Scopolamine Market Synopsis:

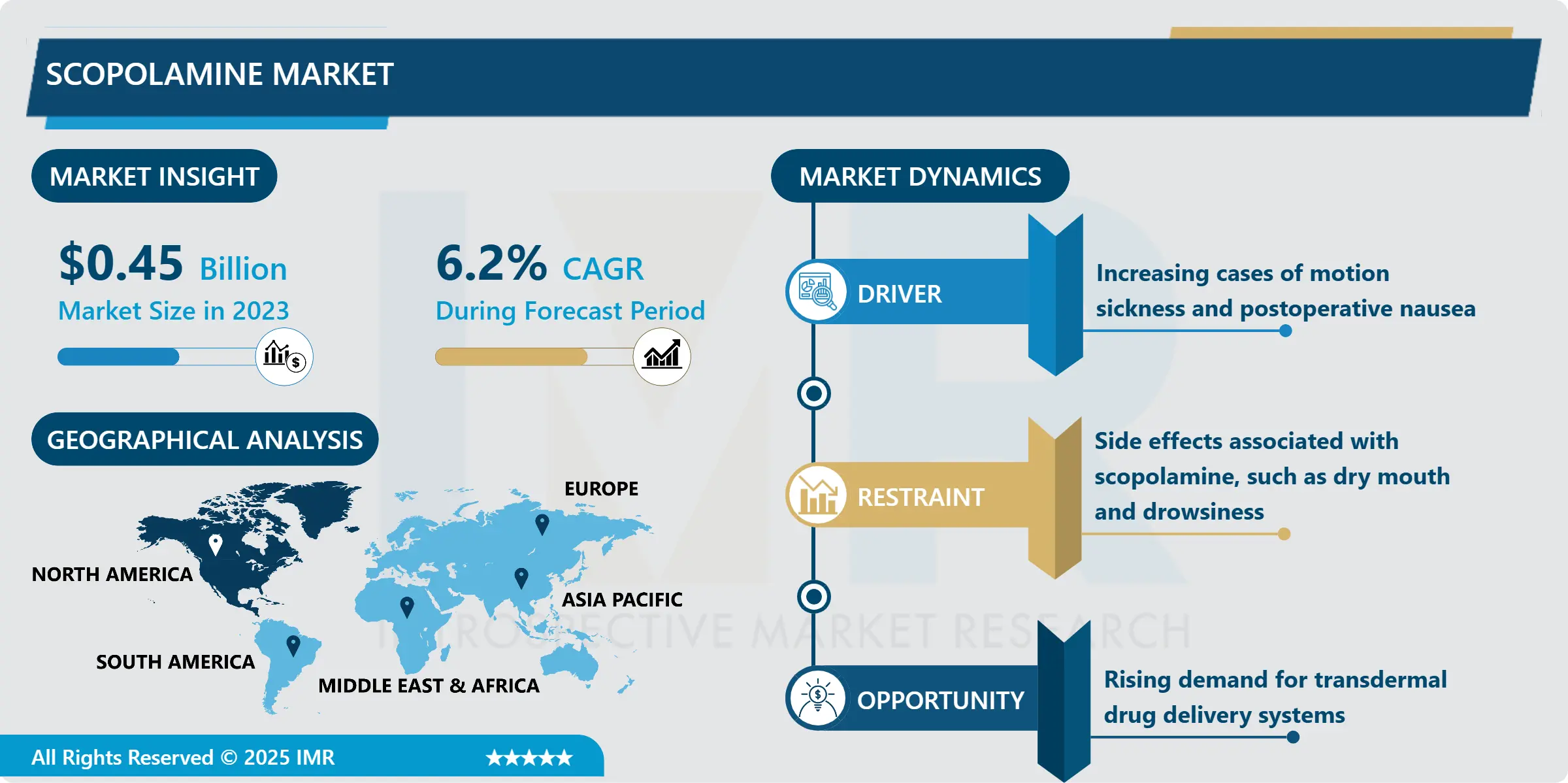

Scopolamine Market Size Was Valued at USD 0.45 Billion in 2023, and is Projected to Reach USD 0.78 Billion by 2032, Growing at a CAGR of 6.2% From 2024-2032.

Hyoscine or scopolamine is a natural alkaloid derived from some plants, such as henbane, or from the nightshade family. It is predomonantly marketed as an antiemetic – for the prevention and treatment of nausea and vomiting caused by motion sickness and postoperative nausea. Due to its anticholinergic activity, it inhibits neurotransmitters in the brain that in turn affects numerous biological processes. The scopolamine market refers to the manufacture, sell and supply of scopolamine substance in the form of tablets, patches and injectables for use by the healthcare and pharma businesses across the globe.

This has created a strong demand for the scopolamine mainly because of the current rising cases of motion sickness, post-surgical nausea, and other related conditions, hence the growth of the market. The growth of the global market is due to developments in both medicine and pharmacy, as well as an increase in the use of scopolamine for a variety of ailments. The transdermal patch and oral tablet formulations available in the market further add to the patient/physician prescription choice and medical need. This market, however, is most affected by the aging population because such people are likely to suffer from such things as motion sickness and post-operation pains.

In addition, increased entertainment in air and sea travel and other traveling activities expanded the need for anti-motion sickness remedies. There is higher instances of motion related discomfort and because of this, there is growing concern and usage of products containing scopolamine in preventive measures. In addition, the copious utilization related to the transdermal scopolamine patches has promoted it because people find it easy to use, particularly for long duration travelling or after surgeries that have improved machinery demand.

Scopolamine Market Trend Analysis:

Growing Demand for Innovative Drug Delivery Systems

- As a result, there is a trend in the using of scopolamine to enhance easier and improved methods for the delivery of the drug. Manufacturers of scopolamine products are concentrating on rendering these products more effective and utilisable by patients. The consummate product in this category is the transdermal patch one again because the reliefs attained are long lasting and the product is applied not very often. Further, the patch development itself is also evolving with some improvements in the field of adhesive used for it and the dosage patterns to maintain the effect for a relatively long time. This is a trend that is seen generally in the pharma sector as the industry shifts towards user-centered, durable and efficient mechanisms for deliveries of the drugs.

Expanding Opportunities in Motion Sickness Prevention

- An important trend in the Scopolamine market is related to a growing understanding of prevention motion sickness and its importance for the travel industry. As the world shifts towards post COVID-19 travel, there are more people on the move with regard to air, sea and ground transport, and this has frequent incidences of motion sickness. The modern trends in recreation like cruise traveling, adventure sports and long-distance travels has necessitated product such as scopolamine patch. This offers a good chance to market players to expand to new markets such as the Asia-Pacific and Latin America in which the travel and tourism booms, contributing to high scopolamine consumption.

Scopolamine Market Segment Analysis:

Scopolamine Market Segmented on the basis of Dosage, Route of Administration, Distribution Channel, and Region.

By Dosage, Transdermal Patches segment is expected to dominate the market during the forecast period

- Based on the dosage, the transdermal patches segment is predicted to lead the scopolamine market throughout the forecast period. This is because the patches are convenient to use, long acting and ease of use more than other dosage forms such as tablets and injections. Scopolamine patches allow for slow and steady delivery of this motion sickness and postoperative nausea medication to save the skin without side effects. The fact that they work topically, and do not injure the skin but can deliver a reliable dose repeatedly over time, appeals to the patients’ comfort and thus increasing the demand for the products in developed and developing regions.

By Route of Administration, Topical segment expected to held the largest share

- Depending on the route of administration, the topical segment is anticipated to dominate the scopolamine market in the course of the forecast period. This is as a result of an increasing demand for minimally invasive procedures, and the topical systems such as transdermal system, a patch that delivers medication to the body through the skin. Topical scopolamine can cause less adverse effects and injection or swallowing problems that may be associated with oral medicine. Patient compliance and acceptability due to the simplicity in the method of application and most importantly the possibility to produce long-term unabated controlled release of the drug all makes this route the most preferred by both the patient and the health care provider hence it dominates the market.

Scopolamine Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is expected to be largest consumer of scopolamine in the year 2023, the total market share of the region is approx 35%.. These factors include; the already developed and well-equipped health care system, well-informed customers, and heft research and development investments in the pharmaceutical industry. The United States especially has taken the lead in the extent to which it has adopted scopolamine products including those that are used in cases of motion sickness and post operative care. Europe follows North America as the second biggest region with key players across key countries including Germany, France and the United Kingdom.

Active Key Players in the Scopolamine Market:

- Baxter International (United States)

- Novartis AG (Switzerland)

- Pfizer Inc. (United States)

- GlaxoSmithKline plc (United Kingdom)

- Myungmoon Pharma Co., Ltd. (South Korea)

- Perrigo Company plc (Ireland)

- Alchem International (India)

- Caleb Pharmaceuticals, Inc. (Taiwan)

- Alkaloids Corporation (India)

- Phytex Australia (Australia)

- Centroflora CMS (Brazil)

- Linnea SA (Switzerland)

- Fine Chemicals Corporation (South Africa)

- Kemwell Biopharma (India)

- Piramal Pharma Solutions (India)

- Other Active Players

|

Scopolamine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.45 Billion |

|

Forecast Period 2024-32 CAGR: |

6.2 % |

Market Size in 2032: |

USD 0.78 Billion |

|

Segments Covered: |

By Dosage |

|

|

|

By Route of Administration |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Scopolamine Market by Dosage

4.1 Scopolamine Market Snapshot and Growth Engine

4.2 Scopolamine Market Overview

4.3 Transdermal Patches

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Transdermal Patches: Geographic Segmentation Analysis

4.4 Tablets

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Tablets: Geographic Segmentation Analysis

4.5 Injectables)

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Injectables): Geographic Segmentation Analysis

Chapter 5: Scopolamine Market by Route of Administration

5.1 Scopolamine Market Snapshot and Growth Engine

5.2 Scopolamine Market Overview

5.3 Topical

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Topical: Geographic Segmentation Analysis

5.4 Oral

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Oral: Geographic Segmentation Analysis

5.5 Parenteral)

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Parenteral): Geographic Segmentation Analysis

5.6

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 : Geographic Segmentation Analysis

Chapter 6: Scopolamine Market by Distribution Channel

6.1 Scopolamine Market Snapshot and Growth Engine

6.2 Scopolamine Market Overview

6.3 Hospital Pharmacies

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospital Pharmacies: Geographic Segmentation Analysis

6.4 Retail Pharmacies

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Retail Pharmacies: Geographic Segmentation Analysis

6.5 Online Pharmacies)

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Online Pharmacies) : Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Scopolamine Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BAXTER INTERNATIONAL

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 NOVARTIS AG

7.4 PFIZER INC.

7.5 GLAXOSMITHKLINE PLC

7.6 MYUNGMOON PHARMA CO. LTD

7.7 OTHER ACTIVE PLAYERS

Chapter 8: Global Scopolamine Market By Region

8.1 Overview

8.2. North America Scopolamine Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Dosage

8.2.4.1 Transdermal Patches

8.2.4.2 Tablets

8.2.4.3 Injectables)

8.2.5 Historic and Forecasted Market Size By Route of Administration

8.2.5.1 Topical

8.2.5.2 Oral

8.2.5.3 Parenteral)

8.2.5.4

8.2.6 Historic and Forecasted Market Size By Distribution Channel

8.2.6.1 Hospital Pharmacies

8.2.6.2 Retail Pharmacies

8.2.6.3 Online Pharmacies)

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Scopolamine Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Dosage

8.3.4.1 Transdermal Patches

8.3.4.2 Tablets

8.3.4.3 Injectables)

8.3.5 Historic and Forecasted Market Size By Route of Administration

8.3.5.1 Topical

8.3.5.2 Oral

8.3.5.3 Parenteral)

8.3.5.4

8.3.6 Historic and Forecasted Market Size By Distribution Channel

8.3.6.1 Hospital Pharmacies

8.3.6.2 Retail Pharmacies

8.3.6.3 Online Pharmacies)

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Scopolamine Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Dosage

8.4.4.1 Transdermal Patches

8.4.4.2 Tablets

8.4.4.3 Injectables)

8.4.5 Historic and Forecasted Market Size By Route of Administration

8.4.5.1 Topical

8.4.5.2 Oral

8.4.5.3 Parenteral)

8.4.5.4

8.4.6 Historic and Forecasted Market Size By Distribution Channel

8.4.6.1 Hospital Pharmacies

8.4.6.2 Retail Pharmacies

8.4.6.3 Online Pharmacies)

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Scopolamine Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Dosage

8.5.4.1 Transdermal Patches

8.5.4.2 Tablets

8.5.4.3 Injectables)

8.5.5 Historic and Forecasted Market Size By Route of Administration

8.5.5.1 Topical

8.5.5.2 Oral

8.5.5.3 Parenteral)

8.5.5.4

8.5.6 Historic and Forecasted Market Size By Distribution Channel

8.5.6.1 Hospital Pharmacies

8.5.6.2 Retail Pharmacies

8.5.6.3 Online Pharmacies)

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Scopolamine Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Dosage

8.6.4.1 Transdermal Patches

8.6.4.2 Tablets

8.6.4.3 Injectables)

8.6.5 Historic and Forecasted Market Size By Route of Administration

8.6.5.1 Topical

8.6.5.2 Oral

8.6.5.3 Parenteral)

8.6.5.4

8.6.6 Historic and Forecasted Market Size By Distribution Channel

8.6.6.1 Hospital Pharmacies

8.6.6.2 Retail Pharmacies

8.6.6.3 Online Pharmacies)

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Scopolamine Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Dosage

8.7.4.1 Transdermal Patches

8.7.4.2 Tablets

8.7.4.3 Injectables)

8.7.5 Historic and Forecasted Market Size By Route of Administration

8.7.5.1 Topical

8.7.5.2 Oral

8.7.5.3 Parenteral)

8.7.5.4

8.7.6 Historic and Forecasted Market Size By Distribution Channel

8.7.6.1 Hospital Pharmacies

8.7.6.2 Retail Pharmacies

8.7.6.3 Online Pharmacies)

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Scopolamine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.45 Billion |

|

Forecast Period 2024-32 CAGR: |

6.2 % |

Market Size in 2032: |

USD 0.78 Billion |

|

Segments Covered: |

By Dosage |

|

|

|

By Route of Administration |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||