Robotic Process Automation in Healthcare Market Synopsis:

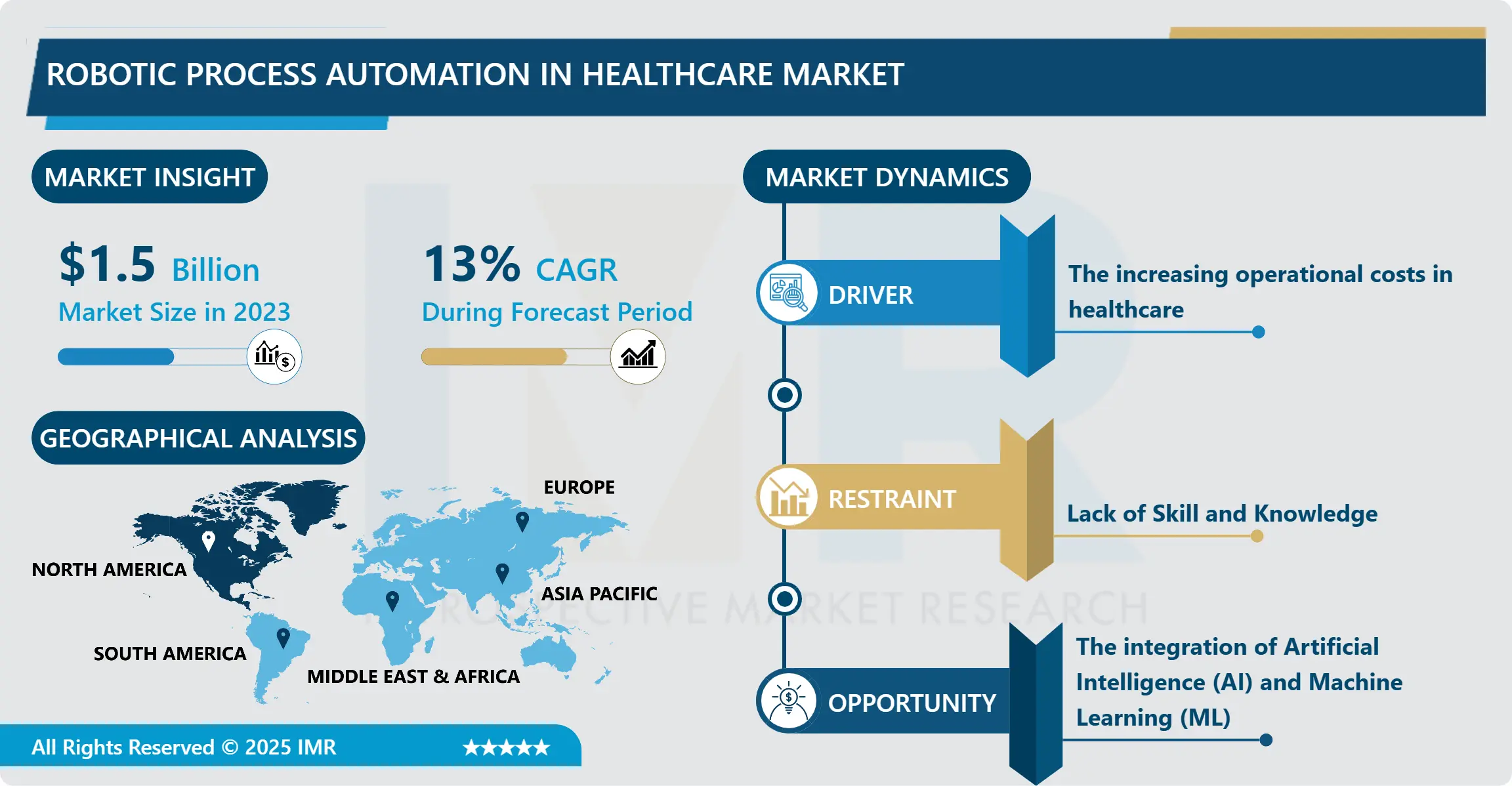

Robotic Process Automation in Healthcare Market Size Was Valued at USD 1.5 Billion in 2023, and is Projected to Reach USD 14 Billion by 2032, Growing at a CAGR of 13% From 2024-2032.

The targeted market for this research is the Robotic Process Automation (RPA) in Healthcare Market which involves the utilization of software robots that automate administrative, operational and clinical processes that are repetitive and rule-based in healthcare organizations. A range of jobs like insurance claims, medical coding, patient appointment, data entry, and report generation, facilitates through RPA and reduces workforce expenses, errors, and cycle time. By eliminating repetitive administrative tasks, RPA helps healthcare providers to spend more time on patients, improve data quality and reduce time-gobring processes such as insurance claim and reimbursements. Amidst the pressure exerted on healthcare entities to reduce expense and enhance the quality of the services they deliver, Application of RPA transcends the limits of conventional working settings – encompassing the massive network encompassing the hospital- clinic-pharmaceutical company-insurer interface-patient triad. In fact, when explain to AI and machine learning with RPA, they should offer improved automation capacity, especially in analytical processes as well as decision-making. Projected to expand at a wonky pace, as the demands for digital changes occur, the generation of more significant health data, and the need to meet regulations; North America, Europe, and Asia Pacific have been seen to be on the front line of the market’s adoption.

The Robotic Process Automation (RPA) in Healthcare Market is growing at its fastest pace as the healthcare organizations are more inclining towards automation to improve operation efficiency, financial skyline and care delivery. RPA is a process where various repetitive tasks that were originally executed by workers are carried out by software robots – or bots. In the field of healthcare these tasks may comprise claims processing, Billing, Scheduling,Data entry work, and compliance with the related rules and regulation, managing inventory etc. In this sense, the implementation of similar processes to work with big data can help to minimize the impact of human factors and organizational inefficiencies on the healthcare providers’ workflow by taking care of routine administrative tasks that occupy much of a healthcare worker’s time so that the personnel can dedicate more time to direct patient care. As healthcare service delivery is on the increase globally, RPA offers an efficient indicator to accomplish the set work demands without direct proportionality of personnel. In addition, the healthcare organizations can also enhance the operational visibility, therefore, enhance accurate and efficient data compilation and analysis for the enhancement of clinical and or business decisions.

The adoption of RPA in healthcare is growing rapidly due to the necessity for the change of the market in this field and to reduction of the costs. Some of the drivers that have been propel the growth of RPA in healthcare include; high complexities in the regulatory environment; growing volumes of healthcare data; and shortage of skilled human resource in the healthcare sector. They are functions, which free the healthcare providers from numerous administrative assignments, such as insurance claims processing, medical coding, as well as data entry, which otherwise would consume much valuable time and contribute to excessive workload. In the future with the further establishment of Electronic Health Records and other related technologies, the integration of RPA with these new technologies becomes easier as it will facilitate in better handling of patient data and creates better communication between a variety of sections in healthcare organizations. North America is the biggest market for healthcare RPA at the moment due to the high utilization of inventive technologies supported by strict regulatory frameworks. However, during the same period, the Asia Pacific is expected to record the highest growth rates due to the surging adoption of high end healthcare facilities, rising government support and the use of IT solutions to enhance healthcare delivery in the emerging nations such as China, India and Japan.

Robotic Process Automation in Healthcare Market Trend Analysis:

Integration with Artificial Intelligence (AI) and Machine Learning (ML)

-

AI and ML with RPA are an emerging trend in healthcare enabling the use of RPA not only for repetitive know-task but even for decision making. While the former type of RPA works really good in cases of dealing with routine and structured procedures such as data input or claims processing, the addition of Artificial Intelligence and Machine Learning allows the RPA systems address tasks that require certain amount of cognition that includes pattern recognition, context awareness and ability to make an accurate foreseeable decision. In a healthcare setting, RPA can catalyse automation not just of backoffice jobs but also of data analysis, including unstructured data such as patient records, analytical results, and notes from the treating physicians. Compared to conventional business process automation, AI-driven RPA can analyze tremendous amounts of information quickly and recognize discrepancies thus producing outcomes such as predicting patient fare or treatment result based on their previous experiences efficiently. For instance, AI-driven RPA can make it easier in identifying apparent incorrect billing codes, or observe outline variations in the patient’s data, which may lead to costly mistakes, saving time in administrative work.

- In addition, the integration of machine learning helps the systems employ new for mation of previous data making them be smarter in performance. This is especially important for the healthcare industry, which receives an almost constant stream of new data, and, therefore, needs to learn how to process these inputs at a fast pace. In terms of operational efficiency or productivity gains, the ML integrated RPA can be applied to forecasting rises in patients demand, foreseeing outbreaks of virus, or realizing probability of readmissions in hospitals. With the help of historical data analysis, getting through RPA systems the healthcare providers are capable to take preventive measures, which will improve the quality of the patients’ treatment as well as make the functions of the healthcare organization more effective. In addition, AI and ML make the rather higher-order functions like NLP for medical document analysis or image analysis for scans automated. This not only enhances the efficiency of the clinical processes but also enables the healthcare organisations to get maximum values of their data. This integration of RPA with AI and ML puts healthcare providers in a position to deliver better, cheaper and efficient services besides optimizing organizational processes.

Improved Patient Experience and Engagement

-

One of the most valuable business benefits opportunities for Robotic Process Automation (RPA) is Improved Patient Experience and Engagement. In the age where healthcare service delivery is becoming patient-centric, RPA significantly helps reduce the workload on employees as they deal with repetitive administration processes that trigger patient dissatisfaction such as booking appointments, registration, reminding them of appointments and follow-up communications. Through automation, such processes do not only improve the patient experience but also minimize the time they take. Different patients are more comfortable with the idea of correct pre-booking, receiving timely alerts, and proactive suggestions about their further visits, tests, or prescriptions refill. Such a smooth flow of information promotes patient’s involvement, minimizes anxiety and brings them satisfaction. Additionally, RPA can use chatbots or virtual assistant for timely answering of frequently asked questions, for example clients and patients can get immediate response to queries relating to billing or appointment date and time, or even simple health tips. This makes it easier and less cumbersome for the patients; thereby, being able to concentrate on their health without undue-session on matter concerning their appointments.

- However, in a broader spectrum, RPA also improves patient satisfaction by providing individualised patient experience. Standard operations of automated systems include sharing appropriate text messages like tips for a healthy lifestyle, or any instruction after the visit, depending on the patient’s choice or medical condition. For example, after a hospital visit, RPA can immediately respond with a configured message with directions for the patients’ recovery, recommended health care organizations or just a simple follow-up call to the hospital. Also, with the use of RPA in implementing systems, patients can always be managed out of hospitals through system prompts for medication intake or enrollment to a certain care physically activity program. Due to minimization of delays which result from excessive paperwork and concurrently facilitating timely communication,robotic process automation plays a major role in increasing general patient satisfaction and improving the bond between the patients and healthcare providers. As an indication of the recognition of patient engagement as a crucial element in management of health outcomes, RPA will remain pertinent in making the necessary positive impacts to the delivery of service to patients.

Robotic Process Automation in Healthcare Market Segment Analysis:

Robotic Process Automation in Healthcare Market is Segmented on the basis of Type, Application, End User, and Region.

By Type, Unattended RPA segment is expected to dominate the market during the forecast period

-

The factors that Unattended RPA segment is likely to be the largest segment of Robotic Process Automation (RPA) in Healthcare Market during the forecast period are due to its ability to work without any human intervention. Unattended RPA is ideal for healthcare organizations where large amounts of repetitive and cumbersome work need to be done on a continuous basis in due course. Claims processing, medical billing, data entry, patient record management, and preparing reports that include compliance reporting are a few types of processes where unattended RPA is most valuable. Such activities usually demand precision and swiftness, aspects in which unattended RPA systems can be employed. Since unmonitored and unattended bots can work without interruption, they can afford considerable efficiency gains to several key administrative processes across a healthcare organization. This gives them a round the clock processing capacity for healthcare providers hence reduces the demand for new manpower to deal with the increasing administrative load ideally hence a cost effective solution to the rationed skilled manpower in the healthcare sector.

- Furthermore, existing and emerging variations of healthcare data complexity with large amounts of generated data and digital transformation’s need make unattended RPA a crucial need in the sector. The workflow management in healthcare organizations has become a major issue of concern given the fact that insurance claims and the management of patients’ information require automation given the high risk that accompanies them. Unmonitored RPA helps healthcare clients to automate routine workflows like insurance claim processing, patient identification, records management, and combining invoices. This liberates the employees from doing most of the work, mitigates the possibility of human mistake and standard violations including HIPAA. Since healthcare organizations have problems regarding operational costs, staffing issues, and an increasing need for immediate data processing, the self-sufficiency of unattended RPA for mainstream and repetitive processes will result in its market dominance. Due to the flexibility and capacity to handle numerous processes within healthcare organizations, unattended RPA is proving to be a vital enabler in improving capacity and cutting cost within those settings.

By Application, Claims Processing & Billing segment expected to held the largest share

-

The Claims Processing & Billing segment is presumed to dominate the market for Robotic Process Automation (RPA) in the Healthcare Market for the duration of the forecast period because these operations are significantly important in the healthcare domain and complex. Medical claims and billing is reported as one of the most complex and tedious operational activities in the healthcare industry. The previous procedures followed in the management of claims entail a considerable amount of input, check and interaction with the insurance companies, which make the whole process time consuming, erroneous and highly expensive. The above steps can be automated using RPA by extracting data from the Patient’s record, the verification of the details of the insurance provider, cross checking the medical codes and preparing the bills to be submitted. Automated RPA bots can work on Flight claims at any one time, without supervision and therefore decrease on the time taken to process claims. This makes it easier for healthcare providers to receive payment and at the same time increase their cash flow without having to wait due to mistake made while billing or missing documentation.

- Apart from increasing the cycle time for billing, the efficiency of the claims processing increases, thus reducing the chances of making losses or have claims rejected. Every healthcare organization loses bulk of its revenue through improper coding, submission of wrong claims, and delays in payment. RPA reduces the possible mistakes made when entering codes by having the claims validated as well as submitted through the system to decrease the number of rejected claims. In addition, with RPA the records of the status of the claims and follow-ups, as well as the resolution of the disputes with the insurance companies can easily be handled, without a lot of strain on the administrative employees. As volume of claims and billing activities continues to grow in a complex and stringent health care setting, RPA becomes tremendously vital in improving accuracy and efficiency while expediting the reimbursement processes. As such, it shall be noted that the Claims Processing & Billing application segment would remain dominant in the market, due to the increasing emphasis of healthcare companies on optimizing its processes vis-à-vis costs associated with such crucial functions.

Robotic Process Automation in Healthcare Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

The Claims Processing & Billing segment is presumed to dominate the market for Robotic Process Automation (RPA) in the Healthcare Market for the duration of the forecast period because these operations are significantly important in the healthcare domain and complex. Medical claims and billing is reported as one of the most complex and tedious operational activities in the healthcare industry. The previous procedures followed in the management of claims entail a considerable amount of input, check and interaction with the insurance companies, which make the whole process time consuming, erroneous and highly expensive. The above steps can be automated using RPA by extracting data from the Patient’s record, the verification of the details of the insurance provider, cross checking the medical codes and preparing the bills to be submitted. Automated RPA bots can work on Flight claims at any one time, without supervision and therefore decrease on the time taken to process claims. This makes it easier for healthcare providers to receive payment and at the same time increase their cash flow without having to wait due to mistake made while billing or missing documentation.

- Apart from increasing the cycle time for billing, the efficiency of the claims processing increases, thus reducing the chances of making losses or have claims rejected. Every healthcare organization loses bulk of its revenue through improper coding, submission of wrong claims, and delays in payment. RPA reduces the possible mistakes made when entering codes by having the claims validated as well as submitted through the system to decrease the number of rejected claims. In addition, with RPA the records of the status of the claims and follow-ups, as well as the resolution of the disputes with the insurance companies can easily be handled, without a lot of strain on the administrative employees. As volume of claims and billing activities continues to grow in a complex and stringent health care setting, RPA becomes tremendously vital in improving accuracy and efficiency while expediting the reimbursement processes.

Active Key Players in the Robotic Process Automation in Healthcare Market

- Accenture (Ireland)

- AntWorks (Singapore)

- Automation Anywhere (USA)

- Blue Prism (UK)

- Capgemini (France)

- Cognizant Technology Solutions (USA)

- Deloitte (USA)

- Genpact (USA)

- IBM (USA)

- Kofax (USA)

- NICE Systems (Israel)

- Pegasystems (USA)

- Softomotive (UK)

- Syntel (Atos Syntel) (USA)

- TCS (Tata Consultancy Services) (India)

- UiPath (USA)

- Wipro (India)

- WorkFusion (USA)

- Other Active Players

|

Robotic Process Automation in Healthcare Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.5 Billion |

|

Forecast Period 2024-32 CAGR: |

13 % |

Market Size in 2032: |

USD 14 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Robotic Process Automation in Healthcare Market by Type

4.1 Robotic Process Automation in Healthcare Market Snapshot and Growth Engine

4.2 Robotic Process Automation in Healthcare Market Overview

4.3 Attended RPA

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Attended RPA: Geographic Segmentation Analysis

4.4 Unattended RPA

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Unattended RPA: Geographic Segmentation Analysis

4.5 Hybrid RPA)

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Hybrid RPA): Geographic Segmentation Analysis

4.6

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 : Geographic Segmentation Analysis

Chapter 5: Robotic Process Automation in Healthcare Market by Application

5.1 Robotic Process Automation in Healthcare Market Snapshot and Growth Engine

5.2 Robotic Process Automation in Healthcare Market Overview

5.3 Claims Processing & Billing

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Claims Processing & Billing: Geographic Segmentation Analysis

5.4 Patient Registration and Scheduling

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Patient Registration and Scheduling: Geographic Segmentation Analysis

5.5 Medical Coding and Billing

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Medical Coding and Billing: Geographic Segmentation Analysis

5.6 Data Entry and Data Management

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Data Entry and Data Management: Geographic Segmentation Analysis

5.7 Regulatory Compliance & Reporting

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Regulatory Compliance & Reporting: Geographic Segmentation Analysis

5.8 Inventory and Supply Chain Management

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Inventory and Supply Chain Management: Geographic Segmentation Analysis

5.9 Patient Engagement and Communication)

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 Patient Engagement and Communication): Geographic Segmentation Analysis

5.10

5.10.1 Introduction and Market Overview

5.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.10.3 Key Market Trends, Growth Factors and Opportunities

5.10.4 : Geographic Segmentation Analysis

Chapter 6: Robotic Process Automation in Healthcare Market by End User

6.1 Robotic Process Automation in Healthcare Market Snapshot and Growth Engine

6.2 Robotic Process Automation in Healthcare Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals: Geographic Segmentation Analysis

6.4 Clinics

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Clinics: Geographic Segmentation Analysis

6.5 Pharmaceutical Companies

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Pharmaceutical Companies: Geographic Segmentation Analysis

6.6 Insurance Providers

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Insurance Providers: Geographic Segmentation Analysis

6.7 Research & Academic Institutions)

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Research & Academic Institutions): Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Robotic Process Automation in Healthcare Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ACCENTURE (IRELAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ANTWORKS (SINGAPORE)

7.4 AUTOMATION ANYWHERE (USA)

7.5 BLUE PRISM (UK)

7.6 CAPGEMINI (FRANCE)

7.7 COGNIZANT TECHNOLOGY SOLUTIONS (USA)

7.8 DELOITTE (USA)

7.9 GENPACT (USA)

7.10 IBM (USA)

7.11 KOFAX (USA)

7.12 NICE SYSTEMS (ISRAEL)

7.13 PEGASYSTEMS (USA)

7.14 OTHER ACTIVE PLAYERS

Chapter 8: Global Robotic Process Automation in Healthcare Market By Region

8.1 Overview

8.2. North America Robotic Process Automation in Healthcare Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Attended RPA

8.2.4.2 Unattended RPA

8.2.4.3 Hybrid RPA)

8.2.4.4

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Claims Processing & Billing

8.2.5.2 Patient Registration and Scheduling

8.2.5.3 Medical Coding and Billing

8.2.5.4 Data Entry and Data Management

8.2.5.5 Regulatory Compliance & Reporting

8.2.5.6 Inventory and Supply Chain Management

8.2.5.7 Patient Engagement and Communication)

8.2.5.8

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Hospitals

8.2.6.2 Clinics

8.2.6.3 Pharmaceutical Companies

8.2.6.4 Insurance Providers

8.2.6.5 Research & Academic Institutions)

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Robotic Process Automation in Healthcare Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Attended RPA

8.3.4.2 Unattended RPA

8.3.4.3 Hybrid RPA)

8.3.4.4

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Claims Processing & Billing

8.3.5.2 Patient Registration and Scheduling

8.3.5.3 Medical Coding and Billing

8.3.5.4 Data Entry and Data Management

8.3.5.5 Regulatory Compliance & Reporting

8.3.5.6 Inventory and Supply Chain Management

8.3.5.7 Patient Engagement and Communication)

8.3.5.8

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Hospitals

8.3.6.2 Clinics

8.3.6.3 Pharmaceutical Companies

8.3.6.4 Insurance Providers

8.3.6.5 Research & Academic Institutions)

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Robotic Process Automation in Healthcare Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Attended RPA

8.4.4.2 Unattended RPA

8.4.4.3 Hybrid RPA)

8.4.4.4

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Claims Processing & Billing

8.4.5.2 Patient Registration and Scheduling

8.4.5.3 Medical Coding and Billing

8.4.5.4 Data Entry and Data Management

8.4.5.5 Regulatory Compliance & Reporting

8.4.5.6 Inventory and Supply Chain Management

8.4.5.7 Patient Engagement and Communication)

8.4.5.8

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Hospitals

8.4.6.2 Clinics

8.4.6.3 Pharmaceutical Companies

8.4.6.4 Insurance Providers

8.4.6.5 Research & Academic Institutions)

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Robotic Process Automation in Healthcare Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Attended RPA

8.5.4.2 Unattended RPA

8.5.4.3 Hybrid RPA)

8.5.4.4

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Claims Processing & Billing

8.5.5.2 Patient Registration and Scheduling

8.5.5.3 Medical Coding and Billing

8.5.5.4 Data Entry and Data Management

8.5.5.5 Regulatory Compliance & Reporting

8.5.5.6 Inventory and Supply Chain Management

8.5.5.7 Patient Engagement and Communication)

8.5.5.8

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Hospitals

8.5.6.2 Clinics

8.5.6.3 Pharmaceutical Companies

8.5.6.4 Insurance Providers

8.5.6.5 Research & Academic Institutions)

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Robotic Process Automation in Healthcare Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Attended RPA

8.6.4.2 Unattended RPA

8.6.4.3 Hybrid RPA)

8.6.4.4

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Claims Processing & Billing

8.6.5.2 Patient Registration and Scheduling

8.6.5.3 Medical Coding and Billing

8.6.5.4 Data Entry and Data Management

8.6.5.5 Regulatory Compliance & Reporting

8.6.5.6 Inventory and Supply Chain Management

8.6.5.7 Patient Engagement and Communication)

8.6.5.8

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Hospitals

8.6.6.2 Clinics

8.6.6.3 Pharmaceutical Companies

8.6.6.4 Insurance Providers

8.6.6.5 Research & Academic Institutions)

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Robotic Process Automation in Healthcare Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Attended RPA

8.7.4.2 Unattended RPA

8.7.4.3 Hybrid RPA)

8.7.4.4

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Claims Processing & Billing

8.7.5.2 Patient Registration and Scheduling

8.7.5.3 Medical Coding and Billing

8.7.5.4 Data Entry and Data Management

8.7.5.5 Regulatory Compliance & Reporting

8.7.5.6 Inventory and Supply Chain Management

8.7.5.7 Patient Engagement and Communication)

8.7.5.8

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Hospitals

8.7.6.2 Clinics

8.7.6.3 Pharmaceutical Companies

8.7.6.4 Insurance Providers

8.7.6.5 Research & Academic Institutions)

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Robotic Process Automation in Healthcare Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.5 Billion |

|

Forecast Period 2024-32 CAGR: |

13 % |

Market Size in 2032: |

USD 14 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||