Silica Sand Market Synopsis

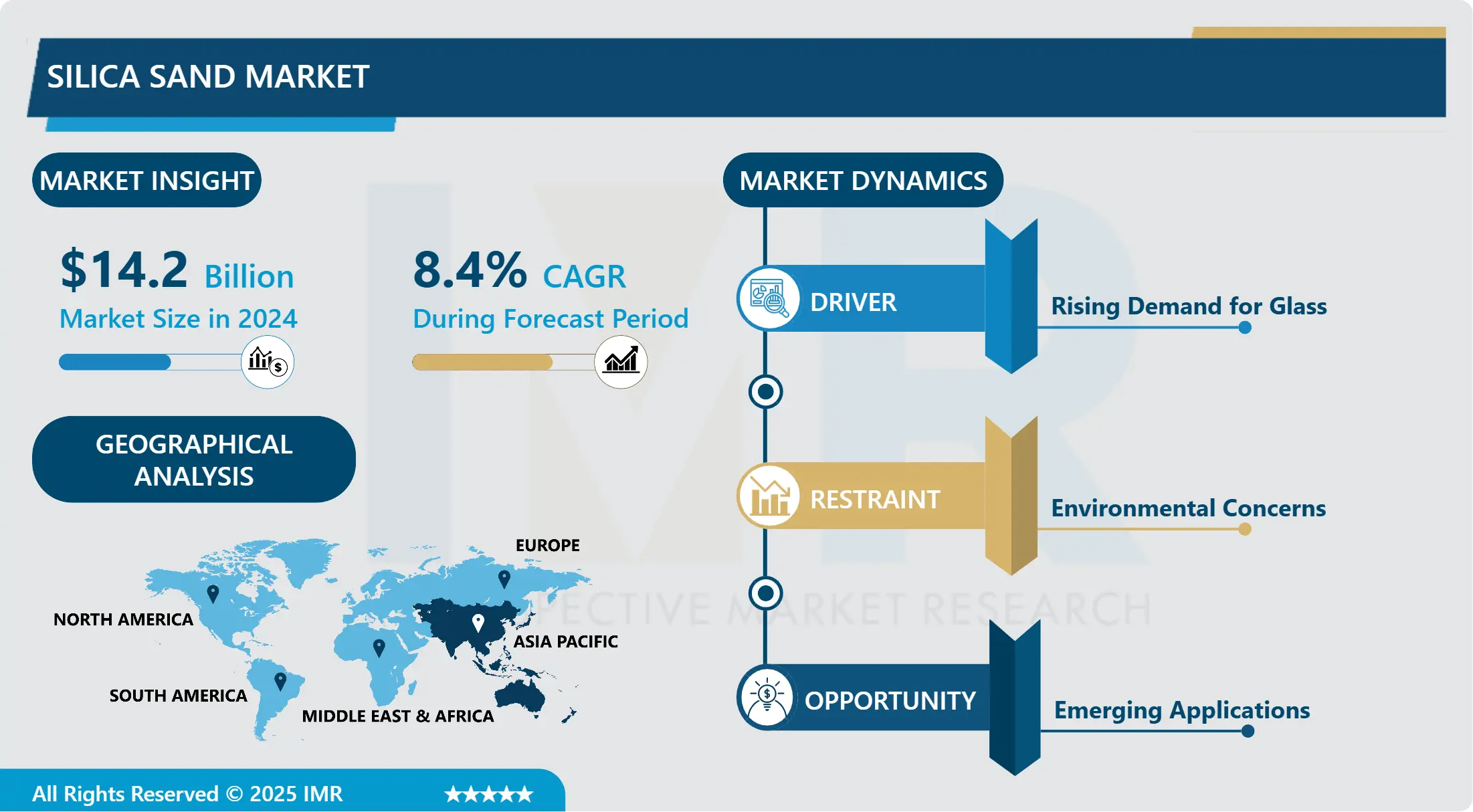

The Silica Sand Market size was valued at USD 14.2 Billion in 2024 and is projected to reach USD 27.07 Billion by 2032, growing at a CAGR of 8.4 % from 2025 to 2032.

The market for silica sand is rising rapidly due to the growing use of this commodity in a variety of industries, including electronics, construction, foundries, glass manufacture, and chemical production. The growing need for high-purity silica sand in industrial operations, especially in the building industry for the production of mortar and concrete, is one of the main causes driving this expansion. Additionally, the growing use of silica sand in the manufacturing of paints, coatings, ceramics, and water filtering systems drives market growth. Geographically speaking, the existence of large producers of silica sand, industrialization, and infrastructure development make nations like Asia Pacific and North America noteworthy suppliers. In the upcoming years, market dynamics may be impacted by issues with mining techniques that raise environmental concerns and by changes in the price of raw materials.

The global silica sand market is witnessing steady expansion, driven by its indispensable role across various industries. Because of its famed purity and adaptability, silica sand—which is mostly made of quartz—is an essential raw material used in the manufacturing of glass, ceramics, chemicals, building materials, and foundry molds. Particularly in the glass sector, silica sand is used extensively in the production of glass containers, flat glass, fiberglass, and specialized glass goods. Furthermore, the ability of silica sand to produce accurate molds and cores for metal casting operations is a necessity for the foundry industry.

Geographically, the major areas propelling market expansion are Asia Pacific and North America. The need for silica sand in hydraulic fracturing, concrete manufacturing, and other building applications is increased in North America by the region's booming shale gas industry and active construction sector. In the meanwhile, fast urbanization, infrastructural growth, and the growing glass manufacturing industry in nations like China and India have made Asia Pacific a prominent market.

The silica sand business is confronted with environmental and regulatory issues notwithstanding its economic significance. Stricter laws are being implemented globally due to worries about how sand mining affects nearby ecosystems and groundwater supplies. These rules frequently mandate sustainable practices and adherence to environmental standards for silica sand mining operations, which can have an impact on production costs and operational effectiveness.

In the future, it is anticipated that the market will continue to expand thanks to developments in processing and mining technology. Innovations that reduce environmental impact like dust suppression and water recycling systems are becoming more and more important for the extraction and processing of silica sand in a sustainable manner. New growth potential for industry participants are also presented by the development of high-purity silica sands for cutting-edge applications like semiconductor production and solar panels.

In conclusion, despite continued difficulties with environmental sustainability and regulatory compliance, the silica sand industry is robust due to its vital position in a variety of sectors as well as continuous attempts to innovate and adjust to changing market conditions.

Silica Sand Market Trend Analysis

Silica Sand Market Growth Driver- Robust demand across diverse industries

- Silica sand is integral to the manufacturing processes of diverse industries due to its unique properties. Silica sand is a basic raw material used in the production of transparent glass products in the glass industry. Because of its high purity levels, the glass will always be clear and impure-free, which is essential for a variety of applications, including specialized glass used in electronics and architectural glass.

- Because it can endure high temperatures and keep its shape when metal is cast, silica sand is an essential molding ingredient in foundry operations. Because of its uniform grain size, accurate molding and casting are made possible, guaranteeing the quality and dimensional precision of the finished metal goods. Because of its dependability, foundries that produce a wide range of metal components for the automotive, aerospace, and equipment sectors rely heavily on silica sand.

- Moreover, silica sand is essential to the processes involved in the manufacture of chemicals. It is the perfect material for chemical processes where contamination might change the chemical characteristics or quality of the final product because of its purity and inert nature. It functions as a carrier material in chromatography columns, a catalyst support in chemical synthesis, and a raw material in the manufacturing of specialized chemicals and medicines. In chemical production, silica sand's homogenous grain size guarantees uniform distribution and performance, which is essential for preserving process effectiveness and product quality.

Silica Sand Market Expansion Opportunity- Environmental Considerations in Silica Sand Mining

- The mining of silica sand has raised environmental issues, which have led regulatory agencies globally to examine extraction methods more rigorously. The main problem is the possible disturbance to nearby ecosystems and populations, which includes effects on air quality, water pollution, and habitat destruction. Governments and environmental organizations have responded by enacting stronger laws and policies to guarantee sustainable mining methods. In order to lessen and control the negative consequences of mining operations, these procedures frequently include environmental impact studies, water management plans, and rehabilitation regulations.

- Businesses in the silica sand industry are progressively using environmentally friendly mining methods in order to comply with these regulations and improve their environmental stewardship. This involves minimizing water use and contamination concerns by utilizing cutting-edge technology for water recycling and treatment. Reclamation initiatives also seek to return mined sites to their pre-mining natural form or find new, advantageous uses for them. These methods improve community connections and the long-term viability of operations in addition to lessening the negative effects on the environment and advancing corporate social responsibility initiatives.

- In addition, in order to create and execute sustainable mining methods, players in the silica sand sector are working with environmental specialists, nearby communities, and governmental organizations. These collaborations promote information exchange, creative problem-solving, and ongoing sector-wide environmental performance improvement. The sector is anticipated to give sustainability even greater priority as awareness and regulatory demands increase, spurring innovation in mining techniques and creating a more ecologically conscious silica sand mining landscape.

Silica Sand Market Segment Analysis:

Silica Sand Market Segmented based on End-use Industry, and Region.

By End-use Industry, Construction segment is expected to dominate the market during the forecast period

- The construction industry is a prominent participant in the abrasives market because of its broad use of abrasive materials for various purposes. When it comes to surface preparation, abrasives are crucial to the endurance and toughness of building materials like metal, wood, and concrete. In order to obtain smooth finishes and maximum adhesion, surfaces frequently need to be meticulously ground and polished before coatings or repairs are made. During this procedure, abrasives are essential because they make it easier to remove rough areas, old coatings, and defects that might jeopardize the integrity of newly applied materials or coatings.

- Additionally, abrasives are utilized in concrete construction to smooth uneven surfaces, polish floors to improve their longevity and aesthetic appeal. This use is especially important for contemporary architectural designs that emphasize the use of exposed concrete surfaces. Abrasive materials are used in metal fabrication in the construction sector to deburr, grind, and polish metal components. This ensures accurate dimensions and smooth finishes that satisfy demanding quality requirements. Similar to this, abrasives are essential in woodworking for shaping and polishing wooden surfaces, whether they are used for ornamental or structural parts.

- The need for abrasives in the construction sector is increasing globally in tandem with the growth of infrastructure and urbanization patterns. The importance of abrasives in producing superior surface finishes is highlighted by the increasing integration of sustainable building materials and creative designs into construction procedures. Abrasives improve a building's structural soundness and operational efficiency in addition to its visual attractiveness. The construction industry holds a significant market share in abrasives due to its ability to provide effective surface preparation solutions that promote building projects that are safe, long-lasting, and aesthetically pleasing. These two benefits together account for this demand.

By End-use Industry, Foundry segment held the largest share in 2024

- Foundries play a critical role in the manufacturing supply chain by producing cast metal components used across various industries such as automotive, aerospace, and industrial machinery. In foundry operations, abrasives are essential instruments for several critical procedures. Abrasive materials are primarily used in foundries for the purpose of cleaning and deburring castings. Following casting, metal parts frequently have uneven surfaces, extra material, or other flaws that detract from their usefulness and visual attractiveness. These undesirable components are eliminated using abrasives, guaranteeing that the finished items adhere to strict surface smoothness guidelines and dimensional specifications.

- Additionally, abrasives are necessary for foundries' surface polishing processes. They make it possible for foundry employees to produce castings with smooth, polished surfaces, which is essential for increasing the components' resistance to wear, improving their look, and satisfying exacting quality requirements. This procedure is especially important for sectors like aerospace and automotive, where the reliability and longevity of metal components are essential to the overall safety and dependability of the product. Abrasives are also useful for surface preparation before painting, coating, or further machining, since they provide the best possible adherence and compatibility with other materials.

- Because cast metal components for a variety of industrial applications are continuously produced, there is a strong need for abrasives in the foundry industry. Foundries depend more and more on abrasives to maintain production quality and competitiveness as technology advances drive increased accuracy and performance requirements in automobile lightweighting, aerospace innovation, and industrial machinery efficiency. The industry's noteworthy contribution to the abrasives market highlights the critical role it plays in meeting the demands of the global manufacturing sector, where delivering high-performance goods to markets throughout the globe depends critically on efficiency, quality, and dependability.

Silica Sand Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Strong urbanization and industrialization tendencies in important markets like China, India, and Japan support Asia Pacific's leadership in the world market for silica sand. There is a significant demand for silica sand in these nations due to the widespread infrastructure development and building that is taking place. The need for silica sand in China is driven by the country's fast urbanization and continuous building projects, which serve the country's domestic as well as international markets by producing concrete and essential components for glass manufacture. Similar to other countries, India is seeing a boom in building projects because to government programs like Smart Cities and affordable housing efforts. Silica sand is essential for many industries, including foundries, glassmaking, and ceramics.

- Furthermore, countries in Southeast Asia including Vietnam and Indonesia are starting to make a big difference in the Asia Pacific silica sand industry. Indonesia uses silica sand in the manufacturing and construction industries due to its expanding infrastructure and industrial base. In contrast, Vietnam is seeing a rise in demand brought on by development projects, especially those involving homes and businesses. Due to their advantageous economic climate and key geographic locations, these nations attract infrastructure projects that increase the demand for silica sand throughout the area.

- Asia Pacific is a key area in the global silica sand industry landscape because of the region's robust expansion in the silica sand market, which is driven by a variety of industrial uses and consistent economic growth.

Active Key Players in the Silica Sand Market

- U.S. Silica (U.S.)

- Sibelco (Belgium)

- Covia Holdings LLC. (U.S.)

- JFE Mineral & Alloy Company, Ltd. (Japan)

- Quarzwerke GmbH (Germany)

- PUM GROUP (Malaysia)

- Badger Mining Corporation (U.S.)

- Mitsubishi Corporation (Japan)

- Preferred Sands (U.S.)

- Aggregate Industries (U.K.)

- Other Active Players

|

Global Silica Sand Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 14.2 Bn. |

|

Forecast Period 2025-32 CAGR: |

8.4 % |

Market Size in 2032: |

USD 27.07 Bn. |

|

|

By End-use Industry |

|

|

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Silica Sand Market by End-use Industry (2018-2032)

4.1 Silica Sand Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Construction

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Glass Manufacturing

4.5 Filtration

4.6 Foundry

4.7 Chemical Production

4.8 Paints & Coatings

4.9 Ceramics & Refractories

4.10 Oil & Gas

4.11 Others

Chapter 5: Company Profiles and Competitive Analysis

5.1 Competitive Landscape

5.1.1 Competitive Benchmarking

5.1.2 Silica Sand Market Share by Manufacturer (2024)

5.1.3 Industry BCG Matrix

5.1.4 Heat Map Analysis

5.1.5 Mergers and Acquisitions

5.2 U.S. SILICA (U.S.)

5.2.1 Company Overview

5.2.2 Key Executives

5.2.3 Company Snapshot

5.2.4 Role of the Company in the Market

5.2.5 Sustainability and Social Responsibility

5.2.6 Operating Business Segments

5.2.7 Product Portfolio

5.2.8 Business Performance

5.2.9 Key Strategic Moves and Recent Developments

5.2.10 SWOT Analysis

5.3 SIBELCO (BELGIUM)

5.4 COVIA HOLDINGS LLC. (U.S.)

5.5 JFE MINERAL & ALLOY COMPANY LTD. (JAPAN)

5.6 QUARZWERKE GMBH (GERMANY)

5.7 PUM GROUP (MALAYSIA)

5.8 BADGER MINING CORPORATION (U.S.)

5.9 MITSUBISHI CORPORATION (JAPAN)

5.10 PREFERRED SANDS (U.S.)

5.11 AGGREGATE INDUSTRIES (U.K.)

Chapter 6: Global Silica Sand Market By Region

6.1 Overview

6.2. North America Silica Sand Market

6.2.1 Key Market Trends, Growth Factors and Opportunities

6.2.2 Top Key Companies

6.2.3 Historic and Forecasted Market Size by Segments

6.2.4 Historic and Forecasted Market Size by End-use Industry

6.2.4.1 Construction

6.2.4.2 Glass Manufacturing

6.2.4.3 Filtration

6.2.4.4 Foundry

6.2.4.5 Chemical Production

6.2.4.6 Paints & Coatings

6.2.4.7 Ceramics & Refractories

6.2.4.8 Oil & Gas

6.2.4.9 Others

6.2.5 Historic and Forecast Market Size by Country

6.2.5.1 US

6.2.5.2 Canada

6.2.5.3 Mexico

6.3. Eastern Europe Silica Sand Market

6.3.1 Key Market Trends, Growth Factors and Opportunities

6.3.2 Top Key Companies

6.3.3 Historic and Forecasted Market Size by Segments

6.3.4 Historic and Forecasted Market Size by End-use Industry

6.3.4.1 Construction

6.3.4.2 Glass Manufacturing

6.3.4.3 Filtration

6.3.4.4 Foundry

6.3.4.5 Chemical Production

6.3.4.6 Paints & Coatings

6.3.4.7 Ceramics & Refractories

6.3.4.8 Oil & Gas

6.3.4.9 Others

6.3.5 Historic and Forecast Market Size by Country

6.3.5.1 Russia

6.3.5.2 Bulgaria

6.3.5.3 The Czech Republic

6.3.5.4 Hungary

6.3.5.5 Poland

6.3.5.6 Romania

6.3.5.7 Rest of Eastern Europe

6.4. Western Europe Silica Sand Market

6.4.1 Key Market Trends, Growth Factors and Opportunities

6.4.2 Top Key Companies

6.4.3 Historic and Forecasted Market Size by Segments

6.4.4 Historic and Forecasted Market Size by End-use Industry

6.4.4.1 Construction

6.4.4.2 Glass Manufacturing

6.4.4.3 Filtration

6.4.4.4 Foundry

6.4.4.5 Chemical Production

6.4.4.6 Paints & Coatings

6.4.4.7 Ceramics & Refractories

6.4.4.8 Oil & Gas

6.4.4.9 Others

6.4.5 Historic and Forecast Market Size by Country

6.4.5.1 Germany

6.4.5.2 UK

6.4.5.3 France

6.4.5.4 The Netherlands

6.4.5.5 Italy

6.4.5.6 Spain

6.4.5.7 Rest of Western Europe

6.5. Asia Pacific Silica Sand Market

6.5.1 Key Market Trends, Growth Factors and Opportunities

6.5.2 Top Key Companies

6.5.3 Historic and Forecasted Market Size by Segments

6.5.4 Historic and Forecasted Market Size by End-use Industry

6.5.4.1 Construction

6.5.4.2 Glass Manufacturing

6.5.4.3 Filtration

6.5.4.4 Foundry

6.5.4.5 Chemical Production

6.5.4.6 Paints & Coatings

6.5.4.7 Ceramics & Refractories

6.5.4.8 Oil & Gas

6.5.4.9 Others

6.5.5 Historic and Forecast Market Size by Country

6.5.5.1 China

6.5.5.2 India

6.5.5.3 Japan

6.5.5.4 South Korea

6.5.5.5 Malaysia

6.5.5.6 Thailand

6.5.5.7 Vietnam

6.5.5.8 The Philippines

6.5.5.9 Australia

6.5.5.10 New Zealand

6.5.5.11 Rest of APAC

6.6. Middle East & Africa Silica Sand Market

6.6.1 Key Market Trends, Growth Factors and Opportunities

6.6.2 Top Key Companies

6.6.3 Historic and Forecasted Market Size by Segments

6.6.4 Historic and Forecasted Market Size by End-use Industry

6.6.4.1 Construction

6.6.4.2 Glass Manufacturing

6.6.4.3 Filtration

6.6.4.4 Foundry

6.6.4.5 Chemical Production

6.6.4.6 Paints & Coatings

6.6.4.7 Ceramics & Refractories

6.6.4.8 Oil & Gas

6.6.4.9 Others

6.6.5 Historic and Forecast Market Size by Country

6.6.5.1 Turkiye

6.6.5.2 Bahrain

6.6.5.3 Kuwait

6.6.5.4 Saudi Arabia

6.6.5.5 Qatar

6.6.5.6 UAE

6.6.5.7 Israel

6.6.5.8 South Africa

6.7. South America Silica Sand Market

6.7.1 Key Market Trends, Growth Factors and Opportunities

6.7.2 Top Key Companies

6.7.3 Historic and Forecasted Market Size by Segments

6.7.4 Historic and Forecasted Market Size by End-use Industry

6.7.4.1 Construction

6.7.4.2 Glass Manufacturing

6.7.4.3 Filtration

6.7.4.4 Foundry

6.7.4.5 Chemical Production

6.7.4.6 Paints & Coatings

6.7.4.7 Ceramics & Refractories

6.7.4.8 Oil & Gas

6.7.4.9 Others

6.7.5 Historic and Forecast Market Size by Country

6.7.5.1 Brazil

6.7.5.2 Argentina

6.7.5.3 Rest of SA

Chapter 7 Analyst Viewpoint and Conclusion

7.1 Recommendations and Concluding Analysis

7.2 Potential Market Strategies

Chapter 8 Research Methodology

8.1 Research Process

8.2 Primary Research

8.3 Secondary Research

|

Global Silica Sand Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 14.2 Bn. |

|

Forecast Period 2025-32 CAGR: |

8.4 % |

Market Size in 2032: |

USD 27.07 Bn. |

|

|

By End-use Industry |

|

|

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||