8.7.4.1 Brazil

8.7.4.2 Argentina

8.7.4.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

Chapter 10 Our Thematic Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Chapter 11 Analyst Viewpoint and Conclusion

Chapter 12 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 13 Case Study

Chapter 14 Appendix

10.1 Sources

10.2 List of Tables and figures

10.3 Short Forms and Citations

10.4 Assumption and Conversion

10.5 Disclaimer

|

Global Smart Inhalers Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 3.1 Bn. |

|

Forecast Period 2025-32 CAGR: |

21% |

Market Size in 2032: |

USD 14.24 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Indication |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge Barrier |

|

||

|

Companies Covered in the Report: |

|

||