Scalp Microneedling Market Synopsis:

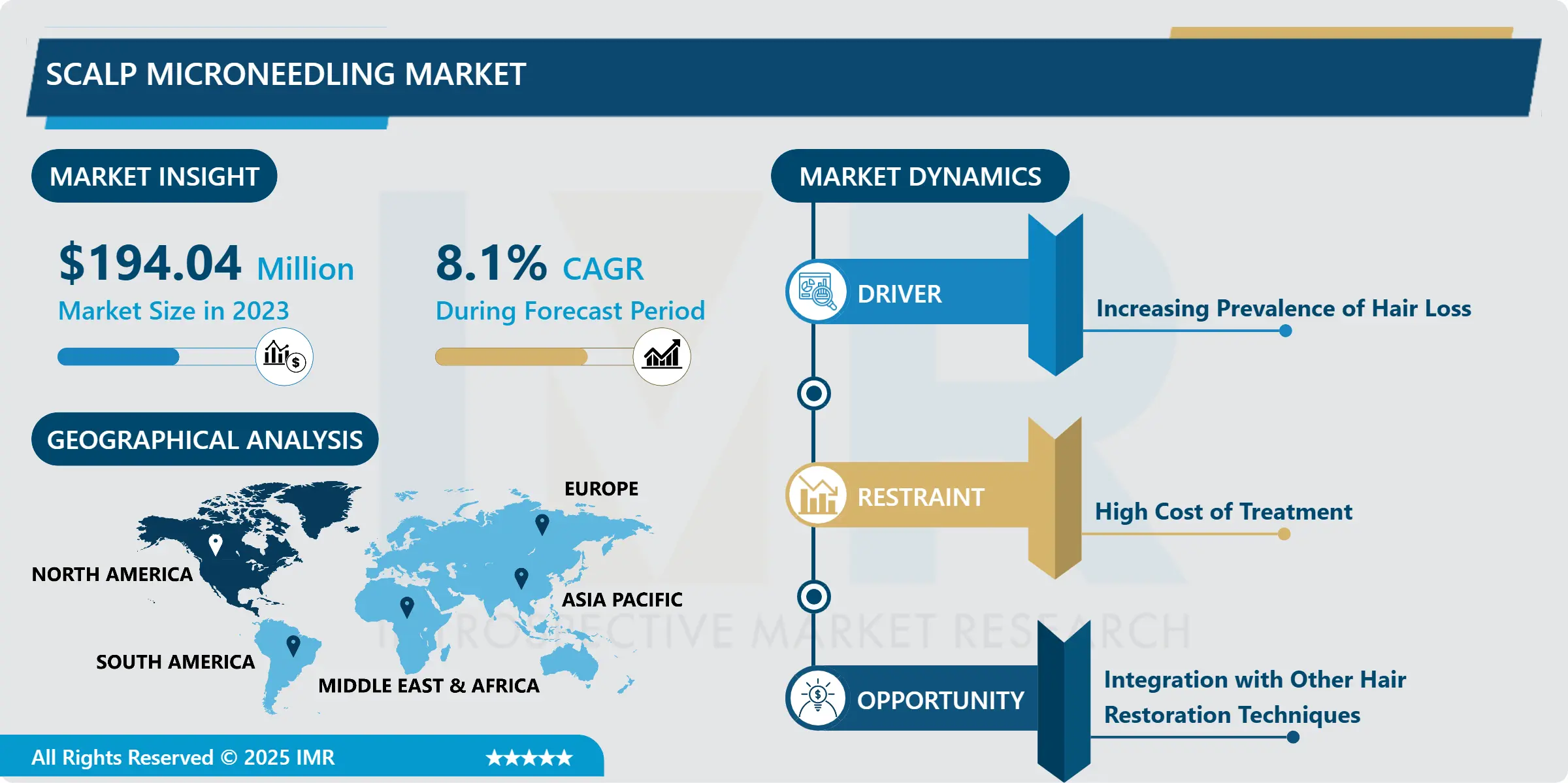

Scalp Microneedling Market Size Was Valued at USD 194.04 Million in 2023, and is Projected to Reach USD 391.13 Million by 2032, Growing at a CAGR of 8.1% From 2024-2032

The scalp microneedling market here means the industry that embraces the application of microneedling to treat the scalp and encourage hair regrowth. This is a non-surgical aesthetic treatment procedure in which a specialist utilizes a tool with small pins to make minor scratches on the skin of the head to improve the efficiency of branded hair treatment solutions. Scalp microneedling is increasingly being used to treat different types of hair loss such as androgenetic alopecia and alopecia areata because it is believed to promotes blood flow together with collagen synthesis and hair follicle health. As more people recognize its potential, it expands the demand coming both from clients who want to address hair loss issue and clinics introducing the latest dermatological services.

It can therefore be argued that the scalp microneedling segment of the hair restoration market has great potential, because hair loss trends are tendencies that are becoming more universal with time.. Microneedling is a procedure that involves the use of needles on the scalp to cause minor injuries which should trigger hair growth. The increasing focus on hair health and improving overall looks is putting pressure on the need for good, nonsurgical treatments for hair issues driving the scalp microneedling market. Further, increased instances for male pattern baldness, female pattern baldness and other types of hair loss with triggers such as stress, hormonal changes and environmental factors have also instigated the increase in demand for microneedling for feasible hair restoration solution.

Technology too has been another contributing factor to the growth of the market for microneedling devices. Technological advancement of microneedle pens, automated microneedle pens and devices with variable depth of needle penetration increases the safety and effectiveness of the treatment to the consumer and other health practitioners. More recently, microneedling of the scalp with PRP injection has been widely used since the combination of two procedures increases the effectiveness of the treatment and improves patient satisfaction. As the culture of individuals going for and embracing natural and holistic therapies continues to rise, people are opting for microneedling rather than opting for conventional hair restoration surgery treatments.

The market is growing significantly in North America, Europe, due to the high disposable income, advancement of infrastructures, increased awareness for beauty and personal care. However, the Asia Pacific region is projected to grow significantly due to growing middle and young adult population and a higher adoption of hair loss solution products. Moreover, the availability of the e-commerce platform means better customer penetration and interaction with the products and services associated with scalp microneedling. Lufkin, Texas, USA-based Intrica Corporation is another innovative participant in this market, which in underway with signing agreements with specialized Cosmetic Surgical Centers that would help the company to broaden its distribution network besides investing in new product development to fulfill consumers demand. On the whole, the dynamics of the scalp microneedling market would look like this, reaping a high level of consumer interest in hair restoration services in the years to come.

Scalp Microneedling Market Trend Analysis

Trend

Emerging Trends in Scalp Microneedling for Hair Restoration

- Scalp microneedling has recently emerged as one of the most effective treatment for hair loss, and has become increasingly popular during the past years, due to the increasing demand of people searching for natural treatment options. One of these methods applies fine needles to make small holes in the scalp which bring about change in the collagen production and the blood flow. Therefore, the hair follicles are supplied with more nutrients as follows: “The more nutrients which reach the hair follicle level, the more the hair thickness and rate of hair regrowth.” It continues to be more acceptable as the people are looking for minimally invasive techniques for hair restoration other than hair transplants.

- The growth in consumer interest in natural remedies for their health problems has also equally propelled the uptake of scalp microneedling. Today’s consumer is more willing to go with treatments that are safe, require fewer risks and side effects. This preference is in sync with the scalp microneedling techniques that depend on invasiveness and healing capabilities of the human body. In addition, as awareness of this treatment increases more practitioners are offering this treatment and as such the availability for this treatment is increasing in the market. These factors should make the scalp microneedling market more promising and broaden the circle of people in search of effective hair regrowing treatments.

Opportunity

Advancements in the Scalp Microneedling Market

- With people staying away from risky operations that lead to hair transplant, the rise of scalp microneedling has been first rate. This pioneering method promotes both the blood circulation and the collagen synthesis in the scalp that results in hair growth and better scalps health. This has also played a role in enhancing its use as a way of ensuring better absorption, and therefore enhancing efficacy of hair growth treatments such as those used in treating alopecia. Due to this increased awareness of the usefulness of the microneedling more people are open to going for treatment instead of going for surgery.

- The increased rate of hair thinning and hair loss as a result of stress, poor diet and other environmental factors is the adding on reason on why the populace need scalp needling. These aspects have become widespread in today’s society, so the effective hair restoration solutions are required more than ever. Depending on the market development in the future, those providers who can explain to the potential customers the advantages of microneedling procedure, and suggest an individual treatment program will have a competitive advantage. With the emphasis on the causes of hair loss and need for proper care of the scalp, the market for scalp microneedling service and products has the potential to achieve large growth in the future for the companies that will offer these services and products.

Scalp Microneedling Market Outlook, 2023 and 2032: Future Outlook

Scalp Microneedling Market Segment Analysis:

Scalp Microneedling Market Segmented on the basis of By Product Type, By Size, By Needle Material and By End User

By Product Type, Derma roller segment is expected to dominate the market during the forecast period

- Derma rollers are cylindrical apparatus, which involve many tiny, slim needles in order to draw small puncture wounds on skin while moving across the skin surface.. They actually enhance the body’s natural healing process and help the creation of collagen and elastin, valuable elements for youthful skin. In this way, derma rollers are capable of boosting beneficial regenerative activities to tightly pack skin layers, thereby smoothening skin surface layers and diminishing fine lines, together with general skin tone enhancement. Its design makes these devices suitable for providing uniform irradiation of different parts of the face and the rest of the body.

- Among the major benefits that have made derma rollers famous, the ability to perform at home is outstandish. This makes it possible for users to use them in their day to day skincare, and get the advantages of microneedle without having to employ the service of a specialist. Due to this convenience, derma rollers have become easily available to the public, putting power in people’s hands concerning skincare. However, when the user gets educated on the right techniques of use and some measures to take afterward, then the user can get a new face with the presence of some difference in the skin texture over time. The low cost and efficiency of derma rollers are other factors that has made them a popular choice in this expanding market of home skin treatment products.

By End User, Hospitals segment expected to held the largest share

- Based on these finding, hospitals are adopting microneedling for the treatment of different ailment that is acknowledging the efficiency of microneedling in treating severe skin ailments. This procedure is especially is used where other treatments might be inadequate such as hypertension, acne scar and surgical scars. Microneedling essentially makes tiny surface injuries to trigger skin actions that facilitate the production of collagen and elastin result aspects that cause skin dullness and wrinkles. The structure of clinical environment also helps in the better control of the application and all the treatments given to various patients will depend on their skin types.

Scalp Microneedling Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is a huge market for scalp microneedling, especially in the United States and Canada due to the huge population base especially concerning alopecia conditions such as androgenetic alopecia.. These conditions are prevalent in a good part of the populace making hair restoration solutions a popular option. Clients in this area prefer sophisticated beautification procedures, due to which the number of innovative approaches, such as, for example, microneedling of the scalp, increases. The healthcare industry in the region is well developed, and due to increased disposable income, people are willing to invest in these cosmetic solutions to enhance their beauty and beauty boosting services therefore boosting the market in the process. In addition, the use of social media and celebrities has also helped in a big way to help push microneedling as a viable treatment for hair loss.pecia. These conditions affect a significant portion of the population, leading to an increased demand for effective hair restoration solutions. Consumers in this region demonstrate a strong preference for advanced cosmetic treatments, which has prompted a surge in the adoption of innovative procedures like scalp microneedling. The region's well-established healthcare infrastructure, combined with a rise in disposable income, enables individuals to invest in these cosmetic solutions, further contributing to the market's expansion.

- Moreover, the influence of social media and celebrity endorsements has played a crucial role in elevating the awareness and acceptance of microneedling as a viable treatment for hair restoration. The scalp microneedling is gaining attraction because of the success stories by beauty influencers and prominent personalities seeking hair restoration solutions. Due to a large availability of online information, people can easily learn about advantages and efficiency of scalp microneedling as well as find professionals to perform the treatment. Another factor contributing to this growth and industry expansion is the enhanced visibility as well as social acceptance of the scalp microneedling in North America that fast track it to cover the location as the leading area for the disposable emission in the global market.

Active Key Players in the Scalp Microneedling Market:

- Dermapen,

- Dermaroller GmbH,

- Zcalp, Envision Medical Spa,

- MDPen Fractional Microdermal Needling,

- Derma Concepts,

- Concept Skincare,

- Ramboll Environ, Inc.,

- Edge Systems LLC.,

- Weyergans High Care,

- Bomtech Electronics Co., Ltd.

- Other Active Players

|

Scalp Microneedling Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 194.04 Billion |

|

Forecast Period 2024-32 CAGR: |

8.1% |

Market Size in 2032: |

USD 391.13 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Size |

|

||

|

By Needle Material |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Scalp Microneedling Market by Product Type

4.1 Scalp Microneedling Market Snapshot and Growth Engine

4.2 Scalp Microneedling Market Overview

4.3 Derma roller

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Derma roller: Geographic Segmentation Analysis

4.4 Derma pen

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Derma pen: Geographic Segmentation Analysis

4.5 Derma-stamp) Size (Under 0.25 mm

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Derma-stamp) Size (Under 0.25 mm: Geographic Segmentation Analysis

4.6 0.25mm-0.3mm

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 0.25mm-0.3mm: Geographic Segmentation Analysis

4.7 0.75mm-1.0mm

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 0.75mm-1.0mm: Geographic Segmentation Analysis

4.8 1.0mm-1.5mm

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 1.0mm-1.5mm: Geographic Segmentation Analysis

4.9 above 1. 5mm) Needle Material (Silicon Microneedle

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 above 1. 5mm) Needle Material (Silicon Microneedle: Geographic Segmentation Analysis

4.10 Metal Microneedle

4.10.1 Introduction and Market Overview

4.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.10.3 Key Market Trends, Growth Factors and Opportunities

4.10.4 Metal Microneedle: Geographic Segmentation Analysis

4.11 Glass Microneedle)

4.11.1 Introduction and Market Overview

4.11.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.11.3 Key Market Trends, Growth Factors and Opportunities

4.11.4 Glass Microneedle) : Geographic Segmentation Analysis

Chapter 5: Scalp Microneedling Market by End User

5.1 Scalp Microneedling Market Snapshot and Growth Engine

5.2 Scalp Microneedling Market Overview

5.3 Hospitals

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Hospitals: Geographic Segmentation Analysis

5.4 Dermatology Clinics

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Dermatology Clinics: Geographic Segmentation Analysis

5.5 Others)

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Others) : Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Scalp Microneedling Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 DERMAPEN

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 DERMAROLLER GMBH

6.4 ZCALP

6.5 ENVISION MEDICAL SPA

6.6 MDPEN FRACTIONAL MICRODERMAL NEEDLING

6.7 DERMACONCEPTS

6.8 CONCEPTSKINCARE

6.9 RAMBOLL ENVIRON INC.

6.10 EDGE SYSTEMS LLC.

6.11 WEYERGANS HIGH CARE

6.12 AND BOMTECH ELECTRONICS CO. LTD

6.13 OTHER ACTIVE PLAYERS

Chapter 7: Global Scalp Microneedling Market By Region

7.1 Overview

7.2. North America Scalp Microneedling Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Product Type

7.2.4.1 Derma roller

7.2.4.2 Derma pen

7.2.4.3 Derma-stamp) Size (Under 0.25 mm

7.2.4.4 0.25mm-0.3mm

7.2.4.5 0.75mm-1.0mm

7.2.4.6 1.0mm-1.5mm

7.2.4.7 above 1. 5mm) Needle Material (Silicon Microneedle

7.2.4.8 Metal Microneedle

7.2.4.9 Glass Microneedle)

7.2.5 Historic and Forecasted Market Size By End User

7.2.5.1 Hospitals

7.2.5.2 Dermatology Clinics

7.2.5.3 Others)

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Scalp Microneedling Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Product Type

7.3.4.1 Derma roller

7.3.4.2 Derma pen

7.3.4.3 Derma-stamp) Size (Under 0.25 mm

7.3.4.4 0.25mm-0.3mm

7.3.4.5 0.75mm-1.0mm

7.3.4.6 1.0mm-1.5mm

7.3.4.7 above 1. 5mm) Needle Material (Silicon Microneedle

7.3.4.8 Metal Microneedle

7.3.4.9 Glass Microneedle)

7.3.5 Historic and Forecasted Market Size By End User

7.3.5.1 Hospitals

7.3.5.2 Dermatology Clinics

7.3.5.3 Others)

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Scalp Microneedling Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Product Type

7.4.4.1 Derma roller

7.4.4.2 Derma pen

7.4.4.3 Derma-stamp) Size (Under 0.25 mm

7.4.4.4 0.25mm-0.3mm

7.4.4.5 0.75mm-1.0mm

7.4.4.6 1.0mm-1.5mm

7.4.4.7 above 1. 5mm) Needle Material (Silicon Microneedle

7.4.4.8 Metal Microneedle

7.4.4.9 Glass Microneedle)

7.4.5 Historic and Forecasted Market Size By End User

7.4.5.1 Hospitals

7.4.5.2 Dermatology Clinics

7.4.5.3 Others)

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Scalp Microneedling Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Product Type

7.5.4.1 Derma roller

7.5.4.2 Derma pen

7.5.4.3 Derma-stamp) Size (Under 0.25 mm

7.5.4.4 0.25mm-0.3mm

7.5.4.5 0.75mm-1.0mm

7.5.4.6 1.0mm-1.5mm

7.5.4.7 above 1. 5mm) Needle Material (Silicon Microneedle

7.5.4.8 Metal Microneedle

7.5.4.9 Glass Microneedle)

7.5.5 Historic and Forecasted Market Size By End User

7.5.5.1 Hospitals

7.5.5.2 Dermatology Clinics

7.5.5.3 Others)

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Scalp Microneedling Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Product Type

7.6.4.1 Derma roller

7.6.4.2 Derma pen

7.6.4.3 Derma-stamp) Size (Under 0.25 mm

7.6.4.4 0.25mm-0.3mm

7.6.4.5 0.75mm-1.0mm

7.6.4.6 1.0mm-1.5mm

7.6.4.7 above 1. 5mm) Needle Material (Silicon Microneedle

7.6.4.8 Metal Microneedle

7.6.4.9 Glass Microneedle)

7.6.5 Historic and Forecasted Market Size By End User

7.6.5.1 Hospitals

7.6.5.2 Dermatology Clinics

7.6.5.3 Others)

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Scalp Microneedling Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Product Type

7.7.4.1 Derma roller

7.7.4.2 Derma pen

7.7.4.3 Derma-stamp) Size (Under 0.25 mm

7.7.4.4 0.25mm-0.3mm

7.7.4.5 0.75mm-1.0mm

7.7.4.6 1.0mm-1.5mm

7.7.4.7 above 1. 5mm) Needle Material (Silicon Microneedle

7.7.4.8 Metal Microneedle

7.7.4.9 Glass Microneedle)

7.7.5 Historic and Forecasted Market Size By End User

7.7.5.1 Hospitals

7.7.5.2 Dermatology Clinics

7.7.5.3 Others)

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Scalp Microneedling Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 194.04 Billion |

|

Forecast Period 2024-32 CAGR: |

8.1% |

Market Size in 2032: |

USD 391.13 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Size |

|

||

|

By Needle Material |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||